Europe Commercial Refrigeration Equipment Market Size, Share, Trends & Growth Forecast Report By Product (Deep Freezers, Bottle Coolers, Storage Water Coolers, Commercial Kitchen Refrigerator, Medical Refrigerator, Chest Refrigerator, Others), End User, Application, And Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest Of Europe), Industry Analysis From 2025 To 2033

Europe Commercial Refrigeration Equipment Market Size

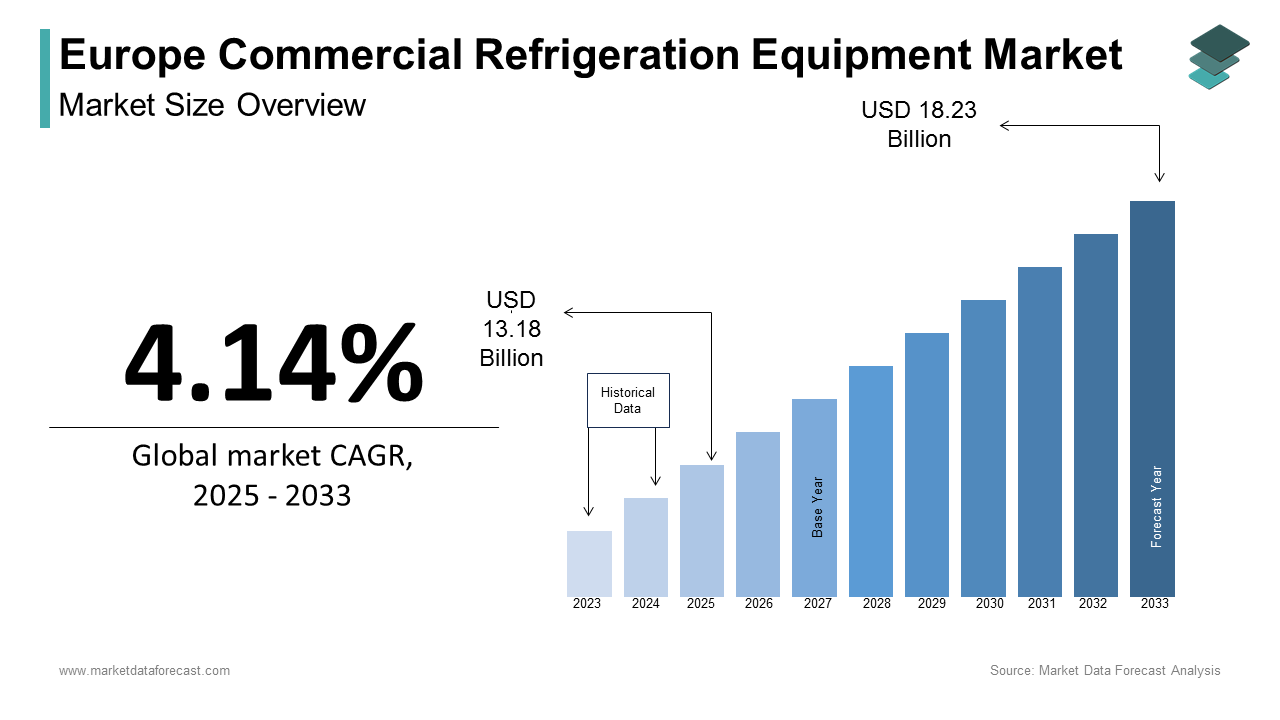

The European commercial refrigeration equipment market size was calculated to be USD 12.66 billion in 2024 and is anticipated to be worth USD 18.23 billion by 2033 from USD 13.18 billion In 2025, growing at a CAGR of 4.14% during the forecast period.

Commercial refrigeration equipment includes a diverse range of products designed to preserve food and beverages across various commercial settings. This market is characterized by its rapid evolution, driven by technological advancements, regulatory changes, and shifting consumer preferences. The increasing demand for energy-efficient and environmentally friendly refrigeration solutions is reshaping the landscape as businesses seek to reduce operational costs while adhering to stringent environmental regulations. The European commercial refrigeration equipment market is projected to witness substantial growth owing to the expansion of the food service and retail sectors, which are increasingly reliant on advanced refrigeration technologies to maintain product quality and safety. Furthermore, the rising trend of online grocery shopping and home delivery services is propelling the demand for commercial refrigeration equipment as retailers strive to ensure the freshness of perishable goods during transit.

