Europe Caustic Potash Market Size, Share, Trends & Growth Forecast Report – Segmented By Form, Grade, End-Use and By Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe), Industry Analysis From 2025 to 2033

Europe Caustic Potash Market Size

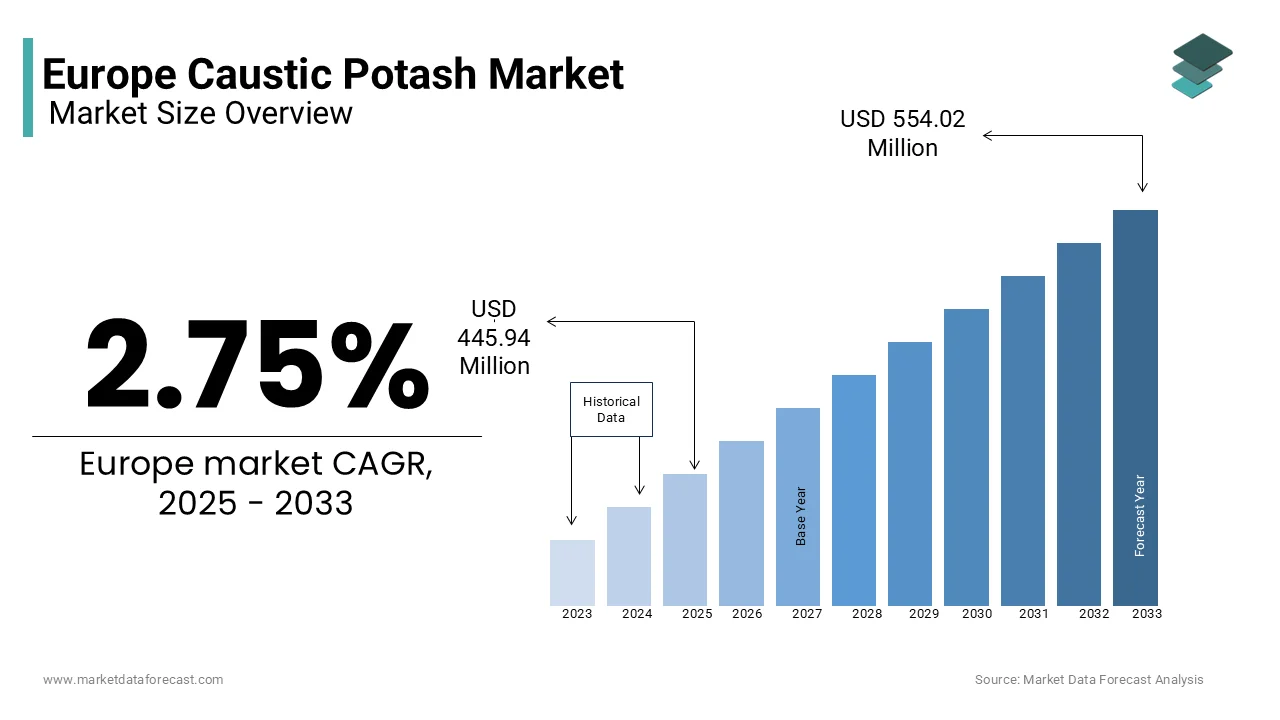

The Europe caustic potash market was valued at USD 434 million in 2024 and is anticipated to reach USD 445.94 million in 2025 from USD 554.02 million by 2033, growing at a CAGR of 2.75% during the forecast period from 2025 to 2033.

Caustic potash is also known as potassium hydroxide (KOH) and is a critical industrial chemical with widespread applications across various sectors, including fertilizers, detergents, and pharmaceuticals. According to the European Chemical Industry Council, caustic potash demand in Europe has grown steadily, driven by its indispensable role in manufacturing potassium-based compounds and its utility in sustainable agricultural practices. The European Union’s emphasis on reducing carbon footprints and promoting eco-friendly solutions has further amplified its importance, particularly in liquid fertilizer production and water treatment processes. Germany and France are among the leading consumers in this region. With an annual production capacity exceeding 1.2 million metric tons, Europe remains a key player in the global caustic potash market. As industries increasingly adopt advanced technologies to enhance efficiency, the demand for high-purity grades of caustic potash is expected to rise, ensuring its continued relevance in both traditional and emerging applications.

