Europe Cider Market Research Report – Segmented Based on Type, Distribution Channels and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe) - Industry Analysis on Size, Share, Trends, COVID-19 Impact & Growth Forecast (2025 to 2033)

Europe Cider Market Size

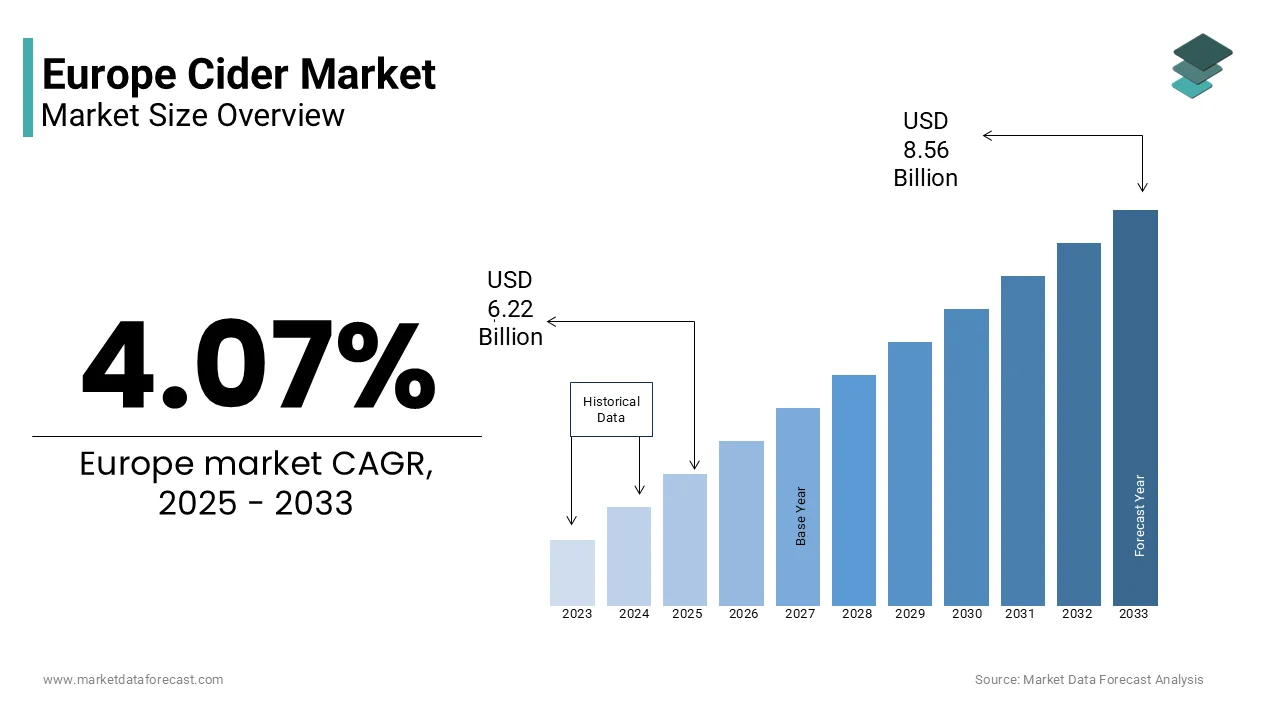

The Europe cider market size was valued at USD 5.98 billion in 2024, and the market size is expected to reach USD 8.56 billion by 2033 from USD 6.22 billion in 2025. The market is predicted to grow at a CAGR of 4.07%.

Cider is an alcoholic beverage that is mainly extracted from apple juice that has been fermented. Certain apples are grown specifically for the purpose of manufacturing cider beverages in order to give the product a distinct flavour. The addition of sugar or any other fruit to the mixture during the second fermentation stage is claimed to increase the alcoholic content. Moreover, cider is made in the same way as wine is made. The fruits are purchased from cultivars and scratted and pressed on-site. Yeasts are used in the fermentation process to convert simple carbohydrates into ethanol. As a result, cider is frequently referred to as "fermented fruit juice." Cider, on the other hand, is utilized discreetly in many popular cultures in place of beer or malt beverages. Furthermore, it contains antioxidants, and the fruits used to make ciders are typically bitter and high in tannins.

CURRENT SCENARIO

The Europe cider market is experiencing a swiftly moving forward. It is regarded as the fastest-expanding and dominant region in the global market. Nations like the United Kingdom, Spain, Germany, and France witnessed a strong cider-drinking culture, and customers are progressively favouring this beverage type over other alcoholic options.

