Europe Construction Aggregates Market Size, Share, Trends & Growth Forecast Report By Type (Crushed Stones, Sand & Gravel, Recycled Aggregates, Others ), Application, End-user and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe), Industry Analysis From 2025 to 2033

Europe Construction Aggregates Market Size

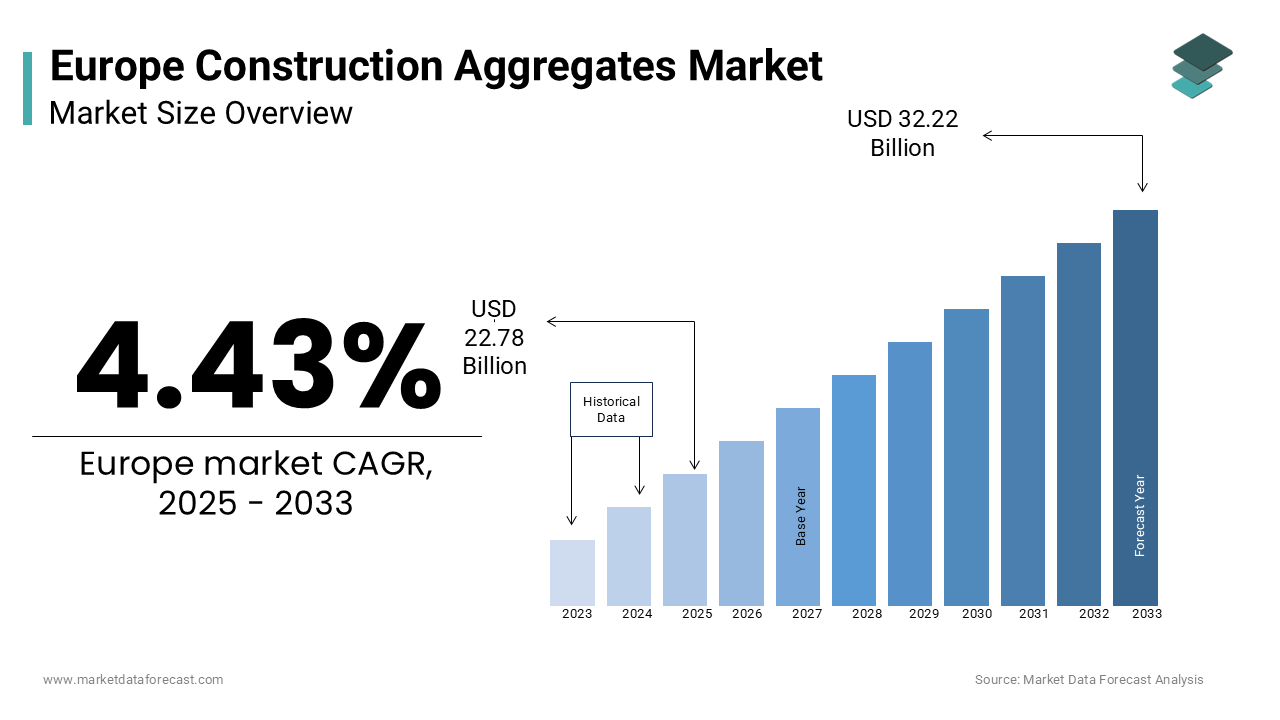

The europe construction aggregates market was worth USD 21.81 billion in 2024. The European market is estimated to grow at a CAGR of 4.43% from 2025 to 2033 and be valued at USD 32.22 billion by the end of 2033 from USD 22.78 billion in 2025.