MARKET DRIVERS

Rising Demand for Liquid Fertilizers in Europe

The rising demand for liquid fertilizers is a significant driver propelling the Europe caustic potash market forward. According to the European Agri Tech Association, liquid fertilizers account for 35% of total fertilizer consumption in Europe, with caustic potash serving as a key raw material in their formulation. These fertilizers are gaining popularity due to their ease of application and rapid nutrient absorption, particularly in precision agriculture. For instance, the Netherlands, a leader in greenhouse farming, has seen a 20% increase in liquid fertilizer usage over the past five years, according to the Dutch Ministry of Agriculture. Additionally, the United Kingdom’s Department for Environment, Food & Rural Affairs highlights that liquid fertilizers reduce nutrient runoff by 25%, aligning with the EU’s environmental sustainability goals. This trend underscores the pivotal role of caustic potash in supporting modern agricultural practices while addressing ecological concerns.

Growing Use in Detergent and Soap Manufacturing

The growing use of caustic potash in detergent and soap manufacturing is another major driver boosting the market. The International Detergent Association states that potassium-based soaps and detergents account for 40% of the European cleaning products market, valued at €15 billion annually. Caustic potash is preferred over sodium hydroxide due to its ability to produce softer, more soluble soaps that are ideal for sensitive skin. For example, Italy’s personal care industry, which contributes €8 billion to the economy, relies heavily on caustic potash for premium-grade soap production. Furthermore, the French National Institute for Industrial Research highlights that eco-friendly detergents formulated with caustic potash have gained traction, with sales increasing by 15% annually. As consumer preferences shift toward sustainable and biodegradable products, the demand for caustic potash in this sector is set to grow significantly.

MARKET RESTRAINTS

High Production Costs and Energy Dependency

High production costs and energy dependency are significant restraints to the growth of the Europe caustic potash market. The European Chemical Industry Council estimates that energy expenses account for 40% of the total production cost of caustic potash, making it highly sensitive to fluctuations in energy prices. For instance, Germany’s reliance on natural gas for industrial processes has led to a 25% increase in production costs since 2021, as reported by the German Federal Ministry of Economics. Additionally, the stringent environmental regulations imposed by the European Union require manufacturers to adopt energy-efficient technologies, further raising operational expenses. In regions like Eastern Europe, where infrastructure is less developed, these challenges are exacerbated, limiting market expansion. While subsidies and renewable energy initiatives aim to mitigate these issues, their impact remains insufficient to address the growing cost pressures faced by producers.

Limited Availability of Raw Materials

The limited availability of raw materials, particularly potassium chloride is another major restraint for the Europe caustic potash market. The International Fertilizer Association reports that Europe imports over 70% of its potassium chloride, primarily from Canada and Belarus, due to the lack of domestic reserves. This dependency on imports creates supply chain vulnerabilities, as evidenced by the 2022 geopolitical tensions that disrupted global potassium trade. For example, Russia’s export restrictions led to a 30% spike in raw material prices, severely impacting manufacturers in countries like Spain and Turkey. The Swiss Chemical Society highlights that the scarcity of affordable raw materials has forced some small-scale producers to halt operations, reducing overall market capacity. Without strategic investments in alternative sourcing or recycling technologies, the market risks stagnation amid growing demand.

MARKET OPPORTUNITIES

Expansion into Pharmaceutical Applications

The expansion of caustic potash into pharmaceutical applications is a major opportunity for market players seeking to diversify their portfolios. The European Pharmaceutical Manufacturers Association forecasts that the pharma-grade caustic potash market will grow at a CAGR of 7% through 2030, driven by its use in synthesizing active pharmaceutical ingredients (APIs) and excipients. For instance, Sweden’s biotech sector, valued at €5 billion, relies on high-purity caustic potash for producing potassium-based medications, such as electrolyte supplements. Additionally, the Italian Ministry of Health highlights that advancements in drug delivery systems have increased the demand for caustic potash in formulating controlled-release tablets. As Europe continues to invest in healthcare innovation and aging populations drive pharmaceutical consumption, the adoption of caustic potash in this sector is poised to accelerate, unlocking new revenue streams for manufacturers.

Adoption in Renewable Energy Technologies

The adoption of caustic potash in renewable energy technologies offers immense potential to drive market growth. The European Renewable Energy Council states that potassium hydroxide is a critical component in the production of hydrogen fuel cells and battery electrolytes, both of which are integral to the continent’s green energy transition. For example, Denmark’s wind energy sector, which accounts for 47% of its electricity generation, uses caustic potash in alkaline electrolysers to produce green hydrogen. Similarly, Germany’s Federal Ministry for Economic Affairs highlights that the demand for potassium-based electrolytes in lithium-ion batteries has surged by 20% annually, supporting the electric vehicle revolution. As Europe accelerates its commitment to achieving net-zero emissions by 2050, the role of caustic potash in enabling clean energy solutions is set to expand, positioning it as a cornerstone of sustainable industrial development.