Presently, the European cider and wine industries employ more than 5000 individuals directly however various indirect jobs also exist in the region. A large number of these are engaged in the agricultural sector, via apples and other fruit production, taking the market forward. Many economies continue to have conventional cider-apple orchards, but they have also grown intensive orchards where reaping is now mechanized.

- In the Brittany and Normandy regions of France, South and South-West in England, and in the Northern part of Spain almost 18 thousand hectares of cider apple trees are nowadays under farming exclusively for the requirements of this market.

In certain regions of Europe, a significant amount of dessert and culinary apples and pears are utilised for making cider and perry. All forms the fundamental base of this market. Besides this, fruit-growing research centers are collaborating with these producers, involving fruit winemakers, to create new varieties and enhance productivity.

MARKET DRIVERS

One of the major factors propelling the cider market forward during the forecast period is millennials' growing acceptance of healthy alcoholic beverages in their daily routines, as well as product makers' diverse product offerings. Thatcher’s had the largest increase in sales value among the top ten cider producers in the UK in 2020, with an increase of 82.4 per cent. In that year, Aston Manor had the lowest sales growth of 1.2 per cent. Because it is prepared with gluten-free apples, ACE Cider and Crispin Cider Co. say that the bulk of their cider is naturally gluten-free.

The rise of small and medium-sized ciders is driving the growth of the European cider market. These tiny enterprises are primarily concerned with producing traditional cider, whereas larger companies are more concerned with diversifying their product line. More dry cider brands have debuted on store shelves in recent years. Asahi Premium Beverages completed the purchase of Carlton and United breweries in June 2020. With the inclusion of some of Australia's most popular and beloved beer brands, this acquisition provides customers and consumers with an even wider selection of fantastic-tasting beverages. H. P. Bulme produces Strongbow, a dry cider in the United Kingdom. With an almost 15% volume share of the global cider market and a 29% volume share of the UK cider market, Strongbow is considered the world's most popular cider.

Owing to a lot of blogging and video uploading on the internet, hard and sweet ciders are gaining a lot of popularity among beer and wine fans searching for a fresh alternative. Furthermore, unlike beer, cider has a light and sweet flavour that appeals to the majority of female drinkers. Aside from that, the cider's low alcohol content and gluten-free credentials appeal to health-conscious consumers, driving rising demand.

Cider-made beverages are becoming increasingly popular due to their anti-platelet and anti-inflammatory qualities. With the presence of bioactive polyphenols, researchers have easily demonstrated that apple cider is a functional beverage. Furthermore, the bioactive polyphenols have all of the anti-platelet capabilities against the inflammatory and thrombotic lipid mediator PAF. Furthermore, PL from all cider product sources was found to be high in PUFA, particularly n-3 PUFA, but also in MUFA, indicating that their significant anti-inflammatory and anti-platelet activities are justified. Furthermore, the presence of polyphenols established a structural similarity, resulting in significant antagonistic effects on numerous cell receptors.

MARKET RESTRAINTS

The high sugar content of cider poses a major restraint to the European cider market. To begin with, because grapes contain more sugar than the majority of apples, cider has a lower glycemic index than wine. Regardless, the fermented result contains a lot of sugar. According to current research, a 470 mL can of "natural cider" has 20.5 g of sugar, which is the maximum amount of sugar an adult should consume in a single day. In addition, when cider is blended with lager or ale, the sugar content might rise by 5x or 10x. Individuals with diabetes suffer from one of the most common cardiovascular disorders. The cider business is up against a significant challenge.

MARKET OPPORTUNITIES

Emerging trends in consumer preferences provide potential opportunities for the expansion of the Europe cider market. Spain and Germany present a favourable landscape for further market growth. In contrast to the United Kingdom, the per-capital consumption of, as well as the total production of cider is significantly low.

- As per the European Cider and Fruit Wine Association, the per capita cider consumption in litres in Germany and Spain is 0,81 and 2,16, whereas the UK's is 12,03. The overall production volume in ‘000HL stands at 8.194,17 for the UK, 1.042,65 for Spain, and 692,46 for Germany. This implies that there is a major scope for the development of the cider business in these regions.

