Europe Blast Chillers Market Size, Share, Trends & Growth Forecast Report By Product (Reach-in, Roll-in), Application, And Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest Of Europe), Industry Analysis From 2025 To 2033

Europe Blast Chillers Market Size

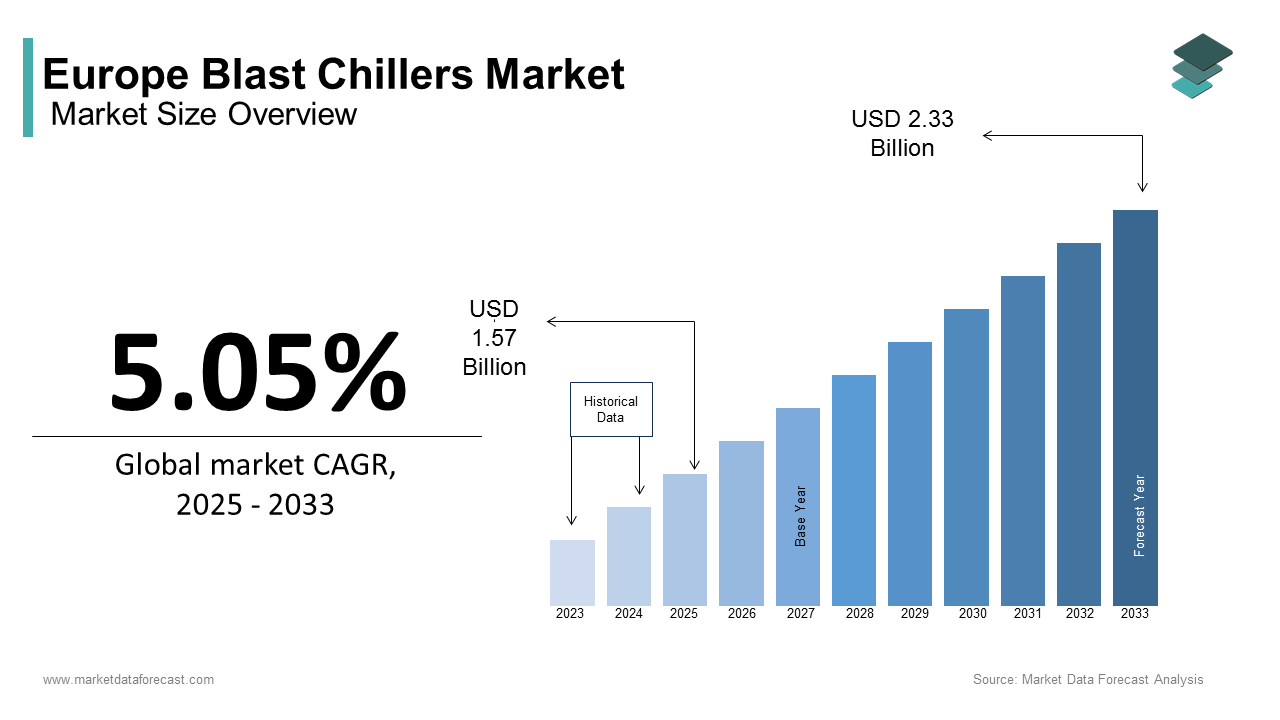

The European blast chillers market size was calculated to be USD 1.49 billion in 2024 and is anticipated to be worth USD 2.33 billion by 2033 from USD 1.57 billion In 2025, growing at a CAGR of 5.05% during the forecast period.

Blast chillers are advanced cooling systems that reduce the temperature of cooked food from +70°C to +3°C within 90 minutes, as mandated by food safety regulations such as those outlined by the European Food Safety Authority (EFSA). This rapid chilling process prevents bacterial growth, extends shelf life, and ensures compliance with stringent hygiene standards, making blast chillers indispensable in professional kitchens, catering services, and food processing units.

The demand for blast chillers is on the rise in Europe due to the growing emphasis on food safety, increasing consumer preference for ready-to-eat meals, and the expansion of the hospitality and foodservice sectors. According to the International Labour Organization, more than 40% of foodborne illnesses in Europe are linked to improper storage practices, which is indicating the importance of efficient chilling solutions. Furthermore, countries like Germany, France, and Italy lead the market due to their robust food processing industries and stringent regulatory frameworks. Innovations in energy-efficient models and smart technologies, such as IoT-enabled monitoring systems, are also propelling market growth. Despite challenges such as high initial costs and limited awareness among small-scale operators, the market remains resilient, supported by government initiatives promoting sustainable food practices. As Europe continues to prioritize food safety and sustainability, the blast chillers market is poised for significant transformation and expansion.

