Europe Commercial Telematics Market Size, Share, Trends & Growth Forecast Report - Segmented By Type, System Type, Provider Type, End-User And By Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe) - Industry Analysis From (2025 to 2033)

Europe Commercial Telematics Market Size

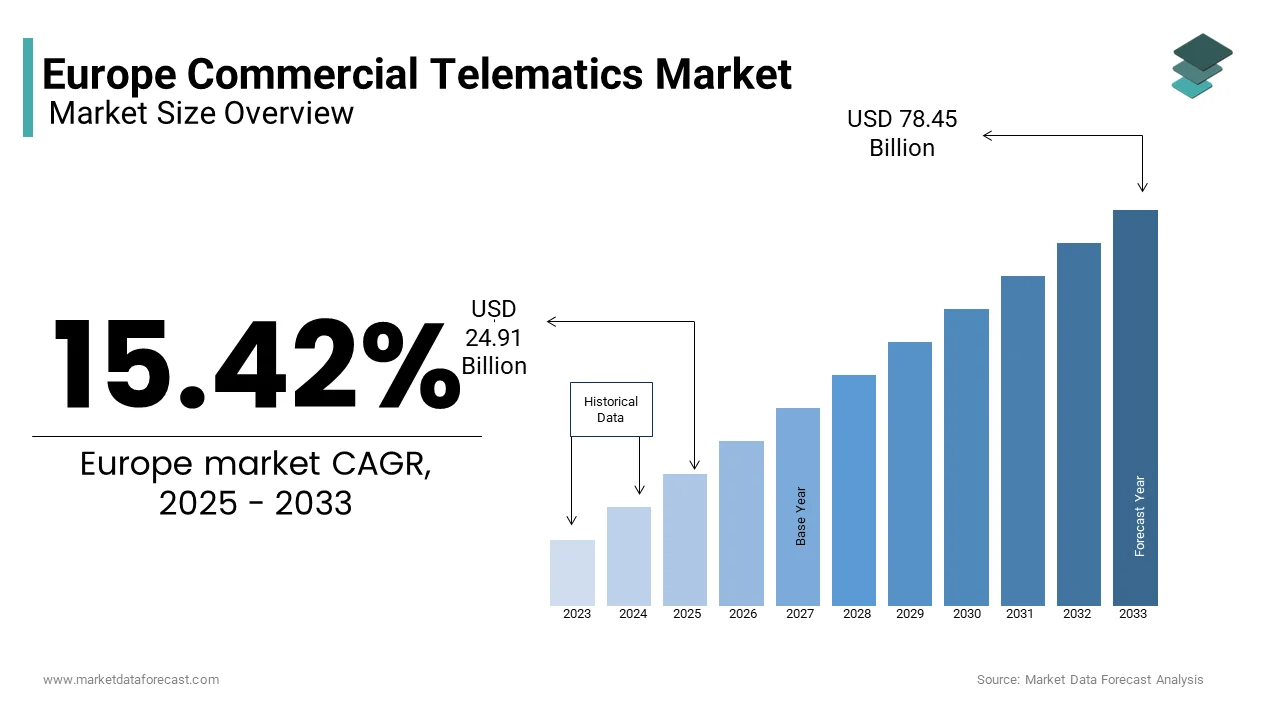

The European commercial Telematics Market Size was valued at USD 21.58 billion in 2024 and is anticipated to reach USD 24.91 billion in 2025 from USD 78.45 billion by 2033, growing at a CAGR of 15.42% during the forecast period from 2025 to 2033.

The Europe commercial telematics market growth is driven by the integration of advanced technologies to enhance fleet management, vehicle tracking, and operational efficiency. Commercial telematics refers to the use of telecommunication and data analytics tools to monitor and manage vehicle fleets, optimize routes, improve driver safety, and reduce fuel consumption. According to Eurostat, over 60% of European logistics companies adopted telematics solutions in 2022, reflecting the growing reliance on data-driven decision-making to address rising operational costs and regulatory pressures. The adoption of telematics systems has led to a 15% reduction in fuel consumption and a 20% improvement in delivery times across Europe, according to the International Transport Forum.

