Europe Cereals Market Size, Share, Trends & Growth Forecast Report By Type (Hot Cereals and Ready To Eat Cereals), Ingredient Type, Distribution Channel, And Country (United Kingdom, France, Spain, Germany, Italy, Russia, Sweden, Denmark) - Industry Analysis (2025 to 2033)

Europe Cereals Market Size

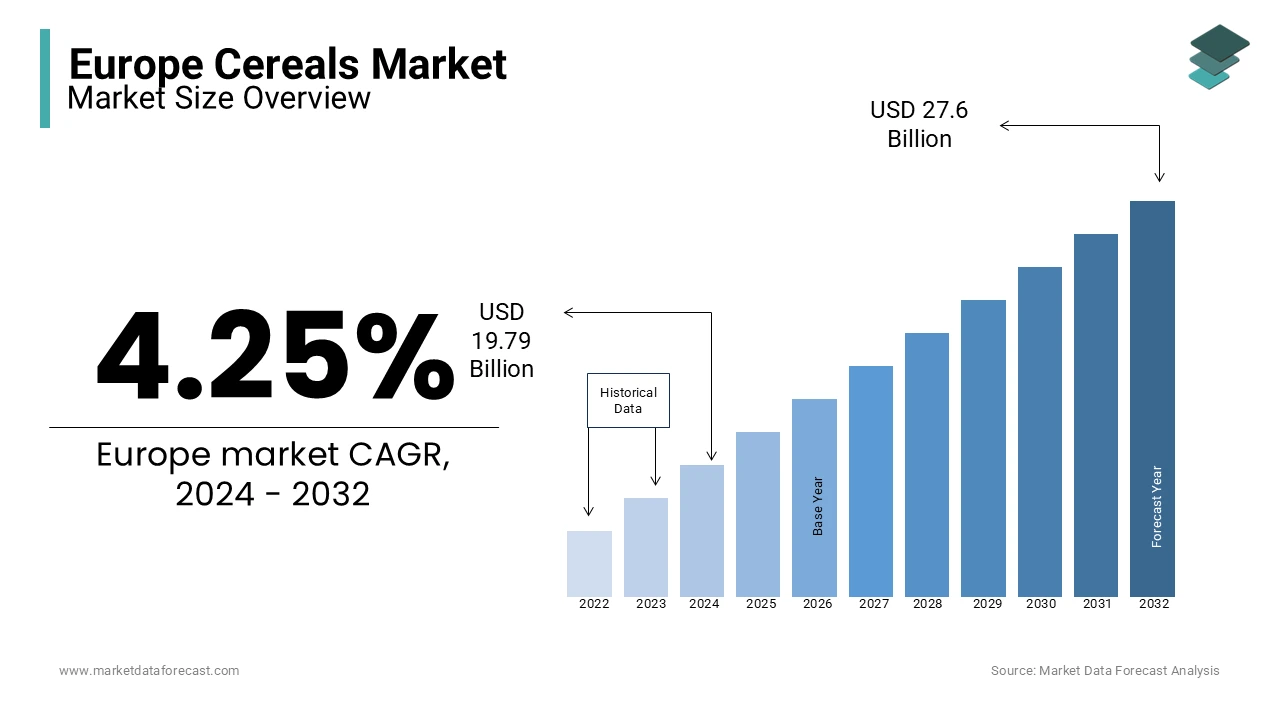

The cereals market size in Europe was valued at USD 19.79 billion in 2024. The European market is estimated to grow at a CAGR of 4.25% from 2025 to 2033 and be worth USD 28.78 billion by 2033 from USD 20.63 billion in 2025.

The European cereals market is being shaped by evolving consumer preferences toward healthier, more sustainable options. A key trend is the increasing demand for whole grain and fiber-rich cereals, which is linked to the rising awareness of the benefits of high-fiber diets in managing chronic conditions such as heart disease and diabetes. For example, studies show that a diet high in fiber can reduce the risk of coronary heart disease by up to 30%. In terms of health-conscious choices, over 20% of European consumers report regularly purchasing gluten-free products, with cereals being a significant category. Additionally, cereals fortified with vitamins and minerals, such as vitamin D and iron, are gaining traction, especially among children, to address common nutritional gaps in European diets. Sustainability is also a key factor, with 64% of Europeans actively seeking brands with eco-friendly packaging and the EU's Green Deal encouraging cereal manufacturers to adopt circular economy practices, including reducing food waste and using renewable energy in production.