MARKET CHALLENGES

Stringent Environmental Regulations

Stringent environmental regulations is a significant challenge to the Europe caustic potash market, particularly for small and medium-sized enterprises. The European Environment Agency mandates rigorous emission controls and waste management protocols, requiring manufacturers to invest heavily in compliance measures. For instance, the French National Institute for Industrial Research reports that upgrading facilities to meet REACH regulations can increase operational costs by 30%, deterring new entrants. Additionally, the German Federal Ministry of Economics highlights that non-compliance penalties, which can exceed €1 million per violation, create financial risks for companies operating on thin margins. While these regulations aim to promote sustainability, their complexity and cost burden often hinder innovation and market expansion, necessitating proactive strategies to balance regulatory adherence with profitability.

Competition from Substitute Products

Competition from substitute products threatens the growth of the Europe caustic potash market, particularly in low-cost applications. The International Chemical Trade Association reports that sodium hydroxide, a cheaper alternative, captures 60% of the market share in non-specialized applications like wastewater treatment. For example, Spain’s municipal water treatment plants have shifted to sodium hydroxide due to its 25% lower cost, as stated by the Spanish Ministry of Environment. Additionally, advancements in bio-based alternatives, such as enzymatic detergents, are gaining traction, reducing reliance on traditional chemicals. The Swiss Chemical Society highlights that these substitutes not only undercut pricing but also align with consumer preferences for eco-friendly options, intensifying competitive pressures. To maintain market relevance, caustic potash manufacturers must innovate and differentiate their offerings, emphasizing unique advantages over competing solutions.

SEGMENTAL ANALYSIS

By Form

The solid caustic potash segment dominated the market by accounting for 58.7% of the European market share in 2024. The stability and ease of storage of solid caustic potash is making it ideal for industrial applications like potassium carbonate production, which is primarily driving the domination of the solid segment in the European market. The German Federal Ministry of Economics reports that solid forms are preferred in sectors requiring high-purity inputs, such as pharmaceuticals, where contamination risks must be minimized. Additionally, their compatibility with automated handling systems enhances operational efficiency, driving widespread adoption. The segment's leadership reflects its critical role in ensuring consistent quality and reliability across diverse applications, making it indispensable for large-scale industrial use.

The liquid segment is the fastest-growing segment and is predicted to grow at the fastest CAGR of 8.87% over the forecast period owing to the increasing use in liquid fertilizers and water treatment, where rapid dissolution and uniform distribution are essential. For instance, the Netherlands’ greenhouse farming sector has adopted liquid caustic potash to optimize nutrient delivery, improving crop yields by 15%. Its versatility and ease of integration into existing systems align with the growing emphasis on efficiency and sustainability, making it a focal point for future innovations.

By Grade

The industrial-grade segment captured the major share of 53.7% of the European market share in 2024. The widespread use of industrial grade caustic potash in manufacturing processes, such as soap production and chemical synthesis is primarily propelling the growth of the industrial grade segment in the European market. The Italian Ministry of Industry reports that industrial-grade caustic potash has reduced production costs by 20% in detergent manufacturing, highlighting its economic advantages. Additionally, its scalability and cost-effectiveness make it a preferred choice for large-scale operations, underscoring its leadership position in the market.

The pharma-grade caustic potash segment is predicted to exhibit the highest CAGR of 9.4% over the forecast period owing to the rising demand for pharma grade caustic potash in producing high-purity APIs and excipients, particularly in countries like Sweden and Switzerland. For example, advancements in drug formulations have increased the demand for pharma-grade inputs, ensuring compliance with stringent regulatory standards. Its ability to meet the exacting requirements of the pharmaceutical industry positions it as a key growth driver in the coming years.

By End Use

The potassium carbonate occupied the leading share of the global caustic potash market in 2024. The domination of potassium segment in the European market is attributed to its extensive use in glass manufacturing and food additives, where purity and consistency are paramount. The French National Institute for Industrial Research reports that potassium carbonate derived from caustic potash has improved product quality by 25% in the glass industry, underscoring its importance. The segment's leadership reflects its versatility and critical role in supporting high-value applications across multiple industries.

The agricultural chemicals segment is growing significantly and is anticipated to witness the fastest CAGR of 10.8% over the forecast period. The rising demand for sustainable farming solutions, particularly in liquid fertilizers and pest control products is driving the growth of the agricultural chemicals segment in the European market. For instance, Germany’s agricultural sector has adopted caustic potash-based formulations to enhance soil fertility, reducing nitrogen losses by 30%. Its alignment with eco-friendly practices makes it a cornerstone of modern agriculture, driving its rapid adoption.

