Europe Caramel Chocolate Market Size, Share, Trends & Growth Forecast Report By Distribution Channel (Supermarkets and Hypermarkets, Convenience Stores, Online Retail, Specialty Stores), And Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest Of Europe), Industry Analysis From 2025 To 2033

Europe Caramel Chocolate Market Size

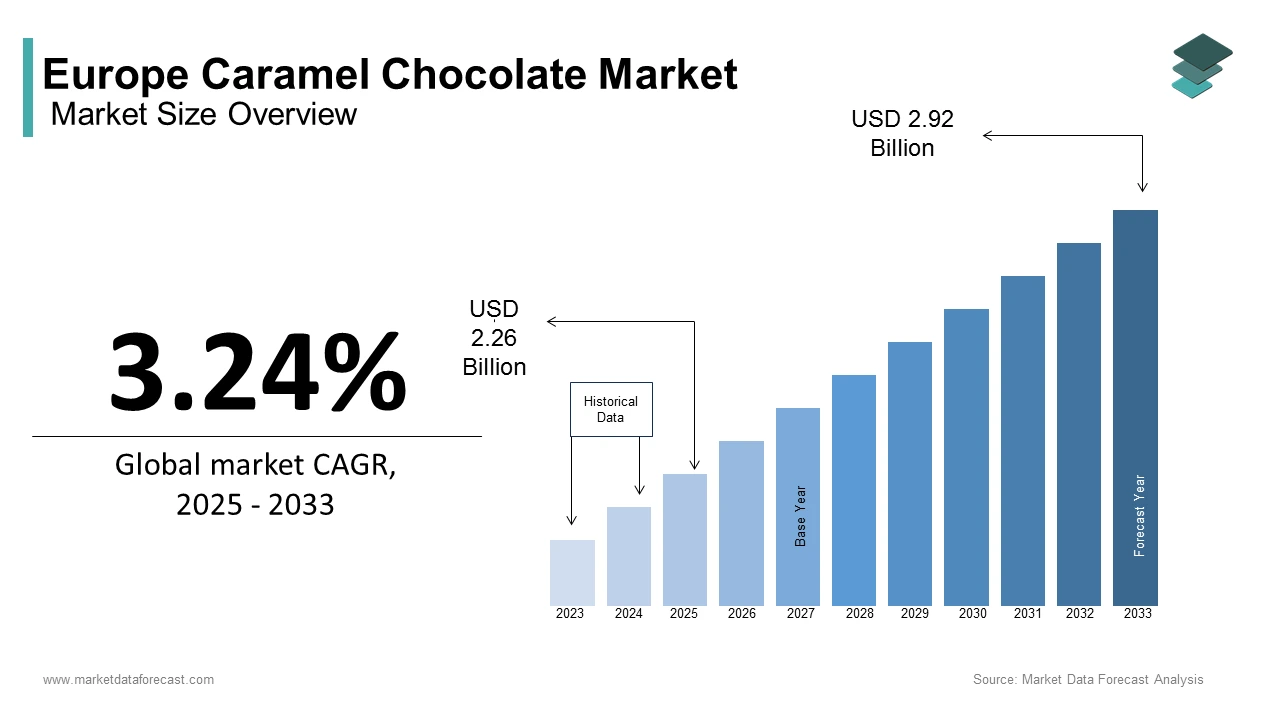

The Europe caramel chocolate market size was calculated to be USD 2.19 billion in 2024 and is anticipated to be worth USD 2.92 billion by 2033 from USD 2.26 billion in 2025, growing at a CAGR of 3.24% during the forecast period.

Caramel chocolate is a decadent fusion of rich caramel and smooth chocolate and has emerged as a popular indulgence across Europe. The versatility of caramel chocolate that range from standalone bars to gourmet desserts appeals to diverse demographics, including millennials and Gen Z. The rising disposable incomes, urbanization, and a growing preference for premium and artisanal chocolates are fuelling the demand for caramel chocolate in the European region. Germany leads Europe in caramel chocolate consumption, accounting for 25% of total sales, while France and the UK follow closely. However, challenges such as fluctuating raw material costs and health-conscious consumer trends pose hurdles to sustained expansion. Despite these challenges, caramel chocolate remains a key player in Europe’s confectionery landscape, driven by innovation and evolving consumer preferences.