MARKET DRIVERS

Demand for Energy-Efficient Solutions

The demand for energy-efficient refrigeration solutions is primarily driving the growth of the Europe commercial refrigeration equipment market. As businesses face escalating energy costs and increasing pressure to minimize their carbon footprints, the adoption of energy-efficient technologies has become imperative. According to the European Commission, energy consumption in the refrigeration sector accounts for approximately 15% of total energy use in the EU, highlighting the potential for significant savings through efficiency improvements. The implementation of advanced technologies, such as variable speed compressors and smart controls, has been shown to reduce energy consumption by up to 30%. Furthermore, the European Union's commitment to reducing greenhouse gas emissions by at least 55% by 2030 has led to stricter regulations on refrigerants and energy efficiency standards. This regulatory environment is driving manufacturers to innovate and develop more efficient refrigeration systems. As a result, the demand for energy-efficient commercial refrigeration equipment is projected to grow significantly during the forecast period, reflecting the increasing prioritization of sustainability in business operations, as noted by the International Energy Agency.

Growth of Online Food Delivery Services

The growing trend of online food delivery services is further boosting the expansion of the Europe commercial refrigeration equipment market. The COVID-19 pandemic accelerated the shift towards e-commerce, with online grocery sales in Europe surging by over 50% in 2020, according to a report by eMarketer. This shift has necessitated the need for efficient refrigeration solutions to ensure the safe transport of perishable goods. As consumers increasingly opt for home delivery, retailers are investing in advanced refrigeration technologies to maintain product quality during transit. The demand for refrigerated delivery vehicles and temperature-controlled storage facilities is on the rise, with the market for refrigerated transport expected to grow at a promising pace in the coming years. Additionally, the expansion of dark stores further drives the need for commercial refrigeration equipment. These facilities require robust refrigeration systems to handle high volumes of perishable products efficiently. As the online food delivery market continues to expand, the demand for commercial refrigeration solutions that cater to this sector is anticipated to grow, positioning it as a key driver of market dynamics in Europe.

MARKET RESTRAINTS

High Initial Investment Costs

The high initial investment required for advanced refrigeration systems is one of the major restraints to the Europe commercial refrigeration equipment market. Many businesses, particularly small and medium-sized enterprises (SMEs), may find it difficult to allocate the necessary capital for upgrading their refrigeration equipment to meet modern efficiency standards. According to a survey conducted by the European Small Business Alliance, nearly 40% of SMEs reported that financial constraints were a major barrier to adopting energy-efficient technologies. This reluctance to invest can lead to a reliance on outdated systems, which not only consume more energy but also fail to comply with evolving regulatory requirements. Furthermore, the ongoing global supply chain disruptions, exacerbated by the COVID-19 pandemic, have resulted in increased costs and delays in obtaining essential components for refrigeration systems. As manufacturers struggle to source materials, the overall market growth may be stunted, as businesses are unable to upgrade or replace their existing equipment in a timely manner, as highlighted by the World Trade Organization.

Stringent Regulatory Landscape

The stringent regulatory landscape surrounding refrigerants is further hindering the growth of the Europe commercial refrigeration equipment market. The European Union has implemented rigorous regulations aimed at phasing out high global warming potential (GWP) refrigerants, such as hydrofluorocarbons (HFCs), in favor of more environmentally friendly alternatives. The F-Gas Regulation, which aims to reduce HFC consumption by two-thirds by 2030, poses significant challenges for manufacturers and end-users alike. Transitioning to low-GWP refrigerants often requires substantial modifications to existing refrigeration systems, leading to increased costs and operational complexities. According to the European Commission, the transition could result in an estimated €1.5 billion in additional costs for businesses across the EU. This regulatory pressure may deter some companies from investing in new refrigeration technologies as they grapple with the financial implications of compliance. Consequently, the market may experience slower growth as businesses navigate these challenges, as noted by the European Environmental Agency.