The market is further propelled by stringent government regulations aimed at reducing carbon emissions and enhancing road safety. According to the European Commission, the use of smart tachographs and real-time tracking systems for commercial vehicles under its Mobility Package 2030 initiative. As per the European Automobile Manufacturers' Association, the demand for connected vehicle technologies grew by 25% in 2022, with telematics playing a pivotal role in enabling these innovations. Countries like Germany, France, and the UK are leading adopters due to their robust logistics sectors and emphasis on sustainability. Despite challenges such as high implementation costs and cybersecurity concerns, the commercial telematics market is poised for sustained growth, supported by advancements in IoT, AI, and 5G connectivity. This sector is set to transform Europe’s commercial transportation landscape by fostering smarter, safer, and more efficient operations with an estimated market value of €8 billion in 2022.

Market Drivers

Stringent Government Regulations for Fleet Management

The implementation of stringent government regulations aimed at enhancing road safety and reducing carbon emissions is majorly prompting the growth rate of the Europe commercial telematics market. As per the European Commission, the use of smart tachographs and real-time tracking systems under its Mobility Package 2030 initiative requires fleet operators to monitor driving hours, vehicle performance, and emissions. According to Eurostat, compliance with these regulations will increase the adoption of telematics by 35% among European logistics companies in 2022. A study by the International Transport Forum revealed that regulated fleets reduced fuel consumption by 15% and improved driver safety by 20%. These regulatory frameworks not only ensure operational transparency but also encourage businesses to adopt telematics solutions to avoid penalties.

Rising Demand for Operational Efficiency and Cost Optimization

The growing demand for operational efficiency and cost optimization within the logistics and transportation sectors is another key driver for the growth rate of the Europe commercial telematics market. As per the European Automobile Manufacturers' Association, telematics adoption led to a 25% improvement in fleet utilization rates in 2022 by enabling businesses to reduce idle times and fuel expenses. According to the Eurostat, logistics companies using telematics achieved a 20% reduction in delivery times and a 10% decrease in maintenance costs through predictive analytics. A study by the International Labour Organization reveals that real-time data provided by telematics systems allows fleet managers to optimize routes, enhance driver productivity, and minimize operational disruptions. Businesses are leveraging telematics to achieve measurable cost savings and improve service quality with rising fuel prices and increasing competition. This focus on efficiency ensures sustained growth for the commercial telematics market across Europe.

High Implementation and Maintenance Costs

The high cost associated with the implementation and maintenance of telematics systems poses a significant barrier for small and medium-sized enterprises (SMEs). According to the European Investment Bank, over 40% of SMEs in the logistics sector cite financial constraints as a primary challenge to adopting advanced technologies like telematics. As per the Eurostat, initial setup costs, including hardware installation and software integration, can exceed €5,000 per vehicle, while annual subscription fees range from €300 to €1,000. Additionally, the International Labour Organization studies shown that ongoing expenses for system upgrades and cybersecurity measures further strain budgets. These financial burdens limit the ability of smaller fleets to invest in telematics despite its potential benefits.

Cybersecurity and Data Privacy Concerns

The growing concern over cybersecurity threats and data privacy issues associated with telematics systems, which handle sensitive information such as vehicle locations and driver behavior. As per the European Union Agency for Cybersecurity (ENISA), cyberattacks on connected vehicle systems increased by 25% in 2022 by raising apprehensions among fleet operators. According to the European Data Protection Board, non-compliance with GDPR regulations can result in fines of up to €20 million or 4% of annual turnover by creating additional risks for businesses. Eurostat studies have shown that 60% of companies expressed concerns about data breaches when implementing telematics solutions. These security challenges create hesitation among adopters is slowing the pace of market growth despite the technology's operational advantages.

Integration of AI and Predictive Analytics

The integration of artificial intelligence (AI) and predictive analytics to enhance fleet management capabilities is greatly influencing the growth rate of the Europe commercial telematics market. As per the European Automobile Manufacturers' Association, predictive maintenance, powered by AI, can reduce vehicle downtime by 30% and lower maintenance costs by 25%. According to the Eurostat, over 50% of logistics companies are investing in AI-driven telematics solutions to analyze real-time data and predict potential issues before they occur. According to the International Transport Forum, AI-based route optimization has led to a 20% reduction in fuel consumption and a 15% improvement in delivery efficiency. These advancements not only improve operational performance but also align with sustainability goals by minimizing resource wastage. The adoption of AI-powered telematics systems presents a transformative growth opportunity for the market.

Expansion into Emerging Applications like Cold Chain Logistics

The expansion of telematics into emerging applications such as cold chain logistics is driven by the rising demand for temperature-sensitive goods like pharmaceuticals and perishable food. The market growth is driven by the increasing need for real-time temperature monitoring and compliance with safety regulations. As per Eurostat, telematics systems equipped with IoT sensors reduced spoilage rates by 40% in 2022 by ensuring product integrity during transit. According to the International Labour Organization, real-time tracking and automated alerts have improved supply chain transparency, particularly in the pharmaceutical sector. Telematics adoption in cold chain logistics offers lucrative growth prospects while addressing critical industry challenges.

