Europe Compound Feed Market Size, Share, Trends, COVID-19 Impact & Growth Forecast Report Segmented, By Ingredients, Supplements, Animal and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe), Industry Analysis From (2025 to 2033)

Europe Compound Feed Market Size

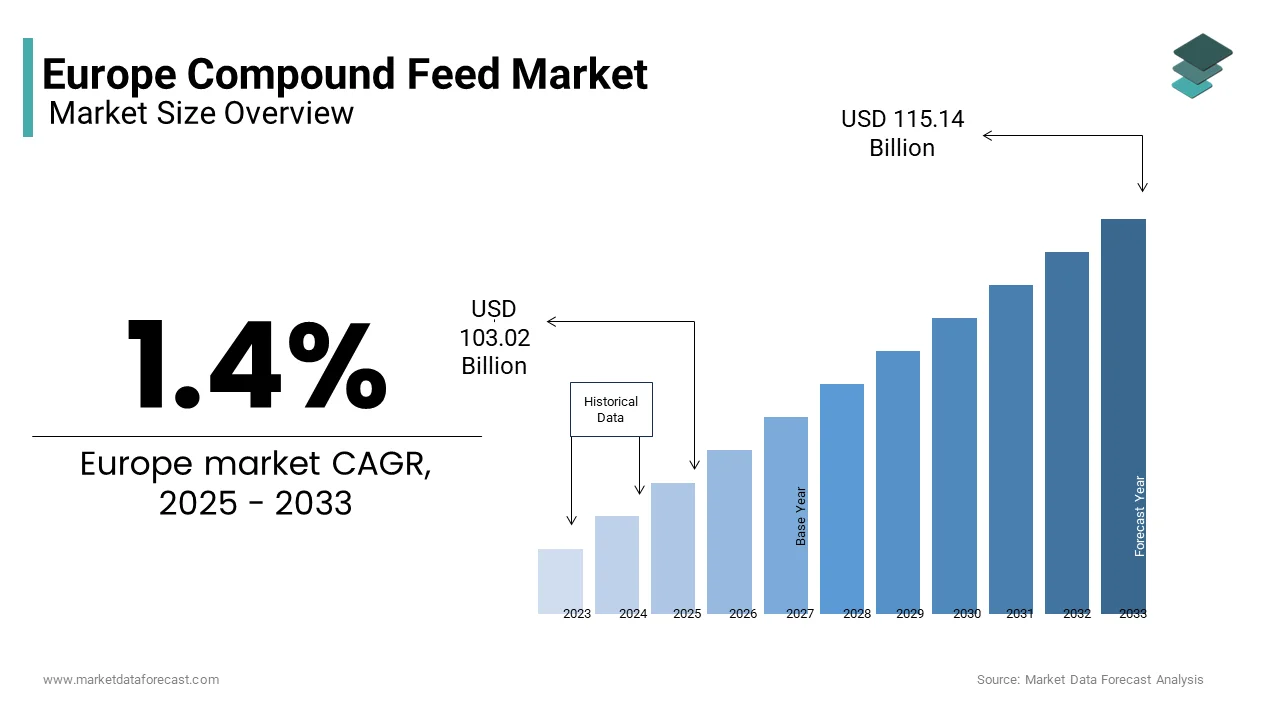

The size of the European compound feed market was valued at USD 101.60 billion in 2024 and is anticipated to reach USD 103.02 billion in 2025 from USD 115.14 billion by 2033, growing at a CAGR of 1.4% during the forecast period from 2025 to 2033.

Increasing demand for meat and aquaculture products is boosting the growth of the European Compound feed market. Meat consumption is increasing across the region due to increased urbanization, disposable incomes, and health concerns. According to the Organization for Economic Co-operation and Development report, demographics, incomes, religious beliefs, and health concerns increase meat consumption. Meat consumption is projected to increase by 0.4% in Europe, which demands the consumption of compound feed for the animals. According to the European Feed Manufacturers Federation, farm animals consumed an estimated 701 million tons of feed in 2021, of which compound feed manufacturers produced 22%. Pigs occupied the most significant compound feed, followed by poultry, cattle, and other categories. Poland is the largest chicken producer, accounting for 20% of European chicken production. The highest meat consumption is expected from Germany, France, Spain, and the UK due to changing diet patterns and economic growth.

Growing investments by key players and government initiatives are enhancing the European compound feed market growth. The feed industry receives investments from various sources for the animals' balanced nutrition, which are crucial protein supplements for people. People are becoming aware of the health concerns and adding high-protein food to their diet. These reasons are boosting the European compound feed market. Governments of many countries are taking initiatives for the healthy growth of animals to avoid the diseases caused by meat consumption. The demand for seafood is increasing due to the health benefits produced by fish consumption. The need for animal proteins increases the demand for compound feed, influencing Europe's market growth. Most of the raw materials used in compound feed are soybean, wheat, corn, barley, and sorghum sourced from plants or animals.

European government regulations, such as the ban on antibiotic growth promoters, are influencing livestock producers to identify new healthy ways for healthy animal growth, which is expected to create opportunities for market expansion. The increasing demand for organic food is influencing the producers to feed animals with organic feed.

he Russia-Ukraine war greatly impacted the Europe compound feed market in 2022, where the feed market fell by 35%. Another hampering factor is animal diseases. According to Alltech's report, 80% of the countries had observed a decline in feed production. Avian Influenza has highly affected European countries like Poland, France, Russia, and the UK. African swine fever and swine flu significantly affected some European countries. The European Feed Manufacturers Federation states that the decrease in European Compound Feed Production in 2022 will be due to animal diseases. Many large compound feed producers have decreased feed production due to supply chain disruptions and the spread of animal diseases, where only a few European countries balanced the sales compared to last year.

