Europe Car Sharing Market Size, Share, Trends & Growth Forecast Research Report – Segmented By Area, vehicle Type, Application, Model and By Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe) - Industry Analysis From (2025 to 2033)

Europe Car Sharing Market Size

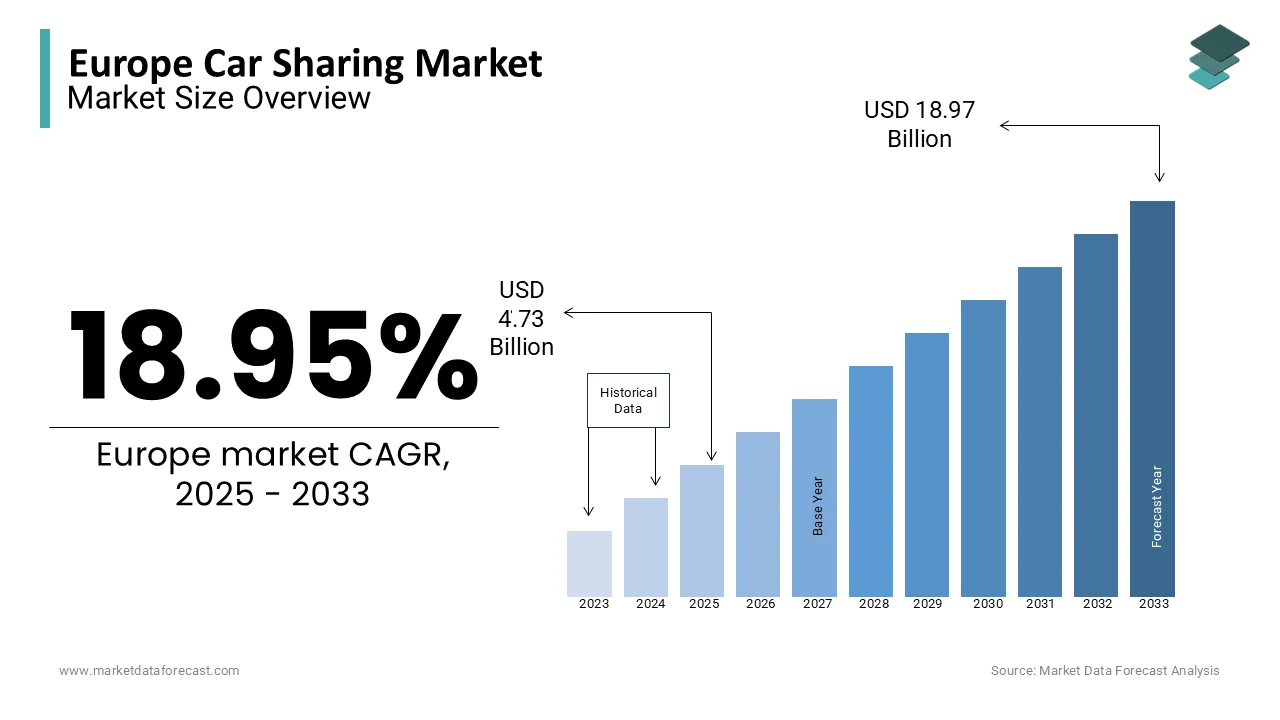

The European car-sharing market size was valued at USD 3.98 billion in 2024 and is anticipated to reach USD 4.73 billion in 2025 from USD 18.97 billion by 2033, growing at a CAGR of 18.95% from 2025 to 2033.

Car sharing is an innovative mobility solution and has emerged as a transformative force in the European transportation industry. Car sharing is a service where individuals can rent vehicles for short periods, often by the hour or minute, through a membership-based model. This concept aligns with the growing demand for sustainable, cost-effective, and flexible transportation options, particularly in urban areas. The demand for car-sharing services has increased considerably in Europe in recent years owing to increasing urbanization, environmental concerns, and the shift towards shared economies. Over the forecast period, the rising adoption of digital platforms, advancements in connected car technologies, and supportive government policies promoting reduced carbon emissions are anticipated to continue to fuel the demand for car-sharing services in the European region. According to the European Environment Agency, car sharing can significantly reduce vehicle ownership and result in lower greenhouse gas emissions and decreased traffic congestion.

