Europe Cable Accessories Market Size, Share, Trends, & Growth Forecast Report By Voltage (Low Voltage Cable Accessories, Medium Voltage Cable Accessories, and High Voltage Cable Accessories), Installation, End User, Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2024 to 2033

Europe Cable Accessories Market Size

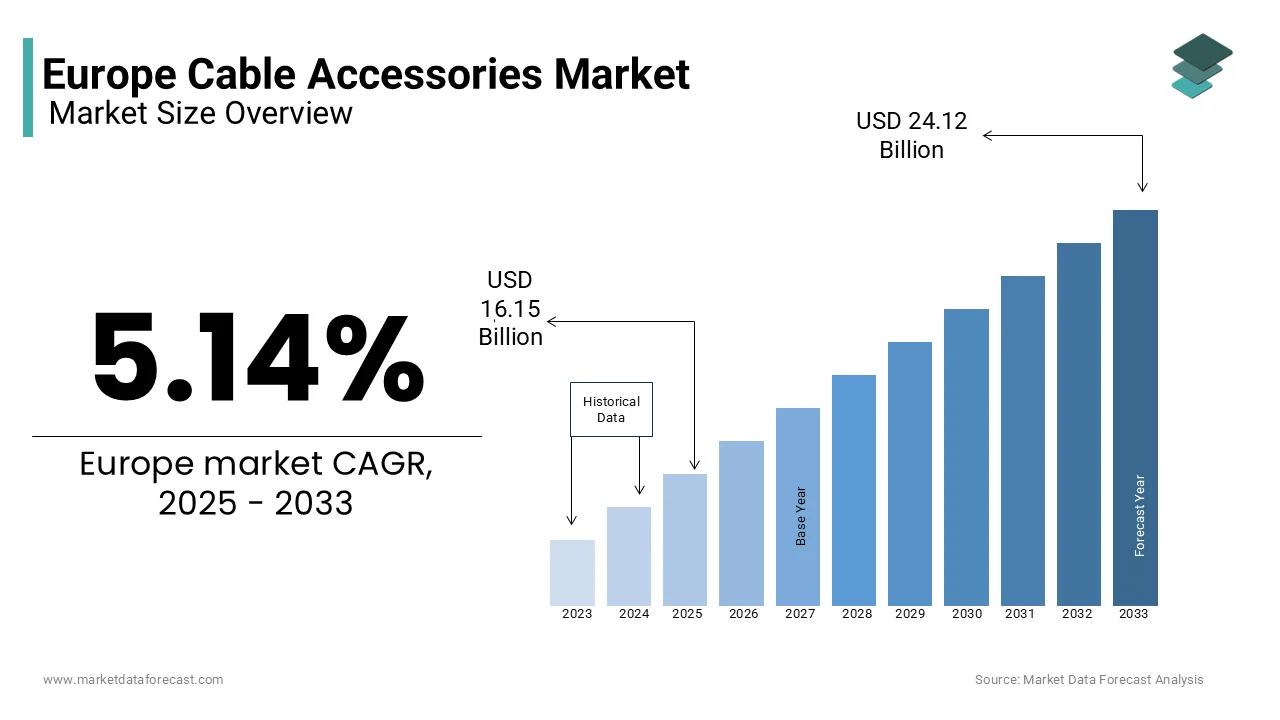

The Europe cable accessories market was worth USD 15.36 billion in 2024. The European market is expected to reach USD 24.12 billion by 2033 from USD 16.15 billion in 2025, growing at a CAGR of 5.14% from 2025 to 2033.

Cable accessories are products such as connectors, joints, terminations, and insulators that ensure the safe and efficient transmission of electricity. According to the European Network of Transmission System Operators for Electricity (ENTSO-E), the demand for cable accessories has surged due to the ongoing modernization of power grids and the integration of renewable energy sources into the grid. In Europe, the demand for cable accessories is experiencing steady growth owing to the investments in smart grid technologies and urban electrification projects. Germany is the largest contributor to the European cable accessories market. The increasing adoption of medium and high-voltage cable accessories is attributed to the expansion of electric vehicle charging networks and industrial automation. Furthermore, according to Eurostat, the European Union’s commitment to achieving carbon neutrality by 2050 has accelerated investments in renewable energy projects, which rely heavily on advanced cable accessories for efficient energy distribution.

