Europe Carbon Capture and Storage (CCS) Market Size, Share, Trends, & Growth Forecast Report By Service (Capture, Transportation, Utilization, and Storage), Product, Application, Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2024 to 2033

Europe Carbon Capture and Storage (CCS) Market Size

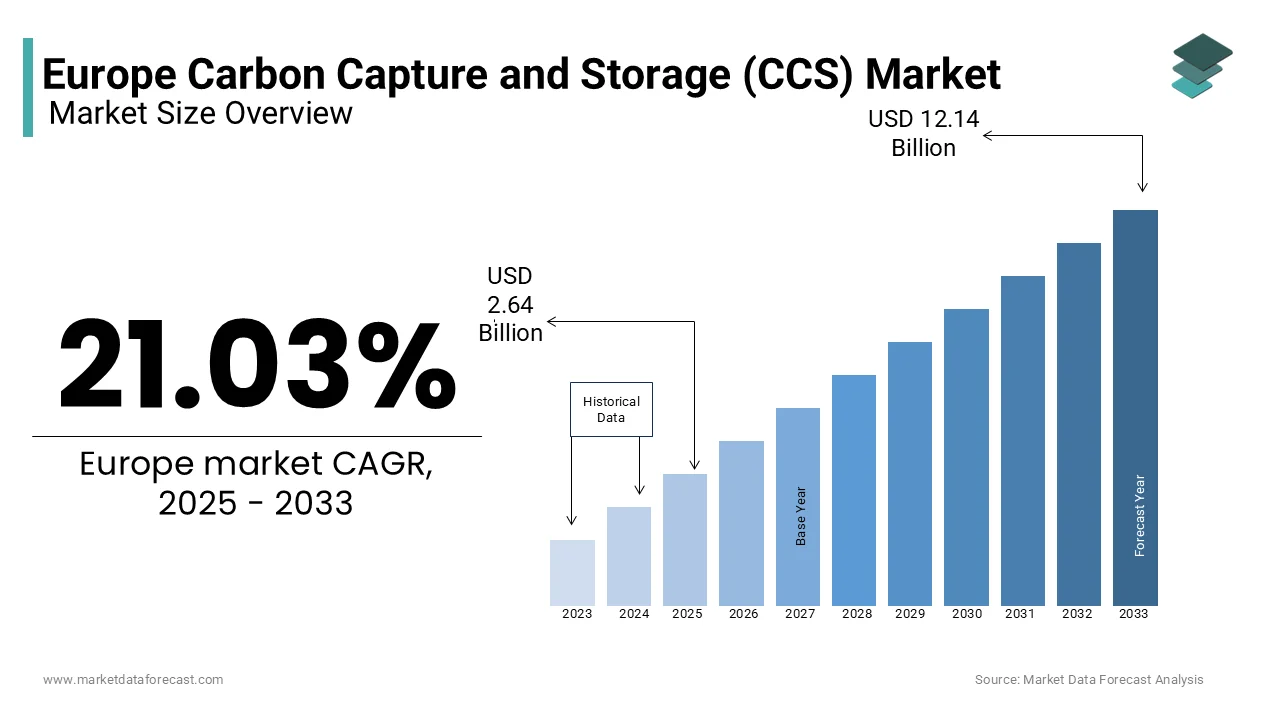

The Europe carbon capture and storage (CCS) market was worth USD 2.18 billion in 2024. The European market is estimated to reach USD 12.14 billion by 2033 from USD 2.64 billion in 2025, rising at a CAGR of 21.03% from 2025 to 2033.

The carbon capture and storage (CCS) technology involves capturing carbon dioxide (CO2) emissions from industrial processes and power generation by transporting it via pipelines or ships and storing it underground in geological formations to prevent its release into the atmosphere. According to the International Energy Agency (IEA), Europe accounts for approximately 15% of global CCS projects, with over 30 initiatives currently in operation or under development. As per the European Commission, CCS is essential for decarbonizing hard-to-abate sectors such as cement, steel, and chemicals, which collectively contribute nearly 20% of Europe’s CO2 emissions.

In 2022, the European Investment Bank allocated €10 billion to fund CCS and related low-carbon technologies by leveraging the region’s commitment to scaling up this solution. According to the Eurostat, Norway leads Europe in operational CCS capacity, with the Sleipner and Snøhvit projects storing over 1.7 million metric tons of CO2 annually. Additionally, the Netherlands and the UK are emerging as key players, investing heavily in large-scale projects like Porthos and Net Zero Teesside. However, the Global CCS Institute emphasizes that advancements in technology and supportive policies, such as carbon pricing under the EU Emissions Trading System (ETS), are driving renewed interest. CCS is poised to play an increasingly vital role in mitigating climate change and achieving ambitious emission reduction targets.

