Europe Bulk Bags Market Size, Share, Trends & Growth Forecast Report By Fabric Type (Type A, Type B, Type C, and Type D), Capacity, Design, End-User, and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2025 to 2033

Europe Bulk Bags Market Size

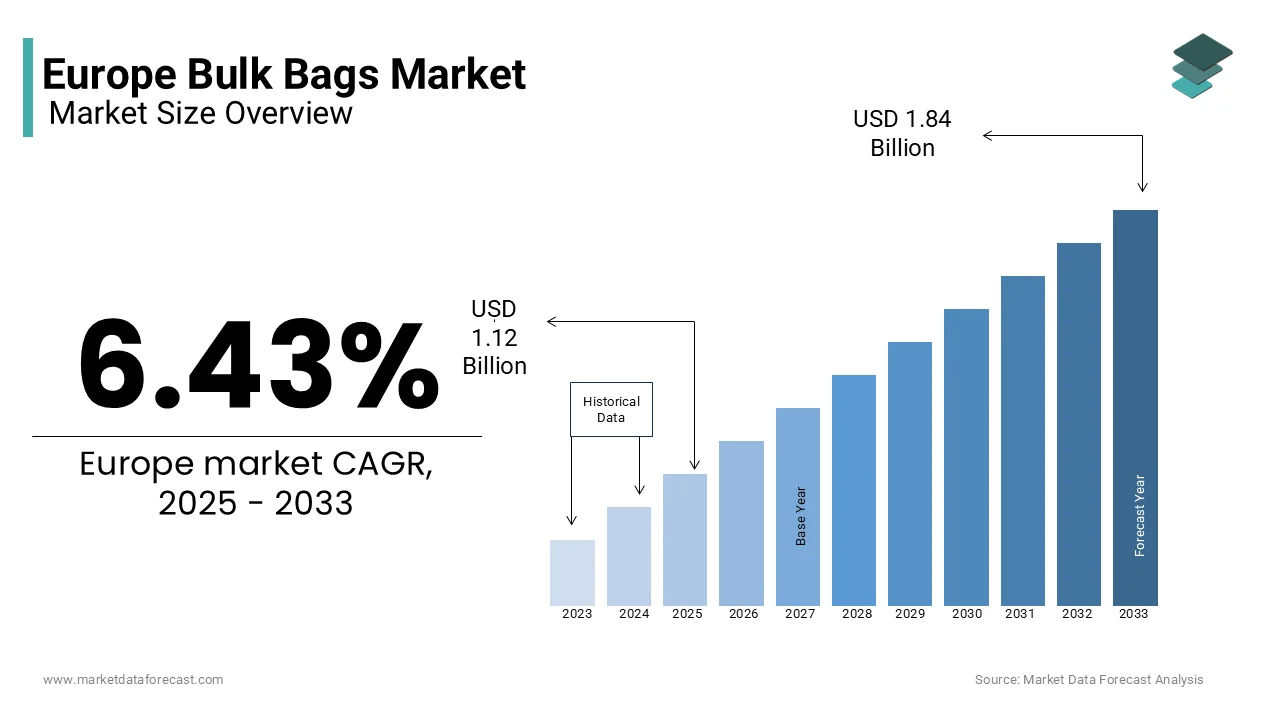

The Bulk Bags market size in Europe was valued at USD 1.05 billion in 2024. The European market is estimated to be worth USD 1.84 billion by 2033 from USD 1.12 billion in 2025, growing at a CAGR of 6.43% from 2025 to 2033.

Bulk bags are also known as flexible intermediate bulk containers (FIBCs) and are designed to carry dry, flowable products such as chemicals, fertilizers, grai ns, and construction materials. These bags are engineered to offer durability, flexibility, and cost-effectiveness, which is making them indispensable in logistics and supply chain operations. According to Eurostat, the demand for industrial packaging solutions, including bulk bags, has surged due to the increasing emphasis on optimizing material handling processes in Europe. The European bulk bags market is witnessing steady growth owing to the rising adoption of bulk bags in sectors such as agriculture, mining, and construction, where efficiency and safety are paramount.

