Europe Coiled Tubing Market Size, Share, Trends, & Growth Forecast Report By Service (Well intervention, Well cleaning, Well completion, and Drilling), Application (Onshore, Offshore, Deep, and Ultra-deep), Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2024 to 2033

Europe Coiled Tubing Market Size

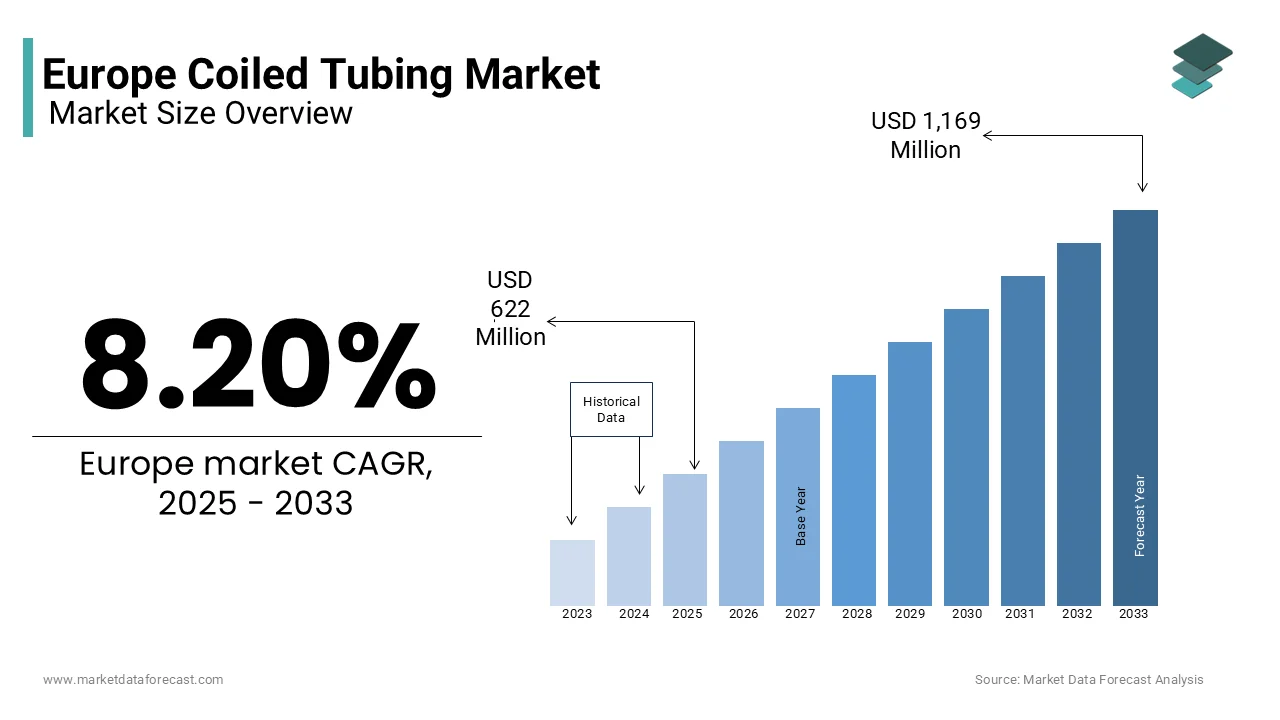

The Europe coiled tubing market was valued at USD 575 million in 2024. The European market is expected to reach USD 1,169 million by 2033 from USD 622 million in 2025, rising at a CAGR of 8.20% from 2025 to 2033.

Coiled tubing technology has gained prominence due to its cost-effectiveness, operational efficiency, and ability to perform tasks in challenging environments such as offshore platforms and mature fields. According to the International Energy Agency (IEA), Europe accounts for approximately 15% of global coiled tubing applications, with significant contributions from countries like Norway, the United Kingdom, and the Netherlands, which are home to extensive offshore hydrocarbon reserves.

In Europe, the demand for coiled tubing is primarily driven by the increasing investments in enhanced oil recovery (EOR) techniques and the rising demand for efficient well intervention solutions. As per the Norwegian Petroleum Directorate, over 60% of offshore wells in the North Sea utilize coiled tubing services with its importance in maintaining production levels in aging fields. Furthermore, the shift toward cleaner energy sources has spurred innovations in coiled tubing technologies by enabling their application in carbon capture, utilization, and storage (CCUS) projects.

