Europe Compounding Pharmacies Market Size, Share, Trends & Growth Forecast Report By Product (Oral Medications, Topical Medications, Suppositories Others), Therapeutic Area, Application & Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of EU) - Industry Analysis From 2025 to 2033

Europe Compounding Pharmacies Market Size

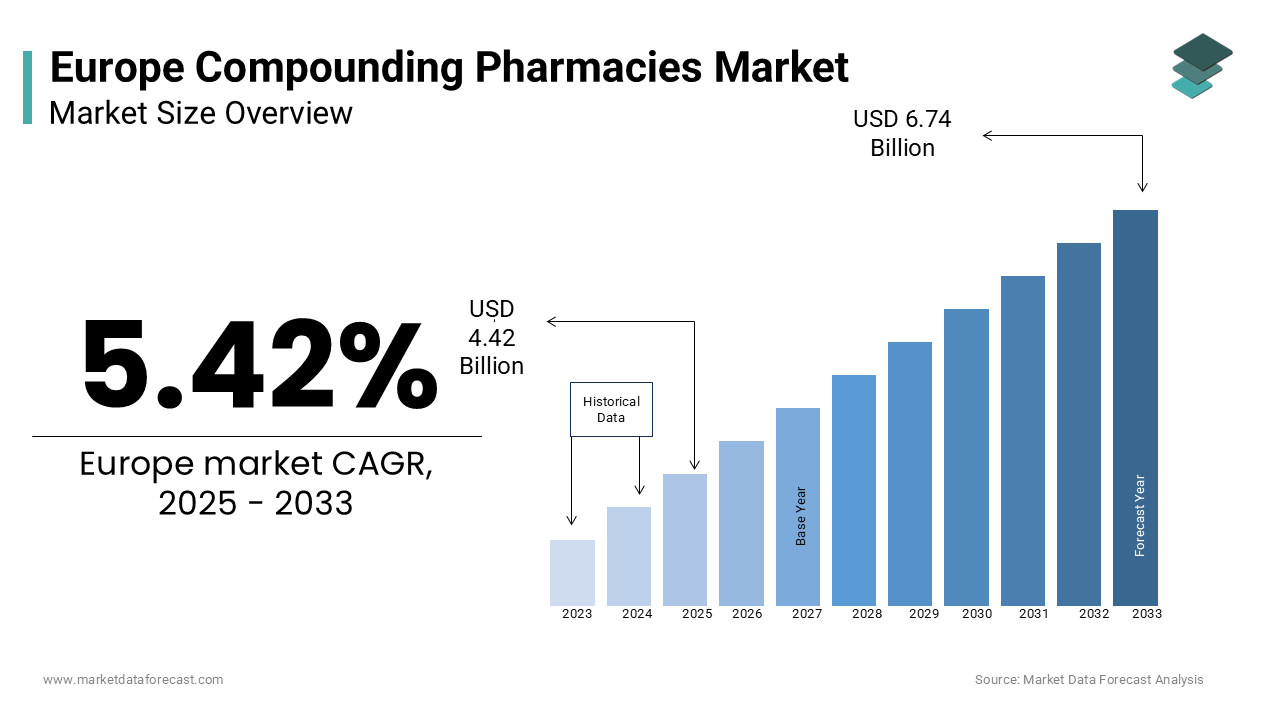

The compounding pharmacies market size in Europe was valued at USD 3.97 billion in 2024. The European market size is further estimated to be growing at a CAGR of 5.42% from 2025 to 2033 and be worth USD 6.74 billion by 2033 from USD 4.42 billion in 2025.

The compounding pharmacies market in Europe is a small but growing part of the pharmaceutical industry, driven by the rise of personalized medicine and patient-focused care. A study by the European Pharmaceutical Market Research Association (EPhMRA) shows steady growth as more people seek custom-made medications tailored to their specific needs. This trend is supported by an aging population and the growing number of chronic illnesses like diabetes and heart disease. Eurostat reports that over 20% of Europe’s population is 65 or older, increasing the demand for personalized treatments. Countries such as Germany and France have put in place supportive regulations that promote compounding while ensuring high-quality standards. The market’s growth is also fueled by new advances in drug formulation and increased awareness among doctors and pharmacists about the advantages of compounded medications for patients with unique health needs.

