Europe Construction Equipment Rental Market Size, Share, Trends & Growth Forecast Research Report – Segmented By Product Insights And By Region (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe) - Industry Analysis From (2025 to 2033)

Europe Construction Equipment Rental Market Size

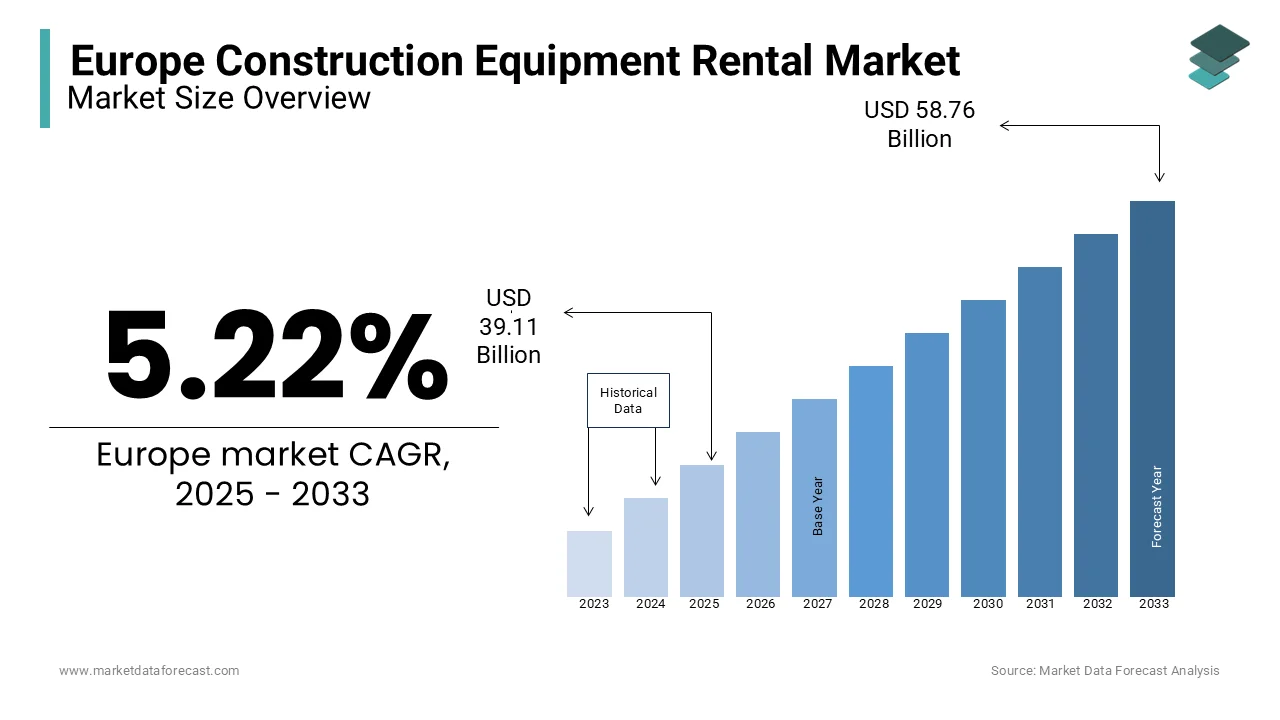

The Europe construction equipment rental market size was valued at USD 37.17 billion in 2024 and is anticipated to reach USD 39.11 billion in 2025 from USD 58.76 billion by 2033, growing at a CAGR of 5.22% from 2025 to 2033.

construction equipment rental involves the leasing of machinery and tools for short-term and long-term construction projects that cater to diverse sectors such as residential, commercial, industrial, and infrastructure development. The growing infrastructure investments, stringent environmental regulations, and the rising demand for sustainable construction practices have contributed to the construction equipment rental market growth in Europe in the recent past. According to the European Investment Bank, infrastructure spending in the EU reached €60 billion in 2023, which is indicating significant opportunities for construction-related services, including equipment rentals. Renting equipment enables companies to access technologically advanced machinery without the financial burden of ownership or maintenance costs.

MARKET DRIVERS

Cost-Effectiveness and Financial Flexibility

One of the primary drivers of the European construction equipment rental market is the cost-effectiveness and financial flexibility it offers to businesses, particularly small and medium-sized enterprises (SMEs). Renting equipment eliminates the high upfront costs associated with purchasing machinery, as well as ongoing maintenance and storage expenses. According to Eurostat, SMEs make up 99% of the construction sector in Europe and frequently rely on rentals to optimize operational budgets. Rental services also provide access to a wide range of advanced equipment, enabling businesses to adapt to project-specific needs without capital investments. The European Rental Association reported in 2023 that renting equipment can reduce overall construction costs by up to 25%, further emphasizing its financial advantages for diverse stakeholders.

