Europe Connector Market Research Report - Segmented By Product ( PCB Connectors , RF Coaxial Connectors ) End User ( Telecom , Automotive ) & Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe) - Industry Analysis, Size, Share, Growth, Trends, & Forecasts (2025 to 2033)

Europe Connector Market Size

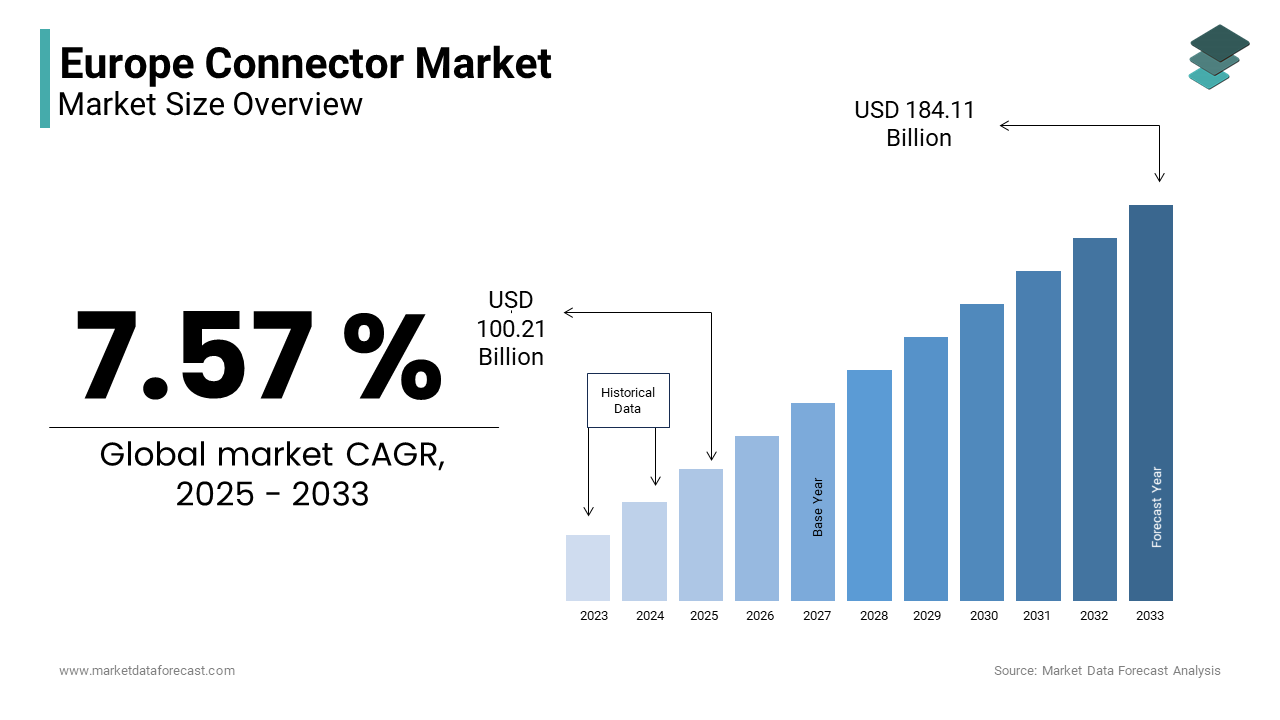

The europe connector market Size was valued at USD 92.87 billion in 2024. The europe connector market Size is expected to have 7.57 % CAGR from 2025 to 2033 and be worth USD 184.11 billion by 2033 from USD 100.21 billion in 2025.

Connectors are electromechanical devices that facilitate the transmission of power, data, and signals between electronic components, systems, or subsystems. In an era defined by rapid technological advancements, the demand for high-performance connectors has surged, driven by applications in automotive, telecommunications, industrial automation, healthcare, and consumer electronics. According to the European Commission, the electronics sector contributes approximately €150 billion annually to the EU economy, with connectors playing an indispensable role in enabling innovation and operational efficiency.

Europe has substantial demand for connections due to the increasing digitalization and electrification trends. In Europe, Germany leads the market and accounts for approximately 25% of regional demand due to its robust automotive and manufacturing sectors. The rise of electric vehicles (EVs) further amplifies demand, with Statista reporting that EV sales in Europe grew by 65% in 2022 alone, necessitating advanced connector solutions for charging infrastructure and vehicle electronics. Additionally, the rollout of 5G networks across Europe has spurred demand for high-speed data connectors, with the European Telecommunications Network Operators’ Association (ETNO) estimating a 40% increase in 5G-related investments since 2021.

