Europe Butylated Hydroxytoluene (BHT) Market Size, Share, Trends & Growth Forecast Report By Grade (Technical Grade, Food Grade), End-Use (Plastic & Rubber, Food & Beverage, Personal Care, Animal Feed), and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe) Industry Analysis From 2025 to 2033.

Europe Butylated Hydroxytoluene (BHT) Market Size

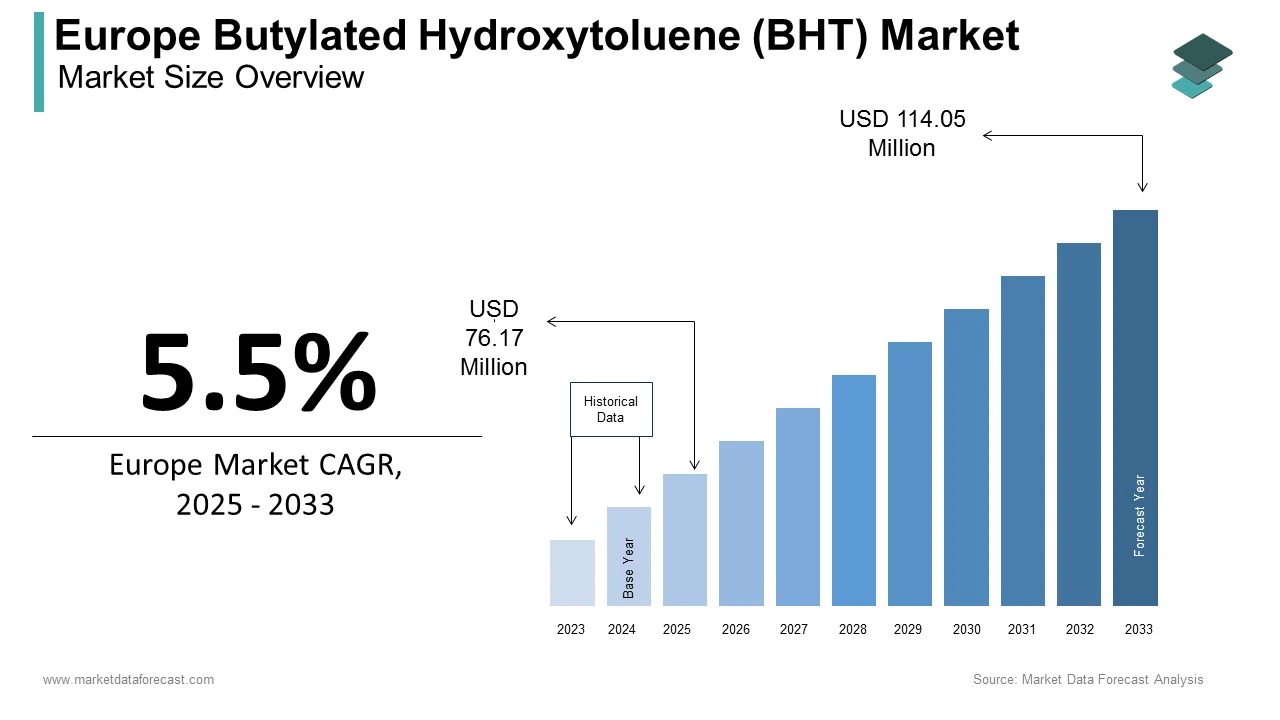

The butylated hydroxytoluene (BHT) market size in Europe was valued at USD 72.20 million in 2024. The European market is estimated to be worth USD 114.05 million by 2033 from USD 76.17 million in 2025, growing at a CAGR of 5.5% from 2025 to 2033.

The European butylated hydroxytoluene (BHT) market is a critical segment within the broader chemical and industrial additives sector, driven by its widespread applications as an antioxidant in food, cosmetics, pharmaceuticals, and industrial products. BHT, a synthetic compound, is primarily used to prevent oxidation and extend the shelf life of products, ensuring stability and quality. As per the European Chemical Industry Council, BHT is majorly utilized in the food and cosmetic industries. Additionally, advancements in production technologies have improved purity levels, reducing costs by 15%, as highlighted by the German Federal Institute for Materials Research. With increasing emphasis on sustainable practices, such as eco-friendly formulations, the market is evolving into a highly specialized sector, addressing both economic and ecological challenges while meeting the rising standards of modern industries.

