Europe Commercial Drone Market Size, Share, Trends, & Growth Forecast Report - Segmented By Type (Fixed Wing, Rotary Blade) Application (Filming and Photography, Inspection and Maintenance) End Use (Agriculture ,Delivery and Logistics) and Country (Germany, UK, France, Italy, Spain) – Industry Analysis from 2025 to 2033.

Europe Commercial Drone Market Size

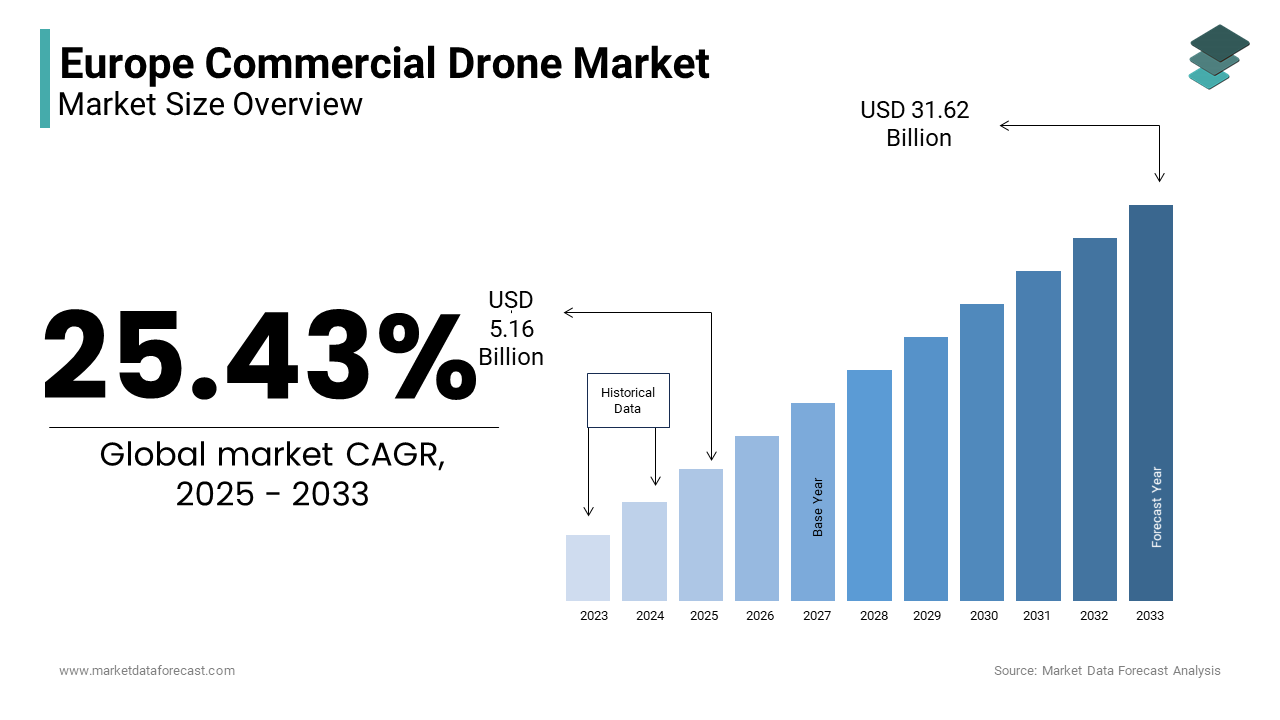

The europe commercial drone market size was valued at USD 4.11 billion in 2024. The europe commercial drone market size is expected to have 25.43% CAGR from 2025 to 2033 and be worth USD 31.62 billion by 2033 from USD 5.16 billion in 2025.

Commercial drones are utilized across diverse sectors, including agriculture, logistics, construction, energy, and public safety that offer innovative solutions for operational efficiency, cost reduction, and enhanced data collection. The demand for commercial drones is on the rise in the Europe owing to the advancements in drone technology and supportive regulatory frameworks. The increasing adoption of drones in precision agriculture has been particularly transformative, with Eurostat reporting that UAVs are now used on nearly 20% of large-scale farms in Western Europe. Similarly, the logistics sector has witnessed significant growth, as companies like DHL and Amazon pilot drone delivery systems in urban and remote areas. Furthermore, the European Commission highlights that investments in drone-related R&D have surged by 30% since 2020, reflecting the industry’s focus on autonomy, payload capacity, and battery longevity. Despite challenges such as airspace regulations and privacy concerns, the market is poised for sustained expansion. With initiatives like the EU’s U-Space framework promoting safe drone integration into airspace, the commercial drone ecosystem in Europe is set to redefine industrial operations and unlock new economic opportunities in the coming years.

