Europe Cold Chain Packaging Market Size, Share, Trends & Growth Forecast Report By Product Type( Expanded Polystyrene (EPS) Containers, Vacuum Insulated Panels (VIPs)), Application, And Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest Of Europe), Industry Analysis From 2025 To 2033

Europe Cold Chain Packaging Market Size

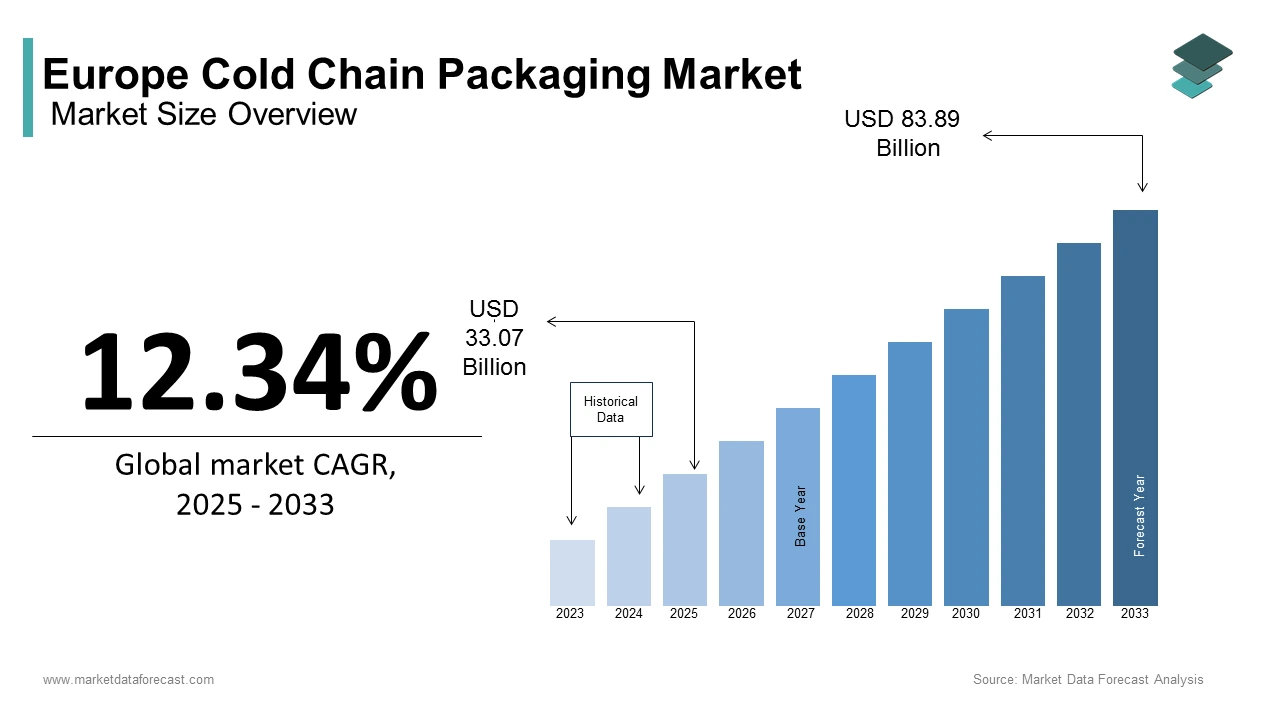

The Europe cold chain packaging market size was calculated to be USD 29.44 billion in 2024 and is anticipated to be worth USD 83.89 billion by 2033 from USD 33.07 billion in 2025, growing at a CAGR of 12.34% during the forecast period.

Cold chain packaging solutions are designed to maintain specific temperature ranges during transit, safeguarding the integrity of perishable goods such as pharmaceuticals, vaccines, and food products. The demand for cold chain packaging in Europe has significantly increased in the recent years due to the increasing emphasis on preserving product quality and compliance with stringent regulatory standards. The European cold chain packaging market is anticipated to experience substantial growth during the forecast period owing to the advancements in packaging technologies, including insulated containers, phase-change materials, and vacuum-insulated panels, which enhance thermal efficiency and extend shelf life. For instance, the European Medicines Agency mandates that vaccines and biologics must be transported under controlled temperatures, underscoring the necessity of reliable packaging solutions. Furthermore, the push for sustainability is influencing innovations in recyclable and biodegradable cold chain packaging materials. According to the European Environment Agency, this trend is expected to fuel the European market expansion to ensure its alignment with circular economy principles while addressing the rising demand for eco-friendly solutions.

