Europe Bottled Water Market Size, Share, Trends & Growth Forecast Report By Product Type (Carbonated Bottled Water, Still Bottled Water, Flavored/Functional Bottled Water), Distribution Channel, and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2025 to 2033

Europe Bottled Water Market Size

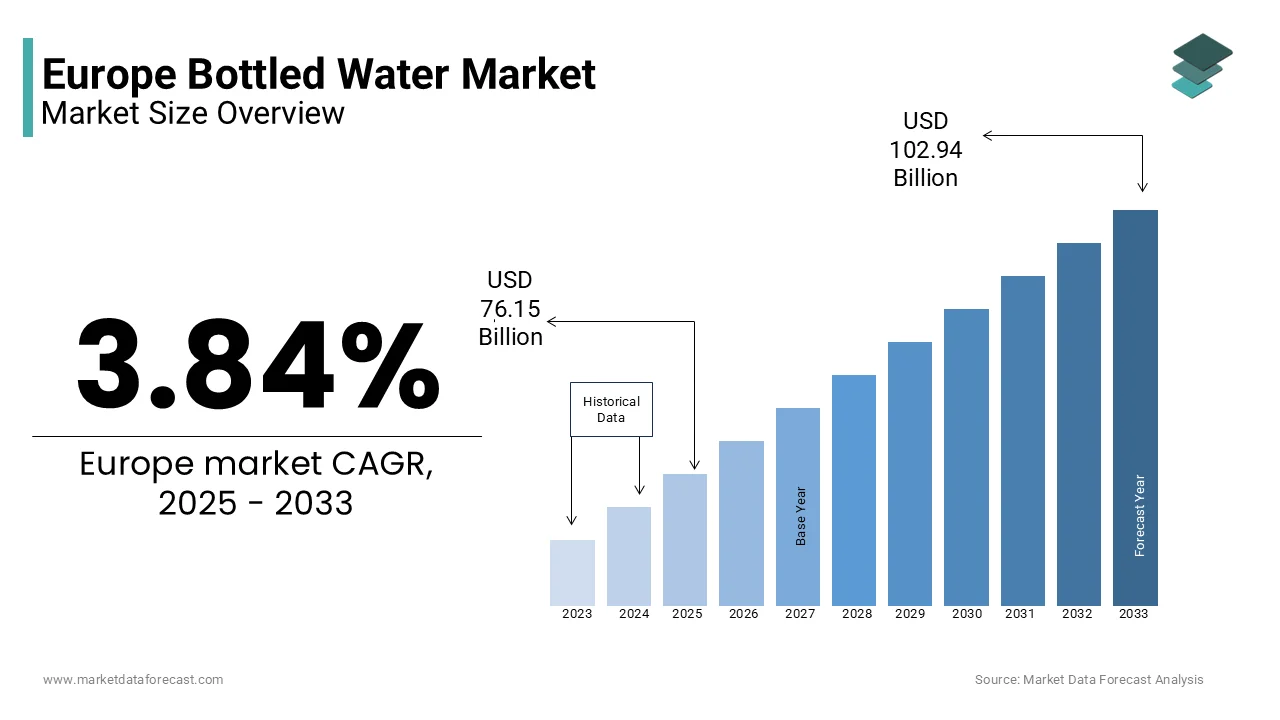

The Europe bottled water market size was valued at USD 73.33 billion in 2024. The European market is estimated to be worth USD 102.94 billion by 2033 from USD 76.15 billion in 2025, growing at a CAGR of 3.84% from 2025 to 2033.

The European bottled water market is undergoing a transformation beyond traditional growth drivers like health consciousness and premiumization. A notable shift is the increasing influence of local and artisanal brands that emphasize regional water sources and unique mineral compositions. Consumers are showing a growing preference for small-batch, naturally sourced waters that offer distinctive taste profiles and authenticity.

Additionally, technological innovations are reshaping the industry. Smart packaging, such as bottles embedded with QR codes, allows consumers to trace water origins, understand mineral compositions, and engage with brand sustainability efforts. This transparency builds trust and aligns with the demand for ethical consumerism. The European Commission reports that 72% of consumers consider a product’s sustainability credentials before purchasing, making such innovations essential.

Another emerging factor is the impact of regulatory changes. Stricter policies on single-use plastics and carbon emissions are pushing companies toward innovative packaging solutions, including biodegradable materials and reusable bottle models. The EU’s directive on reducing plastic waste aims to cut consumption of single-use plastics by 50% by 2030, encouraging refill stations and alternative packaging options.

E-commerce is also redefining the market landscape. Subscription-based bottled water services and direct-to-consumer platforms are gaining traction, catering to convenience-driven urban buyers. With Europe’s online grocery sales expected to surpass €100 billion by 2025, digital channels are becoming increasingly important for beverage brands.