REGIONAL ANALYSIS

Germany is the leading country in the European caustic potash market and accounted for the major share of the European market in 2024. The country’s robust chemical industry, which is one of the largest in the world, significantly drives the demand for caustic potash, primarily used in fertilizers, food processing, and industrial applications. According to the German Chemical Industry Association (VCI), the chemical sector generated around €200 billion in revenue in 2020, with potassium compounds playing a crucial role in agricultural productivity. The increasing focus on sustainable agriculture and the need for high-quality fertilizers to enhance crop yields have further propelled the demand for caustic potash. Additionally, Germany's commitment to environmental regulations and sustainable practices has led to innovations in production processes, making it a key player in the caustic potash market.

France holds a significant share of the European caustic potash market. The growth of the French market is driven by its strong agricultural sector and the increasing demand for high-quality fertilizers. The French Ministry of Agriculture reported that agriculture contributes about €75 billion to the national economy, with potassium fertilizers being essential for improving soil fertility and crop yields. The growing trend towards organic farming and sustainable agricultural practices has also led to an increased adoption of caustic potash, as it is considered a more environmentally friendly option compared to other potassium sources. Furthermore, France's strategic location in Europe facilitates trade and distribution, enhancing its position in the caustic potash market. The presence of major chemical companies, such as Arkema and Solvay, further strengthens the competitive landscape, driving innovation and product development.

Italy is playing a leading role in the European caustic potash market currently owing to the strong emphasis on agricultural production and food processing. The Italian agricultural sector is vital to the economy, contributing around €40 billion annually, and potassium fertilizers are crucial for enhancing crop quality and yield. According to the Italian Ministry of Agricultural, Food and Forestry Policies, the demand for high-quality fertilizers has been rising, particularly in the cultivation of fruits and vegetables. The increasing focus on sustainable farming practices and the adoption of precision agriculture techniques have further driven the demand for caustic potash. Additionally, Italy's diverse agricultural landscape, which includes a variety of crops, necessitates the use of effective fertilizers, positioning it as a key player in the caustic potash market.

Spain holds a notable share of the European caustic potash market. The extensive agricultural sector of Spain particularly in the cultivation of fruits, vegetables, and olives is driving the Spanish market growth. The Spanish Ministry of Agriculture reported that agriculture contributes around €50 billion to the national economy, with potassium fertilizers being essential for improving crop yields and quality. The increasing demand for organic produce and sustainable farming practices has led to a growing adoption of caustic potash, as it is recognized for its effectiveness in enhancing soil fertility. Furthermore, Spain's favorable climate conditions and diverse agricultural practices support the use of high-quality fertilizers, making it a significant player in the caustic potash market. The presence of key companies like Fert Iberia and EuroChem enhances competition and innovation in the sector.

The Netherlands is another key player in the European caustic potash market. The advanced agricultural practices and strong focus on horticulture of Netherlands is fuelling the market growth in this country. The Dutch agricultural sector is known for its high productivity and innovation, contributing around €30 billion to the national economy. The country is a leading exporter of agricultural products, and the demand for high-quality fertilizers, including caustic potash, is essential for maintaining crop yields and quality. According to the Dutch Ministry of Agriculture, Nature and Food Quality, the emphasis on sustainable farming practices and precision agriculture has led to increased adoption of potassium fertilizers. Additionally, the Netherlands' strategic location in Europe facilitates trade and distribution, enhancing its position in the caustic potash market. The presence of major agricultural companies and research institutions further drives innovation and development in the sector.Top of Form

MARKET SEGMENTATION

This research report on the Europe caustic potash market is segmented and sub-segmented into the following categories.

By Form

- Solid

- Liquid

By Grade

- Industrial

- Reagent

- Pharma

By End Use

- Potassium Carbonate

- Potassium Phosphates

- Potassium Soaps and Detergents

- Liquid Fertilizers

- Agricultural Chemicals

- Others

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What is driving the demand for caustic potash in Europe?

Increasing use in fertilizers, chemicals, and pharmaceuticals industries.

Which industries are the major consumers of caustic potash?

Agriculture, food processing, pharmaceuticals, and industrial manufacturing.

What are the key challenges in the caustic potash market?

Supply chain disruptions, fluctuating raw material costs, and environmental regulations.

Which countries dominate the European caustic potash market?

Germany, France, and the UK lead in production and consumption.

How is the market expected to grow in the coming years?

Rising demand for potassium-based fertilizers and industrial applications is expected to drive steady growth.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]