Europe Building Materials Market Size, Share, Trends & Growth Forecast Report By Type, Application and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2025 to 2033

Europe Building Materials Market Size

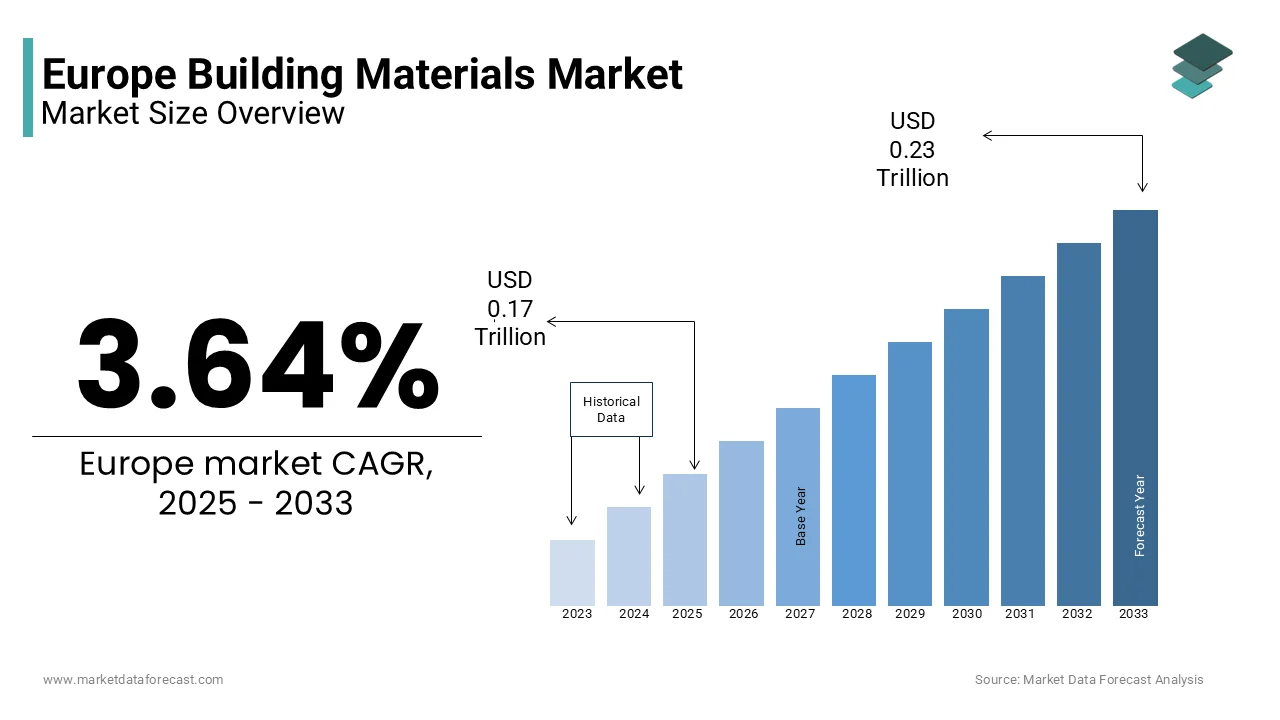

The building materials market size in Europe was valued at USD 0.16 trillion in 2024. The European market is estimated to grow at a CAGR of 3.64% from 2025 to 2033 and be worth USD 0.23 trillion by 2033 from USD 0.17 trillion in 2025.

The building materials market in Europe plays a key role in the region’s construction industry, supported by growing cities, new infrastructure, and strong housing demand. Eurostat reports that construction makes up about 9% of the EU’s total GDP, showing how important building materials are. Germany, France, and the UK lead the market, making up more than 50% of total revenue. The residential sector is a major buyer, helped by programs like Germany’s €110 billion climate action plan, which focuses on energy-efficient homes. The European Green Deal has also increased the need for eco-friendly materials. Even with economic ups and downs, the market stays strong thanks to steady infrastructure projects and strict rules that support sustainable building practices.

