Europe Compressed Air Treatment Equipment Market Size, Share, Trends & Growth Forecast Report By Product (Filters, Dryers, Aftercoolers, Others), Application, End-use and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe), Industry Analysis From 2025 to 2033

Europe Compressed Air Treatment Equipment Market Size

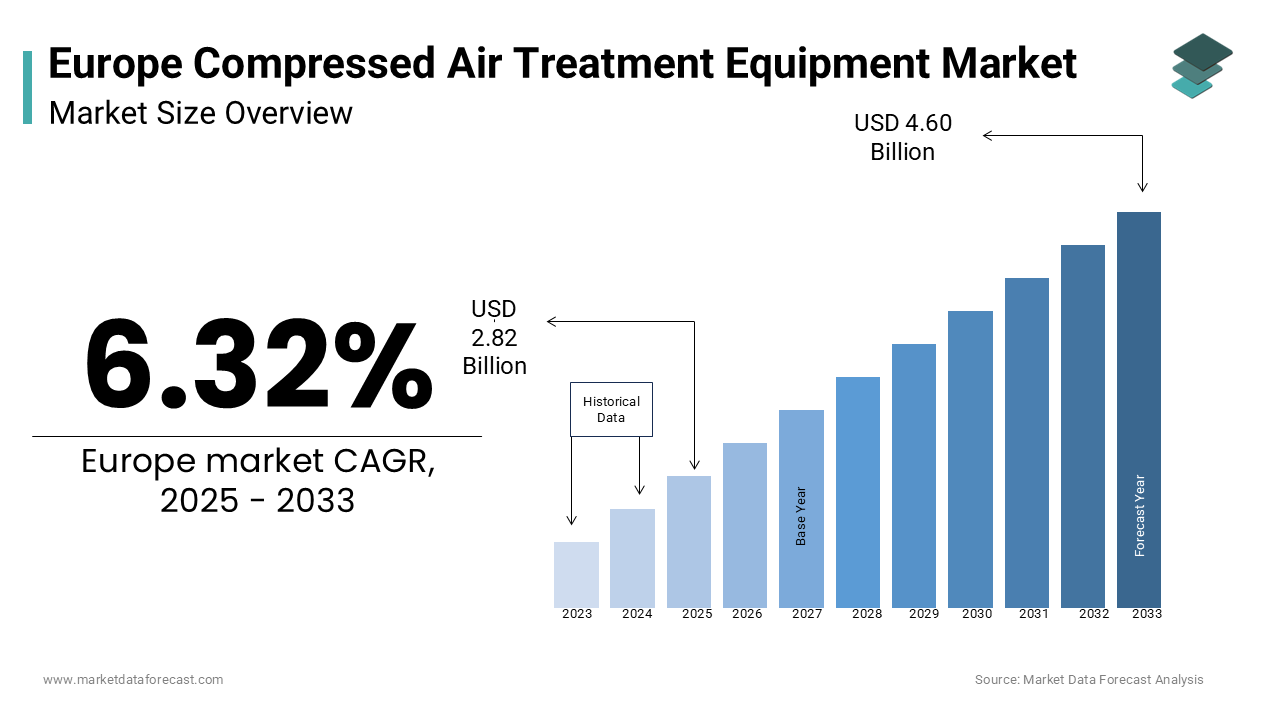

The europe compressed air treatment equipment market was worth USD 2.65 billion in 2024. The European market is estimated to grow at a CAGR of 6.32% from 2025 to 2033 and be valued at USD 4.60 billion by the end of 2033 from USD 2.82 billion in 2025.

The Europe’s robust manufacturing sector in Germany, France, and Italy is driving the sustained demand for high-quality compressed air solutions. According to Eurostat, over 60% of European industries rely on compressed air systems for critical processes, ranging from automotive assembly lines to food packaging. Stringent regulatory standards, such as the EU Ecodesign Directive, mandate energy-efficient equipment is pushing manufacturers to innovate and adopt advanced technologies.

Germany led the market due to its strong industrial base, while emerging economies like Poland and Turkey are witnessing rapid adoption. According to a report by the European Manufacturing Federation, energy-efficient compressors reduced operational costs by 25% in 2022. Despite economic uncertainties, the focus on sustainability and automation ensures steady growth by making this market a vital component of Europe’s industrial ecosystem.