MARKET DRIVERS

Stringent Climate Policies and Carbon Pricing Mechanisms

Stringent climate policies and the implementation of carbon pricing under the EU Emissions Trading System (ETS) is significantly driving the growth rate of the European carbon capture and storage (CCS) market. According to the European Commission, the ETS has increased carbon prices to over €90 per ton in 2023 by incentivizing industries to adopt CCS technologies to reduce emissions cost-effectively. According to the Eurostat, sectors like cement, steel, and chemicals, which account for nearly 20% of Europe’s CO2 emissions. According to the International Energy Agency (IEA), CCS can abate up to 15% of global emissions by 2050 by making it indispensable for achieving net-zero goals. Additionally, the European Green Deal mandates a 55% reduction in greenhouse gas emissions by 2030 that further propel investments in CCS infrastructure. These regulatory frameworks and financial incentives are accelerating the adoption of CCS as a viable solution for emission-intensive industries.

Decarbonization of Hard-to-Abate Industrial Sectors

The urgent need to decarbonize hard-to-abate industrial sectors such as cement, steel, and chemicals is additionally to fuel the growth rate of the European carbon capture and storage market. These sectors collectively emit approximately 1.2 billion metric tons of CO2 annually in Europe, according to the European Environment Agency. These sectors rely heavily on high-temperature processes that are difficult to electrify by making CCS a critical technology for reducing their carbon footprint. As per the Global CCS Institute, CCS can capture up to 90% of CO2 emissions from industrial facilities by significantly contributing to Europe’s net-zero ambitions. Furthermore, the European Investment Bank allocated €10 billion in 2022 to fund low-carbon technologies by including CCS, to support industrial decarbonization. The Netherlands and Norway have emerged as leaders, with projects like Porthos and Northern Lights demonstrating scalable CCS solutions. CCS adoption is expected to grow exponentially as industries strive to align with sustainability goals.

MARKET RESTRAINTS

High Capital and Operational Costs

A significant restraint for the European carbon capture and storage (CCS) market is the high capital and operational costs associated with deploying CCS technologies. According to the International Energy Agency (IEA), the cost of capturing CO2 ranges from €50 to €100 per metric ton is depending on the application and scale of the project. According to the Eurostat, large-scale CCS projects require initial investments exceeding €1 billion, which poses a financial barrier for many industries. As per the European Environment Agency, transportation and storage infrastructure, such as pipelines and geological storage sites, further increase costs, with pipeline construction alone costing up to €1 million per kilometer. These expenses deter smaller companies and countries with limited budgets from adopting CCS. The lack of widespread economic feasibility remains a key obstacle to scaling CCS deployment across Europe.

Public Opposition and Safety Concerns

Public opposition and safety concerns regarding CO2 storage present another major restraint for the European CCS market. According to the European Commission, communities near proposed storage sites often express fears about potential leaks or seismic activity despite studies confirming the safety of geological storage. As per the Global CCS Institute, public skepticism has delayed several projects, including those in Germany and Denmark, where local resistance halted plans due to perceived environmental risks. A study by Eurostat revealed that less than 30% of Europeans are fully aware of CCS technology by contributing to misconceptions and mistrust. According to the European Environment Agency, inadequate public engagement and communication exacerbate these issues that is leading to regulatory delays and increased project timelines. Addressing these concerns through transparent dialogue and education is crucial to overcoming barriers to CCS adoption.

MARKET OPPORTUNITIES

Integration with Hydrogen Production for a Low-Carbon Economy

The integration with hydrogen production, particularly blue hydrogen, which is produced from natural gas with CCS is set to create huge opportunities for the European carbon capture and storage market to grow in the coming years. As per the European Clean Hydrogen Alliance, hydrogen could meet 24% of Europe’s energy demand by 2050, with CCS playing a pivotal role in reducing emissions during production. As per Eurostat, blue hydrogen production costs are approximately €2 per kilogram, compared to €5 for green hydrogen by making it a cost-effective transitional solution. The International Energy Agency (IEA), combining CCS with hydrogen production could abate up to 830 million metric tons of CO2 annually by 2040. Furthermore, the European Investment Bank has allocated €7 billion for hydrogen-related projects, including CCS-enabled facilities.

