Europe Carpet Market Size, Share, Trends & Growth Forecast Report By Raw Material (Nylon, Polyester, Polypropylene, Others), Product (Woven, Tufted, Knotted, Others), Application (Residential, Non-residential, Others), and Country (Germany, UK, France, Italy, Rest of Europe) – Industry Analysis From 2025 to 2033.

Europe Carpet Market Size

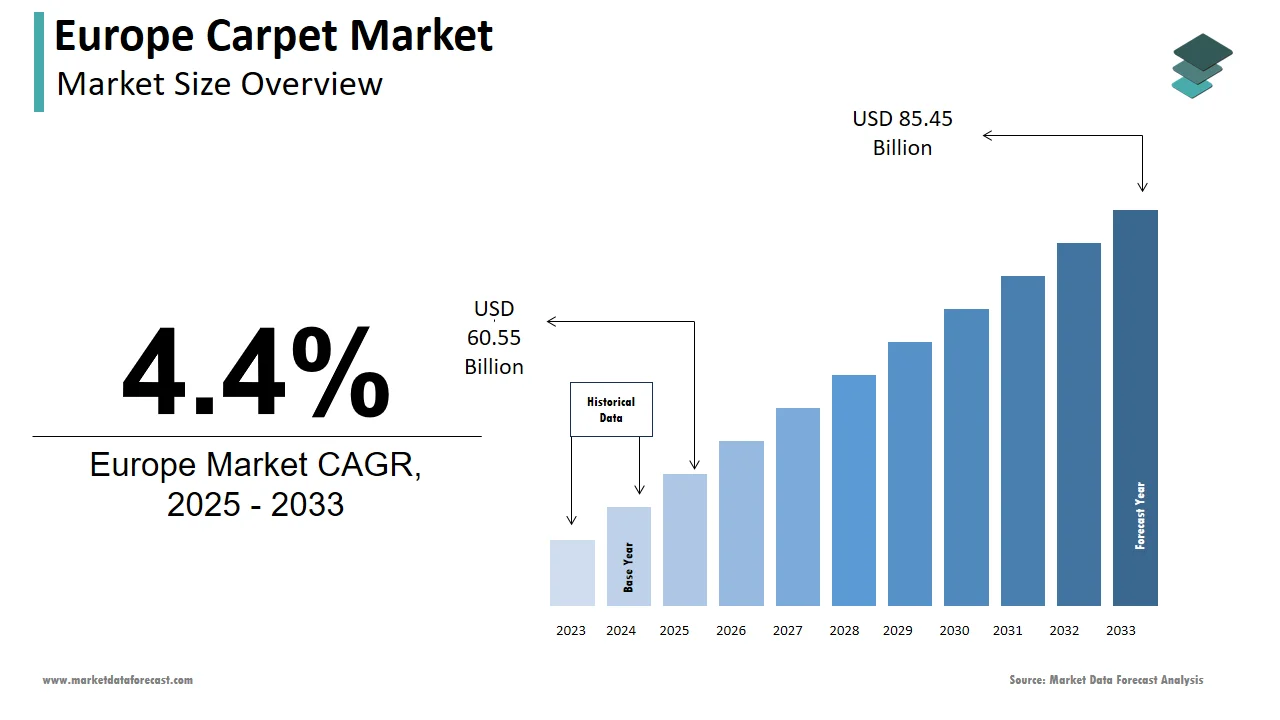

The carpet market size in Europe was valued at USD 58 billion in 2024. The European market is estimated to be worth USD 85.45 billion by 2033 from USD 60.55 billion in 2025, growing at a CAGR of 4.4% from 2025 to 2033.

The carpet market in Europe is an important part of the overall flooring industry, with carpets used widely in homes, businesses, and industrial spaces. Europe’s flooring landscape remains on , and carpets made up a large share of that amount. The demand for carpets in the region depends on cultural habits, economic factors, and changing design styles. Western Europe leads the market, thanks to higher incomes and a strong focus on home decoration. In contrast, Eastern Europe is seeing steady growth due to urban expansion and new construction projects. There’s also growing interest in eco-friendly carpets, as more consumers look for sustainable options. According to the European Carpet and Rug Association, Germany, France, and the UK together make up over 50% of the market, showing how important these countries are in influencing overall trends across the region.

