Europe Contraceptives Market Research Report – Segmented By Drug Type, Medical Devices, End-Users and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe) - Industry Analysis on Size, Share, Trends & Growth Forecast (2024 to 2033)

Europe Contraceptives Market Size

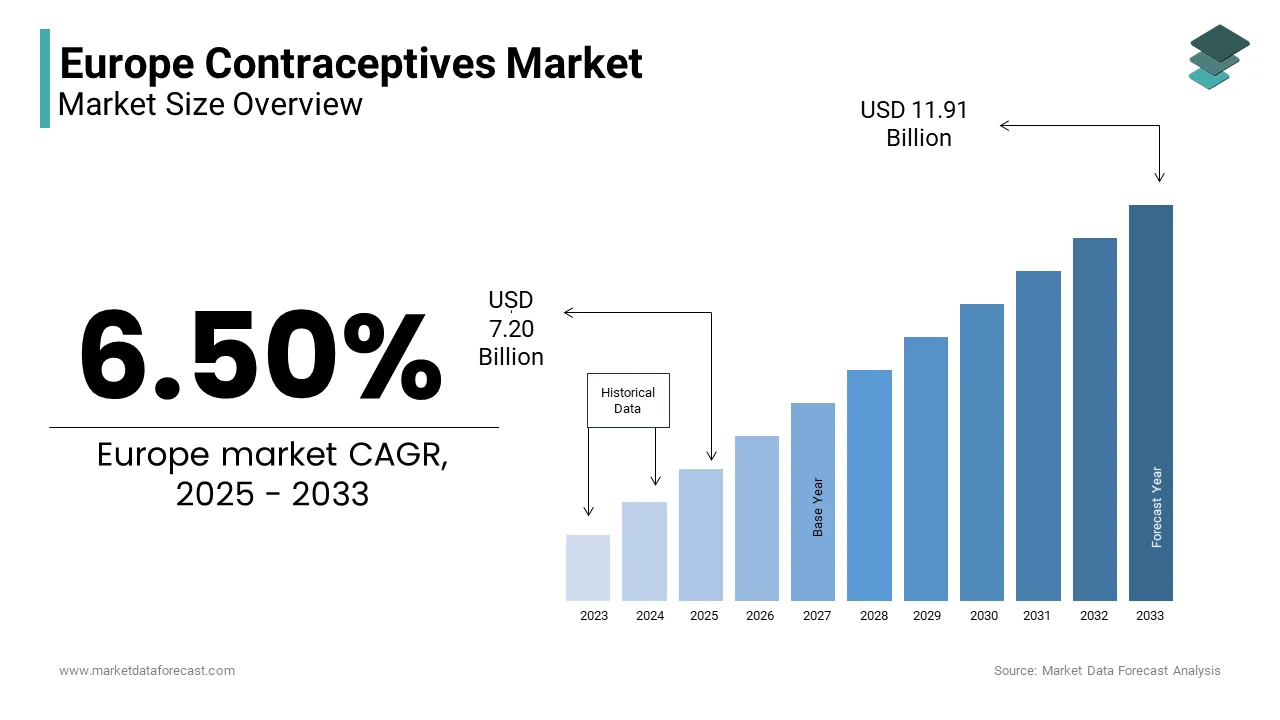

The Europe Contraceptives Market was valued at USD 6.76 billion in 2024. The Europe Contraceptives Market is expected to have 6.50% CAGR from 2025 to 2033 and be worth USD 11.91 billion by 2033 from USD 7.20 billion in 2025.

The contraceptives market in Europe is a well-developed part of the healthcare sector, supported by modern policies, strong public awareness, and advanced medical systems. Eurostat reports that around 60% of women in Europe aged 15 to 49 use some form of birth control, showing widespread acceptance of family planning. The market is backed by strict regulations that ensure contraceptives are safe and effective, according to the European Medicines Agency. Germany and France are leading countries in usage, thanks to their strong healthcare systems and government support for reproductive health. A growing trend is the shift toward non-hormonal contraceptives, as more people look for options with fewer side effects. The World Health Organization also notes that Europe has some of the lowest fertility rates in the world, which further drives demand for contraceptives. Together, these factors are helping the market grow steadily across the region.

