Europe Ceramic Ball Bearings Market Size, Share, Trends & Growth Forecast Report – Segmented By Raw Material, Product Type, Application And By Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe) - Industry Analysis From (2025 to 2033)

Europe Ceramic Ball Bearings Market Size

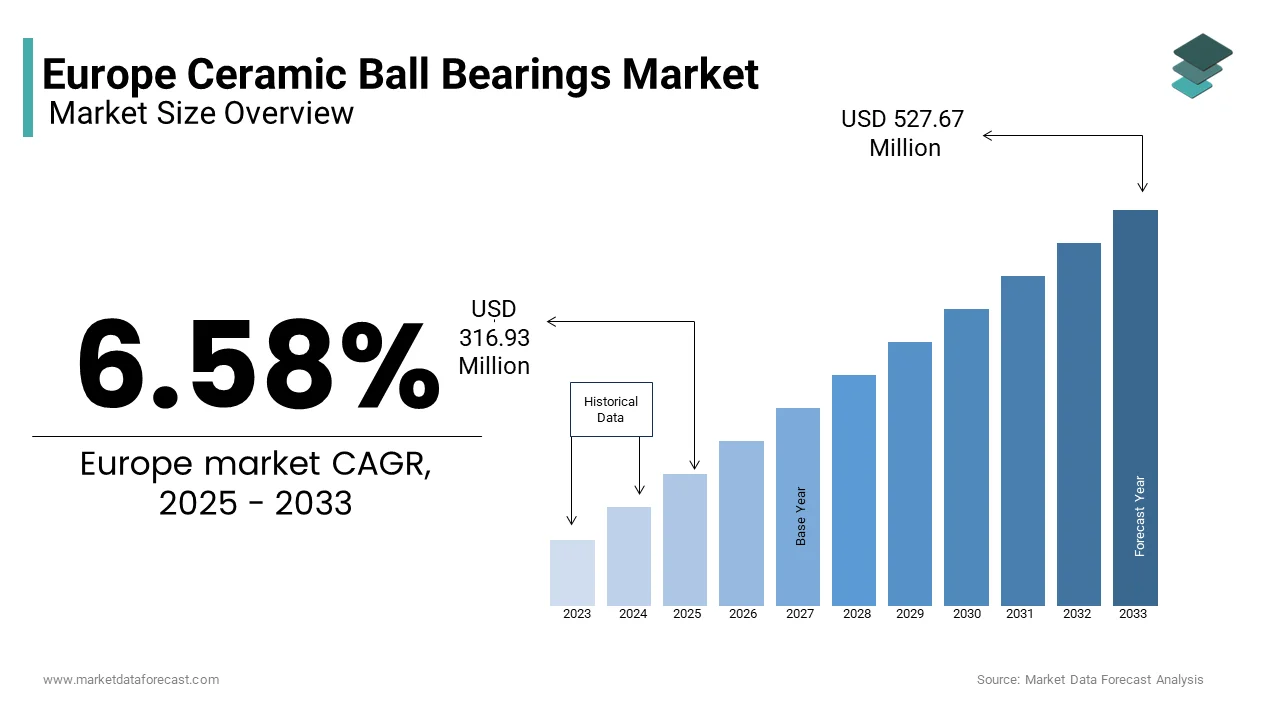

The Europe ceramic ball bearing market size was valued at USD 297.36 million in 2024 and is anticipated to reach USD 316.93 million in 2025 from USD 527.67 million by 2033, growing at a CAGR of 6.58% from 2025 to 2033.

Ceramic ball bearings are advanced mechanical components that utilize ceramic materials, such as silicon nitride or zirconia, for their rolling elements, offering superior properties compared to traditional steel bearings. These include higher corrosion resistance, lower weight, increased operational speeds, and reduced friction, making them ideal for demanding industries such as aerospace, automotive, medical devices, and industrial machinery.

The demand for ceramic ball bearings is growing significantly in Europe owing to the increasing adoption of lightweight and energy-efficient components in electric vehicles (EVs) and renewable energy systems. As per the European Automobile Manufacturers' Association highlights, EV production in Europe grew by over 30% in 2022 and creating significant opportunities for ceramic bearings in motor assemblies and drivetrains. Additionally, the International Labour Organization notes that the rise of Industry 4.0 and smart manufacturing has spurred demand for precision-engineered components capable of withstanding high-speed operations and harsh environments. Countries like Germany, France, and Italy lead the market due to their robust industrial bases and focus on technological innovation. Despite challenges such as high production costs and limited awareness among small-scale manufacturers, the market remains resilient, supported by advancements in material science and government initiatives promoting sustainable industrial practices. As Europe continues to prioritize efficiency and sustainability, the ceramic ball bearings market is poised for transformative growth.

