Europe Commercial Printing Market Size, Share, Trends & Growth Forecast Report By Technology (Lithographic Printing, Digital Printing, Flexographic Printing, Screen Printing, Gravure Printing, and Others), Print Type, Application, and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2025 to 2033

Europe Commercial Printing Market Size

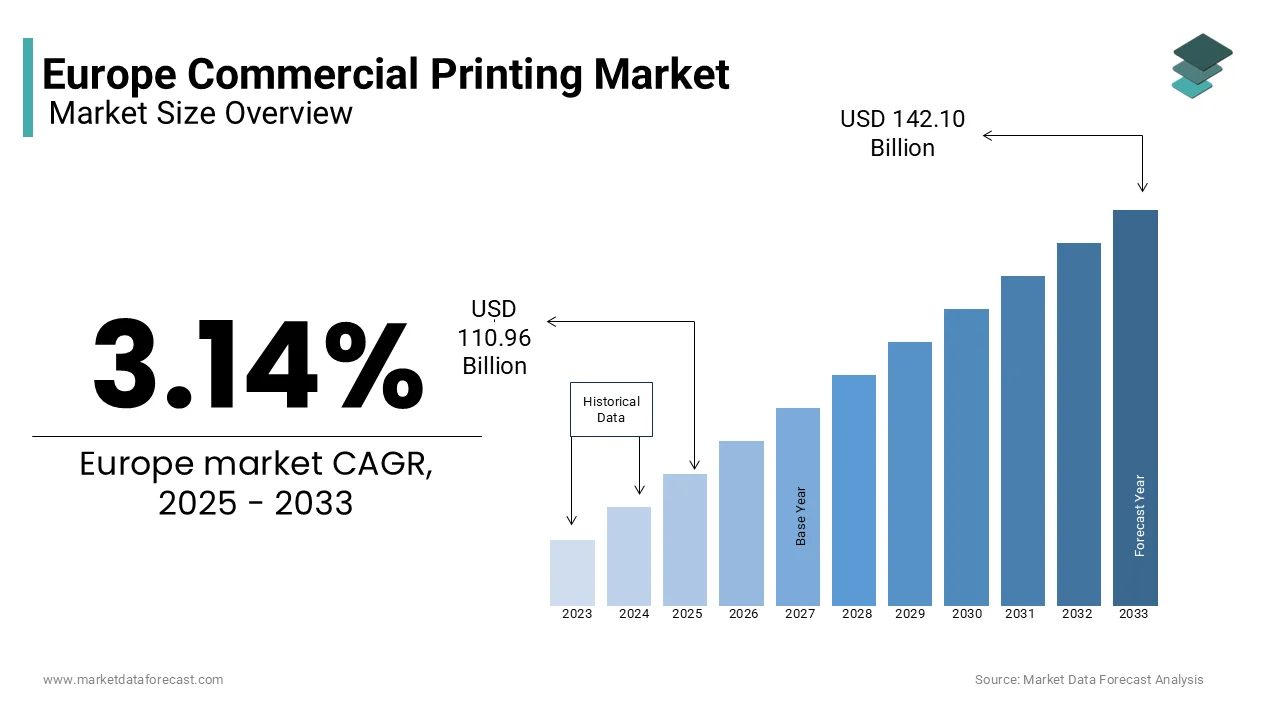

The commercial printing market size in Europe was valued at USD 107.58 billion in 2024. The European market is estimated to be worth USD 142.10 billion by 2033 from USD 110.96 billion in 2025, growing at a CAGR of 3.14% from 2025 to 2033.

The commercial printing is the production of printed materials such as brochures, catalogs, labels, packaging, and promotional items, utilizing advanced technologies like offset, digital, and flexographic printing. The commercial printing sector remains integral to branding, marketing, and product differentiation in industries reliant on tactile customer experiences. According to Eurostat, the European printing industry generated revenues of approximately €85 billion in 2022, with commercial printing accounting for over 60%. The growth is driven by the demand for high-quality and customized print solutions that complement digital strategies.

The market is witnessing a transformation fueled by technological advancements and sustainability initiatives. According to the European Federation of Print and Digital Communication, 40% of printing companies have adopted eco-friendly practices, such as using recycled paper and vegetable-based inks, to align with stringent environmental regulations. Furthermore, the rise of e-commerce has bolstered demand for printed packaging, with the International Trade Administration reporting a 15% annual growth in this segment. Countries like Germany, the UK, and France lead the market due to their robust manufacturing bases and strong retail sectors. However, challenges such as rising raw material costs and competition from digital alternatives persist. The Europe commercial printing market continues to adapt is blending traditional craftsmanship with innovative technologies to meet evolving consumer preferences and regulatory standards.

