Europe Commercial Electric Boiler Market Size, Share, Trends, & Growth Forecast Report Segmented By Voltage Rating (Low Voltage and Medium Voltage), Capacity, Technology, Application, Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2024 to 2033

Europe Commercial Electric Boiler Market Size

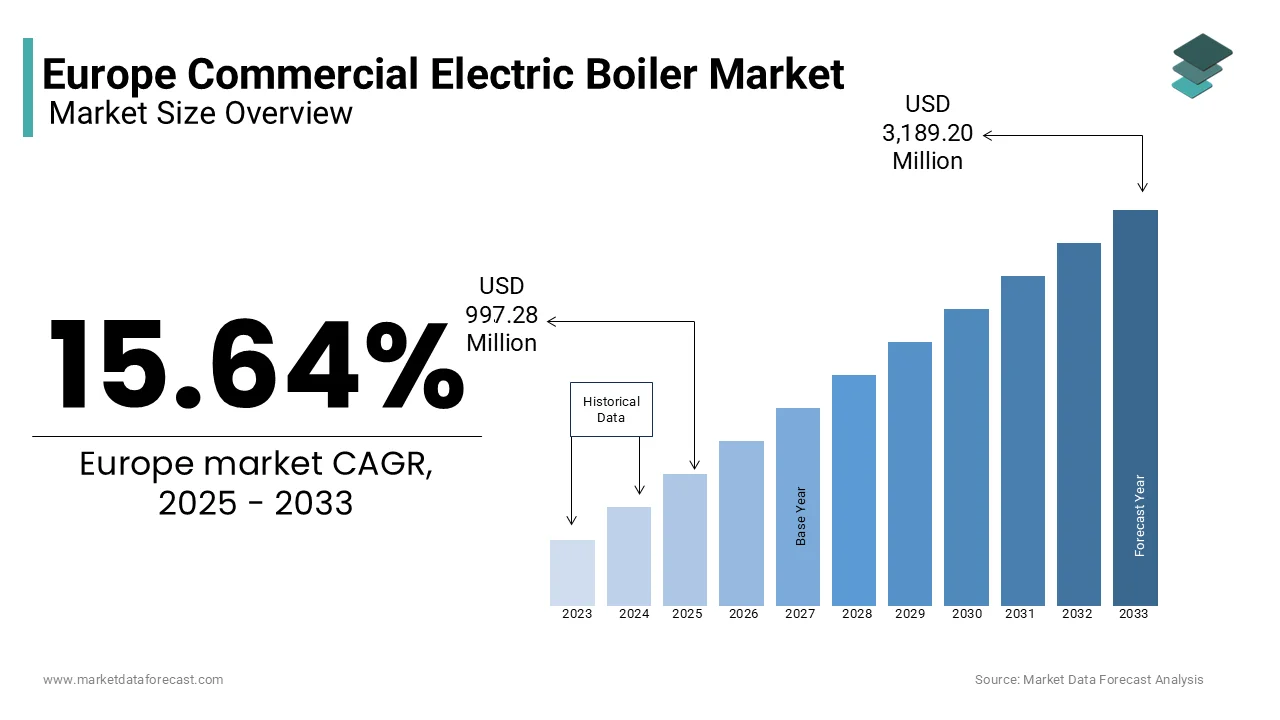

The Europe commercial electric boiler market was worth USD 862.40 million in 2024. The European market is projected to reach USD 3,189.20 million by 2033 from USD 997.28 million in 2025, growing at a CAGR of 15.64% from 2025 to 2033.

Commercial electric boilers are advanced heating systems that utilize electricity to generate heat for space heating, hot water production, and industrial processes. These systems are gaining prominence due to their high efficiency, zero direct carbon emissions, and compatibility with renewable energy sources such as wind and solar power. According to the European Environment Agency, the commercial sector accounts for approximately 30% of Europe’s total energy consumption, with heating being a significant component. This has led to increased adoption of electric boilers as businesses seek to meet stringent environmental regulations under frameworks like the European Green Deal.