MARKET DRIVERS

Health and Wellness Consciousness

As consumers in Europe become more health-conscious, the demand for healthier cereal options is on the rise. A significant 63% of Europeans are actively trying to eat more nutritious foods, with an increasing preference for cereals that offer functional benefits like high fiber, low sugar, and added vitamins. Fiber-rich cereals, in particular, are popular due to their role in digestive health and chronic disease prevention. Research shows that diets high in fiber can lower the risk of type 2 diabetes by up to 25%, fueling the demand for whole grains and plant-based cereals in the European market.

Sustainability and Eco-Friendly Practices

Sustainability is a key driver in the European cereals market. Approximately 64% of European consumers are willing to pay more for environmentally friendly products, which has led brands to focus on eco-friendly packaging and responsible sourcing of ingredients. The European Union’s Green Deal encourages companies to reduce carbon footprints and adopt sustainable practices in food production. Moreover, 72% of Europeans support local sourcing, pushing cereal manufacturers to align with regional agriculture and reduce transportation emissions. This growing eco-conscious mindset is compelling brands to innovate in sustainability, further boosting demand for environmentally responsible cereal options.

MARKET RESTRAINTS

Rising Raw Material Costs

One of the major restraints in the European cereals market is the volatility in raw material costs, particularly due to fluctuating prices of key ingredients such as wheat, oats, and corn. In 2023, global wheat prices surged by nearly 30% due to adverse weather conditions and supply chain disruptions. This directly impacts cereal manufacturers, leading to higher production costs. Consumers may face price hikes, which can dampen demand, especially in price-sensitive segments. Additionally, increased input costs could limit the ability of manufacturers to innovate or maintain competitive pricing, posing a challenge in a price-driven market.

Regulatory Challenges

The European cereals market faces significant regulatory hurdles, particularly around food labeling and health claims. The European Food Safety Authority (EFSA) enforces strict regulations on claims related to health benefits, requiring extensive scientific evidence before claims like "low sugar" or "high fiber" can be used. This creates barriers for companies looking to differentiate their products based on health benefits. Furthermore, the EU’s stricter regulations on pesticide use and genetically modified crops can limit sourcing options for cereal manufacturers, driving up costs and reducing the availability of certain ingredients, which impacts product innovation.

MARKET OPPORTUNITIES

Growth of Plant-Based and Gluten-Free Products

There is a growing opportunity in the European cereals market driven by the rising demand for plant-based and gluten-free products. As awareness of gluten sensitivities and food allergies increases, gluten-free cereal sales have risen by over 20% in recent years. Moreover, plant-based diets are gaining traction, with approximately 9% of Europeans identifying as vegan or vegetarian. This trend opens up new product development avenues for cereal manufacturers to innovate with plant-based proteins like oats, quinoa, and rice, catering to the increasing consumer preference for plant-forward and allergen-free foods, particularly among millennials and Gen Z.

Personalized Nutrition and Functional Foods

The rising trend of personalized nutrition presents a significant opportunity for cereal brands to offer customized, functional products. Over 55% of European consumers are interested in personalized dietary solutions tailored to their individual health needs, such as weight management or gut health. Cereal companies can leverage this by developing products fortified with specific nutrients like probiotics, omega-3s, or antioxidants. Additionally, the increasing popularity of gut health awareness and mental well-being products provides an avenue for innovation, with functional cereals designed to enhance digestive health or boost immunity, aligning with current consumer health goals.

MARKET CHALLENGES

Supply Chain Disruptions

The European cereals market faces significant challenges due to ongoing supply chain disruptions, which have been exacerbated by geopolitical factors like the Russia-Ukraine conflict and extreme weather events. For instance, the war in Ukraine, a major producer of wheat and corn, has led to supply shortages and increased prices for these essential raw materials. In 2023, the global wheat supply dropped by 10%, causing a ripple effect in the cost of cereal production. These disruptions increase costs, limit product availability, and force manufacturers to find alternative sourcing, which can lead to further price hikes and delays in production.