Moreover, many individuals, when questioned regarding the cider regions in this continent answer the name of the UK, Spain, or France. Even though it possesses a long-standing tradition of this drink, generally Germany is overlooked as a cider nation. The very first names that strike the minds of the European people are the Frankfurt and the Hesse part if someone considers it as a cider-producing country. However, the nation has plenty more to provide in respect to this beverage. Another region holding notable prospects is Rhineland Palatinate, known for its Trier and local wine made of apple. Hence, Germany is believed to thrive in the coming year if capitalised on its potential.

In Spain, the market is likely to experience the emergence of new categories as traditional sparkling and natural ciders are getting a revamp, like ice cider which is made of apples sourced from a particular area, and even offers 0.0 per cent alcohol cider. This makes the Spanish market an attractive location for the beverage brands and companies.

MARKET CHALLENGES

Regulatory obstacles, insufficient investment, and unfavourable perceptions of new and innovative food types are just some of the challenges hindering the progress of the Europe cider market. As per prominent industry experts, the major issue for regional food and drink companies and brands, in several cases is regulations. In contrast to other geographies and continents, the entire novel food package is restricting. Moreover, the conservative attitudes among regulatory bodies and consumers often obstructed the advancement of this market. They are also not receptive to emerging technologies and fresh ideas. This reluctance extends to both technological developments and the introduction of novel foods and alternative proteins, making it challenging for new ideas to gain a foothold in the industry.

Another problem within the regulatory factor which is impeding the market expansion is the rules governing Food Contract Materials (FCM) in the European Union and the United Kingdom are complex, making compliance a time-intensive and expensive process.

Additionally, consumer interest in healthier, more sustainable, and minimally processed foods is generally a positive trend, however, it presents difficulties for the market players as they grapples with related costs and other factors. While all these companies aim to improve their sustainability practices, achieving this alongside maintaining competitive pricing and high quality is quite difficult.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

4.07% |

|

Segments Covered |

By Type, Distribution Channel, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, Rest of Europe |

|

Market Leaders Profiled |

Aston Manor Brewery, C&C Group Plc, Carlberg A/S, Distell Group, Halewood International Holdings Plc, Heineken UK Ltd., SABMiller Plc, Carlton & United Breweries Limited,The Boston Beer Company Inc, and others. |

SEGMENTAL ANALYSIS

By Product Insights

Based on product, sparkling cider was the most popular product, accounting for more than 30% of the market.

Non-alcoholic yet carbonated apple juice is also regarded as a celebratory beverage, similar to champagne. In addition, the carbonated beverage contains antioxidants, potassium, vitamin B, and carbohydrates, all of which have nutritional benefits. Riboflavin and niacin, both vitamins B, are found in sparkling cider and help with energy production, eye health, digestion, and neurological function. However, the product is not recommended for diabetic people because it lacks the fiber needed to control sugar absorption.

Companies are attempting to introduce new products infused with various scents. For example, Kopparberg’s Brewery released Sparkling Rosé cider with a raspberry taste in February 2017. S. Martinelli & Company developed novel juice blends in champagne-style bottles in 2018, with tastes like cranberry, grape, pomegranate, pear, and mango.

By Type Insights

Because of the range of tastes available and the enhancements made by different manufacturers to tempt customers, the fruit-flavored category is the most profitable in the European cider market. Cider demand is increasing as consumers become more health-conscious and seek low-alcohol, gluten-free beverages. The emergence of high-grade cider is aided by the presence of well-known brands such as Kopparberg, Woodchuck, and Angry Orchard. The European cider market is more consolidated, whereas the North American market is rapidly growing. Fruit cider will account for 48 percent of all cider by 2023 if present growth rates continue.

REGIONAL ANALYSIS

Due to the presence of important cider-producing companies in Europe, the cider market In Europe is expected to grow significantly during the forecast period. Furthermore, the acceptance of lower levels of alcohol in beverages is boosting the European cider market growth over the predicted period. Cider is a popular beverage in Europe, especially in the United Kingdom and Germany, where many of the main cider-producing companies are based. The center of Europe, which encompasses countries like Spain and Belgium, is known for producing its own kind of cider, with Rhineland-Palatinate and Hesse adding a sour note to the beverage. It's a gluten-free beverage that can be used as a substitute for a range of alcoholic beverages.

The United Kingdom leads the Europe cider market and is the biggest consuming country in this beverage category. It is expected to continue to maintain its dominant position during the forecast period.

- As per a study, its consumption reached around 840 million liters in 2023, which amounts to 4.37 billion dollars in value terms.