As per the International Energy Agency, the demand for electric boilers in Europe is growing significantly due to the government incentives for electrification and renewable energy integration. Countries like Germany, Sweden, and France are leading this transition, with policies promoting the replacement of fossil fuel-based heating systems. The European Commission notes that over 40% of new commercial buildings in Europe are now equipped with low-carbon heating solutions, including electric boilers. Additionally, advancements in smart grid technologies and energy storage systems have enhanced the feasibility of electric boilers, enabling better load management and cost efficiency. As Europe accelerates its shift toward net-zero emissions, the commercial electric boiler market is poised to play a pivotal role in transforming the region’s heating infrastructure, offering an eco-friendly and economically viable alternative to traditional systems.

MARKET DRIVERS

Stringent Environmental Regulations in Europe

One of the primary drivers of the Europe commercial electric boiler market is the implementation of stringent environmental regulations aimed at reducing carbon emissions. The European Environment Agency highlights that heating systems in the commercial sector contribute approximately 35% of total CO2 emissions from buildings, prompting governments to enforce policies under the European Green Deal. For instance, Germany and France have introduced bans on fossil fuel-based heating systems in new commercial buildings by 2025, accelerating the adoption of electric boilers. The International Energy Agency reports that these regulations are expected to drive a 10% annual increase in electric boiler installations across Europe through 2030. Additionally, incentives such as tax rebates and subsidies for renewable energy integration further encourage businesses to transition. This regulatory push underscores the critical role of electric boilers in achieving Europe’s decarbonization targets while promoting sustainable energy solutions.

Growing Integration with Renewable Energy Sources

Another significant driver is the growing integration of commercial electric boilers with renewable energy sources like wind and solar power. The European Commission notes that over 40% of Europe’s electricity generation now comes from renewable sources, creating an ideal environment for electric boilers to operate sustainably. According to the International Renewable Energy Agency, pairing electric boilers with renewable energy reduces operational costs by up to 20%, making them an attractive option for businesses. Countries like Sweden and Denmark lead this trend, leveraging their robust renewable energy infrastructure to maximize efficiency. Furthermore, advancements in smart grid technologies enable better load management, allowing electric boilers to utilize off-peak electricity, which is often cheaper and greener. This synergy between renewables and electric boilers not only enhances energy efficiency but also supports Europe’s broader goals of achieving net-zero emissions by 2050.

MARKET RESTRAINTS

High Initial Investment Costs

One major restraint in the Europe commercial electric boiler market is the high initial investment required for installation, which poses a barrier for small and medium-sized enterprises (SMEs). The European Commission highlights that the upfront cost of commercial electric boilers can be 30-50% higher than traditional gas or oil-based systems, with prices ranging from €20,000 to €100,000 depending on capacity. For businesses operating on tight budgets, this financial burden is significant, despite long-term energy savings. The International Energy Agency notes that while operational costs are lower due to higher efficiency, the payback period for electric boilers can extend up to 7-10 years, deterring immediate adoption. Additionally, retrofitting older buildings with electric boilers often requires costly electrical infrastructure upgrades, further increasing expenses. These financial challenges limit widespread adoption, particularly in regions with weaker economic incentives.

Limited Grid Capacity in Certain Regions

Another key restraint is the limited grid capacity in certain regions, which hinders the scalability of commercial electric boilers. The European Environment Agency reports that peak electricity demand during winter months already strains grids in countries like Italy and Spain, where grid infrastructure has not kept pace with electrification trends. The International Renewable Energy Agency warns that integrating large-scale electric heating systems could exacerbate these issues, leading to potential power outages or increased electricity costs. Furthermore, rural and remote areas often lack the necessary upgrades to support high-capacity electric boilers, limiting their feasibility. While urban centers with advanced grids are better positioned, the European Commission emphasizes that approximately 25% of Europe’s commercial buildings are located in regions with insufficient grid infrastructure, creating a significant barrier to market expansion.