Nutritional Labeling and Regulatory Complexity

Stringent and complex nutritional labeling regulations in Europe pose a significant challenge for cereal manufacturers. The EU requires clear labeling, but the interpretation of health claims, nutrient levels, and ingredient disclosures varies across member states. Additionally, the EU’s Nutri-Score system, which ranks products based on their nutritional value, has led to some cereals receiving lower scores due to high sugar content. This regulatory landscape pressures brands to reformulate products to meet health standards, which can involve significant investment in research and development, especially as consumer demand for healthier alternatives continues to rise.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

4.25% |

|

Segments Covered |

By Type, Ingredient Type, Distribution Channel, And Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, and Czech Republic |

|

Market Leaders Profiled |

General Mills, Kellogg Company, Nestle Inc., PepsiCo Inc. and The Coca-Cola Company |

SEGMENTAL ANALYSIS

By Type Insights

The Ready to Eat (RTE) segment dominated the cereals market in Europe in 2023. The domination of the segment is majorly driven by their convenience and alignment with busy, modern lifestyles. As of 2023, RTE cereals account for nearly 70% of the total cereal market. This dominance is driven by the growing demand for quick, convenient, and nutritious meal options. With busy consumers, particularly working adults and families, RTE cereals offer an easy breakfast or snack, often fortified with essential vitamins, minerals, and fiber. The segment's popularity is also bolstered by the increasing preference for healthier, on-the-go breakfast options, as 40% of global consumers now prioritize convenience in food choices. This growing demand for time-saving solutions underscores the importance of RTE cereals in meeting modern dietary needs.

On the other hand, the hot cereals segment is rapidly growing and is anticipated to witness the fastest-growing segment in the European market over the forecast period. This growth is largely attributed to the rising consumer focus on health and wellness. Hot cereals, particularly those made from whole grains like oats, offer significant health benefits, including high fiber content and heart-healthy properties. As more consumers adopt plant-based and gluten-free diets, hot cereals made from oats, quinoa, and other whole grains are becoming more popular. Furthermore, the increasing awareness of the gut health benefits of whole grain consumption, which can help reduce the risk of chronic diseases such as type 2 diabetes, has fueled demand. In fact, hot cereal consumption is expected to rise in the coming years due to its reputation as a wholesome, nutrient-dense breakfast choice.

By Ingredient Type Insights

The wheat segment led the cereals market in Europe by accounting for 46.4% of the market share in 2023. Wheat is the largest ingredient type in the global cereals market, commanding a substantial share due to its versatility, availability, and nutritional value. Wheat is a staple ingredient in a wide variety of breakfast cereals, including both hot and ready-to-eat (RTE) varieties, due to its cost-effectiveness and ability to provide essential nutrients like fiber, protein, and B vitamins. Furthermore, wheat-based cereals are commonly fortified with additional vitamins and minerals, which makes them popular for consumers seeking a convenient yet nutritious breakfast. The widespread cultivation of wheat across Europe, North America, and Asia further reinforces its dominance. This segment’s importance is also tied to the demand for whole grain cereals, as whole wheat is a key component in meeting consumer interest in high-fiber, heart-healthy options.

However, the rice segment is estimated to be the fastest-growing ingredient segment in the European cereals market and is predicted to showcase a CAGR of 7.3% over the forecast period. This growth is driven by the increasing consumer preference for gluten-free and allergen-free cereals. Rice, being naturally gluten-free, is particularly popular among individuals with gluten sensitivities or those following gluten-free diets, which are gaining traction globally. The rising awareness of gluten-related health issues, such as celiac disease and non-celiac gluten sensitivity, has contributed to the demand for rice-based cereals. Additionally, rice's neutral taste and versatility make it an attractive ingredient for both breakfast cereals and snacks, further expanding its market potential. As consumers continue to prioritize plant-based and allergen-free diets, rice-based cereals are expected to play an increasingly important role in the global market, meeting both nutritional and dietary preferences.

