Europe Carpets and Rugs Market Size, Share, Trends & Growth Forecast Report By Type (Tufted, Woven, Needle-Punched, Knotted, and Others), Material, End-User, and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2025 to 2033

Europe Carpets and Rugs Market Size

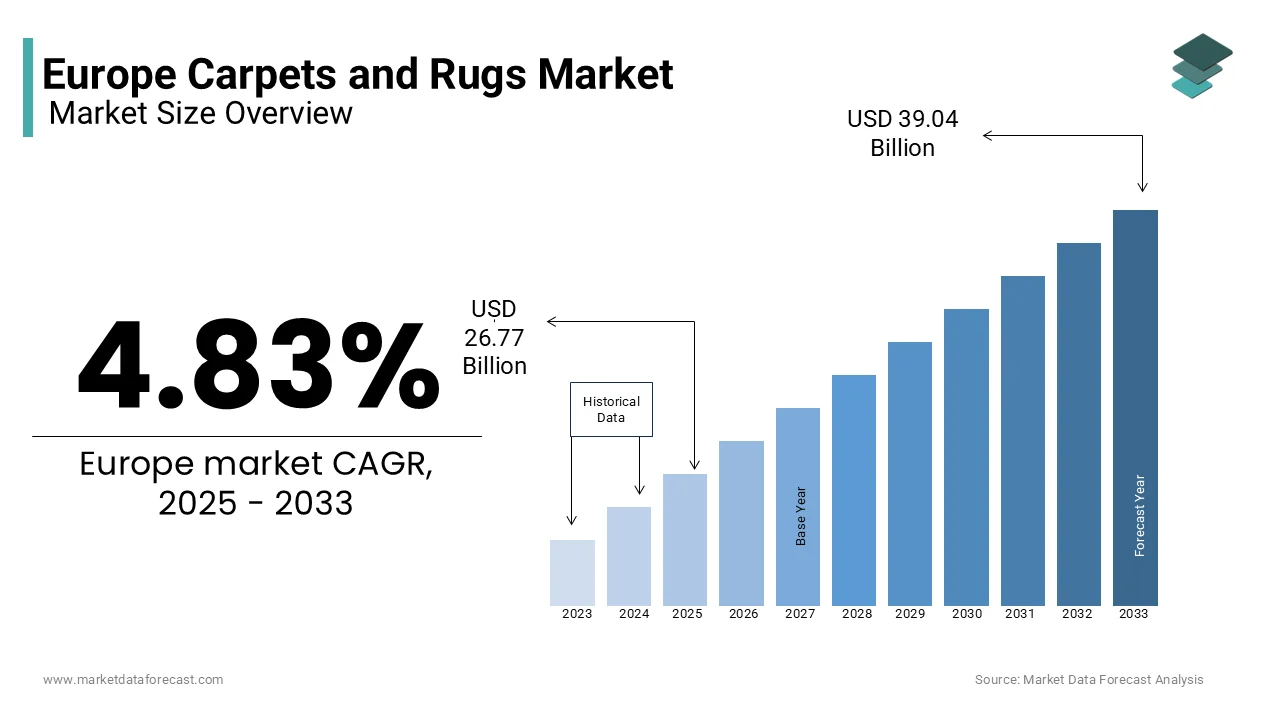

The Europe carpets and rugs market size was valued at USD 25.54 billion in 2024. The European market is estimated to be worth USD 39.04 billion by 2033 from USD 26.77 billion in 2025, growing at a CAGR of 4.83% from 2025 to 2033.

The Europe carpets and rugs market comes under the umbrella of home furnishings and interior design industries. It refers to the field involving the production, distribution, and sale of floor coverings made from materials such as wool, nylon, polyester, polypropylene, or natural fibers (e.g., jute, sisal). These products are ranging from tufted carpets to hand-knotted rugs which serve both functional and aesthetic purposes and offers insulation, comfort, and decorative appeal. The European market is showing steady consumer demand despite economic fluctuations. The diverse cultural heritage and architectural styles in the region have fostered a strong preference for high-quality, durable, and visually appealing floor coverings.

