Europe Citric Acid Market Research Report – Segmented By Form (Liquid, Powder), Application & Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest Of Europe) - Industry Analysis On Size, Share, Trends, COVID-19 Impact & Growth Forecast (2025 To 2033)

Europe Citric Acid Market Size

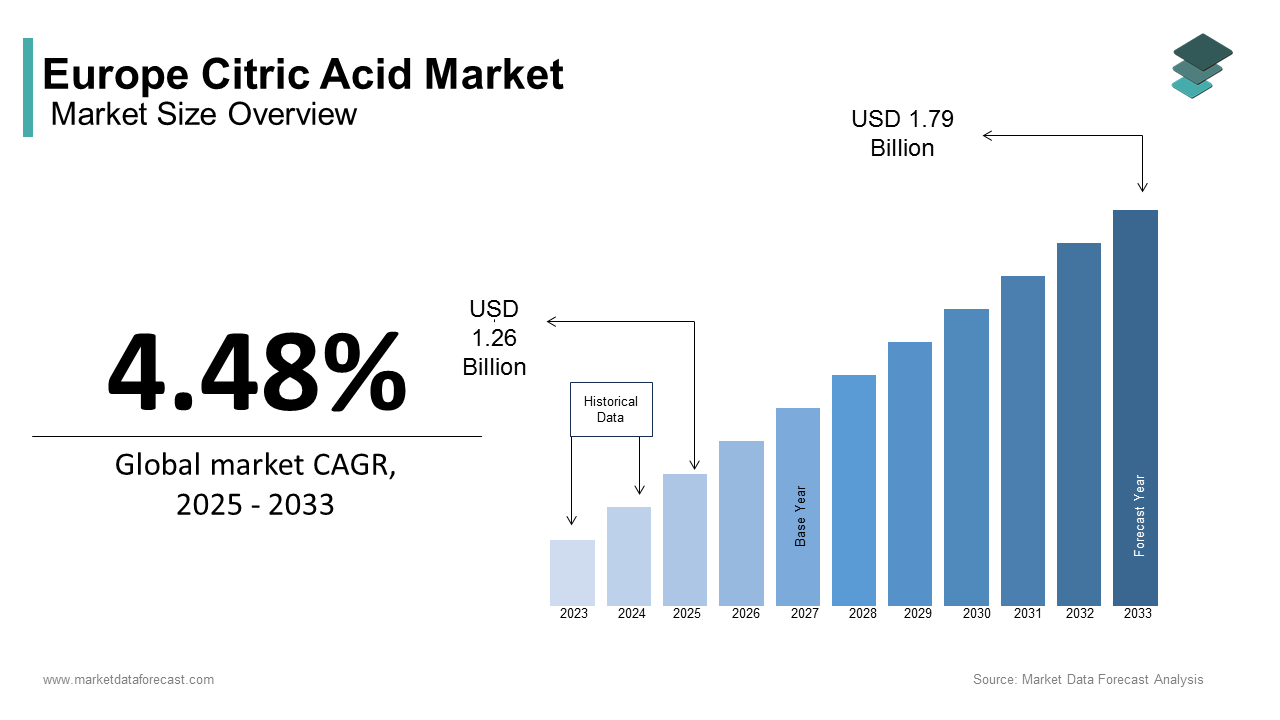

The size of the Europe Citric Acid Market was calculated to be USD 1.21 billion in 2024 and is anticipated to be worth USD 1.79 billion by 2033 from USD 1.26 billion In 2025, growing at a CAGR of 4.48% during the forecast period.

Citric acid is primarily derived from microbial fermentation of carbohydrates and is extensively utilized in food and beverages, pharmaceuticals, cosmetics, and industrial applications. The growing demand for natural and clean-label food products due to the stringent EU regulations on synthetic additives are propelling the demand for citric acid in Europe. The European Food Safety Authority highlights that citric acid is one of the most widely used food additives, approved under E330, due to its safety and versatility. Additionally, the rise of health-conscious consumers has propelled its use in beverages, confectionery, and dietary supplements. Eurostat reports that the food and beverage sector accounted for over 50% of citric acid consumption in 2022, followed by pharmaceuticals and household detergents. Despite challenges such as fluctuating raw material costs and supply chain disruptions, the market remains resilient, supported by innovations in biotechnology and sustainable production practices. With increasing emphasis on eco-friendly solutions, Europe continues to lead in the adoption of bio-based citric acid, ensuring steady growth and alignment with sustainability goals.