MARKET DRIVERS

Rising Prevalence of Chronic Diseases

Chronic illnesses are a dominant factor propelling the Europe compounding pharmacies market forward. According to the World Health Organization (WHO), nearly one-third of Europeans suffer from at least one chronic condition such as hypertension, arthritis, or cancer. These conditions often require medications that are not commercially available in standard formulations and are leading patients to seek compounded alternatives. For instance, pain management solutions tailored to individual tolerances have become increasingly popular. A report published by the European Federation of Pharmaceutical Industries and Associations (EFPIA) estimates that the demand for personalized pain medications accounts for approximately 30% of all compounded prescriptions. Furthermore, advancements in technology allow pharmacists to create precise dosages are enhancing treatment efficacy. With WHO predicting a 17% increase in chronic disease prevalence by 2030, the need for specialized medications will continue to drive market growth.

Growing Geriatric Population

Europe’s rapidly aging demographic is another critical driver shaping the compounding pharmacy landscape. As stated by the United Nations Department of Economic and Social Affairs, the geriatric population in Europe is expected to grow by 40% over the next two decades. Older adults frequently encounter polypharmacy challenges are requiring multiple medications that may conflict or lack compatibility. Compounded medications address these issues by offering simplified regimens and formats suitable for elderly patients, such as liquid suspensions or topical creams. According to a survey conducted by Age UK, over 60% of seniors prefer customized treatments due to difficulties swallowing pills or adhering to complex schedules. Moreover, the British Geriatrics Society draws attention to compounded hormone replacement therapies (HRT) that are particularly sought after by postmenopausal women is contributing significantly to market revenue. This trend underscores how demographic shifts are fueling demand for bespoke pharmaceuticals.

MARKET RESTRAINTS

However, growing restrictions on the manufacture of complex formulations are expected to hamper the growth of the European compounding pharmacies market. The manufacturing of drugs is a tenacious and lengthy process that cannot be produced in bulk unless they have the proper manufacturing authorization, which requires adequate toxicity and pharmacovigilance data. For instance, France plans to allow pharmacists to replace biological products with less expensive biosimilars in the production of prescriptions. This is expected to decrease the need for drugs such as sustained-release products, transdermal patches, liposomal products, and most biologics, which are growing in demand. Other factors such as the high cost of maintaining the sterile environment and the different regulations in various European regions, which can lead to the sale of cheaper products in the market, are likely to restrain the market.

Stringent Regulatory Requirements

One of the primary obstacles hindering the Europe compounding pharmacies market is the stringent regulatory environment governing pharmaceutical compounding. The European Medicines Agency (EMA) mandates rigorous compliance with Good Manufacturing Practices (GMP) and other safety protocols to ensure product quality and patient safety. While these regulations are essential for maintaining high standards, they also impose significant operational burdens on small-scale compounding pharmacies. Based on a study by the Pharmaceutical Journal, nearly 40% of independent compounding facilities cite regulatory hurdles as a major barrier to entry or expansion. Compliance costs including investments in advanced equipment and staff training can be prohibitively expensive for smaller entities. Moreover, frequent audits and inspections disrupt workflow efficiency, further straining resources. Such challenges limit the ability of many pharmacies to scale operations effectively, thereby constraining overall market growth.

Limited Awareness Among Healthcare Providers

A supplementary restraint impacting the market is the relatively low awareness among healthcare providers regarding the benefits of compounded medications. Many physicians remain unfamiliar with the full scope of services offered by compounding pharmacies are often defaulting to mass-produced drugs instead. A survey conducted by the European Society of Clinical Pharmacy found that only 25% of general practitioners actively prescribe compounded medications are citing insufficient knowledge as a key reason. This lack of familiarity stems partly from inadequate educational initiatives targeting medical professionals. Furthermore, misconceptions about the cost-effectiveness and reliability of compounded drugs persist is discouraging broader adoption. According to data from the Royal Pharmaceutical Society, improving awareness through targeted campaigns could potentially increase prescription rates by up to 50%. However, until such efforts gain traction, limited outreach remains a significant impediment to market development.

MARKET OPPORTUNITIES

Expansion into Veterinary Applications

The veterinary segment represents a promising avenue for growth within the Europe compounding pharmacies market. Animals often require medications that are unavailable in commercial forms are necessitating tailored formulations. As reported by the Federation of Veterinarians of Europe, over 70 million pets reside in European households and are creating substantial demand for animal-specific treatments. Conditions such as arthritis, dermatitis, and hormonal imbalances are prevalent among companion animals, driving interest in compounded solutions. For example, flavoured oral suspensions and transdermal gels designed for cats and dogs are gaining popularity due to their ease of administration. Also, findings by the European Animal Health Industry indicates that compounded veterinary products account for roughly 15% of total veterinary pharmaceutical sales. With pet ownership projected to rise by 10% over the next five years, expanding into this underserved niche could unlock new revenue streams and enhance market penetration.

