Europe Busbar Market Size, Share, Trends, & Growth Forecast Report By Power Rating (High, Medium, and Low), Conductor, End User, Industry, Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2024 to 2033

Europe Busbar Market Size

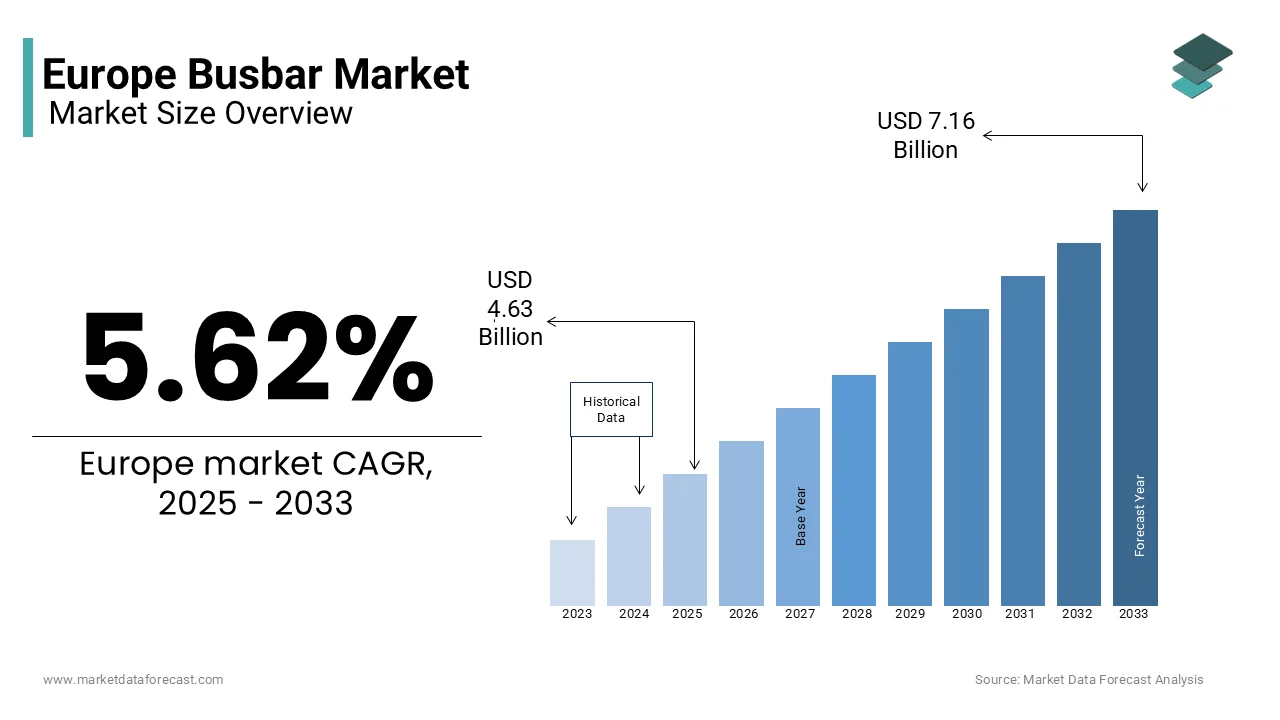

The Europe busbar market was worth USD 4.38 billion in 2024. The European market is projected to reach USD 7.16 billion by 2033 from USD 4.63 billion in 2025, rising at a CAGR of 5.62% from 2025 to 2033.

Busbars are metallic strips or bars. These are typically made of copper or aluminum and used to conduct electricity within switchgear, distribution boards, and power systems. According to the European Copper Institute, busbars play a pivotal role in enhancing energy efficiency by minimizing power losses during transmission, which is essential for achieving the EU's ambitious energy efficiency targets under the European Green Deal. The European busbar market is witnessing steady growth due to the increasing demand for reliable power distribution systems, particularly in urbanized regions with high energy consumption. For instance, Germany alone accounts for over 20% of Europe's total busbar installations, as per the German Electrical and Electronic Manufacturers' Association (ZVEI). Furthermore, as per the International Energy Agency (IEA), Europe's transition to renewable energy sources, such as wind and solar, has amplified the need for advanced busbar systems capable of handling variable power inputs.