MARKET DRIVERS

Rising Awareness and Education on Reproductive Health

Awareness campaigns and educational initiatives have significantly contributed to the growth of the Europe contraceptives market. According to the Guttmacher Institute, over 70% of European women aged 15–49 are aware of multiple contraceptive methods, largely due to government-led programs and NGO efforts. For instance, the UK’s National Health Service runs extensive campaigns showcasing the benefits of LARCs, which saw a 15% increase in adoption between 2019 and 2023. This heightened awareness translates into increased demand, particularly among younger demographics who prioritize convenience and effectiveness. Furthermore, as per the United Nations Population Fund, regions with higher education levels such as Scandinavia exhibit a 20% higher usage rate of modern contraceptives compared to less educated areas. These trends underscore the pivotal role of education in driving market growth.

Increasing Prevalence of Unplanned Pregnancies

Unplanned pregnancies remain a significant concern across Europe, with approximately 43% of pregnancies being unintended, according to data from the European Parliamentary Forum for Sexual and Reproductive Rights. This issue has spurred demand for reliable contraceptive solutions, particularly among women aged 20–35. Countries like Spain and Italy report unplanned pregnancy rates exceeding 50% is prompting governments to subsidize contraceptive access. For example, France offers free contraceptives to women under 25 and is leading to a 25% surge in pill prescriptions since 2021. Similarly, Germany’s statutory health insurance covers LARCs, boosting their adoption by 18% annually. These interventions exhibit how addressing unplanned pregnancies directly fuels market expansion.

MARKET RESTRAINTS

Stringent Regulatory Frameworks

The stringent regulatory landscape in Europe poses a significant challenge to the contraceptives market. As per the European Medicines Agency, all contraceptive products must undergo rigorous clinical trials and post-market surveillance, which can delay product launches by up to three years. For instance, a new intrauterine device introduced in 2022 faced approval delays due to additional safety assessments, impacting its market entry timeline. These regulations, while ensuring safety, often discourage smaller firms from entering the market. Moreover, compliance costs can exceed USD 1 million per product, creating financial barriers for innovation. According to the Federation of European Pharmaceutical Industries and Associations, nearly 30% of new contraceptive innovations are shelved due to regulatory hurdles, stifling market dynamism.

Cultural and Religious Opposition

Cultural and religious beliefs continue to hinder contraceptive adoption in parts of Europe. According to the Pew Research Center, countries like Poland and Italy exhibit resistance to contraceptive use, with only 40% of women utilizing modern methods. Catholic teachings that prevalent in Southern Europe discourage artificial contraception and is influencing public perception. In Poland, opposition to emergency contraceptives led to a 10% decline in sales between 2018 and 2022. Similarly, rural areas in Romania report limited access to contraceptives due to stigma, as noted by the International Planned Parenthood Federation. These cultural barriers not only restrict market penetration but also necessitate targeted awareness campaigns to overcome deeply rooted biases.

MARKET OPPORTUNITIES

Technological Advancements in Contraceptive Solutions

Technological innovations present a golden opportunity for the Europe contraceptives market. As per the European Association of Hospital Pharmacists, smart contraceptives such as app-connected patches and implants are gaining traction. For instance, a Bluetooth-enabled contraceptive patch launched in Sweden in 2023 allows users to monitor hormone levels via smartphones, enhancing user experience. These advancements cater to tech-savvy consumers who prioritize convenience and precision. Moreover, the integration of AI in fertility tracking apps has seen a 20% annual growth, as per the European Fertility Society, creating synergies between digital health and contraception. Such innovations are expected to redefine market dynamics and attract younger demographics.

Expanding Telemedicine Platforms for Contraceptive Access

Telemedicine platforms are revolutionizing contraceptive accessibility across Europe. According to McKinsey & Company, telehealth consultations for contraceptives surged by 40% during the pandemic, with sustained growth thereafter. Platforms like Zava in the UK and Doctolib in France offer online prescriptions and home delivery is catering to over 2 million users annually. This model addresses barriers such as clinic wait times and rural inaccessibility, particularly in Eastern Europe. For example, Romania’s adoption of telemedicine resulted in a 25% increase in contraceptive uptake among rural women. Furthermore, the European Telemedicine Conference states that 60% of users prefer telemedicine for its privacy and convenience, underscoring its potential to drive market expansion.

