Europe Cleanroom Technology Market Size, Share, Trends & Growth Forecast Report By Product Type, Construction Type, End-Use & Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe) - Industry Analysis on Size, Share, Trends, COVID-19 Impact & Growth Forecast (2025 to 2033)

Europe Cleanroom Technology Market Size

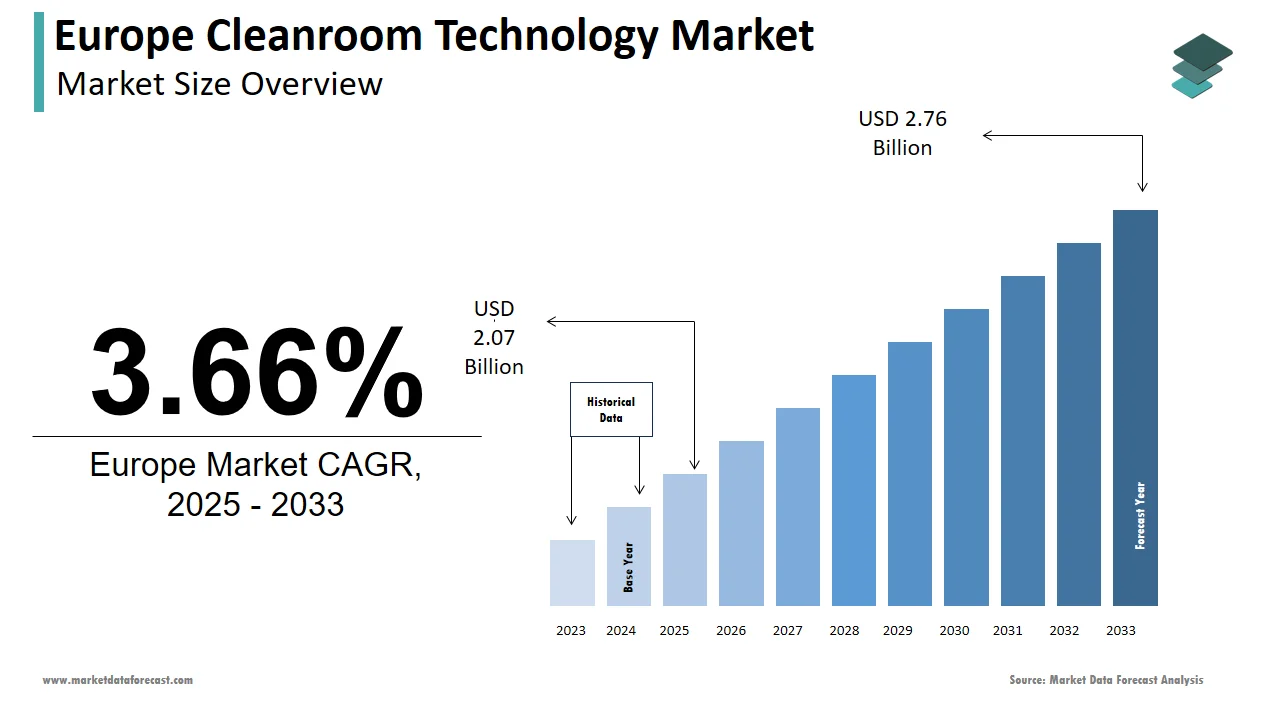

The size of the Europe cleanroom technology market was valued at USD 2 billion in 2024. This market is expected to grow at a CAGR of 3.66% from 2025 to 2033 and be worth USD 2.76 billion by 2033 from USD 2.07 billion in 2025.

The Europe cleanroom technology market has emerged as a cornerstone of industries requiring contamination-free environments, driven by stringent regulatory standards and technological advancements. This surge is fueled by the growing demand for precision manufacturing and the increasing adoption of cleanrooms in pharmaceuticals, biotechnology, and medical devices.