MARKET DRIVERS

Rising Demand for Sustainable Flooring Solutions

A growing emphasis on sustainability has emerged as a key driver of the Europe carpet market. Consumers are increasingly seeking carpets made from recycled or biodegradable materials and are aligning with stringent environmental regulations. Like, polypropylene is a recyclable material that accounts for nearly 40% of raw material usage, as per data from the European Federation of the Carpet Industry. The demand for eco-friendly carpets is further amplified by initiatives such as the EU Green Deal, which encourages sustainable practices across industries. This trend is particularly pronounced in countries like Sweden and Denmark, where environmentally conscious consumers dominate the market. By 2022, sales of sustainable carpets grew by 8% which is reflecting a shift in consumer preferences. The introduction of innovative manufacturing techniques, such as low-VOC production methods and has enabled manufacturers to meet these demands effectively.

Expansion of Residential Construction Activities

The surge in residential construction projects across Europe has significantly fueled carpet demand. According to Eurostat, housing starts increased by 6% in 2022, driven by government incentives and urbanization. Countries like Germany and France have witnessed robust growth, with new housing developments incorporating carpets for aesthetic and functional purposes. Tufted carpets, known for their durability and versatility, dominate installations in newly constructed homes. Additionally, the rise of remote work culture has spurred homeowners to invest in home improvement projects, further boosting demand. A report by the European Construction Industry Federation shows that renovation activities accounted for 45% of total construction spending in 2022, creating a favorable environment for carpet adoption.

MARKET RESTRAINTS

High Initial Costs of Premium Carpets

One significant restraint in the Europe carpet market is the high initial cost associated with premium carpets, which limits accessibility for price-sensitive consumers. Luxury carpets are often crafted from wool or silk and can exceed €50 per square meter which is making them unaffordable for many households. Based on a study by the European Textile Services Association, budget constraints have led to a decline in carpet installations in lower-income regions, particularly in Eastern Europe. While affluent markets like Switzerland and the Netherlands continue to embrace premium options, affordability remains a barrier in emerging economies. This pricing disparity stifles overall market penetration, especially in non-residential sectors where cost-effectiveness is prioritized.

Competition from Alternative Flooring Options

The Europe carpet market faces stiff competition from alternative flooring solutions such as hardwood, tiles, and vinyl, which are perceived as more durable and easier to maintain. For instance, hardwood floors are favoured in commercial spaces due to their longevity and aesthetic appeal. In addition, advancements in laminate and luxury vinyl tile (LVT) technologies have further eroded carpet market share. A survey conducted by the European Flooring Manufacturers Federation revealed that 30% of consumers prefer alternatives due to ease of cleaning and allergen resistance, presenting a significant challenge for the carpet industry.

MARKET OPPORTUNITIES

Growing Adoption of Smart Carpets

Smart carpets are embedded with sensors to monitor foot traffic and detect falls and represent a burgeoning opportunity in the Europe carpet market. These innovative products cater to the elderly care sector which is expanding rapidly due to Europe’s aging population. According to the European Commission, individuals aged 65 and above will constitute 30% of the population by 2030. Smart carpets address safety concerns while offering enhanced functionality and is making them attractive for both residential and healthcare facilities. Pilot projects in Germany and the UK have demonstrated a 20% increase in smart carpet installations in senior living communities. With technological advancements reducing production costs, the market is poised for exponential growth.

Expansion into Emerging Markets

Eastern European countries including Turkey and the Czech Republic and present untapped potential for the Europe carpet market. Economic development and rising disposable incomes in these regions are driving demand for affordable yet stylish carpets. As per World Bank data, Turkey’s GDP growth averaged 5.2% annually between 2019 and 2022 and is fueling consumer spending on home furnishings. Similarly, the Czech Republic’s booming real estate sector has created opportunities for carpet manufacturers to establish a foothold. By tailoring product offerings to local preferences, companies can capitalize on this emerging trend and diversify their revenue streams.

MARKET CHALLENGES

Stringent Environmental Regulations

Stringent environmental regulations pose a significant challenge for the Europe carpet market, particularly regarding waste management and recycling. The European Union’s Circular Economy Action Plan mandates higher recycling targets, compelling manufacturers to adopt costly measures. According to the Ellen MacArthur Foundation, only 15% of carpets are currently recycled in Europe which is leaving ample room for improvement. Non-compliance with these regulations risks penalties and reputational damage, pressuring companies to invest in sustainable practices. However, the financial burden of implementing advanced recycling technologies remains a hurdle for smaller players.

