Europe Chlorine Dioxide Market Size, Share, Trends & Growth Forecast Report By (Gas, Liquid and Solid), Application, End-Use Industry, and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2025 to 2033

Europe Chlorine Dioxide Market Size

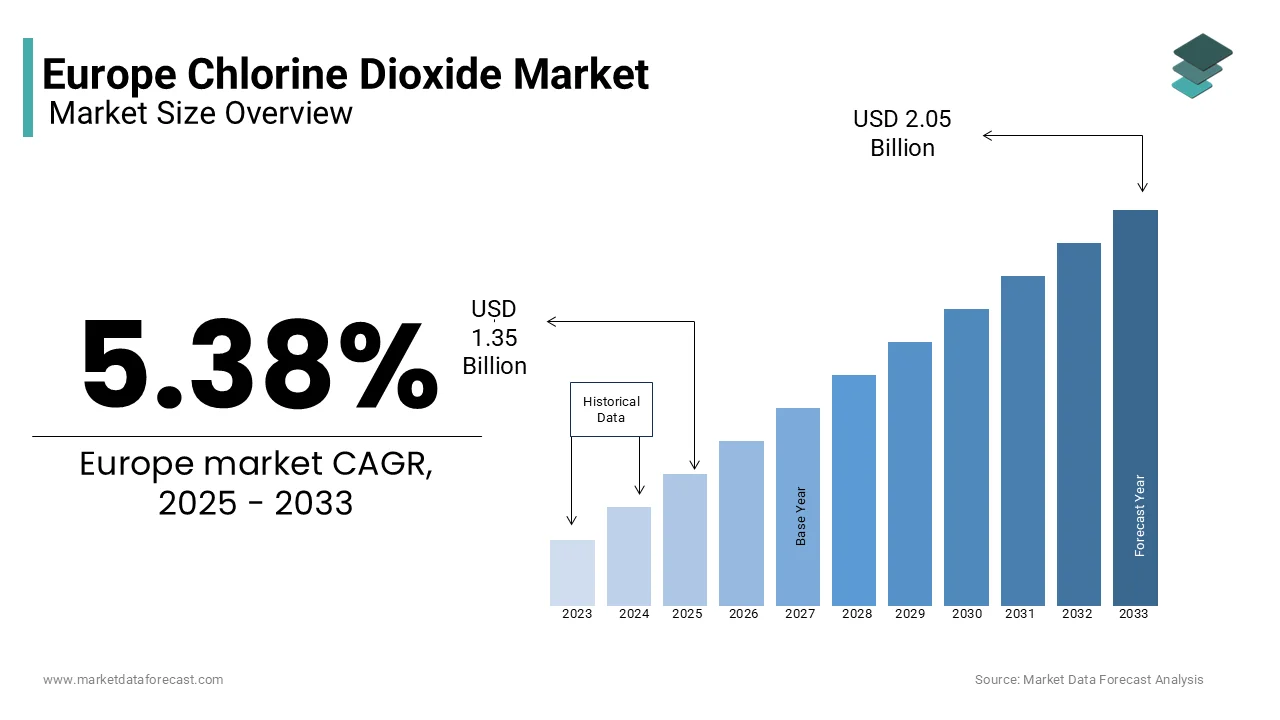

The Europe chlorine dioxide market size was valued at USD 1.28 billion in 2024. The European market is estimated to be worth USD 2.05 billion by 2033 from USD 1.35 billion in 2025, growing at a CAGR of 5.38% from 2025 to 2033.

Chlorine dioxide (ClO₂) is a highly versatile and effective chemical compound widely used for disinfection, oxidation, and water treatment applications. Chlorine dioxide is favored over traditional chlorine-based solutions due to its ability to eliminate pathogens without forming harmful byproducts such as trihalomethanes (THMs). In Europe, the chlorine dioxide market is driven by stringent environmental regulations, increasing demand for clean water, and the need for advanced disinfection technologies across various industries. According to the European Environment Agency, over 40% of Europe's water bodies are under pressure from pollution, necessitating innovative solutions like chlorine dioxide for water purification. Additionally, the European Commission's Green Deal initiative promotes the sustainable practices with the growing demand for eco-friendly disinfectants.

MARKET DRIVERS

Increasing Demand for Clean Water

The rising demand for clean and safe water serves as a major driver for the European chlorine dioxide market. According to the European Environment Agency, approximately 20% of Europe's population relies on groundwater sources that are vulnerable to contamination with advanced water treatment solutions. Chlorine dioxide is extensively used in municipal and industrial water treatment due to its ability to eliminate biofilm, bacteria, and viruses without producing harmful disinfection byproducts. According to the European Commission, investments in water infrastructure exceeded €50 billion in 2022 with a favorable environment for chlorine dioxide adoption. According to the World Health Organization, chlorine dioxide reduces microbial contamination by up to 99.9%, which is ascribed to bolster the growth of the market.