Construction aggregates are a wide range of materials such as sand, gravel, crushed stone, and recycled aggregates. These materials are essential for various construction applications, including concrete production, road construction, and infrastructure development. The European construction aggregates market is characterized by its significant contribution to the overall economy, as aggregates are the most consumed materials globally, second only to water. The European construction sector is experiencing a resurgence, with a reported growth rate of 4.5% in 2021, according to the European Construction Industry Federation. This growth is fueled by government initiatives aimed at enhancing infrastructure, promoting sustainable construction practices, and addressing housing shortages. Furthermore, the shift towards recycling and the use of sustainable materials is reshaping the market landscape, as stakeholders increasingly prioritize eco-friendly practices. As the construction industry evolves, the aggregates market is poised for significant growth, driven by innovation, sustainability, and the ongoing demand for high-quality construction materials.

MARKET DRIVERS

Infrastructure Development Initiatives

The ongoing infrastructure development initiatives across Europe is a primary driver for the construction aggregates market in Europe. Governments are increasingly investing in infrastructure projects to stimulate economic growth, enhance connectivity, and improve public services. According to the European Commission, the EU plans to allocate over €1 trillion for infrastructure projects under the Next Generation EU recovery plan, which aims to support member states in their recovery from the COVID-19 pandemic. This substantial investment is expected to create a surge in demand for construction aggregates, as these materials are fundamental for road construction, bridges, and public transport systems. Additionally, the European Union's commitment to sustainable development and green infrastructure is driving the adoption of innovative construction practices, further increasing the need for high-quality aggregates. As countries prioritize infrastructure improvements to meet the demands of a growing population and evolving economic landscape, the construction aggregates market is set to benefit significantly from these initiatives, ensuring a robust growth trajectory in the coming years.

Urbanization and Housing Demand

The rapid urbanization and increasing housing demand in Europe are further propelling the construction aggregates market expansion in Europe. As urban populations continue to grow, the need for residential and commercial buildings is escalating, leading to a surge in construction activities. According to Eurostat, the urban population in the EU is projected to reach 80% by 2050, necessitating the construction of millions of new housing units. This trend is particularly pronounced in major cities, where housing shortages are becoming critical. The construction of new homes, along with the renovation and expansion of existing structures, requires substantial quantities of aggregates. Furthermore, the European Commission's initiatives to promote affordable housing and sustainable urban development are expected to further stimulate demand for construction aggregates. As the construction industry adapts to meet the challenges of urbanization, the aggregates market is poised for significant growth, driven by the ongoing need for high-quality materials to support housing and infrastructure projects.

MARKET RESTRAINTS

Environmental Regulations and Sustainability Concerns

The stringent environmental regulations and sustainability concerns is a notable restraint on the Europe construction aggregates market. The extraction and production of aggregates can have significant environmental impacts, including habitat destruction, water pollution, and increased carbon emissions. In response to these concerns, European governments have implemented strict regulations governing the extraction and use of natural resources. For instance, the European Union's Environmental Impact Assessment Directive mandates comprehensive assessments for construction projects, which can delay project timelines and increase costs. Additionally, the growing emphasis on sustainability is prompting the construction industry to seek alternative materials and practices, such as recycled aggregates and eco-friendly construction methods. While these trends are beneficial for the environment, they can pose challenges for traditional aggregate suppliers who must adapt to changing market demands. As the industry navigates these regulatory landscapes and sustainability initiatives, the construction aggregates market may face constraints that could impact growth and profitability.

Supply Chain Disruptions

Supply chain disruptions have emerged as a significant challenge for the Europe construction aggregates market, particularly in the wake of the COVID-19 pandemic. The pandemic has exposed vulnerabilities in global supply chains, leading to delays in the delivery of essential materials and increased costs. According to the European Construction Industry Federation, 70% of construction companies reported experiencing supply chain issues in 2021, with many citing difficulties in sourcing aggregates and other construction materials. These disruptions can hinder project timelines, increase construction costs, and ultimately impact the overall growth of the aggregates market. Furthermore, geopolitical tensions and trade restrictions can exacerbate supply chain challenges, leading to further uncertainty in the availability of aggregates. As the construction industry grapples with these supply chain issues, stakeholders must develop strategies to mitigate risks and ensure a stable supply of materials to support ongoing and future projects.

