Europe Biomedical Refrigerators And Freezers Market Size, Share, Trends & Growth Forecast Report By Product (Plasma freezers, Blood bank refrigerators, Lab refrigerators, Lab freezers, Ultra-low temperature freezers, Shock freezers), End Use and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe), Industry Analysis From 2025 to 2033

Europe Biomedical Refrigerators And Freezers Market Size

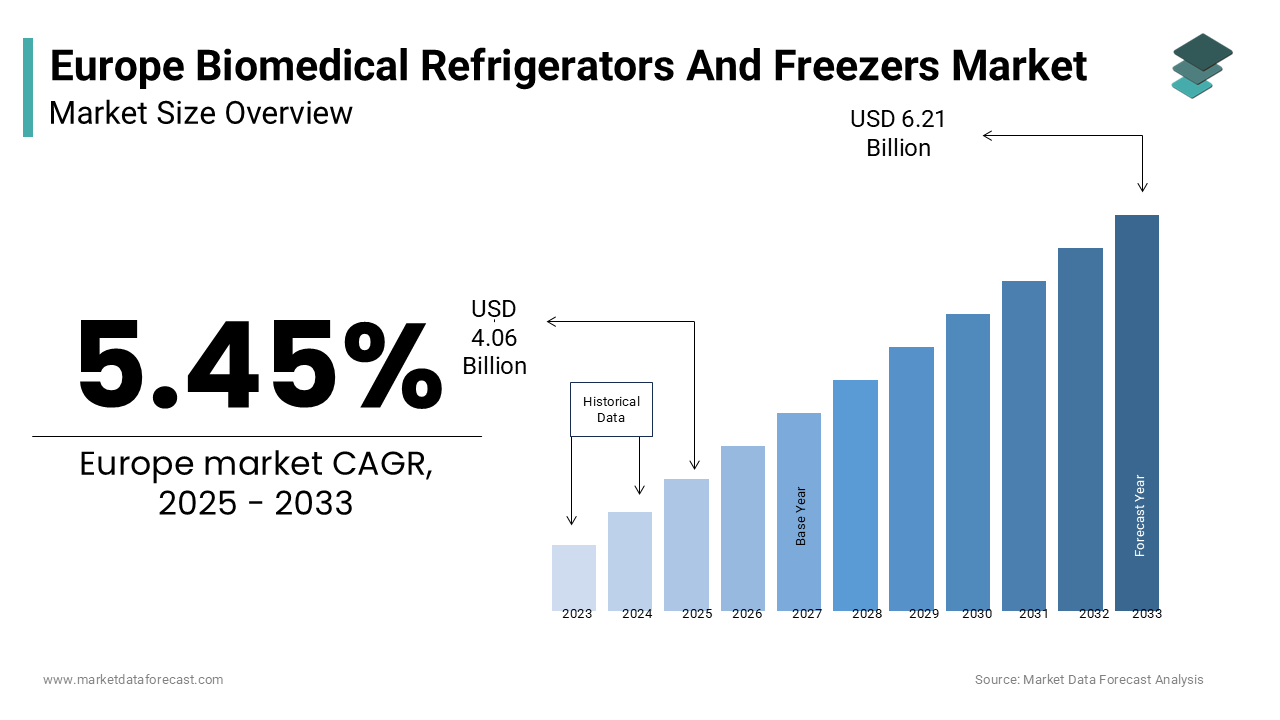

The European biomedical refrigerators and freezers market was worth USD 3.85 billion in 2024. The European market is estimated to grow at a CAGR of 5.45% from 2025 to 2033 and be valued at USD 6.21 billion by the end of 2033 from USD 4.06 billion in 2025.

The biomedical refrigerators and freezers have immense role within the healthcare and life sciences industries those are designed to store temperature-sensitive medical products such as vaccines, blood samples, pharmaceuticals, and biological specimens. These specialized units are engineered to maintain precise temperature ranges with the integrity and efficacy of stored materials. According to Eurostat, the demand for biomedical refrigeration solutions has surged due to the increasing prevalence of chronic diseases, advancements in biotechnology, and the growing emphasis on vaccine storage following the COVID-19 pandemic.

