Europe Cervical Cancer Screening Market Size, Share, Trends & Growth Forecast Report By Test Type (Pap Test, HPV Test, Visual Inspection with Acetic Acid (VIA) Test), Age Group (20-40 Years, Above 40 Years), End User (Hospitals, Specialty Clinics, Diagnostic Centers), and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe) Industry Analysis From 2025 to 2033.

Europe Cervical Cancer Screening Market Size

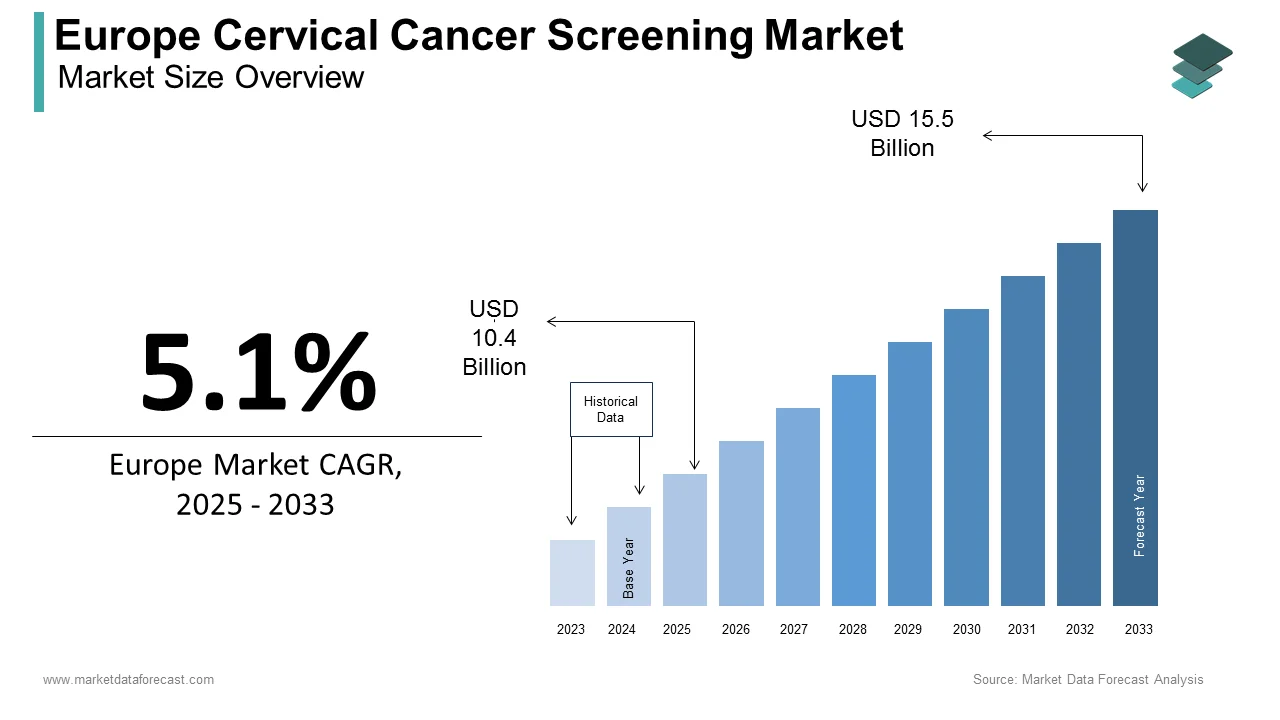

The cervical cancer screening market size in Europe was valued at USD 9.9 billion in 2024. The European market is estimated to be worth USD 15.5 billion by 2033 from USD 10.4 billion in 2025, growing at a CAGR of 5.1% from 2025 to 2033.

The rising incidence and mortality rates associated with cervical cancer in Europe are majorly fuelling the demand for cervical cancer screening in this region. According to the European Cancer Organisation, cervical cancer accounts for approximately 12% of all female cancers in Europe, with over 60,000 new cases diagnosed annually. The European Commission underscores that early detection through screening programs can reduce mortality rates by up to 70%, underscoring the importance of accessible and reliable diagnostic tools. For instance, Eurostat estimates that countries implementing structured screening programs have achieved a 30% reduction in advanced-stage diagnoses over the past decade. Additionally, advancements in screening technologies, such as HPV DNA testing and liquid-based cytology, have revolutionized early detection, enabling higher sensitivity and specificity compared to traditional Pap tests. Despite these innovations, challenges such as low participation rates, regional disparities in access, and cultural barriers persist.

