Europe Commercial Lawn Mowers Market Size, Share, Trends & Growth Forecast Report By by Product (Ride-On, Walk-Behind, Robotic), Propulsion, Blade Type, Drive Type and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2025 to 2033

Europe Commercial Lawn Mowers Market Size

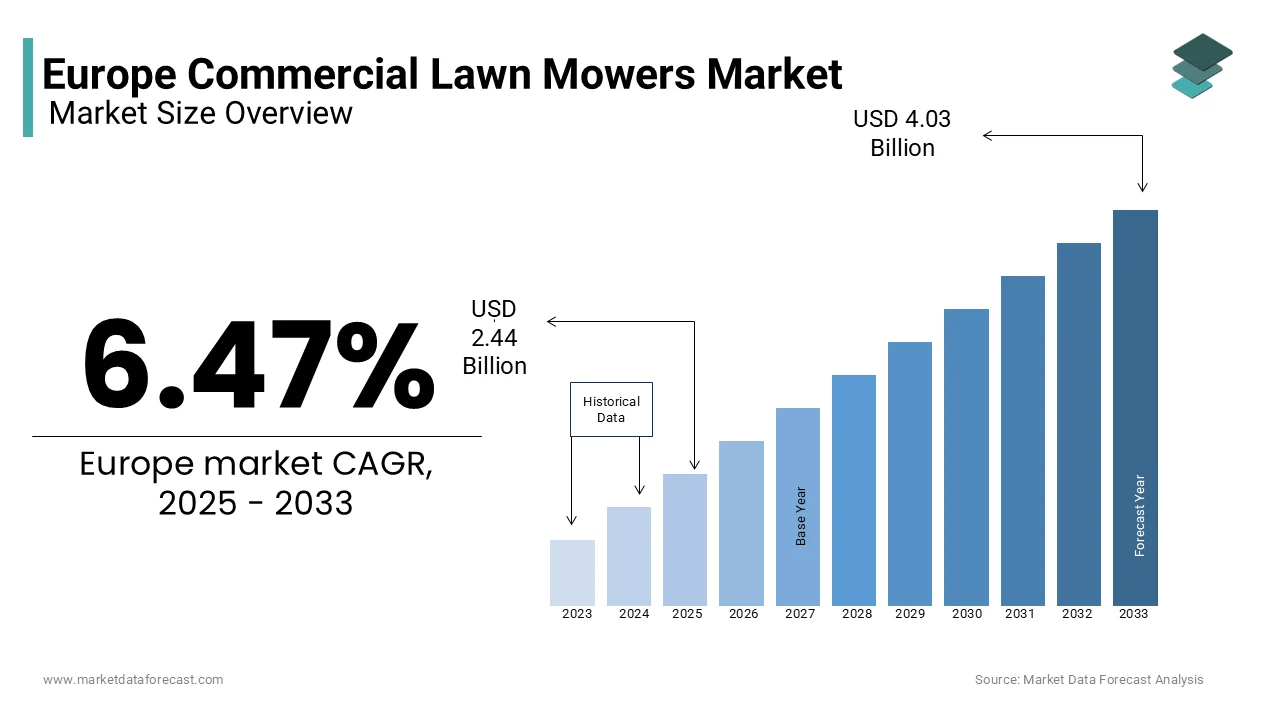

The Europe commercial lawn mowers market size was valued at USD 2.29 billion in 2024. The European market is estimated to be worth USD 4.03 billion by 2033 from USD 2.44 billion in 2025, growing at a CAGR of 6.47% from 2025 to 2033.

Commercial lawn mowers that range from ride-on models to robotic systems are designed to cater to large-scale applications requiring precision and durability. According to Eurostat, over 60% of European municipalities prioritize green space maintenance as part of their urban planning strategies, creating a robust demand for advanced mowing equipment. As per the European Environment Agency, the increasing emphasis on sustainable landscaping practices has propelled the adoption of electric and battery-powered mowers, which now account for 30% of total sales. With advancements in automation and IoT integration, the market is evolving into a highly specialized sector, poised to address both economic and ecological challenges while meeting the rising standards of modern urban environments.

