Europe Construction Equipment Market Size, Share, Trends & Growth Forecast Research Report – Segmented By Product Insights, Equipment Insights, Propulsion Insights, Engine Capacity Insights, Power Output Insights, And By Region (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe) - Industry Analysis From (2025 to 2033)

Europe Construction Equipment Market Size

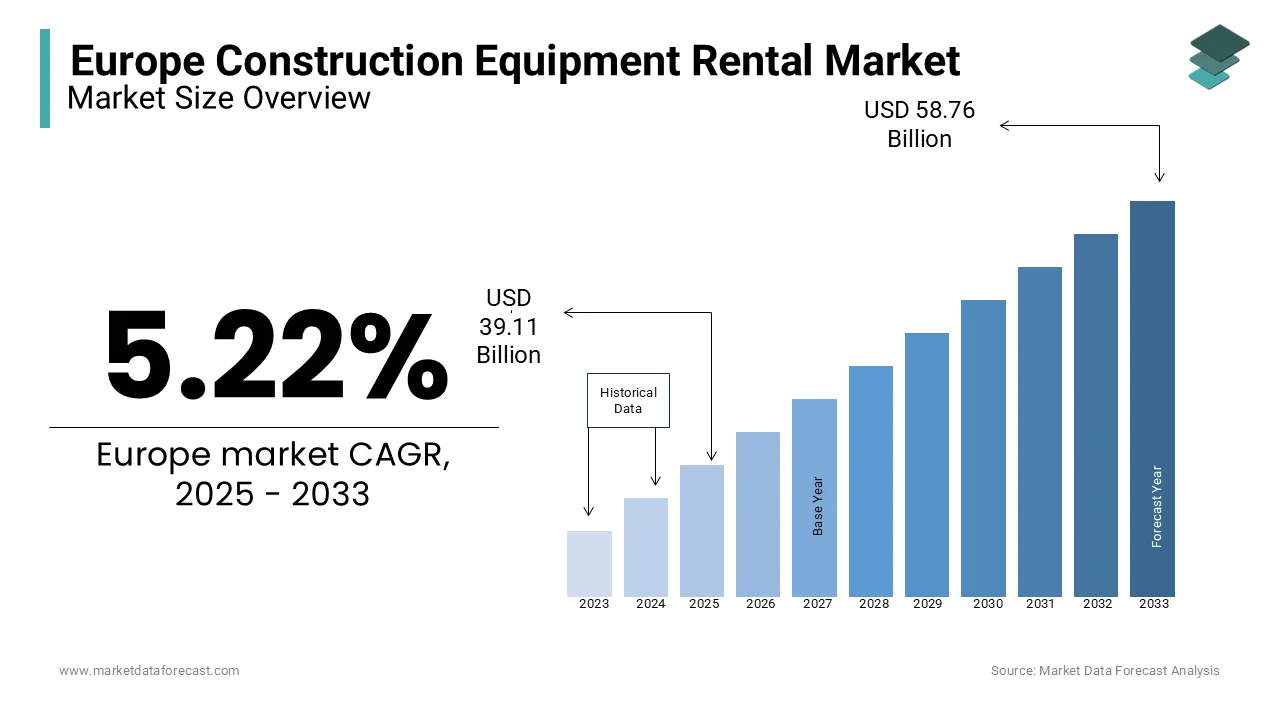

The European construction equipment market size was valued at USD 49.65 billion in 2024 and is anticipated to reach USD 52.79 billion in 2025 from USD 86.19 billion by 2033, growing at a CAGR of 6.32% from 2025 to 2033.

Construction equipment encompasses a broad spectrum of machinery and tools used in various construction activities, including earthmoving, material handling, road building, and concrete mixing. The growth of the Europe construction equipment market is driven by an upsurge in urbanization, government investments in infrastructure, and the adoption of technologically advanced machinery. According to Eurostat, construction activities accounted for approximately 9% of the European Union's GDP in 2022, which indicates the significant contribution of construction equipment to the regional economy. The European Investment Bank also reported an increase in infrastructure investments, totaling €60 billion in 2023, with a focus on sustainable and smart projects.

MARKET DRIVERS

Government Investments in Infrastructure Development in Europe

The European construction equipment market is driven significantly by increased government investments in infrastructure. Initiatives such as the European Union’s Trans-European Transport Network (TEN-T) aim to enhance cross-border connectivity through the development of highways, railways, and ports. According to the European Investment Bank, infrastructure financing reached €60 billion in 2023, with a substantial portion allocated to smart and sustainable construction projects. This surge in funding has amplified the demand for advanced construction machinery, including excavators, loaders, and road-building equipment. Additionally, countries like Germany and France have allocated large budgets for renovating aging infrastructure, further bolstering the sector. These initiatives not only fuel equipment sales but also encourage the adoption of innovative, eco-friendly machinery.