MARKET DRIVERS

Growing Demand for Sustainable and Eco-Friendly Printing Solutions

One of the major drivers of the Europe commercial printing market is the increasing demand for sustainable and eco-friendly printing practices. According to the European Environment Agency, over 60% of consumers in Europe prefer environmentally responsible products, pushing businesses to adopt green printing solutions. According to Eurostat, 40% of printing companies have transitioned to using recycled paper and vegetable-based inks with the EU’s Circular Economy Action Plan. According to the European Federation of Print and Digital Communication, eco-friendly packaging solutions grew by 20% in 2022 is driven by stringent regulations on single-use plastics. This shift not only enhances brand reputation but also meets consumer expectations for sustainability. The emphasis on sustainable printing practices serves as a significant growth driver by ensuring compliance and fostering innovation within the industry.

Expansion of E-Commerce and Customized Packaging Needs

Another key driver is the rapid expansion of e-commerce, which has significantly increased demand for customized and high-quality packaging solutions. The growing demand for the printed packaging is accelerating the growth rate of the market. According to the Eurostat, the packaging segment accounted for 35% of the commercial printing market’s revenue in 2022, which was driven by the need for personalized designs and durable materials. According to the European Retail Forum, at 70% of retailers now prioritize unique packaging to differentiate their products in a competitive market. This trend is further amplified by advancements in digital printing technologies by enabling cost-effective customization. The demand for innovative and visually appealing packaging solutions propels the growth of the commercial printing market across Europe.

MARKET RESTRAINTS

Rising Competition from Digital Media and Paperless Trends

The growing competition from digital media and the shift toward paperless operations is one of the restraining factors for the market growth. According to the European Commission, digital advertising spending surpassed €70 billion in 2022, accounting for over 60% of total marketing budgets, as businesses increasingly prioritize online platforms over traditional print media. As per Eurostat, industries such as banking and education have adopted paperless practices with e-invoicing and digital documentation reducing demand for printed materials by 15% annually. According to the International Labour Organization, this trend is further accelerated by remote work models, which rely heavily on digital communication tools. The decline in demand for conventional printed materials poses a significant challenge to the industry’s growth trajectory while print remains relevant for certain applications like packaging,.

Increasing Costs of Raw Materials and Energy

Another key restraint is the rising costs of raw materials and energy, which have significantly impacted production expenses in the commercial printing sector. According to the Eurostat, the cost of paper, a critical input for printing, increased by 25% in 2022 due to supply chain disruptions and reduced pulp production. As per the European Energy Agency, energy prices surged by 40% during the same period by affecting energy-intensive processes like offset and digital printing. According to the Confederation of European Paper Industries, these cost pressures have forced 30% of small and medium-sized printing businesses to either raise prices or reduce operational capacity. Such financial burdens limit innovation and profitability, particularly for smaller players is creating a challenging environment for sustainable growth in the Europe commercial printing market.

MARKET OPPORTUNITIES

Growing Demand for Personalized and Variable Data Printing

The increasing demand for personalized and variable data printing (VDP) with the need for targeted marketing and customer engagement is more likely to create growth opportunities for the market. As per the European Federation of Print and Digital Communication, businesses using personalized print materials experienced a 30% higher response rate compared to generic campaigns in 2022. According to the Eurostat, the adoption of digital printing technologies, which enable cost-effective customization, grew by 18% in the same year. As per the International Trade Administration, sectors like retail and healthcare are leveraging VDP for tailored packaging, labels, and promotional materials. The ability to deliver unique, high-quality printed products presents a lucrative opportunity for the commercial printing industry.

Expansion into Sustainable Packaging Solutions

Another key opportunity is the rising demand for sustainable packaging solutions is fueled by stringent environmental regulations and consumer preferences for eco-friendly products. According to the European Environment Agency, over 65% of consumers in Europe are willing to pay a premium for sustainable packaging is driving innovation in this segment. According to Eurostat, the sustainable packaging market in Europe grew by 22% in 2022, with printed packaging playing a pivotal role in branding and product differentiation. Additionally, as per the Confederation of European Paper Industries, 45% of printing companies have invested in recyclable and biodegradable materials to align with the EU’s Circular Economy Action Plan. This shift not only addresses regulatory requirements but also positions the commercial printing market as a critical player in supporting Europe’s green transition while tapping into a rapidly expanding niche.