MARKET OPPORTUNITIES

Technological Innovation

The Europe commercial refrigeration equipment market presents numerous growth opportunities, particularly in the realm of technological innovation. The increasing emphasis on smart refrigeration solutions, which integrate IoT (Internet of Things) technology, is transforming the industry landscape. These advanced systems enable real-time monitoring and control of refrigeration units, allowing businesses to optimize energy consumption and reduce operational costs. The smart refrigeration market is projected to grow significantly due to the rising demand for energy efficiency and enhanced operational visibility. The integration of predictive maintenance capabilities further enhances the appeal of smart refrigeration systems, as they can identify potential issues before they escalate, minimizing downtime and repair costs. As businesses increasingly recognize the value of data-driven decision-making, the adoption of smart refrigeration technologies is expected to accelerate, creating significant growth opportunities for manufacturers and service providers in the European market.

Focus on Sustainability

The growing focus on sustainability and eco-friendly practices in the food and beverage industry represents another significant opportunity for the Europe commercial refrigeration equipment market. As consumers become more environmentally conscious, businesses are compelled to adopt sustainable practices, including the use of energy-efficient refrigeration systems. The demand for natural refrigerants, such as carbon dioxide and ammonia, is on the rise, as these alternatives have a lower environmental impact compared to traditional refrigerants. According to a study by the International Institute of Refrigeration, the demand for natural refrigerants is expected to grow exponentially in the coming years due to regulatory support and consumer demand for sustainable solutions. Additionally, the European Green Deal aims to make Europe the first climate-neutral continent by 2050, further incentivizing businesses to invest in eco-friendly refrigeration technologies. This shift towards sustainability not only aligns with regulatory requirements but also enhances brand reputation and customer loyalty, positioning companies to capitalize on the growing market for environmentally responsible products.

MARKET CHALLENGES

Rapid Technological Change

The rapid pace of technological change is one of the significant challenges to the Europe commercial refrigeration equipment market. As the industry evolves, businesses must continuously adapt to new technologies and innovations to remain competitive. This can be particularly daunting for smaller companies that may lack the resources to invest in research and development. According to a survey conducted by the European Commission, nearly 30% of SMEs reported that keeping up with technological advancements was a significant challenge. The constant need for upgrades and training can strain financial and human resources, potentially leading to operational inefficiencies. Furthermore, the integration of new technologies often requires a cultural shift within organizations, as employees must adapt to new processes and systems. This challenge can hinder the overall growth of the market as companies struggle to balance innovation with day-to-day operations, as highlighted by the European Small Business Alliance.

Competition from Alternative Cooling Solutions

The growing competition from alternative cooling solutions is further challenging the expansion of the Europe commercial refrigeration equipment market. The rise of energy-efficient technologies, such as air conditioning and heat pumps, has led to a diversification of cooling options available to businesses. These alternatives often offer lower operational costs and improved energy efficiency, making them attractive to end-users. According to the International Energy Agency, the demand for heat pumps is expected to grow considerably through 2025, driven by their versatility and efficiency. As businesses explore various cooling solutions, traditional commercial refrigeration equipment may face declining demand, particularly in sectors where alternative technologies can provide comparable performance. This competitive pressure necessitates that manufacturers continuously innovate and differentiate their products to maintain market share. Failure to adapt to changing market dynamics could result in stagnation or decline, posing a significant challenge for stakeholders in the European refrigeration market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

4.14% |

|

Segments Covered |

By Product, End use, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, and Czech Republic |

|

Market Leaders Profiled |

Bitzer SE, GEA Refrigeration Technologies, Carel Industries, Viessmann Group, AHT Cooling Systems, Bock GmbH, SCM Frigo S.P.A., De Rigo Refrigeration S.r.l., Freor Lt Uab, FRIGOBLOCK GmbH, INTARCON, Kelvion PHE GmbH, Pfannenberg GmbH, TEXA Industries, Walter Roller GmbH & Co. |

