Europe Butane Market Size, Share, Growth, Trends, And Forecasts Report, Segmented By Application And By Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe), Industry Analysis From 2025 to 2033

Europe Butane Market Size

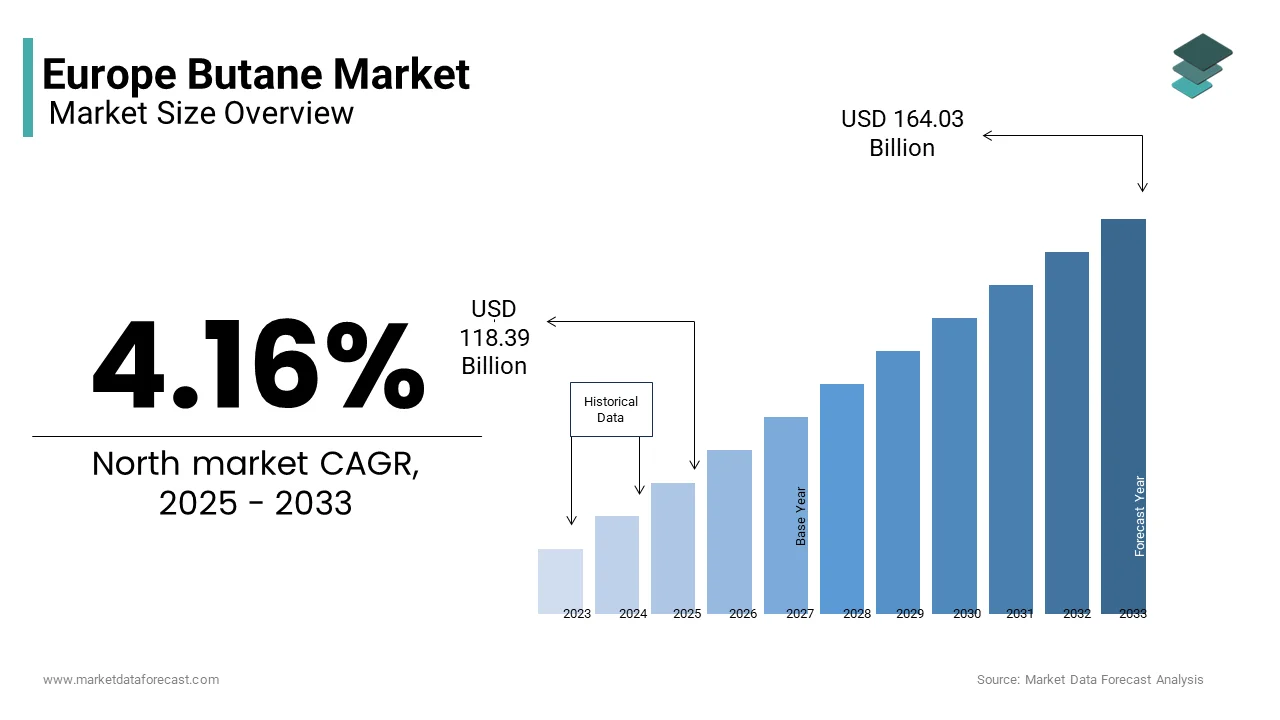

The European butane market was valued at 113.66 billion in 2024 and is anticipated to reach USD 118.39 billion in 2025 from USD 164.03 billion by 2033, growing at a CAGR of 4.16% during the forecast period from 2025 to 2033.

The European butane market remains strong, thanks to its wide range of uses across different industries. According to the European Environment Agency, liquefied petroleum gas (LPG), which includes butane, makes up about 15% of the region’s total energy use. This shows how important butane is as a cleaner option compared to traditional fossil fuels. Supportive policies, like the European Union’s Green Deal that targets carbon neutrality by 2050, are also helping the market grow. Eurostat reports that the EU used around 40 million tonnes of LPG in 2022, with butane making up a large part of that. Demand for butane tends to rise in the winter months due to its use in heating. Countries such as Germany and Italy are among the top users, largely because of their strong industrial activity. While changing crude oil prices can affect production costs, steady demand from refineries and the petrochemical industry helps keep the market stable.

