Europe Business Travel Market Size, Share, Trends & Growth Research Report By Traveler (Solo, Group), Purpose (Marketing, Meetings, Trade Shows/Exhibitions, Product Launch, Others), Industry (Corporate, Government), and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe) Industry Analysis From 2025 to 2033.

Europe Business Travel Market Size

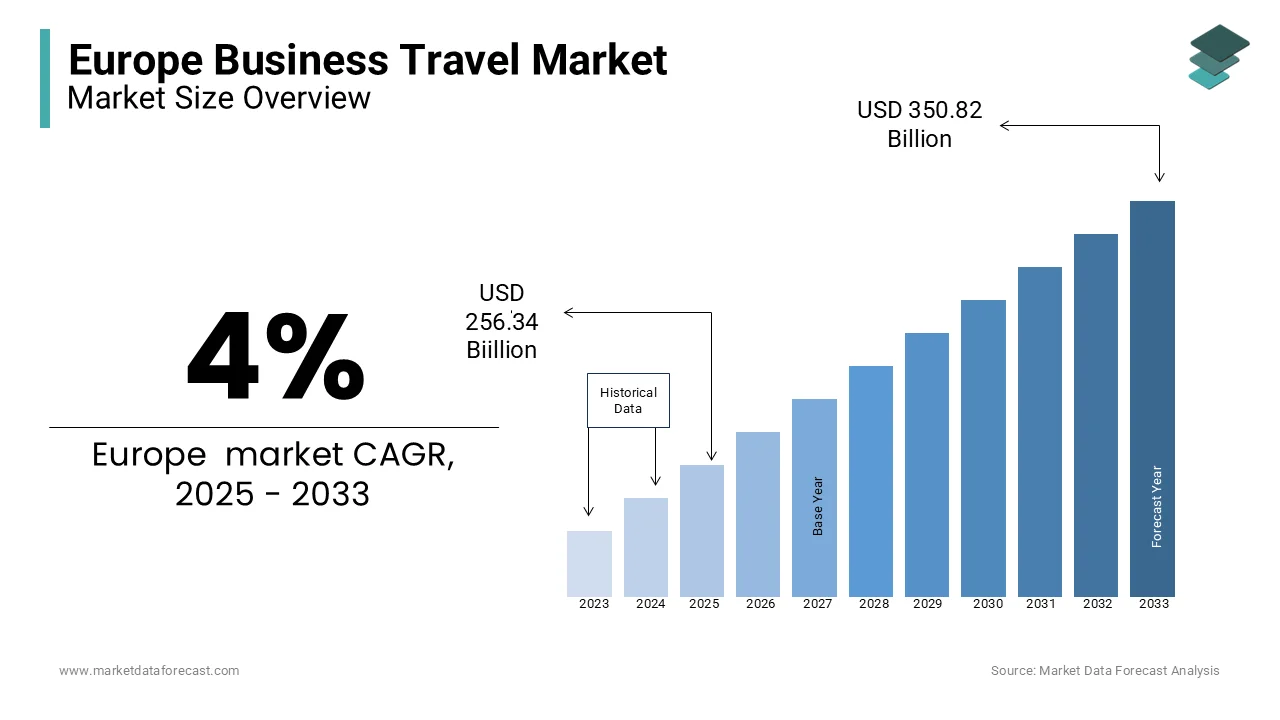

The business travel market size in Europe was valued at USD 246.48 billion in 2024. The European market is estimated to be worth USD 350.82 billion by 2033 from USD 256.34 billion in 2025, growing at a CAGR of 4% from 2025 to 2033.

business travel undertaken for work-related purposes such as meetings, conferences, client visits, and corporate events. The globalization, technological advancements, and the evolving needs of businesses are significantly contributing to the business travel market worldwide. Despite facing challenges such as economic fluctuations and the impact of the COVID-19 pandemic, the market has demonstrated resilience and is on a steady recovery path in Europe. According to the Global Business Travel Association, Europe accounted for 25% of the global business travel expenditure in 2022, which indicates its significance in the international landscape. The robust infrastructure of Europe, including well-connected transportation networks and world-class hospitality services, supports the growth of business travel market.

Germany, the UK and France are key contributors to the European market as these countries are strong economies and have thriving corporate sectors. According to the reports of the European Environment Agency, business travel contributes significantly to greenhouse gas emissions and promotes a shift towards sustainable travel practices. Many companies are now adopting eco-friendly policies, such as opting for virtual meetings or choosing greener transportation options. Additionally, the rise of digital tools and platforms has streamlined travel management to enhance efficiency and cost-effectiveness for businesses.

