Europe Biological Organic Fertilizers Market Size, Share, Trends & Growth Forecast Report – Segmented By Application, Type and By Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe), Industry Analysis From 2025 to 2033

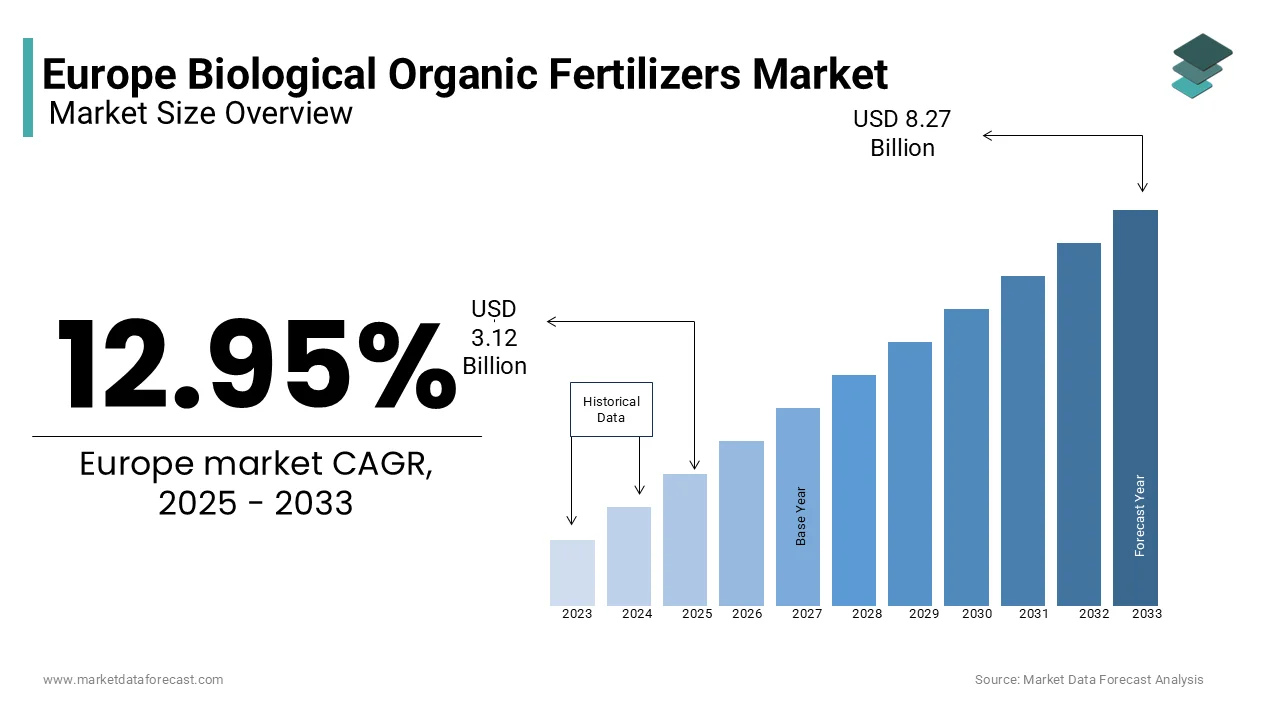

Europe Biological Organic Fertilizers Market Size

The Europe biological organic fertilizers market size was valued at USD 2.77 billion in 2024 and is anticipated to reach USD 3.12 billion in 2025 from USD 8.27 billion by 2033, growing at a CAGR of 12.95% during the forecast period from 2025 to 2033.

Biological organic fertilizers are derived from natural sources such as compost, animal manure, and microbial inoculants and are designed to enhance soil fertility, improve crop yields, and reduce dependency on chemical fertilizers. As per the European Organic Farming Association, over 70% of organic farms utilize biological fertilizers, underscoring their critical role in reducing environmental impact. Additionally, advancements in biotechnology have improved nutrient delivery systems, reducing application costs by 15%, as highlighted by the German Federal Ministry of Agriculture. With increasing emphasis on circular economy practices, the market is evolving into a highly specialized sector, addressing both economic and ecological challenges while meeting the rising standards of modern agriculture.

