Europe Cold Chain Logistics Market Size, Share, Trends & Growth Forecast Report By Type (Refrigerated Warehouses, Refrigerated Transportation [Road, Sea, Rail, Air]), Application (Fruits & Vegetables, Fish, Meat & Seafood, Dairy & Frozen Desserts, Bakery & Confectionery, Processed Food, Pharmaceuticals, Others), and Country (UK, Germany, France, Italy, Spain, Netherlands, Rest of Europe) – Industry Analysis From 2025 to 2033.

Europe Cold Chain Logistics Market Size

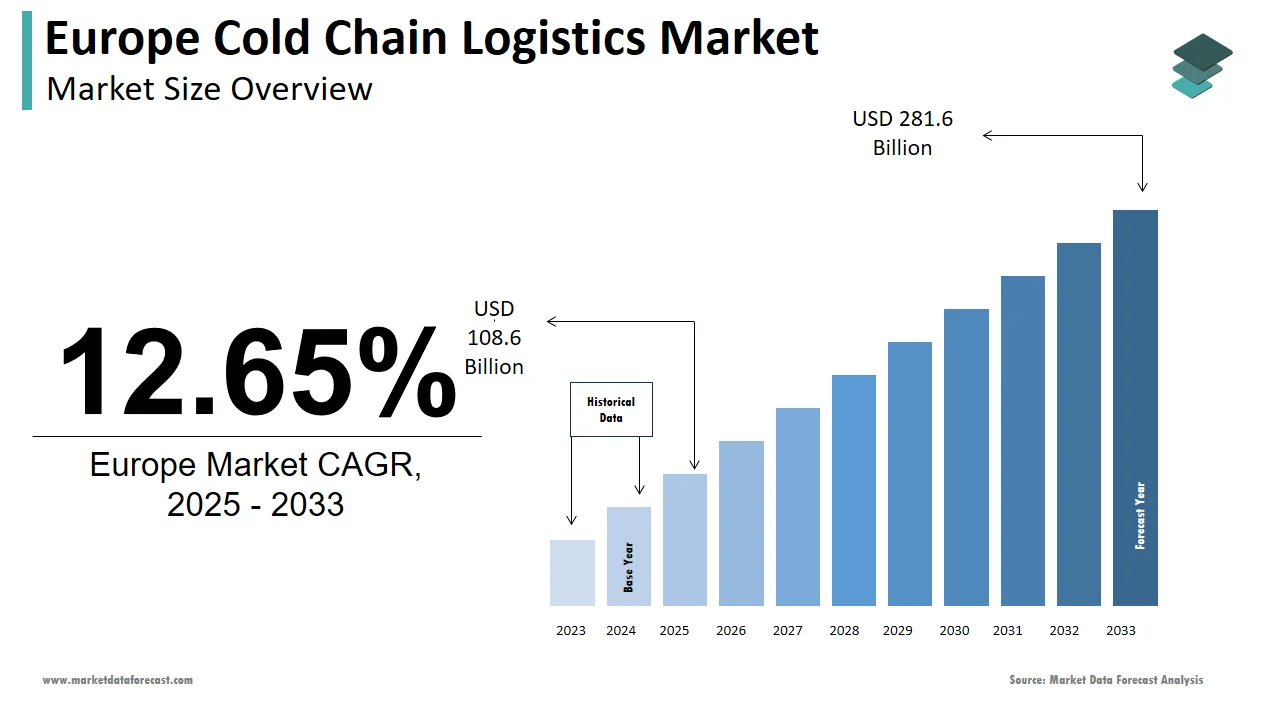

The cold chain logistics market size in Europe was valued at USD 96.4 billion in 2024. The European market is estimated to be worth USD 281.6 billion by 2033 from USD 108.6 billion in 2025, growing at a CAGR of 12.65% from 2025 to 2033.

The European cold chain logistics market is a cornerstone of the region's supply chain infrastructure, driven by the demand for perishable goods and temperature-sensitive products. Moreover, the increase in online grocery shopping has boosted the demand for better cold chain systems, especially in cities. Germany, France, and the UK collectively account for a substantial portion of the market share due to their robust logistics networks and high demand for fresh produce. As per the European Food Safety Authority, approximately 20% of all food products transported in Europe require refrigeration, underscoring the critical role of cold chain logistics. Innovations such as IoT-enabled temperature monitoring systems are enhancing operational efficiency, while regulatory frameworks like the EU’s Food Hygiene Regulations ensure compliance.

