Europe Construction Chemicals Market Size, Share, Trends & Growth Forecast Report By Product (Admixture, Adhesives, Sealants, Coatings), Application, and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2025 to 2033

Europe Construction Chemicals Market Size

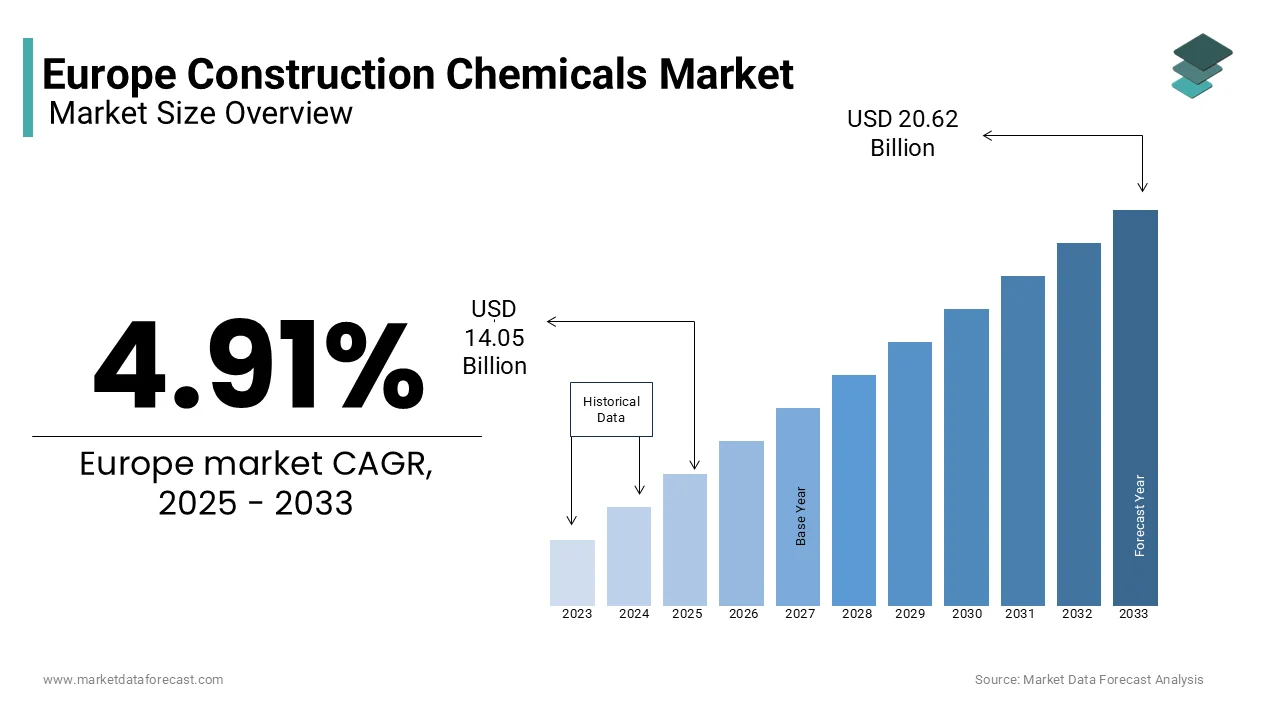

The Construction chemicals market size in Europe was valued at USD 13.39 billion in 2024. The European market is estimated to be worth USD 20.62 billion by 2033 from USD 14.05 billion in 2025, growing at a CAGR of 4.91% from 2025 to 2033.

Construction chemicals are a wide array of chemical formulations designed to enhance the performance, durability, and sustainability of construction materials. These chemicals include admixtures, adhesives, sealants, waterproofing agents, protective coatings, and concrete additives, all of which play pivotal roles in modern construction practices. As urbanization accelerates and infrastructure development gains momentum across Europe, the demand for high-performance construction chemicals has surged due to the need for energy-efficient buildings, sustainable construction solutions, and compliance with stringent environmental regulations.

The demand for construction chemicals in Europe is expected to continue to grow promisingly during the forecast period owing to the increased investments in residential, commercial, and industrial infrastructure projects, particularly in countries like Germany, France, and the United Kingdom. Furthermore, Statista highlights that the rising adoption of green building standards, such as BREEAM and LEED certifications, has bolstered the demand for eco-friendly construction chemicals. The ongoing refurbishment of aging infrastructure, coupled with government initiatives aimed at reducing carbon footprints, further amplifies market prospects. For instance, the European Green Deal emphasizes sustainable construction practices, creating opportunities for innovative chemical solutions that align with circular economy principles.

