Europe Europe CNC Machine Market Size, Share, Trends, & Growth Forecast Report - Segmented By Type (Lathe Machines, Milling Machines, Laser Machines), End-use (Automotive, Aerospace & Defense ,Construction Equipment, Power & Energy) and Country (Germany, UK, France, Italy, Spain) – Industry Analysis from 2025 to 2033.

Europe CNC Machine Market Size

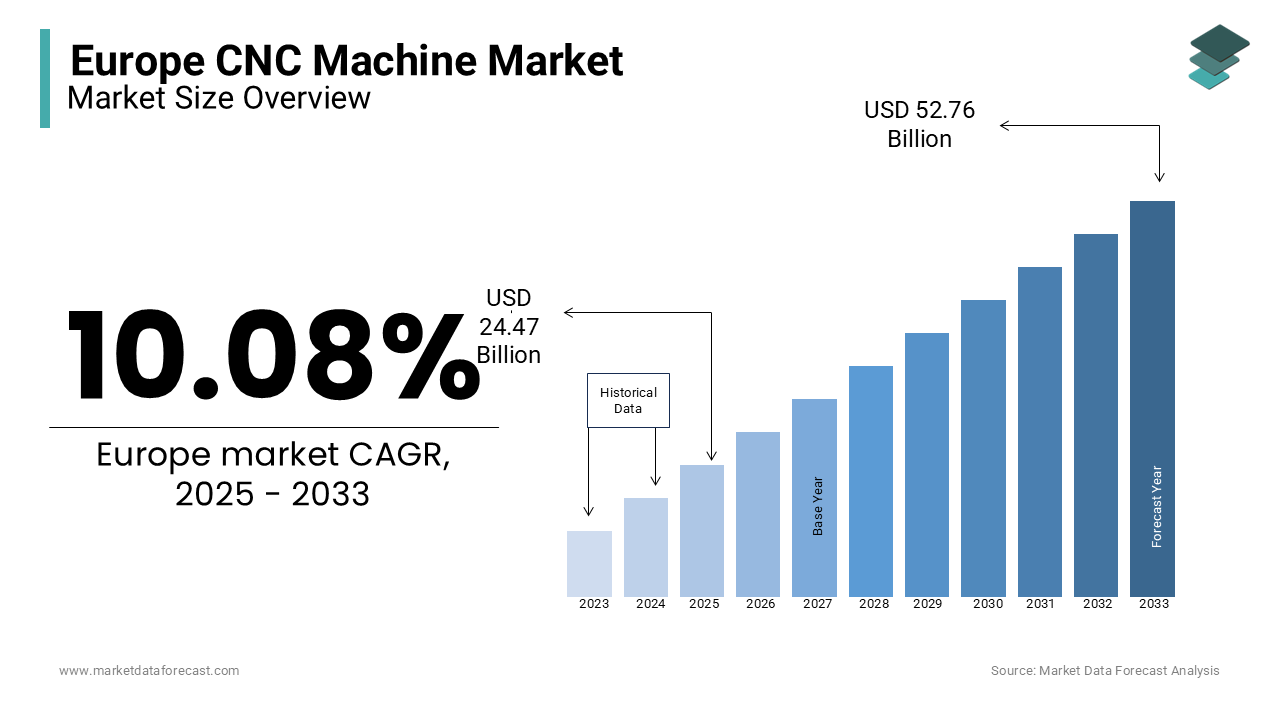

The Europe CNC Machine Market was valued at USD 22.23 billion in 2024. The Europe CNC Machine Market is expected to have 10.08% CAGR from 2025 to 2033 and be worth USD 52.76 billion by 2033 from USD 24.47 billion in 2025.

CNC machines are critical for the advanced manufacturing and industrial automation landscape of Europe. CNC machines are automated tools controlled by pre-programmed software to enable precise and efficient operations in machining processes such as cutting, milling, drilling and turning. The strong industrial base of Europe and its emphasis on adopting advanced technologies to enhance productivity are propelling the European CNC machine market expansion. According to the European Association of the Machine Tool Industries (CECIMO), Europe accounts for approximately 35% of the global machine tool production, which is indicating the dominance of Europe in this sector. Germany, Italy, and Switzerland are playing a key role in the European CNC machine market due to their robust engineering capabilities and high R&D investments.

MARKET DRIVERS

Industrial Automation and Industry 4.0 Adoption

The increasing emphasis on industrial automation and the adoption of Industry 4.0 are significant drivers of the European CNC machine market. As industries strive to enhance efficiency and precision, CNC machines have become integral to smart manufacturing systems. The European Commission highlights that over 70% of manufacturing companies in Europe are integrating advanced technologies such as IoT and AI into their operations. These technologies enable CNC machines to perform complex tasks with minimal human intervention, reducing errors and optimizing productivity. Germany, known for its advanced manufacturing base, leads in implementing CNC systems, contributing significantly to the region’s adoption of Industry 4.0.