MARKET DRIVERS

Growing Demand for Natural and Clean-Label Products

The increasing consumer preference for natural and clean-label products is a major driver of the European citric acid market. The European Food Safety Authority highlights that citric acid, approved under E330, is one of the most widely used natural additives due to its safety and versatility. Eurostat reports that the food and beverage sector, which accounts for over 50% of citric acid consumption, is witnessing a surge in demand for organic and preservative-free products, growing at 6% annually (2021-2022). This trend is particularly strong in Germany, France, and Italy, where health-conscious consumers are driving innovation in beverages, confectionery, and dietary supplements. Additionally, the European Commission emphasizes that stringent regulations on synthetic additives have accelerated the adoption of bio-based citric acid. Its role as a pH regulator and flavor enhancer ensures sustained growth, aligning with consumer demands for transparency and sustainability.

Expansion in Pharmaceutical and Cosmetic Applications

The expansion of pharmaceutical and cosmetic applications is another key driver for the European citric acid market. The European Medicines Agency notes that citric acid is extensively used in pharmaceutical formulations as a stabilizer and antioxidant, with the pharma sector accounting for 20% of total consumption. According to CEFIC, the European pharmaceutical market grew by 4.5% in 2022, driven by aging populations and increased healthcare spending. Similarly, the cosmetics industry, valued at over €80 billion in Europe, utilizes citric acid in skincare and personal care products for its exfoliating and pH-balancing properties. The French Ministry of Health highlights that demand for bio-based ingredients in cosmetics surged by 8% annually, aligning with EU sustainability goals. Citric acid’s versatility and eco-friendly production methods ensure its critical role in these high-growth sectors, bolstering market expansion.

MARKET RESTRAINTS

Fluctuating Raw Material Costs and Supply Chain Disruptions

Fluctuating raw material costs and supply chain disruptions pose significant challenges to the European citric acid market. The European Chemical Industry Council (CEFIC) highlights that the production of citric acid relies heavily on carbohydrate feedstocks like molasses and corn starch, whose prices surged by 15-20% in 2022 due to geopolitical tensions and climate-related crop shortages. Additionally, Eurostat reports that energy costs, which account for approximately 30% of production expenses, increased by 40% in 2022, further straining manufacturers. These cost pressures have impacted profit margins, particularly for small and medium-sized enterprises (SMEs). The German Federal Ministry for Economic Affairs notes that supply chain bottlenecks delayed raw material deliveries, disrupting production schedules. Such uncertainties hinder the industry’s ability to meet rising demand, particularly in food and pharmaceutical sectors, creating operational and financial challenges.

Stringent Environmental Regulations and Compliance Costs

Stringent environmental regulations and associated compliance costs are another major restraint for the European citric acid market. The European Environment Agency emphasizes that citric acid production is energy-intensive and generates significant wastewater, requiring advanced treatment systems to meet EU environmental standards. Under the Industrial Emissions Directive, investments in sustainable technologies, such as bio-based fermentation processes, are estimated at €1-2 billion across the sector, pressuring smaller players. According to CEFIC, compliance with waste management and emission reduction mandates has slowed production growth by 2-3% annually. While these regulations aim to promote sustainability, they also increase operational costs, limiting innovation and expansion opportunities for many producers. Balancing regulatory compliance with profitability remains a persistent challenge for the industry.