MARKET DRIVERS

Growing Health Awareness

The surge in health and wellness consciousness is a key driver for Europe's bottled water market. Over 70% of Europeans, as per the World Health Organization, now opt for healthier beverages is steering clear of sugary drinks. Bottled water is seen as hydrating and pure and has become a top choice. For example, the British Soft Drinks Association notes a 15% rise in UK bottled water sales in 2023, outpacing carbonated drinks. This shift is bolstered by campaigns promoting hydration, such as France’s “Drink Water, Stay Healthy,” cited by the European Public Health Alliance. Nestlé Waters has tapped into this trend with mineral-rich variants targeting health-focused consumers.

Rising Urbanization and Convenience Culture

Urbanization and fast-paced lifestyles are fueling the market's growth across Europe. Eurostat highlights that over 75% of Europeans live in urban areas, where convenience reigns supreme. Bottled water, portable and easily accessible, aligns perfectly with urban demands. The Italian National Institute of Statistics reports that over 80% of Italians favor bottled water for commuting and outdoor activities. Retail innovations and e-commerce platforms have further enhanced accessibility, enabling consumers to purchase premium water products online with ease.

MARKET RESTRAINTS

Environmental Concerns and Plastic Waste

Environmental concerns tied to plastic waste significantly hinder the Europe bottled water market. The European Environment Agency estimates over 30 million tons of plastic waste annually, with single-use bottles being a major contributor. Public backlash against plastic pollution has spurred regulations like the EU Single-Use Plastics Directive, banning certain packaging types. For instance, France banned plastic water bottles under 1 liter in 2023, pushing firms toward alternatives like glass or biodegradable materials. According to the European Plastics Converters Association, adopting eco-friendly packaging raises costs by up to 25%, impacting affordability for smaller brands.

High Production Costs

Elevated production costs, especially for premium and functional water, act as a restraint. The Beverage Marketing Corporation reports a 12% rise in mineral water sourcing and bottling costs in 2023 due to rising energy and transportation expenses. Remote regions face heightened logistical burdens; Swiss alpine water producers, for example, encounter high freight costs, as noted by the Swiss Federal Office for Agriculture. Fluctuating raw material prices for packaging further strain finances are hindering expansion for small-scale operators competing with established brands.

MARKET OPPORTUNITIES

Expansion of Functional and Flavored Water

The rise of functional and flavored water offers a significant opportunity for Europe's bottled water market. Based on a reports, a 25% growth in functional water sales in 2023, driven by demand for health-enhancing beverages. Products fortified with vitamins, minerals, and antioxidants appeal to millennials and Gen Z. Coca-Cola launched vitamin-infused water in Germany, targeting fitness enthusiasts and health-conscious individuals. The European Food Safety Authority notes that over 60% of consumers are willing to pay more for beverages with added health benefits. Innovations in fruit-infused and herbal blends have broadened this segment's appeal.

Adoption of Sustainable Packaging Solutions

Sustainable packaging solutions present another promising opportunity, meeting consumer demand for eco-friendly products. The European Bioplastics Association projects notable growth in biodegradable and recyclable materials through 2030. Danone introduced bottles made from 100% recycled PET, reducing environmental impact while appealing to eco-conscious buyers. The Dutch Ministry of Infrastructure and Water Management reports that over 70% of Dutch consumers prefer brands using sustainable packaging. Government incentives for green initiatives encourage manufacturers to innovate, positioning this segment as a key growth driver.

MARKET CHALLENGES

Competition from Tap Water Initiatives

Competition from tap water initiatives poses a significant challenge for Europe's bottled water market. The European Commission shows that campaigns in countries like Sweden and Denmark promoting tap water as cost-effective and eco-friendly. Stockholm’s “Drink Tap Water” initiative reduced bottled water consumption by 10% in 2023, per the Swedish Environmental Protection Agency. These programs emphasize municipal water quality, challenging perceptions of bottled water superiority. Free refill stations in public spaces further reduce reliance on bottled water, creating hurdles in regions with robust tap water infrastructure.