Rising Demand from the Automotive and Aerospace Sectors

The automotive and aerospace industries are major consumers of CNC machines in Europe, driving market growth through their demand for high-precision components. According to CECIMO, the automotive sector accounts for approximately 30% of machine tool consumption in Europe. CNC machines are vital in producing engine parts, transmission systems, and intricate aerospace components with strict tolerances. The European Aerospace Industry Association reports that Europe produces over 20% of the world’s aerospace components, reflecting the strong demand for advanced machining technologies. This reliance on CNC machines underscores their role in supporting the region’s high-value manufacturing industries.

MARKET RESTRAINTS

High Initial Investment Costs

The significant upfront costs associated with purchasing and installing CNC machines serve as a major restraint for their widespread adoption, particularly among small and medium-sized enterprises (SMEs). CNC machines, especially multi-axis and high-precision variants, require substantial financial investment. According to the European Association of Machine Tool Industries (CECIMO), advanced CNC systems can cost upwards of €150,000, excluding maintenance and operational expenses. This financial barrier often deters smaller manufacturers from adopting CNC technology, slowing market growth. Additionally, the need for ancillary infrastructure, such as software integration and specialized tooling, further escalates costs, making affordability a persistent challenge in the European CNC machine market.

Shortage of Skilled Workforce

The CNC machine market in Europe faces challenges stemming from a shortage of skilled operators and technicians. Operating and maintaining CNC systems require specialized knowledge, including programming, calibration, and troubleshooting skills. The European Centre for the Development of Vocational Training (CEDEFOP) reports that Europe’s manufacturing sector is experiencing a growing skills gap, with over 40% of employers struggling to find adequately trained CNC operators. This shortage is particularly pronounced in countries with high manufacturing output, such as Germany and Italy. The lack of a skilled workforce not only impacts operational efficiency but also slows the adoption of advanced CNC technologies across the region.

MARKET OPPORTUNITIES

Integration of IoT and Smart Manufacturing

The integration of IoT (Internet of Things) and smart manufacturing presents a transformative opportunity for the European CNC machine market. By incorporating IoT capabilities, CNC machines can enable real-time data exchange, predictive maintenance, and remote monitoring, significantly enhancing operational efficiency. The European Commission reports that IoT-enabled manufacturing could increase productivity by 25% in the next decade. For instance, Germany’s "Industrie 4.0" initiative is driving the adoption of smart CNC technologies, enabling manufacturers to achieve higher precision and efficiency. These advancements align with Europe’s focus on digitalization and sustainability, paving the way for innovative CNC applications in diverse industries.

Expansion of Aerospace and Medical Manufacturing

The growing demand for precision components in aerospace and medical manufacturing offers substantial opportunities for CNC machine adoption. Europe’s aerospace sector, which produces over 20% of global components, requires advanced CNC machines for fabricating complex and high-tolerance parts, as highlighted by the European Aerospace Industry Association. Similarly, the medical industry’s increasing need for custom implants and surgical instruments drives the demand for CNC machining solutions. The European Commission notes that medical manufacturing is expected to grow by over 10% annually, fueled by advancements in healthcare technology. This expansion presents significant potential for CNC machine manufacturers to cater to niche, high-value markets.

MARKET CHALLENGES

Environmental Regulations and Energy Consumption

Strict environmental regulations in Europe pose a challenge to the CNC machine market. CNC machines, particularly older models, consume significant energy during operations, contributing to higher carbon emissions. The European Commission’s climate goals mandate a 55% reduction in greenhouse gas emissions by 2030, pressuring manufacturers to adopt energy-efficient technologies. However, retrofitting or replacing existing systems with eco-friendly alternatives involves considerable costs and operational adjustments. Additionally, compliance with environmental standards, such as the EU’s Energy Efficiency Directive, requires continuous monitoring and optimization, increasing the burden on manufacturers to balance productivity with sustainability.

Dependency on Raw Material Supply Chains

The CNC machine market in Europe faces challenges due to dependency on raw material imports for components like precision alloys, electronics, and semiconductors. The European Commission highlights that over 90% of rare earth materials, essential for CNC machine parts, are sourced from non-European countries, primarily China. This reliance creates vulnerabilities to global supply chain disruptions, trade restrictions, and fluctuating material prices. For example, the COVID-19 pandemic exposed supply chain fragilities, leading to delays in production schedules and increased costs. Addressing these challenges requires strategic investments in local manufacturing and raw material sourcing to reduce dependency and ensure supply chain resilience.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

10.08 % |

|

Segments Covered |

By Type, Application and Country. |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Country Covered |

UK, Germany, Italy, France, Spain, Sweden, Denmark, Poland, Switzerland, Netherlands, Rest of Europe. |

|

Market Leaders Profiled |

AMADA MACHINERY CO., LTD.,AMERA.SEIKI,DMG MORI CO., LTD. |

SEGMENTAL ANALYSIS

By Type Insights

The milling machines segment dominated the market by accounting for 35.5% of the European market share in 2024. According to the European Machine Tool Association, milling machines dominate due to their versatility in manufacturing complex components across industries such as automotive, aerospace, and electronics. As per the German Federal Statistical Office, the automotive sector alone contributes over 20% to the demand for milling machines due to the precision engineering requirements. This importance of milling machines segment lies in its ability to enhance production efficiency and accuracy, making it indispensable for high-value manufacturing processes.