Technological Advancements in Construction Equipment

The integration of advanced technologies, such as telematics, automation, and electric drivetrains, is a key driver in the European construction equipment market. Autonomous machinery equipped with GPS and AI capabilities enhances operational efficiency and safety on construction sites. According to the European Commission, the adoption of digital solutions in construction increased by 30% between 2021 and 2023, highlighting a shift towards innovation. Hybrid and electric construction equipment also gained momentum, aligning with the EU’s Green Deal targets for carbon neutrality. Manufacturers like Volvo Construction Equipment reported a 15% increase in sales of electric compact machines in 2022, demonstrating the rising preference for environmentally sustainable solutions across the region.

MARKET RESTRAINTS

High Costs of Advanced Construction Equipment

The high costs associated with advanced construction equipment are a significant restraint in the European market. Technologically enhanced machinery, such as electric excavators and autonomous cranes, often comes with a price tag that is unaffordable for small and medium-sized enterprises (SMEs). According to the European Commission, over 99% of EU construction companies are SMEs, many of which face financial constraints in adopting cutting-edge equipment. The upfront costs of electric machinery can be 20-30% higher than conventional diesel-powered counterparts, as reported by the International Energy Agency in 2023. Additionally, the lack of sufficient subsidies for such equipment further limits its adoption, posing a challenge for market expansion, particularly among smaller firms.

Stringent Environmental Regulations and Compliance Costs

Stringent environmental regulations in Europe, such as those under the EU Green Deal and Emission Standards for Non-Road Mobile Machinery (NRMM), create challenges for manufacturers and end-users alike. These regulations mandate significant reductions in emissions, pushing companies to upgrade their fleets to comply with Stage V emission standards. According to Eurostat, compliance costs for transitioning to low-emission equipment rose by approximately 25% between 2020 and 2023. This financial burden often impacts smaller firms and limits their ability to invest in newer machinery. Furthermore, the phased-out use of diesel engines in several countries, including Germany and France, has increased the urgency for replacements, adding to market constraints.

MARKET OPPORTUNITIES

Rising Demand for Sustainable Construction Solutions

The European construction equipment market is poised to benefit from the increasing focus on sustainable construction solutions. The EU’s commitment to achieving net-zero emissions by 2050 under the European Green Deal has incentivized the adoption of eco-friendly construction practices. According to the European Environment Agency, green construction accounted for 35% of the total sector output in 2022, with expectations to grow further. Equipment manufacturers are capitalizing on this trend by introducing electric and hybrid machinery that reduces carbon footprints. For example, Volvo Construction Equipment reported a 20% rise in sales of electric compact machines in 2023, reflecting the growing demand for low-emission alternatives. This shift provides manufacturers with a lucrative opportunity to innovate and expand their sustainable product offerings.

Expansion of Smart Cities Initiatives

The development of smart cities across Europe presents a significant growth opportunity for the construction equipment market. These initiatives require extensive infrastructure development, including roads, public transport systems, and green buildings, driving demand for advanced machinery. The European Commission estimated that €270 billion will be invested annually in smart city projects through 2030, emphasizing technological integration and sustainability. Smart construction equipment with telematics and automation features is increasingly being utilized to meet the precision and efficiency requirements of such projects. Countries like Germany and France are leading the way, with large-scale investments in smart urban development. This trend positions the construction equipment market to play a pivotal role in shaping Europe’s smart and connected cities.

MARKET CHALLENGES

Shortage of Skilled Operators and Workforce

The European construction equipment market faces a significant challenge due to the shortage of skilled operators and workforce. Modern machinery, especially those incorporating advanced technologies like automation and telematics, requires specialized training for effective operation. According to the European Centre for the Development of Vocational Training (Cedefop), there was a 20% reduction in the availability of skilled construction workers in the EU between 2015 and 2022. This shortage has resulted in project delays and underutilization of high-tech equipment. The problem is further exacerbated in rural areas and smaller markets, where access to training programs is limited. Addressing this challenge requires collaborative efforts between manufacturers, governments, and training institutions to develop targeted skill-development programs.

Fluctuating Raw Material Prices and Supply Chain Disruptions

Volatility in raw material prices and supply chain disruptions significantly impact the European construction equipment market. Key components such as steel and aluminum have experienced price fluctuations due to geopolitical tensions and global supply chain challenges. The World Steel Association reported that European steel prices increased by 35% in 2022 compared to the previous year. Additionally, the COVID-19 pandemic and the ongoing Ukraine conflict have disrupted supply chains, causing delays in equipment production and delivery. Such challenges increase production costs and extend lead times, making it difficult for manufacturers to meet market demand. These disruptions underscore the need for diversifying supply chains and adopting cost-effective material alternatives to ensure stability in the market.

