Europe Broadband Market Size, Share, Trends & Growth Forecast Report By Broadband Connection (Fiber Optic, Wireless, Satellite, Cable, Digital Subscriber Line), End Use (Business, Household), and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, Rest of Europe) – Industry Analysis From 2025 to 2033.

Europe Broadband Market Size

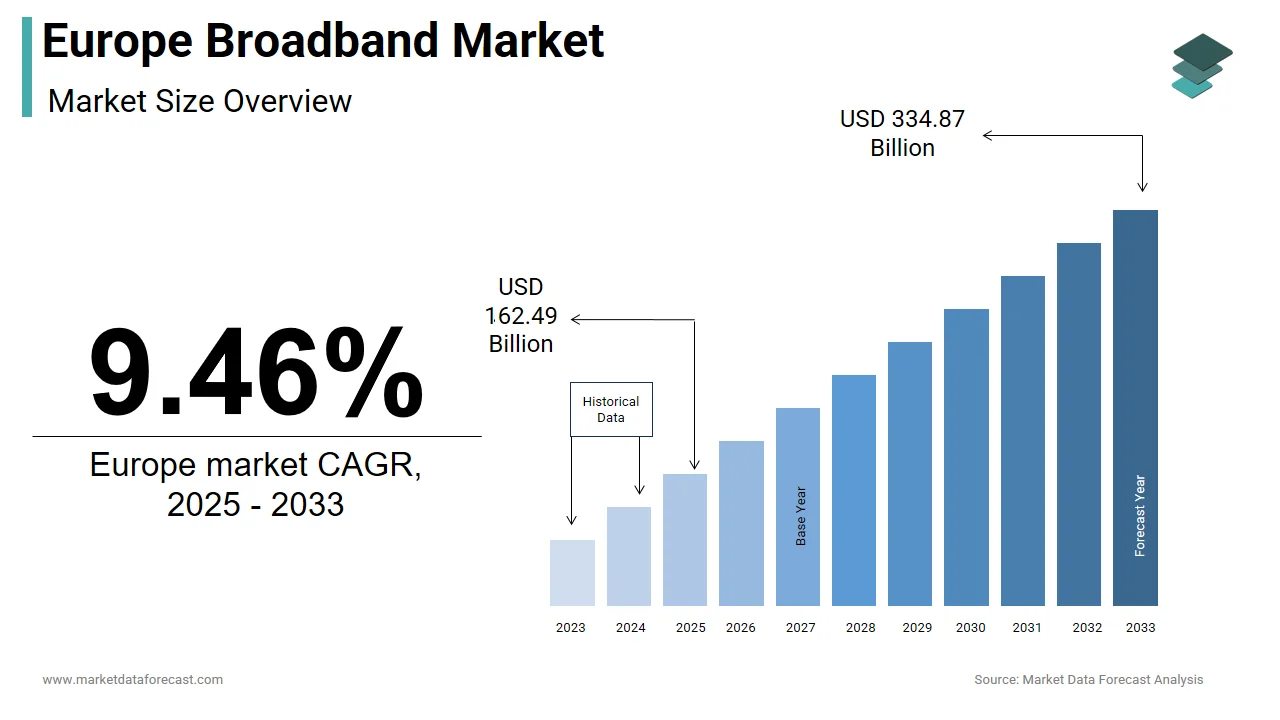

The broadband market size in Europe was valued at USD 148.45 billion in 2024. The European market is estimated to be worth USD 334.87 billion by 2033 from USD 162.49 billion in 2025, growing at a CAGR of 9.46% from 2025 to 2033.

The Europe broadband market is a cornerstone of the region's digital infrastructure, which is fostering economic growth and societal connectivity. A substantial percentage of European households had access to fixed broadband internet in 2022, reflecting a robust penetration rate. Fiber optic connections dominate the landscape, with Germany and France collectively accounting for the majority of total fiber subscriptions. The market thrives on high demand for ultra-fast internet, driven by remote work trends and the proliferation of smart devices. Moreover, regulatory frameworks like the EU’s Digital Decade initiative aim to achieve gigabit connectivity for all by 2030, further propelling investments in broadband infrastructure. Despite regional disparities, Eastern European nations like Poland are rapidly catching up, supported by EU funding programs such as the Connecting Europe Facility.

