Europe Biomass Gasification Market Size, Share, Trends, & Growth Forecast Report By Source (Solid Biomass, Biogas, Municipal Waste, and Liquid Biomass), Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2024 to 2033

Europe Biomass Gasification Market Size

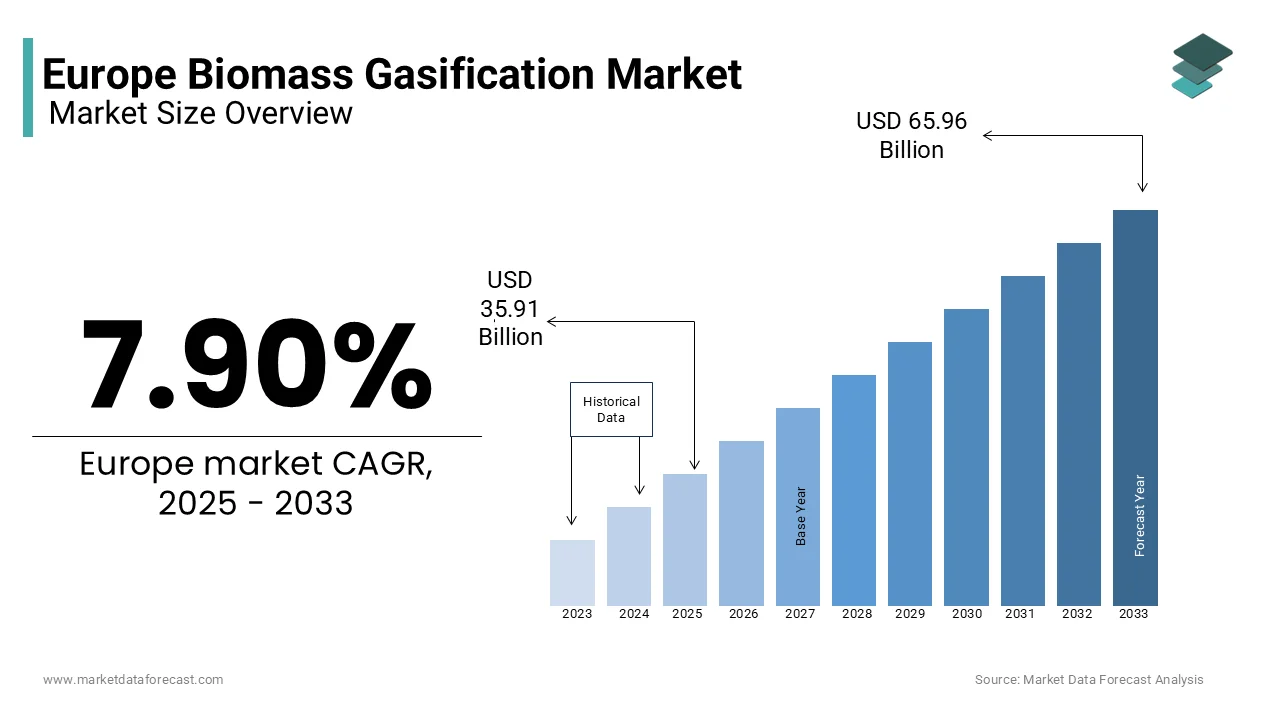

The Europe biomass gasification market was worth USD 33.28 billion in 2024. The European market is estimated to reach USD 65.96 billion by 2033 from USD 35.91 billion in 2025, growing at a CAGR of 7.90% from 2025 to 2033.

Biomass gasification involves heating organic feedstock in a controlled environment with limited oxygen, producing hydrogen, carbon monoxide, and methane. Biomass gasification technology is pivotal in addressing ambitious climate goals of Europe under frameworks such as the European Green Deal, which aims for carbon neutrality by 2050. According to Eurostat, renewable energy accounted for 22.1% of the EU’s gross final energy consumption in 2021, with biomass contributing significantly to this share. The market's prominence stems from its dual role in waste management and energy generation, utilizing feedstocks like agricultural residues, forestry waste, and municipal solid waste. As per the International Energy Agency (IEA), bioenergy remains the largest renewable energy source in Europe, providing approximately 60% of renewable heat and 12% of electricity in 2020. The integration of biomass gasification into district heating systems and industrial processes underscores its strategic importance. Furthermore, as per the European Commission, sustainable bioenergy solutions are critical to reducing reliance on fossil fuels while fostering rural economic development. With increasing investments in research and innovation, the biomass gasification sector is poised to expand its footprint across Europe.