MARKET DRIVERS

Globalization and International Trade in Europe

Globalization has significantly fueled the Europe business travel market, as companies expand their operations across borders and engage in international trade. The European Commission reports that the EU accounts for nearly 16% of global trade, making it a key player in the global economy. This interconnectedness necessitates frequent business travel for meetings, negotiations, and partnerships. For instance, Germany, Europe’s largest economy, saw a 12% increase in business travel expenditure in 2022, driven by its strong export-oriented industries. The need for face-to-face interactions to build trust and foster collaboration continues to drive demand for business travel, particularly in sectors like manufacturing, finance, and technology.

Technological Advancements and Digital Transformation

Technological advancements have revolutionized the business travel market, making it more efficient and accessible. The adoption of digital tools, such as online booking platforms and mobile travel management apps, has streamlined the planning and execution of business trips. According to Eurostat, over 80% of European businesses now use digital tools for travel management, reducing costs and improving productivity. Additionally, the rise of hybrid work models has increased the demand for business travel, as companies balance remote work with in-person meetings. The integration of artificial intelligence and data analytics has further enhanced travel experiences, enabling personalized services and real-time updates.

MARKET RESTRAINTS

Economic Uncertainty and Rising Costs

Economic instability and rising travel costs are significant restraints on the Europe business travel market. Inflation and fluctuating exchange rates have increased the overall cost of business trips, impacting corporate travel budgets. The European Central Bank reports that inflation in the Eurozone reached 5.2% in 2023, leading to higher prices for flights, accommodation, and other travel-related expenses. Companies are increasingly cautious about discretionary spending, with many opting to reduce non-essential travel. For instance, a survey by the European Travel Commission revealed that 40.3% of businesses cut back on travel expenditures in 2023 due to economic pressures. This trend has slowed the recovery of the business travel market post-pandemic.

Environmental Concerns and Sustainability Pressures

Environmental concerns are another major restraint, as businesses face growing pressure to adopt sustainable practices. The European Environment Agency highlights that transportation accounts for 25% of the EU’s greenhouse gas emissions, with business travel contributing significantly. Many companies are now prioritizing virtual meetings over physical travel to reduce their carbon footprint. A report by the International Energy Agency states that 60% of European businesses have implemented policies to limit business travel for environmental reasons. This shift, while beneficial for sustainability, has dampened the growth of the business travel market. Governments and organizations are also incentivizing greener alternatives, further impacting traditional business travel demand.

MARKET OPPORTUNITIES

Adoption of Sustainable Travel Solutions

The growing emphasis on sustainability presents a significant opportunity for the Europe business travel market. Companies are increasingly seeking eco-friendly travel options, such as electric vehicles, carbon offset programs, and green accommodations. The European Commission reports that the EU aims to reduce greenhouse gas emissions by 55% by 2030, creating a demand for sustainable business travel solutions. According to Eurostat, 35% of European businesses have already adopted green travel policies, and this number is expected to rise. By integrating sustainable practices, the business travel market can attract environmentally conscious clients and align with regulatory requirements, fostering long-term growth.

Expansion of Hybrid and Virtual Event Models

The rise of hybrid and virtual event models offers a unique opportunity for the business travel market. While virtual meetings reduce the need for frequent travel, they also create demand for occasional in-person interactions to enhance engagement. The European Parliament highlights that hybrid events have grown by 40.1% since 2020, blending digital and physical participation. This trend allows businesses to optimize travel budgets while maintaining meaningful connections. Additionally, the integration of advanced technologies like augmented reality and virtual reality can enhance the hybrid experience, driving demand for strategic business travel. This evolving model opens new revenue streams for the market.

MARKET CHALLENGES

Geopolitical Instability and Travel Restrictions

Geopolitical tensions and evolving travel restrictions pose a significant challenge to the Europe business travel market. Conflicts, trade disputes, and changing visa policies can disrupt travel plans and create uncertainty for businesses. The European Commission reports that geopolitical instability in regions like Eastern Europe has led to a 15% decline in cross-border business travel in affected areas. Additionally, the lingering impact of Brexit has complicated travel between the UK and EU, with increased paperwork and delays. Such disruptions not only increase costs but also deter companies from planning international trips, hindering market growth.