MARKET DRIVERS

Growing Demand in Electric Vehicles

One of the primary drivers of the Europe ceramic ball bearings market is the surging demand for electric vehicles (EVs), which require lightweight and high-performance components to enhance efficiency. The European Automobile Manufacturers' Association reports that EV production in Europe increased by over 30% in 2022, with sales projected to grow at a CAGR of 15% through 2028. Ceramic ball bearings, known for their low weight and ability to operate at high speeds with minimal friction, are increasingly used in EV motor assemblies and drivetrains. As per the International Labour Organization, these bearings reduce energy losses by up to 20% compared to traditional steel bearings, which is making them vital for improving EV range and performance. Additionally, government policies promoting sustainable transportation, such as subsidies for EV adoption, further boost demand. As Europe accelerates its transition to electric mobility, ceramic ball bearings play a pivotal role in supporting this shift.

Expansion in Renewable Energy Applications

Another significant driver is the growing adoption of ceramic ball bearings in renewable energy systems, particularly wind turbines and solar tracking systems. The European Environment Agency notes that renewable energy accounted for 40% of electricity generation in Europe in 2022, driven by ambitious climate goals under the EU Green Deal. Ceramic ball bearings are preferred in wind turbine generators due to their corrosion resistance and ability to withstand extreme conditions, reducing maintenance costs by 25%, as per Eurostat. Furthermore, the International Labour Organization emphasizes that advancements in solar panel technology have increased the use of precision bearings in solar trackers, enhancing energy capture efficiency. With investments in renewable energy infrastructure exceeding €300 billion annually, the demand for durable and high-performance ceramic ball bearings continues to rise, solidifying their importance in Europe’s sustainable energy transition.

MARKET RESTRAINTS

High Production and Material Costs

One of the major restraints in the Europe ceramic ball bearings market is the high production and material costs associated with manufacturing these advanced components. The European Commission’s Directorate-General for Industry reports that ceramic materials like silicon nitride are up to 5 times more expensive than traditional steel, significantly increasing the overall cost of ceramic ball bearings. Eurostat highlights that small and medium-sized enterprises (SMEs), which account for over 90% of industrial businesses in Europe, often struggle to afford these premium components, limiting their adoption. Additionally, the International Labour Organization notes that the specialized manufacturing processes required for ceramics, such as sintering and precision machining, further escalate production expenses by 20-30%. This financial barrier restricts widespread use, particularly in cost-sensitive industries, hindering market growth despite the superior performance of ceramic ball bearings.

Limited Awareness Among Small-Scale Manufacturers

Another key restraint is the limited awareness and understanding of ceramic ball bearings among small-scale manufacturers, particularly in less industrialized regions of Europe. The European Machinery Association reports that nearly 45% of SMEs in Eastern and Southern Europe lack adequate knowledge about the benefits of ceramic bearings compared to traditional alternatives. This gap in awareness results in underutilization, even in applications where they could offer significant advantages, such as reduced maintenance costs and improved efficiency. The International Labour Organization highlights that only 30% of small-scale manufacturers actively seek advanced bearing solutions due to insufficient technical training and marketing efforts by suppliers. Without targeted education campaigns or incentives, many businesses remain hesitant to adopt ceramic ball bearings, slowing market penetration and limiting its potential for broader adoption across Europe.

MARKET OPPORTUNITIES

Advancements in Material Science and Innovation

A significant opportunity in the Europe ceramic ball bearings market lies in advancements in material science, which are enhancing performance and reducing costs. The European Environment Agency highlights that innovations in composite ceramics, such as hybrid silicon nitride, have improved durability by 30% while lowering production expenses by 15% over the past five years. These advancements make ceramic ball bearings more accessible to industries like aerospace and medical devices, where precision and reliability are critical. Eurostat reports that the demand for high-performance bearings in these sectors is projected to grow at a CAGR of 8.5% through 2028, driven by technological breakthroughs. Additionally, government funding for R&D in advanced materials, exceeding €20 billion annually, supports further innovation. As manufacturers continue to refine ceramic technologies, the market is poised to unlock new applications and expand its reach across diverse industrial domains.