MARKET DRIVERS

Stringent Climate Policies and Decarbonization Goals

Stringent climate policies and decarbonization goals have emerged as one of the most significant drivers propelling the Europe biomass gasification market forward. According to the European Environment Agency, the EU has committed to reducing greenhouse gas emissions by at least 55% by 2030 compared to 1990 levels, as part of the European Climate Law. This legislative framework has created a favorable environment for renewable energy technologies, including biomass gasification, which offers a low-carbon alternative to fossil fuels. In 2020, the European Commission reported that bioenergy contributed to a 10% reduction in CO2 emissions from energy production. The versatility of biomass gasification in generating heat, electricity, and biofuels aligns seamlessly with these targets. For instance, Germany, a leader in renewable energy adoption, generated over 8% of its total energy mix from bioenergy in 2021, according to the Federal Ministry for Economic Affairs and Climate Action. Additionally, the Renewable Energy Directive (RED II) mandates member states to increase their share of renewables, further incentivizing investments in biomass gasification projects. These regulatory measures not only drive demand but also encourage technological innovation, making biomass gasification a cornerstone of Europe's transition to a sustainable energy future.

Abundance of Feedstock Availability

The abundance of feedstock availability serves is another notable factor boosting the growth of the Europe biomass gasification market. According to the Food and Agriculture Organization (FAO), Europe produces over 700 million metric tons of agricultural residues annually, which is offering a vast resource base for biomass gasification. These residues, along with forestry waste and municipal solid waste, provide a consistent and renewable supply of raw materials. For example, Sweden utilizes approximately 4 million cubic meters of forest residues annually for bioenergy production, as per the Swedish Forest Agency. Moreover, the European Biogas Association estimates that biogas production alone could reach 50 billion cubic meters by 2030, driven by the availability of organic waste streams. The circular economy model adopted by several EU countries further enhances feedstock utilization by integrating waste-to-energy initiatives. For instance, Denmark diverts nearly 80% of its municipal waste from landfills, channeling it into energy recovery systems, according to the Danish Environmental Protection Agency. This abundant and diverse feedstock base not only ensures cost-effective operations but also strengthens the resilience of the biomass gasification market, positioning it as a key player in Europe's renewable energy portfolio.

MARKET RESTRAINTS

High Capital Investment Requirements

High capital investment requirements are a significant barrier to the widespread adoption of biomass gasification technologies across Europe. According to the International Renewable Energy Agency (IRENA), the initial costs of setting up a biomass gasification plant can range from €2,000 to €5,000 per kilowatt of installed capacity, depending on the scale and complexity of the project. This financial burden often deters small and medium-sized enterprises from entering the market, limiting the overall growth potential. For instance, a report by the UK Department for Business, Energy & Industrial Strategy highlights that only 15% of proposed biomass projects in the UK progress beyond the feasibility stage due to funding constraints. Additionally, the European Investment Bank notes that access to affordable financing remains a challenge, particularly for emerging economies within the EU. While subsidies and grants are available, they often fall short of covering the substantial upfront costs associated with advanced gasification systems. This financial hurdle is further exacerbated by the long payback periods, which can extend up to 10 years, discouraging private investors. Consequently, the high capital expenditure required for biomass gasification acts as a significant restraint, impeding its scalability and broader deployment across Europe.

