Europe Blood and Blood Components Market Size, Share, Trends & Growth Forecast Report By Product (Whole Blood, Blood Components), Application, End User and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe), Industry Analysis From 2025 to 2033

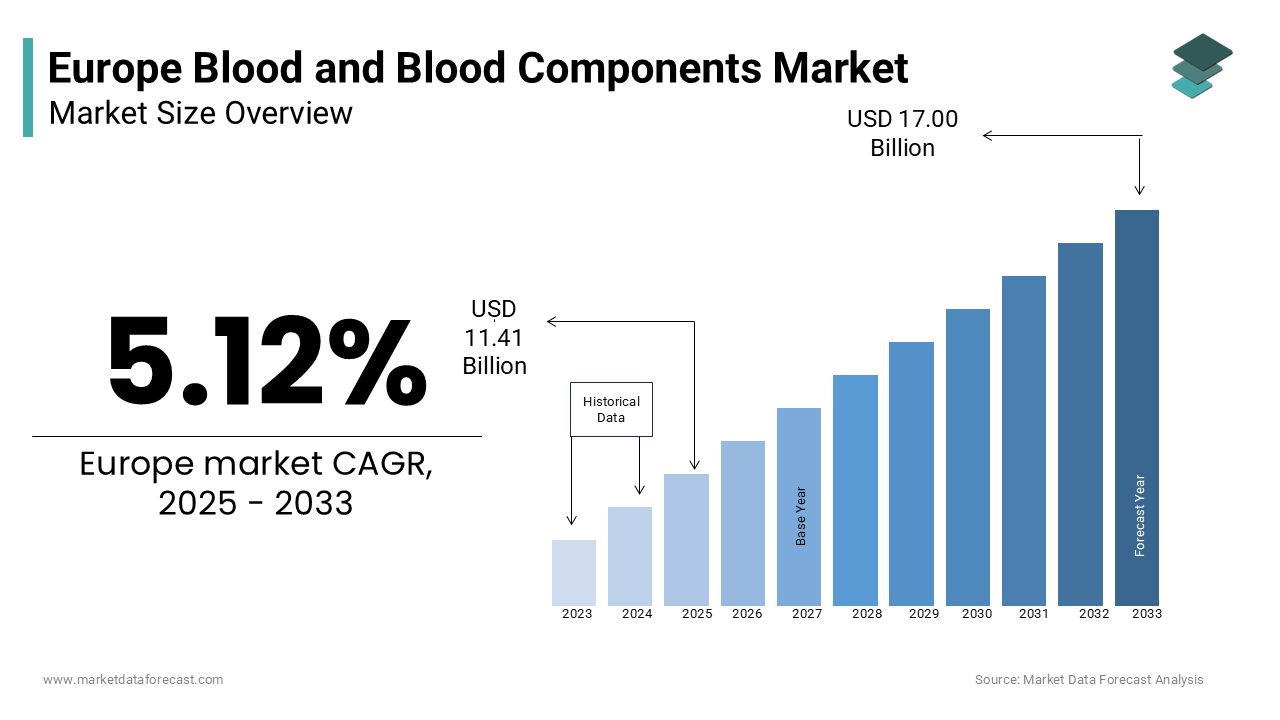

Europe Blood and Blood Components Market Size

The europe blood and blood components market was worth USD 10.85 billion in 2024. The European market is estimated to grow at a CAGR of 5.12% from 2025 to 2033 and be valued at USD 17.00 billion by the end of 2033 from USD 11.41 billion in 2025.

Blood and blood components include whole blood, red blood cells, platelets, plasma, and white blood cells that each serving distinct medical applications ranging from trauma care to chronic disease management. According to the World Health Organization, approximately 118 million blood donations are collected globally annually, with Europe contributing significantly due to its robust healthcare infrastructure and stringent regulatory frameworks ensuring the safety and quality of blood products. The growing aging population of Europe and rising prevalence of chronic diseases such as cancer and anemia further underscore the importance of this market. For instance, according to the estimations of Eurostat, over 20% of the European population will be aged 65 or older by 2030, which is driving demand for blood components in geriatric care. Additionally, advancements in biotechnology and personalized medicine have expanded the scope of blood-derived therapies that is fostering innovation and growth.