MARKET DRIVERS

Rising Demand for High-Speed Connectivity

The insatiable appetite for high-speed internet is a pivotal driver of the Europe broadband market. Like, fiber-optic broadband adoption surged significantly between 2020 and 2022, fueled by increased reliance on cloud computing and video conferencing tools. Remote working became a norm during the pandemic, with research indicating that aportion of European workers now operate remotely at least part-time. This behavioral shift has intensified pressure on service providers to deliver seamless connectivity. Moreover, streaming platforms like Netflix and Amazon Prime Video have driven bandwidth demands, with Sandvine reporting that video streaming makes up a notable percentage of downstream traffic in Europe. Governments are also incentivizing high-speed infrastructure; for instance, the UK’s Project Gigabit aims to provide 1 Gbps speeds to 85% of households by 2025. Such initiatives showcase how consumer preferences and technological advancements are reshaping the broadband ecosystem, ensuring sustained market expansion.

Smart City Initiatives and IoT Adoption

Smart city projects across Europe are catalyzing broadband deployment, particularly in urban hubs. The European Parliament states that over 200 cities have launched smart city programs, integrating IoT devices into public infrastructure. These applications require robust broadband networks to function effectively, which is creating significant demand for advanced connectivity solutions. For example, Barcelona’s smart lighting system relies on real-time data transmission, which necessitates low-latency broadband services. Industrial sectors are also leveraging IoT technologies, with data estimating that manufacturing firms spent a substantial amount on IoT-enabled systems in recent years alone. Broadband acts as the backbone for these innovations, enabling machine-to-machine communication and automation. Consequently, the convergence of smart city development and IoT adoption serves as a formidable driver, propelling investments in next-generation broadband technologies.

MARKET RESTRAINTS

High Infrastructure Costs

Among the main obstacles hindering the Europe broadband market is the exorbitant cost associated with deploying advanced infrastructure. Laying fiber-optic cables, especially in rural or geographically challenging areas, requires substantial investment. Similarly, the estimated cost of achieving full fiber coverage in Europe exceeds €300 billion. Many small-scale Internet Service Providers (ISPs) struggle to secure financing for such large-scale projects, and that is leading to uneven network development. The European Commission noted that around 40% of households in these areas have access to high-speed internet. Additionally, maintenance expenses for existing infrastructure add to the financial burden. These costs often translate into higher subscription fees for consumers, potentially deterring adoption rates.

Regulatory Hurdles and Fragmentation

Regulatory complexities constitute another major barrier to the Europe broadband market. Each country within the EU operates under its own set of telecommunications laws, creating a fragmented regulatory landscape. For example, delays in 5G rollout across member states have been attributed to prolonged negotiations over frequency bands. Furthermore, stringent data protection regulations like GDPR impose additional compliance costs on ISPs. While these measures ensure user privacy, they can stifle innovation and increase operational burdens. Fragmentation also complicates efforts to establish unified pricing models, making it difficult for multinational companies to standardize services. Unless harmonized regulations are implemented, the inefficiencies stemming from bureaucratic hurdles will continue to impede market progress

MARKET OPPORTUNITIES

Expansion of Rural Connectivity

Rural broadband expansion presents a lucrative opportunity for the Europe broadband market. Only a small percentage of Europeans reside in rural areas, yet only half of these regions enjoy fast and reliable internet access, according to studies. Bridging this gap not only enhances quality of life but also stimulates local economies. For instance, improved connectivity enables e-commerce ventures and telehealth services, which are critical for underserved populations. Countries like Finland exemplify success, where fiber-optic networks now cover a significant portion of rural households. This strategic focus on rural connectivity aligns with broader sustainability goals, offering both economic and social dividends.