As per the European Carpet and Rug Association, the residential segment accounts for over 65% of total market share that is driven by increasing homeownership rates and a growing emphasis on home improvement projects. Additionally, advancements in manufacturing technologies have enabled the production of eco-friendly and sustainable carpets which align with the region's stringent environmental regulations. According to the German Environmental Agency, more than 30% of carpets sold in Europe in 2022 were made from recycled or biodegradable materials, drawing attention to the industry's shift towards sustainability. Furthermore, the rise of e-commerce platforms has expanded accessibility by allowing consumers to explore a wide range of designs and materials and thereby fuelling market growth.

MARKET DRIVERS

Increasing Homeownership and Renovation Activities

The rising trend of homeownership and home renovation activities across the region is a significant driver of the Europe carpets and rugs market. As per the Eurostat, homeownership rates in Western Europe exceeded 60% in 2022 to create a robust demand for interior decoration products including carpets and rugs. This pattern is especially evident in countries like Germany and France, where urban dwellers are increasingly investing in home improvement projects. For instance, the French Ministry of Housing states that spending on home renovations increased by 15% in 2022 compared to the previous year, with flooring solutions accounting for a substantial portion of expenditures. Also, the residential segment's dominance is further backed by demographic shifts. In accordance with the UK Office for National Statistics, millennials represent the largest cohort of first-time homebuyers, with above 70% prioritizing interior aesthetics during their purchases. Such consumer behavior has fueled demand for premium carpets and rugs, particularly those featuring contemporary designs and sustainable materials.

Growing Emphasis on Sustainability and Eco-Friendly Products

The growing emphasis on sustainability and the adoption of eco-friendly carpets and rugs is another vital driver for the Europe Carpets and Rugs Market. As mentioned by the European Environmental Bureau, over 40% of European consumers now prioritize environmentally responsible products when making purchasing decisions. This change in consumer preferences has catalyzed the development of carpets made from recycled materials like PET bottles and biodegradable fibers. For example, the Italian Ministry of Ecological Transition reveals that sales of eco-friendly carpets increased by 25% in 2022 and is driven by government incentives and subsidies for sustainable manufacturing practices. Further, advancements in material science have further bolstered this trend. The Swedish Environmental Protection Agency remarks that innovations in bio-based polymers have lowered the carbon footprint of carpet production by 20% over the past five years. Additionally, certifications such as the EU Ecolabel have enhanced consumer trust, accelerating the adoption of sustainable products across the region.

MARKET RESTRAINTS

High Production Costs and Pricing Pressures

The elevated production costs related to these products are among the primary restraints hindering the progress of the Europe carpets and rugs market. The European Commission states that the cost of raw materials such as nylon and polyester has increased by 18% since 2020 due to supply chain disruptions and rising energy prices. This cost disparity is signifying in the final pricing, making premium carpets and rugs less competitive in price-sensitive markets. For instance, data from the UK Department for Business, Energy & Industrial Strategy indicates that high-end carpets are priced 30-40% higher than mass-market alternatives, deterring budget-conscious consumers. The impact of high costs is particularly noticeable in Eastern European countries, where spendable income levels are comparably lower. Eurostat identifies that households in Romania and Bulgaria allocate only 10% to 15% of their monthly expenditure to home furnishings, leaving limited room for premium-priced products. Consequently, the adoption rate of high-quality carpets and rugs in these regions remains sluggish and is posing a major challenge to market expansion.