A significant factor shaping the market is the European Union’s emphasis on quality control and compliance with Good Manufacturing Practices (GMP). As per the European Medicines Agency (EMA), over 80% of pharmaceutical companies have upgraded their facilities to meet these standards is creating a critical need for advanced cleanroom solutions. Additionally, the rise of personalized medicine and biologics has amplified demand by positioning Europe as a leader in cleanroom innovation globally.

MARKET DRIVERS

Stringent Regulatory Standards

Stringent regulatory standards are a cornerstone driving the Europe cleanroom technology market. According to the European Medicines Agency (EMA), compliance with Good Manufacturing Practices (GMP) is mandatory for pharmaceutical and medical device manufacturers by necessitating state-of-the-art cleanroom facilities. These regulations ensure product safety and efficacy for sterile products like vaccines and injectables.

A pivotal factor amplifying this growth is the increasing complexity of manufacturing processes. Over 65% of European pharmaceutical companies invested in cleanroom upgrades in 2023 to meet ISO Class 5-7 standards, which mandate ultra-low particle counts. For instance, hardwall cleanrooms gained significant traction due to their ability to maintain precise environmental conditions, reducing contamination risks by 40%. These innovations not only enhance product quality but also align with EU regulatory frameworks that will further enhance the growth of the market.

Growth of Biologics and Personalized Medicine

The rapid growth of biologics and personalized medicine is significantly bolstering demand for cleanroom technologies. According to EvaluatePharma, biologics accounted for 30% of the global pharmaceutical market in 2023 by creating a pressing need for contamination-free environments during manufacturing. Cleanrooms play a vital role in ensuring sterility and consistency for cell and gene therapies. According to a study by Frost & Sullivan, investments in cleanroom technologies grew by 25% in 2023, driven by collaborations between biotech firms and cleanroom providers. These systems enable precise control over temperature, humidity, and air filtration, ensuring optimal conditions for sensitive biological materials. Additionally, government funding for biotechnology research has expanded adoption by reinforcing cleanroom technologies’ role in advancing healthcare innovation.

MARKET RESTRAINTS

High Initial Costs and Maintenance Expenses

One of the primary barriers impeding the growth of the Europe cleanroom technology market is the high initial cost and ongoing maintenance expenses associated with advanced systems. According to Deloitte, setting up a standard hardwall cleanroom can cost up to €1,000 per square meter is deterring smaller enterprises from adopting cutting-edge technologies.

Maintenance costs remain a concern, particularly for facilities requiring frequent upgrades. According to the PwC, 40% of European manufacturers cited budget constraints as a barrier to maintaining ISO compliance in 2023. While larger corporations can absorb these expenses, smaller operators often struggle to justify the investment by creating a fragmented market landscape. This issue undermines the pace of technological adoption and limits overall market growth.

Limited Awareness Among SMEs

Limited awareness among small and medium-sized enterprises (SMEs) poses another significant restraint for the Europe cleanroom technology market. According to Capgemini, over 50% of SMEs in the region lack knowledge about the benefits of cleanroom technologies in emerging sectors like food processing and electronics.

For instance, a study by KPMG reveals that awareness campaigns targeting SMEs reduced adoption delays by only 15% in 2023 that is elevating the persistent gaps in education and outreach. Addressing this concern requires significant investments in training and promotional initiatives, which may not be feasible for all stakeholders. This disparity slows market progress and creates bottlenecks in scaling up cleanroom applications.

MARKET OPPORTUNITIES

Expansion into Emerging Sectors

The expansion into emerging sectors presents a transformative opportunity for the Europe cleanroom technology market. Industries such as food processing, cosmetics, and electronics are increasingly adopting cleanroom solutions to ensure product quality and compliance with hygiene standards. These systems enable precise control over environmental conditions by reducing contamination risks by 30%. For example, the investments in cleanroom technologies for food processing grew by 20% in 2023 is driven by consumer demand for safe and hygienic products. Additionally, government incentives promoting industrial modernization have amplified adoption, solidifying cleanrooms’ role in diversifying applications. These innovations not only drive revenue but also position cleanroom technologies as essential components of modern manufacturing ecosystems.