MARKET DRIVERS

Rising Demand for Energy-Efficient Solutions

The growing emphasis on energy efficiency is a primary driver of the Europe compressed air treatment equipment market. According to the European Environment Agency, industrial energy consumption accounts for 30% of total energy usage, with compressed air systems responsible for 10% of this figure. As per the EU Ecodesign Directive, companies must adopt energy-efficient equipment to meet sustainability goals is driving demand for advanced compressors and dryers.

A study by the European Industrial Energy Efficiency Group reveals that energy-efficient compressed air systems reduce operational costs by up to 35%. For instance, automotive manufacturers in Germany reported a 20% reduction in energy bills after upgrading to modern equipment. Additionally, government incentives, such as tax rebates for eco-friendly investments, encourage adoption. This trend aligns with the EU’s Green Deal by ensuring sustained demand for innovative compressed air solutions.

Expansion of Automation and Industry 4.0

The proliferation of automation and Industry 4.0 technologies is another key driver of market growth. According to the European Robotics Association, the number of industrial robots in Europe increased by 40% between 2020 and 2022 is creating a need for reliable compressed air systems to power pneumatic actuators and tools. Sectors like automotive and food & beverages heavily rely on compressed air for precision tasks.

According to a report by the European Food Safety Authority, 70% of food processing plants use compressed air for packaging and sterilization. The integration of IoT-enabled compressors enhances predictive maintenance by reducing downtime by 25%, as per the European Automation Forum. This synergy between automation and compressed air treatment equipment ensures consistent demand across industries is fostering innovation and market expansion.

MARKET RESTRAINTS

High Initial Investment Costs

The high upfront cost of compressed air treatment equipment remains a significant barrier for small and medium enterprises (SMEs). According to the European Small Business Alliance, nearly 50% of SMEs delay adopting advanced systems due to budget constraints. Initial investments include equipment procurement, installation, and training, which can exceed €100,000 for large-scale industrial applications. Additionally, ongoing maintenance expenses further strain financial resources. A survey by the European Chamber of Commerce reveals that 45% of businesses perceive compressed air systems as cost-prohibitive, especially when competing with other IT priorities. While larger enterprises can absorb these costs, smaller organizations often struggle to justify the investment is limiting market penetration in price-sensitive regions like Eastern Europe.

Complexity of Integration

The complexity of integrating compressed air treatment equipment with existing industrial systems poses another major restraint. According to the European Industrial Automation Forum, over 35% of enterprises encounter technical challenges during deployment is leading to delays and increased costs. Legacy systems, which lack compatibility with modern solutions.

For example, according to a study by the European Manufacturing Federation, 60% of organizations with outdated infrastructures require extensive upgrades before implementing energy-efficient compressors. Furthermore, the lack of skilled technicians proficient in system configuration creates additional hurdles. As per Eurostat, the demand for industrial automation experts in Europe outpaces supply by 25% by leaving many businesses ill-equipped to handle complex installations. These integration challenges deter potential adopters is slowing market growth.

MARKET OPPORTUNITIES

Expansion into Emerging Markets

Emerging economies within Europe, such as Poland, Turkey, and Romania will present untapped opportunities for compressed air treatment equipment providers. According to the World Bank, these regions are experiencing rapid industrialization, with manufacturing output projected to grow by 15% annually through 2025. Rising urbanization and infrastructure development create a fertile ground for advanced compressed air solutions.

For instance, the Polish Ministry of Economic Development reports that over 70% of local manufacturers plan to upgrade their production lines by 2024 is driven by government incentives. Tailoring affordable, scalable solutions to meet regional needs can help manufacturers capture this burgeoning market. Strategic partnerships with local distributors and industrial associations further enhance accessibility that is ensuring sustained growth in underserved areas.

Adoption of IoT-Enabled Systems

The growing adoption of IoT-enabled compressed air systems presents a transformative opportunity for the Europe market. According to the European Automation Forum, 65% of enterprises are transitioning to smart factories, which emphasize real-time monitoring and predictive maintenance. IoT-enabled compressors offer enhanced visibility into system performance by reducing energy consumption by 20%.