MARKET DRIVERS

Increasing Demand for LPG as a Cleaner Energy Source

The growing preference for liquefied petroleum gas (LPG) as an eco-friendly alternative to coal and oil has been a significant driver for the butane market in Europe. The World LPG Association reveals that LPG reduces carbon emissions by up to 30% compared to conventional fuels, making it an attractive option for households and industries. In 2023, the residential sector accounted for nearly 45% of total LPG consumption in Europe, with butane playing a pivotal role in heating and cooking applications. Countries like France and Spain have witnessed a surge in LPG adoption, driven by government incentives promoting clean energy usage. For instance, France's "Energy Transition for Green Growth" policy targets a 30% reduction in fossil fuel dependency by 2030.

Expansion of Petrochemical Industries

The burgeoning petrochemical industry in Europe has emerged as another critical factor propelling the butane market. Butane serves as a feedstock for producing ethylene and propylene, essential components in manufacturing plastics and synthetic materials. According to the European Chemical Industry Council, the petrochemical sector contributes over €500 billion annually to the EU economy, with butane being a key raw material. Germany and the Netherlands lead in petrochemical production, accounting for nearly 40% of the region's output. A report by the European Plastics Converters Association reveals that plastic production in Europe reached 50 million tonnes in 2022, with butane derivatives forming a substantial portion. The increasing demand for lightweight packaging and automotive components further amplifies the need for butane. Additionally, investments exceeding €10 billion in new petrochemical facilities across Europe are expected to boost butane consumption by 2025.

MARKET RESTRAINTS

Fluctuations in Crude Oil Prices

One of the primary restraints affecting the Europe butane market is the volatility in crude oil prices, given that butane is a byproduct of oil refining. Based on the findings by the Organization of the Petroleum Exporting Countries (OPEC), crude oil prices experienced swings of over 30% in 2023, directly impacting butane production costs. The European Federation of Energy Traders notes that such price instability disrupts supply chains and deters long-term investments in butane infrastructure. Moreover, refineries often adjust their operations based on crude oil profitability, leading to inconsistent butane outputs. In 2022, refinery utilization rates in Europe dropped to 85%, partly due to high crude costs, as per the European Refinery Forum. These fluctuations create uncertainty, hindering market growth despite rising demand for cleaner energy alternatives.

Stringent Environmental Regulations

Stringent environmental regulations targeting hydrocarbon emissions pose another significant challenge to the butane market in Europe. The European Commission's REPowerEU initiative mandates a 55% reduction in greenhouse gas emissions by 2030, pressuring industries reliant on butane to adopt cleaner technologies. In line with the European Environment Agency, butane combustion emits approximately 60 grams of CO2 per megajoule, higher than natural gas. This has led to increased scrutiny and calls for alternatives like hydrogen or bio-LPG. Furthermore, the EU Emissions Trading System (ETS) imposes carbon pricing, which added €95 per tonne of CO2 in 2023 raising operational costs for butane users. A study by the Climate Action Network Europe estimates that these measures could reduce butane demand by 15% in high-emission sectors by 2028. While beneficial for long-term sustainability, these regulations constrain immediate market expansion and necessitate costly adaptations.

MARKET OPPORTUNITIES

Rising Adoption of Bio-LPG

The development and adoption of bio-LPG present a transformative opportunity for the Europe butane market. Bio-LPG, derived from renewable sources like vegetable oils and waste biomass, aligns with the EU's decarbonization goals. According to the European Biogas Association, bio-LPG production capacity in Europe is expected to reach 1.5 million tonnes annually by 2027 creating a niche market for sustainable butane alternatives. France and Sweden are at the forefront of this transition, with France investing €200 million in bio-LPG production facilities. The European Green Deal supports such initiatives are offering subsidies and tax incentives to promote bio-LPG adoption. As per the Renewable Energy Directive, renewable energy's share in Europe's transport sector must reach 14% by 2030, driving demand for bio-LPG. With consumer awareness growing, companies are increasingly blending bio-LPG with traditional butane, enhancing market prospects while meeting environmental standards.

Growth in Rural Electrification Projects

Another promising opportunity lies in rural electrification projects, where butane plays a crucial role in providing decentralized energy solutions. As indicated by the European Network of Transmission System Operators for Gas, over 20 million rural households in Europe rely on LPG for energy needs, with butane being a primary component. Initiatives like the EU's Smart Villages program aim to enhance energy access in remote areas, boosting butane demand. Italy and Spain have already implemented pilot projects, with Spain reporting a 15% increase in rural LPG consumption in 2023. The European Investment Bank highlights that rural electrification projects are expected to attract €5 billion in funding by 2025, further propelling butane usage. Additionally, advancements in portable butane-powered generators offer innovative solutions for off-grid communities, expanding the market's reach and diversifying its applications.