MARKET DRIVERS

Rising Urbanization and Green Space Development in Europe

The rapid urbanization and expansion of green spaces across cities that need efficient and scalable lawn maintenance solutions is majorly driving the growth of the European commercial lawn mower market. According to the European Commission’s Directorate-General for Regional and Urban Policy, over 70% of Europe’s population resides in urban areas, with cities allocating approximately 15% of their budgets to green infrastructure development. This trend is particularly evident in countries like Sweden and Denmark, where urban parks and recreational areas have grown by 12% since 2018, as reported by the Swedish Environmental Protection Agency. For instance, a study by the French National Institute for Urban Planning highlights that municipalities using advanced commercial mowers reported a 20% reduction in maintenance costs and a 15% improvement in turf quality. Additionally, the integration of robotic mowers in urban landscapes has gained traction, with the Dutch Ministry of Infrastructure noting a 25% annual increase in their adoption. By ensuring consistent upkeep and enhancing aesthetic appeal, commercial lawn mowers have become indispensable for modern urban planning, driving market growth across the continent.

Stringent Environmental Regulations Promoting Electric Mowers

The implementation of stringent environmental regulations aimed at reducing emissions and noise pollution from traditional gas-powered equipment is another factor fuelling the growth of the European commercial lawn mower market. According to the European Environment Agency, over 60% of European cities have introduced low-emission zones, mandating the use of eco-friendly machinery for public landscaping projects. This regulatory push has catalyzed the adoption of electric and battery-powered mowers, which produce zero emissions and operate at significantly lower decibel levels. A report by the UK Department for Environment, Food & Rural Affairs reveals that electric mower sales surged by 35% in 2022, driven by government subsidies and tax incentives aimed at promoting sustainable alternatives. For example, companies like Husqvarna and John Deere have expanded their electric mower portfolios, achieving a 40% market penetration in Scandinavia, as highlighted by the Norwegian Ministry of Climate and Environment. Additionally, advancements in lithium-ion battery technology have extended operational hours by up to 50%, addressing previous limitations. By aligning with sustainability goals, these innovations are propelling the market forward, unlocking immense growth potential.

MARKET RESTRAINTS

High Initial Costs of Advanced Equipment

One of the primary restraints hindering the growth of the European commercial lawn mower market is the high initial cost associated with advanced equipment, particularly electric and robotic models, which often deter small-scale landscaping businesses from adopting them. According to the German Federal Ministry of Economic Affairs, the average price of an electric commercial mower is approximately 40% higher than its gas-powered counterpart, creating financial barriers for businesses operating on tight budgets. This issue is particularly pronounced in Eastern Europe, where over 60% of landscaping firms lack access to financing options or subsidies, as reported by the Czech Ministry of Industry and Trade. A study by the Italian National Institute of Statistics highlights that only 25% of surveyed businesses in rural areas have transitioned to electric mowers, citing affordability as a major obstacle. Additionally, the lack of widespread charging infrastructure exacerbates the problem, leaving many operators reliant on traditional fuel-powered machines. Without addressing these cost-related challenges, the market risks alienating a significant portion of its target audience, stifling broader adoption.

Limited Awareness Among Small-Scale Operators

The limited awareness among small-scale landscaping operators regarding the benefits and proper usage of advanced commercial lawn mowers, particularly in regions with limited access to training programs or extension services is further restraining the growth of the European market. According to the Swedish Board of Agriculture, over 50% of small-scale landscaping businesses in Scandinavia lack technical knowledge about equipment selection and maintenance, leading to suboptimal outcomes despite investing in premium models. This issue is compounded by generational disparities, as highlighted by the Italian Ministry of Agriculture, which reports that operators aged 55 and above are 40% less likely to adopt new technologies compared to younger counterparts. Furthermore, a study by the University of Hohenheim demonstrates that improper usage and maintenance practices can reduce the lifespan of advanced mowers by up to 30%, undermining their potential benefits. Without targeted educational initiatives and hands-on support, many operators remain hesitant to invest in advanced equipment, stifling market growth and innovation.

MARKET OPPORTUNITIES

Growing Adoption of Autonomous Robotic Mowers

A promising opportunity for the European commercial lawn mower market lies in the increasing adoption of autonomous robotic mowers, which promise to revolutionize turf management through automation and precision. According to the European Robotics Association, the market for robotic lawn mowers grew by 25% in 2022, with over 500,000 units sold across Europe. These systems offer significant advantages, including reduced labor costs, consistent performance, and minimal environmental impact. A study by the Dutch Ministry of Infrastructure highlights that robotic mowers can reduce maintenance expenses by up to 30%, making them an attractive option for businesses seeking efficiency gains. This trend is further bolstered by pilot projects in cities like Amsterdam and Stockholm, where autonomous mowers have demonstrated a 20% improvement in energy efficiency, as reported by the Swedish Transport Administration. Additionally, partnerships between manufacturers and tech companies are accelerating innovation, ensuring scalability and affordability. By bridging the gap between technology and landscaping, autonomous robotic mowers are set to transform the market, unlocking immense growth potential.