MARKET OPPORTUNITIES

Growth of Recycled Aggregates

The increasing focus on sustainability and the circular economy is a major opportunity for the Europe construction aggregates market, particularly in the realm of recycled aggregates. As the construction industry seeks to minimize its environmental footprint, the demand for recycled materials is on the rise. According to the European Aggregates Association, the use of recycled aggregates in construction is expected to grow at a CAGR of 6% from 2021 to 2026. This growth is driven by regulatory incentives and the industry's commitment to reducing waste and promoting sustainable practices. Recycled aggregates not only help conserve natural resources but also offer cost-effective alternatives to traditional materials. As construction companies increasingly adopt green building practices and prioritize sustainable sourcing, the market for recycled aggregates is poised for substantial expansion. This shift towards recycling and sustainability not only aligns with environmental goals but also presents a lucrative opportunity for businesses to innovate and capture market share in the evolving aggregates landscape.

Technological Advancements in Production

Technological advancements in the production and processing of construction aggregates represent another promising opportunity for market growth. Innovations in extraction techniques, processing technologies, and material handling systems are enhancing the efficiency and sustainability of aggregate production. For instance, the adoption of automated systems and artificial intelligence in quarry operations can significantly improve productivity and reduce operational costs. According to industry estimates, the implementation of advanced technologies in aggregate production can lead to efficiency gains of up to 20%. Furthermore, the integration of digital tools for supply chain management and logistics can streamline operations and enhance transparency in the aggregates market. As companies invest in technology to optimize their production processes and improve product quality, the construction aggregates market is likely to experience significant growth. Embracing these technological advancements not only enhances competitiveness but also aligns with the industry's broader goals of sustainability and efficiency.

MARKET CHALLENGES

Market Volatility and Price Fluctuations

Market volatility and price fluctuations are significant challenges for the Europe construction aggregates market. The prices of raw materials, including aggregates, are influenced by various factors such as demand-supply dynamics, geopolitical events, and economic conditions. For instance, the price of construction aggregates has seen fluctuations of up to 15% in recent years due to changes in demand from the construction sector and disruptions in supply chains. This volatility can create uncertainty for construction companies, making it difficult to budget and plan projects effectively. Additionally, rising costs of energy and transportation can further exacerbate price fluctuations, impacting the overall profitability of aggregate suppliers. As the market grapples with these challenges, stakeholders must develop strategies to mitigate risks associated with price volatility, such as long-term contracts and diversified sourcing strategies, to ensure stability and sustainability in their operations.

Competition from Alternative Materials

The increasing competition from alternative materials is a formidable challenge to the Europe construction aggregates market. As the construction industry evolves, there is a growing interest in using alternative materials, such as engineered aggregates, geopolymer concrete, and other innovative solutions that can replace traditional aggregates. These alternatives often offer enhanced performance characteristics, reduced environmental impact, and potential cost savings. For example, the use of recycled plastic waste as an aggregate substitute is gaining traction, particularly in urban construction projects. According to industry forecasts, the market for alternative construction materials is expected to grow at a CAGR of 8% over the next five years. This shift towards alternatives can pose a threat to traditional aggregate suppliers, who must adapt to changing market dynamics and consumer preferences. To remain competitive, stakeholders in the construction aggregates market must invest in research and development to innovate and diversify their product offerings, ensuring they can meet the evolving needs of the construction industry.

SEGMENTAL ANALYSIS

By Type Insights

The crushed stones segment accounted for 45.4% of the Europe construction aggregates market share in 2024. Crushed stones are widely utilized in various construction applications, including road construction, concrete production, and as a base material for foundations. The versatility and durability of crushed stones make them a preferred choice for construction projects across Europe. According to industry estimates, the demand for crushed stones is projected to grow at a CAGR of 4% from 2021 to 2026, driven by the ongoing infrastructure development and urbanization trends. The importance of this segment lies in its ability to provide essential materials for high-quality construction, ensuring the longevity and stability of structures. As governments and private sectors continue to invest in infrastructure projects, the crushed stones segment is expected to maintain its leading position in the aggregates market, supporting the overall growth of the construction industry.