MARKET CHALLENGES

Competition from Alternative Fuels

The Europe butane market faces stiff competition from alternative fuels like electricity and natural gas, which are gaining traction due to their lower carbon footprints. According to the European Heat Pump Association, heat pump installations in Europe grew by 35% in 2023 were driven by government subsidies and rising electricity grid efficiency. Natural gas, with its extensive pipeline infrastructure, also poses a significant threat, as showcased by the International Gas Union, which notes that natural gas accounts for 25% of Europe's energy mix. For instance, Germany's Energiewende policy prioritizes natural gas over LPG is reducing butane's market share in industrial applications. Furthermore, electric vehicles (EVs) are replacing traditional fuel-powered vehicles, diminishing butane's role in autogas. The European Automobile Manufacturers' Association reports that EV sales surged by 40% in 2023, signaling a shift away from hydrocarbon-based fuels and challenging butane's dominance in transportation.

Infrastructure Limitations

Infrastructure limitations, particularly in storage and distribution networks, present a significant hurdle for the Europe butane market. As per the European Propane and Butane Association, inadequate storage facilities restrict butane supply during peak demand periods such as winter. For example, in 2022, the UK faced shortages due to insufficient storage capacity is leading to a 20% spike in butane prices. Additionally, the fragmented nature of distribution networks in Eastern Europe exacerbates inefficiencies. A study by the European Transport Workers' Federation reveals that logistics costs account for 30% of butane's final price is limiting accessibility in remote regions. Investments in pipeline and terminal expansions are lagging, with only €2 billion allocated in 2023, as per the European Investment Bank. These constraints hinder market growth and require substantial capital inflows to modernize infrastructure and ensure consistent supply.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

4.16% |

|

Segments Covered |

By Application and Country |

|

Various Analyses Covered |

Global, Regional and Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe |

|

Market Leaders Profiled |

British Petroleum, Chevron Corporation, China National Petroleum Corporation (CNPC), Valero Energy Corporation, Conocco Phillips Inc., Devron Energy Corporation, Exxon Mobil Corporation, Perenco, Royal Dutch Shell plc, Linde AG, TotalEnergies, Praxair. |

SEGMENTAL ANALYSIS

By Application

The liquefied petroleum gas (LPG) segment dominated the Europe butane market by holding a market share of 60.8% in 2024. As per the European LPG Association, LPG consumption in Europe reached 40 million tonnes in 2022, with butane being a key component. The dominance of this segment is caused by its widespread use in residential heating and cooking, particularly in rural areas. France and Italy are major contributors, with France accounting for 20% of total LPG demand. Government policies promoting clean energy further bolster LPG adoption. For instance, Italy's National Energy Plan incentivizes LPG usage, resulting in a 10% annual growth rate in household consumption. Additionally, the versatility of LPG in industrial applications, such as metal cutting and drying processes, ensures sustained demand. The European Commission's push for decentralized energy solutions amplifies LPG's prominence, strengthening its position as the largest segment.

The petrochemical segment is the fastest-growing application in the Europe butane market, with a projected CAGR of 4.2% from 2025 to 2033. According to the European Chemical Industry Council, the petrochemical sector's revenue surpassed €500 billion in 2023, driven by rising demand for plastics and synthetic materials. Butane serves as a critical feedstock for producing ethylene and propylene, essential for manufacturing polyethylene and polypropylene. Germany and the Netherlands are leading this growth, with Germany's petrochemical industry expanding by 8% annually. The European Plastics Converters Association reports that plastic production in Europe reached 50 million tonnes in 2022, fueled by lightweight packaging trends. Investments in new petrochemical plants, such as Shell's €1.5 billion facility in the Netherlands, further accelerate butane consumption. These factors collectively drive the segment's rapid expansion.