SEGMENTAL ANALYSIS

By Product Insights

The commercial kitchen refrigerators segment led the market by accounting for 34.7% of the regional market share in 2024. The growth of the commercial kitchen refrigerators segment is driven by the increasing demand from the food service industry, which includes restaurants, hotels, and catering services. The growth of the food service sector, projected to reach €500 billion by 2025, is a key factor propelling the demand for commercial kitchen refrigerators. These units are essential for maintaining food safety and quality, as they provide the necessary temperature control for perishable items. Additionally, the trend toward meal preparation and delivery services has further amplified the need for efficient refrigeration solutions in commercial kitchens. As businesses strive to enhance operational efficiency and comply with stringent food safety regulations, the demand for advanced commercial kitchen refrigerators is expected to continue its upward trajectory, solidifying its position as the dominant segment in the European market, as reported by the European Food Safety Authority.

The medical refrigerator segment is experiencing a remarkable surge in demand and is projected to grow at a CAGR of 8.2% over the forecast period owing to the increasing need for temperature-sensitive medical products, including vaccines, pharmaceuticals, and biological samples. The COVID-19 pandemic has underscored the critical importance of reliable refrigeration solutions in the healthcare sector, leading to heightened investments in medical refrigeration equipment. According to the World Health Organization, the global vaccine market is expected to reach €100 billion by 2025, necessitating robust refrigeration systems to ensure the integrity of vaccines during storage and transportation. Furthermore, advancements in technology, such as smart monitoring systems that provide real-time temperature tracking, are enhancing the appeal of medical refrigerators. As healthcare providers prioritize the safe storage of critical medical supplies, the medical refrigerator segment is poised for significant growth, reflecting the evolving landscape of the European commercial refrigeration market.

By End User Insights

The supermarkets and hypermarkets captured 41.4% of the European commercial refrigeration equipment market share in 2024. The dominating position of the segment in the European market is primarily attributed to the increasing consumer preference for one-stop shopping experiences, which has led to the expansion of large retail formats across Europe. According to a report by the European Retail Association, the supermarket sector is projected to reach €600 billion by 2025, driving the demand for efficient refrigeration solutions to preserve perishable goods. Supermarkets require a diverse range of refrigeration equipment, including display cases, walk-in coolers, and freezers, to maintain product freshness and comply with food safety regulations. Additionally, the growing trend of private label products has prompted retailers to invest in advanced refrigeration technologies to enhance product quality and shelf life. As supermarkets continue to evolve and expand, the demand for commercial refrigeration equipment tailored to this sector is expected to remain robust, solidifying its position as the leading end-user segment in the European market.

The convenience stores segment is anticipated to witness a promising CAGR in the European commercial refrigeration equipment market over the forecast period owing to the rising consumer demand for quick and easy access to food and beverages, particularly in urban areas. Convenience stores are increasingly becoming popular for their ability to offer a wide range of products in a compact space, catering to the on-the-go lifestyle of modern consumers. According to a study by the European Convenience Store Association, the convenience store market is expected to reach €100 billion by 2025, driven by the expansion of retail chains and the introduction of new product lines. The need for efficient refrigeration solutions in convenience stores is paramount, as these establishments often require compact and versatile refrigeration units to maximize space while ensuring product quality. As the trend towards convenience shopping continues to grow, the demand for commercial refrigeration equipment tailored to this segment is anticipated to rise, positioning it as a key driver of market dynamics in Europe.

By Application Insights

The food service segment occupied 44.8% of the European commercial refrigeration equipment market share in 2024. The dominating position of food service segment in the European market is primarily driven by the robust growth of the restaurant and catering industries, which are increasingly reliant on advanced refrigeration solutions to maintain food safety and quality. According to the European Restaurant Association, the food service sector is projected to reach €400 billion by 2025, necessitating significant investments in commercial refrigeration equipment. The need for efficient refrigeration systems in food service establishments is critical, as they play a vital role in preserving perishable ingredients and ensuring compliance with health regulations. Additionally, the growing trend of meal delivery services has further amplified the demand for refrigeration solutions that can accommodate high volumes of food preparation. As the food service industry continues to expand, the demand for commercial refrigeration equipment tailored to this application is expected to remain strong, solidifying its position as the leading segment in the European market.