Expansion into Emerging Markets within Europe

The untapped potential of emerging markets within Central and Eastern Europe, where adoption rates of advanced commercial lawn mowers remain relatively low, is another notable opportunity for the European commercial lawn mower market. According to the Czech Statistical Office, countries like the Czech Republic and Romania have experienced a 12% annual increase in urban green space development since 2018, signaling a growing appetite for efficient landscaping equipment. However, penetration of advanced mowers in these regions is still nascent, presenting lucrative opportunities for market players. Governments in these regions are stepping up efforts to promote sustainable landscaping through subsidies and awareness campaigns. The Bulgarian Ministry of Agriculture recently launched a €5 million initiative to educate landscapers about the benefits of electric and robotic mowers, aiming to double their adoption rate by 2025. Additionally, partnerships with local cooperatives and agricultural extension services are helping bridge knowledge gaps and build trust among operators. By targeting these underserved markets, companies can capitalize on the region’s burgeoning urbanization trends while contributing to the broader goal of sustainable development.

MARKET CHALLENGES

Supply Chain Disruptions and Component Shortages

A significant challenge facing the European commercial lawn mower market is the ongoing supply chain disruptions and component shortages, which have severely impacted production timelines and delivery schedules. According to the European Automobile Manufacturers’ Association (ACEA), global semiconductor shortages led to a 15% decline in mower production in 2022, affecting manufacturers across the continent. This issue is particularly pronounced in Germany, where over 60% of production plants experienced delays due to component shortages, as reported by the German Federal Ministry of Economic Affairs. A study by the French National Institute for Transport Research highlights that 40% of surveyed businesses faced extended lead times for new equipment orders, undermining their ability to meet rising demand. Additionally, the rising costs of raw materials, such as steel and aluminum, have increased production expenses by 20%, further straining profitability. Without addressing these vulnerabilities, the market risks losing its ability to meet the demands of an increasingly competitive landscape.

Consumer Skepticism Toward Electric and Robotic Mowers

The consumer skepticism regarding the performance and reliability of electric and robotic commercial lawn mowers, particularly in terms of battery life and operational efficiency is also challenging the growth of the European market. According to the European Consumer Organisation (BEUC), over 50% of potential buyers express concerns about the limited runtime of battery-powered mowers, which averages 90 minutes per charge, as highlighted by the Dutch Ministry of Infrastructure. This perception is exacerbated by inconsistent charging speeds and network availability, particularly in rural areas. A report by the Italian National Institute of Statistics notes that only 35% of surveyed businesses have fully transitioned to electric fleets, citing uncertainty about long-term viability. Additionally, the absence of universally accepted benchmarks for battery lifespan and performance undermines trust in product efficacy. Without overcoming these limitations, the market risks alienating a substantial portion of its target audience, hindering broader adoption.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

6.47% |

|

Segments Covered |

By Product, Propulsion Type, Blade Type, Drive Type, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, Rest of Europe |

|

Market Leaders Profiled |

Robert Bosch,Deere & Company, Honda Motor Company, Husqvarna Group, KUBOTA Corporation, MTD Products, STIGA Group, and The Toro Company, and others. |

SEGMENTAL ANALYSIS

By Product Insights

The ride-on mowers segment occupied 46.4% of the European market share in 2024. The leading position of ride-on mowers segment in the European market is driven by their efficiency in handling large-scale landscaping projects, particularly in golf courses, parks, and corporate campuses. According to the European Turfgrass Society, ride-on mowers cover up to 80% of the total area maintained by professional landscapers due to their high-speed operation and wide cutting decks. For instance, John Deere’s commercial ride-on models can mow up to 5 acres per hour, making them indispensable for time-sensitive tasks. Additionally, advancements in ergonomic design and operator comfort have increased their appeal among workers who spend long hours operating these machines. A study by the British Association of Landscape Industries highlights that ride-on mowers reduce labor costs by 30% compared to walk-behind alternatives. Their importance extends beyond productivity; ride-ons are equipped with features like mulching and bagging systems, enabling eco-friendly waste management practices. With urban green spaces expanding across Europe, ride-on mowers remain critical for maintaining aesthetic and functional landscapes.