MARKET OPPORTUNITIES

Growing Adoption in Eco-Friendly Cleaning Products

A significant opportunity for the European citric acid market lies in its growing adoption in eco-friendly cleaning products, driven by consumer demand for sustainable household solutions. The European Environment Agency highlights that bio-based cleaning agents, including citric acid, are replacing synthetic chemicals due to their biodegradability and non-toxic properties. Eurostat reports that the European household cleaning products market grew by 5% annually (2021-2022), with natural ingredients accounting for over 30% of new product launches. France and Germany lead this trend, with the French Ministry of Ecology noting a 12% rise in sales of green cleaning products in 2022. Citric acid’s role as a descaler and disinfectant makes it indispensable in this segment. Additionally, EU regulations promoting circular economy principles further boost demand, ensuring steady growth and innovation in sustainable cleaning solutions.

Expansion in Biotechnology and Bio-Based Production

Advancements in biotechnology and bio-based production present another major opportunity for the European citric acid market. The European Chemical Industry Council (CEFIC) emphasizes that innovations in microbial fermentation processes have reduced production costs by 10-15%, enhancing competitiveness. According to the German Federal Ministry for Economic Affairs, investments in bio-based technologies exceeded €500 million in 2022, aligning with EU Green Deal objectives. Italy, a key producer, has adopted these methods to achieve a 20% reduction in carbon emissions, as reported by the Italian National Institute of Statistics. Furthermore, the European Commission highlights that bio-based citric acid production supports sustainability goals, reducing reliance on fossil fuels. These advancements position Europe as a leader in eco-friendly manufacturing, ensuring long-term growth and alignment with global environmental trends.

MARKET CHALLENGES

Rising Competition from Synthetic Alternatives

A significant challenge for the European citric acid market is the rising competition from synthetic alternatives, which are often cheaper and more readily available. The European Chemical Industry Council (CEFIC) highlights that synthetic additives, though less eco-friendly, dominate price-sensitive industries like detergents and industrial applications, capturing over 25% of the market share in these sectors. According to Eurostat, synthetic substitutes witnessed a 7% annual growth in adoption (2021-2022) due to their cost-effectiveness, particularly in Eastern Europe. Additionally, the German Federal Ministry for Economic Affairs notes that fluctuating prices of bio-based citric acid, driven by raw material shortages, have widened the price gap. This trend undermines the competitiveness of natural citric acid, forcing manufacturers to innovate while addressing affordability concerns to retain market share.

Dependence on Imports for Raw Materials

Another major challenge is Europe’s dependence on imports for key raw materials like molasses and corn starch, which are critical for citric acid production. The European Environment Agency reports that over 60% of these feedstocks are sourced externally, primarily from Asia and South America, exposing the market to supply chain vulnerabilities. Geopolitical tensions and trade restrictions have led to price volatility, with molasses prices increasing by 18% in 2022, as noted by CEFIC. Furthermore, the Italian National Institute of Statistics highlights that limited domestic availability of raw materials hampers scalability and innovation. Addressing this challenge requires strategic investments in local agricultural partnerships and alternative feedstock development to ensure long-term stability and reduce reliance on imports.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

4.48% |

|

Segments Covered |

By Form, Application, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis; Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

Germany, France and UK |

|

Market Leaders Profiled |

Pfizer, Inc., Cargill, Inc., Tate & Lyle plc, Danisco A/S, Kenko Corporation, Archer Daniels Midland, Gadot Biochemical, COFCO Biochemical (AnHui) Co., Ltd, RZBC Group Co. Ltd, And S.A. Citrique Belge N.V |

SEGMENTAL ANALYSIS

By Form Insights

The liquid segment dominated the market in Europe by holding 61.7% of the European market share in 2024. In 2022, liquid formulations accounted for $450 billion globally. The domination of liquid segment in the European market is due to their ease of absorption, precise dosing, and high patient compliance, especially among pediatric and geriatric populations. Liquids are critical for delivering medications like syrups, suspensions, and injectables, ensuring better therapeutic outcomes.

The powder segment is predicted to grow at a CAGR of 7.8% during the forecast period due to the increasing demand for protein powders, vitamins, and rehydration solutions. The Asia-Pacific region leads this growth due to rising health awareness and affordability. Powders are preferred for their longer shelf life, portability, and versatility, making them vital in sports nutrition and functional foods.