MARKET DRIVERS

Increasing Demand for Automation in Key Industries

The growing demand for automation across industries such as agriculture, logistics, and construction is a major driver of the Europe commercial drone market. According to Eurostat, the agricultural sector in Europe has adopted drone technology on nearly **20% of large-scale farms**, enabling precision farming practices like crop monitoring and soil analysis. This adoption has led to a **15% increase in crop yields** in regions utilizing drones, as reported by the European Environment Agency. Similarly, the logistics sector is leveraging drones for last-mile delivery, with pilot projects by companies like DHL reducing delivery times by up to **40%** in urban areas. The European Commission highlights that investments in drone-related automation technologies have grown by **30% annually** since 2020, driven by the need for cost efficiency and operational scalability. This trend underscores the pivotal role of drones in transforming traditional workflows across multiple sectors.

Supportive Regulatory Frameworks and U-Space Implementation

The implementation of supportive regulatory frameworks, particularly the EU’s U-Space initiative, is another key driver propelling the Europe commercial drone market. The European Union Aviation Safety Agency (EASA) states that the U-Space framework aims to integrate drones safely into European airspace, enabling scalable operations in urban and rural areas. By 2022, over **70,000 commercial drone operators** were registered in Europe, reflecting the ease of compliance with standardized regulations. Additionally, the European Commission reports that countries like Germany and France have witnessed a **25% annual growth in drone operations** following the introduction of clear operational guidelines. These regulations not only enhance safety but also foster innovation by encouraging startups and established companies to invest in drone technology. As a result, the regulatory environment is playing a crucial role in accelerating market expansion and ensuring sustainable growth.

MARKET RESTRAINTS

Stringent Airspace Regulations and Operational Restrictions

Stringent airspace regulations and operational restrictions pose a significant challenge to the Europe commercial drone market. The European Union Aviation Safety Agency (EASA) mandates strict compliance with no-fly zones, altitude limits, and licensing requirements, which can hinder widespread adoption. According to Eurostat, nearly **40% of drone operators** in Europe reported regulatory barriers as a key obstacle to scaling operations, particularly in urban areas where airspace is densely controlled. Additionally, the European Commission highlights that obtaining permits for beyond visual line of sight (BVLOS) operations remains a complex and time-consuming process, limiting the scope of applications like long-distance logistics. These regulatory hurdles not only increase operational costs but also slow down innovation. As a result, businesses face challenges in fully leveraging drone technology, particularly in sectors requiring extensive mobility and flexibility.

Privacy and Security Concerns

Privacy and security concerns represent another major restraint impacting the Europe commercial drone market. The European Data Protection Board emphasizes that unauthorized data collection by drones has raised public apprehensions about surveillance and misuse of personal information. A survey conducted by Eurostat reveals that **65% of Europeans** express concerns about privacy violations due to drone usage, particularly in residential areas. Furthermore, the European Commission reports that incidents of drone-related security breaches, such as unauthorized surveillance or cyberattacks, have increased by **20% annually** since 2020. These issues have led to stricter enforcement of data protection laws under the General Data Protection Regulation (GDPR), adding compliance burdens for operators. As public trust remains fragile, addressing these concerns is critical to ensuring broader acceptance and sustainable growth of the commercial drone industry.

MARKET OPPORTUNITIES

Adoption of Drones in Agriculture

The European commercial drone market is witnessing significant growth due to the increasing adoption of drones in agriculture, particularly for precision farming. According to the European Environment Agency, approximately 40% of the EU’s land area is dedicated to agriculture, creating a vast opportunity for drone technology. Equipped with advanced sensors and imaging tools, drones enable farmers to monitor crop health, optimize irrigation systems, and reduce pesticide usage. The European Commission highlights that precision farming technologies can enhance crop yields by up to 20% while cutting input costs by 15%. This efficiency has spurred demand for agricultural drones, with Statista projecting the market to grow at a compound annual growth rate (CAGR) of 12.3% from 2023 to 2030. Such data underscores the transformative potential of drones in revolutionizing traditional farming practices across Europe.

Rising Demand for Drone-Based Delivery Services

The growing demand for drone-based delivery services in urban areas presents another major opportunity in the European commercial drone market. The European Union Aviation Safety Agency (EASA) estimates that the drone delivery sector could reach €10 billion by 2030, fueled by the expansion of e-commerce and the need for faster logistics solutions. Pilot projects in cities like Paris and Amsterdam have demonstrated the effectiveness of drones in delivering medical supplies and retail goods, reducing delivery times by up to 80%, as reported by the European Parliament. With Eurostat projecting a 7% increase in Europe’s urban population by 2050, the strain on traditional delivery systems will intensify. Drones offer a sustainable alternative, lowering carbon emissions by 50% compared to conventional vehicles, according to the International Transport Forum. This positions drone delivery as a key innovation for urban logistics in Europe.