Adoption of Advanced Technologies

Technological advancements present another lucrative opportunity for the Europe compounding pharmacies market. Innovations such as automated compounding systems and 3D printing enable precise formulation and customization of medications, addressing unmet patient needs more efficiently. According to a white paper by the European Alliance for Access to Safe Medicines, automation reduces human error by up to 80% ensuring higher accuracy and consistency in drug preparation. Similarly, 3D printing allows pharmacists to produce complex dosage forms, such as multi-layered tablets or implants, tailored to individual requirements. These technologies not only improve production capabilities but also reduce costs associated with manual labor. A study by the European Biopharmaceutical Enterprises predicts that integrating advanced tools could boost operational efficiency by 35% within the next decade. By embracing cutting-edge solutions, compounding pharmacies can position themselves as leaders in personalized medicine while capitalizing on emerging trends.

MARKET CHALLENGES

High Costs of Raw Materials

A significant challenge facing the Europe compounding pharmacies market is the escalating cost of raw materials used in medication preparation. Active pharmaceutical ingredients (APIs) and excipients required for compounding are subject to price volatility due to supply chain disruptions and geopolitical factors. According to the Chemical Business Association, API prices surged by an average of 25% between 2020 and 2022 is placing financial strain on compounding facilities. Smaller pharmacies, which operate on tighter margins, are disproportionately affected by these fluctuations. Additionally, sourcing high-quality materials compliant with EU regulations adds another layer of complexity and expense. The European Generic and Biosimilar Medicines Association notes that rising input costs have forced some pharmacies to either raise prices or discontinue certain services altogether. Unless effective strategies are implemented to stabilize supply chains and mitigate pricing pressures, this issue will continue to hinder market sustainability.

Competition from Mass-Produced Alternatives

Compounding pharmacies face stiff competition from large pharmaceutical companies producing mass-market drugs, which often benefit from economies of scale and extensive marketing budgets. According to IQVIA Institute for Human Data Science, branded medications dominate over 70% of the European pharmaceutical sphere and is leaving limited room for compounded alternatives. Patients and insurers tend to favor commercially available options due to perceived reliability and lower costs. Furthermore, insurance coverage for compounded medications remains inconsistent across Europe, deterring widespread adoption. The European Health Insurance Federation reports that less than 40% of private health plans reimburse compounded prescriptions, making them less accessible to patients. This competitive disadvantage limits the reach of compounding pharmacies, particularly in regions where generic drugs are heavily promoted. Overcoming this challenge requires greater advocacy for the unique value proposition of compounded medications, alongside efforts to secure broader reimbursement policies.

SEGMENTAL ANALYSIS

By Product Insights

The oral medications segment secured the top position in the Europe compounding pharmacies market by accounting for 45.2% of the total market share in 2024. This influence over this market is driven by their convenience, ease of administration, and widespread acceptance among patients. Oral formulations including capsules, tablets, and suspensions are particularly favored for chronic conditions such as diabetes and hypertension, where long-term adherence is critical. In line with the International Diabetes Federation, Europe has over 60 million people living with diabetes, many of whom require customized oral treatments due to varying metabolic responses. Apart from these, advancements in taste-masking technologies have made compounded oral medications more palatable, especially for pediatric and geriatric populations. A report by the European Society for Clinical Pharmacology stresses that oral compounded drugs exhibit a 20% higher compliance rate compared to other forms, further strengthen their place. The segment's growth is also fueled by increasing demand for allergen-free and dye-free formulations, which cater to patients with sensitivities. These factors collectively show why oral medications remain the cornerstone of the compounding pharmacy industry.

The suppositories segment represented the fastest-growing segment within the Europe compounding pharmacies market, with a projected CAGR of 8.5% in the coming years. This rapid expansion is attributed to their effectiveness in treating conditions that require localized or systemic delivery without gastrointestinal interference. For instance, suppositories are widely used for pain management, hormone therapy, and antiemetic treatments, particularly in patients who cannot tolerate oral medications. According to the European Pain Federation, over 20% of chronic pain patients prefer rectal administration due to its rapid onset of action and reduced side effects. Furthermore, innovations in biodegradable bases and controlled-release mechanisms have enhanced the efficacy and patient acceptability of suppositories. The British National Formulary notes that compounded suppositories account for nearly 15% of all prescriptions for nausea and vomiting during pregnancy, reflecting their growing popularity. As awareness of alternative drug delivery systems increases, this section is poised to expand further, driven by both clinical necessity and technological advancements.