Development of Cross-Border CCS Infrastructure Networks

Another major opportunity is the development of cross-border CCS infrastructure networks by enabling Europe to optimize CO2 storage capacity and share resources. As per the Global CCS Institute, Europe has an estimated geological storage capacity of over 300 billion metric tons, with Norway’s North Sea alone capable of storing 70 billion metric tons. According to the European Commission, initiatives like the Northern Lights project, a collaboration between Norway, the UK, and the Netherlands, aim to create shared pipelines and storage hubs by reducing costs and increasing efficiency. According to the Eurostat, such cross-border projects could lower transportation costs by 30% by making CCS more economically viable. Additionally, the European Investment Bank has pledged €10 billion for regional CCS infrastructure by 2030. These networks will enhance scalability and foster international cooperation with CCS as a cornerstone of Europe’s decarbonization strategy.

MARKET CHALLENGES

Limited Geological Storage Capacity and Site Availability

The limited availability of geological storage sites, which restricts the scalability of CCS projects is posing definite challenges for the market key players. According to the European Environment Agency, while Europe has an estimated storage capacity of 300 billion metric tons, only a fraction is currently accessible due to regulatory, technical, and logistical barriers. As per Eurostat, countries like Germany and France face challenges in identifying suitable onshore storage sites by forcing reliance on offshore locations, which are more expensive to develop. According to the International Energy Agency (IEA), offshore storage costs can exceed €50 per metric ton of CO2, compared to €30 for onshore storage. Additionally, public opposition and permitting delays further complicate site selection. Scaling CCS to meet emission reduction targets remains a formidable challenge without expanding accessible storage capacity.

Fragmented Policy Frameworks Across Member States

Another major challenge is the fragmented policy frameworks across European Union member states, which hinder the coordinated development of CCS infrastructure. According to the European Commission, inconsistent regulations and varying levels of financial support create uncertainty for investors. As per Eurostat, that while countries like Norway and the Netherlands have advanced CCS policies and funding mechanisms, others, such as Poland and Italy, lag behind due to economic constraints and lack of political prioritization. According to the Global CCS Institute, this fragmentation results in inefficiencies, with cross-border projects facing regulatory hurdles and delayed approvals. Furthermore, the absence of a unified EU-wide strategy for CCS deployment limits the potential for shared infrastructure and economies of scale. Harmonizing policies and fostering collaboration will be critical to overcoming these barriers.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

21.03% |

|

Segments Covered |

By Service, Product, Application, and Country |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Countries Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, and Rest of Europe |

|

Market Leaders Profiled |

Shell PLC, Aker Solutions, Equinor ASA, Dakota Gasification Company, Linde plc, Siemens Energy, Fluor Corporation, Sulzer Ltd., Mitsubishi Heavy Industries, Japan CCS Co., Ltd., Carbon Engineering Ltd., and LanzaTech. |

SEGMENTAL ANALYSIS

By Service Insights

The capture segment dominated the European CCS market with a prominent share of 60.6% in 2024. Its role as the foundation of the CCS value chain by addressing emissions from hard-to-abate sectors like cement, steel, and chemicals, which emit over 1.2 billion metric tons of CO2 annually in Europe, according to the European Environment Agency. As per Eurostat, advancements in solvent-based capture technologies have reduced costs by 15% since 2020 by making it more accessible. As Europe aims to cut emissions by 55% by 2030, the capture segment remains critical for scaling CCS and achieving decarbonization goals.

The utilization segment is esteemed to have the fastest CAGR of 12.1% during the forecast period. This growth is driven by innovations in converting CO2 into valuable products like synthetic fuels, chemicals, and building materials. According to the Eurostat, e-fuel production using captured CO2 is projected to grow by 20% annually through 2030. The Global CCS Institute emphasizes that utilization aligns with circular economy principles while creating economic value while reducing emissions. This segment is pivotal for sustainable innovation and transforming CO2 from a liability into an asset with an estimated €80 billion annual revenue potential by 2030.

By Product Insights

The post-combustion segment dominated the market by occupying 60.7% of the European CCS market share in 2024 owing to its versatility in retrofitting existing power plants and industrial facilities in sectors like cement and steel, which emit over 400 million metric tons of CO2 annually, according to the European Environment Agency. As per Eurostat, advancements in amine-based solvents have reduced capture costs by 15% since 2020 by enhancing economic feasibility. As Europe targets a 55% emissions reduction by 2030, post-combustion capture remains critical for addressing emissions from hard-to-abate industries by ensuring its central role in the CCS value chain.

The pre-combustion capture segment is attributed to witness a CAGR of 8.3% over the forecast period owing to the rise of blue hydrogen production under the EU Hydrogen Strategy, which aims to produce 10 million metric tons of low-carbon hydrogen by 2030. As per the Eurostat, pre-combustion systems achieve higher efficiency and are integral to integrated gasification combined cycle (IGCC) plants. According to the European Commission, pre-combustion capture aligns with Europe’s decarbonization goals, particularly in energy-intensive industries. This segment is poised to play a transformative role in enabling low-carbon industrial processes across Europe.