MARKET DRIVERS

Increasing Focus on Sustainable and Energy-Efficient Building Practices

The push for sustainable construction practices is a significant driver of the Europe construction chemicals market. The European Union’s ambitious climate goals, as outlined in the European Green Deal, emphasize reducing carbon emissions and enhancing energy efficiency in buildings. Eurostat reveals that nearly 75% of Europe’s existing building stock is energy inefficient, necessitating widespread renovations. This has led to heightened demand for advanced construction chemicals, such as thermal insulation coatings, low-VOC adhesives, and eco-friendly sealants, which contribute to improved energy performance. The International Energy Agency (IEA) reports that the construction sector accounts for approximately 36% of CO2 emissions in Europe, prompting governments to incentivize green building projects. For instance, Germany’s KfW Development Bank provides subsidies for energy-efficient retrofits, further driving the adoption of sustainable chemical solutions. These initiatives underscore the critical role of construction chemicals in meeting Europe’s sustainability targets.

Rising Investment in Infrastructure Development Across Europe

Another major driver is the substantial investment in infrastructure development, supported by the EU’s Recovery and Resilience Facility (RRF). The European Investment Bank highlights that over €672 billion has been allocated under the RRF to modernize infrastructure, including transport networks, housing, and public facilities. This funding has significantly increased the demand for high-performance construction chemicals, particularly concrete admixtures, waterproofing agents, and protective coatings. According to the European Construction Industry Federation (FIEC), infrastructure projects in Eastern Europe are growing at an annual rate of 4.8%, creating lucrative opportunities for chemical manufacturers. Additionally, the United Nations Economic Commission for Europe (UNECE) projects that urbanization rates will reach 85% by 2050, further amplifying the need for durable and innovative materials. The challenging weather conditions in regions like Scandinavia also drive demand for specialized chemicals, ensuring long-term growth prospects for the market.

MARKET RESTRAINTS

Stringent Environmental Regulations and Compliance Costs

The Europe construction chemicals market faces challenges due to stringent environmental regulations that govern the production and use of chemical products. The European Chemicals Agency (ECHA) enforces regulations like REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals), which mandates rigorous testing and approval processes for chemical substances. While these regulations aim to protect human health and the environment, they also increase compliance costs for manufacturers. According to the European Environment Agency, companies spend an estimated €2 billion annually on compliance-related activities, including testing and documentation. These costs often limit innovation and deter smaller players from entering the market. Furthermore, the phase-out of certain hazardous substances under REACH has disrupted supply chains, leading to delays in product availability. Such regulatory pressures create significant barriers, particularly for manufacturers striving to balance sustainability with profitability in a highly competitive market.

Economic Uncertainty and Fluctuating Raw Material Prices

Economic uncertainty and fluctuating raw material prices pose another major restraint for the Europe construction chemicals market. The European Central Bank reports that inflation rates across the Eurozone averaged 8.4% in 2022, driven by geopolitical tensions and supply chain disruptions. This volatility has directly impacted the cost of key raw materials such as epoxy resins, polyurethane, and acrylics, which are essential for manufacturing construction chemicals. The International Monetary Fund (IMF) highlights that rising energy prices have further exacerbated production costs, with natural gas prices in Europe surging by over 200% in 2022. These factors have squeezed profit margins for chemical manufacturers, forcing them to pass on higher costs to end consumers. Additionally, economic slowdowns in key markets like Italy and Spain have dampened construction activity, reducing demand for construction chemicals. Such financial pressures hinder market growth and create uncertainties for stakeholders across the value chain.

MARKET OPPORTUNITIES

Growing Demand for Retrofitting and Renovation Projects

A significant opportunity for the Europe construction chemicals market lies in the increasing demand for retrofitting and renovation projects, driven by aging infrastructure and energy efficiency mandates. The European Commission estimates that over 34 million buildings in Europe require renovation to meet current energy performance standards. Programs like the Renovation Wave Initiative aim to double annual renovation rates by 2030, creating a substantial market for advanced construction chemicals such as insulating coatings, adhesives, and sealants. Eurostat highlights that the renovation sector accounts for nearly 57% of Europe’s total construction activity, with countries like France and Germany leading investments in energy-efficient upgrades. Additionally, the European Investment Bank reports that public and private funding for renovations is expected to exceed €350 billion annually by 2030. This focus on modernizing existing structures presents lucrative opportunities for chemical manufacturers to innovate and cater to the growing retrofitting market.