Technical Challenges and Efficiency Concerns

Technical challenges and efficiency concerns represent another major restraint hindering the Europe biomass gasification market. According to the European Biomass Industry Association, the efficiency of biomass gasification systems typically ranges between 60% and 75%, which is lower than conventional fossil fuel-based technologies. This limitation is primarily attributed to issues such as tar formation, incomplete combustion, and feedstock variability, which affect the overall performance of gasification plants. A study by the German Aerospace Center (DLR) reveals that tar-related problems account for nearly 30% of operational downtime in biomass gasification facilities. Furthermore, the European Commission's Joint Research Centre notes that inconsistencies in feedstock quality, such as moisture content and particle size, can lead to suboptimal gas yields and increased maintenance costs. For example, in Italy, where biomass gasification is gaining traction, operators reported a 15% reduction in system efficiency due to feedstock impurities, as per the Italian National Agency for New Technologies, Energy, and Sustainable Economic Development. These technical inefficiencies not only raise operational costs but also undermine investor confidence, slowing the pace of technological adoption and market expansion.

MARKET OPPORTUNITIES

Integration with Carbon Capture and Storage Technologies

The integration of biomass gasification with carbon capture and storage (CCS) technologies is a transformative opportunity for the Europe biomass gasification market. According to the Global CCS Institute, combining biomass gasification with CCS can achieve negative carbon emissions, effectively removing CO2 from the atmosphere. This synergy is particularly relevant in Europe, where the European Commission has identified CCS as a critical tool for achieving net-zero emissions by 2050. Norway, for instance, has pioneered the Northern Lights project, which captures and stores up to 1.5 million tons of CO2 annually, with plans to integrate bioenergy sources. According to the estimations of The European Investment Bank, CCS-enabled bioenergy projects could reduce emissions by an additional 200 million tons annually by 2040. Moreover, as per the UK Committee on Climate Change, BECCS (Bioenergy with Carbon Capture and Storage) could contribute up to 50 million tons of negative emissions per year by 2050. This integration not only enhances the environmental credentials of biomass gasification but also opens new revenue streams through carbon credits and policy incentives, positioning it as a cornerstone of Europe's sustainable energy strategy.

Expansion into Rural and Remote Areas

The expansion of biomass gasification into rural and remote areas offers a promising opportunity to address energy poverty and foster regional development across Europe. According to the European Network for Rural Development, approximately 20% of Europe's population resides in rural regions, many of which face challenges related to energy access and affordability. Biomass gasification, with its decentralized nature, provides a viable solution by utilizing locally available feedstock to generate energy. Finland, for example, has successfully implemented small-scale gasification plants in rural municipalities, supplying heat and electricity to over 100,000 households, as per the Finnish Innovation Fund Sitra. The European Commission's Rural Energy Initiative further underscores the potential of biomass gasification to create jobs and stimulate local economies. In Romania, the introduction of biomass gasification projects has led to a 15% increase in rural employment, according to the Romanian Ministry of Agriculture. By leveraging regional resources, biomass gasification not only enhances energy security but also contributes to social and economic empowerment, making it a vital component of Europe's rural development agenda.

MARKET CHALLENGES

Competition from Other Renewable Energy Sources

Competition from other renewable energy sources poses a significant challenge to the Europe biomass gasification market, as solar and wind energy continue to dominate the renewable landscape. According to the European Wind Energy Association, wind power accounted for 16% of the EU's electricity demand in 2021, with installed capacity exceeding 200 gigawatts. Similarly, the European Photovoltaic Industry Association reports that solar energy installations grew by 34% in 2022, driven by declining costs and technological advancements. These technologies benefit from higher efficiencies, ranging from 20% to 40%, compared to the 60-75% efficiency of biomass gasification systems, as noted by the European Biomass Association. Additionally, the International Renewable Energy Agency highlights that the levelized cost of electricity (LCOE) for solar and wind has decreased by over 80% since 2010, making them more economically attractive. For instance, Germany's Energiewende program prioritizes wind and solar investments, resulting in a 5% annual decline in biomass project approvals, according to the Federal Ministry for Economic Affairs and Climate Action. This intense competition for funding and policy support limits the market penetration of biomass gasification, despite its unique advantages in waste management and baseload power generation.