Germany, France and the UK are playing the leading role in the European bulk bags market. These countries have robust manufacturing bases and stringent regulations governing the safe transportation of hazardous materials, which drive the adoption of specialized bulk bags. Furthermore, advancements in bag design, such as anti-static and UV-resistant variants, are enhancing their applicability across diverse environments. The evolution of the European bulk bags market is also shaped by sustainability trends, with manufacturers increasingly focusing on recyclable and biodegradable materials. According to the European Environment Agency, the push for circular economy practices is expected to influence future innovations in the bulk bag market.

MARKET DRIVERS

Growing Demand in the Chemicals and Fertilizers Sector in Europe

The burgeoning demand for bulk bags in the chemicals and fertilizers sector is significantly driving the European market growth. According to the European Chemical Industry Council, the chemical industry alone contributes approximately €570 billion annually to the EU economy, with fertilizers being a critical sub-sector. Bulk bags are extensively utilized for transporting and storing granular and powdered chemicals, fertilizers, and other raw materials due to their high load-bearing capacity and resistance to environmental factors. In 2022, the fertilizer segment accounted for nearly 25% of the total bulk bag consumption in Europe, reflecting its importance. The escalating need for food security, driven by population growth, has further amplified fertilizer production, thereby boosting the demand for bulk bags. For instance, according to Eurostat, fertilizer exports from the EU increased by 8% in 2022 compared to the previous year, underscoring the sector's reliance on efficient packaging solutions like bulk bags. This trend is expected to persist as agricultural activities intensify, particularly in Eastern Europe, where arable land is abundant.

Rising Adoption in Construction and Infrastructure Development

The growing adoption of these bags in the construction and infrastructure development sectors is further aiding the European bulk bags market expansion. According to the European Construction Industry Federation, the construction industry in Europe is valued at over €1.3 trillion, with significant investments in urbanization and infrastructure projects. Bulk bags are widely used for transporting construction materials such as sand, gravel, and cement, owing to their ability to handle heavy loads and ensure operational safety. In 2023, the construction sector accounted for approximately 20% of the total bulk bag market share in Europe. The European Investment Bank highlights that infrastructure spending in the EU is projected to grow by 4% annually over the next decade, driven by initiatives like the European Green Deal and Horizon Europe. This surge in construction activities is fostering the demand for durable and cost-effective packaging solutions, positioning bulk bags as an essential component of the supply chain. Moreover, the shift towards sustainable construction practices is encouraging the use of recyclable bulk bags, further bolstering the European market growth.

MARKET RESTRAINTS

Stringent Environmental Regulations

Stringent environmental regulations are restraining the European bulk bags market growth. According to the European Environment Agency, the EU has implemented rigorous policies aimed at reducing plastic waste and promoting sustainable packaging alternatives. These regulations often require manufacturers to adopt eco-friendly materials and recycling practices, which can increase production costs and complicate supply chains. For instance, the Single-Use Plastics Directive, introduced in 2019, mandates the reduction of non-recyclable plastics, impacting the traditional polypropylene-based bulk bags commonly used in the market. As per Eurostat, the cost of compliance with these regulations has led to a 10% rise in production expenses for bulk bag manufacturers over the past three years. Additionally, the lack of standardized recycling infrastructure across Europe exacerbates the challenge, as not all regions possess the necessary facilities to process used bulk bags. This regulatory pressure is likely to persist, potentially hindering market growth unless innovative solutions are developed to align with sustainability goals.

Fluctuating Raw Material Prices

Fluctuating raw material prices is hampering the expansion of the European bulk bags market. According to the European Chemical Industry Council, polypropylene is the primary material used in bulk bag production and has experienced significant price volatility due to global supply chain disruptions and geopolitical tensions. For example, in 2022, the price of polypropylene surged by 15% in Europe, driven by energy crises and logistical bottlenecks. This instability directly impacts the profitability of bulk bag manufacturers, as they face challenges in maintaining competitive pricing while absorbing rising input costs. According to the European Central Bank, inflationary pressures have further compounded the issue, with energy-intensive industries bearing the brunt of escalating expenses. Such fluctuations create uncertainty in the market, deterring long-term investments and innovation. Consequently, manufacturers are compelled to explore alternative materials or pass on the additional costs to end-users, which may dampen demand in price-sensitive segments such as agriculture and construction.