MARKET DRIVERS

Rising Demand for Perishable Goods

The increasing consumption of perishable goods, including fresh fruits, vegetables, and dairy products, is a primary driver of the cold chain logistics market. According to the European Commission, the EU imports over 40 million tons of fresh produce annually, necessitating reliable cold storage and transportation. Urbanization and changing dietary preferences further fuel this demand. Additionally, the surge in e-commerce platforms like Amazon Fresh and Ocado has created a need for last-mile delivery solutions that maintain product quality. This trend is particularly evident in metropolitan areas, where consumers expect same-day or next-day delivery of perishables. Companies are investing heavily in advanced refrigeration technologies to meet these expectations, ensuring minimal wastage and optimal shelf life.

Pharmaceutical Industry Growth

The pharmaceutical sector is another significant driver, with vaccines and biologics requiring precise temperature control during transit. The rollout of COVID-19 vaccines noted the importance of cold chain logistics, with Pfizer-BioNTech vaccines requiring storage at -70°C. This demand has spurred investments in ultra-low temperature freezers and specialized transport vehicles. Furthermore, the European Medicines Agency mandates stringent regulations for drug transportation, pushing companies to adopt cutting-edge solutions.

MARKET RESTRAINTS

High Operational Costs

One of the primary restraints is the high operational cost associated with maintaining cold chain infrastructure. Refrigerated warehouses and transport vehicles require significant energy consumption, according to the European Logistics Association. Rising electricity prices exacerbate this issue, with costs increasing by 15% in 2023 alone. Smaller logistics providers struggle to compete with larger firms that can afford advanced technologies like solar-powered refrigeration systems. Additionally, frequent maintenance and calibration of temperature-controlled equipment add to the financial burden. These challenges hinder the adoption of cold chain solutions, particularly among SMEs operating on tight budgets.

Regulatory Compliance Challenges

Stringent regulatory requirements pose another major restraint. The EU’s Food Hygiene Regulations mandate precise temperature controls throughout the supply chain, leaving little room for error. According to the European Food Safety Authority, non-compliance can result in fines, depending on the severity of the breach. Ensuring adherence to these standards requires continuous monitoring and documentation, which increases administrative overhead. Furthermore, cross-border shipments face additional complexities due to varying national regulations. For instance, transporting perishables from Spain to Germany involves navigating multiple compliance frameworks, as per the European Transport Workers’ Federation. These regulatory hurdles create barriers to seamless operations and deter new entrants from entering the market.

MARKET OPPORTUNITIES

Expansion of E-commerce Platforms

The rapid growth of e-commerce presents a lucrative opportunity for the cold chain logistics market. Surge in digital shopping necessitates efficient cold chain solutions to ensure timely and safe delivery of perishables. Companies are investing in micro-fulfillment centers equipped with advanced refrigeration systems to cater to urban consumers. For example, Ocado partnered with Swisslog to develop automated cold storage facilities capable of processing substantial orders daily. Also, innovations like drone delivery and autonomous vehicles offer new avenues for last-mile logistics, enhancing service reliability and customer satisfaction.

Adoption of IoT and AI Technologies

The integration of IoT and AI technologies is transforming the cold chain logistics landscape. IoT-enabled sensors provide real-time temperature monitoring. These systems also enable predictive maintenance, minimizing downtime and operational disruptions. AI-driven analytics optimize route planning and inventory management, improving efficiency and reducing costs. For instance, DHL implemented AI-based solutions to enhance its cold chain operations, achieving a reduction in energy consumption. Furthermore, blockchain technology ensures transparency and traceability, addressing consumer concerns about product authenticity. These technological advancements not only improve operational performance but also position Europe as a leader in smart logistics solutions.

MARKET CHALLENGES

Infrastructure Gaps

Infrastructure gaps remain a significant challenge, particularly in rural and underdeveloped regions. According to the European Investment Bank, over 30% of European towns lack adequate cold storage facilities, limiting access to fresh produce. This disparity creates bottlenecks in the supply chain, leading to increased wastage and higher costs. In Eastern Europe, for example, inadequate road networks and outdated warehousing systems hinder the efficient movement of perishables, as per the European Logistics Association. While governments are investing in infrastructure development, progress is slow. For instance, Poland plans to construct 50 new refrigerated warehouses by 2026, but this falls short of the estimated 200 required to meet demand. These gaps impede the seamless functioning of cold chain logistics.