MARKET DRIVERS

Urbanization and Infrastructure Development

Urbanization remains a pivotal driver for the Europe building materials market, with cities expanding to accommodate growing populations. As per the United Nations, Europe’s urban population is projected to reach 75% by 2030 necessitating extensive housing and infrastructure projects. This demographic shift fuels demand for aggregates, cement, and bricks. For instance, the European Investment Bank allocated €20 billion in 2023 for urban infrastructure projects including affordable housing and public transit systems. The surge in smart city initiatives further amplifies material consumption, with Germany alone investing €3 billion annually in smart urban solutions. According to PwC, urban development projects across Europe generated a material demand worth €120 billion in 2022. These figures show how urbanization not only boosts material sales but also drives innovation in sustainable construction practices.

Sustainability Regulations and Green Building Initiatives

Sustainability regulations are reshaping the Europe building materials market, mandating eco-friendly practices and materials. The European Commission’s Renovation Wave initiative aims to renovate 35 million buildings by 2030 creating unprecedented demand for low-carbon materials. The International Energy Agency notes that green building materials accounted for 25% of the market in 2022. Countries like Sweden and Denmark lead the charge, with their construction sectors achieving 40% carbon reduction targets. Furthermore, the EU Taxonomy for Sustainable Activities mandates that 60% of new projects must meet environmental standards, as per Deloitte. This regulatory push compels manufacturers to innovate is driving investments in recycled aggregates and bio-based materials. Such trends position sustainability as a key growth catalyst for the market.

MARKET RESTRAINTS

Economic Uncertainty and Inflationary Pressures

Economic uncertainty and inflationary pressures pose significant challenges to the Europe building materials market. Rising costs of raw materials such as steel and cement have surged by 20% since 2021, as noted by the Oxford Economics. This increase stems from supply chain disruptions exacerbated by geopolitical tensions, particularly Russia’s conflict with Ukraine. Besides this, inflation rates in the Eurozone reached 8.5% in early 2023, impacting construction budgets and reducing project viability. The European Construction Industry Federation notes that nearly 30% of planned projects faced delays or cancellations due to cost escalations. Small and medium enterprises (SMEs) in the construction sector are disproportionately affected, as they lack the financial resilience to absorb price volatility. These factors collectively hinder market expansion and dampen investor confidence.

Stringent Environmental Regulations

While sustainability drives innovation, stringent environmental regulations also act as a restraint for the Europe building materials market. Compliance with the EU’s Carbon Border Adjustment Mechanism (CBAM) imposes additional costs on manufacturers importing high-carbon materials. According to McKinsey, these regulations could increase operational costs by 15-20%, particularly affecting non-EU suppliers. Furthermore, the European Environment Agency mandates that companies reduce emissions by 55% by 2030, compelling firms to invest heavily in green technologies. Smaller players struggle to adapt, leading to market consolidation. A report by Bain & Company notes that over 20% of SMEs in the sector risk closure due to regulatory burdens. While these measures aim to promote sustainability, they inadvertently stifle market growth by increasing barriers to entry and operational challenges.

MARKET OPPORTUNITIES

Adoption of Circular Economy Practices

The adoption of circular economy practices presents a lucrative opportunity for the Europe building materials market. The European Commission’s Circular Economy Action Plan aims to recycle 70% of construction waste by 2030, driving demand for recycled aggregates and bio-based materials. In line with Accenture, the circular economy could generate €1.8 trillion in economic benefits by 2030. Companies leveraging recycled materials, such as crushed concrete and reclaimed wood, are gaining traction, with the recycled materials segment growing significantly. Germany leads this trend, recycling 80% of its construction waste, as per the German Federal Environment Agency. Innovations in modular construction and prefabricated components further enhance material efficiency. By embracing circularity, manufacturers can tap into a burgeoning market while aligning with EU sustainability goals.

Expansion of Renewable Energy Projects

Renewable energy projects are creating new avenues for the Europe building materials market, particularly in wind and solar infrastructure. The European Green Deal allocates €1 trillion for renewable energy investments by 2030, as per the European Investment Bank. This initiative drives demand for specialized materials, such as reinforced concrete for wind turbine foundations and photovoltaic glass for solar panels. Spain and France are at the forefront, with solar installations exceeding 15 GW in 2022, according to BloombergNEF. Additionally, offshore wind projects in the UK and Germany require high-performance materials, boosting sales of advanced composites and corrosion-resistant alloys. The renewable energy sector’s material demand is projected to grow by 30% annually, offering manufacturers an untapped revenue stream. By aligning with clean energy goals, companies can secure long-term growth prospects.