MARKET DRIVERS

Increasing Investments in Renewable Energy Infrastructure

The rapid expansion of renewable energy infrastructure is a primary driver for the cable accessories market in Europe. According to the European Environment Agency, renewable energy sources accounted for 40% of the EU’s electricity generation in 2022, with wind and solar energy leading the charge. This transition necessitates advanced cable accessories to connect renewable energy plants to the grid, ensuring reliable power transmission. For instance, the German Federal Ministry for Economic Affairs and Climate Action reports that Germany invested €12 billion in offshore wind projects in 2022, requiring specialized high-voltage cable accessories for undersea connections. Similarly, As per the Ministry of Ecological Transition of Spain, solar farms in Andalusia utilize medium-voltage cable accessories to integrate power into regional grids. According to the European Investment Bank, €30 billion was allocated to renewable energy projects across Europe in 2022, which is creating a robust pipeline for cable accessory manufacturers. With the European Green Deal aiming to quadruple offshore wind capacity by 2030, the demand for high-performance cable accessories will continue to rise, reinforcing their role in sustainable energy systems.

Modernization of Aging Power Grids Across Europe

The modernization of aging power grids is another key driver propelling the cable accessories market in Europe. According to ENTSO-E, over 40% of Europe’s power grid infrastructure is more than 40 years old, necessitating upgrades to enhance efficiency and reliability. France, for example, has committed €10 billion to grid modernization projects by 2025, as stated by the French Transmission System Operator (RTE). Similarly, the UK’s National Grid reports that £20 billion will be invested in upgrading transmission networks by 2030, with a focus on low and medium-voltage cable accessories. The Italian Ministry of Economic Development further emphasizes that grid modernization projects have reduced power outages by 25% in urban areas, underscoring the importance of advanced cable solutions. According to the European Commission, smart grid initiatives that rely heavily on innovative cable accessories are expected to grow significantly by 2030. These efforts not only improve energy security but also support the integration of decentralized energy sources, making cable accessories indispensable to Europe’s energy future.

MARKET RESTRAINTS

Supply Chain Disruptions and Rising Raw Material Costs

Supply chain disruptions and escalating raw material costs is hindering the cable accessories market growth in Europe. According to Eurostat, the cost of copper, a key raw material for cable manufacturing, increased by 25% in 2022 due to geopolitical tensions and supply chain bottlenecks. The German Electrical and Electronic Manufacturers' Association (ZVEI) notes that these disruptions delayed over 30% of cable accessory production schedules in Germany, impacting project timelines. Similarly, Italy’s Ministry of Economic Development reports that the price volatility of aluminum, another critical material, has led to a 15% increase in production costs for local manufacturers. As per the European Commission, these logistical challenges including port congestion and labor shortages, have extended lead times by up to six months in some regions. These factors not only strain manufacturers’ profit margins but also hinder the timely delivery of essential components for energy projects. As supply chain uncertainties persist, the cable accessories market faces constraints that could impede its expansion unless mitigated through strategic sourcing and innovation.

Stringent Regulatory Standards and Compliance Requirements

Stringent regulatory standards and compliance requirements is further hampering the cable accessories market expansion in Europe. According to the European Committee for Electrotechnical Standardization (CENELEC), manufacturers must adhere to rigorous safety and environmental regulations, such as the Restriction of Hazardous Substances (RoHS) Directive and the Low Voltage Directive (LVD). The Swedish Energy Agency notes that compliance with these standards often requires costly testing and certification processes, which can delay product launches by up to 12 months. Similarly, the French Ministry of Ecological Transition highlights that non-compliance with eco-design regulations has resulted in fines exceeding €5 million for several companies in 2022. The European Commission further emphasizes that the complexity of cross-border regulations creates additional barriers, particularly for small and medium-sized enterprises (SMEs) operating in multiple countries. While these standards ensure product quality and safety, they also increase operational complexities and financial burdens, limiting market accessibility for new entrants and slowing overall growth.