Connectors are also pivotal in addressing sustainability goals, as they enable energy-efficient systems and support renewable energy integration. For instance, wind turbines and solar farms rely heavily on durable connectors to ensure uninterrupted power transmission. As Europe continues to prioritize green technologies and Industry 4.0 initiatives, the connector market is poised to expand further over the forecast period.

MARKET DRIVERS

Electrification of the Automotive Industry

The rapid electrification of the automotive industry is a significant driver of the Europe connector market, fueled by stringent emissions regulations and the growing adoption of electric vehicles (EVs). The European Automobile Manufacturers' Association (ACEA) reports that EV registrations in Europe surged by 65% in 2022, with over 2.3 million units sold. This transition necessitates advanced connectors for high-voltage battery systems, charging infrastructure, and powertrain components. According to Germany’s Federal Ministry for Economic Affairs and Climate Action, the demand for EV charging connectors alone is projected to grow at a compound annual growth rate (CAGR) of 25% through 2030. Furthermore, the EU’s commitment to achieving zero-emission mobility by 2050 has accelerated investments in EV technologies, creating a robust market for durable and high-performance connectors. As automakers increasingly prioritize sustainability, connectors have become critical enablers of this transformative shift.

Expansion of 5G Networks and Telecommunications Infrastructure

The rollout of 5G networks across Europe is another major driver propelling the connector market forward. The European Telecommunications Network Operators’ Association (ETNO) estimates that 5G-related investments in Europe exceeded €40 billion in 2022, reflecting the region’s focus on enhancing digital connectivity. High-speed data connectors are essential for supporting the increased bandwidth and low latency demands of 5G infrastructure. France’s National Frequency Agency highlights that over 50% of urban areas in France are now covered by 5G, driving demand for fiber optic and RF connectors. Additionally, the UK’s Department for Digital, Culture, Media & Sport projects that 5G will contribute £158 billion to the UK economy by 2030. This technological evolution not only boosts the connector market but also reinforces Europe’s position as a global leader in telecommunications innovation, ensuring sustained growth in connector applications.

MARKET RESTRAINTS

Supply Chain Disruptions and Material Shortages

Supply chain disruptions and material shortages pose a significant restraint to the Europe connector market, exacerbated by global geopolitical tensions and the aftermath of the COVID-19 pandemic. The European Commission highlights that the electronics industry faced a 20% increase in lead times for critical raw materials like copper and rare earth elements in 2022, driving up production costs. Germany’s Federal Institute for Materials Research and Testing (BAM) notes that copper prices surged by 30% over the past two years, directly impacting connector manufacturing. Additionally, the UK’s Department for Business, Energy & Industrial Strategy reports that semiconductor shortages have delayed the production of advanced connectors, particularly for automotive and telecommunications applications. These challenges hinder the scalability of the connector market, as manufacturers struggle to meet rising demand while managing cost volatility and logistical uncertainties.

Stringent Environmental Regulations and Compliance Costs

Stringent environmental regulations aimed at reducing the ecological footprint of electronic components present another major restraint for the Europe connector market. The European Environment Agency emphasizes that compliance with directives like the Restriction of Hazardous Substances (RoHS) and REACH has increased operational costs for manufacturers by an estimated 15%. France’s Ministry of Ecological Transition highlights that companies must invest heavily in research and development to replace hazardous materials with eco-friendly alternatives, which often require extensive testing and certification. Furthermore, Italy’s National Institute for Environmental Protection and Research states that non-compliance penalties can reach up to €5 million per violation, creating financial risks for smaller firms. While these regulations are essential for sustainability, they impose significant barriers, particularly for small and medium-sized enterprises striving to compete in the evolving connector market.

MARKET OPPORTUNITIES

Growth in Renewable Energy and Smart Grid Infrastructure

The expansion of renewable energy projects and smart grid infrastructure presents a significant opportunity for the Europe connector market. The European Commission reports that renewable energy accounted for 40% of electricity generation in 2022, with investments in wind and solar projects exceeding €100 billion annually. Connectors are essential for integrating renewable energy sources into the grid, ensuring reliable power transmission and distribution. According to Germany’s Federal Ministry for Economic Affairs and Climate Action, the demand for high-voltage connectors in wind turbines is projected to grow by 35% through 2030, driven by offshore wind projects like those in the North Sea. Additionally, the UK’s Department for Business, Energy & Industrial Strategy highlights that smart grid investments will reach €80 billion by 2025, creating a robust market for advanced connectors. These developments position the connector industry as a key enabler of Europe’s green energy transition.