Rising Infrastructure Investments Across Europe

The surge in infrastructure investments across Europe significantly drives the demand for construction equipment rental services. Governments are prioritizing large-scale projects such as road networks, renewable energy facilities, and urban development, creating sustained demand for flexible equipment solutions. According to the European Investment Bank, infrastructure financing in the EU reached €60 billion in 2023, with a significant portion directed toward transportation and energy projects. Rental services play a critical role in these projects by ensuring access to the latest machinery while minimizing long-term asset commitments. Furthermore, public-private partnerships (PPPs) in countries like Germany and France have further increased the reliance on rental equipment to meet tight project deadlines and evolving construction demands.

MARKET RESTRAINTS

High Maintenance and Operational Costs for Rental Providers

The high costs associated with maintaining and operating construction equipment present a significant restraint for rental providers in Europe. Equipment wear and tear, frequent servicing, and compliance with stringent environmental regulations increase operational expenses. According to the European Rental Association, maintenance and servicing account for nearly 20% of a rental provider’s total operational costs. Additionally, adherence to the EU's Emission Standards for Non-Road Mobile Machinery (NRMM) necessitates continuous upgrades to low-emission or electric models, which further escalates costs. Smaller rental companies, in particular, face challenges in managing these financial burdens, potentially limiting their ability to expand inventory and cater to growing demand.

Economic Uncertainty and Fluctuating Construction Activity

Economic volatility and fluctuations in construction activity can adversely impact the European construction equipment rental market. During periods of economic slowdown, construction projects are often delayed or canceled, reducing the demand for rental services. The European Commission reported a 6% decline in construction output during the economic downturn of 2020, illustrating the market's sensitivity to macroeconomic conditions. Additionally, the uneven recovery of construction sectors across different European countries creates disparities in rental demand. For instance, regions with fewer infrastructure investments may experience slower growth in rental activity, limiting market expansion. These factors underscore the market's vulnerability to external economic shifts, affecting both providers and end-users.

MARKET OPPORTUNITIES

Growing Demand for Sustainable and Low-Emission Equipment

The increasing focus on sustainability across Europe presents a major opportunity for the construction equipment rental market. Governments and businesses are prioritizing low-emission and energy-efficient machinery to meet carbon neutrality goals set under the European Green Deal. The European Environment Agency reported that the construction sector accounted for approximately 36% of CO₂ emissions in 2022, highlighting the urgency of transitioning to greener technologies. Rental companies can capitalize on this trend by offering electric, hybrid, and low-emission equipment. The European Rental Association noted in 2023 that the share of eco-friendly equipment in rental fleets increased by 15%, driven by growing demand for sustainable solutions. This shift allows rental providers to align with regulatory trends and cater to environmentally conscious clients.

Expansion of Urban Infrastructure and Smart City Projects

The rapid development of urban infrastructure and smart city initiatives across Europe provides a significant growth opportunity for the construction equipment rental market. These projects require advanced machinery for construction and maintenance, which rental companies can supply flexibly and cost-effectively. The European Commission estimated that €270 billion will be invested annually in smart city projects through 2030, focusing on sustainable transport systems, green buildings, and energy-efficient utilities. For example, countries like the Netherlands and Sweden have launched extensive urban renewal programs to modernize infrastructure. This trend creates a consistent demand for technologically advanced and specialized rental equipment, positioning providers to play a critical role in supporting Europe’s urbanization and sustainability goals.

MARKET CHALLENGES

Intense Competition Among Rental Providers

The European construction equipment rental market faces a significant challenge due to intense competition, particularly among small and medium-sized providers. The market is highly fragmented, with numerous regional and local players striving to capture market share by offering competitive pricing. According to the European Rental Association, over 30,000 rental companies operate within the EU, with the majority being SMEs. This competition drives down rental rates, squeezing profit margins for providers. Additionally, larger rental companies, equipped with extensive fleets and advanced technologies, often dominate urban areas, leaving smaller firms with limited growth opportunities in rural markets. The crowded marketplace pressures rental providers to innovate continuously, which may not always be financially feasible for smaller companies.