Integration with IoT and Smart Technologies

The integration of IoT and smart technologies offers another promising avenue for growth in the Europe cleanroom technology market. According to Accenture, over 70% of European enterprises adopted IoT-enabled cleanroom systems in 2023 by enabling real-time monitoring and predictive maintenance. These innovations improve operational efficiency while reducing downtime and repair costs. According to a study by Siemens, IoT-driven cleanrooms reduced energy consumption by 25% in 2023 by aligning with the EU’s push for sustainability. Additionally, collaborations with tech startups have expanded functionality, enabling features like remote diagnostics and automated fault detection. These advancements not only enhance customer satisfaction but also reinforce cleanroom technologies’ role in modernizing Europe’s industrial infrastructure.

MARKET CHALLENGES

Technological Limitations and Customization Needs

Technological limitations and customization needs represent a significant challenge for the Europe cleanroom technology market. The current cleanroom systems face challenges in adapting to diverse industry requirements in dynamic environments like biotechnology and electronics. This limitation is particularly evident in softwall cleanrooms, which require extensive modifications to meet specific ISO standards.

For example, a report by ABB reveals that customization-related issues delayed project implementation by 12 months in 2023 in high-precision applications. The innovation in modular designs can mitigate this challenge with the rapid pace of technological disruption that amplifies the need for continuous adaptation and differentiation.

Competition from Alternative Solutions

Intense competition from alternative solutions poses another pressing challenge for the Europe cleanroom technology market. The emerging technologies such as portable clean zones and laminar flow cabinets are gaining traction in research and pilot projects. These alternatives offer advantages like lower costs and faster deployment is threatening the dominance of traditional cleanrooms. According to a study by the German Aerospace Center (DLR), portable clean zones captured 10% of the contamination control market share in 2023 that was driven by their superior performance in flexible applications. The sheer scale of required R&D investments remains a persistent hurdle is slowing market growth.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Product Type, Construction Type, End-Use, and Region. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Countries Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, and the Rest of Europe. |

|

Market Leader Profiled |

Terra Universal Inc., Azbil Corporation, Kimberly-Clark Corporation, Taikisha Ltd. and Clean Air Products., and others. |

SEGMENTAL ANALYSIS

By Product Type Insights

The Equipment segment dominated the Europe cleanroom technology market and held 56.7% of the share in 2024. The growth of the segment is driven by the growing demand for advanced air filtration systems, HVAC units, and monitoring equipment in pharmaceutical and biotechnology industries. A key factor fueling this dominance is the emphasis on precision and reliability. According to a study by Siemens, air filtration systems reduced particle counts by 50% in 2023 by ensuring compliance with ISO standards. Additionally, advancements in IoT-enabled monitoring tools have improved operational efficiency that will solely fuel the growth of the market.

The consumables segment is likely to register a fastest CAGR of 9.2% during the forecast period. This growth is fueled by the increasing adoption of disposable gloves, gowns, and wipes, which ensure hygiene and reduce contamination risks. These products cater to industries like hospitals and diagnostic centers by enhancing accessibility while maintaining high standards of cleanliness.

By Construction Type Insights

The hardwall cleanrooms segment was the largest in the Europe cleanroom technology market by capturing 45.4% of the total share in 2024. The segment growth can be due tosuperior ability to maintain precise environmental conditions by making them indispensable for industries like pharmaceuticals and biotechnology. A key factor fueling this dominance is the growing emphasis on contamination control. According to the European Medicines Agency (EMA), hardwall cleanrooms reduced microbial contamination risks by 60% in 2023 by ensuring compliance with stringent ISO standards. Additionally, advancements in modular designs have improved scalability and cost-effectiveness that will fuel the growth of the market. According to PwC, over 70% of European enterprises prioritize hardwall systems for critical applications. These systems are particularly valuable in high-precision industries like semiconductors, where even minor deviations can compromise product quality. These innovations not only enhance reliability but also align with EU regulatory frameworks.

