Europe Cannabis Testing Market Research Report By Product & Software (Terpene Profiling, Potency Testing, Residual Solvent Screening, Pesticide Screening, Genetic Testing, Heavy Metal Testing, Microbial Analysis, Testing Procedures), End User & Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe), Analysis on Size, Share, Trends, COVID-19 Impact & Growth Forecast From 2024 To 2032

Europe Cannabis Testing Market Size

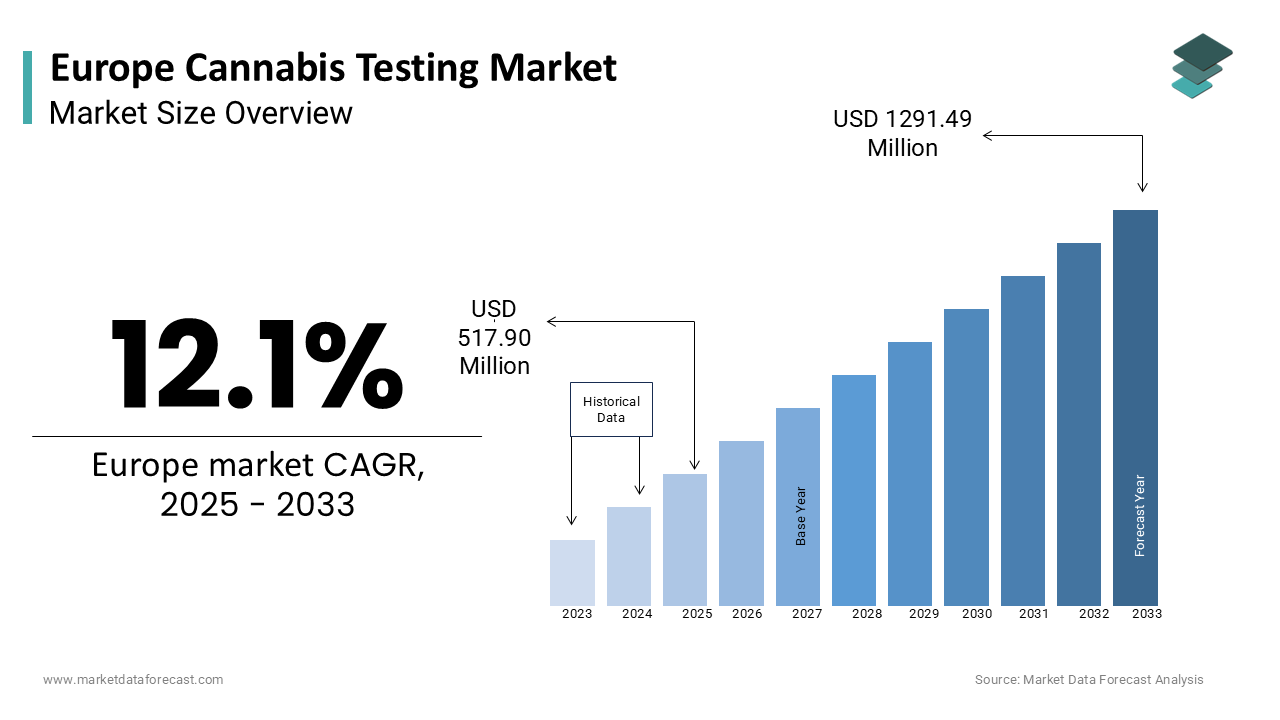

The size of the European cannabis testing market was valued at USD 462 million in 2024. The market size in Europe is anticipated to progress at a CAGR of 12.1% from 2025 to 2033 and be valued at USD 1291.49 million by 2033 from USD 517.90 million in 2025.

Cannabis testing include evaluations for potency, contaminants such as pesticides, heavy metals, microbial pathogens, and residual solvents, as well as profiling of cannabinoids and terpenes. These processes are crucial to guarantee the safety, efficacy, and quality of cannabis products, particularly those intended for medical use. In Europe, the increasing legalization and regulation of medical cannabis have increased the need for advanced testing protocols. Countries such as Germany and Italy have established frameworks for controlled cannabis use and mandated rigorous testing to meet specific safety thresholds. Laboratories conducting these tests utilize sophisticated technologies such as high-performance liquid chromatography (HPLC) and gas chromatography-mass spectrometry (GC-MS) to achieve precise and reliable results.