By Application Insights

The power generation led the market by capturing 40.3% of the European CCS market share in 2024. The significant CO2 emissions from fossil fuel-based plants which exceed 1 billion metric tons annually. As per the European Environment Agency, CCS can reduce emissions by up to 90% by making it indispensable for decarbonizing the energy sector. According to the Eurostat, retrofitting existing plants with post-combustion capture systems enables a smoother transition to cleaner energy. CCS in power generation remains critical for achieving climate goals and ensuring energy security with the EU targeting a 55% emissions reduction by 2030.

The cement segment is likely to experience a fastest CAGR of 10.1% during the forecast period. This growth is driven by the sector’s inherent emission intensity by releasing approximately 200 million metric tons of CO2 annually. As per Eurostat, projects like Heidelberg Materials aim to capture 1 million metric tons of CO2 by 2025. According to the European Commission, CCS is one of the few viable solutions for decarbonizing cement production with Europe’s sustainable construction goals. As demand for low-carbon building materials rises, CCS adoption in cement production will play a transformative role in reducing industrial emissions and advancing circular economy initiatives.

REGIONAL ANALYSIS

Norway led the European carbon capture and storage (CCS) market with 30.9% of share in 2024. Its dominance stems from pioneering projects like Sleipner and Northern Lights, which have collectively stored over 20 million metric tons of CO2 since inception. The Global CCS Institute, Norway’s extensive geological storage capacity in the North Sea, estimated at 70 billion metric tons, provides a significant advantage. Additionally, the Norwegian government allocates €1.6 billion annually to CCS initiatives by fostering innovation and infrastructure development. As per Eurostat, Norway is further reinforced by its commitment to international collaboration by enabling cross-border CO2 transport and storage solutions, positioning it as a global CCS hub.

The Netherlands is estimated to grow at a CAGR of 8.2% during the forecast period with the large-scale projects like Porthos, which aims to store 2.5 million metric tons of CO2 annually by 2025. According to the European Environment Agency, the Netherlands leverages its strategic location and advanced port infrastructure to facilitate CO2 transportation and storage. As per the Eurostat, the Dutch government has committed €2.8 billion to CCS under its National Climate Agreement by supporting industrial decarbonization. Furthermore, the Netherlands’ focus on integrating CCS with hydrogen production aligns with EU Green Deal objectives by ensuring its prominence in Europe’s low-carbon transition.

The United Kingdom is deemed to grow at steady pace during the forecast period with ambitious projects like Net Zero Teesside, which aims to capture and store up to 10 million metric tons of CO2 annually by 2030. As per the Global CCS Institute, the UK benefits from extensive offshore storage capacity in the North Sea, estimated at 78 billion metric tons. As per the Eurostat, the UK government has allocated €1 billion to CCS through its Ten Point Plan for a Green Industrial Revolution. The UK is poised to play a transformative role in scaling CCS adoption across Europe with strong policy support and a focus on industrial cluster decarbonization.

KEY MARKET PLAYERS

The major players in the Europe carbon capture and storage (CCS) market include Shell PLC, Aker Solutions, Equinor ASA, Dakota Gasification Company, Linde plc, Siemens Energy, Fluor Corporation, Sulzer Ltd., Mitsubishi Heavy Industries, Japan CCS Co., Ltd., Carbon Engineering Ltd., and LanzaTech.

MARKET SEGMENTATION

This research report on the Europe carbon capture and storage (CCS) market is segmented and sub-segmented into the following categories.

By Service

- Capture

- Transportation

- Utilization

- Storage

By Product

- Pre-combustion

- Industrial Process

- Post Combustion

- Oxy-combustion

By Application

- Power Generation

- Oil & Gas

- Metal Production

- Cement

- Others

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What is driving the growth of the Europe Carbon Capture and Storage (CCS) market?

The growth is driven by stringent government regulations on carbon emissions, increasing investments in clean energy technologies, and the rising adoption of CCS in industries like power generation, cement, and steel.

What role does the European Union play in CCS development?

The EU provides funding, regulatory frameworks, and policy incentives to accelerate CCS adoption through programs like the Innovation Fund and the European Green Deal.

What is the expected future of the CCS market in Europe?

The market is expected to grow with increasing investments, advancements in technology, and more favorable policies supporting large-scale CCS deployment.

How is CO₂ transported and stored in CCS projects?

Captured CO₂ is transported via pipelines, ships, or trucks and stored in geological formations such as depleted oil and gas fields or deep saline aquifers.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]