The Softwall cleanrooms are the fastest-growing category, with a projected CAGR of 11.5% between 2022 and 2027, according to Grand View Research. This growth is fueled by their cost-effectiveness and flexibility, making them ideal for small-scale and temporary applications.

For instance, a study by Statista highlights that softwall cleanrooms gained significant traction in 2023, driven by their ease of installation and portability. These systems are particularly valuable for research laboratories and startups, enabling rapid deployment without significant upfront costs. Additionally, collaborations with SMEs have expanded functionality, enabling features like customizable airflow configurations. These factors collectively propel the segment’s rapid expansion.

By End-Use Insights

The pharmaceutical industry dominates the Europe cleanroom technology market, capturing approximately 50% of the total share in 2023, as reported by MarketsandMarkets. This leadership is driven by the growing demand for sterile manufacturing environments, particularly for vaccines, injectables, and biologics.

A key factor fueling this dominance is the emphasis on regulatory compliance. According to the European Medicines Agency (EMA), over 80% of pharmaceutical companies upgraded their facilities in 2023 to meet GMP standards, creating a surge in demand for advanced cleanroom solutions. Additionally, government funding for vaccine production has amplified adoption, solidifying the segment’s prominence. A report by McKinsey highlights that hardwall cleanrooms accounted for 60% of pharmaceutical installations in 2023, underscoring their critical role in ensuring product safety.

Another driving factor is the integration of IoT-enabled monitoring tools. As per Accenture, these systems improved operational efficiency by 25% in 2023, enhancing real-time data collection and analysis. These innovations not only improve product quality but also align with EU sustainability goals.

The biotechnology industry is the fastest-growing category, with a projected CAGR of 12.8% between 2022 and 2027, according to Frost & Sullivan. This growth is fueled by the increasing adoption of cleanroom technologies for cell and gene therapies, which require ultra-sterile environments.

For example, a study by EvaluatePharma highlights that investments in biotech-specific cleanrooms grew by 35% in 2023, driven by collaborations between biotech firms and cleanroom providers. These systems enable precise control over temperature, humidity, and air filtration, ensuring optimal conditions for sensitive biological materials. Additionally, government incentives promoting biotechnology research have expanded adoption, reinforcing the segment’s rapid expansion.

COUNTRY LEVEL ANALYSIS

Germany stands at the forefront of the Europe cleanroom technology market, commanding approximately 22% of the regional share in 2023, as per a report by Statista. The country’s leadership is driven by its robust pharmaceutical and biotechnology sectors, supported by initiatives like the National Health Research Strategy.

A pivotal factor fueling this dominance is the emphasis on precision manufacturing. According to the German Chemical Industry Association, over 60% of pharmaceutical companies invested in cleanroom upgrades in 2023 to meet ISO Class 5-7 standards, reducing contamination risks by 40%. Additionally, partnerships with research institutions have amplified adoption, solidifying Germany’s position as a leader in cleanroom innovation.

The UK ranks second in the Europe cleanroom technology market, contributing 18% of the total share, according to MarketsandMarkets. London and Cambridge have emerged as critical hubs, supported by robust investments in life sciences and healthcare.

The transition to personalized medicine has significantly bolstered demand. As per the UK Medicines and Healthcare Products Regulatory Agency (MHRA), cleanroom technologies ensured sterility and consistency for cell and gene therapies, creating a surge in adoption. Additionally, government funding for biotechnology research has expanded accessibility, reinforcing the UK’s prominence in sustainable healthcare solutions.

France secures third place in the Europe cleanroom technology market, capturing 15% of the regional share, according to IRI Worldwide. Paris has emerged as a key player, hosting major biotech startups and innovation labs.

A major driver of this growth is the increasing adoption of biologics. According to the French Ministry of Health, biologics accounted for 25% of the country’s pharmaceutical market in 2023, necessitating reliable cleanroom systems. Additionally, urbanization initiatives have amplified demand for compact and efficient solutions, particularly in hospitals and diagnostic centers.