MARKET OPPORTUNITIES

Expansion into Emerging Markets

The expansion into emerging markets is a lucrative opportunity for the European bulk bags market. According to the European Commission, trade agreements between the EU and emerging economies in Asia, Africa, and Latin America have facilitated increased exports of industrial goods, including bulk bags. For instance, in 2022, the EU exported approximately €300 million worth of packaging solutions to these regions, with bulk bags accounting for a significant share. Emerging markets are witnessing rapid industrialization and infrastructure development and are creating a surge in demand for efficient material handling solutions. According to the International Monetary Fund, countries like India, Brazil, and South Africa are investing heavily in sectors such as agriculture, mining, and construction, all of which rely on bulk bags for logistics. By leveraging advanced technologies and sustainable designs, European manufacturers can position themselves as preferred suppliers in these markets. Furthermore, partnerships with local distributors and governments can enhance market penetration, driving substantial revenue growth for the European bulk bags market.

Technological Advancements in Product Design

Technological advancements in product design offer another promising opportunity for the European bulk bags market. According to the European Patent Office, innovations in material science and engineering have led to the development of smart bulk bags equipped with features such as RFID tracking, anti-static properties, and enhanced load stability. These advancements cater to the evolving needs of industries like pharmaceuticals and food processing, where precision and safety are paramount. For example, in 2023, the adoption of Type C and Type D bulk bags, designed for handling hazardous materials, increased by 12% in Europe, as reported by the European Chemical Industry Council. The integration of IoT-enabled sensors in bulk bags allows real-time monitoring of contents, improving supply chain transparency and efficiency. Additionally, the European Investment Bank notes that investments in R&D for sustainable and high-performance materials are accelerating, enabling manufacturers to meet stringent environmental standards while enhancing product functionality. By capitalizing on these innovations, the European bulk bags market can unlock new revenue streams and strengthen its global competitiveness.

MARKET CHALLENGES

Intense Competition from Low-Cost Imports in Europe

Intense competition from low-cost imports is a notable challenge to the European bulk bags market. According to the European Commission, the influx of inexpensive bulk bags from countries like China and India has intensified price wars, pressuring domestic manufacturers to lower their profit margins. In 2022, imports of bulk bags into the EU surged by 20%, driven by the availability of cheaper labor and raw materials in these regions. The European Trade Union Confederation highlights that this trend has disproportionately affected small and medium-sized enterprises (SMEs) in Europe, which struggle to compete on cost without compromising quality. Furthermore, the lack of stringent quality control measures in some exporting countries results in substandard products entering the market, undermining consumer trust in imported goods. This competitive pressure forces European manufacturers to invest heavily in marketing and branding to differentiate their offerings, adding to operational costs. Unless addressed through trade policies or innovation, this challenge could erode the market share of domestic players in the long term.

Supply Chain Disruptions in Europe

Supply chain disruptions is also another major challenge to the European bulk bags market. According to Eurostat, the COVID-19 pandemic and subsequent geopolitical tensions, such as the Russia-Ukraine conflict, have caused significant delays and shortages in the supply of raw materials like polypropylene. In 2022, the average lead time for raw material procurement increased by 30%, severely affecting production schedules. The European Central Bank notes that these disruptions have been exacerbated by port congestion and labor shortages, leading to a 15% decline in bulk bag production capacity in certain regions. Such uncertainties hinder the ability of manufacturers to meet customer demands promptly, resulting in lost sales opportunities and strained relationships with clients. Moreover, the reliance on global supply chains makes the market vulnerable to external shocks, as highlighted by the European Investment Bank. To mitigate these risks, companies are exploring localized sourcing and vertical integration strategies, though these measures require substantial investment and time to implement effectively.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

6.43% |

|

Segments Covered |

By Fabric Type, Capacity, Design, End-User, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, Rest of Europe |

|

Market Leaders Profiled |

Grief, Inc.; Berry Global Group, Inc.; Intertape Polymer Group; Conitex Sonoco; LC Packaging International BV; Bag Corp; Sackmaker J&HM Dickson Ltd; Emmbi Industries Ltd; RDA Bulk Packaging Ltd; Conrop, s.r.o.; MANICARDI srl; Sokuflex Behälter GmbH; Bulk Containers Europe BV; DIV Trades d.o.o.; TiszaTextil Plastic Processing and Sales LTD.; PLASTCHIM-T AD; Pera Plastic Czech s.r.o.; Romtextil SA; EUROFLEX FIBC LIMITED; BLOCKX GROUP, and others. |