Emergence of 5 G-Integrated Broadband Solutions

The integration of 5G technology with fixed broadband networks offers transformative potential for the Europe broadband market. Ericsson forecasts that 5G subscriptions in Europe will reach 250 million by 2027, driving demand for hybrid connectivity solutions. Fixed Wireless Access (FWA), powered by 5G, provides an alternative to traditional wired connections and particularly in densely populated urban areas. Additionally, 5G boosts capabilities for applications like augmented reality (AR) and virtual reality (VR), which require ultra-low latency. The European Telecommunications Standards Institute emphasizes that combining 5G with fiber backhaul creates a resilient dual-network architecture, capable of supporting future innovations.

MARKET CHALLENGES

Cybersecurity Threats

As broadband networks become increasingly interconnected, cybersecurity threats emerge as a pressing concern. The European Union Agency for Cybersecurity (ENISA) reports that cyberattacks targeting ISPs rose in 2023, exposing vulnerabilities in critical infrastructure. Distributed Denial-of-Service (DDoS) attacks, ransomware, and phishing campaigns disrupt services and erode consumer trust. For instance, a major outage caused by a cyberattack in Sweden affected over 2 million users in early 2023. Small and medium-sized ISPs often lack the resources to deploy strong security protocols, increasing the risk. Estimates suggest that the annual cost of cybercrime in Europe could skyrocket by 2025 if preventive measures are not strengthened. Addressing these challenges requires significant investment in encryption technologies, threat detection systems, and workforce training. However, balancing security enhancements with affordability remains a delicate task for industry players, posing a formidable obstacle to sustainable growth.

Environmental Sustainability Concerns

Environmental sustainability poses another complex challenge for the Europe broadband market. The energy consumption of data centers and network equipment contributes significantly to carbon emissions. Similarly, ICT infrastructure accounts for a significant percentage of global greenhouse gas emissions, with broadband networks being a key contributor. To meet the EU’s Green Deal objectives, ISPs must transition to renewable energy sources and adopt energy-efficient technologies. Yet, retrofitting existing infrastructure is both costly and technically challenging. For example, replacing legacy copper cables with fiber optics reduces energy usage but involves extensive excavation and material waste. Moreover, the proliferation of IoT devices increases electricity demand, straining grid capacities. The European Environment Agency warns that without immediate action, the environmental footprint of broadband operations may double by 2030.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Broadband Connection, End Use, and Region. |

|

Various Analyses Covered |

Global, Regional and Country-Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Countries Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, the Czech Republic, and the Rest of Europe. |

|

Market Leaders Profiled |

AT&T, BCE Inc, Charter Communications, Hughes Network Systems, LLC, Comcast, CenturyLink, KT Corp., LG Uplus Corp., Singtel, SK broadband CO.LTD., T‑Mobile USA, Inc., Verizon, Viasat, Inc., and others. |

SEGMENTAL ANALYSIS

By Broadband Connection Insights

The fiber optic connections segment dominated the Europe broadband market, capturing a 45.5% share in 2024. This growth is attributed to its superior speed and reliability compared to other technologies. Also, driving this dominance is the increasing demand for ultra-fast internet, with Europe’s fiber subscriptions rising notably between 2020 and 2022. Government initiatives play a crucial role; for instance, France’s “France Très Haut Débit” program aims to achieve nationwide fiber coverage by 2025. Additionally, urbanization trends favor fiber deployment, as densely populated areas benefit from centralized infrastructure. Furthermore, businesses reliant on cloud computing and AI-driven analytics prioritize fiber due to its low latency.

The wireless broadband segment emerged as the fastest-growing category, with a CAGR of 12.5% projected from 2025 to 2033. This rapid growth is fueled by advancements in 5G technology, which enable faster speeds and broader coverage. The European Telecommunications Network Operators’ Association highlights that 5 G-enabled wireless broadband can deliver download speeds exceeding 1 Gbps, attracting both urban and rural users. Mobile-first lifestyles further drive adoption, with multiple data sources estimating that smartphone penetration in Europe increased significantly in recent years. Cost-effectiveness also plays a role; wireless solutions eliminate the need for extensive physical installations, reducing barriers to entry. Moreover, governments are promoting wireless infrastructure through subsidies, such as Italy’s €6.5 billion fund for 5G rollout.