Supply Chain Disruptions

Supply chain disruptions caused by geopolitical tensions and logistical challenges have impacted raw material availability in the Europe carpet market. For example, Russia-Ukraine conflicts disrupted polypropylene imports which is leading to a 20% price hike in 2022, as reported by PlasticsEurope. Such volatility affects production schedules and profit margins are forcing manufacturers to explore alternative sourcing strategies. While some companies have diversified suppliers, others face delays in fulfilling orders, emphasizes customer satisfaction.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Raw Material, Product, Application, and Region. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Countries Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, and the Rest of Europe. |

|

Market Leader Profiled |

Agnella S.A., Balta Group N.V., Mohawk Industries Inc., Brinton’s Carpets, Creatuft NV, Associated Weavers International Group, Dekowe GmbH & Co.KG, Fletco Carpets A/S, Royal Carpet SA, Egetapper A/S, Teppichwerke GmbH, Radici Pietro Industries & Brands S.p.A., Tarkett SA, MoquetasRols SA, Birko Birlesik Koyunlu’lular Mensucat Ticaret Ve Sanayi a.s. (Koyunlu AS), Ruckstuhl, and others. |

SEGMENTAL ANALYSIS

By Raw Material Insights

The polypropylene segment dominated the Europe carpet market by holding a market share of 40.9% in 2024. The widespread adoption is attributed to its affordability, durability, and resistance to stains and moisture and is making it ideal for both residential and commercial applications. The material's versatility allows manufacturers to produce carpets in various textures and colors, catering to diverse consumer preferences. Additionally, advancements in extrusion technology have enhanced polypropylene’s quality, further solidifying its position. According to a report by the European Plastics Converters Association, polypropylene production capacity increased by 12% in 2022 driven by growing demand. The material’s recyclability aligns with sustainability goals, appealing to environmentally conscious buyers. These factors collectively ensure polypropylene’s dominance in the raw material segment.

On the other hand, the polyester segment is growing at a rapid pace with a projected CAGR of 7.5% from 2025 to 2033. This rise is influenced by its soft texture, vibrant color retention, and cost-effectiveness compared to natural fibers like wool. Polyester carpets are increasingly used in residential settings due to their hypoallergenic properties and ease of maintenance. Moreover, innovations in polyester recycling have reduced production costs while meeting eco-friendly standards. A study by the European Federation of the Carpet Industry notes that recycled polyester usage grew by 25% in 2022, driven by circular economy initiatives. As consumers prioritize aesthetics and sustainability, polyester’s market penetration is expected to accelerate.

By Product Insights

The tufted carpets segment was in charge of the the largest share of 60.6% of the Europe carpet market in 2024. The popularity of this segment is due to their versatility, affordability, and ease of installation which is making them suitable for both residential and non-residential spaces. Tufted carpets are manufactured using advanced tufting machines enabling high-speed production and customization. As per the Eurostat, the need for tufted carpets in Germany and France surged by 8% in 2022 driven by urbanization and home renovation trends. The segment’s dominance is further reinforced by its compatibility with synthetic fibers like polypropylene and polyester, which offer durability and stain resistance. These attributes ensure tufted carpets remain the preferred choice across applications.

The woven carpets category are the fastest expanding product segment, with a CAGR of 6.8% over the forecast period. This growth is propelled by their luxurious appearance and superior quality, appealing to high-end consumers. Woven carpets are crafted using intricate weaving techniques, resulting in dense piles and intricate designs. A study by the European Carpet and Rug Association reveals that woven carpet sales in luxury markets like Switzerland and the UK surged by 15% in 2022. The segment benefits from increasing disposable incomes and a growing preference for bespoke flooring solutions. Moreover, the integration of sustainable practices in manufacturing has enhanced its appeal among eco-conscious buyers.

By Application Insights

The residential segment possessed the highest portion i.e. 65.4% of the Europe carpet market in 2024. This development over the period is propelled by the region’s strong housing market and rising investments in home décor. Countries like Germany and France witnessed a 10% increase in residential carpet installations in 2022 and is fueled by remote work trends and home improvement projects. Carpets are favoured for their ability to enhance comfort, insulation, and aesthetics in living spaces. According to Eurostat, renovation activities in residential properties made up of €15 billion in spending is creating a robust demand for carpets. The segment’s longevity is further bolstered by the availability of affordable synthetic options tailored to budget-conscious consumers.

The non-residential segment is the swiftest one to grow, with a CAGR of 7.2% in the coming years. The acceleration of this segment is associated with the expansion of commercial spaces, including offices, hotels, and retail outlets. A study by the European Flooring Manufacturers Federation states that non-residential carpet installations in Sweden and Denmark grew by 20% in 2022 and is driven by modernization efforts. Carpets in these settings offer noise reduction, safety, and aesthetic appeal which is making them indispensable. Also, the rise of modular carpet tiles, which allow for easy replacement and customization, has further accelerated adoption. The segment’s growth is also supported by sustainability initiatives, with companies opting for eco-friendly products.