MARKET CHALLENGES

Supply Chain Disruptions

Supply chain disruptions remain a pressing challenge for the Europe building materials market exacerbated by global events and geopolitical tensions. The war in Ukraine disrupted supplies of critical materials like steel and timber, with prices surging by 30% in 2022, according to Boston Consulting Group. Port congestion and labor shortages further compound these issues, delaying project timelines and escalating costs. Italy, reliant on imported raw materials, experienced a 25% drop in construction activity during peak disruptions, as per the Italian National Institute of Statistics. Manufacturers face increased logistical expenses, with freight rates rising by 50% since 2021. These disruptions hinder market stability, forcing companies to explore localized sourcing strategies. However, transitioning to domestic supply chains requires significant investment, posing a barrier for smaller players.

Workforce Shortages and Skill Gaps

Workforce shortages and skill gaps present another major challenge for the Europe building materials market. The construction sector faces a shortfall of 1 million skilled workers by 2025, as per Korn Ferry. Aging demographics exacerbate this issue, with over 30% of the workforce nearing retirement age. The UK Construction Industry Training Board states that training programs fail to meet industry demands, leaving a gap in expertise for advanced technologies like 3D printing and modular construction. Moreover, younger generations show limited interest in manual trades, further widening the labor deficit. These shortages delay project completion and inflate labor costs, reducing overall profitability. Resolving this challenge requires collaborative efforts between governments and private entities to invest in vocational training and attract talent to the sector.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

3.64% |

|

Segments Covered |

By Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, Rest of Europe |

|

Market Leaders Profiled |

CEMEX, LafargeHolcim, Dyckerhoff AG, Buzzi Unicem, CRH Plc, Aditya Birla Group, and Ambuja Cements, and others. |

SEGMENTAL ANALYSIS

By Type Insights

The Cement segment dominated the Europe building materials market by holding a 30.7% market share in 2024. Its prevalence is due its versatility and widespread use in both residential and commercial construction. Germany is the largest producer that contributes 20% of the region’s cement output supported by €5 billion in annual exports. The segment’s dominance is driven by infrastructure projects, such as the €25 billion Stuttgart-Ulm rail expansion, which consumes 2 million tons of cement annually. Moreover, urbanization trends fuel demand, with the European Investment Bank funding €15 billion in housing projects requiring cement-intensive foundations. Cement’s affordability compared to alternatives like steel reinforces its leading position. According to McKinsey, the segment’s growth is further bolstered by innovations in low-carbon cement, which address sustainability concerns while maintaining cost-effectiveness.

The aggregates segment represented the fastest-growing segment, with a CAGR of 5.8% through 2033. This growth is fueled by the rising demand for sustainable construction practices including recycled aggregates. The UK leads this trend, recycling 90 million tons of aggregates annually, as reported by the Mineral Products Association. Infrastructure projects such as the €10 billion Lyon-Turin railway rely heavily on aggregates for roadbeds and foundations. Moreover, the circular economy initiative encourages the use of crushed concrete and reclaimed asphalt, driving market expansion. The PwC notes that the aggregates segment benefits from its cost efficiency, with prices 40% lower than alternative materials. Innovations in lightweight aggregates further enhance their appeal, positioning them as a preferred choice for modern construction needs.

By Application Insights

The residential construction commanded the biggest share of the Europe building materials market that is 45.8% of total revenue in 2024. This market position is driven by government housing initiatives such as France’s €100 billion recovery plan which allocates €20 billion to affordable housing. The segment benefits from urbanization, with cities like Berlin and Paris witnessing a 15% annual increase in housing starts, according to Knight Frank. Also, EU directives promoting energy-efficient homes boost demand for insulation materials and eco-friendly bricks. Germany’s KfW Development Bank funds €5 billion annually in energy-efficient renovations, further propelling residential material consumption. The segment’s growth is sustained by demographic shifts including population growth and migration is ensuring consistent demand for innovative and sustainable building solutions.