Stringent Environmental Regulations

Stringent environmental regulations governing water treatment and industrial emissions represent another significant driver for the European chlorine dioxide market. According to the European Chemicals Agency, chlorine dioxide is classified as a safer alternative to chlorine gas for disinfection, aligning with the EU's REACH and CLP directives. The Industrial Emissions Directive, enforced by the European Commission, mandates strict limits on pollutants by compelling industries to adopt eco-friendly solutions like chlorine dioxide. According to Eurostat, compliance costs for industrial water treatment increased by 15% in 2022 with the demand for advanced disinfectants.

MARKET RESTRAINTS

High Production Costs

High production costs associated with chlorine dioxide represent a significant restraint for the European market. According to the European Chemical Industry Council, the cost of producing chlorine dioxide is approximately 20-30% higher than traditional chlorine-based solutions, limiting its widespread adoption among small and medium-sized enterprises (SMEs). According to the European Federation of Chemical Employers, over 60% of companies cite affordability as a primary barrier to integrating chlorine dioxide into their operations. Additionally, fluctuations in raw material prices, particularly sodium chlorate and sulfuric acid, exacerbate this issue. According to the European Metals Association, the cost of sodium chlorate surged by 25% in 2022 due to supply chain disruptions, impacting profit margins. These financial barriers not only hinder market growth but also constrain investments in scaling production capacities and expanding product portfolios.

Regulatory Scrutiny and Safety Concerns

Regulatory scrutiny and safety concerns surrounding the use of chlorine dioxide pose another critical challenge to the European market. According to the European Chemicals Agency, chlorine dioxide must comply with strict safety protocols due to its potential for accidental release and toxicity if improperly handled or stored. The Industrial Explosives Directive, enforced by the European Commission, mandates rigorous safety measures by compelling manufacturers to invest heavily in compliance. According to Eurostat, compliance costs for chlorine dioxide producers have risen by 20% over the past three years, impacting profitability. As per the European Environment Agency, several small-scale facilities have ceased operations due to non-compliance or prohibitive expenses. These regulatory pressures not only hinder market expansion but also deter new entrants, constraining overall growth prospects.

MARKET OPPORTUNITIES

Advancements in On-Site Generation Technologies

Advancements in on-site generation technologies present a lucrative opportunity for the European chlorine dioxide market. The European Commission's Horizon Europe program emphasizes innovation in water treatment technologies that is boosting demand for on-site solutions. According to the European Chemical Industry Council, on-site generation reduces transportation risks and ensures consistent supply by making it an attractive option for industries such as pulp and paper, oil and gas, and water treatment. This trend positions chlorine dioxide as a critical enabler of sustainable and efficient disinfection practices.

Expansion into Emerging Applications

The growing focus on emerging applications such as food and beverage sanitation offers another promising opportunity for the European chlorine dioxide market. According to the European Food Safety Authority, the demand for chlorine dioxide in food processing and packaging grew by 15% in 2022 due to the increasing consumer awareness of hygiene and safety. Chlorine dioxide is extensively used to sanitize surfaces, equipment, and packaging materials by ensuring compliance with stringent food safety standards. Additionally, the European Commission's Farm to Fork Strategy supports the development of sustainable food solutions by amplifying the need for eco-friendly disinfectants like chlorine dioxide.

MARKET CHALLENGES

Supply Chain Disruptions

Supply chain disruptions pose a significant challenge to the European chlorine dioxide market. According to the European Maritime Safety Agency, shipping delays increased by 25% in 2022 by affecting the timely delivery of raw materials and finished products. The Russia-Ukraine conflict has further disrupted the supply of key raw materials such as sodium chlorate, which accounts for nearly 70% of chlorine dioxide production expenses. According to the European Chemical Industry Council, imports of certain raw materials declined by 40% in 2022 by leading to shortages and price spikes. These disruptions not only elevate operational costs but also hinder production schedules by impacting market stability.

Limited Awareness Among End Users

The limited awareness among end users regarding the benefits of chlorine dioxide represents another critical challenge for the European market. According to the European Federation of Chemical Employers, less than 40% of small and medium-sized enterprises (SMEs) in Europe are aware of the advantages of chlorine dioxide over traditional disinfectants, creating a significant knowledge gap. According to the European Commission, over 50% of industries struggle to adopt advanced disinfection technologies due to insufficient training and education. This lack of awareness not only slows the adoption of chlorine dioxide but also limits innovation and technological advancement. Addressing this challenge requires coordinated efforts between governments, educational institutions, and industry stakeholders to develop comprehensive awareness initiatives.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5.38% |

|

Segments Covered |

By Form, Application, End-Use Industry, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, Rest of Europe |

|

Market Leaders Profiled |

Ecolab Inc., Accepta Ltd., BASF SE, ProMinent GmbH, Lenntech B.V., Grundfos Holding A/S, Chemours Company, Dioxide Pacific, Prominent Fluid Controls Ltd. And Scienco/FAST, and others. |

SEGMENTAL ANALYSIS

By Form Insights

The liquid chlorine dioxide segment dominated the European chlorine dioxide market with a prominent share of 55.4% in 2024, which is attributed to its ease of handling, storage, and application in water treatment and industrial processes. The European Commission's Green Deal initiative propels the importance of sustainable water treatment solutions, which further boosts demand for liquid chlorine dioxide. The versatility and performance of liquid chlorine dioxide ensure its sustained dominance in the market for applications requiring rapid and effective disinfection.