By Therapeutic Area Insights

The pain medications segment constituted the largest therapeutic area in the Europe compounding pharmacies market by holding a market share of 35.9% in 2024. This popularity arises from the high prevalence of chronic pain conditions across the continent, coupled with the need for personalized solutions that address individual sensitivities and comorbidities. For example, neuropathic pain, osteoarthritis, and post-surgical discomfort often necessitate tailored formulations, such as topical creams or transdermal gels, which are not readily available in commercial markets. A study published in the European Journal of Pain reveals that over 75 million Europeans suffer from moderate to severe chronic pain, creating substantial demand for compounded analgesics. Moreover, the opioid crisis has prompted healthcare providers to explore non-opioid alternatives, further boosting the adoption of compounded therapies. The European Federation of Neurological Societies emphasizes that compounded pain medications offer superior flexibility in dosage adjustments, enhancing treatment outcomes. These factors collectively reinforce the segment's leading position in the market.

The dermatological applications are a therapeutic area that is moving ahead quickly in the Europe compounding pharmacies market, with a CAGR of 9.2% anticipated through 2033. This growth is fueled by rising incidences of skin disorders including eczema, psoriasis, and acne, which often require specialized formulations unavailable in standard drug portfolios. According to the European Skin Foundation, dermatological conditions affect nearly 25% of the population, driving demand for compounded topical treatments. Innovations in formulation techniques, such as liposomal delivery systems, have improved the bioavailability and efficacy of active ingredients, making compounded creams and ointments highly desirable. Additionally, the increasing preference for preservative-free and hypoallergenic products has bolstered the appeal of compounded dermatological solutions. A survey conducted by the British Association of Dermatologists indicates that compounded topical steroids account for over 20% of all prescriptions for inflammatory skin conditions. As consumer awareness grows and technological advancements continue, this segment is expected to maintain its upward trajectory.

By Application Insights

The geriatric segment led the Europe compounding pharmacies market by capturing 41.1% of the total application share in 2024. This is primarily propelled by the aging population, which faces complex health challenges requiring personalized medication regimens. Elderly patients often struggle with polypharmacy, swallowing difficulties, and adverse drug interactions, making compounded medications an ideal solution. For instance, liquid formulations and transdermal patches are frequently prescribed to address these issues. Eurostat data indicates that over 20% of Europe’s population is aged 65 or above, spotlighting the vast potential of this demographic. Besides these, compounded hormone replacement therapies (HRT) and pain management solutions are particularly sought after by older adults are contributing significantly to market revenue. The European Geriatric Medicine Journal reports that compounded medications improve adherence rates by up to 30% among geriatric patients, underscoring their clinical and economic value. These factors collectively establish the geriatric segment as the backbone of the compounding pharmacy market.

Veterinary applications symbolised as the rapidly advancing segment in the Europe compounding pharmacies market, with a CAGR of 10.5% projected during the forecast period. This surge is fueled by the increasing number of pet owners seeking specialized treatments for their animals, coupled with the limited availability of commercially produced veterinary drugs. According to the European Pet Food Industry Federation, there are over 70 million companion animals in Europe is creating a robust demand for compounded medications. Conditions such as arthritis, dermatitis, and hormonal imbalances are prevalent among pets are necessitating tailored formulations like flavored oral suspensions and transdermal gels. A study by the European College of Veterinary Internal Medicine found that compounded veterinary products account for nearly 15% of all animal prescriptions, reflecting their growing importance. Also, advancements in formulation technologies, such as palatability enhancers and controlled-release mechanisms have expanded the scope of compounded veterinary solutions. As pet ownership continues to rise and awareness of animal healthcare grows, this segment is poised to experience exponential growth in the coming years.

REGIONAL ANALYSIS

Germany stands as the largest market in Europe, commanding an estimated 28.1% share in 2024. The country’s position in the regional market is due to its established healthcare infrastructure and high demand for personalized medications, particularly among its aging population. With over 21% of Germans aged 65 or above, compounded drugs are widely used for chronic conditions like arthritis and cardiovascular diseases. A report by the Federal Association of German Pharmacists reveal that compounded hormone replacement therapies (HRT) account for nearly 30% of all prescriptions in this category. Additionally, regulatory support under the Medicinal Products Act ensures quality and safety standards, fostering trust among patients. Germany’s strong pharmaceutical manufacturing base further enables innovation in compounding techniques, such as automation and precision dosing systems. These factors collectively position Germany as a key driver of growth in the European market.