MARKET DRIVERS

Increasing Prevalence of Chronic Diseases in Europe

The escalating burden of chronic diseases across Europe is one of the factors propelling the European blood and blood components market growth. According to the European Commission, chronic conditions such as cancer, cardiovascular diseases, and hemophilia account for nearly 77% of all deaths in the region that is necessitating frequent blood transfusions and specialized treatments. For instance, as per the International Agency for Research on Cancer reports, Europe accounts for 23.4% of global cancer cases, with an estimated 4.4 million new cases diagnosed annually. This high incidence rate directly correlates with the demand for blood components like red blood cells and platelets, which are essential for chemotherapy and surgical interventions. Furthermore, the rise in hematological disorders, including sickle cell anemia and thalassemia, has intensified the need for regular blood transfusions. As per a study by the European Hematology Association, over 200,000 individuals in Europe require ongoing blood-derived therapies, which is underscoring the critical role of this market in managing chronic illnesses. The convergence of an aging population and lifestyle-related risk factors amplifies the demand, making chronic disease management a cornerstone of market growth.

Advancements in Biotechnology and Personalized Medicine

Technological innovations in biotechnology and personalized medicine have revolutionized the utilization of blood components, which is another major factor propelling the European market expansion. According to the European Federation of Pharmaceutical Industries and Associations, investments in regenerative medicine and gene therapies have surged by 30% over the past decade, with blood-derived products playing a central role. For instance, Plasma is increasingly utilized in the development of immunoglobulins and clotting factors, which are integral to treating rare genetic disorders. The European Medicines Agency notes that plasma-derived therapies currently address over 150 medical conditions, with annual sales exceeding €10 billion. Moreover, advancements in stem cell research have unlocked new applications for white blood cells in immune system modulation and cancer treatment. A report by the European Biotech Research Institute emphasizes that personalized medicine, tailored to individual genetic profiles, relies heavily on precise blood component formulations, further boosting demand. These technological strides not only enhance therapeutic outcomes but also create lucrative opportunities for market stakeholders, solidifying biotechnological progress as a key driver of growth.

MARKET RESTRAINTS

Stringent Regulatory Frameworks

Stringent regulatory requirements governing blood safety and quality are one of the major restraints for the European blood and blood components market growth. According to the European Directorate for the Quality of Medicines & HealthCare, compliance with Good Manufacturing Practices (GMP) and the European Pharmacopoeia standards imposes substantial operational burdens on manufacturers and suppliers. These regulations mandate rigorous testing protocols, traceability systems, and adherence to ethical sourcing practices, which often result in increased production costs and logistical complexities. For example, the European Blood Alliance reports that non-compliance with these standards can lead to product recalls, financial penalties, and reputational damage, discouraging smaller players from entering the market. Additionally, the fragmented nature of regulatory policies across member states creates inconsistencies in approval processes, delaying market entry for innovative therapies. The European Commission estimates that regulatory compliance accounts for up to 25% of total operational expenses for blood banks and processing facilities. Such barriers not only hinder market expansion but also exacerbate existing supply chain bottlenecks, posing a significant restraint to the European market growth.

Shortage of Blood Donors

A persistent shortage of voluntary blood donors remains a major impediment to the European blood and blood components market. According to the European Blood Alliance, despite widespread awareness campaigns, donor participation rates have stagnated, with only 2.5% of the eligible population actively donating blood annually. This shortfall is particularly pronounced in rural areas, where limited accessibility to donation centers and misconceptions about the process deter potential donors. According to the World Health Organization, seasonal fluctuations, such as holidays and pandemics, further exacerbate supply shortages, leading to critical gaps during peak demand periods. For instance, the COVID-19 pandemic caused a 30% decline in blood collections across Europe, severely impacting hospitals and emergency services. Furthermore, demographic shifts, including urbanization and declining birth rates, have reduced the pool of younger donors, who are essential for sustaining long-term supply levels. The European Commission underscores that addressing this issue requires sustained investment in donor recruitment strategies and infrastructure development, yet such initiatives face funding constraints amidst competing healthcare priorities. This chronic shortage poses a formidable challenge to meeting the continent's growing transfusion needs.

