Europe Cloud Managed Networking Market Size, Share, Trends, & Growth Forecast Report By Type (Hardware, Software, and Cloud Services), Deployment, Industry, Enterprise Size, Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2024 to 2033

Europe Cloud Managed Networking Market Size

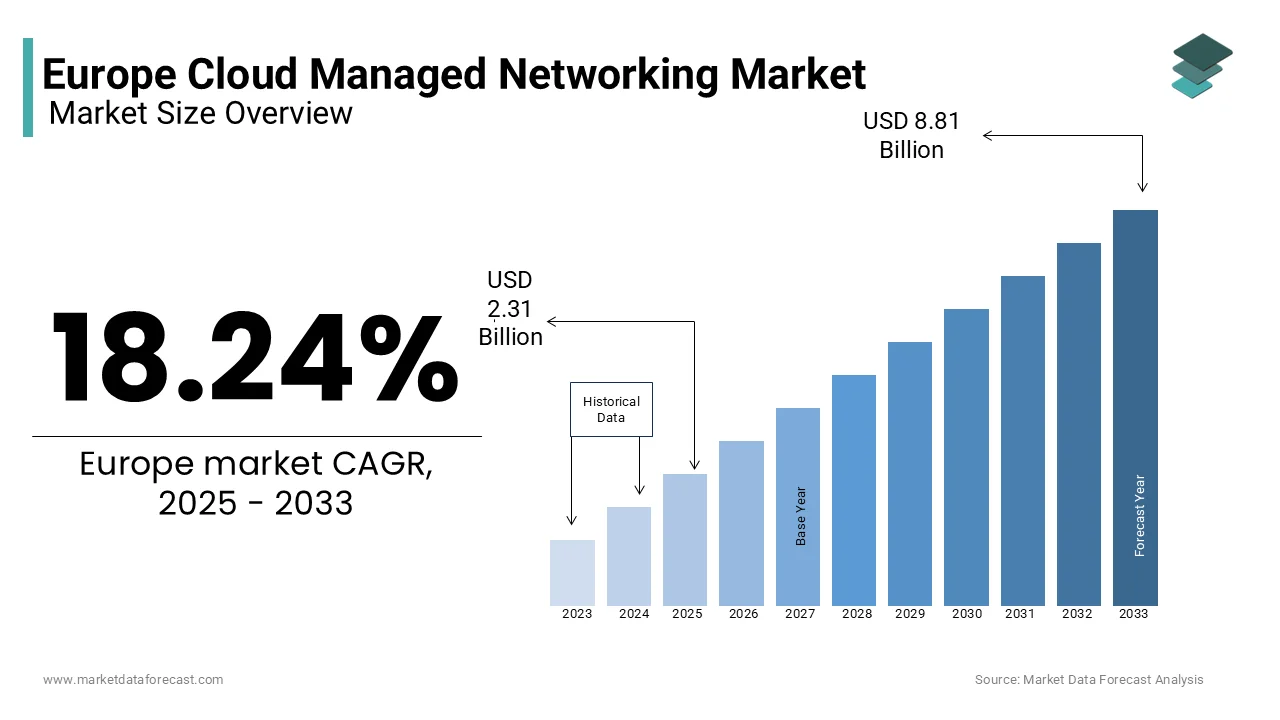

The Europe cloud managed networking market was valued at USD 1.95 billion in 2024. The European market is projected to reach USD 8.81 billion by 2033 from USD 2.31 billion in 2025, growing at a CAGR of 18.24% from 2025 to 2033.

Cloud managed networking is an integration of cloud-based technologies with network management solutions to enhance operational efficiency and scalability. Cloud managed networking refers to the outsourcing of network infrastructure management to third-party providers who leverage cloud platforms for real-time monitoring, optimization, and maintenance.