The UK is experiencing the fastest growth in the region, recording a CAGR of 6.3% in 2024. The nation’s prominence is driven by its advanced healthcare system and increasing adoption of compounded medications for pediatric and geriatric care. As indicated by the NHS England, over 40% of compounded prescriptions cater to children who require customized formulations for rare diseases. Furthermore, the rise in chronic illnesses, including diabetes and cancer, has amplified demand for tailored treatments. The British Association of Dermatologists notes that compounded topical creams for skin disorders constitute a significant portion of the market. The UK’s focus on research and development, coupled with favorable reimbursement policies, enhances accessibility to compounded therapies. These dynamics underscore the UK’s pivotal role in shaping the regional landscape.

France’s market trajectory is shaped by caution and compliance. While growth is steady, the country’s relatively rigid pharmaceutical policies have limited widespread use of compounded medications outside of hospital settings. However, data from Santé Publique France reveals that compounded pain medications are highly sought after, accounting for over 25% of total prescriptions. The growing prevalence of chronic pain syndromes such as fibromyalgia, further fuels demand. Moreover, France’s universal healthcare system promotes equitable access to compounded drugs, particularly for rare diseases. Innovations in biocompatible excipients and advanced delivery systems have also bolstered the segment’s growth. These factors solidify France’s status as a leader in the European compounding pharmacy sector.

In Italy, compounded pharmaceuticals are seeing renewed interest with a 15% market share. The progress is attributed to its aging population and rising incidence of chronic diseases, which necessitate customized solutions. In line with the ISTAT, approximately 23% of Italians are aged 65 or older, creating substantial demand for compounded formulations. Hormone replacement therapies (HRT) and dermatological applications are particularly popular, with compounded anti-aging creams gaining traction among consumers. The Italian Ministry of Health emphasizes the importance of compounding in addressing unmet medical needs, especially for rare conditions. Furthermore, advancements in formulation technologies, such as liposomal carriers, have enhanced the efficacy of compounded products. These trends bring to light that Italy’s critical contribution to the regional market.

Spain’s growth trajectory is gradual but steady. The country’s growth is fueled by increasing awareness of personalized medicine and rising cases of chronic illnesses. A study by the Spanish Ministry of Health indicates that compounded oral suspensions are widely prescribed for pediatric patients, accounting for nearly 40% of all compounded prescriptions. Additionally, Spain’s focus on veterinary applications has created new opportunities, with compounded medications for pets showing a 10% annual growth rate. Regulatory reforms supporting compounding practices have also strengthened the market. These developments position Spain as a key player in the European compounding pharmacy domain.

KEY MARKET PLAYERS

A few promising companies operating in the European compounding pharmacies market profiled in this report are Fagron, Inc., Elixir Compounding Pharmacy, Fresenius Kabi AG, Belle Santé Diagnostic & Therapeutic Institute Pvt. Ltd, Triangle Compounding Pharmacy, Vertisis Custom Pharmacy, Avella Specialty Pharmacy, B. Braun Melsungen AG, PharMEDium Healthcare Holdings, Inc., and US Compounding Inc.

The Europe compounding pharmacies market is characterized by intense competition, with several key players vying for dominance through innovation, quality, and strategic initiatives. The market is fragmented, comprising both multinational corporations and small-scale independent pharmacies. Larger entities, such as Fagron NV and Belmar Pharma Solutions, leverage economies of scale and advanced technologies to maintain their competitive edge. Meanwhile, smaller players focus on niche segments, offering highly specialized services tailored to local needs. Regulatory frameworks play a crucial role in shaping the competitive landscape, as adherence to GMP guidelines ensures consistent quality and fosters consumer trust. Collaborations with healthcare providers and educational institutions further enhance competitiveness by promoting awareness and adoption of compounded medications. Additionally, pricing pressures and the need for differentiation drive companies to innovate continuously, introducing novel formulations and delivery mechanisms. As the demand for personalized medicine grows, competition is expected to intensify, pushing players to adopt aggressive strategies to secure market share.