MARKET DRIVERS

Rising Demand in the Pharmaceuticals Sector in Europe

The growing demand for cold chain packaging in the pharmaceuticals sector is driving the growth of the European cold chain packaging market. According to the European Federation of Pharmaceutical Industries and Associations, the pharmaceutical industry contributes over €800 billion annually to the EU economy, with biologics and vaccines accounting for a substantial share. These products require precise temperature control during transportation to maintain efficacy, making cold chain packaging indispensable. In 2022, the pharmaceutical segment accounted for nearly 40% of the total cold chain packaging consumption in Europe, as highlighted by Eurostat. The rollout of COVID-19 vaccines further amplified this demand, with over 1.5 billion doses distributed across the EU in 2021 alone. The European Medicines Agency emphasizes that temperature excursions during transit can render vaccines ineffective, underscoring the critical role of advanced packaging solutions. Additionally, the rise in personalized medicine and cell therapies, which require ultra-low temperature storage, is driving innovation in specialized packaging designs, ensuring sustained market growth.

Expansion of the Food and Beverage Industry

The expansion of the food and beverage industry is another major factor propelling the European market growth. According to the European Food Safety Authority, the EU food and beverage sector generates over €1.1 trillion annually, with fresh produce, dairy, and frozen foods being major contributors. Cold chain packaging plays a pivotal role in extending the shelf life of perishable items, reducing food waste, and ensuring compliance with hygiene standards. In 2023, the food segment accounted for approximately 35% of the total market share, as per the European Commission. The increasing consumer preference for convenience foods and online grocery shopping has further accelerated the demand for efficient cold chain solutions. For instance, the European Grocery Retail Report highlights that online grocery sales grew by 20% in 2022, necessitating robust packaging systems to maintain product quality during last-mile delivery. This trend is expected to persist, fostering innovation and investment in sustainable and cost-effective packaging technologies.

MARKET RESTRAINTS

High Costs of Advanced Packaging Solutions

The high costs associated with advanced cold chain packaging solutions is negatively impacting the growth of the European cold chain packaging market. According to the European Investment Bank, the initial investment required for cutting-edge technologies such as vacuum-insulated panels and phase-change materials can be prohibitive for small and medium-sized enterprises (SMEs). In 2022, the average cost of implementing advanced cold chain packaging systems increased by 12%, as reported by Eurostat, primarily due to the rising prices of raw materials and energy-intensive manufacturing processes. The European Packaging Federation notes that these costs are often passed on to end-users, leading to higher operational expenses for industries like pharmaceuticals and food. This financial burden is particularly challenging for emerging markets within Europe, where budget constraints limit the adoption of premium packaging solutions. Consequently, the affordability gap hinders widespread adoption, potentially slowing market growth unless cost-effective alternatives are developed.

Stringent Regulatory Compliance Requirements

Stringent regulatory compliance requirements is another notable restraint affecting the European cold chain packaging market. According to the European Medicines Agency, regulations governing the transportation of temperature-sensitive products, such as Good Distribution Practices (GDP), impose rigorous standards that manufacturers must adhere to. Non-compliance can result in hefty fines and reputational damage, creating additional pressures for companies. The European Commission highlights that the complexity of maintaining compliance across diverse regions within Europe often requires significant investments in monitoring systems and staff training. For instance, in 2022, over 25% of cold chain logistics failures were attributed to inadequate temperature monitoring, as per the European Logistics Association. These challenges are compounded by the lack of harmonized standards across member states, forcing companies to navigate varying regulatory landscapes. Such complexities increase operational burdens, deterring smaller players from entering the market and limiting overall growth potential.

MARKET OPPORTUNITIES

Growing E-Commerce and Last-Mile Delivery Solutions

The rapid growth of e-commerce presents a significant opportunity for the European cold chain packaging market. According to the European E-Commerce Report, online retail sales in the EU reached €800 billion in 2022, with grocery and pharmaceutical products witnessing exponential growth. This surge in demand necessitates innovative packaging solutions capable of maintaining product integrity during last-mile delivery, where temperature control is critical. The European Commission highlights that over 60% of consumers now prioritize freshness and quality when purchasing perishable goods online, driving the adoption of advanced cold chain packaging technologies. For instance, insulated pouches and reusable cooling systems are gaining traction due to their ability to ensure consistent temperature regulation. Additionally, the integration of IoT-enabled sensors in packaging allows real-time monitoring, enhancing supply chain transparency and customer satisfaction. By capitalizing on the e-commerce boom, the European cold chain packaging market can unlock new revenue streams and strengthen its position as a leader in innovative logistics solutions.