SEGMENTAL ANALYSIS

By Fabric Type Insights

Type C bulk bags segment held 36.2% of the European bulk bags market share in 2024. C bulk bags are specifically designed to safely transport flammable powders and materials in explosive atmospheres, making them indispensable in industries like chemicals and pharmaceuticals. Their superior conductivity properties prevent static electricity buildup, ensuring compliance with stringent safety regulations. According to Eurostat, the demand for Type C bags increased by 10% in 2022, driven by the growing emphasis on workplace safety and risk mitigation. The dominance of Type C bags is further reinforced by their versatility, as they can be customized to meet specific end-user requirements. For instance, their application in handling hazardous materials aligns with the EU’s REACH regulations, which mandate the safe handling of chemicals. This segment's leadership underscores its critical role in safeguarding industrial operations and ensuring regulatory adherence, solidifying its position as the largest fabric type in the market.

Type D bulk bags segment is expected to grow at a prominent CAGR of 8.5% over the forecast period. These bags are designed for environments where grounding is not feasible, offering inherent anti-static properties without requiring external connections. The increasing adoption of Type D bags is attributed to their suitability for sensitive applications, such as food processing and pharmaceuticals, where contamination risks must be minimized. The European Food Safety Authority highlights that the food industry’s demand for contamination-free packaging solutions grew by 12% in 2022, driving the uptake of Type D bags. Additionally, advancements in material technology have enhanced their durability and performance, making them a preferred choice for high-value products. This segment’s rapid growth reflects its alignment with evolving industry needs and regulatory standards, positioning it as a key growth driver in the European bulk bags market.

By Capacity Insights

The medium capacity segment accounted for 45.1% of the European market share in 2024. The medium capacity bags strike an optimal balance between load-bearing capacity and maneuverability, making them ideal for transporting construction materials, fertilizers, and chemicals. According to Eurostat, the construction sector’s demand for medium-capacity bags increased by 8% in 2022, driven by infrastructure projects under the European Green Deal. Their versatility allows them to cater to a wide range of applications, from handling granular materials to supporting logistics in confined spaces. The dominance of this segment is further reinforced by its cost-effectiveness, as medium-capacity bags require fewer resources to produce compared to larger variants while still meeting the majority of industrial needs.

The large capacity segment is estimated to record a CAGR of 9.12% over the forecast period owing to the rapid adoption of large capacity bags in the mining and agriculture sectors, where the transportation of bulk materials like ores, grains, and fertilizers necessitates higher load capacities. The European Commission highlights that the mining industry’s output grew by 6% in 2022, fueling the demand for large-capacity bags capable of handling heavy loads efficiently. Additionally, advancements in bag design, such as reinforced stitching and UV-resistant coatings, have enhanced their durability and applicability in harsh environments.

By Design Insights

The U-panel segment led the market by holding 40.7% of the European market share in 2024 owing to their seamless design with a single piece of fabric forming the sides and base, providing superior strength and stability. According to Eurostat, the demand for U-panel bags increased by 7% in 2022, driven by their widespread use in the construction and chemical industries. Their robust structure ensures minimal material loss during transportation, making them a preferred choice for handling abrasive and heavy materials. The dominance of U-panel bags is further reinforced by their cost-effectiveness, as their simple yet efficient design reduces production complexities.

The baffle bulk bags segment is estimated to progress at a CAGR of 10.3% over the forecast period. These bags incorporate internal baffles that provide structural stability and prevent bulging, making them ideal for transporting fine powders and granular materials. The European Chemical Industry Council highlights that the demand for baffle bags surged by 15% in 2022, driven by their ability to optimize space utilization during storage and transportation. Additionally, advancements in baffle technology, such as customizable configurations and enhanced load distribution, have expanded their applicability across diverse industries. This segment’s rapid growth reflects its alignment with the need for efficient and reliable packaging solutions, positioning it as a key growth driver in the European bulk bags market.

