Europe Confectionery Market Research Report – Segmented Based on Type (Sugar, Chocolate, Fine Bakery Wares and Others) and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe) - Industry Analysis on Size, Share, Trends, Growth Forecast (2025 to 2033)

Europe Confectionery Market Size

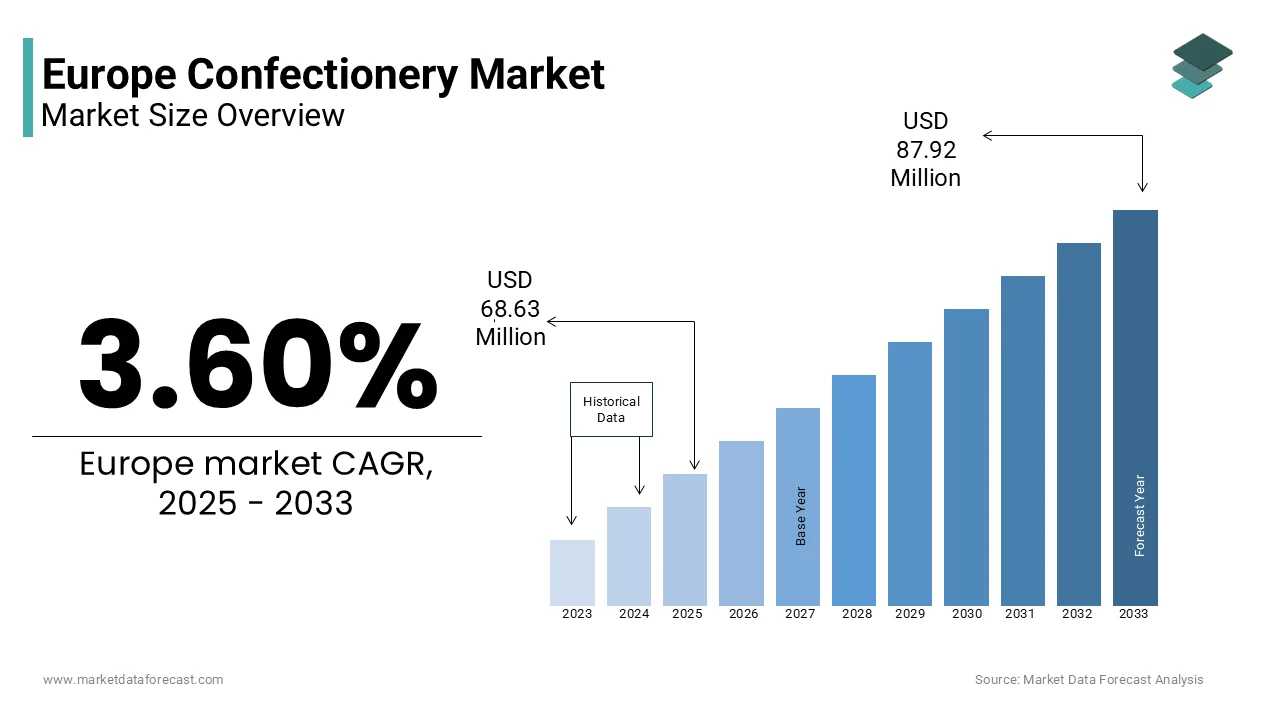

The Europe confectionery market size was valued at USD 66.25 million in 2024, and the market size is expected to reach USD 87.92 million by 2033 from USD 68.63 million in 2025. The market is promising a CAGR for the predicted period is 3.60%.

MARKET DRIVERS

The growing demand for innovative and functional ingredients in confectionery is one of the major factors propelling the Europe confectionery market growth. Consumers are showing massive interest in chocolates, gums, and snack bars, which have functional ingredients such as different kinds of fruits and sea salt, attracting people regarding health and wellness products. Chocolates and sweets are the common concern for all people of different age groups. These are everyone's favorite, and whatever the occasion, confectioneries are compulsory these days. Confectionery with health ingredients is gaining traction due to the health benefits produced by the functional ingredients. The different kinds of fruits give different flavors to the chocolates and snack bars, attracting consumer attention. The usage of these functional ingredients is grabbing the interest of consumers looking for new products; the manufacturers are working on introducing new products to survive in the competitive market. Confectionery companies are adding chai seeds, pomegranate, and sea salt as functional ingredients in their formulations to grab people's attention. Gums are the prominent type that attracts people due to their functional ingredient composition and unique delivery system. Gums help deliver the healthy ingredient. Mint products in gum are gaining popularity due to their benefits, such as teeth whitening, cavity prevention, and loss of bad smell in the mouth.