MARKET DRIVERS

Rising Demand for Premium Confectionery

The increasing demand for premium confectionery products is a significant driver of the European caramel chocolate market. According to Eurostat, over 60% of European consumers prefer premium chocolates, with caramel-infused variants gaining popularity due to their unique taste profile. According to the European Food Safety Authority, premium chocolate sales grew by 15% in 2022, with caramel chocolate accounting for 25% of this growth. For instance, Germany witnessed a 20% increase in caramel chocolate sales during festive seasons, underscoring its appeal as a luxury treat.

Growing Influence of Social Media and Marketing Campaigns

Social media platforms have played a pivotal role in promoting caramel chocolate products. According to the European Advertising Standards Alliance, brands leveraging Instagram and TikTok campaigns reported a 30% increase in sales in 2022. Visual storytelling and influencer collaborations have heightened consumer awareness, particularly among younger demographics. Highlighting this trend, the UK saw a 25% rise in caramel chocolate purchases linked to social media promotions, demonstrating the power of digital marketing in driving demand.

MARKET RESTRAINTS

Health-Conscious Consumer Trends

The growing emphasis on health and wellness poses a significant restraint for the European caramel chocolate market. According to the European Health Organization, more than 40% of consumers are reducing sugar intake, leading to declining sales of high-calorie confectionery products. A study by the European Nutrition Council reveals that caramel chocolate sales in Italy dropped by 10% in 2022 due to concerns about sugar content. This trend forces manufacturers to innovate with low-sugar or sugar-free alternatives, which often come at higher production costs.

Fluctuating Raw Material Costs

Fluctuating prices of cocoa and sugar that are key ingredients in caramel chocolate, hinder the European market growth. According to the European Agricultural Commission, cocoa prices increased by 15% in 2022, impacting profit margins for manufacturers. Similarly, sugar price volatility led to a 12% rise in production costs for caramel chocolate producers in Spain. These cost fluctuations create pricing pressures and limit accessibility for price-sensitive consumers.

MARKET OPPORTUNITIES

Expansion into Emerging Markets

Emerging markets within Europe, particularly Eastern Europe, present significant opportunities for caramel chocolate growth. According to the European Bank for Reconstruction and Development, investments in retail infrastructure in countries like Poland and Romania grew by 20% in 2022, creating a conducive environment for confectionery sales.

Introduction of Sugar-Free and Organic Variants

The introduction of sugar-free and organic caramel chocolate offers immense potential for market expansion. According to the European Organic Food Federation, organic chocolate sales grew by 25% in 2022, driven by rising consumer demand for healthier options.

MARKET CHALLENGES

Regulatory Restrictions on Marketing

Stringent regulations on marketing high-calorie foods pose a significant challenge for caramel chocolate manufacturers. According to the European Commission, restrictions on advertising sugary products to children reduced brand visibility by 18% in 2022. These regulations limit promotional activities, making it harder for brands to reach younger audiences and maintain market share.

Supply Chain Disruptions

Supply chain disruptions, exacerbated by geopolitical tensions and global uncertainties, have impacted the availability of key raw materials like cocoa and sugar. According to the European Supply Chain Institute, 25% of caramel chocolate manufacturers faced delays in sourcing these ingredients in 2022. Such disruptions increase production costs and lead to inconsistent product availability, affecting consumer satisfaction and brand loyalty.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

3.24% |

|

Segments Covered |

By Distribution Channel, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, and Czech Republic |

|

Market Leaders Profiled |

Lindt & Sprüngli AG, Ferrero International SA, Mars Incorporated, Mondelēz International Inc., Nestlé SA, Barry Callebaut AG, August Storck KG, Guylian N.V., Cemoi Chocolatier, Delaviuda Confectionery Group. |

SEGMENTAL ANALYSIS

By Distribution Channel Insights

The supermarkets and hypermarkets segment occupied for 45.7% of the European market share in 2024 owing to their widespread presence, ability to offer competitive pricing, and convenience for consumers. Prominent retailers like Tesco, Carrefour, and Aldi stock a wide variety of caramel chocolate brands, catering to diverse consumer preferences. Their established supply chains and extensive distribution networks further solidify their position as the largest segment in the market.