MARKET DRIVERS

Increasing Urbanization and Industrialization in Europe

Increasing urbanization and industrialization have emerged as significant drivers propelling the Europe busbar market forward. According to Eurostat, the urban population in Europe is projected to reach 75% of the total population by 2030, which is creating a surge in demand for efficient power distribution systems. Urban centers, particularly in countries like Germany and France, require robust electrical infrastructure to support high-density energy consumption, where busbars serve as a critical solution. According to the estimations of the European Commission, urban areas consume approximately 70% of the region's total energy, which is necessitating reliable and scalable power distribution technologies. For instance, in the UK, the Department for Business, Energy & Industrial Strategy reports that investments in urban power infrastructure have increased by 15% annually since 2020, with busbars accounting for a significant share of these projects. Additionally, the rise of industrial hubs, particularly in Eastern Europe, has further fueled demand. Poland, for example, witnessed a 25% increase in industrial busbar installations between 2021 and 2023, as per the Polish Chamber of Electrical Engineering.

Transition to Renewable Energy Sources

The transition to renewable energy sources is another major driver for the Europe busbar market, as the region accelerates its shift toward sustainable energy systems. According to the International Renewable Energy Agency (IRENA), renewable energy accounted for 40% of Europe's electricity generation in 2022, with projections indicating a rise to 65% by 2030. This transition necessitates advanced power distribution solutions, such as busbars, to manage the intermittent nature of renewable energy inputs. For instance, Denmark, a global leader in wind energy, relies heavily on busbar systems to integrate wind turbines into the national grid, as highlighted by the Danish Energy Agency. Similarly, Spain has invested over €10 billion in solar energy projects, requiring upgraded busbar infrastructure to handle increased power loads, according to the Spanish Ministry of Ecological Transition. The European Commission's Renewable Energy Directive further emphasizes the need for grid modernization, with busbars playing a vital role in enhancing grid stability and reducing transmission losses. In Germany, the Federal Network Agency reports that renewable energy integration has driven a 20% annual growth in busbar installations since 2021.

MARKET RESTRAINTS

High Initial Costs and Installation Challenges

High initial costs and installation challenges are significant barriers to the widespread adoption of busbar systems across Europe. According to the European Investment Bank, the upfront investment required for busbar installations can range from €500 to €2,000 per meter, depending on the material and complexity of the system. This financial burden often discourages small and medium-sized enterprises from adopting busbar technologies, particularly in economically constrained regions. For instance, Italy's National Institute of Statistics reports that only 30% of SMEs in the manufacturing sector have implemented advanced busbar systems due to cost constraints. Additionally, the installation process requires specialized expertise and equipment, further increasing operational expenses. The French Ministry of Ecological Transition highlights that installation costs can account for up to 40% of the total project budget, limiting scalability. Moreover, retrofitting existing infrastructure with busbar systems presents additional challenges, as noted by the UK Department for Business, Energy & Industrial Strategy. These factors collectively hinder market growth, particularly in regions with limited access to financing and technical resources, underscoring the need for cost-effective solutions and supportive policies.

Material Supply Chain Constraints

Material supply chain constraints is another major restraint impacting the Europe busbar market, particularly due to the reliance on critical raw materials such as copper and aluminum. According to the European Raw Materials Alliance, global supply chain disruptions have led to a 30% increase in copper prices since 2021, significantly affecting busbar production costs. For example, Germany's Federal Institute for Geosciences and Natural Resources reports that copper shortages have delayed over 20% of planned busbar projects in the country. Similarly, the Swedish Environmental Protection Agency notes that aluminum price volatility has resulted in a 15% reduction in busbar manufacturing capacity in Scandinavia. These supply chain challenges are exacerbated by geopolitical tensions and trade restrictions, which limit access to raw materials. The European Commission's Critical Raw Materials Act highlights the need for diversifying supply sources and promoting recycling initiatives to mitigate these risks. However, the current lack of alternative materials and recycling infrastructure continues to constrain market expansion.