MARKET DRIVERS

Rising Adoption of Organic Farming Practices in Europe

The escalating adoption of organic farming practices that need sustainable alternatives to synthetic fertilizers is one of the major factors propelling the growth of the European biological organic fertilizers market. According to the European Commission, the area under organic farming in Europe grew by 25% between 2018 and 2022, reaching 14.6 million hectares, driven by consumer demand for chemical-free produce. This trend is particularly evident in countries like Austria and Sweden, where organic farms account for over 20% of total agricultural land, as reported by the Austrian Federal Ministry of Agriculture. For instance, as per a study by the French National Institute for Agricultural Research, biological organic fertilizers accounted for 30% of nutrient inputs in organic farms in 2022, driven by government subsidies and certification programs. Additionally, partnerships between farmers and biotech companies have reduced production costs by 20%, making these fertilizers more accessible. By ensuring soil health and enhancing biodiversity, biological organic fertilizers have become indispensable for modern agriculture, driving market growth across the continent.

Stringent Regulations on Chemical Fertilizers

The implementation of stringent regulations targeting chemical fertilizers that have catalyzed the shift toward eco-friendly alternatives is another major factor fuelling the growth of the regional market. According to the European Environment Agency, the Nitrates Directive mandates member states to reduce nitrate pollution by 30% by 2025, driving demand for biological solutions. This trend is particularly pronounced in Denmark, where the government has imposed strict limits on synthetic nitrogen usage, as noted by the Danish Ministry of Environment. As per a report by the Italian National Institute for Environmental Research, biological fertilizer sales surged by 25% in 2022 due to the compliance requirements and farmer awareness campaigns. Additionally, the growing emphasis on sustainable water management has further amplified demand, with companies investing in nutrient-efficient formulations. For example, the Swedish Environmental Protection Agency notes that 40% of surveyed farmers expressed a preference for biological alternatives, citing reduced environmental impact as a key motivator. By addressing regulatory pressures and fostering ecological balance, biological organic fertilizers are unlocking immense growth potential.

MARKET RESTRAINTS

High Costs of Production and Application

High cost associated with production and application that often limits accessibility for small-scale farmers is a significant restraint to the European market. According to the German Federal Ministry of Agriculture, the average cost of producing biological fertilizers exceeds €200 per ton, compared to €100 for synthetic alternatives, creating financial barriers for rural producers. This issue is particularly pronounced in Eastern Europe, where over 60% of farmers lack access to advanced application technologies, as reported by the Czech Ministry of Agriculture. According to a study by the Italian National Institute of Statistics, only 35% of surveyed farms in rural areas have transitioned to biological fertilizers, citing affordability as a major obstacle. Additionally, the absence of standardized pricing models exacerbates the problem, leaving many consumers uncertain about the value proposition of these products. Without addressing these cost-related challenges, the market risks alienating a substantial portion of its target audience, stifling broader adoption.

Limited Awareness Among Conventional Farmers

Limited awareness among conventional farmers regarding the benefits and proper usage of biological organic fertilizers is further hampering the regional market expansion. According to the Swedish Board of Agriculture, over 50% of small-scale farmers in Scandinavia lack technical knowledge about nutrient management and application techniques, leading to suboptimal outcomes despite investing in premium products. This issue is compounded by generational disparities, as highlighted by the Italian Ministry of Economic Development, which reports that farmers aged 55 and above are 40% less likely to adopt new technologies compared to younger counterparts. Furthermore, a study by the University of Hohenheim demonstrates that improper usage and maintenance practices can reduce fertilizer efficacy by up to 30%, undermining their potential benefits. Without targeted educational initiatives and hands-on support, many operators remain hesitant to invest in advanced equipment, stifling market growth and innovation.

MARKET OPPORTUNITIES

Growing Demand for Precision Agriculture Solutions

The growing demand for precision agriculture solutions that leverage advanced technologies to optimize nutrient delivery and enhance crop yields is a major opportunity for the European biologic organic fertilizers market. According to the European Precision Agriculture Association, precision farming technologies accounted for 30% of new agricultural investments in 2022, driven by their ability to reduce input wastage and improve efficiency. This trend is particularly evident in Germany and the Netherlands, where smart farming practices have increased the adoption of biological fertilizers by 25%, as noted by the Dutch Ministry of Agriculture. For instance, a study by the French National Institute for Agricultural Research highlights that precision application systems achieved a 40% reduction in fertilizer usage while maintaining crop quality, making them an attractive option for large-scale farms. Additionally, partnerships between academic institutions and private enterprises are accelerating innovation, ensuring scalability and affordability. The Horizon Europe program has allocated €1 billion for sustainable agriculture projects, including biological fertilizers, as noted by the European Commission. By fostering breakthroughs in precision agriculture, the market is poised to unlock immense growth potential.