Advancements in Sustainable Packaging Technologies

Advancements in sustainable packaging technologies is a promising opportunity for the European cold chain packaging market. According to the European Environment Agency, the push for circular economy practices has led to increased investments in eco-friendly materials, such as biodegradable polymers and recyclable insulating foams. In 2023, the demand for sustainable packaging solutions grew by 15%, as reported by the European Packaging Federation, driven by consumer awareness and regulatory mandates. For example, the Single-Use Plastics Directive encourages the development of alternatives to traditional polystyrene containers, which are widely used in cold chain logistics. The European Investment Bank notes that companies adopting green technologies are likely to benefit from tax incentives and enhanced brand loyalty. Furthermore, innovations such as plant-based phase-change materials and reusable containers are reducing the environmental footprint of cold chain packaging. By aligning with sustainability goals, the market can address ecological concerns while meeting the evolving needs of environmentally conscious consumers.

MARKET CHALLENGES

Limited Infrastructure in Rural Areas

Limited infrastructure in rural areas poses a significant challenge to the European cold chain packaging market. According to the European Logistics Association, approximately 30% of rural regions in the EU lack adequate cold storage facilities and transportation networks, hindering the effective distribution of temperature-sensitive products. The European Commission highlights that this issue is particularly pronounced in Eastern Europe, where logistical bottlenecks result in significant product losses. For instance, in 2022, perishable goods worth €5 billion were wasted due to inadequate cold chain infrastructure, as reported by Eurostat. The absence of reliable power supply and refrigerated transport options exacerbates the problem, making it difficult for manufacturers to ensure consistent quality. This challenge not only impacts food security but also limits market penetration in underserved regions. Addressing these gaps requires substantial investment in infrastructure development, which remains a daunting task for both public and private stakeholders.

Increasing Complexity of Global Supply Chains

The increasing complexity of global supply chains is also challenging the growth of the European cold chain packaging market. According to the European Trade Union Confederation, geopolitical tensions and trade restrictions have disrupted supply chains, which is leading to delays and shortages of essential packaging materials. For example, in 2022, the price of polyurethane foam, a key material used in insulated containers, surged by 18% due to supply chain disruptions, as noted by the European Chemical Industry Council. These fluctuations create uncertainty for manufacturers, who face difficulties in maintaining production schedules and meeting customer demands. The European Central Bank highlights that the reliance on global suppliers makes the market vulnerable to external shocks, such as pandemics or natural disasters. Additionally, the need for seamless coordination across multiple stakeholders adds layers of complexity, increasing operational risks.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

12.34% |

|

Segments Covered |

By Product, Application, And Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, and Czech Republic |

|

Market Leaders Profiled |

Sonoco ThermoSafe, Pelican BioThermal, Cold Chain Technologies, Cryopak, Sofrigam, Intelsius, Softbox Systems, va-Q-tec AG, Orora Group, and Cascades Inc. |

SEGMENTAL ANALYSIS

By Product Type Insights

The expanded polystyrene (EPS) containers segment held 35.4% of the European market share in 2024 due to their excellent thermal insulation properties, lightweight design, and cost-effectiveness that are making them ideal for transporting perishable goods such as food and pharmaceuticals. According to Eurostat, the demand for EPS containers increased by 8% in 2022, driven by their widespread use in the food sector, particularly for fresh produce and frozen goods. Their versatility allows them to cater to diverse applications, from retail distribution to long-haul logistics. The dominance of EPS containers is further reinforced by their ease of customization, enabling manufacturers to tailor solutions to specific end-user requirements.

The vacuum insulated panels (VIPs) is predicted to witness a CAGR of 12.5% over the forecast period. The superior thermal efficiency of vacuum insulated panels compared to traditional insulation materials is making them ideal for applications requiring ultra-low temperature control, such as vaccines and biologics, which is primarily propelling the growth of the VIPs segment in the European market. According to the European Medicines Agency, the demand for VIPs surged by 20% in 2022 due to the increasing focus on precision and reliability in pharmaceutical logistics. Additionally, advancements in panel technology, such as improved durability and reduced thickness, have expanded their applicability across diverse industries.