Supply Chain Disruptions

Supply chain disruptions challenge the market, particularly for imported premium water products. The European Logistics Association states that transportation delays caused by geopolitical tensions and labor shortages in 2023. Italian producers faced difficulties exporting mineral water to Northern Europe, leading to stock shortages and price hikes. Rising energy costs inflate production and logistics expenses, shipping costs rose by 20% in 2023, per the European Transport Workers’ Federation. These disruptions destabilize the market, prompting companies to explore localized sourcing strategies.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

3.84% |

|

Segments Covered |

By Product Type, Distribution Channel, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, Rest of Europe |

|

Market Leaders Profiled |

Nestle Waters, PepsiCo Inc., Icelandic Water Holdings ehf, Groupe Danone, Mountain Valley Spring Company, LLC, The Coca-Cola Company, Sunny Delight Beverages Company, Hangzhou Wahaha Group Co., Ltd., Balance Water Company, and others. |

SEGMENTAL ANALYSIS

By Product Type Insights

The Still bottled water led the Europe bottled water market by holding a 55.3% share in 2024. Its dominance arises from its reputation as a pure and hydrating choice, especially in nations like Germany and Italy. The German Mineral Water Association notes that still water comprises over 70% of consumption in Germany, underscoring its cultural importance. Advances in purification technologies have elevated the segment’s appeal. The International Bottled Water Association shows that producers now use advanced filtration systems to ensure top-notch quality, attracting health-focused consumers. Government hydration campaigns have further fueled demand, reinforcing still water’s stronghold in the market.

The Flavored/functional bottled water is the rapidly rising segment, with an anticipated CAGR of 8.2% through 2033. Rising interest in health-enhancing beverages, particularly among younger demographics, propels this growth. A report reveal that over 60% of millennials favor flavored water over traditional options, spurring innovation. In 2023, PepsiCo launched antioxidant-infused water targeting fitness enthusiasts. The integration of natural flavoring and functional ingredients has accelerated adoption, establishing this segment as a pivotal growth driver.

By Distribution Channel Insights

The Off-trade distribution dominated the Europe bottled water market and captured 65.2% of the share in 2024. This due to the widespread availability of bottled water in supermarkets, hypermarkets, and convenience stores. The French Retail Federation reports that off-trade sales accounted for over 80% of revenue in France, reflecting consumer preference for retail purchases. The rise of private-label brands has amplified the segment’s appeal. The European Private Label Manufacturers Association highlights that retailers like Carrefour and Tesco offer affordable options, enhancing accessibility for budget-conscious buyers. These factors ensure the segment’s sustained dominance.

The On-trade distribution is the fastest-growing segment, with a projected CAGR of 7.5% in the coming years. Increased bottled water consumption in restaurants, cafes, and hotels fuels this growth. The Italian Hospitality Association notes that on-trade sales surged by 20% in 2023, driven by tourism and dining trends. Premium offerings have accelerated adoption; luxury hotels in Switzerland now serve alpine spring water, appealing to affluent patrons. These advancements position on-trade as a significant growth catalyst in the foreseeable future.

REGIONAL ANALYSIS

Germany stood as the largest contributor to the Europe bottled water market by commanding a market share of 24.1% in 2024. This dominance is fueled by the country’s strong preference for still and mineral water, reflecting its emphasis on purity and natural sourcing. For instance, over 80% of Germans consume bottled water daily, underscoring its cultural significance. A key factor propelling Germany’s growth is its robust regulatory framework. According to the German Federal Ministry of Food and Agriculture, stringent quality standards ensure the safety and reliability of bottled water products are boosting consumer trust. These dynamics position Germany as a leader in the regional market.

Italy is emerging as a rapidly growing market within the European bottled water industry. The country’s growth is driven by its thriving mineral water industry, with brands like San Pellegrino and Acqua Panna gaining international recognition. For example, Italian exports of premium bottled water grew by 10% in 2023, reflecting global demand. Another contributing factor is the cultural importance of water purity. As per the Italian Ministry of Health, over 90% of Italians perceive bottled water as safer than tap water, driving domestic consumption. These trends highlight Italy’s pivotal role in shaping the European market.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Key players in the Europe Bottled Water Market are Nestle Waters, PepsiCo Inc., Icelandic Water Holdings ehf, Groupe Danone, Mountain Valley Spring Company, LLC, The Coca-Cola Company, Sunny Delight Beverages Company, Hangzhou Wahaha Group Co., Ltd., And Balance Water Company.

The Europe bottled water market is marked by intense competition, with established giants and emerging players vying for supremacy. According to the European Federation of Bottled Waters, the top five companies account for over 60% of total sales, reflecting the market’s oligopolistic structure. Nestlé Waters, Danone, and Coca-Cola European Partners dominate the landscape, leveraging their technological expertise and extensive distribution networks.

Smaller players, however, are gaining traction through niche offerings, such as organic and artisanal water products. The rise of e-commerce platforms has leveled the playing field, enabling smaller brands to reach wider audiences. Price wars and promotional campaigns are common, particularly in the premium segment. Despite these challenges, innovation remains a key differentiator, with companies continuously introducing advanced solutions to meet evolving consumer demands.