MARKET OPPORTUNITIES

Emerging Applications in Regenerative Medicine

The burgeoning field of regenerative medicine is a major opportunity for the European blood and blood components market. According to the European Society for Blood and Marrow Transplantation, regenerative therapies utilizing blood-derived products, such as platelet-rich plasma (PRP) and stem cells, are gaining traction for their efficacy in tissue repair and wound healing. PRP, for instance, is increasingly employed in orthopedics and dermatology. According to the European Medicines Agency, these therapies are being integrated into standard care protocols owing to their ability to accelerate recovery and reduce complications. Additionally, advancements in bioengineering have enabled the development of synthetic blood substitutes, which hold immense potential for addressing donor shortages and enhancing storage capabilities. As per a study by the European Biotech Research Institute, investments in regenerative medicine technologies have surpassed €5 billion, reflecting strong industry confidence. These innovations not only expand the therapeutic applications of blood components but also position Europe as a global leader in cutting-edge medical solutions, unlocking unprecedented growth avenues.

Expansion of Blood Banking Infrastructure

The strategic expansion of blood banking infrastructure across Europe offers a significant opportunity to enhance market resilience and accessibility. According to Eurostat, government initiatives to modernize blood collection and storage facilities have resulted in a 15% increase in operational capacity over the past five years. For example, Germany and France have invested over €500 million in state-of-the-art blood banks equipped with automated processing systems and cold chain logistics, ensuring the preservation of blood components' integrity. According to the European Blood Alliance, these advancements have reduced wastage rates by 20%, optimizing resource utilization and minimizing costs. Furthermore, partnerships between public and private entities have facilitated the establishment of mobile blood donation units, particularly in underserved regions, thereby broadening donor outreach. A report by the European Commission underscores that such infrastructural developments are crucial for meeting the rising demand driven by an aging population and increasing prevalence of chronic diseases. By bolstering supply chain efficiency and expanding geographical coverage, these initiatives not only address existing challenges but also lay the foundation for sustainable market growth.

MARKET CHALLENGES

Supply Chain Disruptions

Supply chain disruptions is a significant challenge to the European blood and blood components market, threatening the timely availability of critical products. According to the European Centre for Disease Prevention and Control, logistical inefficiencies, exacerbated by geopolitical tensions and natural disasters, have led to delays in the transportation and distribution of blood products. For instance, the ongoing conflict in Ukraine has disrupted cross-border supply routes, resulting in a 10% reduction in plasma imports to Eastern Europe. The European Blood Alliance notes that such disruptions disproportionately affect smaller countries with limited storage capacities, forcing them to rely on emergency reserves. Additionally, the perishable nature of blood components necessitates stringent temperature controls, which are often compromised during transit. A study by the European Logistics Association highlights that 5% of all blood shipments are rendered unusable due to improper handling, further straining already limited supplies. These vulnerabilities underscore the urgent need for resilient supply chain strategies, yet implementing such measures requires substantial investment and coordination among stakeholders, complicating efforts to mitigate risks.

Ethical and Cultural Barriers to Blood Donation

Ethical and cultural barriers continue to impede blood donation rates across Europe, creating a persistent challenge for the blood and blood components market. According to the European Commission, misconceptions surrounding religious prohibitions and health risks deter potential donors, particularly in culturally diverse regions. For example, a survey conducted by the European Blood Alliance reveals that over 40% of non-donors cite fear of needles or adverse reactions as primary deterrents, while 20% express concerns about confidentiality and data misuse. Additionally, cultural stigmas associated with blood donation persist in certain communities, limiting participation despite widespread awareness campaigns. The World Health Organization emphasizes that these barriers are compounded by language gaps and insufficient outreach programs targeting immigrant populations, who represent a growing demographic in urban areas. Furthermore, ethical debates surrounding the commercialization of blood products have sparked public skepticism, hindering efforts to promote voluntary donations. Addressing these challenges requires tailored communication strategies and community engagement initiatives, yet resource constraints and societal resistance often undermine their effectiveness, perpetuating the cycle of donor shortages.

SEGMENTAL ANALYSIS

By Product Insights

The red blood cells segment held 45.9% of the of the European market share in 2024. The growth of the red blood cells segment is driven by their indispensable role in treating anemia, trauma, and surgical procedures, where oxygen delivery to tissues is paramount. According to Eurostat, over 20 million units of red blood cells are transfused annually in Europe, driven by the rising prevalence of chronic diseases and age-related conditions. As per the European Commission, the aging population, with over 20% expected to be above 65 by 2030, further amplifies demand, as elderly patients often require repeated transfusions. Additionally, advancements in storage technologies have extended the shelf life of red blood cells, reducing wastage and enhancing supply chain efficiency. The European Medicines Agency notes that innovations in leukoreduction techniques have improved the safety profile of red blood cell transfusions, mitigating risks of adverse reactions. These factors collectively reinforce the segment's dominance, underscoring its critical importance in ensuring patient outcomes and healthcare continuity.