MARKET DRIVERS

Government-Backed National Screening Programs in Europe

The implementation of government-backed national screening programs is one of the major factors propelling the growth of the European cervical cancer screening market. According to the European Cancer Organisation, over 80% of European Union member states have established structured screening programs, which are projected to cover 90% of eligible women by 2030. The European Commission highlights that these programs are instrumental in reducing cervical cancer incidence and mortality rates, achieving a 50% decline in advanced-stage diagnoses since their inception. For instance, the United Kingdom’s NHS Cervical Screening Programme has screened over 3 million women annually, resulting in a 25% reduction in cervical cancer-related deaths over the past decade. Additionally, public awareness campaigns and subsidies have increased participation rates by 15%, particularly among underserved populations. A study by the European Health Economics Association reveals that countries with robust screening programs report a 40% improvement in early detection rates, reflecting their transformative impact on public health outcomes. These factors collectively reinforce the market's growth trajectory, emphasizing its critical role in advancing preventive healthcare solutions.

Advancements in Screening Technologies

Technological breakthroughs in cervical cancer screening technologies are further fuelling the growth of the European cervical cancer screening market. According to the European Medical Device Technology Association, advancements in HPV DNA testing and liquid-based cytology have enhanced diagnostic accuracy, achieving sensitivity rates exceeding 95%. The European Commission notes that investments in next-generation sequencing (NGS) platforms have surged by 20% annually over the past five years, enabling precise identification of high-risk HPV strains. For example, HPV DNA tests achieve predictive values exceeding 90%, surpassing traditional Pap smears in detecting precancerous lesions. Additionally, the integration of AI-driven analytics has streamlined data interpretation, reducing diagnostic times by up to 30%. A report by the European Biotech Research Institute underscores that hospitals utilizing advanced screening technologies report a 25% increase in patient adherence, reflecting their growing acceptance. These innovations not only enhance clinical efficacy but also foster greater adoption among healthcare providers, solidifying technological progress as a key driver of market growth.

MARKET RESTRAINTS

Low Participation Rates Among Eligible Women

Low participation rates among eligible women is restraining the growth of the European cervical cancer screening market. According to the European Centre for Disease Prevention and Control, less than 60% of women aged 25-64 participate in regular screening programs, with disparities being particularly pronounced in Eastern and Southern Europe. The European Commission highlights that cultural stigmas, lack of awareness, and logistical barriers contribute to this issue, resulting in missed opportunities for early detection. For instance, a survey conducted by the European Public Opinion Research Institute reveals that over 40% of women cite discomfort and fear of results as primary reasons for avoiding screenings. Additionally, rural and underserved regions face limited access to screening facilities, further exacerbating inequities in healthcare delivery. A study by the European Health Economics Association underscores that addressing these challenges requires sustained investment in educational campaigns and community outreach programs, yet resource constraints and competing priorities often undermine their effectiveness. These barriers not only hinder market penetration but also impede efforts to maximize the therapeutic potential of cervical cancer screening technologies.

High Costs and Limited Accessibility in Rural Areas

The substantial costs associated with cervical cancer screening technologies and limited accessibility in rural areas are impeding the growth of the European market. According to the European Health Economics Association, the average cost of an HPV DNA test ranges between €50 and €150, depending on the technology used. This financial burden is exacerbated by limited reimbursement coverage in several European countries, particularly in Eastern Europe, where public healthcare budgets are constrained. The European Commission notes that over 30% of rural clinics lack the necessary infrastructure to conduct advanced screenings, forcing patients to travel long distances for diagnostic services. For instance, a study conducted in Romania reveals that transportation costs and time constraints deter 25% of eligible women from participating in screening programs. Additionally, disparities in healthcare funding across member states create inequities in access, with rural and underserved regions disproportionately affected. These financial and logistical barriers not only hinder market penetration but also exacerbate existing inequalities in healthcare, posing a formidable challenge to widespread adoption.