Germany, France, and the UK are at the forefront of the European car-sharing market, with major cities such as Berlin, Paris, and London witnessing high penetration rates. According to a study by Frost & Sullivan, Germany alone accounts for nearly 30% of the European car-sharing market due to its robust automotive industry and tech-savvy population. Additionally, the integration of electric vehicles (EVs) into car-sharing fleets is gaining momentum and enhancing the sustainability credentials of the European car-sharing market.

MARKET DRIVERS

Urbanization and Congestion Challenges in Europe

Rapid urbanization in Europe has led to increased traffic congestion and limited parking spaces, making car ownership less practical in cities. According to Eurostat, over 75% of the European Union’s population resides in urban areas, with cities like Paris and London experiencing severe congestion. Car sharing offers a convenient alternative, reducing the need for private vehicles and alleviating urban traffic. The European Commission estimates that shared mobility services can decrease the number of cars on the road by up to 15%, significantly improving urban mobility and reducing congestion-related costs.

Environmental Concerns and Emission Regulations

Stringent environmental regulations and growing awareness of climate change are driving the adoption of car sharing in Europe. The European Environment Agency reports that transportation accounts for nearly 25% of the EU’s greenhouse gas emissions. Car sharing, particularly with electric vehicles, helps reduce emissions by promoting efficient vehicle usage. The EU’s Green Deal aims for a 55% reduction in emissions by 2030, further incentivizing shared mobility solutions. A study by the International Transport Forum highlights that car sharing can cut CO2 emissions by up to 18% per user, aligning with Europe’s sustainability goals.

MARKET RESTRAINTS

High Operational Costs and Infrastructure Challenges

The Europe car sharing market faces significant operational costs, including vehicle maintenance, insurance, and fleet management. According to the European Automobile Manufacturers Association, maintaining a shared vehicle fleet can be up to 30% more expensive than private vehicles due to higher wear and tear. Additionally, the lack of adequate infrastructure, such as dedicated parking spaces and charging stations for electric vehicles, poses a challenge. The European Commission highlights that only 40% of urban areas in the EU have sufficient infrastructure to support large-scale car-sharing operations, limiting market expansion and increasing operational complexities.

Regulatory and Legal Barriers

Regulatory hurdles and varying legal frameworks across European countries hinder the growth of the car-sharing market. The European Parliament notes that inconsistent regulations related to insurance, taxation, and data privacy create operational challenges for car-sharing providers. For instance, some countries impose higher taxes on shared vehicles compared to private ones, discouraging adoption. Additionally, data protection laws under the General Data Protection Regulation (GDPR) require stringent compliance, increasing operational costs. These regulatory complexities create an uneven playing field, slowing down the market’s growth potential and limiting cross-border expansion of car-sharing services.

MARKET OPPORTUNITIES

Integration of Electric Vehicles (EVs)

The growing adoption of electric vehicles presents a significant opportunity for the European car-sharing market. According to the European Environment Agency, EV registrations in the EU increased by over 100% in 2022, reflecting a strong shift towards sustainable mobility. Car-sharing platforms incorporating EVs can attract environmentally conscious consumers and align with the EU’s Green Deal objectives, which aim for 30 million EVs on European roads by 2030. The International Energy Agency reports that shared EV fleets can reduce emissions by up to 50% compared to traditional vehicles, making this integration a key driver for market growth and sustainability.

Technological Advancements and Smart City Initiatives

Advancements in digital technologies, such as IoT, AI, and mobile apps, are transforming the car-sharing experience. The European Commission’s Smart Cities and Communities initiative promotes the use of technology to enhance urban mobility, including car sharing. A report by the European Innovation Council states that smart city projects can increase the efficiency of shared mobility services by 25%, improving user accessibility and operational scalability. Additionally, the integration of real-time data analytics and autonomous driving technologies offers opportunities for innovation, making car sharing more convenient and appealing to a broader audience.