Expansion of Smart and Green Building Technologies

The rapid expansion of smart and green building technologies offers another promising avenue for growth in the Europe construction chemicals market. The European Construction Technology Platform (ECTP) states that the green building sector is projected to grow at a CAGR of 10.12% through 2028, driven by policies like the EU Green Deal and BREEAM certifications. These initiatives emphasize the use of sustainable materials and innovative chemical solutions, such as self-healing concrete and photocatalytic coatings, which enhance building longevity and reduce environmental impact. According to the International Energy Agency (IEA), green buildings currently account for 25% of new constructions in Europe, with this share expected to rise significantly. Furthermore, the European Environment Agency notes that smart building technologies, including IoT-enabled systems, are increasingly integrated into construction projects, driving demand for specialized chemicals. This convergence of sustainability and technology creates immense potential for market players to develop cutting-edge products aligned with future construction trends.

MARKET CHALLENGES

Supply Chain Disruptions and Raw Material Scarcity

Supply chain disruptions and raw material scarcity have emerged as significant challenges for the Europe construction chemicals market, exacerbated by geopolitical tensions and global trade uncertainties. The European Commission highlights that over 60% of raw materials used in construction chemicals, such as epoxy resins and polyurethane, are imported from non-EU countries, making the supply chain vulnerable to external shocks. The Organisation for Economic Co-operation and Development (OECD) reports that global supply chain disruptions caused a 15% increase in raw material costs in 2022, severely impacting production timelines and profitability. Additionally, the European Chemical Industry Council (CEFIC) notes that shortages of critical materials like titanium dioxide have led to delays in manufacturing high-performance coatings and adhesives. These challenges are further compounded by logistical bottlenecks, with port congestion and transportation delays reported across major European hubs. Such disruptions hinder the ability of manufacturers to meet rising demand, creating operational inefficiencies.

High Initial Costs and Limited Adoption in Emerging Markets

Another pressing challenge is the high initial cost of advanced construction chemicals, which limits their adoption, particularly in emerging markets within Europe. The European Investment Bank states that small and medium-sized enterprises (SMEs) account for over 90% of construction companies in Eastern Europe, where budget constraints often prioritize cheaper, conventional materials over innovative chemical solutions. According to Eurostat, construction spending in these regions grew by only 2.3% in 2022, reflecting limited financial capacity to invest in premium products. Furthermore, the European Construction Industry Federation (FIEC) highlights that awareness about the long-term benefits of advanced chemicals remains low among smaller contractors, leading to slower market penetration. While larger economies like Germany and France drive innovation, the lack of widespread adoption in less developed markets creates an uneven growth trajectory. Bridging this gap requires targeted education and financial incentives to encourage broader acceptance of advanced construction chemicals.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

4.91% |

|

Segments Covered |

By Product, Application, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, Rest of Europe |

|

Market Leaders Profiled |

Ashland Global Holdings Inc BASF SE MAPEI S.p.A Sika AG Compagnie de Saint-Gobain S.A. Pidilite Industries Limited RPM International Inc Fosroc Inc and Dow Chemicals, and others. |

SEGMENTAL ANALYSIS

By Product Insights

The admixtures segment dominated the Europe construction chemicals market by capturing 36.4% of the European market share in 2024. The domination of the admixtures segment is majorly driven by their critical role in enhancing concrete performance, particularly in infrastructure projects like highways and bridges, which account for over 70% of admixture applications. The segment's importance lies in its ability to improve durability and sustainability, aligning with EU Green Deal objectives. Eurostat highlights that infrastructure spending in Europe exceeded €200 billion in 2022, further propelling demand. With urbanization and renovation drives, admixtures remain indispensable for achieving energy-efficient and long-lasting structures.

The coatings segment is another promising segment and is predicted to grow at a CAGR of 6.2% over the forecast period owing to the rising demand for protective and eco-friendly coatings, such as anti-corrosion and photocatalytic formulations, which reduce air pollution by up to 80% in urban areas, per the European Environment Agency. The push for sustainable construction under the EU Green Deal has amplified adoption, with the segment valued at €10 billion in 2022. Innovations in fire-retardant and thermal-insulating coatings further drive expansion, making this segment pivotal for modernizing Europe’s building stock while addressing environmental challenges.