The platelets segment is anticipated to expand at a promising CAGR of 8.2% over the forecast period due to their increasing application in cancer treatment and bleeding disorders, where they play a vital role in clot formation and wound healing. The European Hematology Association reports that the rising incidence of hematological malignancies, coupled with advancements in chemotherapy protocols, has escalated the demand for platelet transfusions. For instance, over 1.5 million platelet units are utilized annually in cancer care alone. Additionally, innovations in platelet storage and processing, such as cryopreservation, have enhanced their availability and usability, driving adoption rates. The European Commission underscores that investments in research and development have led to the introduction of pathogen-reduced platelets, addressing safety concerns and boosting market confidence. These dynamics position platelets as a pivotal growth driver, reflecting their expanding therapeutic utility and technological advancements.

By Application Insights

The anemia segment had 35.8% of the European market share in 2024. The prominence of anemia segment in the European market is attributed to the widespread prevalence of iron-deficiency anemia and chronic disease-related anemia, particularly among the aging population. According to Eurostat, over 10% of adults in Europe suffer from anemia, with women and the elderly being disproportionately affected. The European Commission highlights that the condition necessitates frequent red blood cell transfusions, driving demand for blood components. Additionally, the rising incidence of chronic kidney disease, which often leads to anemia, further amplifies the segment's significance. The European Medicines Agency notes that advancements in erythropoiesis-stimulating agents have complemented traditional transfusion therapies, improving patient outcomes and reducing hospital stays. These factors collectively underscore the segment's dominance, emphasizing its critical role in addressing a pervasive public health challenge.

The cancer treatment segment emerges as the fastest-growing application segment and is projected to grow at a CAGR of 9.5% over the forecast period owing to the increasing incidence of cancer across Europe, with an estimated 4.4 million new cases annually. The European Society for Medical Oncology reports that chemotherapy and radiation therapy often induce thrombocytopenia and anemia, necessitating platelet and red blood cell transfusions. For instance, over 1.5 million platelet units are utilized annually in oncology care alone. Additionally, advancements in personalized medicine and targeted therapies have expanded the scope of blood-derived treatments, enhancing their efficacy and adoption. The European Commission underscores that investments in cancer research have led to innovative blood-based biomarkers and diagnostics, further propelling market growth. These dynamics highlight the segment's rapid expansion, reflecting its pivotal role in modern oncology care.

By End-Use Insights

The hospitals segment dominated the market and captured 60.8% of the European market share in 2024. The leadership of hospital segment is rooted in the centralized nature of healthcare delivery, where hospitals serve as primary hubs for surgeries, trauma care, and chronic disease management. According to Eurostat, over 70% of all blood transfusions occur within hospital settings, driven by the rising volume of complex procedures and emergency interventions. According to the European Commission, advancements in hospital infrastructure, including specialized blood banks and transfusion services, have streamlined operations and enhanced patient safety. Additionally, the aging population and increasing prevalence of chronic conditions have amplified hospital admissions, further boosting demand for blood components. The European Medicines Agency notes that stringent quality control measures in hospitals ensure the safe and efficient use of blood products, reinforcing their dominance in the market. These factors collectively underscore the segment's critical importance in delivering comprehensive healthcare services.

The ambulatory surgical centers segment is predicted to progress at a CAGR of 7.8% over the forecast period owing to the rising preference for minimally invasive procedures, which require precise blood component support to manage perioperative risks. The European Commission reports that ambulatory centers perform over 30% of all surgical procedures in Europe, driven by their cost-effectiveness and reduced recovery times. Additionally, advancements in outpatient care models have expanded the scope of surgeries conducted in these facilities, increasing the demand for blood products like platelets and plasma. The European Medicines Agency underscores that innovations in point-of-care testing and blood management systems have enhanced the safety and efficiency of transfusions in ambulatory settings. These dynamics position ambulatory surgical centers as a key growth driver, reflecting their pivotal role in modernizing healthcare delivery.