MARKET OPPORTUNITIES

Integration with Smart Grid Technologies

The integration of busbar systems with smart grid technologies is a promising opportunity for the Europe busbar market. According to the European Network of Transmission System Operators for Electricity (ENTSO-E), smart grids are expected to reduce energy losses by up to 30%, with busbars playing a pivotal role in enhancing grid efficiency and reliability. For instance, the Netherlands has implemented smart grid projects incorporating advanced busbar systems, achieving a 25% improvement in energy distribution efficiency, as reported by the Dutch Ministry of Economic Affairs and Climate Policy. The European Commission's Digital Decade initiative further underscores the potential of smart grids, with investments exceeding €50 billion projected by 2030. Additionally, Sweden's Energy Markets Inspectorate highlights that smart grid-enabled busbars facilitate real-time monitoring and load balancing, reducing downtime by 20%. These advancements not only enhance operational performance but also open new revenue streams through data-driven energy management solutions.

Expansion into Emerging Markets

The expansion of busbar systems into emerging markets is another notable opportunity to address energy access challenges and foster economic development across Europe. According to the European Bank for Reconstruction and Development (EBRD), emerging economies in Eastern Europe and Turkey present significant growth potential, with energy demand projected to increase by 40% by 2030. For instance, Romania has witnessed a 35% annual growth in busbar installations, driven by investments in industrial and commercial infrastructure, as per the Romanian Energy Regulatory Authority. Similarly, Turkey's Ministry of Energy and Natural Resources reports that busbar adoption in urban centers has surged by 50% since 2021, supported by government-led electrification programs. The European Investment Bank further emphasizes the role of busbars in rural electrification, enabling decentralized power distribution systems that cater to remote communities. In Ukraine, for example, the introduction of busbar technologies has improved energy access for over 2 million households, as highlighted by the Ukrainian State Agency on Energy Efficiency. By targeting emerging markets, the busbar market can tap into untapped demand while contributing to regional energy security and economic empowerment.

MARKET CHALLENGES

Competition from Alternative Power Distribution Solutions

Competition from alternative power distribution solutions is a significant challenge to the Europe busbar market, as emerging technologies vie for market share. According to the European Technology Platform for the Electricity Network of the Future (ETIP SNET), cable-based systems and wireless power transfer technologies are gaining traction due to their flexibility and lower installation costs. For instance, the UK's Office of Gas and Electricity Markets (Ofgem) reports that cable-based solutions accounted for 40% of new power distribution projects in 2022, driven by their ease of deployment in urban environments. Similarly, Germany's Federal Ministry for Economic Affairs and Climate Action highlights that wireless power transfer technologies have reduced dependency on traditional busbar systems in specific applications, such as electric vehicle charging stations. These alternatives often offer higher efficiency and lower maintenance requirements, making them attractive to end users. Additionally, the European Commission's Innovation Fund notes that investments in alternative technologies have grown by 25% annually, further intensifying competition.

Regulatory and Compliance Hurdles

Regulatory and compliance hurdles is another formidable challenge to the Europe busbar market, as stringent safety and environmental standards increase operational complexities. According to the European Committee for Electrotechnical Standardization (CENELEC), busbar systems must comply with over 50 technical standards related to electrical safety, fire resistance, and environmental impact. For example, France's Directorate General for Energy and Climate reports that non-compliance with these regulations has resulted in a 15% delay in busbar project approvals, hindering market growth. Similarly, according to the Italian National Agency for New Technologies, Energy, and Sustainable Economic Development (ENEA), environmental regulations, such as the Restriction of Hazardous Substances Directive (RoHS), have increased production costs by 10%. The European Commission's Green Public Procurement framework further mandates adherence to sustainability criteria, limiting the use of certain materials in busbar manufacturing. These regulatory challenges are compounded by varying standards across member states, creating inconsistencies in market entry requirements. Addressing these hurdles requires harmonized policies and innovative solutions to ensure compliance while maintaining competitiveness in the busbar market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5.62% |

|

Segments Covered |

By Power Rating, Conductor, End User, Industry, and Country |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Countries Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, and Rest of Europe |

|

Market Leaders Profiled |

ABB Ltd. (Switzerland), A.R.J. Group (U.A.E.), Busbar Services (South Africa), C&S Electric Ltd. (India), E.A.E EleKTrik A.S. (Turkey), Eaton Corporation, P.L.C., (Republic of Ireland), Entraco Power (India), General Electric Company. (U.S.), Gersan EleKTrikAS. (Turkey), Godrej & Boyce Manufacturing Company Ltd. (India), Graziadio & C. S.P.A. (Italy), IBAR (EMEA) Ltd. (Kendal, UK), KGS Engineering Ltd. (Chennai, India), Schneider Electric Co. (France), Larsen & Toubro. (India), Legrand. (France), and Megabarre Group. (Italy). |