Despite the ongoing energy transition, the European coiled tubing market remains resilient and supported by regulatory frameworks promoting sustainable practices. For instance, the European Commission’s Green Deal studies shown that the reducing methane emissions, encouraging operators to adopt advanced coiled tubing methods for leak detection and repair. The coiled tubing market is to play a pivotal role in shaping the future of Europe’s hydrocarbon sector while aligning with broader decarbonization goals. The broader decarbonization goals in Europe with the increasing support from the government organizations is solely to drive the growth rate of the Europe coiled tubing market in the next coming years.

MARKET DRIVERS

Increasing Demand for Enhanced Oil Recovery Techniques

One of the major drivers of the European coiled tubing market is the growing demand for enhanced oil recovery (EOR) techniques, particularly in mature oil fields. According to the International Energy Agency (IEA), over 70% of Europe’s oil fields are in the declining phase of production by necessitating advanced intervention methods to maintain output levels. Coiled tubing plays a pivotal role in EOR operations such as acidizing, fracturing, and nitrogen lifting, which can enhance recovery rates by up to 30%. According to the Norwegian Petroleum Directorate, approximately 65% of offshore wells in the North Sea rely on coiled tubing services for periodic maintenance and stimulation. As per the European Association of Oil & Gas Companies, investments in EOR technologies have increased by 12% annually since 2020.

Rising Adoption in Carbon Capture, Utilization, and Storage Projects

The increasing adoption of coiled tubing in carbon capture, utilization, and storage (CCUS) projects, aligning with Europe’s decarbonization goals is substantially to fuel the growth rate of the Europe coiled tubing market. As per the European Commission, CCUS technologies are essential for achieving the EU’s target of reducing greenhouse gas emissions by 55% by 2030. Coiled tubing is utilized for injecting CO2 into underground reservoirs and monitoring storage integrity by making it indispensable for large-scale CCUS initiatives. According to the Global CCS Institute, Europe accounts for 25% of global CCUS projects, with countries like Norway leading efforts through initiatives such as the Northern Lights project. Furthermore, according to the UK Oil and Gas Authority, coiled tubing applications in CCUS have grown by 18% annually over the past five years.

MARKET RESTRAINTS

High Operational Costs and Budget Constraints

One significant restraint in the European coiled tubing market is the high operational costs associated with deploying and maintaining coiled tubing equipment. As per the European Association of Oil & Gas Companies, the average cost of a single coiled tubing operation can range from €50,000 to €200,000 is depending on the complexity and location. These expenses are particularly burdensome for smaller operators, especially amid fluctuating oil prices, which have seen a 30% decline in profitability for some companies over the past five years, according to the International Energy Agency (IEA). Additionally, offshore operations, which dominate Europe’s hydrocarbon sector, require specialized equipment and personnel, further escalating costs. The Norwegian Petroleum Directorate notes that nearly 40% of offshore projects face delays or budget overruns due to logistical challenges.

Environmental Regulations and Transition to Renewable Energy

The stringent environmental regulations and Europe’s accelerating shift toward renewable energy, which impact the demand for coiled tubing services is hampering the growth rate of the Europe coiled tubing market. The European Commission’s Green Deal aims to reduce fossil fuel dependency, with investments in renewable energy surpassing €450 billion annually by 2023. This transition has led to a 15% reduction in upstream oil and gas activities over the past decade, as reported by the UK Oil and Gas Authority. Furthermore, environmental concerns about methane emissions and drilling waste have prompted stricter permitting processes by increasing project timelines. According to the Global Methane Initiative, regulatory compliance costs have risen by 25% since 2018 by discouraging new hydrocarbon projects. The declining emphasis on fossil fuels poses a long-term challenge to market growth.

MARKET OPPORTUNITIES

Expansion in Offshore Decommissioning Projects

The European coiled tubing market lies in the growing demand for offshore decommissioning projects, driven by aging oil and gas infrastructure. As per the UK Oil and Gas Authority, over 250 platforms and 3,000 wells in the North Sea are expected to be decommissioned by 2030, with associated costs exceeding €50 billion. Coiled tubing plays a crucial role in plugging and abandonment (P&A) operations, which account for approximately 40% of decommissioning expenses. According to the Norwegian Petroleum Directorate, P&A activities have increased by 18% annually over the past five years is creating a robust market for coiled tubing services. According to the European Commission, decommissioning with environmental goals by ensuring safe and sustainable closure of hydrocarbon assets. This trend presents a lucrative opportunity for coiled tubing providers to diversify their revenue streams while contributing to Europe’s energy transition efforts.