Limited Awareness of Product Maintenance and Durability

The lack of widespread consumer awareness regarding the maintenance and durability of carpets and rugs is another critical restraint for the European market. As per a survey conducted by the European Consumer Organization, over 60% of respondents were unaware of the differences between various types of carpets, such as tufted, woven, and needle-punched varieties. This knowledge gap often leads to improper care practices to reduce the lifespan of these products and decreasing their value proposition. For instance, the Dutch Ministry of Infrastructure and Water Management stresses that only 40% of consumers follow manufacturer-recommended cleaning guidelines, resulting in premature wear and tear. Misconceptions about durability also contribute to skepticism among consumers. According to the German Federal Institute for Risk Assessment, nearly 45% of consumers believe that synthetic carpets are less durable than natural fiber alternatives, which is not always accurate. Such misunderstandings reduce consumer confidence and slow down the market penetration, particularly in regions with weaker distribution networks.

MARKET OPPORTUNITIES

Rising Demand for Customization and Personalization

The growing demand for customized and personalized carpets and rugs gives an attractive prospect for market growth in Europe. Based on the information shared by the European Design Institute, over 50% of consumers prefer bespoke home furnishings that reflect their individual tastes and preferences. This trend is especially evident in affluent urban areas, where disposable incomes are higher. For example, the French Ministry of Culture said that custom-designed rugs accounted for 20% of total rug sales in Paris in 2022 to show their popularity among high-net-worth individuals. Technological advancements have further facilitated customization. As per the Italian Ministry of Economic Development, digital printing technologies have reduced production lead times by 30%, enabling manufacturers to offer tailored designs at competitive prices. Additionally, e-commerce platforms have expanded accessibility, allowing consumers to visualize and order custom products online, thereby enhancing customer engagement.

Expansion into Non-Residential and Commercial Segments

Another promising opportunity lies in the expansion of carpets and rugs into non-residential and commercial segments such as offices, hotels, and retail spaces is providing another promising opportunity for the market. According to the European Property Federation, the commercial real estate market in Europe grew by 12% in 2022, creating a substantial demand for durable and aesthetically pleasing flooring solutions. For instance, the Spanish Ministry of Tourism states that luxury hotels in Spain have replaced 30% of their traditional flooring with high-performance carpets and is demonstrating their commitment to enhancing guest experiences. Government initiatives have further accelerated adoption. In accordance with the German Federal Ministry for Economic Affairs, funding programs for sustainable building practices have incentivized the use of eco-friendly carpets in institutional settings, further expanding market opportunities.

MARKET CHALLENGES

Supply Chain Disruptions and Raw Material Scarcity

A grave challenge facing the Europe carpets and rugs market is the vulnerability of supply chains and the scarcity of raw materials required for production. The European Chemical Industry Council reveal that the production of synthetic fibers such as nylon and polyester relies heavily on petrochemical feedstocks, which are subject to price volatility and geopolitical tensions. For example, the UK Department for Business, Energy & Industrial Strategy notes that global crude oil prices increased by 25% in 2022, impacting the availability and affordability of raw materials. Geopolitical tensions and trade restrictions have further strained supply chains. As mentioned by the European Commission, imports of key raw materials from Asia were disrupted in 2022, leading to production delays and increased costs for manufacturers. These challenges pose significant barriers to scaling up production and meeting rising demand.

Environmental Concerns and Regulatory Compliance

A critical challenge is the increasing scrutiny of the environmental impact of carpet production and disposal. According to the European Environmental Agency, carpets account for approximately 3% of total household waste in Europe, with only 20% being recycled. This inefficiency has prompted governments to enforce stricter regulations on waste management and recycling. For instance, the French Ministry of Ecological Transition reports that non-compliance with recycling mandates resulted in fines exceeding €50 million for manufacturers in 2022. The absence of standardized recycling processes further exacerbates the issue. According to the German Federal Environment Agency, inconsistent recycling practices across member states lead to improper disposal, undermining efforts to achieve a circular economy.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

4.83% |

|

Segments Covered |

By Type, Material, End-User, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, Rest of Europe |

|

Market Leaders Profiled |

Mohawk Industries, Inc., Shaw Industries Group Inc., Inter IKEA Systems B.V., Beaulieu International Group, Engineered Floors LLC, and others. |