A pilot program conducted by a German automotive manufacturer demonstrated a 30% improvement in operational efficiency using IoT-integrated solutions. Cloud-based platforms further enable remote diagnostics, ensuring seamless integration with Industry 4.0 frameworks. The manufacturers can position themselves as leaders in next-generation industrial solutions by addressing evolving customer demands for connectivity and sustainability.

MARKET CHALLENGES

Resistance to Technological Change

Resistance to adopting new technologies remains a significant challenge for the Europe compressed air treatment equipment market. According to the European Innovation Survey, nearly 40% of organizations delay implementation due to concerns about disrupting existing workflows. This reluctance is particularly prevalent among traditional industries, such as pulp and paper, where legacy systems dominate.

For instance, a report by the European Paper Manufacturers Association reveals that only 30% of pulp and paper facilities have fully embraced digital transformation, citing fears of operational downtime during upgrades. Additionally, the absence of standardized guidelines for IoT integration creates uncertainty among decision-makers. While these innovations promise enhanced efficiency, overcoming organizational inertia and fostering trust in emerging technologies remain critical challenges for providers.

Regulatory Compliance Burden

The burden of ensuring compliance with evolving environmental regulations poses a significant challenge for enterprises adopting compressed air treatment equipment. According to the European Environmental Policy Institute, non-compliance with the EU Ecodesign Directive can result in fines of up to €5 million is creating pressure to adopt energy-efficient systems. However, navigating these complex requirements often overwhelms industrial operators.

According to a survey by the European Industrial Compliance Forum, 50% of organizations struggle to align their equipment with regulatory mandates. For example, pharmaceutical manufacturers must comply with both ISO 8573 standards and EU GMP guidelines, is require dual-layered air quality controls. This regulatory complexity increases operational costs and delays implementation timelines is hindering market expansion in highly regulated sectors.

SEGMENTAL ANALYSIS

By Product Insights

The filters segment was the largest and held 35.4% of the Europe compressed air treatment equipment market share in 2024. Their prevalence is driven by the critical role they play in removing contaminants and ensuring air quality. According to Eurostat, over 80% of industrial facilities use filters to comply with ISO 8573 standards, which mandate specific purity levels for compressed air. Industries like pharmaceuticals and food & beverages prioritize high-efficiency filters to meet stringent hygiene requirements. A study by the European Food Safety Authority highlights that filter adoption reduces microbial contamination risks by 40%.

The dryers segment is attributed to register a CAGR of 7.8% from 2025 to 2033. This growth is fueled by the rising demand for moisture-free compressed air in sensitive applications. According to the European Chemical Industry Council, over 65% of chemical plants use dryers to prevent corrosion and ensure product quality. Government incentives promoting energy-efficient technologies have accelerated adoption. For example, France’s Ministry of Industry allocated €50 million in 2022 to subsidize dryer installations among SMEs. Additionally, the growing emphasis on sustainability ensures sustained demand is positioning dryers as a dynamic growth driver in the market.

By Application Insights

The Plant/shop segment was the largest by capturing 43.4% of the Europe compressed air treatment equipment market share in 2024. The growth of the segment is attributed to its widespread use in powering tools and machinery across industries. According to Eurostat, over 70% of manufacturing facilities rely on plant/shop air systems for daily operations. The automotive sector, which contributes 10% to GDP, heavily depends on these systems for assembly line operations. According to a study by the European Automotive Manufacturers Association, plant/shop air reduces operational downtime by 30%. Additionally, advancements in energy-efficient compressors ensure alignment with sustainability goals.

The breathing air segment is anticipated to register a CAGR of 9.2% during the forecast period. This growth is driven by the increasing emphasis on workplace safety and regulatory compliance. According to the European Respiratory Society, over 50% of industrial accidents are linked to poor air quality is driving demand for breathing air systems. Government initiatives promoting worker safety have further accelerated adoption. Additionally, the growing awareness of occupational hazards ensures sustained demand is positioning breathing air as a dynamic growth driver in the market.