Health and Safety Concerns Post-Pandemic

Health and safety concerns remain a critical challenge for the business travel market, even as the world recovers from the COVID-19 pandemic. The European Centre for Disease Prevention and Control highlights that 30% of businesses are still hesitant to resume full-scale business travel due to fears of new variants or health risks. Companies are prioritizing employee safety, often opting for virtual alternatives. Additionally, varying health protocols across European countries create confusion and logistical challenges for travelers. These concerns continue to slow the recovery of the business travel market, despite the easing of restrictions.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

4% |

|

Segments Covered |

By Traveler, Purpose, Industry, and Country. |

|

Various Analyses Covered |

Global, Regional, and country-level analysis; Segment-Level Analysis, DROC; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Countries Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, and Rest of Europe. |

|

Market Leaders Profiled |

American Express Global Business Travel, BCD Travel, Booking.com, Expedia Group, International Airlines Group (IAG), Lufthansa Group, Accor Group, InterContinental Hotels Group (IHG), SAP Concur, TravelPerk, and Others. |

SEGMENTAL ANALYSIS

By Traveler Insights

The solo travelers segment was dominant in 2024 and accounted for 60.3% of the European market share in 2024. The prominence of solo travelers segment in the European market is majorly attributed to the need for individualized corporate engagements, such as client meetings, sales visits, and specialized assignments. The flexibility and efficiency of solo travel align with the demands of modern businesses, particularly in sectors like finance, consulting, and technology. Countries like Germany and the UK, with their strong corporate cultures, contribute significantly to this segment. The availability of tailored services, such as single-occupancy accommodations and streamlined transportation, further supports its growth.

The group segment is gaining traction and is estimated to register the fastest CAGR of 7.74% over the forecast period. The resurgence of in-person conferences, corporate events, and team meetings post-pandemic are propelling the expansion of the business segment in the European business travel market. Industries such as technology, healthcare, and finance are driving demand, as they prioritize collaboration and networking. Cities like Paris, Berlin, and Barcelona are popular destinations for group travel, offering world-class event facilities. The segment’s importance lies in its ability to foster teamwork, innovation, and business relationships, making it a key driver of market recovery.

By Purpose Insights

segment is the largest segment and accounted for 40.7% of the European market share in 2024. Marketing plays a critical role in driving brand awareness, customer engagement, and revenue growth. Digital marketing alone accounts for over 60% of total ad spending globally, according to Statista. The rise of social media, data analytics, and personalized campaigns has amplified its importance. For instance, the U.S. Small Business Administration highlights that 82% of businesses use digital marketing tools, underscoring its necessity in a competitive marketplace.

The trade shows and exhibitions segment is anticipated to showcase a CAGR of 5.3% during the forecast period. The resurgence of in-person events post-pandemic and the need for face-to-face networking is driving the growth of the trade shows and exhibitions segment in the European market. According to the International Trade Administration, 95% of marketers believe in-person events are key to achieving business goals. Additionally, the Global Association of the Exhibition Industry (UFI) states that exhibitions generate $325 billion in global sales annually, highlighting their economic significance. The integration of hybrid event models, combining physical and virtual elements, further accelerates this segment's expansion.

By Industry Insights

The corporate segment captured 70.7% of the European market share in 2024 owing to the focus of corporates on marketing, product launches, and employee engagement that are critical for business growth. According to the International Trade Administration, corporate events generate $1,100 billion annually, driven by the need for brand visibility and customer retention. The U.S. Small Business Administration highlights that 82% of businesses prioritize corporate events to build stakeholder relationships, underscoring their importance in fostering innovation and competitiveness in a rapidly evolving market.

The government segment is growing promisingly and is estimated to exhibit a CAGR of 6.2% over the forecast period. The increased public engagement initiatives and the adoption of hybrid event models is fuelling the growth of the government segment in the European market. The U.S. Department of Commerce reports that government-sponsored trade shows contribute $325 billion annually to global sales, emphasizing their role in economic development. Additionally, the European Commission states that 80% of government events now incorporate virtual components, enhancing accessibility and cost-effectiveness. This shift highlights the sector's adaptability and its importance in promoting transparency, international trade, and public participation in governance.