Growing Adoption in Industrial Automation and Robotics

Another major opportunity is the increasing adoption of ceramic ball bearings in industrial automation and robotics, fueled by Europe’s leadership in Industry 4.0 initiatives. The International Labour Organization notes that the robotics market in Europe is expected to grow at a CAGR of 12% from 2023 to 2028, creating significant demand for lightweight, high-speed bearings. Ceramic ball bearings, with their ability to operate at higher speeds and resist wear in harsh environments, are ideal for robotic joints and automated machinery. Eurostat highlights that over 60% of manufacturing facilities in Europe are transitioning to smart manufacturing systems, driving the need for precision components. Furthermore, the European Commission’s focus on digital transformation has led to investments exceeding €150 billion in automation technologies. This trend positions ceramic ball bearings as a critical enabler of efficiency and innovation in Europe’s industrial landscape.

MARKET CHALLENGES

High Initial Investment Barrier for Manufacturers

One of the significant challenges in the Europe ceramic ball bearings market is the high initial investment required for production, which limits entry and expansion for smaller manufacturers. The European Commission’s Directorate-General for Industry reports that setting up a facility to produce ceramic ball bearings can cost up to €50 million, primarily due to the need for specialized equipment like high-temperature sintering furnaces. Eurostat highlights that over 70% of small-scale manufacturers in Europe cite financial constraints as a barrier to adopting advanced manufacturing technologies. Additionally, the International Labour Organization notes that the complexity of ceramic material processing increases operational costs by 25-30%, further deterring new entrants. This financial burden disproportionately affects SMEs, particularly in Eastern Europe, where access to capital is limited. As a result, the market remains concentrated among larger players, slowing broader innovation and competition.

Supply Chain Vulnerabilities and Raw Material Dependency

Another key challenge is the vulnerability of supply chains and dependency on imported raw materials, such as silicon nitride and zirconia, which are critical for ceramic ball bearing production. The European Environment Agency reports that over 80% of these materials are sourced from non-EU countries, exposing manufacturers to geopolitical risks and price volatility. Eurostat highlights those disruptions in global trade, exacerbated by recent geopolitical tensions, have increased raw material costs by 15-20% since 2020, impacting production timelines. Furthermore, the International Labour Organization emphasizes that limited domestic mining and processing capabilities in Europe force manufacturers to rely heavily on imports, creating logistical inefficiencies. These supply chain challenges hinder the scalability of ceramic ball bearing production, making it difficult for the market to meet growing demand across key industries like automotive and renewable energy.

SEGMENTAL ANALYSIS

By Raw Material

The silicon nitride segment was the largest in the Europe ceramic ball bearings market and accounted for 60.8% of the European market share in 2024. The superior properties of silicon nitride, including high strength, low density, and resistance to extreme temperatures that are ideal for EVs and wind turbines is majorly driving the growth of the silicon nitride segment in the European market. According to the International Labour Organization, silicon nitride reduces friction by 40% compared to steel bearings and enhances efficiency. With the focus of Europe on sustainability and technological innovation, silicon nitride remains vital for advancing high-performance applications.

The zirconium oxide segment is anticipated to register the highest CAGR of 7.8% over the forecast period due to the increasing demand in medical devices and industrial machinery, where its toughness and biocompatibility are unmatched. As per the European Machinery Association, zirconium oxide is widely used in surgical tools. Government investments in healthcare infrastructure further boost adoption. Its ability to withstand thermal shocks and mechanical stress makes it indispensable for specialized applications, positioning zirconium oxide as a key material for high-value, niche markets in Europe.

By Product Type

The hybrid ceramic ball bearings segment led the market by holding 70.4% of the European market share in 2024. The cost-effectiveness and superior performance of hybrid ceramic ball bearings that offer reduced friction and higher durability compared to traditional steel bearings is majorly propelling the growth of the segment in the global market. According to the International Labour Organization, hybrid bearings improve energy efficiency by 25%, making them ideal for electric vehicles (EVs) and industrial machinery. Their affordability and compatibility with high-speed applications, such as wind turbines, further boost adoption. With Europe’s focus on sustainable mobility and renewable energy, hybrid ceramic ball bearings play a critical role in enabling energy-efficient solutions while balancing cost-performance demands, solidifying their dominance in the market.