COUNTRY ANALYSIS

Top 5 Leading Countries In The Europe Butane Market

Germany commands the largest share of the European butane market in 2024 and held an estimated 27.2%. Its robust industrial base, coupled with stringent environmental regulations, drives significant butane consumption. According to the German Federal Ministry for Economic Affairs, the country's petrochemical sector utilizes butane extensively for producing plastics is contributing to 30% of Europe's total output. Additionally, Germany's focus on renewable energy integration has spurred bio-LPG adoption. The Energiewende policy promotes cleaner fuels, positioning butane as a transitional energy source. Furthermore, Germany's advanced infrastructure, including pipelines and storage terminals, ensures efficient supply chains, reinforcing its leadership in the regional market.

France isn’t expanding its butane use rapidly, but it remains one of the most seasonally dynamic markets. This is driven by its reliance on LPG for residential applications. As per the French Ministry of Ecological Transition, over 7 million households use LPG for heating and cooking, with butane being a primary component. Government initiatives like the "Energy Transition for Green Growth" policy incentivize LPG usage, boosting demand by 5% annually. France's strategic investments in bio-LPG production, totaling €200 million, further strengthen its market position. Moreover, the country's well-established distribution network ensures widespread accessibility, even in rural areas. These factors, combined with a strong regulatory framework, emphasizes France's prominence in the European butane landscape.

Italy’s butane use tells a story of regional diversity. The regional market rise is attributed to its heavy reliance on LPG for residential and industrial purposes. According to Italy's National Energy Plan, LPG accounts for 10% of the country's energy mix, with butane playing a vital role. Residential heating dominates consumption, particularly in rural regions lacking natural gas infrastructure. The Italian government's subsidies for clean energy solutions have propelled LPG adoption that is resulting in a 10% annual growth rate. Italy's petrochemical industry also contributes significantly, utilizing butane for plastic production. Investments in modernizing storage facilities and pipelines ensure consistent supply, solidifying Italy's influence in the regional market.

Spain has one of the largest bottled butane cylinder user bases in Europe. It is propelled by its growing demand for LPG in both urban and rural settings. As per Spain's Ministry of Ecological Transition, LPG consumption increased by 8% in 2023, fueled by government initiatives promoting cleaner energy. The residential sector dominates, with over 5 million households relying on LPG for heating and cooking. Spain's commitment to renewable energy has spurred bio-LPG adoption, with investments exceeding €50 million. Additionally, the country's strategic location facilitates imports, ensuring a steady butane supply. These factors, coupled with robust infrastructure, enhance Spain's standing in the European butane market.

The UK is emerging as the fastest-growing butane market among its Western European peers, with a projected CAGR of 6.4%. According to the UK Department for Business, Energy & Industrial Strategy, LPG meets 4% of the country's energy needs, with butane being a key contributor. The residential sector accounts for 60% of consumption, driven by limited natural gas availability in remote regions. The UK's focus on decarbonization has accelerated bio-LPG adoption, with £30 million invested in 2023. Furthermore, the country's advanced storage and distribution networks ensure efficient supply chains. These dynamics reinforce the UK's pivotal role in the European butane market.

KEY MARKET PLAYERS

British Petroleum, Chevron Corporation, China National Petroleum Corporation (CNPC), Valero Energy Corporation, Conocco Phillips Inc., Devron Energy Corporation, Exxon Mobil Corporation, Perenco, Royal Dutch Shell plc, Linde AG, TotalEnergies, Praxair. are the market players that are dominating the Europe butane market.

Top 3 Players In The Europe Butane Market

Shell plc

Shell plc is a global leader in the butane market, leveraging its extensive refining and distribution network across Europe. The company operates state-of-the-art facilities including its €1.5 billion petrochemical plant in the Netherlands, which produces butane derivatives for plastics. Shell's strategic focus on sustainability aligns with Europe's green energy goals, as evidenced by its investments in bio-LPG production. The company collaborates with governments and industries to promote cleaner energy solutions, enhancing its market presence.

BP plc

BP plc plays a crucial role in the Europe butane market, with a strong emphasis on innovation and efficiency. The company's integrated supply chain ensures reliable butane delivery to key markets like Germany and the UK. BP's commitment to decarbonization is reflected in its €200 million investment in renewable LPG technologies. By partnering with local distributors, BP strengthens its foothold in rural electrification projects, addressing Europe's energy access challenges while expanding its customer base.