The industrial applications segment represented the fastest-growing segment, with a CAGR of 6.3% in the coming years. This progress is influenced by the expansion of manufacturing hubs and renewable energy projects. Poland and Romania lead industrial construction, with €15 billion invested in automotive plants and logistics facilities in 2022. The rise of electric vehicle manufacturing drives demand for specialized materials like high-strength steel and advanced composites. Additionally, renewable energy projects, such as wind farms in Sweden and solar parks in Spain, require durable materials for turbine foundations and panel installations. According to McKinsey, industrial applications benefit from technological advancements, including prefabrication and modular construction, which enhance efficiency and reduce costs. These trends position industrial construction as a key growth driver for the building materials market.

REGIONAL ANALYSIS

Germany stood as the largest contributor to the Europe building materials market by having a 24.2% share in 2024. The country’s position is due to its robust construction sector, supported by €110 billion in climate action funding. Urbanization drives demand for sustainable materials, with Berlin alone requiring 5 million tons of cement annually for housing projects. Germany’s emphasis on green building practices, including passive house standards, boosts sales of energy-efficient materials. The nation’s export-oriented economy further strengthens its position, with €5 billion in cement exports annually. Innovation in recycled aggregates and low-carbon bricks positions Germany as a leader in sustainable construction.

France is maintaining steady momentum in the market. It us driven by its €100 billion recovery plan, which prioritizes affordable housing and infrastructure, according to the French Ministry of Ecology. Paris, hosting the 2024 Olympics, requires 10 million tons of materials for stadium and transit projects. The country’s focus on energy-efficient renovations, funded by €20 billion annually, propels demand for insulation and eco-friendly bricks. France’s commitment to the circular economy, recycling 80% of construction waste, enhances its leadership. Additionally, smart city initiatives in Lyon and Marseille drive innovation in modular construction, reinforcing France’s prominence in the regional market.

The UK is emerging as the fastest-growing market which is estimated to attain a CAGR of 6.9% in the future. London’s housing crisis fuels demand for residential materials, with 300,000 new homes required annually. The HS2 rail project consumes 10 million tons of aggregates, highlighting the scale of material consumption. The UK leads in recycled aggregates, processing 100 million tons annually. Moreover, renewable energy projects, such as offshore wind farms, create demand for specialized materials. Brexit-induced supply chain challenges have prompted localized sourcing, strengthening the domestic market.

Italy holds a notable market share that is driven by €30 billion in restoration projects, according to the Italian Ministry of Infrastructure. Rome and Milan witness a surge in residential construction, consuming 5 million tons of cement annually. Italy’s focus on cultural heritage preservation boosts demand for traditional materials like bricks and limestone. The country recycles 70% of construction waste, aligning with EU sustainability goals. Also, industrial projects, such as Fiat’s electric vehicle plants, drive demand for advanced materials. Italy’s rich architectural legacy and modernization efforts ensure steady material consumption.

Spain is witnessing gradual growth in the building materials sector, benefiting from €20 billion in renewable energy investments, as per the Spanish Ministry of Ecological Transition. Solar installations exceed 15 GW, driving demand for photovoltaic glass and reinforced concrete. Madrid and Barcelona experience urbanization, requiring 8 million tons of materials annually for housing. Spain’s circular economy initiatives recycle 85% of construction waste, enhancing sustainability. Additionally, infrastructure projects, such as the Mediterranean Corridor, consume massive quantities of aggregates. Spain’s focus on green energy and urban development solidifies its position in the regional market.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

CEMEX, LafargeHolcim, Dyckerhoff AG, Buzzi Unicem, CRH Plc, Aditya Birla Group, and Ambuja Cements are leading players in the Europe building materials market.

The Europe building materials market is characterized by intense competition, driven by innovation and sustainability. Key players like LafargeHolcim, Heidelberg Materials, and CRH plc dominate the landscape, each commanding significant market shares through strategic initiatives. LafargeHolcim leads with its low-carbon cement by capturing 18% of the regional market, as per the European Cement Association. Heidelberg Materials follows closely, leveraging its circular economy practices to secure 15% of the market. CRH plc, with its diversified product range, holds 12%. The market witnesses frequent mergers and acquisitions, with companies consolidating to enhance capabilities. Regulatory pressures and consumer demand for sustainable solutions intensify competition, pushing firms to invest in R&D and adopt advanced technologies. Additionally, localized players in Eastern Europe challenge established giants, fostering a dynamic competitive environment. This rivalry ensures continuous innovation, benefiting consumers and aligning with EU sustainability goals.