The food and beverage distribution segment is anticipated to grow at a CAGR of 10.7% over the forecast period due to the increasing demand for efficient logistics and supply chain solutions in the food and beverage sector. The rise of e-commerce and online grocery shopping has necessitated the need for reliable refrigeration systems to ensure the safe transport of perishable goods. According to a report by the European Logistics Association, the food and beverage distribution market is expected to reach €150 billion by 2025, highlighting the critical role of refrigeration in maintaining product integrity during transit. Additionally, advancements in refrigerated transport technologies, such as temperature-controlled vehicles and smart monitoring systems, are enhancing the efficiency of food distribution operations. As businesses prioritize the safe and timely delivery of perishable products, the demand for commercial refrigeration solutions tailored to the food and beverage distribution segment is anticipated to grow significantly, positioning it as a key driver of market dynamics in Europe.

REGIONAL ANALYSIS

The United Kingdom emerged as a leading player in the European commercial refrigeration equipment market by commanding 26.5% of the European market share in 2024. The UK market is characterized by a robust food service sector, with the restaurant industry alone projected to reach €100 billion by 2025. This growth is driving the demand for advanced refrigeration solutions to ensure food safety and quality. Additionally, the increasing trend of online grocery shopping has further amplified the demand for commercial refrigeration equipment in the UK. According to the British Retail Consortium, online grocery sales surged by over 70% during the pandemic, necessitating efficient refrigeration systems to maintain the freshness of perishable goods during delivery. The UK government’s commitment to sustainability and energy efficiency is also influencing the market, as businesses are encouraged to adopt eco-friendly refrigeration technologies. As a result, the UK is well-positioned to continue leading the European commercial refrigeration equipment market, with significant investments expected in both traditional and innovative refrigeration solutions.

Germany is another key player in the Europe commercial refrigeration equipment market and captured a substantial share of the European market in 2024. The country’s strong manufacturing base and emphasis on technological innovation contribute to its leadership position. The German food service sector is projected to grow to €120 billion by 2025, driving the demand for advanced refrigeration systems. According to the German Federal Statistical Office, the number of restaurants and catering services has increased by 15% over the past five years, further fueling the need for efficient refrigeration solutions. Additionally, Germany’s stringent environmental regulations are pushing businesses to invest in energy-efficient refrigeration technologies, creating a favorable environment for market growth. The combination of a robust food service industry and a commitment to sustainability positions Germany as a significant contributor to the European commercial refrigeration equipment market.

France is also a prominent player in the Europe commercial refrigeration equipment market. The French food service industry, which includes a diverse range of restaurants, cafes, and catering services, is projected to reach €90 billion by 2025. The increasing popularity of gourmet and organic food options is driving the demand for high-quality refrigeration solutions that can maintain product integrity. According to the French National Institute of Statistics and Economic Studies, the number of food service establishments has grown by 10% in recent years, highlighting the sector's expansion. Furthermore, France's commitment to reducing food waste and promoting sustainability is encouraging businesses to invest in energy-efficient refrigeration technologies. As the French market continues to evolve, the demand for commercial refrigeration equipment is expected to remain strong, solidifying its position in the European landscape.

Italy is another significant contributor to the Europe Commercial Refrigeration Equipment Market. The Italian food service sector, renowned for its culinary heritage, is projected to grow to €80 billion by 2025. The increasing focus on food quality and safety is driving the demand for advanced refrigeration solutions in restaurants and catering services. According to the Italian National Institute of Statistics, the number of food service establishments has increased by 12% over the past five years, reflecting the sector's growth. Additionally, Italy's emphasis on sustainability and energy efficiency is prompting businesses to adopt eco-friendly refrigeration technologies. The combination of a rich culinary tradition and a commitment to quality positions Italy as a key player in the European commercial refrigeration equipment market.