Top Players in the Europe Compounding Pharmacies Market

Fagron NV

Fagron NV is a global leader in the compounding pharmacy sector, renowned for its innovative formulations and comprehensive product portfolio. The company specializes in developing customized solutions for dermatology, pain management, and hormone therapies. Fagron’s commitment to quality is evident through its adherence to stringent regulatory standards across Europe. By taking advantage of the advanced technologies such as automated compounding systems Fagron ensures precision and consistency in medication preparation. Its strategic partnerships with healthcare providers enhance accessibility to compounded drugs, particularly for underserved populations. Fagron’s contributions extend beyond Europe, influencing global trends in personalized medicine and setting benchmarks for quality and innovation.

Belmar Pharma Solutions

Belmar Pharma Solutions is a prominent player known for its expertise in producing high-quality compounded medications tailored to individual patient needs. The company focuses on addressing gaps in commercial drug availability, particularly for rare diseases and complex conditions. Belmar’s state-of-the-art facilities enable the production of specialized formulations, including transdermal gels and suppositories. Its dedication to research and development drives continuous improvement in compounding techniques, ensuring optimal therapeutic outcomes. Belmar’s collaborations with clinics and hospitals strengthen its market presence while promoting the adoption of compounded therapies. As a result, it plays a vital role in advancing personalized healthcare globally.

Medisca Inc.

Medisca Inc. is a key contributor to the Europe compounding pharmacies market, offering a wide range of active pharmaceutical ingredients (APIs) and compounding equipment. The company’s focus on education and training empowers pharmacists to deliver superior patient care through customized medications. Medisca’s innovative solutions, such as allergen-free bases and preservative-free formulations, address unmet medical needs effectively. Its commitment to sustainability is reflected in eco-friendly packaging and reduced carbon footprints. Medisca’s extensive distribution network ensures timely access to compounded products, enhancing patient satisfaction. Through its efforts, Medisca continues to shape the future of personalized medicine worldwide.

Top Strategies Used by Key Market Participants

Investment in Automation and Technology

Leading players in the Europe compounding pharmacies market are increasingly adopting automation to enhance operational efficiency and accuracy. Automated compounding systems reduce human error and streamline workflows are enabling faster production of customized medications. For instance, Fagron NV has integrated robotic dispensing units into its facilities, improving dosage precision and reducing contamination risks. This strategy not only boosts productivity but also aligns with regulatory requirements, ensuring compliance with Good Manufacturing Practices (GMP).

Expansion into Emerging Markets

Key participants are expanding their footprint into emerging markets within Europe to tap into untapped potential. Countries like Turkey and the Czech Republic offer lucrative opportunities due to rising healthcare expenditures and increasing awareness of personalized medicine. For example, Belmar Pharma Solutions has established partnerships with local distributors to introduce its products in these regions. Such expansions allow companies to diversify revenue streams and mitigate risks associated with saturated markets. Additionally, localized strategies ensure cultural relevance and better alignment with regional healthcare needs.

Focus on R&D and Innovation

Innovation remains a cornerstone strategy for strengthening market position. Companies are investing heavily in research and development to create novel formulations and delivery systems. Medisca Inc., for instance, has developed proprietary taste-masking technologies to improve patient acceptability of compounded oral medications. These innovations address specific challenges faced by patients such as difficulty swallowing pills or sensitivity to certain ingredients.

RECENT MARKET DEVELOPMENTS

- In April 2024, Fagron NV launched an automated compounding system in its German facility, enabling precise formulation of oral medications and strengthening its leadership in the region.

- In June 2023, Belmar Pharma Solutions partnered with a Turkish distributor to expand its presence in Eastern Europe, targeting underserved markets with specialized compounded therapies.

- In September 2022, Medisca Inc. introduced a new line of allergen-free bases for topical medications, addressing growing consumer demand for hypoallergenic products in Western Europe.

- In February 2023, Fagron NV acquired a French compounding pharmacy chain, consolidating its market position and enhancing its service offerings for dermatological applications.

- In November 2022, Belmar Pharma Solutions collaborated with a Swiss university to develop advanced taste-masking technologies for pediatric formulations, catering to unmet medical needs in Switzerland and neighboring countries.

MARKET SEGMENTATION

This research report on the European compound pharmacies market has been segmented and sub-segmented into the following categories.

By Product

- Oral Medications

- Topical Medications

- Suppositories

- Others

By Therapeutic Area

- Pain Medications

- Hormone Replacement Therapies (HRT)

- Dermatological Applications

- Others

By Application

- Paediatric

- Adult

- Geriatric

- Veterinary

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]