Integration with Digitalization and Automation Technologies

Another major opportunity is the integration of coiled tubing operations with digitalization and automation technologies, enhancing efficiency and reducing costs. According to the European Association of Oil & Gas Companies, investments in digital solutions, such as real-time monitoring and predictive analytics, have grown by 20% annually since 2020. These technologies enable precise control of coiled tubing operations by reducing downtime by up to 30%, according to the International Energy Agency (IEA). Additionally, Norway’s Equinor reports that automated coiled tubing systems have improved operational safety and reduced human error by 25% in offshore environments. The adoption of Industry 4.0 practices is supported by the European Commission’s funding initiatives for smart technologies that further accelerates this trend. By embracing digital transformation, the coiled tubing market can enhance its competitiveness while addressing challenges related to cost and operational complexity.

MARKET CHALLENGES

Aging Infrastructure and Technical Limitations

One of the major challenges facing the European coiled tubing market is the aging infrastructure in mature oil fields, which poses technical and operational difficulties. According to the Norwegian Petroleum Directorate, over 50% of Europe’s offshore wells are more than 30 years old that requires frequent interventions to maintain production. However, older wells often have narrow pressure windows and complex geometries that increases the risk of equipment failure during coiled tubing operations. As per the International Energy Agency (IEA), such complications lead to a 15% higher likelihood of project delays and cost overruns in mature fields. According to the European Association of Oil & Gas Companies, fatigue and wear on coiled tubing strings result in replacement costs exceeding €1 million annually for some operators. These challenges limit efficiency and profitability in regions with declining hydrocarbon reserves.

Competition from Alternative Technologies

Another significant challenge is the rising competition from alternative technologies that offer cost-effective solutions for well intervention. According to the UK Oil and Gas Authority, wireline and snubbing services are increasingly preferred for simpler tasks due to their lower operational costs, which can be up to 40% less than coiled tubing. Furthermore, advancements in hydraulic workover units have reduced the dependency on coiled tubing for certain applications in shallow wells. According to the European Commission, investments in non-coiled tubing technologies have grown by 12% annually over the past five years, that is driven by the need for cheaper alternatives in a volatile energy market. This competition pressures coiled tubing providers to innovate and justify higher costs, especially as operators seek to optimize budgets amid fluctuating oil prices and regulatory constraints.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

8.20% |

|

Segments Covered |

By Service, Application, and Country |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Countries Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, and Rest of Europe |

|

Market Leaders Profiled |

Baker Hughes, a GE company LLC, Calfrac Well Services Ltd., GOES GmbH, Halliburton, Hunting PLC, National Oilwell Varco Inc., Packer Service LLC, Royal IHC, Schlumberger Limited, Stimline AS, Surgutneftegas, Tenaris, Weatherford, and Well Service Group. |

SEGMENTAL ANALYSIS

By Service Insights

The well Intervention segment dominated the European coiled tubing market with a 45.1% share in 2024. The maintenance of aging oil fields in the North Sea, where 60% of offshore wells require regular intervention, according to the Norwegian Petroleum Directorate. Coiled tubing reduces operational costs by up to 30% compared to traditional methods by making it indispensable for addressing issues like scale buildup and pressure management. As per the International Energy Agency, Europe’s focus on maximizing recovery from mature fields ensures steady demand. This segment’s importance lies in sustaining hydrocarbon production while optimizing operational efficiency with Europe’s energy security goals.

The drilling segment is estimated to register a fastest CAGR of 8.5% during the forecast period. This growth is driven by advanced techniques like managed pressure drilling and directional drilling, which enhance safety and precision in challenging environments such as HPHT wells. The European Commission notes that directional drilling accounts for 20% of coiled tubing applications by enabling precise wellbore placement in offshore reservoirs. Innovations in real-time monitoring and automation have further boosted adoption. Its importance lies in supporting complex drilling operations, ensuring efficient resource extraction, and aligning with Europe’s push for technological advancements in the energy sector.