MARKET CHALLENGES

Regulatory Hurdles and Airspace Restrictions

One of the major challenges facing the Europe commercial drone market is the complex regulatory environment and airspace restrictions. The European Union Aviation Safety Agency (EASA) has implemented stringent regulations to ensure safety, including no-fly zones over densely populated areas and critical infrastructure. These restrictions limit the operational scope of drones, particularly for urban delivery services. According to a report by the European Parliament, obtaining permits for beyond visual line of sight (BVLOS) operations remains a significant barrier, with only 15% of applications approved in 2022. Additionally, varying national regulations across EU member states create fragmentation, complicating cross-border operations. EASA estimates that compliance costs for small and medium enterprises (SMEs) can reach up to €50,000 annually, deterring new entrants. Such regulatory hurdles hinder market growth and innovation, posing a challenge to scaling drone operations effectively.

Privacy and Data Security Concerns

Privacy and data security concerns represent another critical challenge for the Europe commercial drone market. Drones equipped with cameras and sensors often collect sensitive data, raising fears of unauthorized surveillance and misuse. The European Data Protection Supervisor (EDPS) highlights that 67% of Europeans are concerned about their privacy when drones are used in public spaces. Furthermore, the General Data Protection Regulation (GDPR) imposes strict requirements on data collection and storage, which can be burdensome for drone operators. A study by the European Commission reveals that non-compliance with GDPR can result in fines of up to €20 million or 4% of annual turnover, whichever is higher. These concerns are amplified by cybersecurity risks, as drones are vulnerable to hacking and data breaches. Addressing these issues requires robust encryption technologies and transparent data policies, adding to operational costs and complexity for businesses in the sector.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

25.43 % |

|

Segments Covered |

By Type, Application, End Use and Region. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leader Profiled |

AeroVironment, Inc.,Autel Robotics, ESA Space Solutions, ModalAI, DJI, Intel Corporation. |

SEGMENTAL ANALYSIS

By Type Insights

The rotary blade segment held 55.4% of the European market share in 2024. The growth of the rotary blade segment in the European market is primarily due to their versatility in vertical takeoff and landing, coupled with precision maneuverability, makes them ideal for urban applications like delivery services and infrastructure inspections. The European Parliament highlights that rotary blade drones achieved a 90% success rate in medical supply deliveries in pilot projects across cities like Dublin. Their ability to operate in confined spaces addresses critical urban logistics challenges. Despite shorter flight times of 20–40 minutes, their widespread adoption in high-demand sectors ensures their leadership, making them indispensable for real-time operations.

The hybrid segment is the most lucrative segment currently and is likely to register the highest CAGR of 18.7% over the forecast period due to theie unique ability to combine vertical takeoff and landing with long-range capabilities, addressing limitations of fixed wing and rotary blade drones. The European Commission estimates hybrid drones could capture 10% of the market by 2025, reducing operational costs by 25%. Their importance lies in applications like surveillance and environmental monitoring, where endurance and flexibility are critical. Advancements in propulsion systems further boost their adoption, positioning them as a transformative solution in the evolving drone landscape.

By Application Insights

The filming and photography represented as the largest application segment in the European commercial drone market by capturing 30.7% of the European market share in 2024. The demand for commercial drones in the filming and photography segment is driven by the growing use of drones in media production, real estate, and tourism industries, where high-quality aerial footage is essential. Drones offer cost-effective and versatile solutions compared to traditional methods like helicopters, reducing filming costs by up to 70%, as highlighted by Eurostat. Their ability to capture dynamic shots in hard-to-reach areas has made them indispensable for filmmakers and content creators. The widespread adoption of drones in this segment underscores their importance in enhancing visual storytelling and marketing strategies across Europe.

The precision agriculture is another promising segment in the European market and is predicted to register a CAGR of 14.5% over the forecast period owing to the increasing need for sustainable farming practices and efficient resource management. The European Commission reports that drones equipped with advanced sensors can improve crop yields by up to 20% while reducing input costs by 15%. With approximately 40% of the EU’s land area dedicated to agriculture, drones are becoming critical tools for monitoring crop health, optimizing irrigation, and minimizing pesticide use. The integration of AI and data analytics further enhances their capabilities, making precision agriculture a transformative application driving innovation and sustainability in the agricultural sector.