The recycled aggregates segment is anticipated to register a promising CAGR of 6.08% over the forecast period owing to the increasing emphasis on sustainability and the circular economy is driving the demand for recycled aggregates, as construction companies seek to minimize waste and reduce their environmental impact. Recycled aggregates, derived from construction and demolition waste, offer a cost-effective and eco-friendly alternative to traditional materials. According to the European Aggregates Association, the use of recycled aggregates in construction is expected to rise significantly, with many countries implementing regulations to promote their use. The importance of this segment lies in its potential to conserve natural resources and reduce landfill waste, aligning with the broader goals of sustainable construction practices. As the industry continues to prioritize eco-friendly solutions, the recycled aggregates segment is poised for substantial growth, contributing to the overall evolution of the construction aggregates market.

By Application Insights

The structural material had the major share of 50.7% of the European market share in 2024. Structural materials are essential for the construction of buildings, bridges, and other infrastructure projects, providing the necessary strength and stability. The demand for structural aggregates is driven by the ongoing growth in the construction sector, particularly in residential and commercial projects. According to the European Construction Industry Federation, the construction sector in Europe is expected to grow at a rate of 4.5% annually, further fueling the need for structural materials. As urbanization and infrastructure development continue to expand, the structural material segment is expected to maintain its dominance in the aggregates market, supporting the overall growth of the construction sector.

The precast concrete segment is estimated to register a prominent CAGR in the European market over the forecast period owing to the increasing adoption of precast concrete in construction projects is driven by its numerous advantages, including reduced construction time, improved quality control, and enhanced sustainability. Precast concrete components are manufactured in controlled environments, allowing for greater precision and consistency compared to traditional on-site construction methods. According to industry analyses, the demand for precast concrete is rising due to its application in various sectors, including residential, commercial, and infrastructure development. The European precast concrete market is expected to benefit from the growing trend towards modular construction and off-site fabrication, which are becoming increasingly popular in response to labor shortages and the need for faster project delivery. The importance of this segment lies in its ability to provide efficient and sustainable construction solutions, aligning with the industry's broader goals of innovation and environmental responsibility. As the construction landscape continues to evolve, the precast concrete segment is well-positioned for significant growth, contributing to the overall advancement of the construction aggregates market.

By End-Use Insights

The infrastructure segment captured 41.4% of the European market share in 2024. This segment encompasses a wide range of applications, including roads, bridges, railways, and public utilities. The demand for aggregates in infrastructure projects is primarily driven by government investments aimed at enhancing transportation networks and public services. According to the European Commission, the EU plans to invest over €1 trillion in infrastructure development as part of its recovery plan, significantly boosting the demand for construction aggregates. The importance of this segment lies in its critical role in supporting economic growth and improving connectivity across regions. As urbanization and population growth continue to drive the need for robust infrastructure, the aggregates market is expected to benefit from sustained demand in this sector, ensuring its position as a key driver of the construction industry.

The residential construction segment is estimated to register a prominent CAGR in the European market over the forecast period owing to the increasing urbanization, population growth, and a rising demand for affordable housing. According to Eurostat, the EU's urban population is expected to reach 80% by 2050, necessitating the construction of millions of new housing units. This trend is particularly pronounced in major cities, where housing shortages are becoming critical. The importance of this segment lies in its ability to address the pressing need for housing while contributing to the overall growth of the construction aggregates market. As governments and private developers invest in residential projects to meet the growing demand, the residential construction segment is poised for significant expansion, reinforcing the aggregates market's role in supporting sustainable urban development.