By Distribution Channel Insights

The supermarkets held 48.7% of the European market share in 2023. This dominance is attributed to the wide accessibility, competitive pricing, and extensive product variety that supermarkets offer. Supermarkets are preferred by consumers due to their one-stop shopping experience, where shoppers can easily find a broad range of cereals, including organic, gluten-free, and fortified options. The importance of supermarkets also lies in their ability to cater to diverse consumer preferences, offering both local and international cereal brands. In 2023, over 60% of global grocery shopping occurred through supermarkets, underscoring their central role in consumer purchasing behavior. Additionally, the ability to offer promotions, discounts, and loyalty programs enhances supermarkets’ competitive edge in the cereal market.

The convenience stores segment is anticipated to register the fastest CAGR of 8.54% over the forecast period. This rapid growth is driven by the increasing demand for on-the-go and quick meal options, particularly among busy urban consumers. Convenience stores cater to the growing trend of impulse buying, as they are strategically located in high-traffic areas such as residential neighborhoods and transport hubs. They also offer a range of single-serve or ready-to-eat cereals, which align with consumer preferences for quick, easy, and portable meal solutions. As lifestyles become increasingly fast-paced, the convenience store segment is expected to continue expanding, particularly in urban areas where consumers seek both accessibility and convenience in their food shopping.

REGIONAL ANALYSIS

In the European cereals market, Germany is the largest player, holding a dominant share of the market in 2024. The country’s leadership in the market is attributed to its established consumer base and a long-standing preference for breakfast cereals. Major cereal manufacturers like Nestlé and Kellogg's also contribute significantly to Germany's market dominance.

Following Germany, the UK is another key market, though its growth has slowed in recent years due to breakfast cereals being a staple food. The UK’s market is expected to see moderate growth moving forward, as cereal consumption remains steady, but it is already well-penetrated. The UK market is mature and faces less expansion potential compared to other European countries.

France holds a significant share of the European cereals market but is also showing slower growth. The French market is mature, and while cereals are a common part of the diet, growth has stagnated, particularly in traditional cereal categories.

On the other hand, Italy is experiencing the fastest growth in the region. With a healthy CAGR, Italy’s cereal market is expanding due to increasing demand for convenience foods, especially ready-to-eat (RTE) cereals. Italian consumers are shifting toward healthier, more nutritious options, and this trend is driving the demand for cereals in the country. The popularity of organic and functional cereals is also contributing to Italy’s rapid market growth.

Spain is another important market, showing steady growth but not at the same rate as Italy. The Spanish market is benefiting from increasing health awareness, with a growing interest in whole grains and organic cereals, but its growth is more gradual compared to Italy’s. As consumer preferences shift toward convenience and healthier options, Spain's cereal market is expected to continue growing, though not as quickly as Italy.

KEY MARKET PLAYERS

General Mills, Kellogg Company, Nestle Inc., PepsiCo Inc. and The Coca-Cola Company are dominating the cereals market in Europe.

MARKET SEGMENTATION

This research report on the European cereals market is segmented and sub-segmented into the following categories.

By Type

- Hot Cereals

- Ready To Eat Cereals

By Ingredient Type

- Rice

- Wheat

- Corn

- Barley

- Others

By Distribution Channel

- Supermarkets

- Hypermarkets

- Independent Retailers

- Specialist Retailers

- Convenience Stores

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1.What are the main types of cereals consumed in Europe?

Europeans consume a variety of cereals, including wheat, rice, oats, corn (maize), barley, and rye. These cereals are used in various forms such as bread, pasta, breakfast cereals, snacks, and beverages.

2.How do manufacturers in Europe innovate in the cereals market?

Manufacturers in Europe innovate in the cereals market by introducing new product varieties, flavors, and formulations to meet changing consumer preferences and dietary trends. This includes developing gluten-free, organic, and fortified cereal products, as well as incorporating functional ingredients such as seeds, nuts, fruits, and superfoods to enhance nutritional value and appeal to health-conscious consumers.

3.Are there any emerging trends or innovations in the cereals market in Europe?

Yes, there are several emerging trends and innovations in the cereals market in Europe, including the rise of plant-based and vegan cereal options, the development of on-the-go and single-serve cereal products for convenience, the use of sustainable and eco-friendly packaging materials, and the integration of digital technologies for personalized nutrition and marketing initiatives. Additionally, there is growing interest in ancient and heirloom cereal varieties, as well as alternative grains and pseudo-cereals, as consumers seek diversity and novelty in their cereal choices.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]