The increasing production and maintenance cost is a significant challenge to the market's growth. The increasing government regulations and restrictions on livestock production are expected to hinder European meat production, which in turn influences the compound feed market's expansion.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

1.4% |

|

Segments Covered |

By Ingredients, Supplements, Animal, and Country Analysis |

|

Various Analyses Covered |

Global, Regional and Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe |

|

Market Leaders Profiled |

Cargill Inc., Archer Daniels Midland Company, Land o’ Lakes, Inc., Nutreco, ALLTECH, INC., Charoen Pokphand Foods, New Hope Group Co. Ltd., Wen’s Group, ForFarmers B.V., Kyodo Shiryo Company, Sodrugestvo Group S.A., DeKalb Feeds, Inc., De Heus B.V., Agribusiness Holding Miratorg, Ballance Agri-Nutrients Ltd., Kent Feeds, Weston Milling Animal Nutrition, J.D. Heiskell & CO and EWOS GROUP |

SEGMENT ANALYSIS

By Ingredients Insights

The cereals segment dominated the European compound feed market with the largest share due to the high contribution of corn, wheat, and barley. These are abundant in many regions and easily accessible. Cereals are highly versatile in formulating compound feed for various animals. They are processed and combined with other ingredients for high nutritional value.

By Supplements Insights

The vitamins segment held the largest share in the European compound feed market revenue, as vitamins are essential supplements for animals' healthy growth. Vitamins are mainly added to the mash feed, which consists of all the ingredients irrespective of the specific requirement, giving animals a balanced diet.

By Animal Insights

The poultry segment dominates the European market as chicken is one of the most consumed forms of meat. The demand for poultry products such as meat and eggs, which are high in protein and nutritional value, is driving the growth of the poultry-related compound feed market. Consuming poultry meat provides essential amino acids, vitamins, minerals, and a high-protein content. Chicken has become a staple in many cuisines and dietary supplements, and the availability of various varieties globally is accelerating the growth of the European poultry compound feed market.

COUNTRY ANALYSIS

Europe stood as the second-largest global compound feed market region, as Germany and Spain are the most prominent compound feed producers. Spain held the 7th rank, and Germany held the 10th rank in the world compound feed production in 2021 and 2022. Spain is the largest producer of soybeans, which are high in protein content.

These countries follow France, Poland, and Italy due to increased meat consumption in the European region. The market players are focusing on investing in the animal feed industry for the better health of the animals, which is driving the market in the UK. The increasing demand for poultry is influencing the compound feed producers for high production, which helps in market expansion. The increasing government initiatives like banning growth-promoting drugs for animals to avoid hormonal diseases for the humans who consume them. These government initiatives are increasing the chances of meeting consumption, which increases the production of animals with more compound feed.

KEY MARKET PLAYERS

Cargill Inc., Archer Daniels Midland Company, Land o’ Lakes, Inc., Nutreco, ALLTECH, INC., Charoen Pokphand Foods, New Hope Group Co. Ltd., Wen’s Group, ForFarmers B.V., Kyodo Shiryo Company, Sodrugestvo Group S.A., DeKalb Feeds, Inc., De Heus B.V., Agribusiness Holding Miratorg, Ballance Agri-Nutrients Ltd., Kent Feeds, Weston Milling Animal Nutrition, J.D. Heiskell & CO and EWOS GROUP are some of the noteworthy companies in the Europe compound feed market.

MARKET SEGMENTATION

This research report on the European compound feed market is segmented and sub-segmented into the following categories.

By Ingredients

- Cereals

- Cereals by-product

- Oilseed Meal

- Oil

- Molasses

- Supplements

- Others

By Supplements

- Vitamins

- Antibiotics

- Antioxidants

- Amino acids

- Feed Enzymes

- Feed Acidifiers

- Others

By Animal

- Ruminant

- Swine

- Poultry

- Aquaculture

- Others

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

How big Is the size European Compound Feed Market?

The size of the European compound feed market was valued at USD 101.60 billion in 2024 and is anticipated to reach USD 103.02 billion in 2025 from USD 115.14 billion by 2033, growing at a CAGR of 1.4% during the forecast period from 2025 to 2033.

What Is Current Rate Of European Compound Feed Market?

The size of the compound feed market in Europe is projected to grow to USD 103.02 billion by 2025.

How Is The Demand For Europe Compound Feed Market Region?

Europe stood as the second-largest global compound feed market region, as Germany and Spain are the most prominent compound feed producers. Spain held the 7th rank, and Germany held the 10th rank in the world compound feed production.

What Are The key Market Players involved In Europe Compound Feed Market?

Cargill Inc., Archer Daniels Midland Company, Land o’ Lakes, Inc., Nutreco, ALLTECH, INC., Charoen Pokphand Foods, New Hope Group Co. Ltd., Wen’s Group, ForFarmers B.V., Kyodo Shiryo Company, Sodrugestvo Group S.A., DeKalb Feeds, Inc., De Heus B.V., Agribusiness Holding Miratorg, Ballance Agri-Nutrients Ltd., Kent Feeds, Weston Milling Animal Nutrition, J.D. Heiskell & CO and EWOS GROUP

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]