REGIONAL ANALYSIS

Germany stands as the leading country in the Europe construction aggregates market by accounting for 25.7% of the European market share in 2024. The robust industrial base and advanced manufacturing capabilities of Germany contribute significantly to this dominance. The country is home to numerous automotive manufacturers and machinery producers, which are major consumers of construction aggregates. According to the German Engineering Federation, the construction sector in Germany generated over €300 billion in revenue in 2021, underscoring the critical role of aggregates in supporting infrastructure and building projects. Additionally, Germany's commitment to sustainability and innovation is driving the development of high-performance aggregates that meet the evolving needs of various industries. As the demand for construction materials continues to grow, Germany's position as a market leader is expected to remain strong, further solidifying its influence in the European aggregates market.

France was the second-largest market for construction aggregates in Europe. The French construction sector is characterized by significant investments in infrastructure and housing, with the government committing to various projects aimed at enhancing public services and transportation networks. According to the French Ministry of Ecological Transition, the construction industry in France is projected to grow at a rate of 3.5% annually, further driving the demand for aggregates. The emphasis on sustainable construction practices and the use of eco-friendly materials is also shaping the market landscape in France. As the country continues to invest in infrastructure and housing projects, the construction aggregates market is poised for continued growth, reinforcing France's position as a key player in the European market.

Italy is another major player in the Europe construction aggregates market. The Italian construction sector is experiencing a resurgence, driven by government initiatives aimed at revitalizing infrastructure and promoting sustainable building practices. According to the Italian National Institute of Statistics, the construction industry in Italy generated over €200 billion in revenue in 2021. The increasing focus on efficiency and performance in Italian industries is propelling the demand for high-quality aggregates. Additionally, Italy's strategic location within Europe facilitates trade and distribution, further enhancing its position in the aggregates market. As the country continues to invest in modernization and innovation, the construction aggregates market is expected to benefit from these developments.

The United Kingdom is also a key player in the Europe construction aggregates market. The UK construction sector is characterized by a diverse range of projects, including residential, commercial, and infrastructure developments. According to the UK Construction Industry Training Board, the construction industry in the UK is projected to grow at a rate of 4% annually, driven by government investments in infrastructure and housing. The emphasis on high-performance aggregates in these industries is driving demand for specialized materials. Furthermore, the UK's commitment to sustainability and regulatory compliance is influencing the development of eco-friendly aggregates, aligning with broader market trends. As the UK navigates post-Brexit challenges, the construction aggregates market is expected to adapt and evolve, presenting opportunities for growth.

Spain is predicted to grow at a healthy CAGR in the European construction aggregates market over the forecast period. The Spanish construction sector is experiencing significant growth, driven by a resurgence in residential and infrastructure projects. According to the Spanish Ministry of Transport, Mobility and Urban Agenda, the construction industry in Spain is projected to grow at a rate of 5% annually, further boosting the demand for aggregates. The emphasis on sustainable construction practices and the use of recycled materials is also shaping the market landscape in Spain. As the country continues to develop its industrial capabilities and invest in infrastructure, the demand for high-quality aggregates is anticipated to rise, reinforcing its position in the European construction aggregates market.

MARKET SEGMENTATION

This research report on the europe construction aggregates market is segmented and sub-segmented based on categories.

By Type

- Crushed Stones

- Sand & Gravel

- Recycled Aggregates

- Others

By Application

- Structural Materials

- Ready Mix Concrete

- Precast Concrete

- Asphalt Types

- Others

By End-Use

- Commercial

- Residential

- Industrial

- Infrastructure

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What are the challenges faced by the Europe Construction Aggregates Market?

Challenges include environmental concerns, fluctuating raw material prices, regulatory pressures, and competition from alternative materials like recycled aggregates.

How is the demand for recycled aggregates growing in Europe?

Demand for recycled aggregates is rising due to sustainability efforts, circular economy initiatives, and government regulations supporting the recycling of construction waste.

What is the future outlook for the Europe Construction Aggregates Market?

The market outlook is positive, with continued demand driven by urbanization, infrastructure needs, and the growing use of recycled aggregates.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]