The European market is witnessing significant traction due to the robust digital transformation initiatives of Europe, stringent data protection regulations, and the growing adoption of hybrid work models post-pandemic. According to a report by the European Commission, over 70% of European enterprises have adopted cloud services in some capacity, underscoring the critical role of cloud managed networking in modern IT ecosystems. As businesses increasingly prioritize agility and cost-effectiveness, the demand for cloud managed networking solutions in Europe is expected to surge over the forecast period.

MARKET DRIVERS

Growing Demand for Scalable and Flexible IT Infrastructure

A key driver propelling the Europe cloud managed networking market is the escalating demand for scalable and flexible IT infrastructure. According to Eurostat, over 60% of European enterprises reported an increase in their reliance on cloud services between 2020 and 2022 due to the need for adaptable solutions amid fluctuating business environments. The ability of cloud managed networking to dynamically scale resources based on demand has made it indispensable for industries such as retail and telecommunications. For instance, during peak shopping seasons, retailers require enhanced bandwidth and storage capabilities that cloud managed networking can seamlessly provide. Additionally, the proliferation of remote work has further amplified this trend, with Gartner estimating that 31% of European workers will remain remote by 2025, which will demand for robust cloud-based networking solutions.

Rising Emphasis on Cybersecurity and Compliance

The growing emphasis on cybersecurity and compliance is another major factor boosting the European cloud managed networking market growth. According to the European Union Agency for Cybersecurity (ENISA), cyberattacks targeting European organizations surged by 28% in 2022, which indicates the critical need for secure networking solutions. Cloud managed networking providers offer advanced encryption protocols, threat detection mechanisms, and compliance with GDPR regulations, that is making them highly attractive to enterprises. A study by PwC revealed that 85% of European businesses consider cybersecurity a top priority when selecting cloud services, underscoring the pivotal role of security in driving market growth.

MARKET RESTRAINTS

High Initial Implementation Costs

One of the primary restraints hindering the Europe cloud managed networking market is the high initial implementation costs associated with transitioning to cloud-based systems. According to the European Investment Bank, small and medium-sized enterprises (SMEs) in Europe face significant financial barriers, with nearly 40% citing budget constraints as a major obstacle to adopting advanced cloud solutions. The upfront expenses related to hardware upgrades, software licensing, and staff training can be prohibitive, particularly for smaller organizations with limited IT budgets. This financial burden often delays or deters the adoption of cloud managed networking, despite its long-term cost-saving potential.

Lack of Skilled Professionals

Lack of skilled professionals capable of managing complex cloud infrastructures is another major restraint to the European cloud managed networking market. According to the European Centre for the Development of Vocational Training (Cedefop), there is a projected shortage of 900,000 IT specialists across Europe by 2025. This skills gap poses a significant challenge for enterprises seeking to implement and maintain cloud managed networking solutions effectively. A survey conducted by IDC revealed that 65% of European companies struggle to find qualified personnel to manage their cloud operations, leading to inefficiencies and increased reliance on external vendors.

MARKET OPPORTUNITIES

Adoption of Internet of Things (IoT) Devices

A promising opportunity for the Europe cloud managed networking market lies in the burgeoning adoption of Internet of Things (IoT) devices. According to the European Telecommunications Network Operators' Association (ETNO), the number of IoT connections in Europe is expected to reach 4.5 billion by 2025, which is due to the advancements in smart cities, healthcare, and industrial automation. Cloud managed networking plays a pivotal role in supporting the massive data volumes generated by IoT devices, offering centralized control, real-time analytics, and seamless connectivity. For instance, in Germany alone, IoT spending is projected to exceed €40 billion annually by 2024, creating a fertile ground for cloud managed networking providers to expand their offerings.

Focus on Sustainability and Green IT Initiatives

The rising focus on sustainability and green IT initiatives is another notable opportunity to the Europe cloud managed networking market. According to the European Environment Agency, the ICT sector accounts for approximately 2.5% of global carbon emissions, which is prompting enterprises to adopt energy-efficient solutions. Cloud managed networking offers a sustainable alternative by optimizing resource utilization and reducing energy consumption through virtualization and centralized management. As per a report by Capgemini, 70% of European organizations are prioritizing eco-friendly IT practices, with cloud-based solutions being a key enabler. These trends underscore how IoT proliferation and sustainability goals are unlocking new avenues for growth in the cloud managed networking market.