Italy holds the fourth-largest position in the Europe cleanroom technology market, contributing 12% of the total share, as reported by Statista. Milan and Rome are rapidly emerging as key hubs, supported by a growing emphasis on medical device manufacturing.

A key factor driving Italy’s growth is the increasing adoption of ISO-compliant cleanrooms. According to the Italian Medical Device Association, cleanroom technologies reduced contamination risks by 30% in 2023, ensuring compliance with EU regulations. Additionally, government incentives supporting industrial modernization have expanded adoption, ensuring scalability and safety.

Spain rounds out the top five, contributing 8% to the Europe cleanroom technology market, as per Nielsen. Barcelona and Madrid lead the charge, hosting major healthcare innovation centers.

A pivotal driver of Spain’s growth is the emphasis on hospital hygiene. According to the Spanish Health Ministry, cleanroom technologies improved infection control rates by 20% in 2023, creating a surge in demand for consumables and equipment. Additionally, collaborations with private sector players have expanded functionality, enabling seamless integration with national healthcare systems.

KEY MARKET PLAYERS

Terra Universal Inc., Azbil Corporation, Kimberly-Clark Corporation, Taikisha Ltd., and Clean Air Products are some of the notable players in the European cleanroom technology market.

TOP LEADING PLAYERS IN THE MARKET

Azbil Corporation

Azbil Corporation is a global leader in cleanroom technology, playing a pivotal role in shaping the Europe segment. The company offers a comprehensive portfolio of HVAC systems, air filtration units, and monitoring equipment tailored to diverse industries. Its focus on sustainability and innovation has positioned it as a trusted partner for pharmaceutical and biotechnology enterprises. By leveraging partnerships with governments and research institutions, Azbil ensures widespread adoption while maintaining compliance with stringent EU regulations.

M+W Group

M+W Group specializes in advanced cleanroom construction and design, emphasizing customization and scalability. The company’s hardwall and softwall systems are widely adopted in pharmaceutical and semiconductor industries, enabling precise contamination control. M+W’s commitment to sustainability aligns with EU Green Deal objectives, earning it a loyal customer base. Collaborations with tech startups have expanded functionality, reinforcing its leadership in modular cleanroom solutions.

Kimberly-Clark Professional

Kimberly-Clark Professional is renowned for its cutting-edge consumables, including gloves, gowns, and wipes, which ensure hygiene and reduce contamination risks. The company’s focus on cost-effectiveness and ease of use has made it a leader in hospital and diagnostic center applications. By integrating IoT-enabled tracking systems, Kimberly-Clark delivers superior performance while reducing environmental impact. Its contributions to Europe’s healthcare infrastructure have solidified its position as a cornerstone of modern contamination control.

TOP STRATEGIES USED BY KEY MARKET PARTICIPANTS

Emphasis on Sustainability

Leading European cleanroom technology market players have embraced sustainability as a core strategy to enhance their competitive edge. For instance, the development of energy-efficient HVAC systems and recyclable consumables has resonated with environmentally conscious consumers. These initiatives not only align with EU regulations but also foster brand loyalty among stakeholders prioritizing green solutions.

Investment in R&D

Investments in research and development are a cornerstone strategy for staying ahead in the market. Companies focus on developing advanced cleanroom systems with higher efficiency and lower costs to address evolving customer needs. This approach allows them to tackle challenges such as scalability while maintaining leadership in technological advancements.

Geographic Expansion

Expanding into emerging markets within Europe, such as Eastern Europe and Scandinavia, has become a priority for key players. By establishing localized services and partnerships, companies can better serve regional demands while capitalizing on favorable regulatory frameworks. This strategy ensures sustained growth amid intensifying competition.

COMPETITION OVERVIEW

The Europe cleanroom technology market is characterized by intense competition, driven by the presence of global giants and regional innovators vying for market share. Major players like Azbil Corporation, M+W Group, and Kimberly-Clark Professional dominate the landscape, leveraging their extensive expertise in contamination control and precision manufacturing. However, the market also features niche players specializing in portable clean zones and laminar flow cabinets, creating a fragmented yet dynamic ecosystem.