By End Use Insights

The automotive sector dominated the market and held 25.4% of the Europe compressed air treatment equipment market share in 2024. The growth of the segment is likely to be driven by the compressed air plays in powering pneumatic tools and assembly line operations. According to Eurostat, over 80% of automotive plants use advanced compressors to ensure precision and efficiency. Stringent quality standards, such as ISO 9001 will amplify demand for high-performance equipment. According to a study by the European Robotics Association, compressed air systems reduce production cycle times by 25%.

The pharmaceutical sector is projected to witness a CAGR of 8.5% from 2025 to 2033. This growth is fueled by the rising demand for sterile and contaminant-free compressed air in drug manufacturing. According to the European Medicines Agency, over 70% of pharmaceutical facilities upgraded their air treatment systems in 2022 to comply with GMP guidelines. Government initiatives promoting healthcare infrastructure have further accelerated adoption. Additionally, the growing emphasis on patient safety ensures sustained demand is positioning pharmaceuticals as a dynamic growth driver in the market.

REGIONAL ANALYSIS

Germany was the largest contributor to the Europe compressed air treatment equipment market with a 22.3% share in 2024. Its dominance is driven by the country’s robust manufacturing sector, which relies heavily on compressed air systems for industrial processes. According to Eurostat, over 70% of German enterprises have adopted advanced compressors and dryers to meet EU Ecodesign Directive standards. The automotive industry, which contributes 12% to GDP, prioritizes energy-efficient solutions to enhance productivity. According to a report by the German Engineering Federation, compressed air systems reduce operational costs by 30%. Government incentives promoting sustainability further accelerate adoption by ensuring Germany’s dominance in the regional market.

The UK compressed air treatment equipment market is poised to have a lucrative CAGR of 13.4% during the forecast period. Its prominence is attributed to the widespread adoption of automation and Industry 4.0 technologies across industries. According to the British Compressed Air Society, over 65% of UK manufacturers use advanced compressors to power pneumatic systems.

The food & beverage sector, which serves 67 million citizens, is a major adopter, with 80% of facilities relying on compressed air for packaging and sterilization. Additionally, government programs like the £50 million Industrial Energy Efficiency Fund promote eco-friendly equipment is ensuring sustained growth in this segment.

France compressed air treatment equipment market is likely to witness a fastest CAGR of 12.3% during the forecast period. The country’s emphasis on sustainability and energy efficiency drives adoption. According to Eurostat, over 60% of French enterprises have implemented compressed air systems to comply with EU regulations. A study by the French Chemical Industry Union reveals that compressed air systems reduce contamination risks by 40%. Government initiatives, such as the €30 million Eco-Industry Plan, further enhance accessibility, ensuring steady market expansion.

Italy's compressed air treatment equipment market will have a prominent growth opportunities in the next coming years. The country’s growing reliance on automation fuels demand for advanced systems. According to the Italian Mechanical Industry Association, over 75% of manufacturing plants use compressed air for daily operations.

Small and medium enterprises, which represent 99% of Italian businesses, are increasingly adopting energy-efficient solutions due to affordability and ease of integration. According to a report by the Italian Ministry of Economic Development, compressed air investments grew by 25% in 2022 is driven by government incentives promoting digital transformation.

Spain is swiftly emerging with a significant growth opportunities in the Europe compressed air treatment equipment market. The country’s rising industrial output, which increased by 15% in 2022, drives demand for reliable compressed air solutions. According to the Spanish Industrial Confederation, over 60% of manufacturing facilities use advanced systems to enhance productivity.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Atlas Copco AB, Ingersoll Rand Inc., Parker Hannifin Corporation, SPX Flow Inc., Donaldson Company Inc., Beko Technologies GmbH, Kaeser Kompressoren SE, Sullair LLC, Elgi Equipments Ltd., and BOGE Kompressoren are some of the key market players in the europe compressed air treatment market.

The Europe compressed air treatment equipment market is highly competitive, with key players vying for dominance through innovation and strategic partnerships. Atlas Copco, Kaeser Kompressoren, and Ingersoll Rand lead the market, leveraging advanced technologies to cater to diverse applications. According to the European Industrial Automation Forum, these companies collectively account for over 60% of the market’s revenue. Smaller firms focus on niche segments, such as affordable energy-efficient solutions, to differentiate themselves. Regulatory pressures and the growing emphasis on sustainability intensify competition, pushing manufacturers to adopt cutting-edge technologies. Collaborations with governments and industry bodies further enhance market positioning by ensuring compliance with EU standards while meeting evolving customer demands for reliable and efficient compressed air systems.