By Application Insights

The residential segment led the Europe construction chemicals market by occupying a share of 45.8% in the European market in 2024. Factors such as urbanization, increasing demand for durable and energy-efficient housing are propelling the growth of the residential segment in the European market. The European Mortgage Federation (EMF) highlights that renovation projects, supported by initiatives like Germany’s KfW subsidies, are propelling growth. Residential applications heavily rely on adhesives, sealants, and insulation coatings to meet stringent energy efficiency standards. The International Energy Agency (IEA) notes that improving residential energy performance can reduce household energy use by 30%, underscoring the segment's importance. With urban housing needs rising, residential construction remains pivotal for sustainable development.

The non-residential segment is predicted to grow at the highest CAGR of 5.8% over the forecast period. The growth of the non-residential segment is fueled by EU investments, including €672 billion under the Recovery and Resilience Facility, targeting infrastructure, hospitals, and commercial buildings. The push for green certifications like BREEAM drives demand for advanced coatings and admixtures, which enhance durability and sustainability. The European Investment Bank reports that non-residential projects are central to modernizing aging infrastructure, particularly in Eastern Europe, where industrial output grew by 4.8% annually. This segment’s focus on innovation and sustainability ensures its rapid expansion, making it crucial for achieving Europe’s climate goals.

REGIONAL ANALYSIS

Germany had largest share of 26.1% of the European market share in 2024. The domination of Germany is driven by its robust infrastructure development initiatives, supported by the European Investment Bank, which highlights that Germany accounts for over €100 billion annually in construction investments. The push for energy-efficient buildings under the EU Green Deal has further driven demand for advanced chemical solutions like thermal insulation coatings and eco-friendly adhesives. Additionally, the Federal Ministry for Economic Affairs and Climate Action emphasizes that Germany’s focus on retrofitting aging infrastructure aligns with sustainability goals. With strong industrial growth and innovation in green technologies, Germany remains pivotal in shaping the region’s construction chemicals landscape.

France is another top performer in the European market and had 18.6% of the European market share in 2024. The prominent position of France in the European market is attributed to its large-scale renovation projects and adherence to BREEAM certifications, which promote sustainable construction practices. The French Environment and Energy Management Agency (ADEME) reports that over 40% of public buildings are undergoing energy-efficient upgrades, driving demand for high-performance sealants and coatings. Furthermore, the European Construction Industry Federation (FIEC) highlights France’s commitment to modernizing urban infrastructure, particularly in Paris and Lyon, creating lucrative opportunities for chemical manufacturers. These initiatives ensure France remains at the forefront of the construction chemicals market.

Italy is projected to expand at a CAGR of 4.9% during the forecast period in the European market. The extensive focus of France on restoring historical structures and upgrading aging infrastructure, supported by EU funding programs like the Recovery and Resilience Facility are driving the Italian market growth. The Italian Ministry of Infrastructure and Transport states that over €30 billion is allocated for infrastructure projects, boosting demand for admixtures and protective coatings. Additionally, the European Environment Agency notes that Italy’s adoption of green building standards has accelerated the use of eco-friendly chemicals in residential and non-residential sectors. This blend of heritage preservation and modernization solidifies Italy’s prominence in the regional market.

KEY MARKET PLAYERS

The major key players in Europe Construction Chemicals market are Ashland Global Holdings Inc BASF SE MAPEI S.p.A Sika AG Compagnie de Saint-Gobain S.A. Pidilite Industries Limited RPM International Inc Fosroc Inc and Dow Chemicals

MARKET SEGMENTATION

This research report on the Europe construction chemicals market is segmented and sub-segmented into the following categories.

By Product

- Admixture

- Adhesives

- Sealants

- Coatings

By Application

- Residential

- Non-Residential

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. What is the growth outlook for the construction chemicals market in Europe?

The European construction chemicals market is expected to grow from USD 13.39 billion in 2024 to USD 20.62 billion by 2033, with a CAGR of 4.91%.

2. What opportunities exist in the European construction chemicals market?

The European construction chemicals market is poised for growth due to increasing demand for retrofitting and renovation projects. The European Commission estimates that over 34 million buildings require renovation to meet current energy performance standards.

3. Who are the key players in the European construction chemicals market?

The major key players in Europe Construction Chemicals market are Ashland Global Holdings Inc BASF SE MAPEI S.p.A Sika AG Compagnie de Saint-Gobain S.A. Pidilite Industries Limited RPM International Inc Fosroc Inc and Dow Chemicals

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]