MARKET OPPORTUNITIES

Expansion of Electric Vehicle Charging Infrastructure

The rapid expansion of electric vehicle (EV) charging infrastructure is a major opportunity for the cable accessories market in Europe. According to the European Automobile Manufacturers' Association (ACEA), the number of EVs on European roads surpassed 10 million in 2022, which is driving demand for reliable charging networks. According to the reports of the German Federal Ministry for Digital and Transport Infrastructure, more than 50,000 public charging stations were installed in Germany alone in 2022, each requiring specialized low-voltage cable accessories for safe and efficient operation. Similarly, the UK’s Office for Zero Emission Vehicles highlights that £1.6 billion was allocated to expand EV charging infrastructure by 2025, which is creating a robust pipeline for cable accessory manufacturers. The European Investment Bank further notes that investments in EV-related infrastructure are projected to reach €50 billion by 2030, underscoring the sector’s growth potential. This expansion not only supports Europe’s transition to sustainable mobility but also positions cable accessories as a critical enabler of the EV revolution, fostering innovation and economic growth.

Growing Adoption of Smart Grid Technologies

The growing adoption of smart grid technologies offers a promising opportunity for the cable accessories market in Europe. According to ENTSO-E, smart grid investments are expected to exceed €100 billion by 2030, driven by the need for enhanced grid resilience and efficiency. Italy leads this trend, with the Italian Transmission System Operator (TERNA) reporting that smart grid projects have reduced energy losses by 15% in urban areas. Similarly, Sweden’s Energy Markets Inspectorate highlights that smart meter, which rely on advanced cable accessories, have been installed in over 90% of households, improving energy management and reducing costs. The European Commission further emphasizes that smart grid initiatives are integral to achieving the EU’s 2050 carbon neutrality goals, with cable accessories playing a pivotal role in enabling real-time data monitoring and grid optimization. As Europe accelerates its digital transformation, the demand for innovative cable solutions will continue to rise, creating lucrative opportunities for manufacturers to capitalize on this emerging market.

MARKET CHALLENGES

Competition from Low-Cost Imports

The influx of low-cost imports from Asia poses a significant challenge to the European cable accessories market. According to Eurostat, imports of cable accessories from China and India increased by 20% in 2022, accounting for over 30% of the total market share. The German Electrical and Electronic Manufacturers' Association (ZVEI) notes that these imports, often priced 25-30% lower than locally manufactured products, create intense pricing pressure and erode profit margins for European manufacturers. The French Ministry of Economy and Finance further highlights that domestic companies face difficulties competing with imported products that do not always meet stringent EU quality and safety standards. Additionally, the European Commission reports that anti-dumping investigations have been initiated against several Asian manufacturers, yet the impact on market dynamics remains limited. This competition not only threatens the sustainability of local industries but also raises concerns about the reliability and durability of imported products, potentially compromising grid safety and performance.

Technological Advancements Outpacing Industry Adaptation

The rapid pace of technological advancements in the energy sector outstrips the ability of many manufacturers to adapt, posing another formidable challenge for the cable accessories market in Europe. According to the European Technology Platform for the Electricity Network of the Future (ETIP SNET), innovations such as superconducting cables and IoT-enabled accessories are transforming grid infrastructure, yet adoption rates remain uneven. The UK’s National Grid reports that only 40% of existing cable accessories are compatible with emerging smart grid technologies, necessitating costly upgrades. Similarly, the Spanish Ministry of Science and Innovation highlights that smaller manufacturers struggle to invest in research and development, leaving them ill-equipped to compete in a rapidly evolving market. The European Commission further notes that the lack of standardized protocols for integrating new technologies creates additional barriers, delaying widespread implementation. As the industry races to keep pace with innovation, manufacturers face the dual challenge of balancing investment in R&D with maintaining profitability, threatening long-term competitiveness.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5.14% |

|

Segments Covered |

By Voltage, Installation, End User, and Country |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Countries Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, and Rest of Europe |

|

Market Leaders Profiled |

Nexans, Prysmian Group, Pfisterer Group, HellermannTyton, Hager Group, Electrium, and Fischer Connectors. |