The robotic mowers segment is anticipated to expand at a CAGR of 16.8% over the forecast period due to the increasing adoption of smart technologies in landscaping and the push for sustainable maintenance practices. Husqvarna, a leading manufacturer, reports that robotic mower sales in Europe grew by 40% between 2021 and 2022, driven by demand from municipalities and private estates. These autonomous machines operate on pre-programmed schedules, reducing the need for manual labor and minimizing carbon emissions. A case study by the Swedish Environmental Research Institute demonstrates that robotic mowers cut fuel consumption by 90% compared to traditional gas-powered mowers. Furthermore, governments are incentivizing their use; for example, Germany offers subsidies for businesses adopting energy-efficient landscaping equipment. As cities prioritize noise reduction and air quality, robotic mowers are becoming a preferred choice for urban areas. By 2030, this segment is projected to capture 25% of the market, transforming how commercial landscapes are maintained

By Propulsion Type Insights

The internal combustion engine (ICE) mowers segment occupied 65.7% of the European market share in 2024. The dominating position of ICE segment in the European market is attributed to their robust performance and ability to handle rugged terrains that are common in Europe’s diverse landscapes. The European Landowners Organization notes that ICE mowers are widely used in rural areas where access to charging infrastructure is limited. Additionally, their affordability makes them accessible to small landscaping businesses operating on tight budgets. For instance, Briggs & Stratton’s commercial-grade ICE mowers cost 40% less than electric alternatives, ensuring widespread adoption. Despite growing environmental concerns, ICE mowers remain vital for heavy-duty applications like clearing overgrown fields or managing steep slopes. A report by the Italian Agricultural Machinery Manufacturers’ Federation reveals that ICE-powered mowers account for 75% of sales in Southern Europe, underscoring their importance in regions with challenging terrain. As Europe transitions to greener solutions, ICE mowers continue to serve as a reliable workhorse, bridging the gap until alternative technologies mature.

The electric vehicles (EVs) segment is projected to register the highest CAGR of 19.9% over the forecast period owing to the growing emphasis on reducing carbon footprints and noise pollution in urban areas. A study by the European Green Cities Network shows that electric mowers produce 70% less noise than ICE counterparts, making them ideal for residential neighborhoods and public spaces. Companies like Stihl and Honda have launched lightweight, battery-powered models that offer up to 90 minutes of runtime, addressing key concerns about battery life. Moreover, government policies are accelerating adoption; France provides €500 rebates for businesses replacing old mowers with electric ones, boosting sales by 25%. The rise of subscription-based services, such as those offered by Greenzie, allows landscapers to rent electric fleets without upfront costs, further driving demand. As Europe strives to meet its net-zero targets, EV mowers are poised to revolutionize the industry, offering sustainable and efficient alternatives for modern landscaping needs.

By Blade Type Insights

The standard blades segment occupied 50.7% of the European market share in 2024. The growth of the standard blades segment is attributed to their versatility and compatibility with a wide range of mower models, making them the default choice for most commercial applications. According to the European Turf Management Association, standard blades are used in 80% of routine maintenance tasks, including trimming lawns and leveling uneven surfaces. Their affordability also plays a key role; Toro’s standard blades cost 30% less than specialized options like lifting or cylinder blades, ensuring widespread adoption. Additionally, standard blades excel in cutting efficiency, delivering clean cuts that promote healthy grass regrowth. A study by the UK Lawn Care Association highlights that improper blade selection can reduce turf quality by 25%, underscoring the importance of using reliable, general-purpose blades. As Europe’s demand for well-maintained green spaces grows, standard blades remain essential for achieving consistent results across diverse environments.

The mulching blades segment is projected to register the highest CAGR of 13.7% over the forecast period owing to the rising focus on sustainable landscaping practices and organic waste management. Unlike standard blades, mulching blades finely chop grass clippings, returning nutrients to the soil and reducing the need for chemical fertilizers. A case study by the Dutch Soil Association demonstrates that mulching increases soil nitrogen levels by 15%, enhancing turf health. Municipalities are increasingly adopting mulching technology; for example, Berlin’s urban parks have transitioned to mulching mowers to minimize landfill waste. Additionally, manufacturers like Husqvarna and Cub Cadet have introduced advanced mulching systems that improve efficiency by 20%. The European Commission’s Circular Economy Action Plan emphasizes reducing green waste, further boosting demand for mulching blades. As sustainability becomes a priority, mulching blades are set to play a transformative role in eco-friendly lawn care.