Moreover, currently, the country’s market is witnessing moderate growth in the last few years. The landscape of cider and beer has been consistently moving towards premium offerings, with consumers becoming more willing to pay extra for genuine and quality, which subsequently boosts value in stores. The market shows a clear trend of premiumization, despite a 12 per cent year-on-year drop in overall volumes, however, more superior ciders are gaining popularity. This downward trajectory is primarily linked to the ongoing decline of mainstream drinks in this market like Strongbow. At the same time, premium brands such as Inch’s, Henry Westons, and Thatchers are contributing to this growth, as well as the country’s market share, but their success has not been sufficient to offset the decrease in the overall category.

Spain holds the position of the second-biggest cider consumer in Western Europe, with Germany and France leading. Both natural cider and sparkling cider in the past few years have expanded with the advent of new options including table cider, canned ciders, and prestigious ciders. As a result, this market in the nation is thriving, with numerous fresh products being enjoyed. Apart from this, Asturias accounts for 80 per cent of cider production in the country, and it's important to also highlight the Basque Country as another significant region in this category.

- According to the Brew & Hub, cider consumption in Spain is largely divided by type. Approximately 52 per cent is attributed to natural cider, while the sparkling variety holds 45 per cent, primarily enjoyed in regions like Valencia, Madrid, and Andalusia, particularly during celebrations.

Germany is a growing region in the Europe cider market and is expected to advance moderately during the forecast period. There is a growing inclination towards craft and artisanal ciders. Despite not being a large market in comparison to other countries, big beverage companies are investing in the nation’s cider landscape. Similar to Spain, in the German industry the market share of dealcoholized drinks has already gone past 10 per cent. The customer base in these nations is often older, with an inclination to consume such drinks at home. Besides this, the country’s market size is likely to expand owing to the resurgence of perry. There is a rising interest among the producers in utilising the fruits from the old large trees scattering considerable parts of the German rural areas.

France holds a notable share of the Europe cider market. It is in the same category as Belgium and Spain where low alcoholic ciders are consumed which are substitutes for sparkling white wines. Additionally, in France, it is generally made from bittersweet apples and is deeply rooted in the nation’s culinary heritage, often served alongside meals, and top chefs readily incorporate this drink into their dishes. Moreover, it has historically been part of the 3 major hubs of cider production in Europe and the epicenter of the cider industry in the country is right across the English Channel in the regions of Normandy and Brittany. However, in the last few years, its production has unfortunately declined. Although it continues to hold popularity in the country, it is mainly regarded as a seasonal beverage linked to religious holidays at the beginning of the year and visits to cider-producing regions, as well as Norman, Breton, and Basque restaurants. Efforts are being made to revive this culture and elevate its status to that of wine, which results in rising sales. But, low-quality commercial ciders marketed to younger consumers as sweeter and lighter alternatives to beer are damaging the drink’s image

KEY MARKET PLAYERS

Aston Manor Brewery, C&C Group Plc, Carlberg A/S, Distell Group, Halewood International Holdings Plc, Heineken UK Ltd., SABMiller Plc, Carlton & United Breweries Limited and The Boston Beer Company Inc. are some of the major players in the Europe cider market.

RECENT HAPPENINGS IN THE MARKET

- In March 2024, Strongbow Zest Cider was introduced by Heineken under its UK-owned brand Strongbow. This launch of a new flavour marks the expansion of the brand’s range of flavour products. Moreover, it is an apple cider mixed with orange, lemon, and lime flavours. It adds to the brand’s fruit variants comprising tropical, cloudy apple, and dark fruit. In addition, the new product has an ABV of 4 per cent, does not have synthetic colours, sweeteners or flavours and is fit for gluten-free and vegan diets.

- The Mixed Fruit Tropical flavor from Kopparberg now comes in an alcohol-free variant. After a limited-edition cider last summer, the 0.05 percent abv drink would answer to "increasing consumer hunger" for more virtuous options, according to Kopparberg.

- Listel, a French wine brand, launched two fruit sparkling wine variations in the UK in June 2016, which had been revamped for the British market. Listel Sparkling Apple and Listel Sparkling Raspberry, which have been popular across the Channel for years, are now available at Sainsbury's.

MARKET SEGMENTATION

This research report on the Europe cider market has been segmented and sub-segmented into the following categories.

By Product

- Still Cider

- Sparkling Cider

- Draft Cider

- Apple Wine

- Others

By Type

- Perry

- Fruit Flavoured

- Apple

- Others

Europe Cider Market By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]