TOP PLAYERS IN THE EUROPE BOTTLED WATER MARKET

Nestlé Waters

Nestlé Waters maintains a strong presence in the European bottled water market, offering a diverse range of well-known brands. The company’s focus on premium and functional water products aligns with shifting consumer preferences toward healthier hydration options. Its sustainability initiatives, including the use of eco-friendly packaging and responsible water sourcing, reinforce its market leadership. By continuously innovating and expanding its product offerings, Nestlé Waters remains a preferred choice for both everyday consumers and premium buyers seeking high-quality bottled water.

Danone

Danone stands out in the industry with its expertise in mineral and functional water, catering to consumers who prioritize purity and health benefits. The company's portfolio includes well-regarded brands recognized for their commitment to quality and natural sourcing. Danone’s efforts in sustainable packaging and environmental stewardship strengthen its position, appealing to eco-conscious customers. By consistently enhancing its product range and responding to evolving market demands, the company continues to be a key player in the European bottled water sector.

Coca-Cola European Partners

Coca-Cola European Partners secures a strong foothold in the market by leveraging its extensive distribution network and established brand reputation. The company’s bottled water offerings include a mix of traditional, flavoured, and functional varieties, catering to diverse consumer tastes. With a focus on health-oriented innovations, it adapts to changing preferences by introducing products that emphasize hydration and wellness. Its strategic approach to branding and product expansion helps maintain its competitive position in an evolving marketplace.

TOP STRATEGIES USED BY KEY MARKET PLAYERS

Sustainability Initiatives

Leading bottled water companies in Europe focus on sustainability as a core strategy to strengthen their market presence. By integrating environmentally friendly packaging solutions and promoting responsible water sourcing, they align with growing consumer concerns about ecological impact. Many brands are investing in advanced recycling technologies and reducing plastic waste to enhance their reputation and meet regulatory standards. These efforts not only improve brand perception but also attract environmentally conscious consumers, reinforcing their market position in an increasingly sustainability-driven industry.

Product Diversification

To cater to evolving consumer preferences, key players in the bottled water industry continually expand their product portfolios. By introducing a variety of options, including flavored, functional, and mineral-enriched waters, they appeal to a broader audience. This diversification allows companies to meet the demands of health-conscious individuals, athletes, and premium buyers looking for specific benefits. Offering a wider selection enhances customer loyalty and enables brands to differentiate themselves in a competitive marketplace.

Brand Positioning and Premiumization

Establishing a strong brand identity is crucial for success in the European bottled water market. Companies invest in premiumization strategies, emphasizing product quality, natural sources, and purity to position themselves as leaders in the segment. Luxury packaging, exclusive branding, and strategic endorsements help create a perception of high value. By targeting niche consumer groups willing to pay more for superior products, companies solidify their presence and maintain a competitive edge.

RECENT HAPPENINGS IN THE MARKET

- In February 2024, Nestlé Waters launched a line of biodegradable bottles. This initiative aimed to reduce plastic waste and appeal to eco-conscious consumers.

- In April 2024, Danone partnered with a European recycling firm. This collaboration aimed to enhance its sustainability efforts and achieve carbon neutrality by 2025.

- In June 2024, Coca-Cola European Partners acquired a regional water brand in Italy. This acquisition was intended to expand its portfolio of premium products.

- In August 2024, San Pellegrino introduced a new line of mineral water infused with herbal extracts. This innovation aimed to cater to health-conscious consumers seeking unique flavors.

- In October 2024, Evian unveiled a reusable aluminum bottle. This initiative aimed to align with environmental regulations and reduce single-use plastic consumption.

MARKET SEGMENTATION

This research report on the Europe bottled water market is segmented and sub-segmented into the following categories.

By Product Type

- Carbonated Bottled Water

- Still Bottled Water

- Flavored/Functional Bottled Water

By Distribution Channel

- On-trade

- Off-trade

- Supermarkets/ Hypermarkets

- Convenience Stores

- Online Retail Stores

- Others Distribution Channels

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1.What are the key factors driving the demand for bottled water in Europe?

Understanding the drivers behind the demand helps stakeholders identify market opportunities and develop effective marketing strategies. Factors may include health and wellness trends, concerns about tap water quality, convenience, and lifestyle choices.

2.What are the different types of bottled water available in the European market?

Bottled water comes in various forms, including still water, sparkling water, flavored water, mineral water, and functional water. Knowing the preferences of consumers and trends in consumption helps businesses tailor their product offerings.

3.What are the popular packaging formats for bottled water in Europe?

Packaging formats play a crucial role in consumer preferences and convenience. Common formats include PET bottles, glass bottles, cartons, and pouches. Understanding packaging trends helps companies optimize their product offerings.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com