MARKET OPPORTUNITIES

Expansion of Electrification Policies

One major opportunity in the Europe commercial electric boiler market lies in the expansion of electrification policies and incentives aimed at decarbonizing the heating sector. The European Commission highlights that over 40% of Europe’s energy consumption is attributed to heating, creating a strong impetus for transitioning to low-carbon solutions like electric boilers. Governments across Europe are introducing subsidies and tax incentives, with countries like Germany offering up to 30% financial support for businesses adopting renewable heating technologies. The International Energy Agency reports that such policies could drive a 15% annual growth rate in electric boiler installations by 2030. Additionally, the European Green Deal’s goal of achieving climate neutrality by 2050 further amplifies this opportunity, as businesses seek compliance with stricter emission standards. This policy-driven environment positions electric boilers as a key solution for sustainable commercial heating.

Integration with Smart Grids and Energy Storage

Another significant opportunity arises from advancements in smart grid technologies and energy storage systems, which enhance the efficiency and feasibility of commercial electric boilers. The European Environment Agency notes that smart grids enable better load management, allowing electric boilers to operate during off-peak hours when electricity is cheaper and often sourced from renewables. According to the International Renewable Energy Agency, integrating energy storage systems can reduce operational costs by up to 25%, making electric boilers more economically viable. Countries like Sweden and Denmark are leading this trend, leveraging their advanced grid infrastructure to optimize energy use. Furthermore, the European Commission projects that investments in smart grid technologies will grow by 8% annually through 2030, creating a conducive ecosystem for electric boilers. This synergy between innovation and sustainability presents a transformative opportunity for the market.

MARKET CHALLENGES

High Electricity Prices in Certain Regions

One major challenge in the Europe commercial electric boiler market is the variability of electricity prices, which can significantly impact operational costs. The European Environment Agency highlights that electricity prices in countries like Germany and Denmark are among the highest in Europe, often exceeding €0.30 per kWh, compared to an EU average of €0.22 per kWh. For businesses relying on electric boilers, this creates financial pressure, particularly during peak heating seasons when electricity demand surges. The International Energy Agency notes that high electricity costs can offset the benefits of lower emissions, making electric boilers less attractive for some commercial users. Additionally, fluctuations in energy prices due to geopolitical factors or supply chain disruptions further exacerbate this challenge. These economic barriers hinder widespread adoption, particularly in regions where electricity remains a costly energy source.

Limited Awareness and Technical Expertise

Another significant challenge is the limited awareness and technical expertise surrounding commercial electric boilers among businesses and installers. The European Commission reports that only 20% of SMEs in Europe are fully aware of the benefits and operational requirements of electric boilers, leading to slower adoption rates. Furthermore, the International Renewable Energy Agency emphasizes that a shortage of skilled technicians trained in installing and maintaining these systems creates additional hurdles. Retrofitting older buildings with electric boilers often requires specialized knowledge, which is currently in short supply. This knowledge gap is particularly pronounced in Eastern Europe, where electrification initiatives are still nascent. Without adequate training programs and awareness campaigns, the market struggles to overcome resistance from potential adopters, slowing its overall growth trajectory.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

15.64% |

|

Segments Covered |

By Voltage Rating, Capacity, Technology, Application, and Country |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Countries Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, and Rest of Europe |

|

Market Leaders Profiled |

Ariston Holding, Babcock Wanson, Bosch Industriekessel, Bradford White Corporation, Burnham Commercial, Clayton Industries, Cleaver-Brooks, Ecotherm Austria, Ferroli, Flexi heat UK, Fonderie Sime, FONDITAL, Fulton, Lochinvar, Thermal Solutions, Vaillant Group, Viessmann, and Weil-McLain |

SEGMENTAL ANALYSIS

By Voltage Rating Insights

The low voltage segment accounted for the leading share of 60.5% in the European market in 2024. The cost-effectiveness and ease of integration of low voltage commercial electric boilers into existing electrical systems, particularly in small and medium-sized buildings are majorly contributing to the domination of the segment in the European market. As per the International Energy Agency, low voltage boilers priced between €20,000 and €50,000 and are ideal for businesses seeking affordable sustainable heating solutions. Their widespread adoption is further driven by their compatibility with moderate heating demands, such as in offices and retail spaces. This segment’s dominance underscores its importance in enabling broader electrification of heating systems, supporting Europe’s decarbonization goals while addressing budget constraints for smaller enterprises.