COUNTRY LEVEL ANALYSIS

Germany occupied 25.9% of the Europe business travel market share in 2024. The dominating role of Germany in the European market is driven by its robust industrial base and strategic position as a hub for trade fairs and conferences. Cities like Frankfurt, Munich, and Berlin host some of the largest international events, attracting millions of business travelers annually. The strong presence of multinational corporations in Germany is further boosting the German business travel market growth. As per a study by Roland Berger, over 50% of Fortune Global 500 companies have operations in Germany, necessitating frequent travel for executives and technical teams. Additionally, the government’s investment in sustainable travel infrastructure has positioned the country as a leader in eco-friendly business mobility.

The UK accounted for the second largest share of the European business travel market over the forecast period. London serves as a critical hub, hosting over 40% of the country’s business travelers. The region’s strategic location and world-class hospitality infrastructure have made it a preferred destination for corporate events and meetings. The rise of fintech and professional services sectors has fuelled the demand for business travel in the UK. According to Barclays, 60% of UK-based firms prioritized international travel in 2023 to expand their global footprint. Moreover, the UK government’s £10 billion investment in travel infrastructure has enhanced connectivity, further solidifying the nation’s prominence in the market.

France secured a considerable share of the Europe business travel market in 2024. Paris has emerged as a key player, hosting major international conferences and trade shows. The country’s rich cultural heritage and tourism offerings complement its appeal as a business destination. The growing number of corporate events in France is one of the major factors propelling the French market growth. As per Capgemini, France hosted over 800 major trade shows in 2023, attracting participants from diverse sectors. Additionally, the emphasis on sustainability has encouraged operators to adopt green travel solutions, aligning with national environmental goals.

Spain is anticipated to showcase a prominent CAGR in the European business travel market over the forecast period. Barcelona and Madrid are rapidly emerging as key hubs, supported by robust airline networks and hospitality infrastructure. The country’s focus on innovation and entrepreneurship has attracted startups and tech firms, driving demand for business travel. The commitment of Spain to hosting international summits is boosting the Spanish business travel market. According to BBVA, Spain hosted over 100 high-profile events in 2023, creating a surge in demand for travel services. Additionally, the rise of remote work has positioned Spain as an attractive destination for corporate retreats.

Italy is predicted to register a prominent CAGR in the European business travel market over the forecast period. Milan and Rome lead the charge, hosting major fashion weeks, trade shows, and cultural events. The country’s unique blend of business and leisure offerings has made it a popular destination for corporate travelers. The integration of technology in travel planning in Italy is driving the Italian market growth. According to Telecom Italia, 50% of Italian businesses adopted AI-driven travel management tools in 2023, enhancing efficiency and cost-effectiveness. Additionally, tax incentives introduced by the government have encouraged investments in travel infrastructure, underscoring the nation’s rising prominence.

MARKET KEY PLAYERS

Some of the notable companies dominating the Europe business travel market profiled in this report are American Express Global Business Travel, BCD Travel, Booking.com, Expedia Group, International Airlines Group (IAG), Lufthansa Group, Accor Group, InterContinental Hotels Group (IHG), SAP Concur, TravelPerk, and Others.

TOP LEADING PLAYERS IN THE MARKET

American Express Global Business Travel (GBT)

American Express GBT is a global leader in business travel management, playing a pivotal role in shaping the Europe market. The company offers end-to-end solutions, including travel booking, expense management, and data analytics. Its focus on sustainability has led to the introduction of carbon-neutral travel options, aligning with EU environmental goals. By leveraging AI and machine learning, GBT enhances operational efficiency while maintaining customer satisfaction.

BCD Travel

BCD Travel specializes in providing innovative travel management solutions tailored to corporate needs. The company’s TripSource platform integrates real-time data and predictive analytics to optimize travel planning. BCD’s emphasis on sustainability and employee well-being has made it a trusted partner for European enterprises. Additionally, its global network ensures seamless travel experiences across borders, reinforcing its leadership in the market.

CWT (formerly Carlson Wagonlit Travel)

CWT is renowned for its cutting-edge technology and personalized services, catering to diverse business travel needs. The company’s myCWT platform offers intuitive booking tools and 24/7 support, ensuring a seamless experience for travelers. CWT’s focus on sustainability and innovation has positioned it as a leader in the European market. By collaborating with airlines and hotels, CWT delivers cost-effective solutions while maintaining high standards of service quality.