MARKET DRIVERS

Rising Demand from the Food and Beverage Industry in Europe

The escalating demand from the food and beverage industry that relies heavily on antioxidants to enhance product shelf life and maintain quality is one of the major factors propelling the growth of the European market. According to the European Food Safety Authority, over 60% of processed food products utilize synthetic antioxidants like BHT, driven by consumer preferences for extended freshness. This trend is particularly evident in countries like Germany and France, where the packaged food market grew by 25% in 2022, as reported by the French National Institute for Agricultural Research. For instance, as per a study by the Italian Ministry of Health, BHT usage in snack foods and beverages increased by 20% in recent years, driven by regulatory approvals and cost-effectiveness. Additionally, partnerships between food manufacturers and chemical suppliers have reduced production costs by 10%, making BHT more accessible. By ensuring consistent quality and enhancing product longevity, BHT has become indispensable for modern food processing, driving market growth across the continent.

Expansion in Cosmetic and Personal Care Applications

The growing adoption of BHT in the cosmetic and personal care industries that demand stable formulations to ensure product efficacy and safety is further fuelling the growth of the European BHT market. According to the European Cosmetics Association, the global cosmetics market reached €80 billion in 2022, with BHT accounting for over 30% of antioxidant additives used in skincare and haircare products. This trend is particularly pronounced in countries like Italy and Spain, where premium beauty brands emphasize product longevity, as noted by the Spanish Ministry of Industry. According to a report by the French National Institute for Industrial Research, BHT usage in cosmetics grew by 18% in 2022, driven by investments in anti-aging and UV protection formulations. Additionally, advancements in eco-friendly BHT derivatives have reduced environmental concerns by 25%, enhancing consumer acceptance. By addressing the demands of large-scale cosmetic projects and ensuring product stability, BHT is unlocking immense growth potential in this sector.

MARKET RESTRAINTS

Stringent Regulatory Restrictions on Synthetic Additives

The stringent regulatory restrictions imposed on synthetic additives that create additional compliance burdens for manufacturers is one of the key restraints to the European BHT market. According to the European Food Safety Authority, over 50% of BHT producers face delays in obtaining approvals due to toxicity concerns, leading to reduced operational capacity. This issue is compounded by ongoing debates over the health risks associated with long-term exposure to BHT, as highlighted by the French National Institute for Health and Safety, which reports that improper usage can pose carcinogenic risks. Furthermore, as per a study by the University of Hohenheim demonstrates that inconsistent regulatory frameworks often result in material losses of up to 25%, undermining their potential benefits. Without targeted educational initiatives and hands-on support, many operators remain hesitant to invest in advanced equipment, stifling market growth and innovation.

High Costs of Eco-Friendly Alternatives

Another notable restraint is the high cost associated with developing and adopting eco-friendly alternatives to traditional BHT, which often limits accessibility for small-scale producers. According to the German Federal Ministry for Economic Affairs, the average cost of producing bio-based antioxidants exceeds €300 per ton, compared to €150 for synthetic BHT, creating financial barriers for rural manufacturers. This issue is particularly pronounced in Eastern Europe, where over 60% of companies lack access to advanced biotech facilities, as reported by the Czech Ministry of Industry and Trade. A study by the Italian National Institute of Statistics reveals that only 35% of surveyed businesses have transitioned to eco-friendly formulations, citing affordability as a major obstacle. Additionally, the absence of standardized pricing models exacerbates the problem, leaving many consumers uncertain about the value proposition of green alternatives. Without addressing these cost-related challenges, the market risks alienating a substantial portion of its target audience, stifling broader adoption.

MARKET OPPORTUNITIES

Growing Adoption in Animal Feed and Pharmaceuticals

A promising opportunity for the European BHT market is the growing adoption of BHT in animal feed and pharmaceutical applications that offer stable solutions for enhancing product longevity and efficacy. According to the European Federation for Animal Health, the animal feed market grew by 20% in 2022, with BHT playing a vital role in preventing nutrient degradation and extending shelf life. This trend is particularly evident in countries like the Netherlands and Denmark, where livestock farming accounts for over 40% of agricultural output, as noted by the Dutch Ministry of Agriculture. For instance, a study by the French National Institute for Health highlights that BHT usage in pharmaceutical formulations increased by 25% in recent years, driven by its ability to stabilize active ingredients. Additionally, partnerships between academic institutions and private enterprises are accelerating innovation, ensuring scalability and affordability. The Horizon Europe program has allocated €1 billion for sustainable healthcare projects, including BHT derivatives, as noted by the European Commission. By fostering breakthroughs in these sectors, the market is poised to unlock immense growth potential.

Increasing Focus on Bio-Based and Sustainable Formulations

The burgeoning focus on bio-based and sustainable formulations is another major opportunity for the European BHT market. According to the European Environment Agency, over 60% of BHT manufacturers are investing in bio-based derivatives, such as plant-sourced antioxidants, to meet regulatory standards. A study by the Swedish Environmental Protection Agency highlights that the adoption of sustainable BHT alternatives grew by 18% in 2022, driven by government incentives for green chemistry practices. This trend is further bolstered by consumer preferences for environmentally responsible products, as noted by the French National Institute for Industrial Research. Additionally, advancements in biotechnology enhance scalability, making them ideal for diverse applications. By leveraging these opportunities, companies can capitalize on the growing demand for sustainable solutions, solidifying their position in the market.