Advancements in Medical Electronics and Healthcare Technologies

The rapid advancements in medical electronics and healthcare technologies offer another major opportunity for the Europe connector market. The European Federation of Pharmaceutical Industries and Associations (EFPIA) states that the medical device market in Europe grew by 8% in 2022, reaching a value of €135 billion. High-performance connectors are critical for applications such as diagnostic imaging, patient monitoring systems, and robotic surgeries. France’s National Health Innovation Institute notes that the demand for miniaturized and high-reliability connectors in portable medical devices is expected to increase by 20% annually over the next decade. Furthermore, Italy’s Ministry of Health emphasizes that aging populations and rising healthcare expenditures are driving innovation in telemedicine and remote monitoring, further boosting connector demand. As Europe prioritizes digital health solutions, the connector market stands to benefit significantly from this transformative growth in the healthcare sector.

MARKET CHALLENGES

Rising Competition from Low-Cost Imports

One of the major challenges facing the Europe connector market is the intense competition from low-cost imports, particularly from Asia. The European Commission highlights those imports of electronic components, including connectors, from countries like China and India have increased by 25% over the past five years, underscoring the pricing pressure on domestic manufacturers. Germany’s Federal Ministry for Economic Affairs and Climate Action reports that European manufacturers face a cost disadvantage of up to 30% compared to their Asian counterparts due to higher labour and production costs. This disparity threatens the competitiveness of local firms, especially small and medium-sized enterprises (SMEs). Additionally, the UK’s Department for International Trade notes that counterfeit connectors entering the market pose significant safety and reliability risks, further complicating the competitive landscape. These factors challenge Europe’s ability to sustain its manufacturing base amidst global price wars.

Technological Complexity and Rapid Innovation Requirements

Another significant challenge is the increasing technological complexity and the need for rapid innovation in connector design. The European Telecommunications Standards Institute (ETSI) states that the demand for high-speed, miniaturized connectors has surged by 40% since the advent of 5G and IoT technologies, requiring manufacturers to invest heavily in R&D. France’s National Research Agency highlights that developing connectors capable of handling data rates exceeding 100 Gbps involves costs that can exceed €10 million per project, straining smaller firms. Furthermore, Italy’s National Institute for Innovation in Technology reports that failure to keep pace with technological advancements results in a loss of market share, as customers prioritize cutting-edge solutions. The rapid evolution of industries like automotive and telecommunications demands continuous upgrades, posing a significant challenge for companies struggling to balance innovation with profitability.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

7.57% |

|

Segments Covered |

By Product,End User and Country. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Country Covered |

UK, Germany, Italy, France, Spain, Sweden, Denmark, Poland,Switzerland, Netherlands, Rest of Europe. |

|

Market Leader Profiled |

Nexans SA,ABB Ltd,Ametek, Inc.,Aptiv PLC,Huawei Technologies Co. Ltd.,Koch Industries, Inc. |

SEGMENT ANALYSIS

By Product Insights

The PCB connectors segment dominated the market by accounting for 35.5% of the European market share in 2024. The domination of PCB connectors segment in the European market is majorly driven by their critical role in compact electronic devices, particularly in automotive and industrial automation sectors. Germany’s Federal Ministry for Economic Affairs and Climate Action reports that advancements in miniaturization have driven a 20% annual increase in demand since 2021. PCB connectors ensure reliable signal and power transmission in densely packed circuits, making them indispensable for IoT-enabled devices and Industry 4.0 applications. With Europe’s focus on smart manufacturing and digital transformation, PCB connectors are vital for supporting high-density electronics, ensuring they remain the largest and most significant segment in the market.

The fiber optic connectors segment is predicted to showcase a CAGR of 12.4% over the forecast period owing to the push of Europe for universal broadband access, with Sweden’s Innovation Agency reporting a 40% increase in fiber optic connector usage since 2021 due to FTTH network expansions. These connectors enable high-speed, low-latency data transmission, essential for cloud computing, AI, and 5G technologies. The UK Department for Digital, Culture, Media & Sport emphasizes that fiber optics are pivotal for achieving Europe’s digital infrastructure goals. As demand for faster connectivity rises, fiber optic connectors play a crucial role in bridging the gap between traditional systems and next-generation communication networks.