Spain is anticipated to account for a considerable share of the European market over the forecast period. The Spanish food service industry is projected to reach €70 billion by 2025, driven by the increasing popularity of dining out and the growth of the tourism sector. According to the Spanish National Institute of Statistics, the number of restaurants and bars has grown by 8% in recent years, further fueling the demand for commercial refrigeration equipment. The emphasis on fresh and locally sourced ingredients is also driving the need for efficient refrigeration solutions to maintain product quality. Additionally, Spain's commitment to sustainability and energy efficiency is encouraging businesses to invest in advanced refrigeration technologies. As the Spanish market continues to expand, the demand for commercial refrigeration equipment is expected to grow, reinforcing its position in the European market landscape.

TOP STRATEGIES BY THE KEY PLAYERS

Innovation in Energy Efficiency and Sustainability

With increasing regulatory pressure and consumer demand for eco-friendly solutions, companies like Bitzer SE, GEA Refrigeration Technologies, Kelvion PHE GmbH, and Pfannenberg GmbH focus on developing energy-efficient and sustainable refrigeration systems. Bitzer SE invests heavily in R&D to create compressors that use natural refrigerants such as CO2 and ammonia, ensuring compliance with F-Gas regulations. GEA Refrigeration Technologies offers advanced heat exchangers and chillers designed for minimal environmental impact while maximizing efficiency. Meanwhile, Kelvion PHE GmbH develops plate heat exchangers that reduce energy consumption and integrate seamlessly into green building designs. These innovations help companies align with EU sustainability goals, attract environmentally conscious customers, and reduce operational costs for end-users.

Expansion of Product Portfolio

To cater to diverse industries such as food retail, logistics, and pharmaceuticals, companies like Carel Industries, Viessmann Group, and AHT Cooling Systems diversify their product offerings. Carel Industries provides a wide range of controllers, humidifiers, and monitoring systems tailored for different refrigeration applications. Viessmann Group expands its portfolio beyond traditional refrigeration to include integrated climate solutions for commercial spaces. AHT Cooling Systems focuses on plug-and-play refrigeration units suitable for small to medium-sized businesses. A broader product portfolio allows these companies to address diverse customer needs, enter niche markets, and increase revenue streams.

Strategic Partnerships and Collaborations

Strategic partnerships and collaborations are critical for enhancing capabilities and reaching new markets. SCM Frigo S.P.A. collaborates with software companies to integrate IoT and smart technologies into its refrigeration systems. De Rigo Refrigeration S.r.l. works with local distributors to expand its presence in Eastern Europe and other emerging markets. FRIGOBLOCK GmbH teams up with logistics companies to develop specialized transport refrigeration solutions. These partnerships enable companies to leverage complementary strengths, access new customer segments, and accelerate innovation.

Focus on Digitalization and Smart Solutions

Digitalization is transforming the refrigeration industry, with companies like Walter Roller GmbH & Co., TEXA Industries, and Freor Lt Uab incorporating IoT, AI, and cloud-based technologies into their products. Walter Roller GmbH & Co. develops smart cooling solutions with real-time temperature monitoring and automated alerts. TEXA Industries integrates AI-driven diagnostics to optimize system performance and reduce downtime. Freor Lt Uab offers connected refrigeration units that can be controlled via mobile apps or centralized platforms. Digitalization enhances customer experience, improves operational efficiency, and creates opportunities for recurring revenue through service subscriptions.

Geographic Expansion and Localization

Geographic expansion and localization are key strategies for companies like INTARCON and Bock GmbH. INTARCON expands its footprint in Southern Europe by offering compact and modular refrigeration systems suited to smaller retail spaces. Bock GmbH establishes manufacturing facilities closer to key markets to reduce lead times and transportation costs. Geographic expansion increases market share, while localization ensures compliance with regional regulations and preferences, enabling companies to better serve local customers.