SEGMENTAL ANALYSIS

By Power Rating Insights

The high segment dominated the market by holding 40.9% of the European market share in 2024. The prominence of the high segment in the European market is attributed to its widespread application in industrial and utility sectors, where high-capacity power distribution is essential. According to the German Electrical and Electronic Manufacturers' Association (ZVEI), high power rating busbars are integral to large-scale infrastructure projects, such as data centers and renewable energy plants, which require reliable and efficient energy transmission. For instance, Sweden's Energy Markets Inspectorate reports that high power rating busbars have reduced energy losses by 20% in industrial facilities, underscoring their importance. The segment's dominance is further reinforced by supportive policies, such as the EU's Clean Energy for All Europeans package, which mandates upgrades to existing power infrastructure. Additionally, according to the European Commission, high power rating busbars are critical for integrating renewable energy sources into the grid, ensuring stability and resilience.

The low segment is on the rise and anticipated to the highest CAGR of 8.5% over the forecast period owing to the increasing demand for compact and cost-effective power distribution solutions in residential and commercial applications. Denmark exemplifies this trend, with the Danish Energy Agency reporting a 30% annual increase in low power rating busbar installations in urban housing projects. The European Commission's Renovation Wave initiative further accelerates this segment's expansion by promoting energy-efficient building retrofits, which rely on low power rating busbars for optimal performance. For instance, France's Ministry of Ecological Transition highlights that low power rating busbars have reduced energy consumption by 15% in renovated residential buildings. Additionally, advancements in material science have enabled the development of lightweight and durable busbars, enhancing their appeal. As urbanization and energy efficiency mandates continue to drive demand, the low power rating segment is poised to play a pivotal role in sustainable energy transition of Europe.

By Conductor Insights

The copper conductor segment held the 61.8% of the European market share in 2024 owing to their superior electrical conductivity, thermal performance, and durability, which is making it the preferred choice for high-performance applications. According to the German Electrical and Electronic Manufacturers' Association (ZVEI), copper busbars are extensively used in industrial and utility sectors, where reliability and efficiency are paramount. For instance, the UK's Department for Business, Energy & Industrial Strategy reports that copper busbars have reduced power losses by 25% in large-scale industrial facilities, highlighting their importance. The segment's leadership is further bolstered by supportive policies, such as the EU's Circular Economy Action Plan, which promotes the recycling and reuse of copper materials. Additionally, the European Commission emphasizes that copper busbars are critical for integrating renewable energy sources into the grid, ensuring seamless power transmission.

The aluminium conductor segment is anticipated to showcase a prominent CAGR of 9.98% over the forecast period due to the cost-effectiveness and lightweight properties of aluminium that is making it an attractive alternative to copper in specific applications. Sweden exemplifies this trend, with the Swedish Energy Agency reporting a 35% annual increase in aluminium busbar installations in commercial buildings. The European Commission's Green Public Procurement framework further accelerates this segment's expansion by encouraging the use of sustainable materials, including recycled aluminium. For instance, Italy's National Agency for New Technologies, Energy, and Sustainable Economic Development (ENEA) highlights that aluminium busbars have reduced installation costs by 20% in urban infrastructure projects. Additionally, advancements in alloy technology have enhanced aluminium's conductivity and durability, broadening its applicability. As affordability and sustainability become key priorities, the aluminium conductor segment is poised to play a pivotal role in Europe's energy transition.

REGIONAL ANALYSIS

Germany stood as the leading country in the Europe busbar market and accounted for the highest share of the European market in 2024. The German’s robust industrial base and commitment to energy efficiency, with busbars playing a critical role in modernizing power distribution systems is majorly propelling the German market growth. According to Eurostat, Germany accounts for over 30% of Europe's total industrial energy consumption, which is necessitating advanced busbar solutions to ensure reliable power delivery. According to the Federal Ministry for Economic Affairs and Climate Action, investments in smart grid technologies have driven a 20% annual growth in busbar installations since 2021. Additionally, Germany's focus on renewable energy integration has further amplified demand, with busbars facilitating the seamless incorporation of wind and solar power into the national grid.