MARKET DRIVERS

Expanding Medical Cannabis Legalization in Europe

The legalization of medical cannabis across several European countries has been a primary driver for the cannabis testing market in Europe. Nations such as Germany, Italy, and the United Kingdom have implemented legal frameworks permitting the use of cannabis for therapeutic purposes. Germany, for example, legalized medical cannabis in 2017, and by 2021, the country had imported over 10 tons of medical cannabis for patient use, according to the German Federal Institute for Drugs and Medical Devices. Such regulatory shifts have significantly increased the demand for rigorous cannabis testing to ensure product safety and efficacy. The European Monitoring Centre for Drugs and Drug Addiction notes that as cannabis use expands for medical purposes, so does the need for advanced and standardized testing protocols.

Increasing Focus on Consumer Safety and Quality Control

The growing emphasis on consumer safety has intensified the need for advanced cannabis testing in Europe. Regulatory bodies require rigorous screening for contaminants, including pesticides, heavy metals, and microbial pathogens. The European Food Safety Authority highlights the importance of identifying pesticide residues in consumable goods, including cannabis, to prevent adverse health impacts. Additionally, a 2021 report by the European Medicines Agency (EMA) underscored that accurate cannabinoid profiling is essential to ensure therapeutic consistency. This focus on safety is further amplified by the increasing potency of cannabis products, with THC levels in European cannabis resin averaging 20%, as per the European Monitoring Centre for Drugs and Drug Addiction, necessitating precise testing protocols to safeguard the public.

MARKET RESTRAINTS

High Costs of Advanced Testing Technologies

The adoption of sophisticated testing technologies, such as liquid chromatography-mass spectrometry (LC-MS) and gas chromatography-mass spectrometry (GC-MS), poses a significant restraint for the European cannabis testing market. These advanced systems require substantial investment, with initial setup costs ranging from €100,000 to €500,000. Moreover, ongoing expenses for maintenance, skilled personnel, and reagents further increase operational costs. The European Medicines Agency highlights that small and medium-sized testing laboratories often struggle to afford these advanced technologies, limiting market penetration. Additionally, the European Monitoring Centre for Drugs and Drug Addiction notes that cost barriers can impede the establishment of comprehensive testing frameworks, especially in countries with less-developed cannabis regulations, potentially restricting market growth.

Complex and Varied Regulatory Landscapes

The lack of harmonized cannabis regulations across Europe significantly restrains market development. While countries like Germany and Italy have established clear medical cannabis frameworks, others remain in nascent stages or have ambiguous guidelines, creating challenges for testing laboratories. For instance, the European Commission acknowledges that regulatory discrepancies across member states hinder the creation of a standardized cannabis testing market. Furthermore, a report by the European Monitoring Centre for Drugs and Drug Addiction indicates that the inconsistent classification of cannabis products, particularly those with low THC content, complicates testing requirements. These regulatory complexities often delay market entry for testing services and create operational inefficiencies, limiting the market's ability to scale uniformly across Europe.

MARKET OPPORTUNITIES

Growth of the Medical Cannabis Industry in Europe

The rapid expansion of the medical cannabis industry in Europe presents a significant opportunity for the cannabis testing market. Germany, the largest market for medical cannabis in Europe, recorded imports of over 20 tons in 2022, according to the German Federal Institute for Drugs and Medical Devices. This growth is driven by increasing patient access programs and broader acceptance of cannabis-based treatments for chronic pain, epilepsy, and multiple sclerosis. As the European Monitoring Centre for Drugs and Drug Addiction emphasizes, the rising prevalence of medical cannabis use necessitates rigorous safety and quality testing to meet regulatory standards. This demand creates a fertile landscape for testing laboratories to expand their services and develop innovative solutions tailored to therapeutic applications.

Advancements in Testing Technology

Technological advancements in cannabis testing methodologies present a substantial opportunity for market growth in Europe. Innovations in spectrometry and chromatography, such as real-time cannabinoid detection, have significantly improved testing accuracy and efficiency. The European Medicines Agency highlights the importance of these technologies in ensuring compliance with stringent safety standards for medical cannabis products. Furthermore, the European Commission has allocated funding to support research and development in analytical sciences, fostering innovation in cannabis testing. As such, the adoption of cutting-edge tools and techniques enables laboratories to expand their service offerings, reduce turnaround times, and enhance the reliability of testing results, positioning the market for sustained growth and improved consumer trust.