The non-grocery retailers segment is estimated to register the fastest CAGR of 8.8% over the forecast period. According to the European E-commerce Association, online sales of caramel chocolate grew by 35% in 2022 due to the convenience of home delivery and personalized shopping experiences. Specialty stores, on the other hand, appeal to niche markets seeking artisanal or organic caramel chocolate products, further driving growth in this segment.

REGIONAL ANALYSIS

Western Europe accounts for 60% of the European caramel chocolate market share. This domination of Western Europe is driven by advanced retail networks, high disposable incomes, and a strong tradition of indulging in premium chocolates. Countries like Germany, the UK, and France are at the forefront of adopting innovative caramel chocolate products, ensuring sustained demand.

Eastern Europe is anticipated to be the fastest-growing region in the overall European market. The growth of the Eastern Europe is fueled by rising urbanization, increasing disposable incomes, and expanding retail infrastructure. Countries like Poland and Romania are emerging as key markets, offering affordable yet high-quality caramel chocolate products to attract price-sensitive consumers.

KEY MARKET PLAYERS

Key market players in the Europe caramel chocolate market include Lindt & Sprüngli AG, Ferrero International SA, Mars Incorporated, Mondelēz International Inc., Nestlé SA, Barry Callebaut AG, August Storck KG, Guylian N.V., Cemoi Chocolatier, Delaviuda Confectionery Group.

Ferrero, Nestlé, and Lindt & Sprüngli dominate the Europe caramel chocolate market, collectively contributing to over 60% of total sales. Ferrero focuses on innovation and branding, leveraging its iconic products like Rocher to capture consumer attention. Nestlé emphasizes sustainability, investing in ethical cocoa sourcing and eco-friendly packaging to align with evolving consumer preferences. Lindt & Sprüngli positions itself as a premium brand, targeting affluent consumers with its luxurious caramel chocolate offerings. These players leverage their expertise in product development, marketing, and distribution to maintain their leadership positions in the competitive market.

KEY MARKET STRATEGIES

To strengthen their market positions, key players in the Europe caramel chocolate market employ several strategic approaches. Product innovation is a primary focus, with Ferrero introducing new flavors and formats to cater to changing consumer tastes. According to the European Innovation Council, Nestlé invests heavily in sustainable practices, such as using recyclable packaging and sourcing cocoa through fair-trade initiatives. Lindt & Sprüngli focuses on premium branding, emphasizing craftsmanship and quality to differentiate itself from competitors. Additionally, digital marketing and e-commerce strategies are gaining prominence, with brands leveraging social media platforms and online retail channels to enhance visibility and accessibility. These strategies not only drive growth but also ensure long-term customer loyalty in a dynamic market environment.

DETAILED SEGMENTATION OF EUROPE CARAMEL CHOCOLATE MARKET INCLUDED IN THIS REPORT

This research report on the Europe caramel chocolate market has been segmented and sub-segmented based on distribution channel, & region.

By Distribution Channel

- Supermarkets and Hypermarkets

- Convenience Stores

- Online Retail

- Specialty Stores

By Region

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. Which factors are driving the growth of the Europe caramel chocolate market?

The market is driven by increasing consumer preference for premium chocolates, growing demand for innovative flavors, and the rising popularity of caramel-infused confectionery.

2. What are the key trends in the Europe caramel chocolate market?

Key trends include the rise of organic and artisanal caramel chocolates, increasing consumer interest in healthier chocolate alternatives, and the expansion of e-commerce sales.

3. How are manufacturers innovating in the caramel chocolate market?

Manufacturers are introducing sugar-free and organic caramel chocolates, experimenting with new flavors and fillings, and adopting sustainable packaging solutions to attract eco-conscious consumers.

4. Who are the key players in the Europe caramel chocolate market?

Major players include Lindt & Sprüngli AG, Ferrero International SA, Mars Incorporated, Mondelēz International Inc., Nestlé SA, Barry Callebaut AG, August Storck KG, Guylian N.V., Cemoi Chocolatier, and Delaviuda Confectionery Group.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]