The medium segment is predicted to register the highest CAGR of 8.8% over the forecast period owing to the increasing demand for high-capacity systems in industrial facilities and district heating networks. The International Renewable Energy Agency notes that medium voltage boilers excel in energy-intensive applications, offering scalability and efficiency when integrated with renewable energy sources and smart grids. Although installation costs exceed €100,000, their ability to reduce operational expenses through load optimization drives adoption. This segment’s expansion highlights its critical role in supporting large-scale decarbonization efforts, making it a key enabler of Europe’s transition to sustainable, high-performance heating solutions.

By Capacity Insights

The > 2.5 - 10 MMBTU/hr capacity segment accounted for the major share of 30.1% of the global market in 2024. The versatility of > 2.5 - 10 MMBTU/hr capacity commercial boilers that cater to medium-sized buildings like schools, hospitals, and offices with moderate heating demands is boosting the segmental expansion in the European market. The International Renewable Energy Agency highlights that these boilers are cost-effective, with installation costs ranging from €30,000 to €70,000, and their compatibility with renewable energy systems enhances their appeal. This segment’s dominance underscores its importance in enabling widespread electrification of heating systems while supporting Europe’s decarbonization goals, making it a cornerstone for sustainable commercial heating solutions.

The > 50 - 100 MMBTU/hr capacity segment is predicted to witness a prominent CAGR of 9.12% over the forecast period due to the increasing demand for large-scale heating solutions in district heating networks and industrial facilities. The European Commission notes that these boilers excel in energy-intensive applications, offering scalability and integration with renewable energy systems, which reduce operational costs by up to 20%. Installation costs exceed €150,000, but their efficiency in managing heavy heating loads justifies the investment. This segment’s expansion highlights its critical role in decarbonizing Europe’s urban and industrial heating sectors, aligning with ambitious climate targets.

By Technology Insights

The hot water segment had the leading share of 70.6% of the global market share in 2024. The domination of the hot water segment in the global market is driven by their versatility and cost-effectiveness. The International Energy Agency highlights that hot water systems are highly efficient and compatible with renewable energy sources, such as solar thermal panels, reducing operational costs by up to 25%. Their ease of maintenance and ability to meet both heating and domestic hot water needs further solidify their dominance. This segment’s importance lies in its role as a cornerstone for sustainable, low-carbon heating solutions across Europe.

The steam segment is projected to grow at a noteworthy CAGR of 8.5% over the forecast period. An increasing demand from energy-intensive industries like pharmaceuticals, food processing, and manufacturing, where high-temperature heating is essential is driving the growth of the steam segment in the global market. The International Renewable Energy Agency notes that advancements in electric steam boiler technology have improved efficiency and reduced emissions, aligning with Europe’s decarbonization goals. Although installation costs exceed €150,000 for large-scale systems, their ability to meet rigorous industrial requirements drives adoption. This segment’s rapid expansion underscores its critical role in transforming industrial heating processes, supporting Europe’s transition to sustainable and eco-friendly energy solutions.

By Application Insights

The lodgings accounted for the leading share of 26.6% of the European market in 2024. The growing focus of hospitality industry on sustainability and guest comfort is propelling the growth of the lodgings segment in the European market. The International Renewable Energy Agency highlights that these systems reduce operational costs by up to 20% when integrated with renewable energy. Installation costs range from €40,000 to €120,000, making them accessible for various lodging sizes. This segment’s dominance underscores its importance in promoting eco-friendly tourism and achieving green certifications, aligning with Europe’s decarbonization goals.

The healthcare facilities segment is estimated to register the fastest CAGR of 9.7% over the forecast period. The critical need of healthcare facilities for reliable, hygienic, and precise heating solutions in hospitals and clinics is propelling the growth of the segment in the European market. The International Energy Agency notes that electric boilers are ideal for healthcare applications, offering zero-emission operation and compatibility with renewable energy, reducing energy costs by up to 25%. Installation costs typically range from €50,000 to €150,000, justifying the investment due to their compliance with health and safety standards. This segment’s expansion highlights its importance in ensuring sustainable and resilient heating systems for critical healthcare infrastructure, supporting Europe’s transition to low-carbon solutions.