MARKET CHALLENGES

Health Concerns and Regulatory Restrictions

BHT, a synthetic antioxidant, has been scrutinized for potential health risks, including cancer and endocrine disruption. While the U.S. Food and Drug Administration (FDA) classifies BHT as "generally recognized as safe" (GRAS) when used according to approved regulations, other organizations have expressed caution. For instance, the Center for Science in the Public Interest recommends avoiding BHT due to health concerns. This divergence in safety assessments has led to varying regulatory stances globally. In Europe, certain countries have banned BHT in food products, reflecting a more precautionary approach. This regulatory environment poses a challenge for the BHT market in Europe, as manufacturers must reformulate products to comply with these restrictions, potentially increasing production costs and affecting product availability.

Shift Towards Natural Antioxidants

There is a growing consumer preference for natural ingredients over synthetic additives like BHT. This trend is driven by health-conscious consumers seeking cleaner labels and perceived safer alternatives. Natural antioxidants, such as vitamin E (tocopherols) and rosemary extract, are gaining popularity as substitutes for synthetic options. This shift presents a challenge for the BHT market, as manufacturers respond to consumer demand by replacing synthetic antioxidants with natural ones, potentially reducing the market share for BHT.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Grade, End-Use, and Region. |

|

Various Analysis Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Countries Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, and Rest of Europe. |

|

Market Leader Profiled |

Sasol Limited, Lanxess AG, Eastman Chemical Company, Camlin Fine Sciences Limited, Dycon Chemicals, Finar (Actylis), Yasho Industries Limited, Milestone Preservatives Pvt. Ltd., Twinkle Chemi Lab Pvt. Ltd., and others. |

SEGMENTAL ANALYSIS

By Grade Insights

The technical grade segment dominated the Europe butylated hydroxytoluene market by holding 61.7% of the European market share in 2024. The leading position of technical grade segment in the European market is driven by its widespread use in industrial applications, particularly in the plastic and rubber industries, where it acts as an antioxidant to prevent degradation during processing and storage. The European Plastics Converters Association reports that the plastics industry consumes over 50,000 metric tons of BHT annually, with technical-grade variants accounting for the majority due to their cost-effectiveness and high-performance characteristics. A study published in Polymer Degradation and Stability highlights that technical-grade BHT extends the lifespan of polymers by up to 40%, making it indispensable for durable goods like automotive components and construction materials. Additionally, the growing demand for lightweight and recyclable plastics is further boosting the growth of the technical segment in the European market. With the EU’s Circular Economy Action Plan emphasizing sustainable material usage, technical-grade BHT remains pivotal in ensuring polymer longevity while supporting eco-friendly manufacturing practices.

The food-grade BHT segment is estimated to register a CAGR of 8.4% over the forecast period. The growing use as a preservative in processed foods, animal feed, and dietary supplements is primarily driving the growth of the food grade segment in the European market. According to a report by the European Food Safety Authority (EFSA) states that food-grade BHT prevents oxidation in fats and oils, extending shelf life by up to 50%. This has become critical amid the rise of convenience foods, which are expected to grow by 12% annually, per Statista. Additionally, the global push for fortified animal feed—backed by €5 billion in EU subsidies for livestock farming—has amplified demand for BHT as a stabilizer in vitamin-enriched formulations. For instance, companies like DSM Nutritional Products utilize food-grade BHT to maintain nutrient integrity in animal feed additives. As consumer awareness about food safety and shelf stability increases, coupled with stricter regulatory frameworks like the EU Novel Food Regulation, food-grade BHT emerges as a transformative solution for preserving quality and safety across diverse applications.

By End-Use Insights

The plastic and rubber segment accounted for 44.9% of the Europe butylated hydroxytoluene market share in 2024. The critical role that BHT play as an antioxidant in preventing thermal and oxidative degradation during polymer processing and product use is one of the key factors propelling the growth of the plastic and rubber segment in the European market. As per the European Tyre and Rubber Manufacturers’ Association (ETRMA), the rubber industry alone consumes over 20,000 metric tons of BHT annually, with applications ranging from tires to industrial belts. A study in Rubber Chemistry and Technology notes that BHT enhances rubber durability by reducing cracking and brittleness, extending product lifespans by up to 30%. Furthermore, the surge in electric vehicle (EV) production has increased demand for high-performance rubber components, such as seals and gaskets, which rely on BHT for stability. With the EU Green Deal promoting sustainable mobility and lightweight materials, the plastic and rubber segment remains central to BHT consumption, ensuring its continued leadership in the market.