Limited Adoption Among Small and Medium-Sized Enterprises (SMEs)

The limited adoption among small and medium-sized enterprises (SMEs) due to financial constraints and lack of awareness is challenging the market key players. According to the European Investment Bank, over 60% of SMEs in the transportation sector have not adopted telematics solutions citing high upfront costs and perceived complexity as key barriers. As per Eurostat, the average cost of implementing telematics systems ranges from €5,000 to €10,000 per vehicle, which is prohibitive for smaller fleets operating on narrow margins. As per the International Labour Organization, 45% of SMEs lack the technical expertise to integrate and manage these systems effectively. This underutilization limits the overall market potential, as SMEs account for a significant portion of Europe’s logistics industry. Encouraging wider adoption through subsidies or simplified solutions remains a pressing challenge.

Fragmentation in Regulatory Standards Across Countries

Another significant challenge is the fragmentation in regulatory standards across European countries, which complicates compliance and increases operational burdens for fleet operators. As per the European Automobile Manufacturers' Association, differing national requirements for vehicle tracking, emissions monitoring, and driver safety create inconsistencies in telematics implementation. According to the Eurostat, only 50% of cross-border fleets fully comply with varying regulations leading to inefficiencies and legal risks. According to the International Transport Forum, non-standardized frameworks increase system customization costs by 20% by discouraging widespread adoption. While initiatives like the EU’s Mobility Package aim to harmonize rules, regional disparities persist and are hindering the seamless integration of telematics solutions. Addressing this fragmentation is crucial for fostering a unified and efficient commercial telematics ecosystem across Europe.

SEGMENTAL ANALYSIS

By Type

The fleet tracking and monitoring segment led the market and held 35.2% of the Europe commercial telematics market share in 2024. The ability to reduce fuel costs by 20% and improve route efficiency by 15%, as per a report by Eurostat. Real-time vehicle data ensures compliance with EU emission regulations is making it indispensable for logistics companies. According to the International Transport Forum, urban fleets adopting these systems saw 25% drop-in idle times. Its measurable impact on operational efficiency and regulatory adherence levels up the growth rate of the market.

The insurance telematics segment is anticipated to witness the fastest CAGR of 18.5% from 2025 to 2033. As per the Eurostat, 40% of insurers now use telematics for usage-based policies by reducing claims frequency by 25% in 2022. The International Labour Organization studies reveal that improved driver safety due to behavior-based incentives. This segment’s rapid growth is driven by consumer demand for personalized premiums and fair risk assessment by positioning it as a key innovation in blending technology with insurance practices.

By System Type

The embedded systems segment dominated the market by capturing a 45.4% share in 2024. These systems are factory-integrated into vehicles by ensuring reliable real-time data on performance and compliance. According to Eurostat, 60% of new commercial vehicles in 2022 will be equipped with embedded telematics, whereas EU regulations mandate safety and emissions monitoring. The segment’s role in reducing fleet operational disruptions by 30%. Despite higher costs, their seamless functionality and regulatory alignment make them indispensable for large fleets.

The smartphone-integrated systems are the fastest-growing segment, with a CAGR of 20.5% from 2025 to 2033. As per Eurostat, 50% of small fleet operators adopted these cost-effective solutions in 2022 by leveraging smartphone apps for GPS tracking and driver behavior monitoring. Their accessibility and scalability drive rapid adoption by making them a key enabler of telematics democratization across Europe.

By Provider Type

The OEM segment led the Europe commercial telematics market with a 60.3% share in 2024, owing to the integration of telematics during vehicle manufacturing. As per Eurostat, 70% of new commercial vehicles in 2022 were equipped with OEM-installed systems that offer seamless functionality and reliability. According to the International Transport Forum, OEM solutions reduce operational disruptions by 30%. Their factory integration and regulatory alignment make them indispensable for large fleets despite higher costs.

The aftermarket segment is likely to experience the fastest CAGR of 15.8% from 2025 to 2033. According to Eurostat, 45% of SMEs will adopt aftermarket telematics in 2022 due to affordability and flexibility. These systems enable retrofitting older vehicles by extending fleet lifecycles. The International Labour Organization extends their role in democratizing telematics for smaller operators. The segment’s cost-effectiveness and adaptability drive its rapid growth by making it crucial for broadening telematics adoption across diverse fleet sizes in Europe.