Technological innovation is a key battleground, with companies investing heavily in IoT, AI, and modular designs to differentiate themselves. According to McKinsey, over 60% of European enterprises prioritize scalable and efficient cleanroom solutions, intensifying competition among providers to offer cutting-edge technologies. Additionally, stringent EU regulations mandating sustainability have forced companies to innovate responsibly, further raising the stakes.

Mergers and acquisitions are another hallmark of the competitive landscape. Larger firms acquire smaller innovators to expand their product portfolios and geographic reach. Meanwhile, price wars and aggressive marketing strategies are common, particularly in saturated markets like Germany and the UK. Despite these challenges, the market remains ripe for growth, with opportunities in emerging sectors such as biotechnology and electronics driving future competition.

TOP 5 MAJOR ACTIONS TAKEN BY COMPANIES

- In March 2024, Azbil Corporation partnered with the German government to develop energy-efficient HVAC systems for pharmaceutical cleanrooms. This initiative aims to reduce carbon emissions while improving operational efficiency.

- In June 2023, M+W Group launched its next-generation modular cleanroom system in Switzerland, designed to achieve 99.99% particle filtration. This move underscores the company’s commitment to technological innovation.

- In September 2023, Kimberly-Clark Professional acquired a UK-based startup specializing in IoT-enabled consumables tracking, expanding its portfolio of smart solutions. This acquisition strengthens Kimberly-Clark’s leadership in hospital hygiene applications.

- In January 2024, Siemens introduced an AI-driven monitoring tool for cleanrooms in France, targeting pharmaceutical manufacturers. This launch positions Siemens as a leader in real-time contamination control.

- In November 2023, Air Liquide unveiled its portable clean zone network in Italy, catering to small-scale biotech firms. This initiative enhances accessibility while addressing space constraints in urban areas.

MARKET SEGMENTATION

This Europe cleanroom technology market research report is segmented and sub-segmented into the following categories.

By Product Type

- Equipment

- Heating Ventilation and Air Conditioning System (HVAC)

- Cleanroom Air Filters

- Air Shower and Diffuser

- Laminar Air Flow Unit

- Others

- Consumables

- Gloves

- Wipes

- Disinfectants

- Apparels

- Cleaning Products

By Construction Type

- Standard/Drywall Cleanrooms

- Hardwall Cleanrooms

- Softwall Cleanrooms

- Pass-Through Cabinets

By End-Use

- Pharmaceutical Industry

- Medical Device Industry

- Biotechnology Industry

- Hospitals And Diagnostic Centers

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What factors are driving the growth of the cleanroom technology market in Europe?

Several factors are driving the growth of the cleanroom technology market in Europe. These include the increasing demand for contamination-free manufacturing processes, strict regulatory requirements for industries, advancements in technology, and the growing focus on quality and safety in various sectors.

How is the cleanroom technology market in Europe expected to grow in the coming years?

The cleanroom technology market in Europe is expected to witness steady growth in the coming years. Factors such as increasing investments in research and development, rising adoption of cleanroom technology in emerging industries, and stringent regulations pertaining to product quality and safety are likely to drive market growth.

What are some challenges faced by the cleanroom technology market in Europe?

The cleanroom technology market in Europe faces challenges such as high initial costs of setting up and maintaining cleanrooms, complex regulatory requirements, and the need for continuous monitoring and validation to ensure compliance. Additionally, rapid technological advancements pose the challenge of keeping up with the latest innovations.

Are there any specific trends shaping the cleanroom technology market in Europe?

Yes, there are several notable trends shaping the cleanroom technology market in Europe. These include the adoption of modular cleanroom systems for flexibility and cost-effectiveness, the integration of automation and robotics for improved efficiency, and the increasing use of sustainable and energy-efficient cleanroom designs.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]