MARKET DRIVERS

Stringent Food Safety Regulations

One of the primary drivers of the Europe blast chillers market is the implementation of stringent food safety regulations, which mandate rapid cooling to prevent bacterial contamination. The European Food Safety Authority (EFSA) emphasizes that improper food storage practices contribute to over 40% of foodborne illnesses in the region. To address this, regulations require food to be cooled from +70°C to +3°C within 90 minutes, a standard achievable only through advanced blast chilling systems. According to Eurostat, compliance with these norms has increased the adoption of blast chillers by 15% annually in commercial kitchens and food processing units since 2020. Additionally, the International Labour Organization highlights that non-compliance can result in penalties of up to €50,000 per violation, further incentivizing businesses to invest in these systems. This regulatory push ensures food safety while driving significant market growth.

Rising Demand for Ready-to-Eat Meals

Another major driver is the growing consumer preference for ready-to-eat meals, fueled by busy lifestyles and urbanization trends across Europe. Eurostat reports that the consumption of convenience foods has surged by 25% over the past five years, with urban populations exceeding 75% in many European countries. This shift has created a pressing need for efficient chilling solutions to preserve food quality and extend shelf life. The European Environment Agency notes that blast chillers reduce food waste by 30%, aligning with sustainability goals under the EU Green Deal. Furthermore, the International Labour Organization highlights that the ready-to-eat meal market is projected to grow at a CAGR of 7.8% from 2023 to 2028, directly boosting demand for blast chillers. As manufacturers aim to meet consumer expectations for freshness and safety, blast chillers have become integral to the food production process.

MARKET RESTRAINTS

High Initial Investment Costs

One of the significant restraints in the Europe blast chillers market is the high initial investment required for purchasing and installing these systems, which limits adoption among small-scale food businesses. According to Eurostat, the average cost of a commercial-grade blast chiller ranges from €5,000 to €20,000, depending on capacity and features, making it unaffordable for many small enterprises. The European Commission’s Directorate-General for Industry reports that over 60% of small and medium-sized enterprises (SMEs) in the food sector cite financial constraints as a barrier to adopting advanced refrigeration technologies. Additionally, the International Labour Organization highlights that installation costs, including electrical upgrades and space modifications, can increase expenses by 20-30%, further deterring smaller operators. This financial burden slows market penetration, particularly in rural areas where budget limitations are more pronounced.

Limited Awareness Among End Users

Another key restraint is the limited awareness and understanding of the benefits of blast chillers among end users, particularly in less industrialized regions of Europe. The European Food Safety Authority (EFSA) notes that nearly 45% of foodservice operators in Eastern and Southern Europe lack adequate knowledge about modern chilling technologies and their role in food safety. This gap in awareness results in underutilization of blast chillers, despite their proven efficiency. The International Labour Organization reports that only 30% of restaurants and catering services in these regions have adopted blast chilling systems, compared to over 70% in Western Europe. Furthermore, insufficient training programs and marketing efforts by manufacturers exacerbate the issue. Without targeted education campaigns, the market struggles to achieve widespread adoption, hindering its overall growth potential.

MARKET OPPORTUNITIES

Growing Adoption of Energy-Efficient Models

A significant opportunity in the Europe blast chillers market lies in the increasing demand for energy-efficient models, driven by stringent environmental regulations and sustainability goals. The European Environment Agency highlights that energy-efficient appliances can reduce electricity consumption by up to 30%, aligning with the EU’s commitment to achieving carbon neutrality by 2050. According to Eurostat, the adoption of eco-friendly commercial refrigeration equipment has grown by 18% annually since 2020, with blast chillers being a key beneficiary of this trend. Government incentives, such as tax rebates and subsidies for energy-efficient technologies, further encourage businesses to invest. The International Labour Organization notes that companies adopting green technologies can save approximately 25% on operational costs, making energy-efficient blast chillers an attractive option. This shift not only supports environmental objectives but also opens new revenue streams for manufacturers focusing on sustainable innovation.