COUNTRY LEVEL ANALYSIS

Germany leads the Europe carpet market, contributing approximately 25% to the regional market share, as per Statista. The country’s robust construction industry and high disposable incomes drive demand for premium carpets. Urbanization and government incentives for energy-efficient homes have spurred residential carpet installations. According to Eurostat, Germany’s housing starts increased by 5% in 2022, boosting the market.

France ranks second, holding a 20% market share. The country’s focus on interior design and home improvement fuels carpet demand. A report by the French National Institute of Statistics highlights a 12% rise in renovation projects in 2022, benefiting the carpet industry.

The UK accounts for 18% of the market, driven by its strong real estate sector. According to the UK Office for National Statistics, residential property sales grew by 8% in 2022, supporting carpet sales.

Italy holds a 15% share, with demand driven by its luxury market. The Italian Ministry of Economic Development reports a 10% increase in high-end carpet imports in 2022, reflecting consumer preferences.

Spain contributes 12% to the market, supported by tourism-driven hotel renovations. The Spanish Tourism Board notes a 25% rise in hospitality investments in 2022, driving non-residential carpet demand.

KEY MARKET PLAYERS

Some notable companies that dominate the Europe carpet market profiled in this report are Agnella S.A., Balta Group N.V., Mohawk Industries Inc., Brinton’s Carpets, Creatuft NV, Associated Weavers International Group, Dekowe GmbH & Co.KG, Fletco Carpets A/S, Royal Carpet SA, Egetapper A/S, Teppichwerke GmbH, Radici Pietro Industries & Brands S.p.A., Tarkett SA, MoquetasRols SA, Birko Birlesik Koyunlu’lular Mensucat Ticaret Ve Sanayi a.s. (Koyunlu AS), Ruckstuhl, and others.

TOP LEADING PLAYERS IN THE MARKET

Desso (Tarkett Group)

Desso, part of the Tarkett Group, is a leading innovator in sustainable carpet solutions. The company focuses on Cradle-to-Cradle principles, producing recyclable carpets that align with EU environmental goals. Desso’s expertise in designing functional carpets for workplaces and educational institutions strengthens its global reputation.

Interface Inc.

Interface Inc. specializes in modular carpet tiles, emphasizing sustainability and design flexibility. Its mission to achieve zero environmental impact has resonated globally, enhancing its presence in Europe’s non-residential sector.

Shaw Industries

Shaw Industries offers a wide range of carpets, leveraging advanced manufacturing technologies. Its commitment to innovation and customer-centric solutions has established it as a key player in Europe’s residential market.

TOP STRATEGIES USED BY KEY PLAYERS

Sustainability Initiatives

Companies like Desso and Interface have adopted eco-friendly practices, such as using recycled materials and implementing carbon-neutral production processes, to meet regulatory requirements and consumer expectations.

Product Innovation

Firms invest in R&D to develop smart carpets and modular designs, addressing emerging needs in safety, functionality, and aesthetics.

Strategic Partnerships

Collaborations with architects and interior designers enable players to expand their reach and influence design trends.

COMPETITION OVERVIEW

The Europe carpet market is highly competitive, characterized by the presence of global leaders and regional players. Companies differentiate themselves through innovation, sustainability, and customer service. Intense competition drives firms to adopt advanced manufacturing techniques and expand their product portfolios.

MAJOR ACTIONS TAKEN BY COMPANIES

- In April 2024, Desso launched a new line of biodegradable carpets, reinforcing its commitment to sustainability.

- In June 2023, Interface introduced a smart carpet system with integrated sensors for fall detection in elderly care facilities.

- In February 2023, Shaw Industries partnered with a leading European retailer to expand its distribution network.

- In September 2022, Balta Group acquired a smaller competitor to strengthen its foothold in Eastern Europe.

- In January 2022, Beaulieu International Group invested in advanced recycling technologies to enhance production efficiency.

MARKET SEGMENTATION

This Europe carpet market research report is segmented and sub-segmented into the following categories.

By Raw Material

- Nylon

- Polyester

- Polypropylene

- Others

By Product

- Woven

- Tufted

- Knotted

- Others

By Application

- Residential

- Non-residential

- Others

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. What is driving the Europe carpet market growth?

Increasing demand from residential and commercial sectors is driving the Europe carpet market.

2. Which material type is popular in the Europe carpet market?

Nylon is one of the most popular materials in the Europe carpet market.

3. What is a key trend in the Europe carpet market?

Rising preference for eco-friendly and sustainable carpets is a key trend in the Europe carpet market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]