Europe Clinical Laboratory Tests Market Size, Share, Trends & Growth Forecast Report By Test Type, Service Provider, End-User and Country (Germany, UK, France, Italy, Rest of Europe) – Industry Analysis From 2025 to 2033.

Europe Clinical Laboratory Tests Market Size

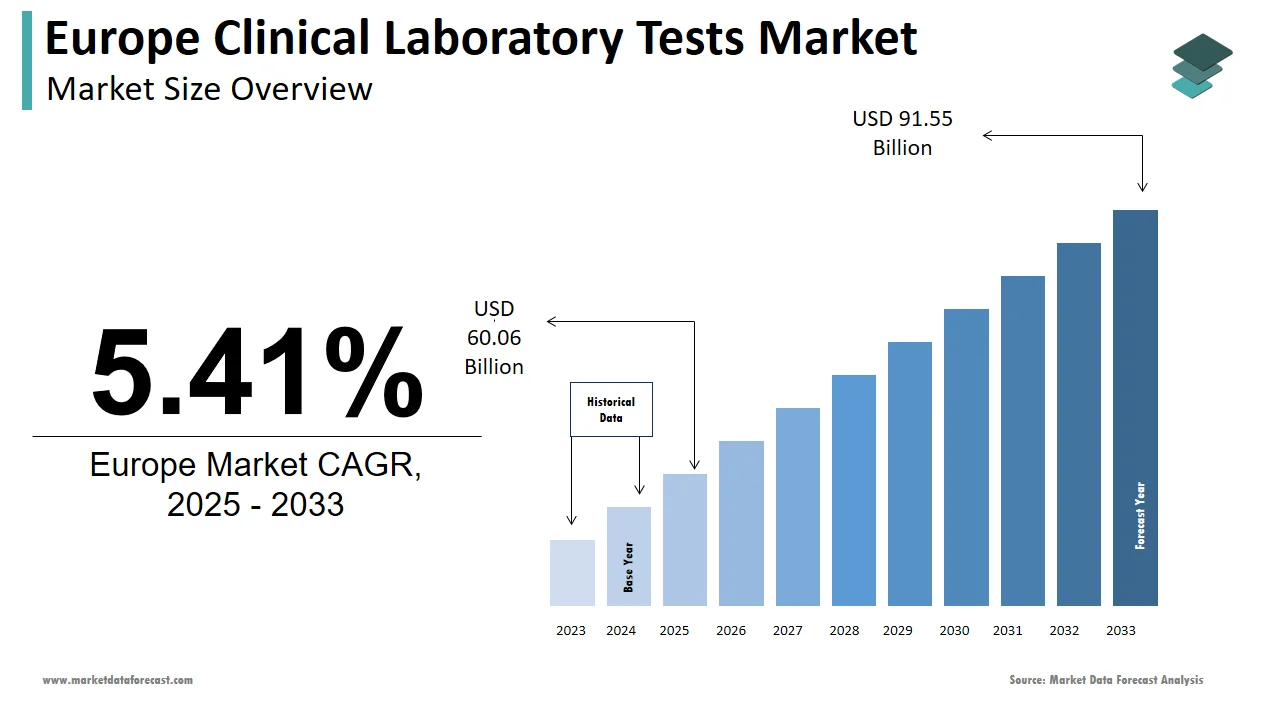

The clinical laboratory tests market size in Europe was valued at USD 57 billion in 2024. The European market is estimated to be worth USD 91.55 billion by 2033 from USD 60.06 billion in 2025, growing at a CAGR of 5.41% from 2025 to 2033.

MARKET DRIVERS

Rising Prevalence of Chronic Diseases

The market has grown due to the rising frequency of chronic diseases and increased awareness among health-conscious people. In addition, growing investments in detecting specific diseases such as cardiovascular problems, TB, and diabetes drive demand for clinical laboratory testing. Furthermore, the rising rate of insufficient exercise, unhealthy food consumption, and the resulting rise in obesity cases are projected to accelerate the prevalence of numerous chronic diseases. Therefore, the demand for clinical laboratory tests is predicted to rise as healthcare professionals and people in the region become more aware of the importance of frequent body profiling.

Government Efforts to Prevent New Diseases

In addition, government efforts to avoid new diseases are projected to drive market growth throughout the forecast period. In addition, vitamin and mineral deficiencies and other minor disorders are detected with these tests. Another type of clinical laboratory test is DNA testing and the growth is likely to be fueled by increased test accuracy, the introduction of technologically advanced technologies such as biochips, and the high efficiency of these tests. In addition, molecular diagnostic technologies are becoming more popular because they can quickly detect viruses in patient samples. They are also relatively inexpensive, driving demand for the European market for clinical laboratory tests.

Rising Demand for Medical Lab Tests

As more clinicians understand the relevance of lab trials in verifying diagnoses and monitoring their patients' responses to treatment, the demand for medical lab tests is increasing. Clinical lab studies are also used to detect and monitor diseases that are public health problems. A key pillar of high-quality patient care has always been the necessity for high-quality diagnostic testing. This effort is the driving force behind the market for clinical laboratory tests. As the incidence of chronic diseases and the morbidity of non-communicable diseases has increased, so has the demand.

MARKET CHALLENGES

FDA Regulation Slowing New Treatment Introduction

The FDA's regulation over laboratory-based tests slows the introduction of new treatments. At the same time, a shortage of competent experts in clinics hampers the expansion of the clinical laboratory tests market in the European region. Furthermore, over the forecast period, rising costs of specialty laboratory tests and unfavorable reimbursement regulations are likely to interfere with revenue growth in the clinical laboratory tests market.

COUNTRY LEVEL ANALYSIS

The Europe market accounted for the largest share of the global market in 2024. Germany and the United Kingdom have a combined market share of roughly 28% in Europe's clinical laboratory test market. Germany is known around the world for its automobile technology. However, Germany is now experiencing massive competition from outside.

In Europe, Germany is the largest market for laboratory technology. Labco and synlab have teamed up to form one of Europe's major clinical laboratory services companies. Due to increased demand for early and accurate disease diagnosis, Germany is leading the European market expansion. Furthermore, boosting the quality of laboratory services allows speedy and accurate disease detection, increasing medical laboratories' popularity. Moreover, Europe is one of the most developed regions globally, with significant investments in healthcare. The market's growth is fueled by increased government and private investments in advanced laboratory testing procedures, and technological advancements in clinical diagnostic techniques and equipment.

KEY MARKET PARTICIPANTS

Quest Diagnostics, Inc., Laboratory Corporation of America, LLC, Eurofins Scientific, Fresenius Medical Care, NeoGenomics Laboratories Inc., Siemens Healthineers, OPKO Health, Inc., Abbott Laboratories, Inc., Charles River Laboratories International, Inc., Sonic Healthcare Ltd., and Genoptix, Inc. are some of the noteworthy companies operating in the European clinical laboratory tests market profiled in this report.

MARKET SEGMENTATION

This Europe clinical laboratory tests market research report is segmented and sub-segmented into the following categories.

By Analytics Type

- Descriptive Analytics

- Predictive Analytics

- Prescriptive Analytics

By Component

- Software

- Services

By Delivery Mode

- On-demand

- On-premises

By Application

- Clinical and Preclinical Trials

- Research and Development

- Regulatory Compliance

- Sales and Marketing

- Supply Chain Management

- Pharmacovigilance

By End-User

- Pharmaceutical and Biotechnology Companies

- Medical Device Companies

- Biomedical Research Centers

- Third-party Administrators (TPA)

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]