SEGMENTAL ANALYSIS

By Product Insights

The earth-moving machinery segment dominated the market by capturing 45.3% of the European market share in 2024. The extensive use of earth-moving machinery in infrastructure development, mining, and urban construction projects is one of the key factors contributing to the domination of the earth-moving machinery segment in the European market. As per the reports of the German Federal Statistical Office, Germany was Europe’s largest construction market and invested over €100 billion in infrastructure projects in 2022. Earth-moving machinery is essential for foundational construction activities, making it a cornerstone of the regional construction industry's growth and development.

On the other hand, the concrete and road construction machinery segment is anticipated to be the fastest-growing segment and exhibit a CAGR of 7.8% over the forecast period. According to the European Commission, investments in road networks and sustainable infrastructure, such as the €1.8 trillion European Green Deal, are increasing. A report by the International Road Federation notes that road construction activities in Europe grew by 12% in 2023, fueled by urbanization and the need for efficient transportation networks. Concrete and road construction machinery, including pavers and mixers, are critical for building durable and eco-friendly infrastructure, underscoring their importance in achieving Europe’s long-term development goals.

By Equipment Insights

The heavy construction equipment segment captured the leading share of 60.9% of the European market in 2024. The domination of heavy construction equipment in the European market is primarily due to its critical role in large-scale infrastructure projects such as highways, bridges, and commercial developments. According to the reports of the German Federal Statistical Office, the construction sector of Germany is valued at over €400 billion and relies heavily on heavy equipment like cranes, excavators, and bulldozers for major projects. Heavy construction equipment is indispensable for handling demanding tasks, ensuring efficiency, and meeting the growing infrastructure needs across Europe.

The compact construction equipment segment is predicted to grow at a CAGR of 8.2% over the forecast period. The European Commission highlights that urbanization and the rise of small-scale residential projects are driving demand for compact machinery such as mini excavators and skid-steer loaders. A report by the European Urban Initiative notes that urban construction activities increased by 10% in 2023, fueled by the need for space-efficient solutions in densely populated areas. Compact construction equipment is vital for its versatility, maneuverability, and ability to operate in confined spaces, making it essential for modern urban development and sustainable construction practices.

By Propulsion Insights

The ICE equipment segment ruled the market and had 75.1% of the European market share in 2024. According to the European Construction Equipment Association, ICE-powered machinery dominates due to its widespread availability, high power output, and suitability for heavy-duty applications. The German Federal Ministry for Economic Affairs and Energy reports that ICE equipment remains the preferred choice for large-scale infrastructure projects, with over 80% of construction sites relying on diesel-powered machinery. Despite environmental concerns, ICE equipment’s reliability and performance make it indispensable for meeting the demands of Europe’s construction industry.

The electric segment is anticipated to grow significantly over the forecast period by registering a CAGR of 12.5%. According to the European Commission, stringent emissions regulations and the push for sustainability under the European Green Deal are driving the adoption of electric machinery. A report by the International Energy Agency notes that electric construction equipment sales in Europe increased by 25% in 2023, supported by advancements in battery technology and government incentives. Electric equipment is crucial for reducing carbon emissions, lowering operational costs, and aligning with Europe’s goal of achieving carbon neutrality by 2050, making it a key driver of the segmental expansion.

By Engine Capacity Insights

The 250-500 HP range segment dominated the market by accounting for 45.4% of the European market share in 2024. The versatility of 250-500 HP range engine capacity in handling medium to heavy-duty tasks across infrastructure, mining, and industrial projects is primarily propelling the segmental growth. According to the German Federal Statistical Office, equipment in this range, such as mid-sized excavators and loaders and is widely used in Germany’s construction sector and accounts for over 20% of Europe’s total construction output. Its balance of power and efficiency makes it essential for a wide range of applications, driving the expansion of the 250-500 HP range segment in the European market.

The more than 500 HP segment is predicted to witness the fastest CAGR of 9.3% over the forecast period. The growing investments in large-scale infrastructure projects, such as highways, ports, and renewable energy installations, are fueling demand for high-capacity machinery. A report by the International Energy Agency notes that the renewable energy sector’s expansion, with a 20% annual growth in wind farm construction, is a key driver. High-capacity equipment, such as heavy-duty cranes and bulldozers, is critical for executing large projects efficiently, underscoring its importance in supporting Europe’s infrastructure development and sustainability goals.

By Power Output Insights

The 101-200 HP range segment accounted for 40.3% of the European market share in 2024 owing to the widespread use of the 101-200 HP range in residential and commercial construction projects, as these offer an optimal balance of power and fuel efficiency. The equipment of 101-200 HP in this range, such as compact excavators and loaders, is highly popular in urban development projects, which grew by 8% in 2022. Its versatility and cost-effectiveness make it indispensable for small to medium-scale construction activities across Europe.