Increasing Focus on Urban and Vertical Farming

The growing emphasis on urban and vertical farming that offers innovative solutions for food production in densely populated areas is another notable opportunity for the European market. According to the European Urban Farming Federation, urban farming projects grew by 20% in 2022, with biological organic fertilizers playing a vital role in nutrient management for indoor crops. This trend is particularly pronounced in countries like Spain and Italy, where urban agriculture accounts for over 15% of local food production, as noted by the Spanish Ministry of Agriculture. This trend is further bolstered by consumer preferences for locally sourced and sustainably grown produce, as highlighted by the Italian National Institute for Environmental Research. Additionally, advancements in hydroponic and aeroponic systems enhance scalability, making them ideal for diverse applications. By leveraging these opportunities, companies can capitalize on the growing demand for innovative farming solutions, solidifying their position in the market.

MARKET CHALLENGES

Higher Costs Compared to Synthetic Fertilizers

One major challenge is the higher cost of biological organic fertilizers relative to synthetic alternatives. These organic options often come with increased expenses, making them less attractive to cost-sensitive farmers. This price disparity can deter widespread adoption, especially among small-scale farmers who operate on tight budgets. The higher costs are attributed to factors such as more expensive raw materials and complex production processes. This economic hurdle poses a significant barrier to the broader acceptance of organic fertilizers in the European agricultural sector.

Logistical Constraints in Supply Chain Management

The logistical constraints within the supply chain management of biological organic fertilizers is one of the other significant challenges to the European biological organic fertilizers market. The distribution of these fertilizers is often hampered by inadequate infrastructure and complex regulatory requirements. These logistical issues can lead to delays and increased costs, further complicating the adoption of organic fertilizers. Improving supply chain efficiency is crucial to overcoming these barriers and promoting the use of sustainable agricultural inputs.

SEGMENTAL ANALYSIS

Europe Biological Organic Fertilizers Market By Application

The microorganisms segment occupied the leading share of 65.6% of the European market share in 2024. The domination of microorganisms segment in the European market is attributed to their ability to enhance soil fertility and crop yield through natural processes like nitrogen fixation and phosphorus solubilization. According to the European Biostimulants Industry Council (EBIC), microbial fertilizers improve nutrient uptake efficiency by up to 30%, reducing dependency on synthetic fertilizers. For instance, rhizobacteria and mycorrhizal fungi are widely used in cereals and legumes, with studies from the Journal of Agricultural Science showing a 25% increase in root biomass and nutrient absorption. Additionally, the EU’s Farm to Fork Strategy mandates a 20% reduction in chemical fertilizer use by 2030, accelerating adoption of microbial solutions. As per a report by Eurostat, over 40% of European farmers have transitioned to biofertilizers, citing improved soil health and compliance with organic farming certifications. With the global push for sustainable agriculture, microorganisms remain indispensable in fostering resilient agricultural systems.

The organic residues segment is the fastest-growing segment in the Europe biological organic fertilizers market and is projected to witness a CAGR of 1.3% over the forecast period owing to the increasing utilization of agricultural and industrial waste, such as compost, manure, and plant residues, as sustainable fertilizers. As per a study by the European Environment Agency, repurposing organic waste reduces landfill contributions by 20%, aligning with the EU’s circular economy goals. Moreover, the rise of urban farming and vertical agriculture is expected to grow by 15% annually, which is further fuelling the demand for nutrient-rich organic residues. For example, companies like Agricycle convert food waste into biofertilizers, achieving a 40% reduction in production costs compared to traditional inputs. The growing popularity of regenerative farming practices, which prioritize soil carbon sequestration, further boosts adoption. As Europe strives to achieve net-zero emissions by 2050, organic residues emerge as a transformative solution for sustainable nutrient management.

Europe Biological Organic Fertilizers Market By Type

The cereals segment was the largest application segment in the Europe biological organic fertilizers market and held 40.5% of the European market share in 2024. Cereal is a staple crop across Europe, with wheat, barley, and maize accounting for over 50% of arable land, as reported by Eurostat. Biological fertilizers play a critical role in boosting cereal yields while maintaining soil health, particularly in regions facing nutrient depletion. According to a study published in Nature Sustainability, microbial inoculants can increase cereal productivity by 15-20%, making them vital for meeting Europe’s food security goals. Additionally, the EU Common Agricultural Policy (CAP) incentivizes sustainable practices, offering subsidies for farmers adopting biofertilizers. For instance, Germany’s Federal Ministry of Agriculture allocated €500 million in 2022 to promote organic farming, benefiting cereal growers. With global cereal demand projected to rise by 10% annually, per the Food and Agriculture Organization (FAO), the importance of biological fertilizers in this segment cannot be overstated.