By End Use Insights

The households segment constituted the biggest end-use with 65.5% of the Europe broadband market in 2024. This position fo the segment is supported by the widespread residential internet usage, driven by entertainment, education, and remote work needs. Streaming platforms dominate household traffic, with Sandvine reporting that video content consumes over 60% of downstream bandwidth. Affordable pricing models introduced by ISPs, coupled with government subsidies, enhance accessibility. These appliances rely on stable broadband connections, reinforcing household demand. Urbanization also bolsters this segment, as densely populated areas facilitate efficient network deployment.

The businesses segment represented the quickest expanding end-use category, with a CAGR of 9.8% during the forecast period. This acceleration results from enterprises adopting digital tools to enhance productivity and competitiveness. Also, cloud computing dominates business broadband usage, with Gartner estimating European corporate spending on cloud services to significantly increase by 2025. Remote collaboration platforms like Microsoft Teams and Zoom further drive demand. The rise of Industry 4.0 technologies, including robotics and AI, necessitates high-capacity networks are driving investments in premium broadband solutions. Moreover, regulatory mandates like GDPR compel businesses to invest in secure, high-performance connectivity.

COUNTRY LEVEL ANALYSIS

Germany stood as the largest contributor to the Europe broadband market with a 22.4% share of the regional landscape in 2024. This leading position is backed by the country’s robust industrial base and advanced digital infrastructure. With over 30 million fiber-optic connections as of 2023, Germany has positioned itself as a pioneer in high-speed internet deployment. The government’s “Digital Strategy 2025” initiative plays a pivotal role, aiming to achieve nationwide gigabit connectivity by the end of the decade. Additionally, rural broadband expansion programs, such as the €12 billion allocated under the "Gigabit Strategy," ensure inclusivity across geographies. Germany’s emphasis on innovation, coupled with its strategic investments, not only solidifies its dominance but also sets a benchmark for other European nations. Its rise is further reinforced by partnerships between public and private entities, fostering a collaborative approach to digital transformation.

Spain is believed to be the fastest-growing country in the Europe broadband market, with a CAGR of 11.2%. This swift expansion is influenced by aggressive government-led initiatives which prioritizes bridging the urban-rural digital divide. Substantial investments have been channeled into deploying fiber-optic networks and enhancing 5G capabilities. The rollout of affordable broadband packages for underserved regions has significantly increased adoption rates, particularly among small businesses and households. Furthermore, Spain’s proactive approach to spectrum auctions has enabled ISPs to accelerate 5G integration, creating a fertile ground for wireless broadband growth. So, this momentum positions Spain as a critical driver of regional market dynamism, offering valuable lessons for neighboring countries.

France, Italy, and the UK are expected to exhibit steady growth trajectories in the coming years, which is driven by their respective digitization agendas. France’s “France Relance” plan focuses on achieving universal fiber coverage, with investments surpassing €7 billion earmarked for rural broadband projects. On the other hand, Italy is leveraging EU funding to modernize its aging infrastructure, targeting a major fiber penetration rate by 2026. The UK remains a key player, prioritizing 5G integration through its “Project Gigabit” initiative, which aims to deliver ultrafast internet to a significant portion of households by 2025. These nations are also addressing environmental sustainability concerns by transitioning to renewable energy sources for data centers and network operations.

KEY MARKET PLAYERS

A few notable companies operating in the Europe broadband market profiled in this report are AT&T, BCE Inc, Charter Communications, Hughes Network Systems, LLC, Comcast, CenturyLink, KT Corp., LG Uplus Corp., Singtel, SK broadband CO.LTD., T‑Mobile USA, Inc., Verizon, Viasat, Inc., and others.