REGIONAL ANALYSIS

Germany was the leading player in the European blood and blood components market and accounted for 22.5% of the European market share in 2024. The dominance of Germany in the European market is attributed to the country's advanced healthcare infrastructure and robust regulatory framework, which ensures the highest standards of blood safety and quality. According to Eurostat, Germany accounts for over 15% of all blood donations in Europe, supported by a well-established network of blood banks and donation centers. According to the German Medical Association, the aging population, with over 21% aged 65 or older, drives demand for blood transfusions in chronic disease management and surgical procedures. Additionally, the country's strong emphasis on research and development has fostered innovations in blood-derived therapies, further solidifying its market position. These factors collectively underscore Germany's leadership, reflecting its commitment to healthcare excellence and patient safety.

France held a substantial share of the European market in 2024. The prominent position of France in the European market is primarily due to the country's proactive approach to blood donation campaigns and investments in modern blood banking infrastructure. The French National Institute of Health reports that over 3 million blood donations are collected annually, ensuring a steady supply for domestic and regional needs. Additionally, France's universal healthcare system facilitates equitable access to blood products, particularly for underserved populations. The European Commission highlights that advancements in regenerative medicine and personalized therapies have positioned France as a hub for innovation, attracting significant investments. These dynamics reinforce France's leadership, emphasizing its role in advancing blood-related healthcare solutions.

The UK is anticipated to account for a notable share of the European blood and blood components market over the forecast period owing to the country's extensive donor base and cutting-edge research initiatives in hematology and transfusion medicine. According to the British Blood Transfusion Society, the UK collects over 2 million blood donations annually, supported by nationwide awareness campaigns and mobile donation units. The UK Department of Health underscores that the rising prevalence of chronic diseases, coupled with advancements in cancer treatment, has amplified demand for blood components. Additionally, the country's focus on sustainability and ethical sourcing aligns with global trends, enhancing its market reputation. These factors collectively highlight the UK's pivotal role in shaping the future of blood-related healthcare.

Italy is expected to register a healthy CAGR over the forecast period. The strategic investments of Italy in blood banking infrastructure and its strong tradition of voluntary blood donation are propelling the Italian market growth. According to the reports of the Italian Ministry of Health, over 1.8 million blood donations are collected annually, ensuring a reliable supply for both domestic and international needs. Additionally, Italy's expertise in plasma-derived therapies has positioned it as a leader in the development of immunoglobulins and clotting factors. The European Medicines Agency highlights that collaborations between public and private entities have accelerated innovation, driving market growth. These dynamics underscore Italy's significance, reflecting its contributions to advancing blood-related medical solutions.

Spain is projected to hold a noteworthy role in the European market over the forecast period owing to the country's robust regulatory framework and high donor participation rates, with over 1.5 million donations collected annually. The Spanish Society of Hematology emphasizes that Spain's aging population and increasing prevalence of chronic diseases have heightened demand for blood transfusions. Additionally, the country's focus on regenerative medicine and biotechnological advancements has expanded the therapeutic applications of blood components. The European Commission highlights that Spain's strategic initiatives to enhance blood safety and accessibility have strengthened its market position. These factors collectively reinforce Spain's importance, underscoring its role in addressing regional healthcare needs.

MARKET SEGMENTATION

This research report on the europe blood and blood components market is segmented and sub-segmented based on product, end-user and region.

By Product

- Whole Blood

- Blood Components

- Red Blood Cells

- Platelets

- Plasma

- White Blood Cells

By Application

- Anemia

- Trauma & Surgery

- Cancer Treatment

- Bleeding Disorders

By End-Users

- Hospitals

- Ambulatory Surgical Centers

- Other End-Users

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What is the future outlook for the Europe Blood and Blood Components Market?

The market is expected to grow steadily due to increasing healthcare needs, technological advancements in blood processing, and expanding demand for blood-related therapies and treatments.

What are the challenges in the Europe Blood and Blood Components Market?

Challenges include the risk of blood shortages, strict regulatory requirements, high costs of blood collection and processing, and ensuring the safety and quality of blood components.

What factors are driving the growth of the blood and blood components market in Europe?

Factors driving growth include the increasing demand for transfusions, a rising number of surgeries, advancements in blood processing technologies, and a higher incidence of medical conditions requiring blood products.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]