MARKET CHALLENGES

Complexity of Integrating Legacy Systems

A significant challenge facing the Europe cloud managed networking market is the complexity of integrating legacy systems with modern cloud infrastructures. According to the European Commission’s Digital Economy and Society Index (DESI), over 50% of European enterprises still rely on outdated IT systems, which are incompatible with cloud-based solutions. This integration challenge often results in prolonged deployment timelines, increased costs, and operational disruptions. For example, a study by McKinsey revealed that 45% of European companies experienced delays exceeding six months when migrating legacy applications to the cloud, which indicates the technical hurdles involved.

Data Sovereignty and Regulatory Compliance

Another pressing challenge is the growing concern over data sovereignty and regulatory compliance. According to the European Data Protection Board (EDPB), cross-border data transfers remain a contentious issue, with stringent regulations like GDPR imposing strict requirements on where and how data can be stored. A survey by Deloitte found that 60% of European enterprises expressed apprehension about storing sensitive data in public clouds due to compliance risks. This uncertainty creates a barrier to adoption, as organizations must navigate complex legal frameworks while ensuring data privacy. These challenges emphasize the need for innovative solutions to address integration complexities and regulatory concerns in the cloud managed networking landscape.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

18.24% |

|

Segments Covered |

By Type, Deployment, Industry, Enterprise Size, and Country |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Countries Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, and Rest of Europe |

|

Market Leaders Profiled |

Aruba (Hewlett Packard Enterprise Company) (California, United States), NETGEAR, Inc. (California, United States), Cisco System, Inc. (California, United States), Prodec Networks (Twyford, Berkshire), APSU, Inc. (Chattanooga, Tennessee), Fortinet, Inc. (California, United States), Mindsight (Illinois, United States), Total Communications, Inc. (Connecticut, United States), Huawei Technologies Co., Ltd. (Shenzhen, China), DynTek, Inc. (California, United States), Extreme Networks, Inc. (California, United States), and CommScope, Inc. (North Carolina, United States). |

SEGMENTAL ANALYSIS

By Type Insights

The cloud services segment dominated the market by accounting for 45.5% of the European market share in 2024 owing to its ability to provide comprehensive solutions, including Software-as-a-Service (SaaS), Platform-as-a-Service (PaaS), and Infrastructure-as-a-Service (IaaS), which cater to diverse enterprise needs. The importance of cloud services lies in their flexibility that enable businesses to scale operations without significant upfront investments. For instance, according to a study by the European Investment Bank highlights that cloud services reduce IT infrastructure costs by up to 30%, making them highly attractive to SMEs and large enterprises alike.

The software segment is projected to grow at the fastest CAGR of 18.5% over the forecast period due to the increasing adoption of network automation tools and software-defined networking (SDN) solutions, which enhance operational efficiency. According to the European Commission, over 65% of enterprises are investing in software to streamline network management processes due to the need for real-time analytics and predictive maintenance.

By Deployment Insights

The public cloud segment held 60.7% of the Europe cloud managed networking market share in 2024. The dominance of public cloud segment in the European market is attributed to cost-effectiveness, scalability, and ease of deployment, making it ideal for SMEs and startups. According to the European Investment Bank, public cloud adoption reduces IT infrastructure costs by up to 40%, fostering widespread acceptance.

The SMEs segment is growing at a remarkable pace and is estimated to progress at a CAGR of 20.3% over the forecast period owing to the increasing number of government initiatives promoting digital transformation among SMEs, such as the EU’s Digital Innovation Hubs program. According to the European Commission, over 70% of SMEs are leveraging cloud managed networking to enhance competitiveness, underscoring the segment's significance.