TOP LEADING PLAYERS IN THE MARKET

Deutsche Telekom, Orange S.A., and BT Group lead the Europe broadband market, shaping its trajectory through strategic investments and technological advancements. Deutsche Telekom's holding in the market is bolstered by its expansive fiber-optic network spanning over 600,000 kilometers. The company’s focus on next-generation technologies, including AI-driven network optimization, enhances service reliability and scalability. Orange S.A. distinguishes itself through its leadership in 5G deployment, with over 50 cities across Europe benefiting from its cutting-edge wireless solutions. The French telecom giant also emphasizes customer experience, introducing personalized pricing models tailored to diverse user needs. BT Group, headquartered in the UK, contributes significantly to the global broadband ecosystem through strategic partnerships with tech firms like Nokia and Huawei.

TOP STRATEGIES USED BY KEY PLAYERS

Key players in the Europe broadband market employ a range of innovative strategies to strengthen their positions and drive growth. Mergers and acquisitions remain a cornerstone tactic. Spectrum auctions represent another critical strategy, enabling companies like Orange to secure prime frequencies for 5G deployment, thereby enhancing wireless broadband capabilities. Sustainability initiatives are gaining traction, with Vodafone launching a green energy transition program aimed at reducing carbon emissions by 50% by 2025. Customer-centric approaches, such as BT Group’s introduction of tiered pricing models, cater to varying budgets while fostering loyalty. Strategic partnerships with technology firms like Nokia and Ericsson further amplify service offerings, ensuring compatibility with emerging trends like IoT and smart city development. These multifaceted strategies underscore the industry’s adaptability and forward-thinking mindset.

COMPETITION OVERVIEW

The Europe broadband market is characterized by intense competition, driven by technological innovation, price wars, and regulatory scrutiny. Established giants like Deutsche Telekom face mounting pressure from agile startups offering niche solutions, such as low-cost rural broadband or specialized IoT connectivity. Consolidation through mergers and acquisitions has intensified rivalry, with smaller players often being absorbed by larger entities seeking to expand their reach. Regulatory frameworks, enforced by bodies like the European Commission, ensure fair practices while mandating transparency in pricing and service quality. Despite these challenges, the competitive environment fosters continuous improvement, benefiting consumers through enhanced service portfolios and reduced costs. Moreover, the race to deploy 5G and fiber-optic networks has spurred unprecedented levels of investment, propelling the market toward greater efficiency and inclusivity.

RECENT MARKET DEVELOPMENTS

- In January 2023, Deutsche Telekom acquired Unitymedia, expanding its fiber-optic network and consolidating its position as a market leader.

- In June 2023, Orange launched a €5 billion 5G investment plan, enhancing wireless broadband capabilities across Europe.

- In September 2023, BT Group partnered with Nokia to upgrade its core infrastructure, ensuring compatibility with next-generation technologies.

- In November 2023, Vodafone initiated a green energy transition program, committing to reduce carbon emissions by 50% by 2025.

- In February 2024, Telecom Italia introduced affordable rural broadband plans, targeting underserved regions and boosting inclusivity.

MARKET SEGMENTATION

This Europe broadband market research report is segmented and sub-segmented into the following categories.

By Broadband Connection

- Fiber Optic

- Wireless

- Satellite

- Cable

- Digital Subscriber Line

By End Use

- Business

- Household

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. What are the key drivers of growth in the Europe broadband market?

Growth is driven by increasing demand for ultra-fast internet due to remote work, smart device proliferation, government initiatives like the EU’s Digital Decade, and expanding fiber-optic broadband coverage.

2. What challenges does the Europe broadband market face?

Major challenges include the high cost of deploying fiber infrastructure, especially in rural and difficult terrains, fragmented regulatory environments across countries, and uneven network development.

3. Which technologies and countries dominate the Europe broadband market?

Fiber-optic broadband leads the technology segment, with Germany and France accounting for the majority of fiber subscriptions, while Eastern European countries like Poland are rapidly expanding their broadband infrastructure.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com