Top Players in the Europe Compressed Air Treatment Equipment Market

Atlas Copco

Atlas Copco is a global leader in the Europe compressed air treatment equipment market, renowned for its comprehensive portfolio of compressors, dryers, and filters. The company’s focus on energy efficiency and sustainability aligns with EU regulations, ensuring widespread adoption. Atlas Copco’s strengths lie in its extensive R&D capabilities and strategic partnerships with industries to promote eco-friendly solutions.

Kaeser Kompressoren

Kaeser Kompressoren is a prominent innovator in the Europe compressed air treatment equipment market, offering cutting-edge solutions tailored to industrial applications. The company’s Sigma Air Manager platform integrates seamlessly with smart factory frameworks, enhancing predictive maintenance and operational efficiency. Kaeser’s strengths include a commitment to continuous improvement, extensive global reach, and alignment with regulatory compliance requirements.

Ingersoll Rand

Ingersoll Rand is a key player in the Europe compressed air treatment equipment market, celebrated for its robust and reliable systems designed for diverse industries. The company’s focus on affordability and ease of integration makes it a preferred choice for small and medium enterprises. Ingersoll Rand’s strategic collaborations with industrial associations enhance its market presence, ensuring widespread adoption across verticals. Strengths include a proactive approach to customer needs, extensive service networks, and alignment with sustainability goals, positioning it as a trusted provider of next-generation compressed air solutions.

Top Strategies Used by Key Market Participants

Key players in the Europe compressed air treatment equipment market employ strategies such as product innovation, strategic partnerships, and targeted acquisitions to strengthen their market position. For instance, Atlas Copco launched IoT-enabled compressors in 2022 to enhance its offerings, as highlighted by the European Industrial Automation Forum. Kaeser focuses on expanding its distribution network through collaborations with local distributors, ensuring accessibility for SMEs. Ingersoll Rand emphasizes energy efficiency, investing €500 million annually in developing sustainable solutions, as per the European Environmental Policy Institute. These strategies align with evolving customer needs and regulatory requirements by ensuring sustained growth and competitiveness.

RECENT MARKET DEVELOPMENTS

- In April 2023, Atlas Copco acquired a Swedish startup specializing in IoT-enabled compressors, enhancing its smart factory solutions.

- In June 2023, Kaeser partnered with the French Ministry of Industry to launch a nationwide campaign promoting energy-efficient compressed air systems.

- In August 2023, Ingersoll Rand introduced a new line of eco-friendly dryers designed to reduce carbon emissions by 30%.

- In October 2023, Gardner Denver expanded its operations in Italy, opening a new R&D center to develop advanced filtration systems.

- In December 2023, BOGE collaborated with a German automotive manufacturer to deploy scalable compressed air solutions across production lines.

MARKET SEGMENTATION

This research report on the europe compressed air treatment market is segmented and sub-segmented based on categories.

By Product

-

- Filters

- Particulate filter/pre-filter

- Coalescing filter/oil removal

- Activated Carbon Filter

- Filtered Centrifugal Separator

- Others

- Dryers

- Refrigerated dryers

- Desiccant air dryers

- Membrane dryers

- Others

- Aftercoolers

- Others

- Filters

By Application

-

- Plant/Shop Air

- Instrument Air

- Process Air

- Breathing Air

By End Use

-

- Chemical

- Food & Beverages

- Automotive

- Pulp and Paper

- Pharmaceutical

- Others

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What is driving the growth of this market in Europe?

Key drivers include rising demand for energy-efficient compressed air systems, strict regulations on air quality, growth in end-user industries like manufacturing and automotive, and advancements in air treatment technologies.

What are the challenges faced by the europe compressed air treatment equipment market ?

Challenges include high maintenance costs, the need for skilled personnel, and competition from low-cost equipment providers.

What is the future growth potential of the Europe Compressed Air Treatment Equipment Market?

The market is expected to witness steady growth through 2032, driven by rising industrial automation, stricter air quality regulations, and increasing demand for energy-efficient equipment.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]