MARKET CHALLENGES

Consumer Behaviour and Trust Issues

Changing consumer behavior and building trust remain significant challenges for the European car sharing market. According to a study by the European Commission, only 35% of Europeans are willing to fully adopt shared mobility services due to concerns about vehicle availability, cleanliness, and safety. Additionally, the lack of familiarity with car-sharing models in rural and suburban areas limits market penetration. The European Consumer Organisation highlights that 60% of potential users hesitate to adopt car sharing due to privacy concerns and data security risks, particularly under the GDPR framework. Overcoming these barriers requires extensive consumer education and transparent operational practices.

Competition from Traditional and Emerging Mobility Solutions

The Europe car sharing market faces intense competition from traditional car rental services and emerging mobility options like ride-hailing and bike-sharing. Eurostat data shows that traditional car rentals still account for over 65% of the short-term vehicle hire market, overshadowing car sharing. Additionally, the rise of micro-mobility solutions, such as e-scooters and bike-sharing, diverts demand from car-sharing services. The European Transport Safety Council notes that these alternatives are often perceived as more convenient for short-distance travel, further challenging the growth of car sharing. Competing in this crowded market requires car-sharing providers to differentiate their offerings and enhance user experience.

SEGMENTAL ANALYSIS

Europe Car Sharing Market By Area

The intracity segment dominated the market in 2024 by accounting for 69.8% of the European market share in 2024. The domination of the intracity segment in the European market is majorly driven by high urbanization rates, with over 75% of the EU population residing in cities, as reported by the European Commission. Intracity services address urban challenges like traffic congestion and limited parking, offering short-term, flexible mobility solutions. The European Environment Agency highlights that intracity car sharing can reduce private vehicle usage by up to 10%, significantly lowering emissions. Its convenience and alignment with sustainability goals make it a critical component of urban transportation systems.

The intercity segment is predicted to be the fastest-growing segment and is likely to register a CAGR of 20.8% over the forecast period owing to the increasing demand for sustainable long-distance travel options and the expansion of highway networks. The International Transport Forum notes that intercity car sharing can reduce CO2 emissions by 30% compared to private car usage, making it an eco-friendly alternative. Additionally, rising fuel costs and the integration of electric vehicles into intercity fleets are driving adoption. This segment’s importance lies in bridging the gap between urban and rural mobility, offering a scalable solution for regional travel.

Europe Car Sharing Market By Vehicle Type

The economy cars segment led the market and captured 61.8% of the European market share in 2024. The affordability, fuel efficiency, and low maintenance costs of economy cars make them the preferred choice for middle-income households. In 2022, the IEA reported that over 50 million economy cars were sold worldwide, driven by rising urbanization and demand for cost-effective transportation. Governments, such as India’s Ministry of Road Transport, promote economy cars through subsidies and tax incentives, further boosting their adoption. Their importance lies in providing accessible mobility solutions while reducing carbon emissions, aligning with global sustainability goals.

The executive car segment is estimated to register a CAGR of 7.5% over the forecast period. The growing disposable incomes, particularly in emerging markets like China and India, and the demand for advanced technology and luxury features are propelling the growth of the executive car segment in the European market. According to McKinsey & Company, more than 40% of luxury car buyers prioritize electric or hybrid models, reflecting a shift toward sustainability. The segment’s importance lies in driving innovation, with automakers investing heavily in autonomous driving and electrification. For instance, the European Automobile Manufacturers Association (ACEA) reports that 30% of executive cars sold in Europe in 2023 were electric, underscoring their role in the EV revolution.

Europe Car Sharing Market By Application

The private vehicles segment dominated the automotive market and accounted for 75.9% of the European market share in 2024. The universal need for personal mobility, especially in regions with inadequate public transportation, is one of the key factors driving the growth of the private vehicles segment in the European car-sharing market. In 2022, as per the European Environment Agency, 80% of passenger cars in Europe were privately owned, underscoring their importance in daily life. Private vehicles provide flexibility, convenience, and independence, making them indispensable for individuals and families. Governments, such as India’s Ministry of Road Transport, support private vehicle ownership through subsidies and infrastructure development, further solidifying their dominance in the market.