MARKET CHALLENGES

Declining Print Media Consumption and Advertising Spend

The steady decline in print media consumption and advertising spend is subsequently to pose a challenge for the Europe commercial printing market. According to the European Commission, print advertising revenues dropped by 12% annually between 2020 and 2022, as businesses shifted budgets toward digital platforms. As per Eurostat, newspaper circulation in Europe fell by 35% over the past decade that further reducing demand for traditional printed materials. According to the International Labour Organization, sectors like publishing and journalism have been particularly affected, with 40% of companies downsizing their print operations. This trend is exacerbated by younger demographics favoring online content by leaving the commercial printing industry grappling with shrinking market segments. Adapting to this shift while maintaining profitability remains a significant challenge.

Environmental Regulations and Sustainability Compliance Costs

Another key challenge is the increasing pressure to comply with stringent environmental regulations, which impose additional costs on the commercial printing industry. According to the European Environment Agency, new regulations under the EU’s Circular Economy Action Plan require printers to adopt sustainable practices, such as using recycled materials and reducing emissions. As per Eurostat, 30% of small and medium-sized printing businesses struggle to afford the high costs of transitioning to eco-friendly technologies. According to the Confederation of European Paper Industries, energy-intensive processes, coupled with rising electricity prices have increased operational expenses. These financial burdens, combined with the need for continuous innovation, create significant obstacles for companies striving to balance sustainability goals with economic viability in a competitive market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

3.14% |

|

Segments Covered |

By Technology, Print Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, Rest of Europe |

|

Market Leaders Profiled |

RR Donnelley & Sons, Duncan Print, Mixam, Quad/Graphics Inc Class A, Cenveo, Acme Printing, Quebecor Inc Shs -B- Subord.Voting, LSC Communications, Dai Nippon Printing Co Ltd, Gorham Printing, Cimpress PLC, Transcontinental Inc Shs -A- Voting Subord, and others. |

SEGMENTAL ANALYSIS

By Technology Insights

The lithographic printing segment was the largest and held 35.1% of the Europe commercial printing market share in 2024. This dominance is driven by its cost-effectiveness for high-volume print jobs, such as brochures, catalogs, and packaging materials. According to the Eurostat, lithographic printing accounts for over 40% of all printed packaging in Europe, a sector that grew by 15% in 2022 due to rising e-commerce demands. According to the International Trade Administration, industries like retail and publishing rely heavily on lithographic printing for its superior color accuracy and consistency. However, the segment faces challenges from digital alternatives, with the European Commission reporting a 10% annual decline in traditional print media. Despite this, lithographic printing’s ability to deliver high-quality outputs at scale.

The digital printing segment is anticipated to exhibit a fastest CAGR of 8.5% from 2025 to 2033. This growth is fueled by increasing demand for personalized and on-demand printing solutions in marketing and packaging. According to the Eurostat, variable data printing, a key application of digital technology, grew by 20% in 2022 with businesses seeking targeted customer engagement. Additionally, the Confederation of European Paper Industries, digital printing’s flexibility and shorter turnaround times make it ideal for small-scale projects, such as customized labels and promotional materials. While the segment currently holds a smaller market share compared to lithographic printing, its alignment with consumer trends toward personalization and sustainability positions it as a transformative force in the industry.

By Print Type Insights

The image-based printing segment dominated the Europe commercial printing market with 40.1% of share in 2024 owing to the widespread use of image printing in applications such as advertising, packaging, and promotional materials, where visual appeal plays a critical role. As per Eurostat, industries like retail and e-commerce rely heavily on high-resolution image printing to enhance brand visibility and customer engagement. For instance, product packaging with vibrant imagery saw a 25% increase in consumer preference in 2022, according to the International Trade Administration. However, the segment faces challenges from digital alternatives, which offer dynamic visuals at lower costs. Despite this, the demand for visually striking printed materials ensures the continued dominance of image-based printing.

The pattern-based printing is the fastest-growing segment, with a CAGR of 9.2% from 2025 to 2033. This growth is fueled by the increasing popularity of patterned designs in textiles, wallpapers, and luxury packaging in the fashion and home decor industries. According to the Confederation of European Paper Industries, patterned packaging grew by 18% in 2022 with increasing consumer demand for unique and aesthetically pleasing products. Additionally, advancements in digital printing technologies have enabled cost-effective customization of intricate patterns by making them accessible to smaller businesses. Its ability to cater to niche markets and evolving design trends positions it as a key driver of innovation in the commercial printing industry.