TOP PLAYERS IN THIS MARKET

LafargeHolcim

LafargeHolcim is a global leader in the building materials sector, contributing significantly to the Europe market through its innovative product portfolio. The company specializes in low-carbon cement and sustainable aggregates, aligning with EU environmental regulations. LafargeHolcim’s EcoPlanet range reduces carbon emissions by 30%, making it a preferred choice for green building projects. Its investments in digital tools, such as predictive analytics for supply chain optimization, enhance operational efficiency. The company’s partnerships with renewable energy firms further strengthen its market presence, positioning it as a pioneer in sustainable construction solutions.

Heidelberg Materials

Heidelberg Materials plays a pivotal role in the Europe building materials market, focusing on circular economy practices. The company recycles 10 million tons of construction waste annually, supporting EU recycling targets. Heidelberg’s iQ series offers energy-efficient cement, reducing CO2 emissions by 25%. Its collaboration with smart city projects in Germany and France underscores its commitment to innovation. The company’s R&D investments in carbon capture technologies position it as a leader in sustainability. Heidelberg Materials’ strategic focus on eco-friendly solutions ensures its relevance in a rapidly evolving market.

CRH plc

CRH plc is a key player in the Europe building materials market, renowned for its diverse product range and operational excellence. The company supplies aggregates, asphalt, and precast concrete, catering to infrastructure and residential projects. CRH’s acquisition of small-scale producers enhances its market reach, particularly in Eastern Europe. Its focus on modular construction and prefabrication aligns with industry trends, reducing material waste and project timelines. CRH’s commitment to sustainability is evident in its net-zero roadmap, targeting a 40% reduction in emissions by 2030. These initiatives reinforce its leadership in the regional market.

TOP STRATEGIES USED BY THE KEY MARKET PLAYERS

Strategic Acquisitions

Key players in the Europe building materials market leverage acquisitions to expand their footprint and diversify offerings. For instance, CRH plc acquired 15 regional players in 2022, enhancing its presence in emerging markets like Poland and Romania. These acquisitions provide access to localized supply chains, reducing dependency on imports. LafargeHolcim’s purchase of Firestone Building Products expanded its roofing solutions portfolio, aligning with growing demand for energy-efficient buildings. Such strategies enable companies to consolidate market share while addressing regional-specific needs.

Investments in R&D

Investments in research and development drive innovation and sustainability in the Europe building materials market. Heidelberg Materials allocates €500 million annually to develop low-carbon products, such as carbon-neutral cement. LafargeHolcim’s R&D initiatives focus on 3D printing technologies, reducing material waste by 40%. These innovations cater to EU regulations and consumer preferences for eco-friendly solutions. By prioritizing R&D, companies enhance their competitive edge and align with long-term market trends.

Partnerships for Sustainability

Partnerships with renewable energy firms and governmental bodies strengthen market positions. LafargeHolcim collaborates with Siemens to integrate carbon capture technologies into production processes. Heidelberg Materials partners with the European Investment Bank to fund green infrastructure projects. These alliances not only enhance sustainability but also open new revenue streams. By aligning with global decarbonization goals, companies secure their leadership in the evolving market landscape.

RECENT HAPPENINGS IN THE MARKET

- In April 2024, LafargeHolcim launched its EcoPlanet Cement line, reducing carbon emissions by 30% and targeting green building projects across Europe.

- In June 2023, Heidelberg Materials partnered with Siemens to integrate carbon capture technologies, aiming to achieve net-zero emissions by 2030.

- In March 2023, CRH plc acquired 15 regional producers in Eastern Europe, expanding its supply chain and market reach.

- In September 2022, LafargeHolcim purchased Firestone Building Products, enhancing its roofing solutions portfolio for energy-efficient buildings.

- In January 2022, Heidelberg Materials collaborated with the European Investment Bank to fund €1 billion in green infrastructure projects, promoting sustainable construction practices.

MARKET SEGMENTATION

This research report on the Europe building materials market is segmented and sub-segmented into the following categories.

By Type

- Aggregates

- Bricks

- Cement

- Others

By Application

- Residential

- Commercial

- Industrial

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]