REGIONAL ANALYSIS

Germany held the major share of 25.4% of the Europe commercial electric boiler market in 2024. The leading position of Germany in the European market is driven by stringent environmental regulations under the European Green Deal that mandate the decarbonization of heating systems. The International Energy Agency highlights that Germany’s robust renewable energy infrastructure, including wind and solar power, supports the integration of electric boilers, reducing operational costs by up to 30%. Additionally, government incentives, such as subsidies for low-carbon heating solutions, have accelerated adoption. Germany’s focus on electrification and sustainability in both urban and industrial sectors underscores its pivotal role in advancing eco-friendly heating technologies across Europe.

Sweden is one of the leading markets for commercial electric boiler in Europe and accounted for 15.8% of the European market share in 2024. The leading position of Sweden in the European market is majorly driven by its strong commitment to renewable energy, with over 50% of its electricity generated from hydropower and other renewables. The International Renewable Energy Agency notes that Sweden’s advanced district heating networks and cold climate conditions make electric boilers an ideal solution for efficient heating. Furthermore, government policies promoting fossil-free heating systems have spurred rapid adoption. Sweden’s proactive approach to achieving net-zero emissions by 2045 has positioned it as a pioneer in sustainable heating technologies, making it a model for other European nations transitioning to low-carbon solutions.

France is also a key contributor to the Europe commercial electric boiler market. This growth is fueled by France’s ambitious climate goals, including the phasing out of fossil fuel-based heating systems in commercial buildings by 2030. The European Commission highlights that France’s extensive nuclear energy infrastructure ensures a stable and low-cost electricity supply, enhancing the feasibility of electric boilers. Additionally, tax incentives and grants for energy-efficient systems have encouraged businesses to adopt electric boilers, particularly in urban areas. France’s strategic investments in green building initiatives and renewable energy integration underscore its importance in driving the transition to sustainable heating solutions across Europe.

KEY MARKET PLAYERS

The major players in the Europe commercial electric boiler market include Ariston Holding, Babcock Wanson, Bosch Industriekessel, Bradford White Corporation, Burnham Commercial, Clayton Industries, Cleaver-Brooks, Ecotherm Austria, Ferroli, Flexi heat UK, Fonderie Sime, FONDITAL, Fulton, Lochinvar, Thermal Solutions, Vaillant Group, Viessmann, and Weil-McLain.

MARKET SEGMENTATION

This research report on the Europe commercial electric boiler market is segmented and sub-segmented into the following categories.

By Voltage Rating

- Low Voltage

- Medium Voltage

By Capacity

- ≤ 0.3 - 2.5 MMBTU/hr

- > 2.5 - 10 MMBTU/hr

- > 10 - 50 MMBTU/hr

- > 50 - 100 MMBTU/hr

- > 100 - 250 MMBTU/hr

By Technology

- Hot Water

- Steam

By Application

- Offices

- Healthcare Facilities

- Educational Institutions

- Lodgings

- Retail Stores

- Others

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What is driving the growth of the Europe commercial electric boiler market?

The market is growing due to rising demand for clean energy solutions, stricter carbon emission regulations, and the increasing adoption of electrification in heating systems.

What types of commercial electric boilers are commonly used in Europe?

The most common types include resistance boilers and electrode boilers, both of which are used in commercial buildings, district heating, and industrial applications.

What are the key applications of commercial electric boilers in Europe?

These boilers are widely used in hotels, hospitals, office buildings, educational institutions, and district heating networks for space and water heating.

What are the major advantages of commercial electric boilers over gas boilers?

Electric boilers offer zero emissions, higher efficiency, lower maintenance costs, and easier installation compared to traditional gas or oil-fired boilers.

What are the future trends in the Europe commercial electric boiler market?

Advancements in energy storage integration, smart heating solutions, and increased use of heat pumps alongside electric boilers will shape the market's future.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]