By Industry Insights

The telecom & IT segment held the leading share of the European cloud managed networking market in 2024 and is expected to grow at a notable CAGR over the forecast period owing to the industry's reliance on robust networking solutions to support 5G rollouts and IoT ecosystems. The educational institutions segment is expected to grow at a promising CAGR of 22.7% over the forecast period due to the shift to e-learning and hybrid education models. According to the reports of the European Commission, 80% of educational institutions are adopting cloud managed networking to ensure seamless connectivity and data security.

REGIONAL ANALYSIS

Western Europe had the leading share of the overall European market in 2024 due to its mature IT ecosystem and high adoption rates. However, the market in Eastern Europe is expected to be growing at a significant CAGR over the forecast period owing to the increasing investments in digital transformation and cloud adoption. The UK held the major share of the European market in 2024 and is anticipated to hold a promising position in the European market throughout the forecast period owing to its advanced digital infrastructure and strong regulatory framework. Germany follows with a notable share, supported by its industrial base and IoT adoption. France, Italy, and Spain contribute significantly due to government-backed digital initiatives.

Top 3 Players in the Europe Cloud Managed Networking Market

Cisco dominates the market with its comprehensive portfolio of cloud managed networking solutions, including Meraki and Catalyst platforms. According to IDC, Cisco holds a 25% market share in Europe, driven by its focus on innovation and customer-centric strategies.

HPE contributes significantly with its Aruba Networks division, offering advanced cloud-based networking solutions. Eurostat reports that HPE holds a 15% market share, bolstered by its partnerships with European enterprises.

VMware is a key player, leveraging its expertise in virtualization and cloud services. The European Cloud Alliance highlights VMware’s 12% market share, attributed to its robust SD-WAN and SASE offerings.

Major Strategies Used by Key Players

Key players are adopting strategies such as strategic partnerships, mergers, and acquisitions to strengthen their market position. For instance, Cisco has partnered with European telecom providers to expand its footprint. According to Eurostat, HPE has acquired several startups to enhance its cloud capabilities, while VMware focuses on R&D to innovate cutting-edge solutions. These strategies aim to consolidate market presence and drive growth in the competitive landscape.

KEY MARKET PLAYERS

The major players in the Europe cloud managed networking market include Aruba (Hewlett Packard Enterprise Company) (California, United States), NETGEAR, Inc. (California, United States), Cisco System, Inc. (California, United States), Prodec Networks (Twyford, Berkshire), APSU, Inc. (Chattanooga, Tennessee), Fortinet, Inc. (California, United States), Mindsight (Illinois, United States), Total Communications, Inc. (Connecticut, United States), Huawei Technologies Co., Ltd. (Shenzhen, China), DynTek, Inc. (California, United States), Extreme Networks, Inc. (California, United States), and CommScope, Inc. (North Carolina, United States).

MARKET SEGMENTATION

This research report on the Europe cloud managed networking market is segmented and sub-segmented into the following categories.

By Type

- Hardware

- Software

- Cloud Services

By Deployment

- Public Cloud

- Private Cloud

By Industry

- Telecom & IT

- Retail

- Media & Entertainment

- Educational Institutions

- Others (Government, etc.)

By Enterprise Size

- Small and Medium Enterprises (SMEs)

- Large Enterprises

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What is driving the growth of the Europe cloud-managed networking market?

The market is growing due to increasing adoption of cloud-based solutions, rising demand for remote work capabilities, and the need for simplified network management.

Which industries are adopting cloud-managed networking in Europe?

Key industries include IT & telecom, healthcare, retail, BFSI, education, and manufacturing, where businesses seek scalable and secure networking solutions.

What role does cybersecurity play in the cloud-managed networking market?

Cybersecurity is a major concern, leading to the integration of advanced security features like AI-driven threat detection, zero-trust networking, and encryption.

What is the future outlook for cloud-managed networking in Europe?

The market is expected to expand with increasing adoption of AI-driven networking, 5G integration, and growing demand for hybrid work solutions.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]