MARKET CHALLENGES

High Costs of Long-Acting Reversible Contraceptives (LARCs)

Despite their efficacy, LARCs remain prohibitively expensive for many consumers, posing a significant challenge to market inclusivity. This financial burden limits accessibility, particularly in low-income regions like Eastern Europe. For instance, Bulgaria reports an adoption rate of only 10% for LARCs due to affordability issues. Also, private healthcare systems, such as those in Switzerland, often exclude full coverage for these devices is forcing patients to bear substantial out-of-pocket expenses. These cost barriers hinder widespread adoption and contribute to socioeconomic disparities in contraceptive access.

Misinformation and Myths Surrounding Contraceptives

Misinformation continues to undermine trust in contraceptives, particularly among older demographics. The European Health Information Gateway notes that rumors linking hormonal contraceptives to infertility persist in countries like Greece and Portugal is deterring 30% of women from using them. Social media platforms exacerbate this issue by amplifying unverified claims, as spotlighteed by the European Centre for Disease Prevention and Control. For example, a viral myth in 2021 falsely linked contraceptive pills to cancer, causing a temporary 15% drop in sales across Spain. Addressing these misconceptions requires sustained educational campaigns and collaboration with healthcare providers to rebuild consumer confidence.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

6.50 % |

|

Segments Covered |

By Drug Type, Medical Devices, End User and Country. |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Country Covered |

UK, Germany, Italy, France, Spain, Sweden, Denmark, Poland, Switzerland, Netherlands, Rest of Europe. |

|

Market Leaders Profiled |

C.H. Robinson Worldwide Inc. (US), IJ.B. Hunt Transport Services (US), Ceva Holdings LLC (France), FedEx Corp (US) |

SEGMENT ANALYSIS

By Drug Type Insights

The contraceptive pills segment dominated the Europe contraceptives market by holding a staggering 45.1% market share in 2024. This control over the market is caused by their widespread availability, ease of use, and decades-long trust among consumers. The affordability of oral contraceptives makes them accessible to diverse income groups. According to the World Health Organization, approximately 60% of women using hormonal contraception prefer pills due to their reversibility and minimal side effects compared to other methods. Besides these, government initiatives such as France’s free provision of pills to women under 25 have further strengthen their position. Another aspect is the high awareness levels; for instance, the UK’s National Health Service actively promotes pill usage is resulting in a 10% annual increase in prescriptions since 2020. These elements collectively ensure the continued leadership of contraceptive pills in the market.

The subdermal contraceptive implants segment is the quickest one to accelerate in the market, with a CAGR of 8.5% projected from 2025 to 2033. Their popularity is influenced by their long-lasting efficacy, lasting up to five years, and minimal user intervention. For example, Germany reported a 30% surge in implant adoption between 2021 and 2023, driven by campaigns showcasing their convenience and effectiveness. Moreover, advancements in biocompatible materials have reduced side effects, increasing consumer confidence. As per the International Planned Parenthood Federation, countries like Sweden and Denmark have witnessed a 25% annual growth in implant usage due to subsidies and awareness programs. These factors underscore why subdermal implants are outpacing other segments in terms of growth.

By Medical Devices Insights

The male contraceptive devices, particularly condoms, accounted for 35.3% of the medical devices segment in the Europe contraceptives market in 2024. Their rising share is associated with dual protection against sexually transmitted infections (STIs) and unintended pregnancies which is making them a preferred choice among younger demographics. As stated by the United Nations Population Fund, condom sales in Europe exceeded 1.2 billion units in 2023, with Germany and the UK being the largest contributors. The reduced cost of condoms ensures widespread accessibility. Furthermore, public health campaigns promoting safe sex practices have bolstered demand. For instance, Switzerland’s “Safe Sex Saves Lives” initiative led to a 15% increase in condom purchases in 2022. These factors cement condoms as the leading medical device in this segment.