By Application Insights

The packaging segment led the market by occupying 45.2% of the Europe commercial printing market share in 2024. This dominance is driven by the rapid expansion of e-commerce and the growing emphasis on sustainable, visually appealing packaging solutions. According to the Eurostat, the demand for printed packaging materials grew by 20% in 2022, with industries like food, beverages, and retail relying heavily on customized designs to enhance brand identity. According to the International Trade Administration, 70% of consumers associate premium packaging with product quality, further boosting this segment. However, rising raw material costs, which increased by 25% in 2022, pose challenges. Despite this, packaging remains a critical driver of growth due to its integral role in branding and product differentiation.

The advertising segment is likely to experience a CAGR of 8.7% from 2025 to 2033. This growth is fueled by businesses increasingly investing in targeted print campaigns to complement digital strategies, particularly in sectors like retail and real estate. According to the Eurostat, personalized print advertising, such as brochures and direct mail, achieved a 30% higher response rate compared to generic campaigns in 2022. According to the Confederation of European Paper Industries, advancements in digital printing technologies have enabled cost-effective customization by making print advertising more accessible to small and medium-sized enterprises. The tactile and localized nature of print advertising ensures its continued relevance and steady growth in niche markets.

REGIONAL ANALYSIS

Germany commercial printing market was accounted in holding a 22.1% share in 2024 with its robust manufacturing base and strong demand for high-quality packaging solutions, particularly in the automotive and pharmaceutical sectors. According to the Eurostat, Germany’s e-commerce sector grew by 18% in 2022 by boosting demand for printed packaging materials. According to the European Federation of Print and Digital Communication, 40% of German printing companies have adopted sustainable practices by aligning with stringent EU environmental regulations. Germany’s dominance from its advanced technological infrastructure, skilled workforce, and focus on innovation. The country’s ability to blend traditional printing craftsmanship with cutting-edge digital technologies ensures its dominant growth in the market.

The United Kingdom is expected to register a CAGR of 6.8% during the forecast period. The expansion of e-commerce and retail sectors, which rely heavily on customized packaging and promotional materials is anticipated to level up the growth rate of the market. According to the British Retail Consortium, printed packaging demand increased by 20% in 2022 with the increasing online shopping trends. Furthermore, the UK government’s £3 billion investment in green technologies has encouraged printers to adopt eco-friendly practices, as per the Confederation of European Paper Industries. The UK’s market growth is supported by its strong regulatory framework, emphasis on sustainability, and adaptability to digital transformation. These factors position the UK as a key player in meeting evolving consumer and regulatory demands.

France commercial printing market is esteemed to have potential growth opportunities in the next coming years. The country’s prominence is attributed to its thriving luxury goods and cosmetics industries, which prioritize premium packaging and branding solutions. According to the International Trade Administration, France’s luxury sector accounted for 25% of global exports in 2022 along with the driving demand for high-end printed materials. As per the French Ministry of Economy, 50% of printing companies have invested in digital printing technologies to meet customization needs. The integration of eco-friendly practices and advanced printing techniques ensures its competitive edge in the European commercial printing landscape.

KEY MARKET PLAYERS

The major key players in Europe commercial printing market are RR Donnelley & Sons, Duncan Print, Mixam, Quad/Graphics Inc Class A, Cenveo, Acme Printing, Quebecor Inc Shs -B- Subord.Voting, LSC Communications, Dai Nippon Printing Co Ltd, Gorham Printing, Cimpress PLC, Transcontinental Inc Shs -A- Voting Subord, and others.

MARKET SEGMENTATION

This research report on the Europe commercial printing market is segmented and sub-segmented into the following categories.

By Technology

- Lithographic Printing

- Digital Printing

- Flexographic Printing

- Screen Printing

- Gravure Printing

- Others

By Print Type

- Image

- Painting

- Pattern

- Others

By Application

- Packaging

- Advertising

- Publishing

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. What is the current size of the Europe Commercial Printing Market?

The Europe Commercial Printing Market was valued at USD 107.58 billion in 2024 and is expected to grow steadily in the coming years.

2. What are the key challenges faced by the Europe Commercial Printing Market?

The market faces challenges such as the shift toward digital media, rising environmental concerns, fluctuating raw material costs, and increasing adoption of paperless communication methods.

3. What factors are driving the demand for commercial printing in Europe?

The demand is driven by expanding e-commerce and retail sectors, rising demand for printed packaging and labels, technological advancements in printing techniques, and increasing advertising and branding needs.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]