By Application Insights

The pharmaceutical segment was the largest application segment and accounted for 48.7% of the European market share in 2024. The rising demand for liquid and powder formulations in medications, vaccines, and supplements is majorly driving the growth of the pharmaceuticals segment in the European market. This dominance of the pharmaceutical segment is further attributed to the critical role of precise dosing, ease of administration, and high patient compliance in medical treatments. The pharmaceutical sector's importance lies in addressing chronic diseases, aging populations, and advancements in drug delivery systems.

The food & beverages segment is anticipated to progress at a CAGR of 8.5% during the forecast period, The growth of the F&B is expected to be fueled by rising consumer demand for fortified foods, powdered proteins, and functional beverages. The growth is driven by health-conscious trends, urbanization, and the popularity of convenience foods. For instance, protein powders alone accounted for $16 billion in 2022, with sports nutrition being a key contributor. This segment's importance lies in meeting evolving dietary needs and promoting wellness through innovative food solutions.

REGIONAL ANALYSIS

Germany led the European citric acid market by holding 32.7% of the European market share in 2024. The domination of Germany in the European market is attributed to its robust pharmaceutical, food, and beverage industries, supported by advanced manufacturing technologies and a focus on high-quality standards. Germany's strategic emphasis on sustainable production methods and innovation in product applications further solidifies its position. The country’s strong regulatory framework for food safety and clean-label products has also driven demand for citric acid in various end-use sectors.

France is expected to account for a noteworthy share of the European market during the forecast period. The prominence of France is majorly driven by the growing preference for organic and natural food additives, particularly in the bakery and confectionery sectors. France’s strict food safety regulations and increasing consumer awareness about health and wellness have fueled the demand for citric acid in low-sugar beverages and preservative-free foods. Its proactive approach to adopting clean-label ingredients has positioned it as a key player in the regional market.

The United Kingdom is estimated to showcase a notable CAGR during the forecast period. The UK’s market growth is driven by rising demand for health supplements, functional foods, and low-sugar beverages. Consumer awareness about healthy lifestyles and the popularity of convenience foods have significantly contributed to the expansion of the citric acid market. Additionally, the UK’s focus on sustainability and eco-friendly production practices aligns with global trends, reinforcing its importance in the European citric acid landscape.

KEY MARKET PLAYERS

Major key Players in the European citric Acid Market are Pfizer, Inc., Cargill, Inc., Tate & Lyle plc, Danisco A/S, Kenko Corporation, Archer Daniels Midland, Gadot Biochemical, COFCO Biochemical (AnHui) Co., Ltd, RZBC Group Co. Ltd, And S.A. Citrique Belge N.V

RECENT HAPPENINGS IN THE MARKET

- On May 4th, 2021, Tate & Lyle, declared a leading global provider of food and beverage solutions and ingredients, is happy to announce that its award-winning PROMITOR Soluble Fiber line has been expanded.

DETAILED SEGMENTATION OF THE EUROPE CITRIC ACID MARKET INCLUDED IN THIS REPORT

This research report on the Europe citric acid market has been segmented and sub-segmented based on form, application, and region.

By Form

- Liquid

- Powder

By Application

- Food & Beverages

- Personal care

- Pharmaceuticals

- Others

By Region

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. Who are the key players in the Europe citric acid market?

The key players in the Europe citric acid market include major manufacturers such as Cargill, Archer Daniels Midland (ADM), Jungbunzlauer, Tate & Lyle, and COFCO Biochemical. These companies dominate production and supply across various industries.

2. What are the main applications of citric acid in Europe?

Citric acid is widely used in food and beverages as a preservative and flavor enhancer, in pharmaceuticals for medicinal formulations, in cosmetics for pH regulation, and in cleaning products as a natural descaler.

3. How is citric acid produced?

Citric acid is primarily produced through the fermentation of carbohydrates using Aspergillus niger, a type of mold. The process involves the conversion of sugars derived from corn or molasses into citric acid through microbial action.

4. Which factors are driving the growth of the citric acid market in Europe?

The growth of the market is driven by increasing demand for natural food additives, a rising preference for organic and clean-label products, expansion in the pharmaceutical and personal care sectors, and growing awareness about eco-friendly cleaning agents.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]