The contraceptive patches segment emerged as the fastest-growing category, with a CAGR of 9.2% anticipated during the forecast period. Their discreet application and consistent hormone delivery make them appealing to working professionals and students. For example, France saw a 22% rise in patch prescriptions in 2023 driven by campaigns emphasizing their convenience over daily pills. Additionally, innovations like extended-wear patches have enhanced user compliance and is contributing to their rapid adoption. As per the European Medicines Agency, Scandinavian countries report a 30% annual growth in patch usage due to their non-invasive nature. These advancements position contraceptive patches as a key growth driver in the medical devices segment.

By End User Insights

Clinics represented the largest end-user segment by capturing 40% of the Europe contraceptives market in 2024. Their prominence is due to their role as primary distribution points for contraceptives, offering personalized consultations and immediate access to products. In countries like France and Spain, clinics provide subsidized or free contraceptives, ensuring affordability for low-income groups. According to the European Parliamentary Forum for Sexual and Reproductive Rights, clinics perform over 70% of IUD insertions and implant procedures, underscoring their critical role. Furthermore, their integration with telemedicine platforms has expanded reach, particularly in rural areas. For instance, Italy’s clinic-based telehealth services resulted in a 25% increase in contraceptive uptake in 2023. These factors reinforce clinics as the basis of contraceptive distribution.

Home care is the rapidly advancing end-user segment, with a CAGR of 10.1% in the coming years. This progress is propelled by the rising adoption of home-administered contraceptives such as patches and self-injectables. For example, the Netherlands reported a 35% surge in home care-based contraceptive use in 2023 is driven by the convenience of at-home solutions. Additionally, telemedicine platforms facilitating online prescriptions and home delivery have further accelerated this trend. As per McKinsey & Company, over 50% of European women aged 18–35 prefer home care options for privacy and flexibility. These dynamics exhibit why home care is emerging as a pivotal segment in the market.

Country Level Analysis

Germany continues to lead the region’s contraceptives market, accounting for 23.5% of the total European market share in 2024. It is reflecting its robust healthcare infrastructure and progressive policies. The country’s statutory health insurance covers a wide range of contraceptives, including LARCs, driving adoption rates. According to the Federal Statistical Office of Germany, contraceptive usage among women aged 15–49 exceeds 70%, one of the highest in Europe. Initiatives like free access to pills for women under 22 have further boosted market penetration. Additionally, Germany’s emphasis on research and development has positioned it as a hub for contraceptive innovation, attracting global players. These factors solidify Germany’s leadership in the regional market.

France maintains a stable growth trajectory which is driven by its comprehensive reproductive health policies. The French government subsidizes contraceptives for women under 25, resulting in a 25% increase in pill prescriptions since 2021. According to Santé Publique France, over 80% of French women utilize modern contraceptive methods, underscoring high awareness levels. Furthermore, France’s focus on STI prevention has bolstered condom usage, with sales exceeding 300 million units annually. These initiatives highlight France’s pivotal role in shaping contraceptive trends across Europe.

The United Kingdom is currently the fastest growing market in the region with an estimated CAGR of 6.2% in 2024. This growth is primarily driven by the increasing availability of over-the-counter contraceptives, government-backed education programs on sexual health, and a rise in online pharmacy adoption. The post-pandemic digital health shift has encouraged wider use of telemedicine platforms that prescribe and deliver contraceptives directly to consumers. The UK’s National Health Service (NHS) initiatives targeting teenage pregnancies and expanding contraceptive access in underserved areas are also contributing to market expansion, particularly among younger and more diverse populations.

Italy’s contraceptives market shows modest but consistent growth, with notable disparities between the more progressive north and traditionally conservative southern regions. While urban areas are seeing increased uptake of modern methods like vaginal rings and patches, access and awareness in rural areas remain limited. Public education campaigns have begun to gain traction, especially among young adults and working women. Pharmacies are expanding their portfolio to include more discreet, user-friendly products is reflecting a gradual cultural shift and a wider acceptance of family planning tools.

Spain is experiencing moderate growth, fueled by a combination of expanding healthcare coverage and a generational shift in preferences. Younger consumers, particularly in urban hubs like Madrid and Barcelona, are favoring flexible contraceptive options such as implants and injectables. There’s also increasing demand for organic and non-hormonal solutions, aligning with the country’s broader health-conscious trends. While the public healthcare system provides basic contraceptive services, rising demand for privacy and convenience is pushing private clinics and online providers to diversify offerings and improve accessibility.