According to the European Medicines Agency (EMA), over 70% of vaccines and biologics require cold chain storage, with the importance of reliable refrigeration systems. Germany, France, and the UK lead the market, collectively accounting for over 55% of total sales with robust healthcare infrastructure and research activities. According to the European Commission, the adoption of energy-efficient and smart refrigeration technologies has grown by 12% annually since 2021 due to sustainability goals and the integration of IoT for real-time monitoring. The demand for advanced biomedical refrigerators and freezers is expected to rise further with Europe’s aging population and rising healthcare expenditure. This dynamic landscape positions the market as a cornerstone of modern healthcare by ensuring safe and effective storage solutions for critical medical applications.

MARKET DRIVERS

Increasing Demand for Vaccine Storage and Cold Chain Solutions

The growing demand for vaccine storage and cold chain solutions is a major driver of the European biomedical refrigerators and freezers market. According to the European Medicines Agency (EMA), over 70% of vaccines and biologics require precise temperature-controlled environments by making reliable refrigeration systems indispensable. Following the COVID-19 pandemic, Eurostat vaccine distribution efforts increased the adoption of biomedical refrigerators by 25% in 2021 alone with sustained demand for booster doses and routine immunizations. According to the World Health Organization (WHO), improper storage leads to over €1 billion in annual losses due to vaccine spoilage by prompting investments in advanced cold chain infrastructure. The need for specialized refrigeration solutions continues to grow by ensuring their critical role in safeguarding public health.

Advancements in Biotechnology and Pharmaceutical Research

The rapid advancements in biotechnology and pharmaceutical research are significantly propelling the demand for biomedical refrigerators and freezers. According to the European Commission, R&D spending in the life sciences sector grew by 10% annually since 2020 that was driven by innovations in gene therapy, personalized medicine, and biologics. According to the Germany’s Federal Ministry of Education and Research, over 60% of biotech companies rely on ultra-low temperature freezers to store sensitive samples like DNA, RNA, and enzymes. These advancements, coupled with stringent regulatory requirements for sample integrity to ensure that biomedical refrigeration remains pivotal in supporting cutting-edge research and development across the continent.

MARKET RESTRAINTS

Stringent Regulatory Standards

One major restraint in the Europe biomedical refrigerators and freezers market is stringent regulatory standards that increase compliance costs. The European Medicines Agency (EMA) enforces strict guidelines for temperature-controlled storage of pharmaceuticals, vaccines, and biological samples. According to a report by the European Commission, over 30% of manufacturers face challenges in meeting these regulations due to high investment in advanced cooling technologies. Non-compliance can lead to penalties or product recalls, which further strain businesses. For instance, the EU’s General Data Protection Regulation (GDPR) indirectly impacts this sector by mandating secure data handling for smart refrigeration systems. These regulatory hurdles often deter small and medium enterprises from entering the market by limiting competition and innovation. According to the European Commission, such barriers contribute to a 15% slower growth rate in the region compared to less regulated markets.

High Energy Consumption and Operational Costs

Another significant restraint is the high energy consumption associated with biomedical refrigerators and freezers, which raises operational costs. According to the International Energy Agency (IEA), medical cold chain equipment accounts for approximately 20% of total healthcare facility energy use in Europe. With rising electricity prices, as noted by Eurostat, where average industrial electricity costs increased by 12% in 2022 alone, hospitals and research labs face financial pressure. This issue is compounded by the need for uninterrupted power supply to avoid compromising sensitive materials. Although energy-efficient models exist, their adoption is slow due to higher upfront costs. According to the IEA, improving energy efficiency in this sector could reduce operating expenses by up to 30%, whereas budget constraints hinder widespread implementation across Europe.

MARKET OPPORTUNITIES

Increasing Demand for Vaccine Storage

A significant opportunity in the Europe biomedical refrigerators and freezers market is the growing demand for vaccine storage, driven by vaccination campaigns and pandemic preparedness. According to the European Centre for Disease Prevention and Control (ECDC), over 1.5 billion vaccine doses were administered across the EU during the COVID-19 pandemic by requiring robust cold chain infrastructure. This surge is due to the need for specialized refrigeration systems capable of maintaining ultra-low temperatures. The World Health Organization (WHO) also emphasizes the importance of investing in energy-efficient cold storage solutions to meet this demand sustainably. This trend presents manufacturers with an opportunity to innovate and cater to the expanding needs of healthcare facilities.