The fruits and vegetables segment is the fastest-growing segment in the Europe biological organic fertilizers market and is estimated to register a CAGR of 11.7% over the forecast period. The rising demand for organic produce and premium-quality fruits and vegetables is one of the major factors driving the growth of the fruits and vegetables segment in the European market. As per a report by Euromonitor, organic fruit and vegetable sales in Europe grew by 25% annually between 2020 and 2022, reaching €15 billion. Biological fertilizers enhance flavor, nutritional value, and shelf life, making them ideal for high-value crops like tomatoes, strawberries, and leafy greens. For example, a study by Wageningen University found that biofertilizers increase antioxidant levels in tomatoes by 30%, appealing to health-conscious consumers. Additionally, the rise of controlled-environment agriculture (CEA), such as greenhouses and hydroponics that amplifies demand for tailored nutrient solutions. The Netherlands, a leader in greenhouse farming, uses biofertilizers to achieve a 40% reduction in water usage while boosting yields. As Europe prioritizes sustainable food systems under initiatives like the Green Deal, fruits and vegetables emerge as a key driver of innovation in the biofertilizer market.

COUNTRY ANALYSIS

Germany accounted for 36.9% of the European biological organic fertilizers market in 2024. The dominance of Germany in the European market is attributed to the country's robust organic farming sector. In 2020, Germany had approximately 1.6 million hectares under organic cultivation, representing about 9.6% of its total agricultural land. The supportive policies of German government, including financial incentives for organic farmers and stringent environmental regulations, have further propelled the adoption of organic fertilizers. Additionally, Germany's strong emphasis on research and development in sustainable agriculture has led to innovations in bio-fertilizer formulations, enhancing their effectiveness and appeal among farmers.

France holds a significant position in the European biological organic fertilizers market. The extensive organic farming sector of France is one of the major factors boosting the French market growth. In 2020, France had approximately 2.3 million hectares dedicated to organic agriculture, accounting for about 8.5% of its total agricultural land. The French government's commitment to environmental sustainability and the promotion of organic farming practices have been pivotal in this growth. Initiatives such as the "Ambition Bio 2022" plan aimed to increase the share of organic farmland to 15% by 2022, reflecting the country's dedication to organic agriculture. This substantial organic farming area has naturally led to increased demand for biological organic fertilizers, solidifying France's importance in the European market.

Italy has established itself as a key player in the European biological organic fertilizers market. The rich tradition in organic farming in Italy is contributing to the Italian market growth. As of 2020, Italy had approximately 2 million hectares under organic cultivation, representing about 15.2% of its total agricultural land cite turn search. The country's favorable climate and diverse agricultural practices have facilitated the growth of organic farming. Moreover, Italy's strong emphasis on high-quality, sustainable food production has driven the demand for organic fertilizers. The Italian government's support through subsidies and certification programs has further encouraged farmers to adopt organic practices, thereby bolstering the market for biological organic fertilizers.

Spain has emerged as a significant contributor to the European biological organic fertilizers market, with a substantial organic farming sector. In 2020, Spain had approximately 2.4 million hectares dedicated to organic agriculture, accounting for about 10% of its total agricultural land cite turn search. The country's diverse climatic conditions and extensive agricultural land have supported the expansion of organic farming. Government initiatives promoting sustainable agriculture and the growing export market for organic products have further fueled the demand for biological organic fertilizers in Spain.

The Netherlands, though smaller in land area compared to its counterparts, has made significant strides in the biological organic fertilizers market. The country's innovative agricultural sector, known for its advanced technologies and sustainable practices, has embraced organic farming methods. As of 2020, the Netherlands had approximately 72,000 hectares under organic cultivation, representing about 3.7% of its total agricultural land citeturn search. The Dutch government's policies supporting sustainable agriculture and the circular economy have encouraged the use of biological organic fertilizers. Additionally, the Netherlands' focus on reducing chemical fertilizer usage to mitigate environmental impacts has led to increased adoption of organic alternatives, underscoring its importance in the European market.

MARKET SEGMENTATION

This research report on the Europe biological organic fertilizers market is segmented and sub-segmented into the following categories.

By Application

- Microorganisms Segment

- Organic Residues Top of Form

By Type

- Cereals Segment

- Fruits And Vegetables Segment

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]