Top 3 Players in the market

Bayer AG

Bayer AG is a global leader in the contraceptives market, renowned for its innovative portfolio of hormonal contraceptives. The company’s flagship product, Yasmin, remains a top-selling oral contraceptive in Europe, valued for its efficacy and minimal side effects. Bayer invests heavily in R&D, dedicating over USD 5 billion annually to develop next-generation contraceptives. Its partnerships with European governments have facilitated widespread distribution, particularly in Germany and France.

Pfizer Inc.

Pfizer Inc. is a key player in the European contraceptives market, offering a diverse range of products, including patches and injectables. The company’s focus on affordability and accessibility has strengthened its market presence. Pfizer’s collaboration with healthcare providers ensures seamless distribution, particularly in the UK and Spain.

Merck KGaA

Merck KGaA specializes in long-acting reversible contraceptives, such as implants and IUDs. The company’s commitment to quality and safety has earned it a loyal customer base. Merck’s initiatives to educate healthcare providers on LARC benefits have significantly contributed to their adoption across Europe.

Top strategies used by the key market participants

Product Innovation and Diversification

Companies like Bayer AG and Merck KGaA invest in R&D to introduce innovative products, such as smart contraceptives and extended-wear patches, catering to evolving consumer preferences.

Strategic Partnerships with Governments

Firms collaborate with governments to promote subsidized access, enhancing affordability and adoption rates, particularly in low-income regions.

Expansion of Digital Health Platforms

Key players integrate telemedicine and digital tools to streamline distribution and improve user experience, aligning with the growing trend of remote healthcare.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Bayer HealthCare AG, Teva Pharmaceutical Industries Limited, Medisafe Distribution Inc, Pace Pharmaceuticals Inc., Medicines360, Church & Dwight, Co., Inc., Actavis, Inc., CooperSurgical, Inc., Merck & Co., Inc., Reckitt Benckiser plc, Mayer Laboratories, Inc., and Pfizer, Inc. are some of the key players in the European contraceptives market.

The Europe contraceptives market is highly competitive, characterized by the presence of global giants like Bayer AG, Pfizer Inc., and Merck KGaA. These companies leverage advanced technologies and strategic collaborations to maintain their dominance. Smaller firms focus on niche segments, such as natural contraceptives, to carve out a presence. Regulatory frameworks ensure fair competition while fostering innovation. As per the European Medicines Agency, over 20 new products entered the market in 2023, intensifying rivalry.

RECENT HAPPENINGS IN THE MARKET

- In April 2023, Bayer AG launched a Bluetooth-enabled contraceptive patch in Germany, enhancing user monitoring capabilities.

- In June 2023, Pfizer Inc. partnered with the UK government to offer free injectables to women under 25, boosting adoption rates.

- In September 2023, Merck KGaA introduced a biodegradable IUD in France, addressing environmental concerns.

- In November 2023, HRA Pharma acquired a Danish startup specializing in non-hormonal contraceptives, expanding its product portfolio.

- In January 2024, Teva Pharmaceuticals launched a telemedicine platform in Spain, facilitating online consultations and home delivery.

MARKET SEGMENTATION

This research report on the Europe Contraceptives Market has been segmented and sub-segmented into the following categories.

By Drug Type

- Contraceptive Pills

- Subdermal Contraceptive Implants

By Medical Devices

- Male Contraceptive Devices (Condoms)

- Contraceptive Patches

By End User

- Clinics

- Home Care

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe.

Frequently Asked Questions

What was the size of the Europe contraceptives market in 2024?

The Europe contraceptives market was valued at USD 6.76 billion in 2024.

Which countries are major players in the Europe contraceptives market?

Germany, France, and the United Kingdom are major players in the Europe contraceptives market.

What are the growth opportunities for the Europe contraceptives market?

The factors driving the growth of the Europe contraceptives market include increasing awareness, technological advancements, government initiatives, growing demand for long-acting contraceptives, rising prevalence of sexually transmitted diseases, increasing need for family planning, availability of over-the-counter contraceptives, increasing disposable income, and rising demand for hormonal contraceptives.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]