Environmental Sustainability Concerns

Environmental sustainability poses another challenge, as cold chain operations contribute significantly to carbon emissions. Refrigerated trucks and warehouses account for 2% of the logistics sector’s total emissions, according to the European Environment Agency. Transitioning to eco-friendly alternatives, such as electric vehicles and renewable energy sources, requires substantial investment. While initiatives like the EU Green Deal aim to reduce emissions by 55% by 2030, implementation remains inconsistent across member states. For instance, a notable share of cold chain providers in Southern Europe have adopted green technologies, as per the European Sustainable Energy Association.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Type, Application, and Region. |

|

Various Analyses Covered |

Global, Regional and Country-Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Countries Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, and the Rest of Europe. |

|

Market Leaders Profiled |

U.S. Cold Storage, AmeriCold Logistics LLC, LINEAGE LOGISTICS HOLDING, LLC, VersaCold Logistics Services, NICHIREI LOGISTICS GROUP INC., CONGEBEC LOGISTICS INC., Burris Logistics, CONESTOGA COLD STORAGE, Kloosterboer, COLD BOX EXPRESS, INC, and others. |

SEGMENTAL ANALYSIS

By Type Insights

The refrigerated warehouses segment dominated the European cold chain logistics market by holding a 60.9% share in 2024. This lead is mainly due to the growing need for long-term storage, especially for items that spoil easily. Countries like Germany and France have invested heavily in state-of-the-art facilities, with capacities exceeding 10 million cubic meters. Additionally, the rise of e-commerce has spurred the development of micro-fulfillment centers, enabling faster order processing. These factors collectively sustain the segment’s leadership, despite the growing popularity of refrigerated transportation.

The refrigerated transportation segment is the fastest-growing segment, with a CAGR of 9.3%. This growth is fueled by the expansion of cross-border trade and the rise of last-mile delivery services. Countries like Spain and Italy lead adoption. Government incentives, such as tax breaks for eco-friendly vehicles, further accelerate growth. For instance, the UK provides subsidies for electric refrigerated trucks, which helps increase their sales. Technological advancements, including IoT-enabled tracking systems, enhance reliability and efficiency. These factors place refrigerated transportation as the future of the market, outpacing traditional segments in growth potential.

By Application Insights

The fruits and vegetables segment commanded the European cold chain logistics market by accounting for 36.3% of the overall share in 2024. This pre-eminence is credited to the high perishability of fresh produce, which requires precise temperature control during transit. The EU imports over 40 million tons of fruits and vegetables annually, creating a steady demand for cold chain solutions. According to Eurostat, countries like Spain and Italy are major contributors, exporting over 15 million tons combined. Further, consumer awareness about healthy eating habits drives domestic consumption, further boosting demand. Innovations like vacuum cooling systems and modified atmosphere packaging enhance shelf life, ensuring consistent quality and reducing wastage.

The pharmaceuticals category is the swiftest expanding application , with a CAGR of 12.6%. This is propelled by the increasing demand for temperature-sensitive drugs, including vaccines and biologics. Also, the rollout of COVID-19 vaccines emphasized the importance of cold chain logistics, with Pfizer-BioNTech vaccines requiring storage at -70°C. Investments in ultra-low temperature freezers and specialized transport vehicles have surged, ensuring compliance with stringent regulations. For instance, Germany allocated €500 million in 2023 to upgrade its pharmaceutical cold chain infrastructure. These aspects place pharmaceuticals as a key growth driver, outpacing other applications in the coming years.

COUNTRY LEVEL ANALYSIS

Germany spearheaded the European cold chain logistics market by commanding a 25.4% share in 2024. The dominance is caused by a robust infrastructure network, including over 650,000 kilometers of paved roads and advanced warehousing facilities. Additionally, Germany’s strategic location in Central Europe facilitates cross-border trade, with key share of cold chain shipments originating or transiting through the country. Investments in eco-friendly technologies such as solar-powered warehouses, further enhance its leadership position.

France shows the fastest growth, with a CAGR of 8.3%. Urbanization and the rise of e-commerce platforms like Picnic and Gorillas have fueled demand for last-mile delivery solutions. In 2023, France set up many micro-fulfillment centers, helping cut down delivery times and spoilage. The country’s focus on sustainability aligns with EU Green Deal targets, making it a hub for innovation in green logistics.

Italy and Spain show steady growth due to their strong agricultural exports, particularly fruits, vegetables, and seafood. Italy’s focus on premium products like Parmesan cheese drives demand for specialized cold storage. Spain, a leader in fish exports, benefits from its extensive coastal infrastructure. The UK faces challenges post-Brexit but remains competitive in pharmaceutical logistics, leveraging its expertise in handling temperature-sensitive vaccines and biologics.