Expansion into Emerging Markets and SMEs

Another promising opportunity is the untapped potential in emerging markets and among small and medium-sized enterprises (SMEs) across Europe. Eurostat reports that over 90% of food businesses in Eastern and Southern Europe are SMEs, many of which still rely on traditional cooling methods. The European Commission’s Directorate-General for Industry estimates that providing affordable and compact blast chiller models could increase adoption rates by 40% in these regions. Additionally, government initiatives promoting food safety compliance offer financial support to SMEs, reducing their investment burden. The International Labour Organization highlights that improving access to training programs about modern chilling technologies can further boost adoption. By targeting underserved markets and tailoring solutions to meet SME needs, manufacturers can unlock significant growth opportunities while enhancing food safety standards across Europe.

MARKET CHALLENGES

High Maintenance and Operational Costs

One of the major challenges in the Europe blast chillers market is the high maintenance and operational costs associated with these systems, which can deter long-term adoption. The European Commission’s Directorate-General for Industry reports that annual maintenance costs for commercial blast chillers can range from 10% to 15% of the initial investment, including expenses for servicing, spare parts, and energy consumption. Eurostat highlights that energy usage accounts for approximately 40% of the total operational costs, making it a significant burden for small-scale operators. Additionally, the International Labour Organization notes that over 50% of businesses in the foodservice sector cite rising electricity prices as a barrier to sustained use of energy-intensive equipment like blast chillers. These financial pressures are particularly pronounced in regions with weaker economic infrastructure, limiting the scalability of the technology despite its benefits.

Complexity in Installation and Space Constraints

Another key challenge is the complexity of installation and space requirements for blast chillers, which can hinder their adoption, especially in urban areas. The European Environment Agency states that installing a blast chiller often requires dedicated electrical upgrades and ventilation systems, increasing setup costs by 20-30%. Furthermore, Eurostat reports that over 65% of commercial kitchens in densely populated cities face space constraints, making it difficult to accommodate large-scale chilling equipment. The International Labour Organization emphasizes that improper installation or insufficient space can lead to reduced efficiency, with some units operating at only 70% of their optimal performance. This challenge is further compounded by the lack of standardized guidelines for integrating blast chillers into existing kitchen layouts, creating logistical barriers for businesses aiming to adopt this advanced technology.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5.05% |

|

Segments Covered |

By Product, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, and Czech Republic |

|

Market Leaders Profiled |

Electrolux Group, Irinox S.p.A., Williams Refrigeration, Foster Refrigerator, Alto-Shaam Inc., Hoshizaki Corporation, Friginox, Infrico S.L. |

SEGMENTAL ANALYSIS

By Product Insights

The reach-in blast chiller segment dominated the market by holding 60.1% of the European market share in 2024. The affordability, compact design, and suitability of reach-in blast chillers for small to medium-sized food businesses that dominate foodservice sector in Europe is majorly driving the growth of the segment in the European market. According to the European Food Safety Authority, more than 75% of urban commercial kitchens prefer reach-in models due to space constraints and their ability to cool food safely within regulatory timeframes. With capacities ranging from below 50KG to 50-100KG, these chillers are ideal for restaurants and catering services. Their importance lies in addressing the needs of urbanized areas, where demand for efficient, cost-effective chilling solutions is rising, ensuring compliance with food safety standards while supporting small-scale operators.

The roll-in blast chiller segment is also a major segment and is anticipated to progress at a CAGR of 7.2% during the forecast period. The growing demand from large-scale food processors and industrial kitchens requiring high-capacity models (e.g., 100-200KG and above 200KG) to handle bulk production is propelling the growth of the roll-in blast chiller segment in the European market. According to the European Environment Agency, roll-in chillers reduce cooling times by 30% compared to traditional methods, enhancing efficiency and compliance with food safety norms. Additionally, government incentives for energy-efficient equipment have boosted adoption. With Europe’s food processing industry contributing over 20% to the EU’s GDP, this segment is critical for scaling operations, reducing food waste, and meeting the growing demand for processed and ready-to-eat meals.

By Application Insights

The hotels & restaurants segment was the largest segment by application in the Europe blast chillers market and held 40.7% of the European market share in 2024. The growing need for rapid chilling systems to comply with stringent EU food safety regulations that mandate cooling food from +70°C to +3°C within 90 minutes is contributing to the growth of the segment in the global market. According to the European Food Safety Authority, improper food storage contributes to over 70% of foodborne illness outbreaks, underscoring the importance of blast chillers. With urbanization driving the growth of restaurants and hotels, particularly in metropolitan areas, this segment ensures efficient handling of high-volume meal preparation while maintaining hygiene standards, making it indispensable for commercial kitchens.