MARKET CHALLENGES

Limited Access to Skilled Professionals

A significant challenge in the European cannabis testing market is the shortage of skilled professionals proficient in advanced analytical techniques. The European Centre for the Development of Vocational Training reported a 15% skills gap in laboratory sciences in 2022, highlighting a lack of trained personnel in fields like chromatography and spectrometry. This deficit affects the ability of testing facilities to deliver accurate and timely results, especially as the demand for cannabis testing continues to grow. Additionally, the European Medicines Agency notes that the specialized training required for compliance with Good Laboratory Practices (GLP) increases recruitment costs for laboratories, further complicating market operations and hindering scalability in the region.

Inadequate Infrastructure in Emerging Markets

Emerging markets within Europe face significant infrastructure challenges that impede the growth of the cannabis testing sector. Countries with newly established cannabis programs, such as Poland and the Czech Republic, often lack sufficient laboratories equipped with advanced testing tools like gas chromatography-mass spectrometry (GC-MS). According to the European Monitoring Centre for Drugs and Drug Addiction, only a limited number of facilities in these regions meet the stringent testing standards necessary for regulatory compliance. This lack of infrastructure delays the rollout of comprehensive testing services complicates the cross-border trade of cannabis products, and slows the adoption of medical cannabis programs, thereby restraining the overall growth potential of the cannabis testing market.

REGIONAL ANALYSIS

Germany dominated the cannabis testing market in Europe in 2023 and is likely to retain its dominating position in this regional market throughout the forecast period. According to the German Federal Institute for Drugs and Medical Devices, Germany imported over 20 tons of medical cannabis in 2022, accounting for the majority of Europe’s total imports. The robust regulatory framework of Germany including mandatory testing for contaminants and potency, has established it as a leader in the cannabis testing market. The high prevalence of chronic illnesses, with approximately 25% of adults experiencing persistent pain, per Germany’s Federal Statistical Office, further underscores the importance of rigorous testing to ensure safety and efficacy in medical treatments.

Netherlands is another prominent regional market for cannabis testing in Europe. The Netherlands is a pioneer in cannabis research and testing, with its well-established medical cannabis program dating back to 2003. The Dutch Office for Medicinal Cannabis oversees stringent testing protocols, ensuring product safety and quality. The Netherlands exported over €100 million worth of cannabis in 2021, according to the European Monitoring Centre for Drugs and Drug Addiction, emphasizing its position as a major supplier. With advanced research facilities and a focus on innovation, the country plays a crucial role in driving technological advancements in cannabis testing, setting benchmarks for the broader European market in areas like pesticide screening and terpene profiling.

Switzerland is estimated to play a promising role in the European cannabis testing market over the forecast period. Switzerland has emerged as a leader in the European cannabis testing market due to its progressive policies and robust research infrastructure. The Federal Office of Public Health permits the sale of cannabis with less than 1% THC, requiring rigorous testing to ensure compliance. The Swiss market saw a 25% growth in low-THC cannabis sales in 2021, driven by increasing consumer demand, as reported by the Swiss Federal Statistical Office. Switzerland's advanced laboratories leverage cutting-edge technologies like liquid chromatography-mass spectrometry (LC-MS) to ensure product consistency and safety, solidifying its role as a model for cannabis testing practices across Europe.

KEY MARKET PLAYERS

A few of the promising companies operating in the European cannabis testing market profiled in the report are Agilent Technologies, Inc., Shimadzu Corporation, Waters Corporation, PerkinElmer, Inc., AB SCIEX LLC, Millipore Sigma, Restek Corporation, LabLynx, Inc. (U.S.), Steep Hill Labs, Inc., PharmLabs, LLC, SC Laboratories, Inc., Digipath Labs, Inc., CannaSafe Analytics, and Accelerated Technology Laboratories, Inc.

MARKET SEGMENTATION

This research report on the European cannabis testing market is segmented and sub-segmented into the below categories.

By Testing Procedures

- Terpene Profiling

- Potency Testing

- Residual Solvent Screening

- Pesticide Screening

- Genetic Testing

- Heavy Metal Testing

- Microbial Analysis

By End-user

- Cannabis Cultivators

- Laboratories

- Drug Manufacturers & Dispensaries

- Research Institutes

By Product & Software

- Analytical Instruments

- Consumables

- Software

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]