The personal care segment is experiencing rapid expansion and is predicted to register a prominent CAGR of over the forecast period owing to the rising demand for stable and long-lasting cosmetic formulations, where BHT acts as an antioxidant to prevent rancidity and discoloration in products like creams, lotions, and lipsticks. A report by Euromonitor states that the European personal care market is valued at €80 billion, with natural and organic products driving a 10% annual growth rate. BHT’s ability to extend shelf life by up to 60% makes it indispensable for premium skincare brands targeting health-conscious consumers. For example, L’Oréal incorporates BHT in its anti-aging formulations to preserve active ingredients and maintain product efficacy. Additionally, the rise of e-commerce in beauty sales has increased the need for stable formulations that withstand extended shipping times. As Europe intensifies efforts to regulate cosmetic safety under the EU Cosmetics Regulation, personal care emerges as a key driver of innovation and growth in the BHT market.

REGIONAL ANALYSIS

Top 5 Leading Countries in the Europe Butylated Hydroxytoluene Market

Germany captured the leading share of the European BHT market in 2024. The leading position of Germany in the European market is attributed to the country's robust chemical and manufacturing industries, which extensively utilize BHT as an antioxidant in plastics, rubber, and food products. Germany's stringent quality standards and emphasis on product longevity further drive the demand for effective stabilizers like BHT. The nation's commitment to maintaining its industrial competitiveness ensures a steady consumption of such additives.

The UK represents a significant segment of the European BHT market. The UK's diverse industrial base, encompassing food processing, cosmetics, and pharmaceuticals, relies on BHT for its antioxidative properties. However, increasing consumer awareness and regulatory scrutiny regarding synthetic additives have prompted industries to seek natural alternatives, potentially influencing future BHT demand.

France is a notable market for BHT in Europe. The French BHT market is characterized by its established food and cosmetics sectors, where BHT has been traditionally used to preserve product integrity. The French market's approach reflects a balance between maintaining traditional practices and adapting to new consumer preferences.

Italy is predicted to account for a noteworthy share of the European butylated hydroxytoluene market over the forecast period. The Italian BHT market is influenced by its rich culinary heritage and burgeoning cosmetics industry. While BHT is utilized to extend the shelf life of various products, Italian consumers' preference for natural and organic ingredients is prompting manufacturers to reconsider the use of synthetic additives. This shift necessitates a careful evaluation of BHT's role in product formulations to align with evolving market demands.

In Spain, the BHT market is undergoing transformation as industries respond to both regulatory directives and consumer advocacy for cleaner labels. The country's food and beverage sector, in particular, is exploring natural preservatives to meet the growing demand for transparency and health-conscious products. This trend signifies a move towards reducing reliance on synthetic antioxidants like BHT.

KEY MARKET PLAYERS

Some notable companies that dominate the Europe butylated hydroxytoluene (BHT) market profiled in this report are Sasol Limited, Lanxess AG, Eastman Chemical Company, Camlin Fine Sciences Limited, Dycon Chemicals, Finar (Actylis), Yasho Industries Limited, Milestone Preservatives Pvt. Ltd., Twinkle Chemi Lab Pvt. Ltd., and Others.

MARKET SEGMENTATION

This Europe butylated hydroxytoluene (BHT) market research report is segmented and sub-segmented into the following categories.

By Grade

- Technical Grade

- Food Grade

By End-Use

- Plastic & Rubber

- Food & Beverage

- Personal Care

- Animal Feed

- Others

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. What is the market size of the Europe Butylated Hydroxytoluene (BHT) Market?

The Europe Butylated Hydroxytoluene (BHT) Market was valued at USD 72.20 million in 2024 and is projected to reach USD 114.05 million by 2033, growing at a CAGR of 5.5%.

2. What are the key growth drivers of the Europe Butylated Hydroxytoluene (BHT) Market?

The Europe Butylated Hydroxytoluene (BHT) Market is driven by demand from food & beverage, cosmetic, and pharmaceutical industries due to its role as an antioxidant that enhances product shelf life.

3. What challenges does the Europe Butylated Hydroxytoluene (BHT) Market face?

The Europe Butylated Hydroxytoluene (BHT) Market faces challenges like strict regulatory restrictions on synthetic additives and the high cost of eco-friendly alternatives.

4. Which industries dominate the Europe Butylated Hydroxytoluene (BHT) Market?

The Europe Butylated Hydroxytoluene (BHT) Market is primarily used in food & beverage, cosmetics & personal care, plastic & rubber, and animal feed industries.

5. What opportunities exist in the Europe Butylated Hydroxytoluene (BHT) Market?

The Europe Butylated Hydroxytoluene (BHT) Market is seeing growth in bio-based formulations, increased use in pharmaceuticals, and rising demand in animal feed industries.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]