By Application Insights

The Onshore segment dominated the European coiled tubing market with a 50.1% share of the European market in 2024. The prevalence of mature onshore fields in regions like Russia and Eastern Europe, where cost-effective interventions are essential is escalating the growth rate of the market. According to the International Energy Agency (IEA), onshore operations reduce logistical costs by up to 40% compared to offshore by making coiled tubing ideal for well maintenance and workovers. As per the UK Oil and Gas Authority, aging infrastructure in onshore fields necessitates frequent interventions, with coiled tubing reducing downtime by 25%. Its importance lies in optimizing production from existing assets while supporting Europe’s energy security through sustainable hydrocarbon extraction.

The Offshore segment is anticipated to exhibit the fastest CAGR of 9.2% during the forecast period. This growth is fueled by Europe’s extensive offshore reserves in the North Sea, where 60% of wells rely on coiled tubing for intervention and completion. According to the European Commission, advancements in deepwater technologies have expanded its use in challenging environments. As per the International Energy Agency (IEA), offshore projects increasingly adopt coiled tubing for managed pressure drilling and cleanouts by ensuring safety and efficiency. This segment’s importance lies in enhancing production from complex reservoirs while adhering to strict environmental regulations governing marine operations.

REGIONAL ANALYSIS

Norway led the market in Europe and held with 25.1% of the European coiled tubing market share in 2024 owing to its extensive offshore hydrocarbon reserves in the North Sea, where over 60% of wells rely on coiled tubing for intervention and maintenance. The country’s advanced infrastructure and expertise in offshore drilling and production have positioned it as a global leader. As per the International Energy Agency (IEA), Norway, nearly 30% of Europe’s total oil and gas production is driving demand for coiled tubing services. Additionally, Norway’s commitment to sustainable practices is supported by the Norwegian government’s funding for low-emission technologies, which ensures steady adoption. Its focus on maximizing recovery from mature fields while adhering to environmental regulations leverages its dominance.

The United is deemed to grow with a CAGR of 7.9% in the foreseen years. This growth is driven by the increasing focus on decommissioning aging offshore infrastructure in the North Sea, where coiled tubing plays a critical role in plugging and abandonment operations. According to the European Commission, the UK plans to decommission over 250 platforms by 2030 by creating significant opportunities for coiled tubing providers. Furthermore, investments in enhanced oil recovery (EOR) techniques have risen by 15% annually, as operators seek to extend the life of mature fields. The UK’s strategic emphasis on balancing energy security with environmental goals has made it a key player in the coiled tubing market.

Russia is expected to pose significant growth opportunities for the European coiled tubing market in the next coming years. This growth is fueled by the country’s vast onshore oil and gas fields, particularly in Western Siberia, where coiled tubing is extensively used for well intervention and maintenance. As per the International Energy Agency (IEA), Russia accounts for approximately 20% of global hydrocarbon production by ensuring sustained demand for coiled tubing services. Additionally, the Russian government’s push for modernizing aging infrastructure has increased investments in advanced technologies.

KEY MARKET PLAYERS

The major players in the Europe coiled tubing market include Baker Hughes, a GE company LLC, Calfrac Well Services Ltd., GOES GmbH, Halliburton, Hunting PLC, National Oilwell Varco Inc., Packer Service LLC, Royal IHC, Schlumberger Limited, Stimline AS, Surgutneftegas, Tenaris, Weatherford, and Well Service Group.

MARKET SEGMENTATION

This research report on the Europe coiled tubing market is segmented and sub-segmented into the following categories.

By Service

- Well intervention

- Well cleaning

- Well completion

- Fishing

- Perforation

- Logging

- Others

- Drilling

- Managed pressure drilling

- Directional drilling

By Application

- Onshore

- Offshore

- Deep

- Ultra-deep

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What is driving the growth of the Europe coiled tubing market?

The market is primarily driven by increasing oil and gas exploration activities, rising demand for well intervention services, and advancements in coiled tubing technology.

What are the main applications of coiled tubing in the European oil and gas industry?

Coiled tubing is widely used for well intervention, drilling, completion, hydraulic fracturing, and cleanout operations in both onshore and offshore oilfields.

What technological advancements are influencing the coiled tubing industry in Europe?

Innovations include real-time data monitoring, automated coiled tubing units, and high-strength tubing materials that enhance operational efficiency and safety.

What is the future outlook for the Europe coiled tubing market?

The market is expected to grow steadily, driven by increased offshore activities, technological advancements, and the need for efficient well intervention solutions.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]