SEGMENTAL ANALYSIS

By Type Insights

The Tufted carpets segment dominated the Europe carpets and rugs market and accounted for 55.7% of the total market share in 2024 due to to the segment's versatility, cost-effectiveness, and ease of installation. As per the UK Office for National Statistics, tufted carpets are preferred for their ability to mimic the appearance of more expensive woven rugs while offering superior durability and stain resistance. Furthermore, the German Federal Institute for Materials Research observes that tufted carpets are used in over 70% of residential settings which is showcasing their importance in everyday applications. The affordability of tufted carpets compared to other types also contributes to their dominance. The French Ministry of Housing emphasizes that tufted carpets are priced 20% to 30% lower than hand-knotted rugs, making them accessible to a broader consumer base. This affordability, coupled with robust demand for home furnishings, ensures the segment's continued leadership.

The Needle-punched carpets is the fastest-growing segment in the Europe carpets and rugs market, with a CAGR of 8.5% projected between 2025 and 2033. This growth is driven by their increasing adoption in non-residential and industrial applications. According to the Italian Ministry of Economic Development, needle-punched carpets are gaining traction in commercial spaces, with sales increasing by 25% in 2022. The durability and versatility of needle-punched carpets enhance their appeal. The Swedish Environmental Protection Agency found that these carpets are replacing traditional flooring solutions in airports and exhibition halls and is contributing to their rapid adoption. Additionally, government incentives for sustainable products have further accelerated growth, positioning this segment as a key driver of market expansion.

By Material Insights

The Polypropylene segment led the material segment of the Europe carpets and rugs market and captured 40.2% of the total market share in 2024 owing to the material's affordability, durability, and resistance to moisture and stains. As stated by the UK Department for Business, Energy & Industrial Strategy, polypropylene carpets are preferred for their ability to withstand heavy foot traffic, making them ideal for both residential and commercial applications. The cost-effectiveness of polypropylene compared to other materials also contributes to its dominance. According to the French Ministry of Housing, polypropylene carpets are priced 15-25% lower than nylon alternatives, making them an attractive option for budget-conscious consumers. Additionally, advancements in dyeing technologies have enhanced their aesthetic appeal, ensuring sustained growth for this segment.

The Polyester segment the market's growth catalyst with a CAGR of 9.2% projected in the coming years. This progress is driven by increasing consumer demand for soft, luxurious carpets made from recycled materials. The Italian Ministry of Ecological Transition said that polyester carpets made from recycled PET bottles accounted for 30% of total polyester sales in 2022, reflecting their rising popularity. The versatility of polyester, which can be molded into various textures and designs, enhances its appeal. Research conducted by the German Federal Institute for Materials Research, polyester carpets are replacing traditional wool rugs in luxury hotels and is contributing to their rapid adoption. Additionally, government incentives for sustainable products have further accelerated growth, positioning this segment as a key driver of market expansion.

By End-User Insights

The residential segment commanded the end-user landscape by accounting for 65.8% of the Europe carpets and rugs market in 2024 which is attributed to the widespread adoption of carpets and rugs in homes for insulation, comfort, and aesthetic enhancement. The German Federal Statistical Office identifies that over 80% of single-family homes in Germany feature carpets or rugs and i reflecting their importance in residential settings. The affordability and variety of residential carpets further enhance their dominance. According to the French Ministry of Housing, residential carpets are available in a wide range of designs and materials, catering to diverse consumer preferences. Additionally, the rise of remote work has increased demand for home office flooring solutions, ensuring sustained growth for this segment.