TOP STRATEGIES USED BY KEY MARKET PARTICIPANTS

Emphasis on Sustainability

Leading players in the Europe business travel market have embraced sustainability as a core strategy to enhance their competitive edge. For instance, partnerships with airlines and hotels to offer carbon-neutral travel options have resonated with environmentally conscious clients. These initiatives not only align with EU regulations but also foster brand loyalty among corporate customers.

Integration of AI and Data Analytics

Investments in AI-driven platforms have become a cornerstone strategy for staying ahead in the market. Companies leverage predictive analytics to optimize travel routes, reduce costs, and enhance traveler experiences. This approach allows them to address challenges such as budget constraints and traveler preferences while maintaining leadership in technological advancements.

Expansion into Emerging Markets

Expanding into emerging markets within Europe, such as Eastern Europe and Scandinavia, has become a priority for key players. By establishing localized services and partnerships, companies can better serve regional demands while capitalizing on favorable regulatory frameworks. This strategy ensures sustained growth amid intensifying competition.

COMPETITION OVERVIEW

The Europe business travel market is characterized by intense competition, driven by the presence of global giants and regional innovators vying for market share. Major players like American Express GBT, BCD Travel, and CWT dominate the landscape, leveraging their extensive expertise in travel management solutions. However, the market also features niche players specializing in vertical-specific services, creating a fragmented yet dynamic ecosystem.

Technological innovation is a key battleground, with companies investing heavily in AI, IoT, and data analytics to differentiate themselves. According to McKinsey, over 60% of European enterprises prioritize secure and scalable travel solutions, intensifying competition among providers to offer cutting-edge technologies. Additionally, stringent EU regulations mandating sustainability have forced companies to innovate responsibly, further raising the stakes.

Mergers and acquisitions are another hallmark of the competitive landscape. Larger firms acquire smaller innovators to expand their product portfolios and geographic reach. Meanwhile, price wars and aggressive marketing strategies are common, particularly in saturated markets like Germany and the UK. Despite these challenges, the market remains ripe for growth, with opportunities in emerging segments such as sustainable travel and tech-driven solutions driving future competition.

TOP 5 MAJOR ACTIONS TAKEN BY COMPANIES

- In March 2024, American Express GBT partnered with Lufthansa to offer carbon-neutral flight options for corporate travelers. This initiative aims to enhance sustainability and align with EU environmental goals.

- In June 2023, BCD Travel launched its AI-driven TripSource platform in Europe, enabling real-time travel planning and expense tracking. This launch underscores BCD’s commitment to leveraging technology for efficiency.

- In September 2023, CWT collaborated with Marriott International to develop eco-friendly hotel packages. This partnership seeks to cater to environmentally conscious travelers while reducing the carbon footprint.

- In January 2024, Expedia Group expanded its business travel division in Italy by introducing localized booking tools. This move aims to enhance accessibility and increase market penetration.

- In November 2023, HRS Group unveiled its blockchain-based payment solution in Germany, designed to streamline expense management and improve transparency. This initiative positions HRS as a leader in innovative travel solutions.

MARKET SEGMENTATION

This Europe business travel market research report is segmented and sub-segmented into the following categories.

By Traveler

- Solo

- Group

By Purpose

- Marketing

- Meetings

- Trade Shows/Exhibitions

- Product Launch

- Others

By Industry

- Corporate

- Government

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. What is the current size and projected growth of the Europe business travel market?

In 2024, the Europe business travel market was valued at USD 246.48 billion. It is projected to reach USD 350.82 billion by 2033, growing at a compound annual growth rate (CAGR) of 4% from 2025 to 2033.

2. What factors are driving the growth of the business travel market in Europe?

Key drivers include globalization and international trade, which necessitate frequent business travel for meetings, negotiations, and partnerships. Technological advancements and digital transformation have also streamlined travel management, making business travel more efficient and accessible.

3. Which countries are the major contributors to the Europe business travel market?

Germany, the UK, and France are significant contributors, owing to their strong economies and thriving corporate sectors.

4. How is sustainability influencing business travel practices in Europe?

Growing awareness of environmental impacts has led companies to adopt eco-friendly policies, such as opting for virtual meetings or choosing greener transportation options, to reduce greenhouse gas emissions associated with business travel.

5. What challenges does the Europe business travel market face?

Economic uncertainty and rising travel costs pose significant challenges. Additionally, the market is still recovering from the impacts of the COVID-19 pandemic, which has altered travel behaviors and corporate policies.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]