TotalEnergies SE

TotalEnergies SE is a prominent player in the Europe butane market, renowned for its diversified energy portfolio. The company's advanced refining capabilities enable it to meet Europe's growing butane demand, particularly in the petrochemical sector. TotalEnergies invests heavily in sustainable solutions, including bio-LPG production, with €100 million allocated in 2023. Its collaboration with European governments on clean energy initiatives underscores its leadership, positioning it as a key contributor to the region's energy transition.

Top Strategies Used By Key Players

Investment in Sustainable Technologies

Key players in the Europe butane market are prioritizing investments in sustainable technologies to align with regulatory mandates and consumer preferences. For instance, Shell plc has allocated €500 million to develop bio-LPG production facilities, enabling the company to offer eco-friendly alternatives. This strategy not only enhances market competitiveness but also addresses environmental concerns. Partnerships with research institutions further accelerate innovation, ensuring compliance with the EU's Green Deal objectives.

Expansion of Distribution Networks

Expanding distribution networks is another critical strategy adopted by market leaders to enhance accessibility and market penetration. BP plc has invested €300 million in upgrading pipelines and storage terminals across Europe, particularly in underserved regions. This infrastructure development ensures consistent butane supply, even during peak demand periods. Collaborations with local distributors amplify reach, reinforcing BP's position as a reliable supplier.

Strategic Acquisitions and Partnerships

Strategic acquisitions and partnerships enable key players to consolidate their market presence and diversify offerings. TotalEnergies SE recently acquired a mid-sized bio-LPG producer in France, bolstering its renewable energy portfolio. Such moves enhance operational efficiency and expand customer bases. Additionally, partnerships with governments on rural electrification projects provide new revenue streams, strengthening the company's influence in the European butane market.

COMPETITION OVERVIEW

The Europe butane market is characterized by intense competition, with key players vying for dominance through innovation and strategic initiatives. Shell plc, BP plc, and TotalEnergies SE lead the market, leveraging their extensive refining capabilities and distribution networks. According to the European Propane and Butane Association, these companies collectively account for over 50% of the region's butane supply. Smaller players focus on niche segments, such as bio-LPG, to differentiate themselves. The market's competitive landscape is further shaped by regulatory pressures, driving investments in sustainable technologies. Collaborations with governments and industries enhance market reach, while mergers and acquisitions consolidate market share. Pricing strategies remain a focal point, with fluctuations in crude oil prices intensifying rivalry.

RECENT HAPENINGS IN THIS MARKET

- In April 2024, Shell plc launched a €500 million initiative to expand its bio-LPG production facilities in the Netherlands, aiming to meet Europe's growing demand for renewable energy solutions.

- In June 2024, BP plc partnered with the UK government to invest €300 million in upgrading rural LPG distribution networks, enhancing accessibility and supporting clean energy adoption.

- In August 2024, TotalEnergies SE acquired BioGreen Solutions, a French bio-LPG producer, to bolster its renewable energy portfolio and strengthen its market position.

- In October 2024, Shell plc signed a memorandum of understanding with Germany's Federal Ministry for Economic Affairs to develop sustainable butane technologies, aligning with the EU's Green Deal objectives.

- In December 2024, BP plc announced a €200 million investment in carbon capture technologies to reduce emissions from butane production, reinforcing its commitment to environmental sustainability.

MARKET SEGMENTATION

This research report on the Europe butane market is segmented and sub-segmented into the following categories.

By Application

- Liquid Petroleum Gases (LPG)

- Residential/Commercial

- Chemical/Petrochemical

- Industrial

- Auto Fuel

- Refinery

- Others

- Petrochemicals

- Refineries

- Others

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What’s driving the butane market in Europe?

Increased demand for LPG in residential heating and petrochemicals is a major growth factor. The shift toward cleaner fuels in transport also boosts butane usage.

How do EU environmental policies affect the market?

Strict EU regulations push for lower emissions, impacting fossil fuel use. Butane, being cleaner than coal or oil, still holds value as a transition fuel.

Who are the main consumers of butane in Europe?

Key sectors include residential (LPG use), petrochemicals, and automotive (LPG/autogas). It’s also used in fuel blending and refining processes.

How does Europe’s butane market differ from other regions?

Europe is more regulated and sustainability-focused than Asia-Pacific or North America. It depends more on imports, making it sensitive to global energy shifts.

What are the biggest challenges in the European butane market?

Price volatility, geopolitical risks, and rising competition from renewables. Seasonal demand swings and limited infrastructure also pose hurdles.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com