By End Use Insights

The agriculture segment led the market by capturing 28.1% of the European market share in 2024. The widespread adoption of drones in agriculture is driven by their ability to enhance precision farming practices, which are critical for optimizing resource use and increasing crop yields. The European Commission highlights that drones can reduce pesticide usage by up to 30% and improve irrigation efficiency by 25%. With around 40% of the EU’s land area dedicated to agriculture, drones play a pivotal role in monitoring crop health, conducting soil analysis, and managing large-scale farming operations. Their cost-effectiveness and ability to cover vast areas quickly make them indispensable for modernizing traditional agricultural practices across Europe.

The delivery and logistics segment is estimated to register the fastest CAGR of 16.2% over the forecast period owing to the rising demand for faster and more sustainable urban delivery solutions, particularly in e-commerce and healthcare. The European Parliament reports that drone deliveries can reduce delivery times by up to 80% and lower carbon emissions by 50% compared to traditional vehicles. Pilot projects in cities like Paris and Amsterdam have demonstrated their potential for delivering medical supplies and retail goods efficiently. Eurostat projects that urban populations in Europe will grow by 7% by 2050, further intensifying the need for innovative logistics solutions. This positions drone-based delivery systems as a transformative force in addressing urban mobility challenges.

REGIONAL ANALYSIS

Germany led the Europe commercial drone market with a market share of 22.7% in 2024. The domination of Germany is primarily attributed to its strong industrial base, particularly in automotive, logistics, and manufacturing sectors, which are rapidly adopting drones for inspection, delivery, and inventory management. According to Eurostat, Germany accounts for over 30% of Europe’s total R&D spending on drone technologies, fostering innovation and attracting significant investments. The presence of leading drone manufacturers like DJI Europe and local startups further strengthens its position. Additionally, supportive government policies, including BVLOS (Beyond Visual Line of Sight) testing corridors, have accelerated adoption. These factors make Germany a hub for cutting-edge drone applications and technological advancements.

France holds the second-largest position in the Europe commercial drone market. The robust aerospace and defense industries of France that leverage drones for surveillance, mapping, and security applications is propelling the French commercial drone market growth. A report by the European Parliament notes that France has invested heavily in drone-based urban air mobility projects, particularly in cities like Paris, where drones are being tested for medical deliveries. Furthermore, France’s strategic focus on precision agriculture has boosted drone adoption in rural areas, with the Ministry of Agriculture reporting a 25% increase in drone usage for crop monitoring since 2020. These initiatives solidify France’s role as a key innovator in the European drone ecosystem.

The UK commercial drone market is estimated to be exhibiting a CAGR of 15.1% during the forecast period. The advanced regulatory framework of the UK that facilitates innovation while ensuring safety is boosting the UK market growth. The CAA has established dedicated drone testing zones, enabling companies to experiment with new applications such as urban delivery and infrastructure inspection. A study by the Department for Transport highlights that the UK’s e-commerce sector, valued at £150 billion in 2022, is driving demand for drone logistics solutions. Additionally, the UK’s emphasis on environmental sustainability has spurred the use of drones in renewable energy projects, with offshore wind farms utilizing drones for maintenance. These factors position the UK as a leader in both regulatory innovation and commercial drone adoption.

KEY MARKET PLAYERS

Companies playing a prominent role in the Europe Commercial Drone Market include are AeroVironment, Inc.,Autel Robotics, ESA Space Solutions, ModalAI, DJI, Intel Corporation,Griff Aviation,EHang Holdings Limited,Parrot Drones SAS,Autel Robotics Co. Ltd.,Draganfly Inc.

MARKET SEGMENTATION

This Europe Commercial Drone Market research report has been segmented and sub-segmented into the following categories.

By Type

- Fixed Wing

- Rotary Blade

- Hybrid Type

By Application

- Filming and Photography

- Inspection and Maintenance

- Mapping and Surveying

- Precision Agriculture

- Surveillance and Monitoring

By End Use

- Agriculture

- Delivery and Logistics

- Energy

- Media and Entertainment

- Real Estate and Construction

- Security and Law Enforcement

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What is driving the growth of the commercial drone market in Europe?

Factors include technological advancements, increased regulatory support, and growing demand for drone-based services.

Which industries are the primary users of commercial drones in Europe?

Agriculture, construction, logistics, security, energy, and media are major industries using drones.

Which countries in Europe have the largest commercial drone markets?

Germany, the UK, France, and Italy are among the leading markets.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]