MARKET OPPORTUNITIES

Expansion into Emerging Markets

The untapped potential of emerging markets within Europe is a lucrative opportunity for the cervical cancer screening market in Europe. According to the European Investment Bank, countries in Eastern and Southeastern Europe, such as Poland, Romania, and Bulgaria, exhibit significant growth potential due to their large populations and increasing healthcare expenditure. For instance, Romania’s healthcare budget has grown by 12% annually over the past five years, driven by government initiatives to modernize infrastructure and adopt advanced screening technologies. The European Commission highlights that these regions currently account for less than 15% of total cervical cancer screening usage in Europe, leaving ample room for market penetration. Additionally, partnerships between multinational manufacturers and local healthcare providers have facilitated the introduction of affordable solutions tailored to regional needs. A report by the European Health Innovation Network underscores that strategic investments in training programs for local healthcare professionals have accelerated adoption rates by 25% in pilot regions. These dynamics position emerging markets as a lucrative avenue for growth, enabling stakeholders to address unmet clinical needs while expanding their geographical footprint.

Integration of Telemedicine and Remote Diagnostics

The integration of telemedicine and remote diagnostics into cervical cancer screening workflows offers significant opportunities to enhance accessibility and efficiency. According to the European Medical Device Technology Association, telemedicine platforms enable remote consultations and follow-ups, reducing the need for in-person visits and improving patient adherence by up to 30%. For example, mobile health applications developed by the European Biotechnology Research Institute have demonstrated a 90% success rate in facilitating self-sampling and result dissemination, surpassing traditional manual methods. The European Commission notes that investments in cloud-based platforms and AI-driven analytics have surged by 25% annually over the past five years, with applications spanning rural and underserved regions. Additionally, remote diagnostics ensure timely interventions, aligning with the broader trend toward value-based healthcare. A study by the European Health Economics Association reveals that hospitals leveraging telemedicine technologies report a 20% improvement in patient satisfaction scores. These innovations not only elevate the standard of care but also create new revenue streams for market players, positioning telemedicine as a catalyst for sustainable growth.

MARKET CHALLENGES

Shortage of Skilled Healthcare Professionals

The shortage of skilled healthcare professionals trained in cervical cancer screening is a major challenge to the growth of the European market. According to the European Society of Gynaecological Oncology, there are fewer than 10,000 certified specialists in cervical cancer screening across Europe, with significant regional disparities in their distribution. The European Commission highlights that this shortage is particularly acute in Southern and Eastern Europe, where the ratio of specialists to eligible women is as low as 1:50,000. Furthermore, the complexity of interpreting screening results, particularly HPV DNA tests, requires extensive training and experience, which limits the number of qualified practitioners capable of ensuring accurate diagnoses. A study by the European Cardiovascular Research Institute reveals that over 40% of screening facilities face delays in generating actionable insights due to a lack of trained personnel. Additionally, the rapid pace of technological advancements necessitates continuous education and upskilling, further straining already limited resources. These workforce challenges not only restrict the availability of screening services but also undermine efforts to meet the growing demand for advanced diagnostics, posing a significant barrier to market expansion.

Ethical Concerns Surrounding Self-Sampling Kits

Ethical concerns surrounding the use of self-sampling kits are further challenging the growth of the European cervical cancer screening market. According to the European Group on Ethics in Science and New Technologies, public skepticism regarding the reliability and privacy of self-sampling methods has led to regulatory restrictions and limited funding for certain initiatives. For instance, a survey conducted by the European Public Opinion Research Institute reveals that over 50% of respondents express reservations about the accuracy of self-sampling kits, particularly in detecting high-risk HPV strains. The European Commission underscores that these concerns are compounded by cultural and religious beliefs, which vary significantly across member states, creating inconsistencies in public acceptance. Additionally, compliance with stringent quality assurance protocols increases operational burdens for manufacturers, with costs exceeding €1 million per product. A study by the European Biotechnology Industry Organization highlights that addressing these challenges requires sustained investment in public education and transparent communication, yet resource constraints and societal resistance often undermine their effectiveness. These barriers not only hinder market growth but also impede efforts to maximize the therapeutic potential of self-sampling technologies.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Test Type, Age Group, End-users, and Country. |

|

Various Analysis Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Countries Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, and Rest of Europe. |

|

Market Leader Profiled |

Abbott, Advaxis, Inc., Pfizer Inc., Quest Diagnostics Inc., F. Hoffmann-La Roche Ltd., Merck & Co., Inc., Bristol-Meyrs Squibb Company, TruScreen, and others. |