SEGMENTAL ANALYSIS

By Voltage Insights

The medium voltage segment accounted for a dominating share of 45.4% in the European market in 2024. The domination of medium voltage segment is attributed to their widespread use in industrial applications, renewable energy projects, and urban electrification. Germany is the largest adopter in Europe that utilizes medium voltage accessories in over 60% of its renewable energy grid connections, generating 15 billion kilowatt-hours annually, according to the German Federal Ministry for Economic Affairs and Climate Action. The Italian Ministry of Economic Development further notes that medium voltage accessories reduce energy losses by 20%, making them indispensable for efficient power distribution. Their importance lies in their versatility, bridging the gap between low and high-voltage systems while supporting the integration of decentralized energy sources. With renewable energy projects set to triple by 2030, medium voltage cable accessories will remain pivotal to Europe’s energy infrastructure.

The high voltage segment is projected to expand at a CAGR of 8.2% over the forecast period owing to the expansion of offshore wind farms and cross-border interconnections. The UK’s National Grid highlights that high voltage accessories are essential for connecting offshore wind turbines, with over 10 GW of capacity added in 2022. Similarly, the French Transmission System Operator (RTE) reports that high voltage systems account for 70% of cross-border energy exchanges, underscoring their importance. The European Commission further emphasizes that investments in high voltage infrastructure are projected to reach €40 billion by 2030, driven by the EU’s goal to quadruple offshore wind capacity. Their ability to transmit large volumes of electricity over long distances makes them critical for achieving energy security and sustainability targets.

By Installation Insights

The underground segment occupied 60.8% of the European market share in 2024. The dominance of the underground installation segment in the European market is driven by their aesthetic appeal, reduced risk of damage, and suitability for urban environments. Germany leads this trend, with the German Electrical and Electronic Manufacturers' Association (ZVEI) reporting that underground systems account for 70% of new installations in metropolitan areas. The Italian Ministry of Infrastructure and Transport further notes that underground accessories reduce maintenance costs by 30%, enhancing their economic viability. Their importance lies in their ability to minimize environmental impact while ensuring reliable power transmission. With urbanization expected to increase by 15% by 2030, underground cable accessories will remain a cornerstone of Europe’s energy infrastructure.

The overhead segment is predicted to grow at the highest CAGR of 7.5% over the forecast period owing to their cost-effectiveness and suitability for rural electrification projects. France leads this trend, with the French Rural Electrification Agency reporting that overhead systems provide electricity to over 80% of rural households. Similarly, the Spanish Ministry of Agriculture highlights that overhead accessories reduce installation costs by 40%, making them ideal for remote areas. The European Investment Bank further notes that investments in rural electrification are projected to reach €20 billion by 2030, creating a robust pipeline for overhead cable accessories. Their ability to deliver affordable energy solutions underscores their importance in bridging the urban-rural divide.

By End User Insights

The industrial segment led the market by occupying a share of 55.9% in the European market in 2024. The domination of the industrial segment in the European market is attributed to the sector’s reliance on robust cable accessories for machinery, automation, and process control systems. Germany, the largest industrial hub, utilizes industrial-grade accessories in over 70% of its manufacturing facilities, generating €50 billion in annual output, according to the German Federal Ministry for Economic Affairs and Climate Action. The Italian Ministry of Economic Development further notes that industrial applications reduce downtime by 25%, enhancing operational efficiency. Their importance lies in their ability to support high-power requirements while ensuring safety and reliability. With industrial automation projected to grow by 10% annually, industrial cable accessories will remain central to Europe’s manufacturing landscape.