The gas emerges as the fastest-growing segment, with a projected CAGR of 8% from 2023 to 2030, as per the European Environment Agency. This rapid growth is fueled by the increasing adoption of gaseous chlorine dioxide in air purification and surface disinfection applications, where it provides superior efficacy against pathogens. Additionally, the European Commission's Horizon Europe program supports the development of advanced gas-based disinfection solutions that promotes innovative and sustainable practices.

By Application Insights

The municipal water treatment segment was the largest by capturing 40.6% of the European chlorine dioxide market share in 2024 with the extensive use of chlorine dioxide in purifying drinking water and eliminating harmful pathogens such as bacteria, viruses, and biofilm. The European Commission's Green Deal initiatives like prompting the importance of clean water will further amplify the demand for chlorine dioxide in municipal applications.

The swimming pool water treatment segment is likely to achieve a significant CAGR of 9.1% from 2025 to 2033. This rapid growth is driven by the increasing adoption of chlorine dioxide in swimming pools, where it provides superior disinfection without causing skin and eye irritation. Additionally, the European Commission's emphasis on public health and safety supports the use of eco-friendly disinfectants like chlorine dioxide by enabling sustainable swimming pool management.

By End-Use Industry Insights

The water treatment segment was accounted in holding 35.4% of the European chlorine dioxide market share in 2024 due to the widespread use of chlorine dioxide in municipal, industrial, and wastewater treatment applications due to its superior biocidal properties and environmental compatibility. The European Commission's Green Deal initiative emphasizes the importance of sustainable water management that further enhances the demand for the chlorine dioxide.

The food and beverage segment is likely to experience a CAGR of 10.5% from 2025 to 2033. This rapid growth is driven by the increasing adoption of chlorine dioxide in food processing and packaging, where it ensures compliance with stringent hygiene and safety standards. Additionally, the European Commission's Farm to Fork Strategy supports the development of sustainable food solutions, amplifying the need for eco-friendly disinfectants like chlorine dioxide. This trend positions chlorine dioxide as a key enabler of innovation in the food and beverage industry.

REGIONAL ANALYSIS

Germany chlorine dioxide market held a dominant share of 25.3% in 2024. This prominence is attributed to the country's robust industrial base and strong emphasis on environmental sustainability. According to the German Federal Ministry for the Environment, over 60% of industrial water treatment facilities in Germany utilize chlorine dioxide by reflecting the region's commitment to innovation. Additionally, Germany's strategic investments in on-site generation technologies is attributed to create a favorable environment for market growth.

France is attributed to register a CGAR of 8.4% during the forecast period. The country's water treatment and food and beverage sectors are key contributors to chlorine dioxide adoption. According to the French Ministry of Health, growing use of chlorine dioxide in municipal water systems is accelerating the growth of the market. Furthermore, France's focus on sustainable practices boosts the use of eco-friendly disinfectants.

The UK chlorine dioxide market is more likely to have robust growth opportunities in the next coming years. The country's strong presence in the water treatment and pharmaceutical sectors drives chlorine dioxide demand. The UK government's commitment to clean water initiatives supports the use of advanced disinfectants by ensuring steady market growth. Additionally, the UK's investment in on-site generation technologies amplifies its dominance in chlorine dioxide innovation.

The growing scale of food and beverage and water treatment sectors that rely heavily on chlorine dioxide for ensuring hygiene and safety in Italy is ascribed to fuel the growth of the market. Italy's dominance in sustainable manufacturing amplifies demand for eco-friendly disinfectants. Furthermore, the Italian government's focus on environmental regulations aligns with the growing adoption of chlorine dioxide that further escalates the market growth.

KEY MARKET PLAYERS

The major key players in Europe Chlorine Dioxide market are Ecolab Inc., Accepta Ltd., BASF SE, ProMinent GmbH, Lenntech B.V., Grundfos Holding A/S, Chemours Company, Dioxide Pacific, Prominent Fluid Controls Ltd. And Scienco/FAST, and others.

MARKET SEGMENTATION

This research report on the Europe chlorine dioxide market is segmented and sub-segmented into the following categories.

By Form

- Gas

- Liquid

- Solid

By Application

- Municipal Water Treatment

- Industrial Water treatment

- Swimming Pool Water Treatment

- Wastewater Treatment

By End-Use Industry

- Chemical, Oil & Gas

- Power Generation

- Pulp & Paper

- Water Treatment

- Food & Beverage

- Construction industry

- Pharmaceutical Industry and Others

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]