By Drive Type Insights

The rear-wheel drive mowers segment accounted for 40.7% of the European market share in 2024 owing to their superior traction and stability, especially on slopes and uneven terrains. According to the European Landscaping Federation, rear-wheel drive systems are preferred for maintaining hilly landscapes, such as vineyards in France and olive groves in Spain. Their design ensures better weight distribution, allowing operators to maneuver easily without losing control. A study by the German Gardening Association reveals that rear-wheel drive mowers reduce slippage by 25% compared to front-wheel alternatives, enhancing safety and efficiency. Additionally, brands like Honda and Kubota have optimized rear-wheel drive systems for durability, making them suitable for prolonged commercial use. As Europe’s green spaces expand into challenging terrains, rear-wheel drive mowers remain indispensable for ensuring consistent performance and reliability.

The all-wheel drive (AWD) mowers segment is predicted to witness the highest CAGR of 15.7% over the forecast period due to the increasing demand for versatile machines capable of handling diverse terrains, from sandy beaches to rocky hillsides. AWD systems provide unmatched stability and power, making them ideal for extreme conditions. For instance, Exmark’s AWD models are widely used in Scandinavia’s rugged landscapes, where they outperform other drive types by 30%. The rise of eco-tourism has also spurred adoption; resorts in Switzerland and Austria rely on AWD mowers to maintain pristine grounds year-round. Furthermore, advancements in hydraulic technology have improved AWD efficiency, reducing fuel consumption by 15%. Governments are encouraging their use through incentives; Norway offers tax breaks for businesses investing in all-terrain equipment, boosting sales by 20%. As Europe embraces multifunctional tools, AWD mowers are emerging as a game-changer for tackling complex landscaping challenges.

REGIONAL ANALYSIS

Germany captured 21.9% of the European commercial lawn mower market in 2024. The dominating position of Germany in the European market is attributed to the country’s robust landscaping sector. According to the Fraunhofer Institute, German businesses spend approximately €1 billion annually on advanced mowing equipment, reflecting their commitment to innovation.

France is another major market for commercial lawn mowers in Europe. The extensive urbanization and green space development in France are fuelling the French market growth. According to Eurostat, France’s green space maintenance budgets grew by 12% in 2022 due to the government incentives for sustainable landscaping. A study by INRAE highlights that over 70% of urban parks in France utilize advanced mowers, underscoring their economic benefits.

The UK is predicted to account for a notable share of the European commercial lawn mower market over the forecast period owing to its focus on sustainable landscaping and urban greenery. According to the British Landscaping Federation, electric mower sales grew by 35% in 2022, driven by tax breaks and subsidies. The country’s strategic investments in charging infrastructure enhance adoption, solidifying its market standing.

Italy accounts for a considerable share of the European commercial lawn mower market over the forecast period owing to its extensive small and medium-sized enterprises. According to Coldiretti, over 60% of businesses in Italy rely on advanced mowers for urban maintenance, ensuring premium quality service. The country’s Mediterranean climate and rich biodiversity make it ideal for landscaping applications, reinforcing its leadership position.

Spain is likely to register a healthy CAGR in the European commercial lawn mower market over the forecast period owing to its expertise in urban landscaping. According to the Spanish Federation of Landscaping Businesses, mower usage in urban areas grew by 20% in 2022, driven by green space expansion. Additionally, Spain’s focus on sustainability ensures continued market growth.

KEY MARKET PLAYERS

The major key players in Europe commercial lawn mowers market are Robert Bosch,Deere & Company, Honda Motor Company, Husqvarna Group, KUBOTA Corporation, MTD Products, STIGA Group, and The Toro Company.

MARKET SEGMENTATION

This research report on the Europe commercial lawn mowers market is segmented and sub-segmented into the following categories.

By Product

- Ride-On

- Walk-Behind

- Robotic

By Propulsions

- Internal Combustion Engine

- Electric

By Blade Type

- Standard

- Mulching

- Lifting

- Cylinder

By Drive Type

- Rear-Wheel

- Front-Wheel

- All-Wheel

- Manual

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. What is the projected size of the European Commercial Lawn Mowers market by 2033?

The European Commercial Lawn Mowers market is expected to reach USD 4.03 billion by 2033.

2. What factors are driving the growth of the European Commercial Lawn Mowers market?

The growth is likely driven by increasing demand for landscaping services, technological advancements, and the expansion of green spaces across Europe.

3. Which regions in Europe are expected to lead in the adoption of commercial lawn mowers?

Northern and Western Europe are typically strong markets due to their extensive green spaces and landscaping needs.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]