By End User Insights

The chemicals segment was the largest end-user segment in the European bulk bags market and occupied 31.8% of the European market share in 2024. Bulk bags are extensively used in this sector for transporting raw materials, intermediates, and finished products, given their ability to handle hazardous and sensitive materials safely. According to Eurostat, the chemical industry’s output grew by 5% in 2022, driven by increased demand for specialty chemicals and polymers. The dominance of this segment is further reinforced by stringent safety regulations, which mandate the use of specialized bulk bags like Type C and Type D variants. These bags ensure compliance with EU safety standards, making them indispensable for chemical manufacturers. The growing usage of bulk bags to facilitate the safe and efficient transportation of chemical products is driving the expansion of the chemicals segment in the European market over the forecast period.

The pharmaceuticals segment is growing at the fastest and is expected to progress at a CAGR of 11.2% over the forecast period. Bulk bags are increasingly adopted in this sector for transporting active pharmaceutical ingredients (APIs) and excipients, where contamination-free packaging is paramount. According to the European Pharmaceutical Market Research Association, the pharmaceutical industry’s revenue grew by 8% in 2022 due to the advancements in drug development and biotechnology. The demand for Type D bulk bags that prevent static discharge without requiring grounding has surged by 14% in this sector to ensure compliance with stringent hygiene and safety standards.

REGIONAL ANALYSIS

Germany dominated the European bulk bags market by accounting for 22.7% of the European market share in 2024. The robust manufacturing base and stringent safety regulations of Germany drive the adoption of bulk bags in sectors like chemicals, automotive, and construction, which is majorly boosting the German bulk bags market growth. According to Eurostat, Germany’s chemical industry alone accounts for €200 billion annually, with bulk bags playing a crucial role in logistics. The emphasis on sustainability has further propelled the demand for eco-friendly bulk bags, aligning with the country’s green initiatives.

France captured the second largest share of the European market in 2024. The strong presence in the food and beverage sector of France drives the demand for bulk bags, particularly in transporting grains and dairy products is propelling the French bulk bags market growth. According to the French Ministry of Agriculture, the agri-food industry contributes €180 billion annually, with bulk bags ensuring efficient supply chain operations.

The UK is anticipated to account for a promising share of the European market over the forecast period owing to the construction boom of the UK, driven by infrastructure projects like HS2, boosts the demand for bulk bags. According to the UK Office for National Statistics, construction output grew by 6% in 2022, underscoring the sector’s reliance on bulk bags.

Italy accounts for a prominent position in the European market. The thriving fashion and textile industries of Italy utilize bulk bags for transporting raw materials is boosting the Italian bulk bags market growth.

Spain is estimated to grow at a healthy CAGR in the European market over the forecast period. The agricultural sector of Spain, particularly olive oil and wine production is driving the demand for bulk bags to ensure efficient logistics and storage, which is driving the Spanish bulk bags market.

KEY MARKET PLAYERS

The major key players in Europe Bulk Bags market are Grief, Inc.; Berry Global Group, Inc.; Intertape Polymer Group; Conitex Sonoco; LC Packaging International BV; Bag Corp; Sackmaker J&HM Dickson Ltd; Emmbi Industries Ltd; RDA Bulk Packaging Ltd; Conrop, s.r.o.; MANICARDI srl; Sokuflex Behälter GmbH; Bulk Containers Europe BV; DIV Trades d.o.o.; TiszaTextil Plastic Processing and Sales LTD.; PLASTCHIM-T AD; Pera Plastic Czech s.r.o.; Romtextil SA; EUROFLEX FIBC LIMITED; BLOCKX GROUP

MARKET SEGMENTATION

This research report on the Europe bulk bags market is segmented and sub-segmented into the following categories.

By Fabric Type

- Type A

- Type B

- Type C

- Type D

By Capacity

- Small (less than 0.75 cu.m)

- Medium (0.75 to 1.5 cu.m)

- Large (greater than 1.5 cu.m)

By Design

- U-Panel Bags

- Baffles

- Four Side Panels

- Cross Corner

- Tabular

- Circular

By End User

- Mining

- Fertilizers

- Chemicals

- Construction

- Food

- Beverage

- Pharmaceuticals

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. What is the projected market size of the European bulk bags market by 2033?

The European bulk bags market is estimated to reach USD 1.84 billion by 2033.

2. What role do Type C and Type D bulk bags play in the market?

Type C and Type D bulk bags, designed for handling hazardous materials, saw a 12% increase in adoption in 2023, as per the European Chemical Industry Council.

3. Which country dominated the European bulk bags market in 2024?

Germany led the European bulk bags market with a 22.7% share in 2024.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]