The laser machines segment is anticipated to register the fastest CAGR of 9.2% over the forecast period. According to the European Commission, the adoption of laser machines is growing due to their application in cutting, engraving, and additive manufacturing, particularly in the renewable energy and medical device sectors. According to the report of the International Energy Agency, the solar panel production in Europe is growing at a 15% annual increase, which is driving the demand for laser machines. Laser machines are crucial for their precision, speed, and ability to work with diverse materials, making them vital for innovative and sustainable manufacturing solutions.

By Application Insights

The automotive segment led the market and occupied 40.8% of the European market share in 2024. According to the European Automobile Manufacturers Association, the reliance of the automotive sector on CNC machines stems from the need for precision manufacturing of engine components, transmission parts, and chassis systems. The German Federal Ministry for Economic Affairs and Energy reports that Germany, Europe’s largest automotive producer, contributes significantly to this demand, with over 4 million vehicles manufactured annually. CNC machines are critical for ensuring high-quality, efficient production, making them indispensable for maintaining Europe’s competitive edge in global automotive manufacturing.

The aerospace and defense segment is estimated to grow at the fastest CAGR of 8.5% over the forecast period. The European Defence Agency highlights that increasing defense budgets, driven by geopolitical tensions, and the need for advanced aircraft components are key growth drivers. Airbus, a leading aerospace manufacturer, reported a 15% increase in aircraft production in 2023, further boosting demand for CNC machines. These machines are vital for producing lightweight, high-strength components essential for modern aircraft and defense systems. Their precision and ability to handle complex materials like titanium and composites underscore their importance in advancing Europe’s aerospace and defense capabilities.

Country Level Analysis

Germany held the major share of the European CNC machine market in 2024 owing to the advanced manufacturing base of Germany and high investments in engineering innovation. According to the European Association of Machine Tool Industries (CECIMO), Germany contributes approximately 40% of Europe’s total machine tool production. The country’s strong emphasis on Industry 4.0 technologies and smart manufacturing solutions has further solidified its dominance. Additionally, Germany’s extensive industrial network and skilled workforce enable high production volumes and technological advancements in CNC systems.

Italy ranks among the top performers in the European CNC machine market and is estimated to account for a prominent share of the European market over the forecast period. The growth of the Italian market is primarily driven by the specialization of Italy in precision machinery and robust export capabilities. CECIMO reports that Italy is the second-largest machine tool producer in Europe, contributing over 20% to the region’s output. The country’s focus on high-quality CNC systems and tailored solutions for industries such as automotive and aerospace supports its leading position.

Switzerland is also a promising market for CNC machines in Europe. Switzerland is renowned for its precision engineering and innovation. The country is known for producing advanced CNC systems for medical, watchmaking, and micro-machining applications. Swiss manufacturers leverage high R&D investments and cutting-edge technology to maintain global competitiveness. CECIMO highlights Switzerland’s consistent contribution to Europe’s high-value machine tool exports, emphasizing its leadership in quality and precision.

KEY MARKET PLAYERS

Companies playing a prominent role in the Europe CNC Machine Market are AMADA MACHINERY CO., LTD.,AMERA.SEIKI,DMG MORI CO., LTD.,General Technology Group Dalian Machine Tool Co., Ltd.,FANUC CORPORATION,Haas Automation, Inc.,Hurco Companies, Inc.,Okuma Corporation.,Shenyang Machine Tool Part Co., Ltd.,Yamazaki Mazak Corporation.

MARKET SEGMENTATION

This Europe CNC Machine Market research report has been segmented and sub-segmented into the following categories.

By Type

-

Lathe Machines

-

Milling Machines

-

Laser Machines

-

Grinding Machines

-

Welding Machines

-

Winding Machines

-

Others

By Application

-

Automotive

-

Aerospace & Defense

-

Construction Equipment

-

Power & Energy

-

Industrial

-

Others

By Country

-

UK

-

France

-

Spain

-

Germany

-

Italy

-

Russia

-

Sweden

-

Denmark

-

Switzerland

-

Netherlands

-

Turkey

-

Czech Republic

-

Rest of Europe

Frequently Asked Questions

Which industries are the major consumers of Europe CNC Machine Market

Key industries include automotive, aerospace, healthcare, electronics, and industrial manufacturing.

What are the future trends in the European CNC machine market

Increasing adoption of AI-powered CNC machines, robotics integration, 3D printing hybrid machines, and advancements in automation technology.

What is the current size of the Europe CNC Machine Market

The European CNC machine market is growing, driven by increasing industrial automation and demand for precision manufacturing.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]