Public Perception and Social Acceptance Issues

Public perception and social acceptance issues present another formidable challenge to the Europe biomass gasification market, as misconceptions about environmental impacts hinder widespread adoption. According to a survey conducted by the European Social Survey, over 40% of respondents expressed concerns about air pollution and deforestation associated with biomass energy production. These perceptions are often fueled by misinformation, despite evidence from the European Environment Agency indicating that sustainably sourced biomass reduces lifecycle greenhouse gas emissions by up to 90%. In France, opposition to a proposed biomass gasification plant in Normandy delayed the project by two years, as reported by the French Ministry of Ecological Transition. Furthermore, the European Biomass Association notes that public resistance is particularly pronounced in densely populated areas, where residents fear noise, odor, and visual impacts. For example, in the Netherlands, protests against biomass facilities have led to stricter zoning regulations, as per the Dutch Environmental Assessment Agency. Addressing these social barriers requires targeted awareness campaigns and transparent stakeholder engagement to build trust and demonstrate the environmental and economic benefits of biomass gasification.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

7.90% |

|

Segments Covered |

By Source, and Country |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Countries Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, and Rest of Europe |

|

Market Leaders Profiled |

Beltran Technologies, Inc., Ankur Scientific Energy Technologies Pvt. Ltd., Chanderpur Works Private Limited, Valmet Corporation, Vaskiluoto Voima Oy, KASAG Swiss AG, EQTEC plc, Infinite Energy Pvt. Ltd., Goteborg Energi AB, and Thyssenkrupp AG. |

SEGMENTAL ANALYSIS

By Source Insights

The solid biomass segment accounted for the dominating share of 66.2% in the European market in 2024. The prominence of solid biomass segment in the European market is attributed to its widespread availability and compatibility with existing gasification technologies. According to Eurostat, solid biomass, including wood chips, pellets, and agricultural residues, supplied over 85% of bioenergy feedstock in 2021. Germany leads in solid biomass utilization, generating over 100 terawatt-hours of energy annually, as reported by the Federal Ministry for Economic Affairs and Climate Action. The segment's importance lies in its ability to provide stable and reliable energy, particularly for industrial applications and district heating systems. For instance, Sweden derives nearly 25% of its total energy consumption from solid biomass, as highlighted by the Swedish Energy Agency. Additionally, the European Commission emphasizes that solid biomass plays a critical role in replacing coal in cogeneration plants, reducing emissions by up to 90%. Its dominance is further reinforced by supportive policies, such as the Renewable Energy Directive, which mandates a 32% renewable energy target by 2030, ensuring sustained demand for solid biomass gasification.

The municipal waste segment emerges as the fastest-growing segment in the Europe biomass gasification market and is predicted to expand at a 12.5% over the forecast period owing to the increasing urbanization and stringent waste management regulations. Denmark exemplifies this trend, diverting over 80% of its municipal waste from landfills into energy recovery systems, as per the Danish Environmental Protection Agency. The European Commission's Circular Economy Action Plan further accelerates this segment's expansion by promoting waste-to-energy initiatives. For instance, the UK's Department for Environment, Food & Rural Affairs reports that municipal waste gasification projects have increased by 20% annually since 2020, supported by landfill tax reforms. Additionally, the International Energy Agency highlights that municipal waste gasification reduces greenhouse gas emissions by up to 85% compared to traditional waste disposal methods. This segment's growth is also bolstered by technological advancements, enabling higher efficiency and lower operational costs. As urban populations grow, municipal waste gasification is poised to play a pivotal role in Europe's sustainable energy transition.

REGIONAL ANALYSIS

Germany stands as the leading country in the Europe biomass gasification market and commanded for 30.8% of the European market share in 2024. The leading position of Germany in the European market is attributed to its robust policy frameworks, such as the Renewable Energy Sources Act (EEG), which incentivizes bioenergy production. According to Eurostat, Germany generated over 100 terawatt-hours of energy from biomass in 2021, accounting for 8% of its total energy mix. The country's emphasis on sustainability is evident in its investment in advanced gasification technologies, with over €5 billion allocated to bioenergy projects between 2020 and 2022, as reported by the German Federal Environment Agency. Additionally, Germany's extensive agricultural and forestry sectors provide a steady supply of feedstock, ensuring cost-effective operations. The integration of biomass gasification into district heating networks further enhances its importance, supplying clean energy to over 15 million households. Germany's proactive approach to renewable energy adoption positions it as a global benchmark for biomass gasification development.