Expansion of Biobanking and Research Facilities

Another major opportunity lies in the expansion of biobanking and research facilities, which require advanced refrigeration systems for storing biological samples. According to the European Biobanking and BioMolecular Resources Research Infrastructure (BBMRI-ERIC), there are over 600 biobanks across Europe, with this number expected to grow by 15% over the next five years. These facilities rely heavily on precise temperature control to preserve the integrity of samples such as DNA, RNA, and tissues. According to the Eurostat, R&D expenditure in the EU reached €418 billion in 2022 by reflecting increased investment in life sciences and medical research. This growth drives demand for high-performance biomedical freezers. According to the European Commission, advancements in personalized medicine and genomics will amplify the need for reliable cold storage solutions by creating a lucrative market for manufacturers specializing in cutting-edge refrigeration technologies.

MARKET CHALLENGES

High Initial Investment Costs

A significant challenge in the Europe biomedical refrigerators and freezers market is the high initial investment required for advanced equipment, which limits accessibility for smaller healthcare facilities. According to Eurostat, the average cost of a medical-grade refrigerator can range from €5,000 to €20,000, depending on its specifications and capacity. For ultra-low temperature freezers, prices can exceed €30,000 by creating financial barriers for small clinics and research labs. According to the European Investment Bank (EIB), nearly 40% of healthcare institutions in Europe face budget constraints that hinder their ability to upgrade or replace outdated equipment. This issue is further compounded by the need for regular maintenance and calibration to ensure compliance with regulatory standards. The EIB emphasizes that limited access to affordable financing options exacerbates this challenge, particularly in Eastern and Southern Europe, where healthcare infrastructure funding remains insufficient.

Environmental Concerns and Sustainability Pressures

The environmental impact of biomedical refrigerators and freezers, which are under scrutiny due to their high energy consumption and refrigerant use is also declining the growth rate of the Europe biomedical refrigerators and freezers market. According to the European Environment Agency (EEA), refrigerants like hydrofluorocarbons (HFCs), commonly used in these systems that contribute significantly to greenhouse gas emissions. Under the EU F-Gas Regulation, there is a mandate to phase down HFC usage by 79% between 2015 and 2030 with manufacturers to adopt eco-friendly alternatives. However, transitioning to low-global-warming-potential (GWP) refrigerants often increases production costs. The EEA also notes that only 25% of biomedical refrigeration systems currently meet the EU’s stringent energy efficiency standards. This regulatory push for sustainability creates challenges for manufacturers and end-users alike, as they must balance environmental compliance with operational affordability while upgrading existing equipment.

SEGMENTAL ANALYSIS

By Product Insights

The ultra-low temperature freezers segment dominated the Europe biomedical refrigerators and freezers market with 35.1% of share in 2024. The increasing prominence to store mRNA vaccines, cell therapies, and biologics is escalating the growth of the market. According to the European Centre for Disease Prevention and Control (ECDC), over 70% of advanced therapies require -80°C storage. As per ECDC, vaccine wastage rates drop by 40% with reliable ultra-low freezers. Their importance is further propelled by the €15 billion global biobanking industry, as reported by BBMRI-ERIC.

The plasma freezers segment is expected to witness a fastest CAGR of 9.5% during the forecast period from 2025 to 2033. This growth is driven by rising demand for plasma-derived therapies, with the European Blood Alliance reporting a 10% annual increase in plasma usage across Europe. Plasma freezers maintain temperatures between -30°C and -40°C by ensuring the viability of blood products. According to the European Medicines Agency, plasma therapies treat over 120 medical conditions, including hemophilia and immune disorders. Additionally, government initiatives to expand blood banking infrastructure, coupled with advancements in energy-efficient designs are propelling this segment’s rapid expansion by making it pivotal for healthcare modernization.