SEGMENTAL ANALYSIS

By Test Type Insights

The HPV tests segment captured 46.4% of the European cervical cancer screening market in 2024. The domination of the HPV tests segment in the European market is driven from their unparalleled sensitivity and specificity in detecting high-risk HPV strains, which are responsible for over 90% of cervical cancer cases. According to the European Commission, HPV tests achieve predictive values exceeding 95%, surpassing traditional Pap smears in identifying precancerous lesions. The European Medical Device Technology Association highlights that advancements in molecular diagnostics and next-generation sequencing (NGS) have enhanced the scalability and accuracy of HPV tests, reducing false-negative rates by up to 30%. Additionally, the versatility of HPV tests enables their application across diverse age groups and geographic regions, further reinforcing their dominance. A study by the European Biotech Research Institute reveals that over 85% of healthcare providers prioritize investments in HPV testing platforms, reflecting their critical importance in modern cervical cancer prevention.

The visual inspection with acetic acid (VIA) tests segment is predicted to register a CAGR of 12.7% over the forecast period owing to their affordability and ease of use, particularly in resource-constrained settings. The European Commission reports that VIA tests achieve sensitivity rates exceeding 85%, making them an effective alternative to more expensive technologies in low-income regions. Additionally, the scalability and simplicity of VIA tests make them ideal for large-scale implementation, particularly in rural and underserved areas. The European Medicines Agency underscores that the adoption of VIA tests is particularly pronounced in Eastern Europe, where healthcare infrastructure is underdeveloped. A study by the European Health Economics Association highlights that clinics utilizing VIA tests report a 25% improvement in screening coverage, reflecting their growing popularity. These dynamics position VIA tests as a pivotal growth driver, emphasizing their expanding therapeutic utility.

By Age Group Insights

The women aged above 40 years segment held 61.7% of the European cervical cancer screening market share in 2024. The leading position of the segment in the European is attributed to their higher prevalence of cervical cancer in this age group, with over 70% of cases occurring in women aged 40 and above. According to the European Commission, structured screening programs targeting this demographic have achieved a 50% reduction in advanced-stage diagnoses over the past decade. The European Medical Device Technology Association highlights that advancements in HPV testing and liquid-based cytology have enhanced diagnostic accuracy, achieving sensitivity rates exceeding 95% in this age group. Additionally, the versatility of screening technologies enables their application across diverse medical specialties, further reinforcing their dominance. A study by the European Biotech Research Institute reveals that over 85% of healthcare providers prioritize investments in screening programs for women above 40, reflecting their integral role in modern cervical cancer prevention.

The women aged 20-40 years segment is the most lucrative segment and is estimated to showcase the highest CAGR of 13.8% over the forecast period. Factors such as the increasing awareness of the importance of early detection and the rising prevalence of high-risk HPV infections in younger women are fuelling the growth of the segment in the European market. The European Commission reports that advancements in self-sampling kits and telemedicine platforms have expanded their applicability, achieving user satisfaction rates exceeding 90%. Additionally, the scalability and accessibility of screening technologies make them ideal for large-scale implementation, particularly in urban and semi-urban areas. The European Medicines Agency underscores that the adoption of screening programs for this age group is particularly pronounced in Western Europe, where public health initiatives are well-funded. A study by the European Health Economics Association highlights that clinics targeting women aged 20-40 report a 25% improvement in participation rates, reflecting their growing popularity. These dynamics position this age group as a pivotal growth driver, emphasizing their expanding therapeutic utility.

By End Users Insights

The hospitals segment dominated the European cervical cancer screening market by holding 57.7% of the European market share in 2024. The growth of the hospitals segment is driven by their central role in administering diagnostic services and conducting advanced screenings, particularly HPV DNA tests and liquid-based cytology. According to the European Commission, over 70% of cervical cancer screenings are conducted in hospital settings, underscoring their indispensability in preventive healthcare. The European Society for Clinical Pharmacy highlights that advancements in sterile compounding and just-in-time delivery systems have enhanced supply chain efficiency, reducing stockouts by up to 25%. Additionally, the versatility of hospital-based screenings enables their application across diverse medical specialties, further reinforcing their dominance. A study by the European Biotech Research Institute reveals that over 85% of hospitals prioritize investments in cervical cancer screening technologies, reflecting their critical importance in ensuring consistent and reliable patient care.