By End User Insights

The telecom segment led the connector market in Europe by accounting for 28.8% of the European market share in 2024. The domination of telecom segment in the European market is driven by the rapid deployment of 5G networks and fiber-to-the-home (FTTH) initiatives. Sweden’s Innovation Agency highlights that telecom infrastructure investments exceeded €40 billion in 2022, with connectors ensuring seamless data transmission and low latency. The UK Department for Digital, Culture, Media & Sport emphasizes that Europe aims to achieve universal broadband access by 2030, further boosting demand for fiber optic and RF coaxial connectors. As high-speed connectivity becomes critical for digital transformation, telecom connectors play an indispensable role in enabling next-generation communication technologies.

The automotive segment is growing remarkably and is likely to register a CAGR of 25.5% over the forecast period owing to the surge in electric vehicle (EV) adoption, with EV registrations increasing by 65% in 2022, as per the European Automobile Manufacturers' Association (ACEA). Advanced PCB and circular connectors are essential for EV battery systems, charging infrastructure, and autonomous driving technologies. The shift toward sustainable mobility and stringent emissions regulations has amplified demand for reliable connectors. As Europe accelerates its transition to clean energy, the automotive segment’s rapid expansion underscores its pivotal role in shaping the future of transportation and reducing carbon emissions.

REGIONAL ANALYSIS

Germany had the leading share of 28.7% of the European market in 2024 and emerged as the leading performer. The dominance of Germany in automotive manufacturing and industrial automation is majorly driving the German market growth. According to the German Electrical and Electronic Manufacturers' Association (ZVEI), the German automotive sector accounts for 20% of global EV production and has significantly increased demand for advanced PCB and circular connectors. Additionally, Germany’s commitment to Industry 4.0 initiatives has spurred investments in IoT-enabled systems, further boosting connector adoption. The Federal Ministry for Economic Affairs and Climate Action reports that the connector market in Germany is growing at a CAGR of 7.5%, supported by robust R&D capabilities and strong export networks. As Europe’s largest economy, Germany’s focus on electrification and smart manufacturing solidifies its position as a leader in the connector market.

The UK connector market is anticipated to hold a substantial share of the European market over the forecast period owing to the leadership of the UK in telecom and digital infrastructure development. The UK Department for Digital, Culture, Media & Sport states that investments in 5G networks and fiber-to-the-home (FTTH) projects exceeded €15 billion in 2022, driving demand for RF coaxial and fiber optic connectors. The UK’s push for universal broadband access by 2030 has positioned it as a hub for high-speed connectivity solutions. Furthermore, the rise of smart cities and IoT applications has amplified the need for reliable connectors. With its strong emphasis on digital transformation and innovation, the UK continues to play a pivotal role in shaping the future of Europe’s connector market.

The connector market in France is estimated to grow at a CAGR of 8.8% over the forecast period owing to its focus on renewable energy and aerospace industries. France’s Ministry of Ecological Transition highlights that the country’s renewable energy capacity grew by 20% in 2022, increasing demand for high-voltage connectors in wind and solar projects. Additionally, France’s aerospace sector, supported by companies like Airbus, relies heavily on specialized connectors for satellite systems and aircraft, as noted by the French Aerospace Industries Association. The Netherlands Organisation for Applied Scientific Research emphasizes that France’s strategic investments in sustainable technologies and defense systems have bolstered its connector market growth. This dual focus on green energy and aerospace innovation ensures France remains a key player in the regional market.

KEY MARKET PLAYERS

Key players operating in the Europe connector market profiled in this report are Nexans SA,ABB Ltd,Ametek, Inc.,Aptiv PLC,Huawei Technologies Co. Ltd.,Koch Industries, Inc. (Molex LLC),Amphenol Corporation (Amphenol RF),

Prysmian Group,TE Connectivity Ltd.

MARKET SEGMENTATION

This research report on the Europe Connector Market has been segmented and sub-segmented into the following categories.

By Product

- PCB Connectors

- RF Coaxial Connectors

- Circular Connectors

- I/O Connectors

- Fiber Optic Connectors

- Others

By End User

- Telecom

- Automotive

- Consumer Electronics

- Energy & Power

- Aerospace & Defense

- Others

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What types of connectors are gaining traction in the European market?

High-density variants and customized solutions, especially rectangular connectors, are becoming increasingly popular due to their versatility in various applications.

How does the European connector market compare globally?

Europe holds a significant share of the global connector market, with Germany being a major contributor. The region's focus on technological advancements and automation positions it as a key player in the global market.

How is the adoption of 5G technology influencing the connector market in Europe?

The rollout of 5G technology is driving demand for high-performance RF connectors essential for wireless communication systems, including cellular networks and IoT devices.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]