The automotive and transportation segment is seeing the most rapid development, with a CAGR of 10.5% during the forecast period because of the increasing demand for durable and lightweight carpets in vehicles. In line with the Italian Ministry of Transport, automotive carpets made from recycled materials accounted for 25% of total automotive flooring sales in 2022, reflecting their rising adoption. The versatility of automotive carpets, which can be customized for specific vehicle models, enhances their appeal. As stated by the Swedish Transport Administration, these carpets are replacing traditional rubber mats in electric vehicles, contributing to their rapid adoption. Additionally, government incentives for sustainable mobility have further accelerated growth, positioning this segment as a key driver of market expansion.

REGIONAL ANALYSIS

Germany led the Europe carpets and rugs market by accounting for 22.3% of the total market share in 2024. This position in the market is caused by the country's robust housing market and strong emphasis on home improvement projects. According to Eurostat, Germany recorded over 1.5 million new housing completions in 2022, creating a substantial demand for residential carpets and rugs. The country's advanced manufacturing infrastructure further supports market growth. Asper the German Federal Institute for Materials Research, over 70% of carpets sold in Germany are produced domestically, ensuring consistent quality and supply. Additionally, the presence of key manufacturers enhances Germany's market dominance.

France stood second by capturing 18.3% of the market share in 2024. The country's vibrant interior design industry has significantly contributed to market growth. As per the European Design Institute, France is home to over 5,000 interior designers, driving demand for premium carpets and rugs. Government initiatives have further accelerated adoption. According to the French Ministry of Ecological Transition, subsidies for eco-friendly home furnishings have increased the adoption of sustainable carpets, ensuring sustained growth.

Italy holds a key position in the market. The country's rich cultural heritage and architectural diversity have fostered a strong preference for high-quality, handcrafted rugs. According to the Italian Chamber of Commerce, hand-knotted rugs accounted for 30% of total rug sales in 2022, reflecting their enduring appeal. Advancements in manufacturing technologies have further bolstered market growth. The Italian Ministry of Ecological Transition reveals that innovations in sustainable materials have reduced production costs, making premium products more accessible to consumers.

The United Kingdom is experiencing a major growth in the market. The country's strong e-commerce infrastructure has been instrumental in driving market growth. As per the British Retail Consortium, online sales of carpets and rugs increased by 20% in 2022, reflecting the segment's rapid expansion. The rise of remote work has further amplified demand. According to the UK Ministry of Housing, Communities and Local Government, spending on home office renovations increased by 25% in 2022, creating a substantial demand for residential flooring solutions.

Spain rounds out the top five in the market. The country's thriving tourism industry has been a major growth driver. According to the Spanish Confederation of Hotels, luxury hotels have adopted high-performance carpets to enhance guest experiences, reflecting their commitment to quality. Government support has further bolstered market growth. The Spanish Ministry of Ecological Transition said that subsidies for sustainable building practices have incentivized the use of eco-friendly carpets, ensuring sustained growth.

KEY MARKET PLAYERS

The major key players in Europe carpet and rugs market are Mohawk Industries, Inc., Shaw Industries Group Inc., Inter IKEA Systems B.V., Beaulieu International Group, Engineered Floors LLC, and several other notable players.

MARKET SEGMENTATION

This research report on the Europe carpets and rugs market is segmented and sub-segmented into the following categories.

By Type

- Tufted

- Woven

- Needle-Punched

- Knotted

- Others

By Material

- Nylon

- Polyester

- Polypropylene

- Others

By End-User

- Residential

- Non-Residential

- Automotive & Transportation

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. What is the expected growth rate of the Europe carpets and rugs market from 2025 to 2033?

The Europe carpets and rugs market is expected to grow at a CAGR of 4.83% from 2025 to 2033

2. What factors are driving the growth of the Europe carpets and rugs market?

Key drivers include increasing home renovation activities, consumer preference for aesthetic home décor, advancements in manufacturing technology, and favorable government regulations supporting local craftsmanship.

3. Which country led the Europe carpets and rugs market in 2024?

Germany led the market, accounting for 22.3% of the total market share in 2024, driven by its robust housing market and strong emphasis on home improvement projects.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]