The supermarkets segment is estimated to grow at a CAGR of 6.8% over the forecast period. The growth of the supermarkets segment in the global market is attributed to the rising consumer demand for ready-to-eat meals and pre-cooked foods, which require advanced chilling solutions to preserve freshness. According to the European Environment Agency, supermarkets using blast chillers can reduce food waste by 25% and align with the EU Green Deal’s sustainability goals. Additionally, government incentives for energy-efficient refrigeration systems have accelerated adoption. With the supermarket sector contributing over €1 trillion annually to Europe’s retail food sales, this segment plays a vital role in meeting consumer expectations for safe, fresh, and convenient food options while promoting environmental sustainability.

REGIONAL ANALYSIS

Germany held the major share of the Europe blast chillers market in 2024 and is anticipated to continue to hold the dominating position in the European market throughout the forecast period. The robust food processing industry of Germany is majorly contributing to the domination of Germany in the European market. The stringent food safety regulations of Germany that are enforced by the European Food Safety Authority are mandating rapid chilling systems, which is boosting adoption in commercial kitchens and industrial facilities. Additionally, government incentives for energy-efficient technologies have encouraged businesses to invest in advanced blast chillers. The presence of leading manufacturers and a strong emphasis on sustainability further solidify Germany’s position. With urbanization and the growing demand for ready-to-eat meals, Germany remains pivotal in driving innovation and growth within the blast chillers market.

France is another leading performer in the Europe blast chillers market and held a substantial share of the European market in 2024. The thriving hospitality sector of France and widespread use of blast chillers in restaurants, catering services, and bakeries are boosting the French market growth. As per Eurostat, France ranks among the top three European countries for foodservice revenue, with over €100 billion annually, driving demand for efficient chilling solutions. The International Labour Organization highlights that France’s focus on reducing food waste by 30% by 2030, as part of the EU Green Deal, has accelerated adoption. Government subsidies for eco-friendly equipment and innovations in compact models further support growth, making France a key player in the blast chillers market.

Italy holds a notable share of the European blast chillers market. The strong culinary culture, with blast chillers widely used in restaurants, pizzerias, and bakeries to preserve food quality is driving the Italian blast chillers market growth. The European Food Safety Authority emphasizes that Italy’s strict hygiene standards have increased the adoption of advanced chilling systems. Additionally, the country’s food processing industry, which contributes 10% to its GDP, supports demand for industrial-grade blast chillers. Government initiatives promoting sustainable practices and energy-efficient technologies have further boosted adoption. Italy’s blend of cultural preferences for fresh food and industrial advancements ensures its critical role in shaping the future of the blast chillers market.’

KEY MARKET PLAYERS

Major Players of the Europe blast chillers market include Electrolux Group, Irinox S.p.A., Williams Refrigeration, Foster Refrigerator, Alto-Shaam Inc., Hoshizaki Corporation, Friginox, Infrico S.L.

MARKET SEGMENTATION

This research report on the Europe blast chillers market has been segmented and sub-segmented based on product, application, and region.

By Product

- Reach-in

- By Capacity

- Below 50KG

- 50 - 100KG

- By Capacity

- Roll-in

- By Capacity

- Below 100KG

- 100 - 200KG

- Above 200KG

- By Capacity

By Application

- Hotel & restaurants

- Supermarkets

- Catering services

- Bakery & confectionery

- Others

By Region

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. Who are the primary end-users of blast chillers in Europe?

Restaurants, hotels, catering services, food processing industries, and healthcare institutions widely use blast chillers.

2. Which factors are driving the demand for blast chillers in Europe?

Stringent food safety regulations, increasing demand for frozen and ready-to-eat meals, and the growing foodservice sector are key drivers.

3. What are the latest trends in the European blast chillers market?

Trends include energy-efficient models, IoT-enabled blast chillers for remote monitoring, and the adoption of eco-friendly refrigerants.

4. How is the European market for blast chillers expected to grow in the next five years?

The market is projected to grow due to increasing demand from commercial kitchens, advancements in refrigeration technology, and sustainability initiatives in food storage.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]