The >401 HP category segment is on the rise and is estimated to register a CAGR of 10.2% over the forecast period. The growing investments in large-scale infrastructure, such as highways, ports, and renewable energy projects, are driving demand for high-power machinery and contributing to the segmental expansion. A report by the International Energy Agency notes that the renewable energy sector, particularly wind and solar farm construction, grew by 18% in 2023, significantly boosting the need for heavy-duty equipment. High-power machinery, such as cranes and bulldozers, is critical for executing large projects efficiently, underscoring its importance in supporting Europe’s infrastructure modernization and sustainability initiatives.

REGIONAL ANALYSIS

Germany held the major share of the European construction equipment market in 2024. The advanced manufacturing capabilities of Germany, strong infrastructure investments, and emphasis on sustainable development have led to Germany's dominance in the European market. The German Construction Industry Federation reported that infrastructure projects accounted for €150 billion in investments in 2023, driven by renewable energy initiatives and urban development. Germany's focus on technological advancements, including automation and electrification in equipment, also positions it as a leader. Major manufacturers like Liebherr and Wirtgen Group, headquartered in Germany, further contribute to the market's dominance with innovative machinery and global exports.

The UK is another key regional market for construction equipment in Europe. The substantial investments in urban renewal and housing projects is one of the major factors driving the UK construction equipment market growth. According to the UK Department for Levelling Up, Housing, and Communities, the government allocated £12 billion in 2023 for housing and transport infrastructure, boosting demand for construction machinery. The UK’s ongoing commitment to achieving net-zero emissions by 2050 has also driven the adoption of energy-efficient equipment, making it a leader in sustainability-focused construction efforts.

France ranks highly in the European construction market and is likely to account for a substantial share of the European market over the forecast period due to the availability of investments in high-speed railways and urban infrastructure under the Grand Paris Express project, Europe’s largest transport initiative. The French Ministry of Ecological Transition reported that €40 billion was allocated for this project in 2023 alone. France’s focus on modernizing its aging infrastructure and promoting eco-friendly construction equipment solidifies its position as a top market leader.

KEY MARKET PLAYERS

Caterpillar Inc., Komatsu Ltd., Volvo Construction Equipment, Hitachi Construction Machinery, Liebherr Group, JCB (Joseph Cyril Bamford Excavators Ltd.), CNH Industrial (Case Construction & New Holland Construction), Doosan Infracore, Hyundai Construction Equipment, Manitou Group. These are the market players that are dominating the Europe construction equipment market.

MARKET SEGMENTATION

This research report on the Europe construction equipment market is segmented and sub-segmented into the following categories.

By Product

- Earth Moving Machinery

- Excavators

- Wheel

- Crawler

- Loaders

- Backhoe Loaders

- Skid Steer Loaders

- Crawler/Track Loaders

- Wheeled Loaders

- Dump Trucks

- Moto Graders

- Dozers

- Wheel

- Crawler

- Excavators

- Material Handling Machinery

- Crawler Cranes

- Trailer Mounted Cranes

- Truck Mounted Cranes

- Forklift

- Concrete and Road Construction Machinery

- Concrete Mixer & Pavers

- Construction Pumps

- Others

By Equipment Type

- Heavy Construction Equipment

- Compact Construction Equipment

By Propulsion Type

- ICE

- Electric

- CNG/LNG

By Engine Capacity

- Up to 250 HP

- 250-500 HP

- More than 500 HP

By Power Output

- <100 HP

- 101-200 HP

- 201-400 HP

- >401 HP

By Region

- UK

- Russia

- Germany

- Italy

- France

- Spain

- Sweden

- Denmark

- Poland

- Switzerland

- Netherlands

- Rest of Europe

Frequently Asked Questions

what is the is the current market size of the Europe construction equipment market?

The European construction equipment market size is expected to reach USD 52.79 Bn by 2025

What are the market drivers that are driving the Europe construction equipment market?

Government Investments in Infrastructure Development in Europe and Technological Advancements in Construction Equipment are driving the European construction equipment market.

What segments are added in the Europe construction equipment market?

These are the market segments that are added in the Europe construction equipment market are Equipment Insights, Propulsion Insights, Engine Capacity Insights, Power Output Insights,

who are market key players that are dominating the Europe construction equipment market?

Caterpillar Inc., Komatsu Ltd., Volvo Construction Equipment, Hitachi Construction Machinery, Liebherr Group, JCB (Joseph Cyril Bamford Excavators Ltd.), CNH Industrial (Case Construction & New Holland Construction), Doosan Infracore, Hyundai Construction Equipment, Manitou Group.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]