Sweden held a substantial share of the European market in 2024 and is expected to grow at a promising CAGR over the forecast period. The success of Sweden is rooted in its commitment to phasing out fossil fuels, with bioenergy contributing over 25% to its total energy consumption in 2021. Sweden's extensive forest resources provide a reliable feedstock base, with over 4 million cubic meters of forest residues utilized annually, as per the Swedish Forest Agency. The Swedish government's investment in research and innovation has also propelled the adoption of advanced gasification technologies, reducing operational costs by 15% over the past decade. Furthermore, Sweden's district heating systems, powered largely by biomass gasification, supply heat to over 60% of households, as highlighted by the Swedish Environmental Protection Agency. This integration not only reduces emissions but also fosters energy independence, reinforcing Sweden's position as a pioneer in sustainable bioenergy solutions.

France is anticipated to account for a noteworthy share of the European market over the forecast period. The growth of France in the European market is driven by strategic investments in renewable energy infrastructure, supported by the Multiannual Energy Program (PPE), which aims to increase bioenergy capacity by 30% by 2030. According to Eurostat, France generated over 50 terawatt-hours of energy from biomass in 2021, primarily from agricultural residues and municipal waste. The French government has also introduced subsidies and tax incentives to encourage biomass gasification projects, resulting in a 25% increase in installations since 2020, as reported by the French Environment and Energy Management Agency (ADEME). Additionally, France's focus on rural development has spurred the adoption of decentralized gasification systems, created jobs and enhancing energy security. These initiatives underscore France's commitment to leveraging biomass gasification as a key pillar of its renewable energy strategy.

Italy claims a prominent spot in the Europe biomass gasification market. The country's leadership is driven by its innovative approach to bioenergy, with over 200 biomass gasification plants operational as of 2022. Italy's agricultural sector provides abundant feedstock, with over 50 million tons of residues available annually, as per the Italian Ministry of Agricultural, Food, and Forestry Policies. The government's Green New Deal initiative has further accelerated growth, allocating €10 billion to renewable energy projects, including biomass gasification. Additionally, Italy's focus on industrial applications has positioned it as a hub for technological advancements, with companies developing high-efficiency systems capable of achieving up to 75% conversion rates. These efforts highlight Italy's role as a key innovator in the European biomass gasification landscape.

Denmark is likely to account for a considerable share of the European market over the forecast period. The comprehensive waste management strategies of Denmark that prioritize energy recovery over landfilling is boosting the Denmark biomass gasification market growth. Denmark diverts over 80% of its municipal waste into gasification plants, generating enough energy to power 2 million households annually, as reported by the Danish Energy Agency. The government's commitment to sustainability is further demonstrated by its investment in carbon-neutral technologies, with biomass gasification playing a central role in achieving net-zero emissions by 2050. Additionally, Denmark's district heating systems, powered by biomass, supply heat to over 60% of the population, underscoring the technology's importance. These initiatives position Denmark as a model for sustainable energy practices, driving the adoption of biomass gasification across Europe.

KEY MARKET PLAYERS

The major players in the Europe biomass gasification market include Beltran Technologies, Inc., Ankur Scientific Energy Technologies Pvt. Ltd., Chanderpur Works Private Limited, Valmet Corporation, Vaskiluoto Voima Oy, KASAG Swiss AG, EQTEC plc, Infinite Energy Pvt. Ltd., Goteborg Energi AB, and Thyssenkrupp AG.

MARKET SEGMENTATION

This research report on the Europe biomass gasification market is segmented and sub-segmented into the following categories.

By Source

- Solid Biomass

- Biogas

- Municipal Waste

- Liquid Biomass

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What is driving the growth of the Europe biomass gasification market?

The market is driven by increasing demand for renewable energy, government incentives, and the need to reduce carbon emissions.

What are the main applications of biomass gasification in Europe?

Biomass gasification is used for power generation, heat production, and biofuel manufacturing.

What is the future outlook for the Europe biomass gasification market?

The market is expected to grow steadily with advancements in gasification technology and increasing demand for clean energy solutions.

What technological advancements are shaping the biomass gasification market in Europe?

Innovations in gas cleanup systems, more efficient gasifiers, and integration with carbon capture technologies are enhancing performance and adoption.

4o

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]