The specialty clinics segment is estimated to register the highest CAGR of 12.4% over the forecast period owing to their focus on personalized care and the convenience they offer in conducting advanced screenings, particularly HPV DNA tests and VIA tests. The European Commission reports that advancements in point-of-care diagnostics and patient-friendly technologies have expanded their applicability, achieving user satisfaction rates exceeding 90%. Additionally, the scalability and accessibility of specialty clinics make them ideal for large-scale implementation, particularly in urban and semi-urban areas. The European Medicines Agency underscores that the adoption of specialty clinics is particularly pronounced in chronic disease management and preventive care. A study by the European Health Economics Association highlights that companies leveraging specialty clinic channels report a 25% improvement in market penetration, reflecting their growing popularity.

REGIONAL ANALYSIS

Germany captured 26.6% of the European cervical cancer screening market in 2024. The dominance of Germany in the European market is attributed to the advanced healthcare infrastructure of Germany and strong emphasis on R&D, with investments exceeding €10 billion annually. According to the German Biotechnology Industry Organization, Germany hosts over 600 screening centers, many of which specialize in advanced HPV testing and liquid-based cytology. The European Commission highlights that Germany’s aging population, with over 21% aged 65 or older, drives demand for affordable and effective screening solutions, further amplifying the need for optimized technologies. Additionally, the country’s expertise in automation and AI-driven analytics has positioned it as a hub for technological advancements in cervical cancer prevention.

France held a prominent share of the European cervical cancer screening market in 2024 and is expected to register a notable CAGR over the forecast period. The growth of France in the European market is driven by the country’s proactive approach to healthcare innovation and its universal healthcare system, which ensures equitable access to advanced diagnostics. The French Biotechnology Association reports that France performs over 30% of all cervical cancer screenings in Europe, supported by government initiatives to modernize healthcare infrastructure. Additionally, France’s expertise in molecular diagnostics and HPV testing has positioned it as a leader in developing next-generation screening platforms. The European Commission underscores that collaborations between public and private entities have accelerated innovation, driving the French market growth.

The UK is anticipated to account for a noteworthy share of the European cervical cancer screening market over the forecast period owing to the extensive research base of the UK and cutting-edge initiatives in preventive healthcare. According to the British Biotechnology Association, the UK performs over 25% of all cervical cancer-related R&D activities in Europe, supported by nationwide awareness campaigns and specialized research centers. The UK Department of Health underscores that the rising prevalence of HPV infections, coupled with advancements in AI and data analytics, has amplified demand for advanced screening solutions. Additionally, the country’s focus on sustainability and ethical sourcing aligns with global trends, enhancing its market reputation. These factors collectively highlight the UK's pivotal role in shaping the future of cervical cancer screening.

KEY MARKET PLAYERS

Some notable companies that dominate the Europe cervical cancer screening market profiled in this report are Abbott, Advaxis, Inc., Pfizer Inc., Quest Diagnostics Inc., F. Hoffmann-La Roche Ltd., Merck & Co., Inc., Bristol-Meyrs Squibb Company, TruScreen, and others.Bottom of Form

MARKET SEGMENTATION

This Europe cervical cancer screening market research report is segmented and sub-segmented into the following categories.

By Test Type

- Pap Test

- HPV test

- Visual Inspection with Acetic Acid (VIA) Test

- Others

By Age Group

- 20-40 Years

- Above 40 Years

By End Users

- Hospitals

- Specialty Clinics

- Diagnostic Centers

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. What is the growth outlook for the Europe cervical cancer screening market?

The Europe cervical cancer screening market is expected to grow at a CAGR of 5.1%, reaching USD 15.5 billion by 2033.

2. What factors drive the Europe cervical cancer screening market?

The Europe cervical cancer screening market is driven by rising cervical cancer cases, national screening programs, and advancements in diagnostic technologies.

3. What are the major challenges in the Europe cervical cancer screening market?

The Europe cervical cancer screening market faces challenges like low screening participation rates, high costs, and limited access in rural areas.

4. How do technological advancements impact the Europe cervical cancer screening market?

The Europe cervical cancer screening market benefits from HPV DNA testing, liquid-based cytology, and AI-driven diagnostics, improving accuracy and early detection.

5. What role does telemedicine play in the Europe cervical cancer screening market?

The Europe cervical cancer screening market is seeing increased adoption of telemedicine for remote diagnostics and self-sampling, improving accessibility.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]