The renewable energy is segment is estimated to progress at a CAGR of 9.4% over the forecast period owing to the increasing adoption of wind and solar energy projects. Spain leads this trend, with the Spanish Ministry of Ecological Transition reporting that renewables account for 40% of the country’s energy mix, relying heavily on specialized cable accessories. Similarly, the Danish Energy Agency highlights that offshore wind farms utilize high-performance accessories to integrate power into national grids. The European Investment Bank further notes that renewable energy investments are projected to reach €100 billion by 2030, creating a robust pipeline for cable accessories.

REGIONAL ANALYSIS

Germany held the leading position in the European cable accessories market by occupying a share of 25.9% in the European market in 2024. The dominance of Germany in the European market is driven by its robust industrial base and commitment to renewable energy. Germany invested €12 billion in offshore wind projects in 2022, requiring advanced high-voltage accessories, according to the German Federal Ministry for Economic Affairs and Climate Action. The ZVEI further notes that Germany’s cable accessories industry contributes €3 billion annually to the economy. Its leadership is reinforced by strong R&D capabilities and adherence to stringent quality standards. With ambitious decarbonization targets, Germany will continue to do well in the European market over the forecast period.

France captured a notable share of the European market in 2024. The focus of France on grid modernization and rural electrification has gained a promising position to France in the European cable accessories market. For instance, France committed €10 billion to grid upgrades by 2025, which is creating a robust pipeline for manufacturers, according to the French Ministry of Ecological Transition. The RTE further highlights that France’s investments in smart grid technologies have reduced energy losses by 15%.

Italy is likely to play a key role in the European cable accessories market over the forecast period due to the increasing urban electrification and renewable energy projects. According to the TERNA reports of Italy, smart grid initiatives have improved energy efficiency by 20%, which is underscoring the importance of advanced accessories. The Italian government further emphasizes that investments in renewable energy will reach €20 billion by 2030.

Spain accounted for a considerable share of the European market in 2024 and is expected to grow at a healthy CAGR over the forecast period. The growth of the Spain cable accessories market is driven by its renewable energy ambitions, with renewables contributing 40% to the energy mix. Spain’s investments in solar and wind projects have created a robust demand for medium and high-voltage accessories. The ministry further notes that rural electrification projects have expanded access to affordable energy.

The UK is projected to expand at a steady CAGR during the forecast period owing to the EV charging infrastructure of the UK and offshore wind projects. The UK allocated £1.6 billion to expand EV charging networks, creating a robust pipeline for cable accessories. The National Grid further highlights that offshore wind farms generate 10 GW of capacity, relying on high-performance accessories. The UK’s commitment to decarbonization reinforces its regional importance.

KEY MARKET PLAYERS

The major players in the Europe cable accessories market include Nexans, Prysmian Group, Pfisterer Group, HellermannTyton, Hager Group, Electrium, and Fischer Connectors.

MARKET SEGMENTATION

This research report on the Europe cable accessories market is segmented and sub-segmented into the following categories.

By Voltage

- Low Voltage Cable Accessories

- Medium Voltage Cable Accessories

- High Voltage Cable Accessories

By Installation

- Overhead Cable Accessories

- Underground Accessories

By End User

- Industrial

- Renewables

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What are the key drivers of the Europe cable accessories market?

The market is driven by the rising demand for electricity, increasing investments in renewable energy projects, modernization of power grids, and expansion of telecommunication networks.

Which industries are the major consumers of cable accessories in Europe?

The major consumers include power utilities, construction, telecommunications, oil & gas, transportation, and manufacturing industries.

What are the latest trends in the Europe cable accessories market?

Trends include the use of eco-friendly materials, smart cable accessories with monitoring features, and increasing adoption of high-voltage direct current (HVDC) technology.

What is the future outlook for the Europe cable accessories market?

The market is expected to grow steadily, supported by increasing investments in renewable energy, infrastructure modernization, and technological advancements in cable accessories.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]