Growing advancements in the European food and beverage industry are accelerating the growth of the European confectionery market. Increasing investments by the key market players in the R&D department for innovations in confectionery are driving the market. The increasing disposable incomes of the people in the region are influencing them to lead more convenient and better lifestyles, which is expected to boost the market over the forecast period. The increasing consumption of confectionery among people of all age groups is prompting the growth in the European market. The presence of key market players in the region is projected to create lucrative opportunities for market growth over the forecast period. The increasing launch of sugar-free candies into the market is gaining traction, and possibilities for market growth are expected to be found during the forecast period. Sugar-free products are beneficial for health due to their low-calorie content.

MARKET RESTRAINTS

Growing health awareness among people may hinder market growth. The increasing number of diabetic cases across the region is causing people to step back from consuming confectionaries to maintain good health. High-sugar foods are not that good for people who have balanced diets. Another restraining factor is the fluctuation in the raw materials prices necessary to produce confectionery. The price of raw materials for production depends on the cultivation and supply of raw materials. The growing number of obesity and diabetic cases due to high sugar and calorie content is a challenge for market expansion. Consumer spending habits will also hamper the market's growth in the upcoming years. However, people are becoming more health conscious and consuming healthy ingredients to maintain a healthy diet and lifestyle.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

3.58% |

|

Segments Covered |

By Type, and By Region |

|

Various Analyses Covered |

Global, Regional, and Country Level Analysis; Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe |

|

Market Leaders Profiled |

Delfi Limited (Singapore), Ezaki Glico Co., Ltd. (Japan), Ferrero SpA (Italy), Lindt & Sprüngli AG (Switzerland), Lotte Confectionery Co. Ltd. (South Korea), Mars, Incorporated (U.S.), Mondelez International, Inc. (U.S.), Nestlé S.A. (Switzerland), The Hershey Company (U.S.), and Wm. Wrigley Jr. Company (U.S.) |

REGIONAL ANALYSIS

Europe held the second position in the global confectionery market, with a share of 34.6% worldwide. Germany dominated the European confectionery market due to its large cocoa production and chocolate candy manufacture. This helps Germany maintain the most organic and sustainable cocoa market, which is expected to increase the market value in Germany. The increasing number of online consumer purchases drives the European confectionery market as people seek online distributors for significant offers and savings. Snack bar sales are the highest in Germany, even though it has key online distributors such as Amazon, eBay, Otto, and Weltbild. According to Handelsverband Deutschland (German Retail Association), the online food business, including confectionery, attained a market share of 2.8% in 2021, and all confectionery sales in Germany are worth EUR14.46 billion. According to the Association of Chocolate, Biscuit, and Confectionery Industries of Europe, sugar and chocolate confectionery consumption is high in Germany.

The UK is expected to have a significant growth rate in the upcoming years due to the increasing trend of premium chocolates with cereals or grains among consumers in the country. The increase in the vegan population is making manufacturers introduce vegan chocolates, driving the European confectionery market trend. The UK, a developed country, needs the best in everything, making manufacturers focus on the premium packaging of the chocolates as the younger generations are highly aware of sustainability. Emerging countries like Italy, France, and Spain are projected to have decent growth rates over the forecast period due to increasing disposable incomes, allowing them to spend on a convenient lifestyle.

KEY MARKET PLAYERS

Delfi Limited (Singapore), Ezaki Glico Co., Ltd. (Japan), Ferrero SpA (Italy), Lindt & Sprüngli AG (Switzerland), Lotte Confectionery Co. Ltd. (South Korea), Mondelez International, Inc. (U.S.), Nestlé S.A. (Switzerland), The Hershey Company (U.S.) and Wm. Wrigley Jr. Company (U.S.) are some of the notable companies in the European confectionery market.

MARKET SEGMENTATION

This research report on the European confectionery market has been segmented and sub-segmented into the following categories.

By Type

- Sugar

- Hard-boiled sweets

- Caramels & Toffees

- Gums & Jellies

- Medicated Confectionery

- Mints

- Others

- Chocolate

- White

- Milk

- Dark

- Fine Bakery Wares

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

Which countries contribute the most to the confectionery market in Europe?

Germany, France, and the United Kingdom are among the leading contributors to the confectionery market in Europe.

What factors are driving the growth of the confectionery market in Europe?

The growing consumer demand for premium and indulgent confectionery products, as well as innovation in flavors and ingredients are majorly driving the growth of the Europe confectionery market.

What impact has the COVID-19 pandemic had on the confectionery market in Europe?

The pandemic initially led to disruptions in the supply chain and changes in consumer behavior, but the market has shown resilience, with a shift towards online sales.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com