KEY MARKET PLAYERS

Some notable companies that dominate the Europe cold chain logistics market profiled in this report are U.S. Cold Storage, AmeriCold Logistics LLC, LINEAGE LOGISTICS HOLDING, LLC, VersaCold Logistics Services, NICHIREI LOGISTICS GROUP INC., CONGEBEC LOGISTICS INC., Burris Logistics, CONESTOGA COLD STORAGE, Kloosterboer, COLD BOX EXPRESS, INC, and others.

TOP LEADING PLAYERS IN THE MARKET

Kuehne + Nagel

Kuehne + Nagel is a global leader in cold chain logistics, contributing significantly to Europe’s market. Its state-of-the-art facilities handle over 1 million tons of perishables annually, ensuring compliance with stringent EU regulations. The company’s partnerships with agribusinesses and pharmaceutical firms solidify its reputation for reliability and precision.

DHL Supply Chain

DHL dominates Europe’s cold chain logistics, focusing on sustainability and technological innovation. Its adoption of electric vehicles and renewable energy sources aligns with the EU Green Deal. DHL’s expertise in pharmaceutical logistics, particularly for vaccines, positions it as a key player in the fastest-growing segment.

XPO Logistics

XPO Logistics excels in pharmaceutical logistics. Its acquisition of niche providers like PharmaCold enhances its capabilities in handling ultra-low temperature products. XPO’s focus on real-time tracking and predictive analytics ensures seamless operations for sensitive goods.

TOP STRATEGIES USED BY KEY PLAYERS

Key players employ diverse strategies to maintain their competitive edge. Digital transformation is a priority, with companies investing in IoT-enabled sensors and AI-driven analytics to optimize operations. For instance, Kuehne + Nagel partnered with IBM to develop blockchain solutions that enhance transparency and traceability in the supply chain.

Sustainability initiatives are another focus area. DHL has committed to reducing carbon emissions by 30% by 2030, adopting electric refrigerated trucks and solar-powered warehouses. Governments incentivize these efforts through subsidies, accelerating the adoption of green technologies.

Mergers and acquisitions also play a pivotal role. XPO Logistics acquired PharmaCold to expand its pharmaceutical capabilities, while DB Schenker partnered with Siemens to develop AI-driven route optimization tools. These strategies ensure scalability and adaptability in a rapidly evolving market.

COMPETITION OVERVIEW

The European cold chain logistics market is very competitive, with leading companies trying to stay ahead through new ideas and specialized services. Kuehne + Nagel leads with its comprehensive warehousing and transportation solutions, catering to diverse industries like agriculture and pharmaceuticals. DHL differentiates itself through sustainability, adopting eco-friendly technologies to meet regulatory standards and consumer expectations.

XPO Logistics focuses on niche markets, particularly pharmaceuticals, leveraging its expertise in handling ultra-low temperature products. Smaller players compete by offering tailored solutions for specific applications, such as seafood or dairy. Regulatory compliance and environmental sustainability remain key battlegrounds, driving differentiation and ensuring a vibrant competitive landscape.

Technological advancements further intensify rivalry. Companies invest in IoT, AI, and blockchain to enhance efficiency and transparency. Price wars and service innovations create a dynamic environment where only the most agile and customer-centric players thrive.

TOP 5 MAJOR ACTIONS BY COMPANIES

- In April 2024, Kuehne + Nagel launched a blockchain-based tracking system, enhancing transparency for perishable goods.

- In June 2023, DHL introduced electric refrigerated trucks, reducing carbon emissions by 15%.

- In March 2023, XPO Logistics acquired PharmaCold, strengthening its pharmaceutical logistics capabilities.

- In July 2023, DB Schenker partnered with Siemens to develop AI-driven route optimization tools.

- In February 2024, Agility Logistics expanded its cold storage facilities in Spain, increasing capacity by 20%.

MARKET SEGMENTATION

This Europe cold chain logistics market research report is segmented and sub-segmented into the following categories.

By Type

- Refrigerated Warehouses

- Refrigerated Transportation

- Road

- Sea

- Rail

- Air

By Application

- Fruits & Vegetables

- Fish, Meat, and Seafood

- Dairy & Frozen Desserts

- Bakery & confectionery

- Processed Food

- Pharmaceuticals

- Others

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. What is the projected size of the Europe cold chain logistics market?

The Europe cold chain logistics market is expected to grow from USD 108.6 billion in 2025 to USD 281.6 billion by 2033, at a CAGR of 12.65%.

2. What factors are driving Europe cold chain logistics market growth?

Growth is driven by increasing demand for perishable goods, e-commerce expansion, and stringent regulatory requirements for food and pharmaceutical safety.

3. Which countries dominate the cold chain logistics market in Europe?

Germany, France, and the UK lead the market due to robust logistics networks and high demand for temperature-sensitive products.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]