Mergers, Acquisitions, and Joint Ventures

Mergers, acquisitions, and joint ventures allow companies to consolidate their market presence and acquire new technologies. GEA Refrigeration Technologies acquires companies specializing in heat pump technology to complement its existing offerings. Pfannenberg GmbH engages in joint ventures to develop hybrid cooling systems combining refrigeration and air conditioning. These activities enable companies to quickly scale operations, gain access to cutting-edge technologies, and eliminate competition, strengthening their overall market position.

Focus on After-Sales Services

Providing comprehensive after-sales services is a priority for companies like Carel Industries and Viessmann Group. Carel Industries offers global technical support and training centers to ensure proper installation and operation of its products. Viessmann Group implements service contracts that include regular inspections, repairs, and upgrades. Strong after-sales services build customer loyalty, generate recurring revenue, and differentiate companies from competitors, ensuring long-term relationships with clients.

Compliance with Regulations and Standards

Compliance with stringent EU regulations, such as the Ecodesign Directive and F-Gas Regulation, is a critical strategy for all key players in the market. Companies invest in R&D to phase out high-GWP (Global Warming Potential) refrigerants and adopt low-GWP alternatives. They also obtain certifications, such as ISO standards, to demonstrate adherence to quality and safety norms. Regulatory compliance minimizes legal risks, enhances brand reputation, and opens doors to government-funded projects, ensuring sustained growth in a highly regulated market.

KEY MARKET PLAYERS

Major Players of the Europe commercial refrigeration equipment market include Bitzer SE, GEA Refrigeration Technologies, Carel Industries, Viessmann Group, AHT Cooling Systems, Bock GmbH, SCM Frigo S.P.A., De Rigo Refrigeration S.r.l., Freor Lt Uab, FRIGOBLOCK GmbH, INTARCON, Kelvion PHE GmbH, Pfannenberg GmbH, TEXA Industries, Walter Roller GmbH & Co.

Recent Market Developments

- In March 2023, Danfoss completed the acquisition of Bock GmbH, a German manufacturer of compressors and condensing units for refrigeration and air-conditioning. This strategic move integrated Bock's expertise into Danfoss' Climate Solutions division, enhancing their offerings in the European market.

- In 2022, GEA Refrigeration Technologies continued its focus on sustainability by developing energy-efficient refrigeration systems utilizing natural refrigerants, such as ammonia, carbon dioxide, propane, and isobutane. This ongoing commitment aligns with the European Union's environmental regulations and strengthens GEA's position in the market.

MARKET SEGMENTATION

This research report on the European commercial refrigeration equipment market has been segmented and sub-segmented based on product, end user, application, and region.

By Product

- Deep Freezers

- Bottle Coolers

- Storage Water Coolers

- Commercial Kitchen Refrigerator

- Medical Refrigerator

- Chest Refrigerator

- Others

By End User

- Hotels & Restaurants

- Supermarkets & Hypermarkets

- Convenience Stores Bakery

By Application

- Food Service

- Food & Beverage Retail

- Food & Beverage Distribution

- Food & Beverage Production

By Region

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. What are the key factors driving the growth of the commercial refrigeration equipment market?

The growth of the commercial refrigeration equipment market is driven by factors such as increasing demand for frozen and processed food, advancements in energy-efficient refrigeration technologies, government regulations on food safety, and the expansion of the retail and hospitality sectors.

2. Who are the major players in the commercial refrigeration equipment industry?

Key market players in the commercial refrigeration equipment industry include Carrier Global Corporation, Daikin Industries Ltd., Dover Corporation, Emerson Electric Co., Hussmann Corporation, Johnson Controls International plc, and Panasonic Corporation.

3. How is technological advancement impacting commercial refrigeration equipment?

Technological advancements are enhancing energy efficiency, improving temperature control, integrating IoT-based monitoring systems, and enabling the use of eco-friendly refrigerants, which help reduce environmental impact and operational costs.

4. Which industries are the primary end-users of commercial refrigeration equipment?

The primary end-users of commercial refrigeration equipment include food and beverage retail (supermarkets, convenience stores), foodservice (restaurants, hotels, catering), healthcare (hospitals, laboratories), and cold storage logistics providers.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]