By End-use Insights

The hospitals segment was the largest by occupying 40.2% of the Europe biomedical refrigerators and freezers market share in 2024 with the growing requirement for diverse refrigeration solutions like blood bank refrigerators, lab freezers, and ultra-low temperature units. According to the European Centre for Disease Prevention and Control (ECDC), hospitals handle over 80% of all blood transfusions and vaccine storage in Europe with their reliance on precise cold chain systems. As per Eurostat, energy costs for hospital refrigeration exceed €10,000 annually per facility by reflecting the scale of investment. Hospitals' dominance is driven by their critical role in patient care by making them indispensable to the biomedical refrigeration ecosystem.

The research labs segment is predicted to exhibit a fastest CAGR of 9.2% from 2025 to 2033. This growth is fueled by Europe's prominence in pharmaceutical R&D by accounting for 25% of global spending, according to the European Federation of Pharmaceutical Industries and Associations (EFPIA). Research labs require advanced refrigeration for storing biological samples, reagents, and experimental materials, with investments in equipment reaching €20,000–€50,000 annually per lab. The advancements in genomics and personalized medicine are driving demand for ultra-low freezers. The EU investing €120 billion annually in research that is augmented to fuel the importance in supporting innovation and scientific breakthroughs across Europe.

REGIONAL ANALYSIS

Germany

Germany led the Europe biomedical refrigerators and freezers market with a 25.4% of share in 2024 owing to a robust healthcare infrastructure and strong pharmaceutical industry, which accounts for 30% of Europe’s total pharmaceutical revenue, as reported by the European Federation of Pharmaceutical Industries and Associations (EFPIA). Germany’s market growth is further supported by stringent regulatory standards enforced by the Federal Ministry of Health by ensuring high adoption of advanced refrigeration systems. The German government’s focus on innovation is evident in its €15 billion annual investment in medical research, as per the European Commission. Additionally, the country’s emphasis on energy-efficient technologies aligns with EU sustainability goals, making it a hub for cutting-edge biomedical refrigeration solutions.

France

France biomedical refrigerators and freezers market is likely to hold a CAGR of 7.2% during the forecast period. The presence of world-class biotechnology sector, which contributes €70 billion annually to the economy, according to the French Ministry of Higher Education, Research, and Innovation is ascribed to bolster the growth of the market in this country. France’s extensive network of research labs and diagnostic centers drives demand for specialized refrigeration systems. According to the European Centre for Disease Prevention and Control (ECDC), France administers over 120 million vaccine doses annually by necessitating reliable cold chain infrastructure. Furthermore, government initiatives like the "France 2030" plan, which allocates €54 billion to healthcare innovation bolsters the growth of the market. France’s commitment to sustainability and healthcare modernization is also to elevate the biomedical refrigerators and freezers market growth.

UK

The UK biomedical refrigerators and freezers market growth is fueled by its prominence in life sciences research, with the UK government investing £1.5 billion annually in R&D, according to the Department for Business, Energy & Industrial Strategy. The UK Biobank is one of the largest biorepositories globally, relies heavily on ultra-low temperature freezers with the demand for advanced refrigeration. According to the European Medicines Agency (EMA), the UK accounts for 20% of clinical trials conducted in Europe with increasing need for precise storage solutions. Additionally, post-Brexit trade regulations have encouraged domestic manufacturing of biomedical equipment, further boosting market growth and innovation in this segment.

SEGMENTAL ANALYSIS

This research report on the Europe biomedical refrigerators and freezers market is segmented and sub-segmented based on product, end-user and region.

By Product

- Plasma freezers

- Blood bank refrigerators

- Lab refrigerators

- Lab freezers

- Ultra-low temperature freezers

- Shock freezers

By End-use

- Blood banks

- Pharmacies

- Hospitals

- Research labs

- Diagnostic centers

- Other end-users

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

Which countries dominate the Europe Biomedical Refrigerators and Freezers Market?

Germany, France, and the UK are the dominant countries in the market. Italy and Spain also show increasing demand.

What challenges does the europe biomedical refrigerators and freezers market face?

The market faces challenges such as high costs, energy consumption, and the need to meet strict regulatory requirements.

What drives the growth of the Europe Biomedical Refrigerators and Freezers Market?

Growth is driven by the increasing healthcare industry, rising biotechnological research, and advancements in refrigeration technology.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]