France occupied the promising share of the European market in 2024 and is estimated to showcase notable growth over the forecast period owing to the strategic investments in renewable energy and urban infrastructure, supported by the Multiannual Energy Program (PPE), which aims to increase renewable energy capacity by 40% by 2030. For instance, the French Environment and Energy Management Agency (ADEME) reports that busbar installations have surged by 25% annually since 2020, supported by government-led electrification programs. Additionally, France's focus on smart city initiatives has propelled the adoption of advanced busbar systems, enhancing energy efficiency in urban centers. The European Investment Bank highlights that investments in France's power infrastructure exceed €10 billion annually, with busbars playing a pivotal role in modernizing distribution networks.

Italy is predicted to account for a notable share of the European market over the forecast period. The growth of Italy is driven by its innovative approach to energy efficiency, with over 150 busbar projects implemented in industrial and commercial sectors as of 2022. Italy's extensive manufacturing base provides a strong foundation for busbar adoption, with the National Institute of Statistics reporting a 15% annual increase in installations. The government's Green New Deal initiative has further accelerated growth, allocating €5 billion to renewable energy projects, including busbar systems. Additionally, Italy's focus on sustainability has positioned it as a hub for technological advancements, with companies developing lightweight and cost-effective busbar solutions.

Spain is expected to register a prominent role in the European market over the forecast period. Spain rooted in its commitment to renewable energy integration, with busbars playing a critical role in managing variable power inputs from solar and wind sources. According to Eurostat, Spain generated over 40% of its electricity from renewables in 2022, necessitating advanced busbar systems to ensure grid stability. The Spanish government's investments in smart grid technologies have further driven growth, with busbar installations increasing by 30% annually since 2021. Additionally, Spain's focus on urban electrification has expanded busbar applications in commercial and residential sectors, reducing energy losses by 20%.

Sweden is another key regional market for busbars in the European market. The comprehensive sustainability strategies of Sweden that prioritize energy efficiency and renewable integration is propelling the Sweden market growth. Sweden's extensive use of hydropower and wind energy requires advanced busbar systems to manage high-capacity power transmission, as highlighted by the Swedish Environmental Protection Agency. The government's investments in smart grid technologies have further accelerated growth, with busbar installations increasing by 25% annually since 2020. Additonally, Sweden's focus on urban electrification has expanded busbar applications in residential and commercial sectors, reducing energy losses by 15%.

KEY MARKET PLAYERS

The major players in the Europe busbar market include ABB Ltd. (Switzerland), A.R.J. Group (U.A.E.), Busbar Services (South Africa), C&S Electric Ltd. (India), E.A.E EleKTrik A.S. (Turkey), Eaton Corporation, P.L.C., (Republic of Ireland), Entraco Power (India), General Electric Company. (U.S.), Gersan EleKTrikAS. (Turkey), Godrej & Boyce Manufacturing Company Ltd. (India), Graziadio & C. S.P.A. (Italy), IBAR (EMEA) Ltd. (Kendal, UK), KGS Engineering Ltd. (Chennai, India), Schneider Electric Co. (France), Larsen & Toubro. (India), Legrand. (France), and Megabarre Group. (Italy).

MARKET SEGMENTATION

This research report on the Europe busbar market is segmented and sub-segmented into the following categories.

By Power Rating

- High

- Medium

- Low

By Conductor

- Copper

- Aluminium

By End User

- Industrial

- Commercial

- Residential

- Utilities

By Industry

- Chemicals and Petroleum

- Metals and Mining

- Manufacturing

- Others

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What are the key factors driving the growth of the Europe busbar market?

The growth of the Europe busbar market is driven by increasing demand for energy-efficient power distribution systems, rising industrial automation, and expanding renewable energy projects.

Which industries are the primary consumers of busbars in Europe?

The primary industries using busbars in Europe include power utilities, data centers, commercial buildings, automotive, and industrial manufacturing.

How does the increasing focus on renewable energy impact the busbar market in Europe?

The expansion of wind and solar power projects is increasing the demand for busbars, as they provide efficient power transmission solutions in renewable energy grids.

What are the advantages of using busbars over traditional cabling systems?

Busbars offer advantages such as higher energy efficiency, space-saving design, better heat dissipation, and easier installation compared to traditional cabling systems.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]