By Application Insights

The pharmaceuticals segment led the market by holding 40.1% of the European market share in 2024. Cold chain packaging is indispensable in this sector for transporting vaccines, biologics, and other temperature-sensitive medications to ensure their efficacy and safety. According to Eurostat, the pharmaceutical industry’s output grew by 7% in 2022 owing to the advancements in biotechnology and personalized medicine. The dominance of the pharmaceuticals segment in the European market is further supported by stringent regulatory requirements that mandate the use of specialized packaging solutions to comply with Good Distribution Practices (GDP). These solutions not only safeguard product integrity but also enhance supply chain transparency, making them critical for maintaining trust and compliance.

The food segment is the fastest-growing application segment and is predicted to showcase a CAGR of 9.8% over the forecast period. Cold chain packaging is increasingly adopted in this sector for transporting perishable items such as fresh produce, dairy, and frozen foods, where maintaining freshness and quality is paramount. According to the European Commission, the food industry’s revenue grew by 6% in 2022 owing to the rising consumer demand for convenience foods and online grocery shopping. The demand for insulated containers and reusable cooling systems has surged by 15% in this sector, ensuring compliance with hygiene standards and reducing food waste.

KEY MARKET PLAYERS

Major Players of the Europe Cold Chain Packaging Market include Sonoco ThermoSafe, Pelican BioThermal, Cold Chain Technologies, Cryopak, Sofrigam, Intelsius, Softbox Systems, va-Q-tec AG, Orora Group, and Cascades Inc.

REGIONAL ANALYSIS

Germany held the leading position in the European cold chain packaging market and accounted for 27.2% of the European market share in 2024. The robust pharmaceutical and food processing industries of Germany drive the demand for advanced packaging solutions, ensuring compliance with stringent regulatory standards. According to Eurostat, Germany’s pharmaceutical exports exceeded €80 billion in 2022, underscoring the sector’s reliance on reliable cold chain logistics.

France is estimated to register a promising CAGR in the European market over the forecast period. The strong presence of France in the food and beverage sector drives the demand for cold chain packaging, particularly for transporting fresh produce and dairy products. According to the French Ministry of Agriculture, the agri-food industry contributes €180 billion annually, which is highlighting the sector’s dependence on efficient packaging solutions.

The UK is anticipated to hold a notable share of the European cold chain packaging market over the forecast period owing to its thriving pharmaceutical and e-commerce sectors boost the demand for cold chain packaging, ensuring product integrity during last-mile delivery.

Italy is predicted to do well in the European market over the forecast period due to its food processing industry, particularly in pasta and cheese production that relies heavily on cold chain packaging to maintain product quality.

Spain is expected to play a noteworthy role in the European market over the forecast period owing to the Spain’s agricultural sector, particularly in fresh produce and seafood, drives the demand for efficient cold chain solutions, ensuring timely delivery and minimal wastage.

DETAILED SEGMENTATION OF EUROPE COLD CHAIN PACKAGING MARKET INCLUDED IN THIS REPORT

This research report on the Europe cold chain packaging market has been segmented and sub-segmented based on product type, application & region.

By Product Type

- Expanded Polystyrene (EPS) Containers

- Vacuum Insulated Panels (VIPs)

By Application

- Pharmaceuticals

- Food

By Region

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. What are the key drivers of the Europe Cold Chain Packaging Market?

The market is driven by increasing demand for temperature-sensitive food and pharmaceutical products, advancements in packaging technologies, and strict regulatory standards for product safety and quality.

2. Which materials are commonly used in cold chain packaging?

Common materials include expanded polystyrene (EPS), vacuum insulated panels (VIPs), polyurethane (PU), gel packs, phase change materials (PCMs), and dry ice packaging.

3. How does cold chain packaging help in the pharmaceutical industry?

It ensures the safe transportation of vaccines, biologics, and temperature-sensitive drugs by maintaining the required temperature range, preventing spoilage, and complying with Good Distribution Practices (GDP).

4. Who are the major players in the Europe Cold Chain Packaging Market?

Leading companies include Sonoco ThermoSafe, Pelican BioThermal, Cold Chain Technologies, Cryopak, Sofrigam, Softbox Systems, va-Q-tec AG, and Intelsius.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]