The business application segment is anticipated to be growing at a CAGR of 8.2% over the forecast period, owing to the rise of e-commerce, ride-hailing services, and the need for efficient logistics. According to the reports of the International Energy Agency (IEA), 30% of commercial vehicles sold in 2023 were electric, reflecting a shift toward sustainable business practices. Companies like Amazon are investing heavily in electric delivery fleets, aiming to deploy 100,000 electric vans by 2030. The segment’s importance lies in enabling economic growth, reducing operational costs, and meeting environmental goals, making it a key driver of innovation in the automotive industry.

Europe Car Sharing Market By Model

Largest Segment: Stationary Model

The stationary model segment held the largest share of 50.9% of the European market share in 2024. The structured approach of the stationary model ensures organized vehicle distribution and reduces urban clutter. For example, the European Cyclists’ Federation reports that 60% of bike-sharing systems in Europe use stationary docks, highlighting their reliability and ease of management. Stationary systems are crucial for cities with high population density, offering predictable access to vehicles and supporting sustainable urban transportation. Governments, such as the UK’s Department for Transport, invest in stationary models to promote eco-friendly commuting and reduce traffic congestion.

The P2P model is predicted to witness a CAGR of 10.5% over the forecast period. The sharing economy and digital platforms that connect vehicle owners with users are driving the expansion of the P2P segment in the European market. According to the International Transport Forum (ITF), 35% of car-sharing users in 2023 preferred P2P services due to cost-effectiveness and flexibility. Platforms like Turo and Get Around are expanding rapidly, with Turo reporting 5 million users in 2023. The P2P model’s importance lies in maximizing vehicle utilization, reducing idle time, and providing an income source for owners, making it a key player in the future of shared mobility.

REGIONAL ANALYSIS

Germany is the leader in the European car-sharing market. The domination of Germany in the European market is primarily due to its high urban population, environmental consciousness, and advanced infrastructure. Major players like Share Now and Miles operate extensively across the country. Government initiatives promoting sustainable mobility is further strengthening the position of Germany in the European market.

France is a hub for sustainable mobility and accounts for a substantial share of the European car-sharing market during the forecast period. Paris serves as a key center for car-sharing services, such as BlaBlaCar in France. The commitment of France to reducing carbon emissions and promoting eco-friendly transportation has significantly driven market growth. The strong consumer adoption and regulatory support of France are further aiding the French market growth.

The UK is predicted to showcase a notable CAGR during the forecast period. London is leading the adoption due to congestion charges and a well-developed public transport network. Increasing urbanization and stringent environmental regulations have further propelled the car-sharing market.

KEY MARKET PLAYERS

Share Now, Zipcar, Ubeeqo, Flinkster, Zity by Mobilize, Go To, Wible. These are the market players that are dominating the Europe car sharing market.

MARKET SEGMENTATION

This research report on the Europe car sharing market is segmented and sub-segmented into the following categories.

By Area

- Intercity

- Intracity

By Vehicle Type

- Economy cars

- Mid-Range cars

- Executive cars

By Application

- Private

- Business

By Model

- Free float

- Stationary

- Peer to Peer

By Country

- UK

- Russia

- Germany

- Italy

- France

- Spain

- Sweden

- Denmark

- Poland

- Switzerland

- Netherlands

- Rest of Europe

Frequently Asked Questions

What is the current market size of the Europe car sharing market?

The Europe car sharing market size was valued at USD 3.98 billion in 2024

what are the market drivers that are driving the Europe car sharing market?

The Urbanization and Congestion Challenges and Environmental Concerns and Emission Regulations are driving the Europe car sharing market.

Who are the market players that are dominating the Europe car sharing market?

Share Now, Zipcar, Ubeeqo, Flinkster, Zity by Mobilize, Go To, Wible. These are the market players that are dominating the Europe car sharing market.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]