By End Use Industry

The transportation and logistics sector led the market by capturing 45.2% of the Europe commercial telematics market share in 2024. The segment’s dominance is driven by the need for fleet optimization and regulatory compliance, with Eurostat reporting a 20% reduction in fuel consumption and a 15% improvement in delivery efficiency through telematics adoption. According to the International Transport Forum, real-time tracking ensures adherence to EU emissions and safety standards.

The healthcare segment is expected to exhibit a CAGR of 17.3% from 2025 to 2033. According to Eurostat, there will be a 30% rise in telematics adoption in 2022 for medical shipments like vaccines by ensuring temperature integrity. The International Labour Organization emphasizes improved ambulance response times by 25%. Its focus on supply chain transparency and timely deliveries drives rapid growth by making it pivotal for addressing healthcare logistics challenges.

COUNTRY LEVEL ANALYSIS

Germany led the Europe commercial telematics market with 25% share in 2024 owing to its robust logistics sector, which accounts for over 30% of Europe’s total freight volume, as per Eurostat. The country’s emphasis on sustainability and compliance with EU emissions regulations has accelerated telematics adoption, with the International Transport Forum noting a 20% reduction in fleet emissions through real-time monitoring. Additionally, Germany’s advanced manufacturing base and high investment in IoT and 5G technologies have fostered innovation in telematics solutions. Germany’s dominance is due to its strong infrastructure, regulatory alignment, and focus on operational efficiency by ensuring its position as a key driver of market growth.

United Kingdom

The United Kingdom commercial telematics market is likely to grow with a CAGR of 13.5% during the forecast period. The expansion of e-commerce and urban logistics is driving the growth rate of the market in this country, with telematics adoption increasing by 25% in 2022, as per the British Retail Consortium. The UK government’s stringent safety and emissions regulations, such as the Road to Zero strategy with the use of advanced fleet management systems. According to the Confederation of British Industry, businesses leveraging telematics achieved a 15% improvement in delivery times. The growing focus on digital transformation, smart city initiatives, and sustainability goals is attributed to fuel the growth rate of the market.

France

France's commercial telematics market is likely to grow at a steady pace in the next coming years. The country’s prominence is attributed to its thriving transportation and healthcare sectors, which rely heavily on telematics for fleet optimization and medical logistics. According to Eurostat, France’s healthcare logistics sector adopted telematics at a 30% higher rate in 2022 to ensure the safe transport of temperature-sensitive pharmaceuticals. According to the French Ministry of Ecology, telematics has reduced urban fleet emissions by 18% with national sustainability targets. France’s focus on innovation, regulatory compliance, and addressing critical industry needs are greatly to influence the growth rate of the market.

KEY MARKET PLAYERS

Webfleet Solutions BV, Verizon Communications Inc., ABAX UK Ltd, Masternaut Limited, Targa Telematics SpA. These are the market players dominating Europe's commercial telematics market.

MARKET SEGMENTATION

This research report on the Europe commercial telematics market is segmented and sub-segmented into the following categories.

By Type

- Solution

- Fleet Tracking and Monitoring

- Driver Management

- Insurance Telematics

- Safety and Compliance

- V2X Solutions

- Others

- Services

- Professional Services

- Managed Services

By System Type

- Embedded

- Tethered

- Smartphone Integrated

By Provider Type

- OEM

- Aftermarket

By End Use Industry

- Transportation and Logistics

- Media and Entertainment

- Government and Utilities

- Travel and Tourism

- Construction

- Healthcare

- Others

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What is the current market size of the Europe commercial telematics market?

The current market size of the European commercial Telematics Market Size was valued at USD 24.91 billion in 2025

How big is the Europe commercial telematics market?

The European commercial Telematics Market Size was valued at USD 21.58 billion in 2024 and is anticipated to reach USD 24.91 billion in 2025 from USD 78.45 billion by 2033, growing at a CAGR of 15.42% during the forecast period from 2025 to 2033.

What drivers are driving the Europe commercial telematics market?

The stringent government regulations for fleet management and rising demand for operational efficiency and cost optimization are the major market drivers in Europe's commercial telematics market.

Who are the market players that are dominating the Europe commercial telematics market?

Webfleet Solutions BV, Verizon Communications Inc., ABAX UK Ltd, Masternaut Limited, Targa Telematics SpA. These are the market players that are dominating the Europe commercial telematics market.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]