The full ceramic ball bearings segment is predicted to grow at an impressive CAGR of 8.2% over the forecast period due to their unmatched performance in extreme environments, such as aerospace and medical devices. Advancements in material science have reduced production costs, enhancing accessibility for specialized industries. Additionally, their corrosion resistance and non-magnetic properties make them indispensable for chemical processing and healthcare applications. As Europe prioritizes innovation in advanced engineering and sustainability, full ceramic ball bearings are becoming vital for high-value sectors, driving their rapid expansion in the market.

By Application

The electric motor segment held the major share of 35.6% of the European market share in 2024. Ceramic ball bearings are integral to electric vehicles (EVs) and industrial motors, with over 40% of Europe’s electricity consumption attributed to electric motors, according to the European Environment Agency. Their lightweight and high-speed capabilities align with EU sustainability goals, driving adoption in renewable energy systems and EVs. As Europe prioritizes energy-efficient solutions, ceramic ball bearings remain vital for optimizing motor performance and supporting green initiatives.

The aerospace segment is anticipated to be the fastest growing segment and register a CAGR of 9.1% over the forecast period due to the rising demand for high-temperature-resistant components, capable of withstanding conditions exceeding 800°C. Ceramic ball bearings’ durability and lightweight properties reduce maintenance costs and improve fuel efficiency in aircraft engines. Government investments in aerospace technology, exceeding €20 billion annually, further accelerate adoption. With Europe leading in aerospace innovation, these bearings are critical for ensuring reliability and safety in extreme environments, making them indispensable for advancing the industry’s technological frontiers.

REGIONAL ANALYSIS

Germany stands at the forefront of the European ceramic ball bearings market and occupied 28.7% of the European market share in 2024. The advanced automotive and manufacturing industries of Germany that demand high-performance components is primarily fuelling the ceramic ball bearings market growth in Germany. The growing focus of Germany on precision engineering and innovation in material sciences is further expanding the German market growth.

The UK market is estimated to progress at a CAGR of 5.9% over the forecast period. The nation's aerospace sector plays a pivotal role in driving demand for ceramic ball bearings. Continuous advancements in aerospace technologies have positioned the UK as a key player in this specialized market.

France secures a notable share of European market. The rising emphasis of France on industrial machinery innovations and sustainable manufacturing practices is promoting the French market growth. France's commitment to research and development in high-performance materials further strengthens its competitive edge in the European market.

KEY MARKET PLAYERS

Saint-Gobain (France), SKF (Sweden), CoorsTek, Inc. (U.S.), Tsubaki Nakashima Co., Ltd. (Japan), Tipton Corp. (Japan), Toshiba Materials Co. Ltd. (Japan), Fineway Inc. (Canada), Topack Ceramics Pvt. Ltd. (India), Devson Catalyst Private Limited (India), Madhya Bharat Ceramics (India). These are the market players that are dominating the Europe ceramic ball bearing market.

Market segmentation

This research report on the Europe ceramic ball bearing market is segmented and sub-segmented into the following categories.

By Raw Material

- Zirconium Oxide

- Silicon Nitride

- Others

By Product Type

- Hybrid Ceramic Ball Bearings

- Full Ceramic Ball Bearings

By Application

- Electric Motor

- Automobile

- Under Water Equipment

- Laboratory Equipment

- Aerospace

- Others

By Region

- UK

- Russia

- Germany

- Italy

- France

- Spain

- Sweden

- Denmark

- Poland

- Switzerland

- Netherlands

- Rest of Europe

Frequently Asked Questions

The current market size of the Europe ceramic ball bearing market?

The current market size of the Europe ceramic ball bearing market size was valued at USD 316.93 million in 2025

What are the market drivers that are driving the Europe ceramic ball bearing market?

The Growing demand for electric vehicles and Expansion in renewable energy applications are the market drivers that are driving the europe ceramic ball bearing market.

Who are the market players that are dominating the Europe ceramic ball bearing market?

Saint-Gobain (France), SKF (Sweden), CoorsTek, Inc. (U.S.), Tsubaki Nakashima Co., Ltd. (Japan), Tipton Corp. (Japan), Toshiba Materials Co. Ltd. (Japan), Fineway Inc. (Canada), Topack Ceramics Pvt. Ltd. (India), Devson Catalyst Private Limited (India), Madhya Bharat Ceramics (India).

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]