Fluctuating Equipment Utilization Rates

Fluctuating equipment utilization rates, driven by seasonal and project-based construction activity, pose a challenge for the rental market. The European Commission reported that construction activity in the EU dropped by 4% during the winter months of 2022 due to adverse weather conditions and reduced project launches. This seasonal variation leads to periods of low demand, during which rental providers must bear the costs of maintaining idle machinery. Furthermore, unpredictable delays or cancellations of construction projects exacerbate this issue, affecting revenue stability. Addressing this challenge requires rental companies to diversify their client base and explore emerging markets to offset the impact of underutilization during off-peak periods.

SEGMENTAL ANALYSIS

By Product Insights

The earth-moving machinery segment dominated the Europe construction equipment rental market in 2024 by occupying 52.8% of the European market share. The domination of the segment is majorly driven by its extensive use in infrastructure projects, mining, and urban development. The German Federal Statistical Office reports that earth-moving equipment, such as excavators and bulldozers, is in high demand, with rental services growing by 12% in 2022. Its versatility and cost-effectiveness for short-term projects make it indispensable for contractors, driving its leadership in the rental market.

The concrete and road construction machinery segment is estimated to showcase the fastest CAGR during the forecast period owing to the increasing investments in road networks and sustainable infrastructure, such as the €1.8 trillion European Green Deal.

REGIONAL ANALYSIS

Germany emerged as the top performer in the European construction equipment rental market in 2024. The growth of the German market is majorly driven by the advanced infrastructure of Germany and high construction activity. According to the German Federal Statistical Office, the construction sector contributed approximately €143 billion to the economy in 2023, with significant investments in renewable energy projects and urban development. The demand for construction rental equipment in Europe is also driven by government-backed infrastructure initiatives and strict regulations promoting low-emission machinery. Major providers, such as Zeppelin Rental, dominate the market by offering diverse and sustainable fleets, catering to both residential and industrial projects.

The UK held a substantial share of the European market in 2024 and is expected to progress at a prominent CAGR during the forecast period owing to the large-scale housing and transport infrastructure projects. According to the UK Department for Transport, £24 billion was allocated in 2023 for road and rail upgrades, fueling demand for construction equipment rentals. The UK’s emphasis on cost-efficiency and short-term project flexibility makes renting equipment more viable than purchasing. Companies like Speedy Hire lead the market by providing extensive rental options and technology-integrated solutions.

France is a lucrative for construction rental equipment in Europe. The focus of France on urban modernization and sustainability is driving the French market growth. The Grand Paris Express project, Europe’s largest urban transport initiative, requires significant use of rental equipment for efficiency. The French Ministry of Ecological Transition reported that €40 billion was allocated to sustainable urban infrastructure in 2023. Key players, such as Loxam, dominate by offering specialized equipment for large-scale projects, reinforcing France’s leadership in this sector.

KEY MARKET PLAYERS

Loxam, Boels Rental, Ramirent, Kiloutou, Cramo, Mateco Group, HSS Hire, Zeppelin Rental, Riwal, Speedy Hire. These are the market players that are dominating the Europe construction equipment rental market.

MARKET SEGMENTATION

This research report on the Europe construction equipment rental market is segmented and sub-segmented into the following categories.

By Product Insight

- Earth Moving Machinery

- Excavators

- Wheel

- Crawler

- Loaders

- Backhoe Loaders

- Skid Steer Loaders

- Crawler/Track Loaders

- Wheeled Loaders

- Dump Trucks

- Moto Graders

- Dozers

- Wheel

- Crawler

- Excavators

- Material Handling Machinery

- Crawler Cranes

- Trailer Mounted Cranes

- Truck Mounted Cranes

- Forklift

- Concrete and Road Construction Machinery

- Concrete Mixer & Pavers

- Construction Pumps

- Others

By Region

- UK

- Russia

- Germany

- Italy

- France

- Spain

- Sweden

- Denmark

- Poland

- Switzerland

- Netherlands

- Rest of Europe

Frequently Asked Questions

What is the current market size of the Europe construction equipment rental market?

The Europe construction equipment rental market size was is anticipated to reach USD 39.11 billion in 2025

What segments are covered in the Europe construction equipment rental market?

The Product insights segment was covered in Europe's construction equipment rental market.

What are the market drivers that are driving the Europe construction equipment rental market?

The Cost-effectiveness and Financial Flexibility and Rising Infrastructure Investments Across Europe are driving the Europe construction equipment rental market

Who are the market players that are dominating the Europe construction equipment rental market?

Loxam, Boels Rental, Ramirent, Kiloutou, Cramo, Mateco Group, HSS Hire, Zeppelin Rental, Riwal, Speedy Hire. These are the market players that are dominating the Europe construction equipment rental market

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]